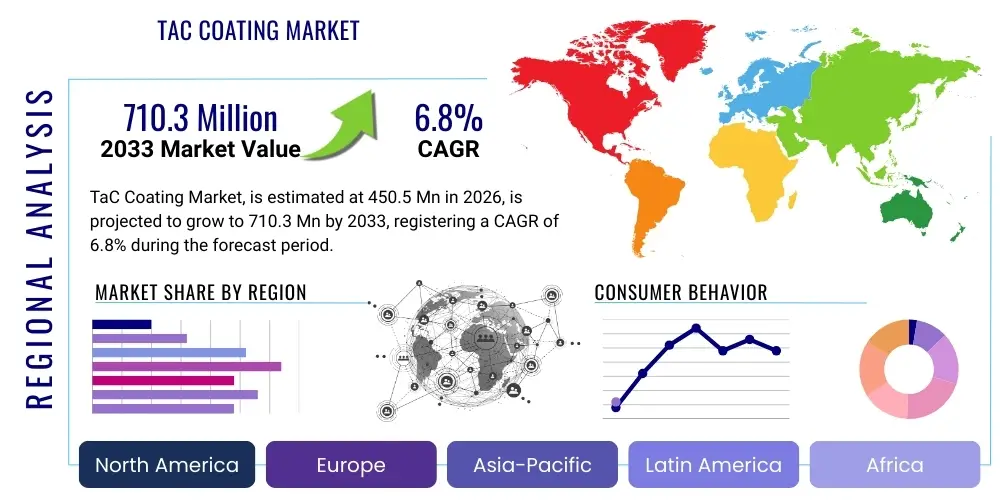

TaC Coating Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441299 | Date : Feb, 2026 | Pages : 248 | Region : Global | Publisher : MRU

TaC Coating Market Size

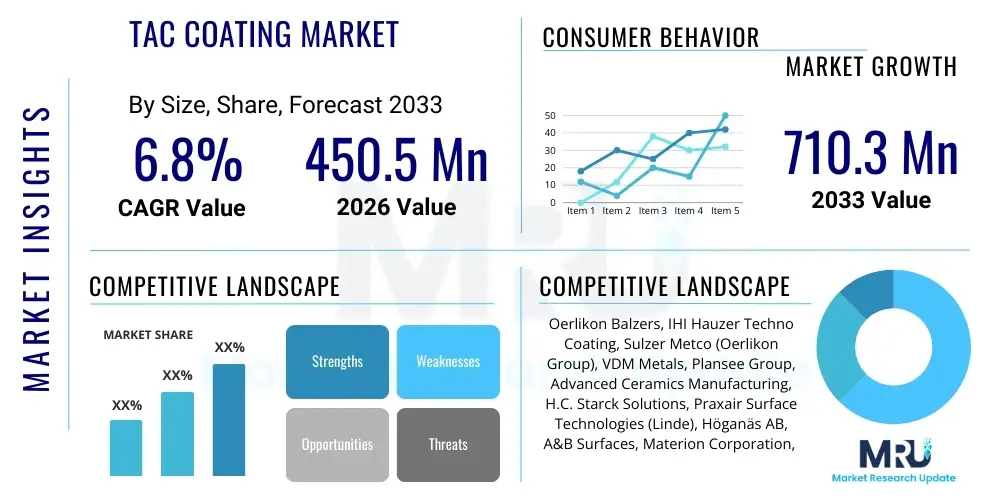

The TaC Coating Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 450.5 Million in 2026 and is projected to reach USD 710.3 Million by the end of the forecast period in 2033. This growth trajectory is fundamentally driven by the increasing demand for high-performance materials capable of operating efficiently under extreme conditions, specifically high heat, severe friction, and corrosive chemical environments. Tantalum Carbide (TaC) coatings, known for their exceptional hardness and refractory properties, are becoming indispensable across critical industries such as aerospace, nuclear energy, and high-precision tooling.

The valuation reflects the specialized nature of TaC application, primarily in domains where material failure is not permissible, justifying the premium cost associated with Tantalum-based coatings and their complex deposition processes, such as Chemical Vapor Deposition (CVD) and Physical Vapor Deposition (PVD). Furthermore, the expanding utilization of TaC in the manufacturing of next- generation semiconductor components and microelectromechanical systems (MEMS) is contributing substantially to the overall market valuation. Market analysts observe a strong correlation between global capital expenditure in advanced manufacturing and the incremental growth within the TaC coating sector.

TaC Coating Market introduction

The Tantalum Carbide (TaC) Coating Market encompasses the global commercialization, production, and application of thin films of Tantalum Carbide, an ultra-hard refractory ceramic material characterized by an extremely high melting point (over 3880°C), superior wear resistance, and high chemical inertness. These coatings are primarily utilized to enhance the surface properties of various substrates, including metals, alloys, and specialized composites, significantly extending their operational lifespan and improving performance metrics in demanding applications. TaC coatings are typically applied using advanced vacuum deposition techniques, ensuring dense, uniform, and highly adherent layers essential for performance integrity.

Product description highlights TaC as one of the hardest known materials, offering unparalleled resistance to oxidation and thermal shock, making it a critical material in environments subject to rapid temperature fluctuations and aggressive erosion. Major applications span several high-tech sectors, including wear parts in industrial machinery, protective layers for cutting tools used in high-speed machining (where they reduce friction and tool wear), structural components in jet engines and rocket propulsion systems (due to high thermal stability), and corrosion barriers in chemical processing equipment. The primary benefits derived from adopting TaC coatings include dramatic increases in hardness, improved tribological performance, and enhanced resistance to acidic and alkaline media.

Driving factors propelling this market include the global pursuit of lightweight and durable materials in the aerospace sector, the rapid expansion of electric vehicle (EV) battery manufacturing requiring precision tooling with extended service life, and regulatory pressures in the energy sector pushing for more robust and reliable infrastructure, particularly in high-temperature gas reactors and advanced nuclear facilities. The continuous advancement in deposition technology, lowering the cost and increasing the scalability of TaC coating processes, further supports market proliferation across new industrial segments seeking material solutions for severe service conditions.

TaC Coating Market Executive Summary

The TaC Coating Market demonstrates robust growth, primarily influenced by strong business trends focusing on material science innovations and the push for industrial sustainability through enhanced component longevity. Key business trends include the consolidation of specialized coating service providers, significant R&D investment into hybrid coating compositions (e.g., TaC/TaN multilayers), and the adoption of advanced automation in deposition processes to ensure consistent quality and yield. The market's competitive landscape is defined by the technological capabilities of participants in executing complex, high-vacuum coating procedures, providing a high barrier to entry for new competitors. The trajectory suggests a steady shift towards customized, application-specific coating formulations rather than standardized offerings, responding directly to the intricate requirements of end-user industries.

Regional trends indicate that Asia Pacific (APAC) currently dominates the consumption of TaC coatings, fueled by massive manufacturing bases in China, Japan, and South Korea, particularly within the electronics and automotive supply chains. North America and Europe, while representing mature markets, exhibit high growth rates in specialized, high-value applications such as aerospace components and medical devices, driven by stringent quality standards and high defense spending. The Middle East and Africa (MEA) region is emerging, notably due to large-scale investment in oil, gas, and renewable energy infrastructure that necessitates components coated with superior corrosion and wear protection. Regional variations in environmental regulations governing deposition precursor materials also influence market dynamics.

Segment trends highlight the cutting tools and components segment as the largest revenue generator, benefiting from the global increase in hard material machining where TaC coatings offer indispensable protection against abrasive wear and heat generation. Technological segmentation shows that Chemical Vapor Deposition (CVD) remains a cornerstone due to its ability to produce highly conformal and dense coatings, crucial for internal surfaces and complex geometries, while Physical Vapor Deposition (PVD) techniques, specifically magnetron sputtering and cathodic arc deposition, are rapidly gaining share due to their lower processing temperatures, making them suitable for substrates sensitive to high heat, such as precision bearing components and specialized molds. The overall market summary emphasizes resilience and sustained expansion, contingent upon continued technological breakthroughs in deposition efficiency and material integration.

AI Impact Analysis on TaC Coating Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the TaC Coating Market frequently center on predictive maintenance models, optimization of complex coating parameters, and accelerated materials discovery. Users are keenly interested in how machine learning (ML) algorithms can analyze real-time data from deposition chambers (e.g., gas flow, temperature profiles, plasma characteristics) to ensure the highly precise and repeatable synthesis of TaC films, thereby reducing batch-to-batch variability which is a critical concern in high-stakes applications. Another major theme is the expectation that AI can drastically shorten the R&D cycle for novel TaC-based ceramic formulations, allowing manufacturers to quickly tailor coatings for specific industrial requirements, thereby democratizing access to high-performance material solutions and potentially lowering overall production costs by optimizing precursor usage and energy consumption during the complex CVD or PVD processes.

- AI-driven optimization of coating parameters: Machine learning algorithms analyze deposition variables (pressure, temperature, gas composition) to maximize coating homogeneity, density, and adherence, leading to superior quality control and reduced failure rates.

- Predictive lifetime modeling: AI models utilize sensor data from coated components in operational environments to accurately predict component failure due to wear, erosion, or thermal fatigue, enabling precise predictive maintenance schedules for critical infrastructure (e.g., nuclear reactor components or aerospace turbine blades).

- Accelerated materials informatics: Utilizing AI and big data analytics to screen thousands of potential Tantalum-based compounds and multi-layer structures, dramatically accelerating the discovery and formulation of new TaC alloys or composites with enhanced mechanical or chemical properties.

- Automated quality inspection: Implementing computer vision and deep learning techniques to perform non-destructive testing and microscopic analysis of coating surfaces, quickly identifying and classifying defects such as pinholes, cracks, or non-uniformities far more efficiently than traditional manual inspection methods.

- Supply chain risk management: AI tools analyze global Tantalum supply chains, predicting potential disruptions, price volatility, and geopolitical risks associated with sourcing raw materials, thereby ensuring supply stability for TaC coating manufacturers.

DRO & Impact Forces Of TaC Coating Market

The dynamics of the TaC Coating Market are governed by a complex interplay of Drivers, Restraints, Opportunities, and broader Impact Forces. The primary drivers revolve around the non-negotiable need for extreme performance materials in advanced manufacturing sectors, particularly aerospace components subjected to high operational temperatures and friction, and in machining applications demanding unparalleled tool life. Restraints mainly stem from the high initial capital investment required for sophisticated deposition equipment (CVD/PVD), the high cost and supply chain complexity associated with Tantalum (a refractory and often geopolitically sensitive metal), and the technical difficulty in scaling up highly specialized coating processes while maintaining consistent quality and precision.

Significant opportunities exist in emerging applications, notably in solid oxide fuel cells (SOFCs) and next-generation battery technologies where TaC can act as an effective diffusion barrier or electrode material, and in the burgeoning field of medical devices, where its biocompatibility combined with wear resistance offers potential for long-lasting implants and surgical tools. Impact forces shaping the market include strict regulatory standards in aerospace and defense sectors mandating the use of proven, certified high-reliability materials, and the rapid pace of miniaturization in electronics, which requires atomically precise coating thickness control. Geopolitical stability affecting Tantalum sourcing also remains a perpetual high-impact force, influencing raw material costs and strategic manufacturing decisions globally.

The market is also heavily influenced by technological substitution risk; while TaC offers unique advantages, ongoing research into alternative hard ceramic coatings like advanced Tungsten Carbide (WC) or specialized Borides presents a constant competitive pressure, forcing TaC producers to continually innovate in deposition efficiency and performance enhancement. Furthermore, the environmental impact associated with certain volatile precursors used in CVD processes is increasingly scrutinized, pushing the industry towards greener, more sustainable coating methodologies, which represents both a challenge and an opportunity for differentiation and market leadership.

Segmentation Analysis

The TaC Coating Market is extensively segmented based on the deposition technology utilized, the end-use application domain, and the specific substrate material being coated. This stratification allows market players to focus their technological development and marketing strategies on specific high-value niches. The segmentation based on technology (CVD, PVD, Thermal Spray) reveals distinct competitive landscapes and differential growth rates, largely determined by the temperature tolerance of the substrate material and the required coating thickness uniformity. Application segmentation (e.g., Aerospace, Cutting Tools, Energy) dictates the performance specifications and regulatory hurdles that must be met by the coating providers, resulting in tailored product offerings and certification processes. The nuanced analysis of these segments is vital for accurate market forecasting and strategic planning.

- By Deposition Technology:

- Chemical Vapor Deposition (CVD): High uniformity, deep penetration, high temperature.

- Physical Vapor Deposition (PVD): Lower temperature, high bond strength, targeted deposition.

- Thermal Spray Techniques (e.g., HVOF): Thick layers, repair, wear resistance in large components.

- By End-Use Application:

- Cutting Tools and Wear Parts: High-speed machining inserts, molds, dies.

- Aerospace and Defense: Turbine blades, combustion liners, missile components.

- Energy and Power: Nuclear reactor components, heat exchangers, gas turbine hot sections.

- Automotive: Engine components, high-wear transmission parts, braking systems.

- Chemical and Petrochemical Processing: Reactor vessels, pumps, valves, pipeline protection against corrosive media.

- Semiconductors and Electronics: Diffusion barriers, advanced MEMS components.

- By Substrate Material:

- Cemented Carbides

- High-Speed Steel (HSS)

- Superalloys (Ni-based, Ti-based)

- Ceramic Matrix Composites (CMCs)

Value Chain Analysis For TaC Coating Market

The TaC Coating Market value chain is structured, beginning with the highly specialized upstream procurement of raw materials, primarily high-purity Tantalum metal and various carbon precursors (such as methane or acetylene). Upstream analysis reveals that Tantalum supply is highly concentrated and price-sensitive, requiring sophisticated hedging strategies from major coating chemical suppliers and manufacturers. Following material procurement, the chain moves to the synthesis and purification of TaC precursor compounds suitable for advanced deposition techniques like CVD and PVD. This stage is characterized by high intellectual property barriers and significant quality control requirements, as precursor purity directly impacts coating performance and defect formation.

The intermediate stage involves the core coating service providers, who own and operate the expensive, capital-intensive deposition facilities. These firms focus intensely on process optimization, developing proprietary coating recipes, and securing necessary industry certifications (e.g., AS9100 for aerospace applications). Distribution channels are highly dependent on the target application: for cutting tools, distribution often flows through industrial equipment suppliers and specialized tool distributors (indirect channels), emphasizing rapid logistics and standardized product availability. Conversely, for highly customized components (like aerospace or nuclear), the channel is predominantly direct, involving long-term contracts and close technical collaboration between the coating firm and the OEM (Original Equipment Manufacturer).

Downstream analysis focuses on the end-use applications, where the performance of the TaC coating translates directly into component durability and operational efficiency. The downstream segment is highly fragmented, encompassing specialized machining workshops, major aerospace integrators, and critical energy facility operators. The success of the coating firm in this final stage depends heavily on post-sales support, quality assurance documentation, and the proven longevity of the coated product in real-world environments. The entire value chain is critically dependent on technological expertise and compliance with rigorous industry standards, especially concerning material traceability and safety protocols.

TaC Coating Market Potential Customers

The primary customers and end-users of TaC coatings are entities requiring extreme protection and performance enhancement for mission-critical components that operate in severe environments characterized by high temperatures, abrasive wear, and chemical exposure. These buyers are typically characterized by long procurement cycles, stringent specification requirements, and a preference for long-term relationships with certified suppliers. The most significant customer base resides within the manufacturing sectors that utilize high-precision machining, relying on TaC coatings to extend the life of carbide inserts and tools, thereby achieving substantial cost savings by reducing downtime and replacement frequency.

In the aerospace and defense sector, customers are major aircraft engine manufacturers and defense contractors seeking to improve the efficiency and reliability of hot section components, where the superior thermal stability and erosion resistance of TaC are essential for optimizing engine performance and fuel efficiency. Furthermore, customers in the nuclear power industry utilize TaC coatings to protect fuel rods, cladding materials, and structural elements against aggressive coolants and irradiation damage, demanding coatings with impeccable uniformity and long-term radiological stability. These buyers prioritize quality certifications and proven operational history over marginal cost reductions.

Emerging customers include manufacturers in the highly regulated medical device sector, where TaC’s inertness makes it suitable for biocompatible coatings on orthopedic implants and surgical instruments, offering enhanced wear resistance without adverse biological reactions. Finally, advanced battery and electronics manufacturers constitute a rapidly growing customer segment, utilizing TaC as a high-performance diffusion barrier or electrode material to improve the lifespan and efficiency of solid-state devices and high-energy batteries, demonstrating a broad spectrum of high-value industrial buyers across the global economy.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450.5 Million |

| Market Forecast in 2033 | USD 710.3 Million |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Oerlikon Balzers, IHI Hauzer Techno Coating, Sulzer Metco (Oerlikon Group), VDM Metals, Plansee Group, Advanced Ceramics Manufacturing, H.C. Starck Solutions, Praxair Surface Technologies (Linde), Höganäs AB, A&B Surfaces, Materion Corporation, Bodycote PLC, Eurocoating S.p.A., Saint-Gobain Ceramic Materials, CemeCon AG, KOBELCO. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

TaC Coating Market Key Technology Landscape

The TaC Coating Market technology landscape is dominated by sophisticated vacuum deposition processes designed to leverage the refractory nature of Tantalum Carbide while ensuring maximum adhesion and microstructure control. Chemical Vapor Deposition (CVD) remains a cornerstone technology, particularly the utilization of Tantalum halides (e.g., TaCl5) and carbon-containing gases at elevated temperatures (typically 800°C to 1200°C). This process excels at achieving high film density and perfect conformality, critical for coating complex geometries and internal component surfaces, and is widely deployed for large-scale production of coated cutting tool inserts due to the resulting high bond strength between the TaC layer and the cemented carbide substrate. Recent technological evolution in CVD focuses on Plasma-Enhanced CVD (PECVD) variants, which allow for deposition at lower temperatures, mitigating thermal stress and distortion in heat-sensitive substrate materials.

Physical Vapor Deposition (PVD) techniques, including Magnetron Sputtering and Cathodic Arc Deposition, represent the fastest-growing technological segment due to their ability to provide excellent control over stoichiometry and nanostructure at reduced processing temperatures, often below 500°C. Sputtering, in particular, offers precise thickness control, enabling the production of ultra-thin, highly functional TaC films suitable for microelectronics and precision bearing surfaces. The innovation within PVD focuses heavily on incorporating pulsed plasma and specialized target materials to improve deposition efficiency and reduce the incidence of macroparticles, which can compromise coating integrity and performance in high-stress applications like aerospace.

Furthermore, Hybrid Deposition Systems, combining the strengths of PVD and CVD, are gaining prominence. These hybrid processes allow for the creation of multi-layer or graded TaC coatings, optimizing different zones of the coating for specific functions—for example, a robust TaC layer for hardness combined with a Tantalum Nitride (TaN) intermediate layer for superior adhesion to the substrate. Advanced research is also exploring Atomic Layer Deposition (ALD) for TaC, which offers unparalleled thickness control at the atomic scale, potentially revolutionizing the application of TaC as a diffusion barrier in cutting-edge semiconductor manufacturing where feature sizes are shrinking rapidly and require near-perfect uniformity and minimal film thickness variability across large wafer areas. These technological advancements collectively aim to enhance wear resistance, thermal performance, and oxidation stability while driving down the overall cost per coated unit.

The persistent challenge in the technological domain is achieving reliable, large-area coating uniformity and minimizing intrinsic stress within the deposited TaC films, which can lead to premature cracking or delamination under thermal cycling. Innovations in chamber design, process monitoring (using optical emission spectroscopy and mass spectrometry), and real-time feedback loops driven by data analytics are central to overcoming these manufacturing obstacles. For instance, the refinement of process gas distribution and the dynamic control of plasma power are essential elements in next-generation coating systems designed to meet the escalating performance demands of industries like hypersonic flight and fusion energy research, where the thermal load on components is unprecedented and failure is highly critical. The integration of advanced robotics for substrate handling and pre-treatment preparation also plays a vital role in ensuring high throughput and minimizing contamination, directly contributing to the economic viability of complex TaC coating operations on a commercial scale.

Regional Highlights

The global TaC Coating Market exhibits distinct regional characteristics shaped by local industrial concentration, regulatory frameworks, and technological adoption rates. Asia Pacific (APAC) stands as the largest and most dynamic region, characterized by its dominant position in global manufacturing, especially within the automotive, electronics, and general industrial machining sectors. Countries like China, India, Japan, and South Korea are experiencing massive infrastructure development and rapid growth in high-precision manufacturing, necessitating vast quantities of coated cutting tools and wear components. The APAC region is also witnessing significant investment in domestic aerospace and defense capabilities, further stimulating the demand for high-performance TaC coatings to improve component longevity and operational reliability in mission-critical systems. This region’s growth is underpinned by competitive pricing structures and rapid technology adaptation, often sourcing specialized equipment from European and North American suppliers.

North America maintains a leading position in the high-value, stringent specification segments, particularly aerospace, defense, and specialized energy applications. The market here is driven by substantial research and development budgets, strict military and Federal Aviation Administration (FAA) certifications, and a continuous push for advanced material solutions to optimize performance in next-generation platforms, including commercial airliners and highly advanced military hardware. The U.S. market, in particular, showcases high demand for TaC in critical components for turbine engines and in the evolving nuclear energy sector (e.g., small modular reactors, or SMRs). European countries, including Germany, Switzerland, and Sweden, serve as pivotal technological hubs, hosting key players in coating equipment manufacturing and providing highly specialized coating services. Europe's market growth is propelled by its strong automotive sector’s pivot toward electric vehicles (EVs) and its robust general engineering industry, demanding wear-resistant solutions to improve component efficiency and extend operational life in complex machinery.

The Middle East and Africa (MEA) and Latin America (LATAM) are emerging markets, currently contributing a smaller but rapidly increasing share to the global TaC market. Growth in the MEA region is closely linked to its large investments in the oil and gas sector, where TaC coatings are employed to protect drilling equipment, pipelines, and processing machinery from extreme abrasion and corrosive environments inherent to hydrocarbon extraction and processing. Latin America's demand is spurred by the growth of regional automotive manufacturing and the increasing sophistication of general industrial manufacturing, particularly in Brazil and Mexico. Across all regions, the trend is moving toward localized coating facilities to reduce logistics costs and improve turnaround times, a critical factor for maintaining the efficiency of high-throughput manufacturing operations.

- Asia Pacific (APAC): Dominates consumption driven by electronics, large-scale automotive manufacturing, and significant investment in cutting tool production; characterized by competitive landscape and rapid industrialization.

- North America: Focus on high-reliability, premium applications in Aerospace, Defense (military and commercial aviation), and specialized Medical devices; high expenditure on R&D and strict regulatory compliance.

- Europe: Leading technology development in coating equipment (CVD/PVD); strong demand from advanced automotive (EV transition) and high-precision industrial machinery sectors, emphasizing sustainable coating practices.

- Middle East & Africa (MEA): Growing segment primarily fueled by large-scale oil, gas, and petrochemical projects requiring superior corrosion and abrasion resistance for capital equipment.

- Latin America (LATAM): Steady growth linked to localized automotive production and increasing industrial component refinement, focusing on basic wear part enhancement and tooling longevity.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the TaC Coating Market.- Oerlikon Balzers (Oerlikon Group)

- IHI Hauzer Techno Coating

- Sulzer Metco (Oerlikon Group)

- VDM Metals

- Plansee Group

- Advanced Ceramics Manufacturing

- H.C. Starck Solutions

- Praxair Surface Technologies (Linde)

- Höganäs AB

- A&B Surfaces

- Materion Corporation

- Bodycote PLC

- Eurocoating S.p.A.

- Saint-Gobain Ceramic Materials

- CemeCon AG

- KOBELCO (Kobe Steel Group)

- Kurt J. Lesker Company

- Nippon Tungsten Co., Ltd.

- CeramTec GmbH

- GuoChuang High-Tech (GCHT)

Frequently Asked Questions

Analyze common user questions about the TaC Coating market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary performance advantages of Tantalum Carbide (TaC) coatings over conventional ceramics?

TaC coatings offer superior thermal stability, maintaining structural integrity and ultra-high hardness at temperatures exceeding 1,000°C, combined with exceptional chemical inertness and extreme resistance to erosion and abrasive wear, particularly crucial in high-speed cutting applications and aerospace hot sections.

Which deposition technology is most effective for applying TaC coatings to complex internal geometries?

Chemical Vapor Deposition (CVD) is generally considered the most effective method for coating complex internal geometries due to its gas-phase nature, which ensures excellent throwing power and high conformality, resulting in a dense, uniform, and tightly adhered TaC film even on intricately shaped substrates.

How does the volatile price of Tantalum metal affect the overall TaC coating market economics?

The high and often volatile price of Tantalum, a critical raw material, increases the production cost of TaC coatings, serving as a significant restraint. Manufacturers mitigate this by optimizing deposition efficiency, utilizing precursor recycling techniques, and focusing on high-value, performance-critical applications where the added material cost is justified by enhanced component lifespan and reliability.

What role does the aerospace and defense sector play in driving the demand for TaC coatings?

The aerospace and defense sector is a crucial driver, requiring TaC coatings for components exposed to extreme friction and high operational temperatures, such as turbine engine parts and thermal management systems, where the coating's ability to resist thermal shock and oxidation directly improves engine efficiency and ensures safety under severe operating conditions.

Are TaC coatings used in the medical device industry, and if so, for what purpose?

Yes, TaC coatings are utilized in the medical device industry, primarily due to their biocompatibility, high hardness, and corrosion resistance. They are applied to orthopedic implants, surgical instruments, and wear components within medical robotics to significantly extend their service life and maintain functionality in the human body environment.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager