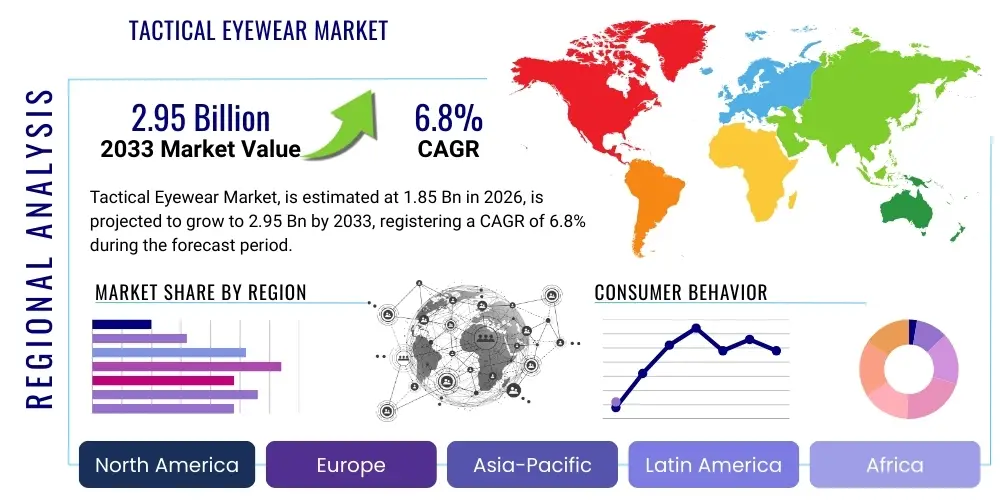

Tactical Eyewear Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443081 | Date : Feb, 2026 | Pages : 246 | Region : Global | Publisher : MRU

Tactical Eyewear Market Size

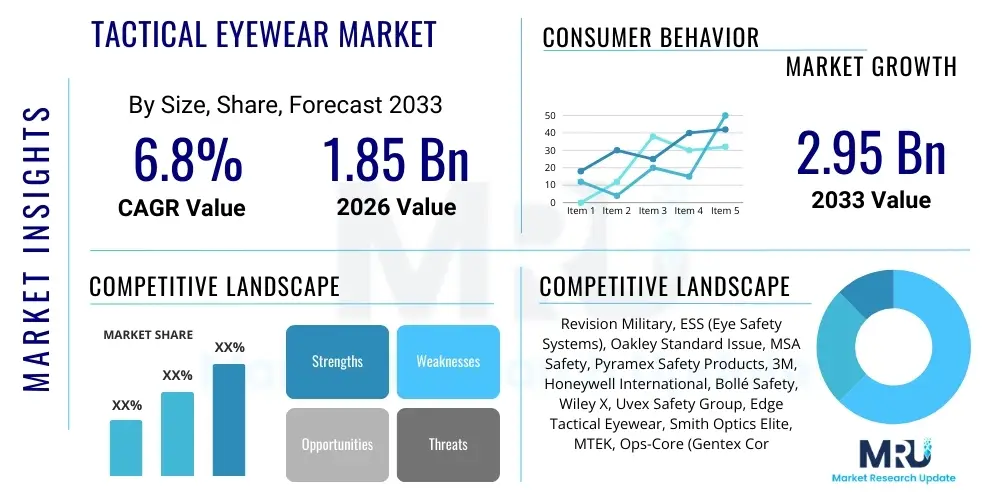

The Tactical Eyewear Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 1.85 Billion in 2026 and is projected to reach USD 2.95 Billion by the end of the forecast period in 2033. This consistent growth trajectory is primarily fueled by increasing global defense expenditures, heightened demand for superior ballistic protection among military and law enforcement personnel, and continuous technological advancements in material science focused on enhancing durability and visibility in extreme operational environments.

The imperative for personal protective equipment (PPE) meeting stringent military and industry standards, such as ANSI Z87.1+ and MIL-PRF-32432A, is driving market expansion across developed and emerging economies. Furthermore, the rising awareness among armed forces about the long-term debilitating effects of ocular injuries sustained during combat or training exercises mandates the adoption of high-performance tactical eyewear. Manufacturers are increasingly integrating features like anti-fog coatings, interchangeable lens systems, and compatibility with night vision devices (NVDs) and helmets to meet these complex operational requirements, positioning the market for sustained, robust growth over the forecast horizon.

Tactical Eyewear Market introduction

The Tactical Eyewear Market encompasses specialized protective gear, including goggles, spectacles, and ballistic visors, designed to shield the eyes from hazards encountered in high-risk operational settings, primarily military, law enforcement, and specialized industrial or tactical sports environments. These products are fundamentally characterized by their extreme durability, high impact resistance against fragmentation and projectiles, and advanced optical clarity necessary for mission success. Major applications span combat operations, training exercises, riot control, and critical infrastructure protection, where eye safety is non-negotiable. The primary benefits include preventing severe ocular trauma, reducing glare, filtering harmful UV radiation, and providing unimpaired visual acuity under dynamic conditions. Key driving factors accelerating market demand include the modernization programs of global militaries, the escalating frequency of internal security threats necessitating specialized equipment for police forces, and mandatory adoption policies set by national defense organizations.

Tactical eyewear differentiates itself from conventional safety glasses through its adherence to rigorous military performance standards, emphasizing resistance to high-velocity impacts, known as ballistic protection. Product designs often incorporate ergonomic features for prolonged wear, such as adjustable straps, cushioned frames, and ventilation systems to combat lens fogging. The market is witnessing a strong shift towards modular systems that allow users to quickly adapt lens tints and protection levels based on mission profiles and environmental light conditions. This adaptability, coupled with continuous material innovations like Trivex and high-grade polycarbonate, underpins the core value proposition of tactical eyewear in safeguarding the visual capability of elite personnel globally.

Tactical Eyewear Market Executive Summary

The Tactical Eyewear Market is undergoing transformative growth driven by geopolitical instability and the subsequent surge in defense spending, particularly across North America and Asia Pacific. Business trends indicate a strong move toward lightweight materials, smart integration capabilities, and enhanced ergonomic designs to improve user comfort during extended deployment. Key manufacturers are focusing on mergers, acquisitions, and strategic partnerships with defense contractors to secure long-term government procurement contracts. Furthermore, sustainability in material sourcing and manufacturing processes is emerging as a niche, yet influential, trend, appealing to environmentally conscious defense organizations.

Regionally, North America maintains market dominance due to the robust procurement activities of the U.S. Department of Defense (DoD) and advanced technological innovation hubs focused on military-grade protection. However, the Asia Pacific region is projected to exhibit the fastest CAGR, propelled by military modernization initiatives in India, China, and South Korea, coupled with significant investments in domestic manufacturing capabilities to reduce reliance on Western suppliers. European markets are characterized by stringent regulatory compliance (e.g., CE marking) and a high demand for specialized tactical eyewear for counter-terrorism units and border security forces.

Segment trends reveal that the Goggles segment, offering superior coverage and sealing against dust and debris, remains the largest revenue contributor, especially within military applications. Concurrently, the Spectacles segment is experiencing rapid adoption due to its versatility, low-profile design, and suitability for non-combat roles and law enforcement activities. The Material Science segment highlights the increasing preference for high-grade polycarbonate and proprietary anti-scratch/anti-fog coatings, as performance enhancement features directly correlate with mission effectiveness and product lifespan, thereby influencing procurement decisions across all major end-user groups.

AI Impact Analysis on Tactical Eyewear Market

User queries regarding the impact of Artificial Intelligence (AI) on tactical eyewear often center on three critical themes: integration of smart capabilities, enhanced threat assessment, and optimization of manufacturing processes. Users frequently ask if AI can enable eyewear to detect and highlight threats in real-time, how machine learning (ML) algorithms improve ballistic material testing, and whether predictive maintenance for protective coatings is feasible. The analysis confirms that AI is beginning to transform tactical eyewear beyond passive protection into active, data-driven systems. AI/ML algorithms are being employed in advanced materials research to simulate ballistic performance and identify optimal composite structures faster than traditional testing, leading to stronger, lighter, and more compliant products. Furthermore, integration with augmented reality (AR) systems, powered by AI, is enabling heads-up displays (HUDs) that provide real-time situational awareness, navigation data, and facial recognition overlays, effectively making the eyewear a sophisticated information platform.

In the realm of operational enhancement, AI-driven sensor fusion within tactical eyewear is crucial for optimizing visibility under extreme conditions. For instance, ML models can rapidly analyze light input, contrast levels, and environmental factors (smoke, fog) to dynamically adjust lens tint or enhance digital vision feeds, ensuring optimal visual performance without manual intervention. This level of automation significantly reduces cognitive load on the wearer during critical moments. Moreover, AI is instrumental in quality control during the manufacturing phase, utilizing computer vision systems to detect microscopic flaws in lens coatings or frame integrity that could compromise ballistic protection standards, thereby guaranteeing the reliability of the final product and reducing manufacturing waste.

The long-term impact of AI integration points towards the development of truly "smart" tactical eye protection capable of independent decision-making regarding data presentation and protective measures. This includes features like automated identification of laser threats and instantaneous activation of protective filters, or personalized visual corrections based on the individual wearer's physiological data and fatigue levels, tracked via integrated biometrics. While currently nascent, the trajectory suggests AI will be foundational to the next generation of mission-critical personal protective equipment, moving tactical eyewear from a static safety device to a dynamic, interconnected intelligence node on the battlefield.

- AI-driven Predictive Material Testing: Machine learning optimizes composite structures for superior ballistic resistance and lighter weight.

- Enhanced Situational Awareness (AR Integration): AI powers heads-up displays for real-time data overlays, navigation, and threat identification.

- Dynamic Lens Optimization: Algorithms analyze environmental conditions (light, fog, smoke) to automatically adjust lens parameters for optimal clarity.

- Manufacturing Quality Control: Computer vision systems detect microscopic defects in coatings and materials, ensuring compliance with military standards.

- Automated Threat Detection: AI enables instantaneous response mechanisms, such as automatic filtering against laser dazzle and infrared threats.

- Integration with Biometrics: ML algorithms personalize visual feedback and track user fatigue based on integrated physiological sensors within the frame.

DRO & Impact Forces Of Tactical Eyewear Market

The Tactical Eyewear Market is significantly influenced by a confluence of accelerating drivers (D), persistent restraints (R), emerging opportunities (O), and critical impact forces (F). Primary drivers include the continuous escalation of global security concerns, leading to increased defense and homeland security budgets dedicated to equipping personnel with advanced PPE, especially high-performance ballistic eye protection. Mandatory safety regulations instituted by NATO, the U.S. DoD, and various international law enforcement agencies enforce the continuous replacement and upgrade cycles of compliant tactical gear. This demand is further amplified by technological progress in materials science, offering lighter, tougher, and more optically precise solutions than previous generations.

Conversely, the market faces restraints such as the high initial cost associated with specialized manufacturing processes and materials (like proprietary anti-fog coatings and high-impact polycarbonate), which can limit adoption in budget-constrained developing nations. Counterfeiting and the proliferation of non-compliant, low-quality products pose a significant risk, jeopardizing user safety and eroding consumer trust in certified products. Furthermore, the complexities involved in achieving universal compatibility across diverse helmet systems, night vision devices, and respiratory protection apparatus present ongoing design and engineering challenges that necessitate complex and costly R&D efforts, sometimes slowing down market penetration of new designs.

Significant opportunities arise from the increasing adoption of tactical gear within the civilian and tactical sports markets (e.g., shooting, airsoft, professional hunting), creating a large, untapped commercial segment for high-quality, military-derived protective eyewear. The rise of integrated digital systems and Augmented Reality (AR) in military command structures offers manufacturers the chance to evolve traditional eyewear into smart visual interfaces, generating substantial revenue streams through high-value electronics integration. The impact forces are generally high, driven by geopolitical risk assessments and the rapid deployment of new military technologies, which force the eyewear market to innovate rapidly to keep pace with evolving threats, such as sophisticated laser weapons and advanced fragmentation munitions.

Segmentation Analysis

The Tactical Eyewear Market is systematically segmented based on Product Type, Application, and Distribution Channel, reflecting the diverse needs of end-users across high-risk environments. The analysis of these segments is crucial for understanding market dynamics, target audience purchasing patterns, and identifying high-growth niches. Product type segmentation delineates the specific protective form factors required, ranging from full-sealing goggles to streamlined spectacles, each optimized for different operational contexts and threat levels. Application segmentation distinguishes the primary end-users—Military, Law Enforcement, and Civil/Tactical—each possessing unique regulatory compliance requirements and performance expectations, which directly influence product specification and pricing strategies.

The market analysis reveals that the effectiveness of the segmentation lies in the detailed breakdown of protective features. For instance, within the Product Type segment, ballistic goggles are often mandatory for harsh combat conditions where comprehensive perimeter protection against dust, wind, and impact is required, while spectacles are favored for perimeter security and training due to their lighter weight and ease of integration with everyday clothing. Furthermore, the distribution channel segmentation highlights the critical role of direct government procurement contracts versus commercial retail and online sales in reaching different end-user groups. Understanding these segmented demands allows manufacturers to tailor marketing efforts and R&D investments effectively, ensuring the development of products that meet specific, mission-critical needs globally.

- By Product Type:

- Tactical Goggles (High coverage, dust/debris sealing, primary military use)

- Tactical Spectacles (Lightweight, versatile, primarily law enforcement and training use)

- Ballistic Visors (Integrated into helmets, specialized use like EOD or vehicle crews)

- By Application:

- Military & Defense (Combat, Special Forces, Training)

- Law Enforcement & Security (Riot Control, Patrol, SWAT Teams)

- Civilian/Tactical Sports (Professional Shooting, Airsoft, Hunting)

- By Distribution Channel:

- Direct Government Procurement (High-volume contracts)

- Retail & Specialized Dealers (Commercial sales to individual operators)

- Online Sales (E-commerce platforms)

- By Material:

- Polycarbonate (Standard ballistic protection)

- Trivex (Enhanced optical clarity and lightweight)

- Proprietary Composites (Specialized high-impact materials)

Value Chain Analysis For Tactical Eyewear Market

The value chain for the Tactical Eyewear Market begins with upstream activities centered on raw material procurement, primarily focusing on advanced optical-grade polymers such as high-density polycarbonate and Trivex, along with specialized anti-fog and scratch-resistant coatings. Key upstream challenges involve maintaining strict material quality to ensure ballistic compliance (e.g., meeting MIL-PRF standards) and securing reliable sources for proprietary chemical formulations necessary for coating technologies. This stage is highly capital-intensive, requiring advanced polymer science expertise and specialized molding equipment to create lenses that offer distortion-free vision under extreme stress. Strategic partnerships between eyewear manufacturers and chemical material suppliers are crucial at this initial stage to control costs and guarantee material performance integrity.

The midstream phase involves manufacturing, assembly, and testing. Production includes precision injection molding of lenses and frames, application of specialized coatings in controlled environments, and rigorous quality control testing (e.g., ballistic impact tests, optical clarity measurements). Downstream analysis focuses on distribution and sales. The distribution channel is segmented into direct sales to governmental entities (military and defense contracts), which usually involve high volume and lengthy procurement cycles, and indirect sales through authorized distributors, specialized tactical retailers, and e-commerce platforms catering to law enforcement and civilian users. Direct channels emphasize compliance and logistics management, while indirect channels focus on marketing, branding, and immediate availability of certified products.

The efficiency of the value chain is highly dependent on managing inventory effectively, especially for specialized products requiring country-specific certifications. Manufacturers must maintain traceability throughout the process, from raw material batch numbers to final product packaging, given the critical safety nature of the product. The strong reliance on stringent international military and safety standards means that certification costs and compliance audits form a significant part of the value chain expenditure. This complex structure necessitates a robust supply chain management system capable of handling both large-scale, long-term government contracts and flexible, high-turnover commercial retail demands.

Tactical Eyewear Market Potential Customers

The primary customer base for tactical eyewear is dominated by official governmental and institutional entities, including various branches of the military, such as army infantry, air force ground crews, and naval special operations units, which procure vast quantities through centralized defense budgets. Law enforcement agencies, spanning local police, state troopers, specialized SWAT teams, and border patrol organizations, represent another critical institutional buyer, focusing on protection against non-ballistic hazards, riots, and fragmentation from flashbangs. These institutional customers prioritize products that demonstrate proven compliance with rigorous military standards, possess high durability, and offer seamless compatibility with existing combat and protective gear, ensuring interoperability during complex missions.

A rapidly expanding segment of potential customers includes specialized security contractors and private military companies (PMCs) operating in high-risk zones globally. These entities often operate under commercial procurement rules, offering manufacturers a faster sales cycle compared to traditional government contracts. Furthermore, the civilian market segment comprises competitive shooters, professional hunters, and enthusiasts participating in tactical simulation sports (like MilSim or airsoft). While their primary requirement is generally slightly lower than military standards, they still seek high-quality, ANSI Z87.1+ certified eyewear, driven by a preference for products derived from military specifications due to their perceived superiority in performance and resilience.

The purchasing decisions of these end-users are intrinsically linked to operational requirements and threat assessments. Military buyers demand MIL-PRF-32432A compliance for fragmentation protection, mandatory anti-fog features for extreme environments, and robust frame designs. Law enforcement buyers often prioritize quick-release mechanisms and compatibility with gas masks and riot gear. For all institutional buyers, brand reputation, warranty service, and the ability to fulfill large, multi-year supply contracts are major determining factors. Successful engagement requires manufacturers to deeply understand the specific tactical doctrines and threat environments faced by each distinct customer group.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.85 Billion |

| Market Forecast in 2033 | USD 2.95 Billion |

| Growth Rate | CAGR 6.8% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Revision Military, ESS (Eye Safety Systems), Oakley Standard Issue, MSA Safety, Pyramex Safety Products, 3M, Honeywell International, Bollé Safety, Wiley X, Uvex Safety Group, Edge Tactical Eyewear, Smith Optics Elite, MTEK, Ops-Core (Gentex Corporation), Tifosi Optics, Fobus International, Valken Tactical, Z87 Safety Gear, Kimber Tactical, Voodoo Tactical |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Tactical Eyewear Market Key Technology Landscape

The technological evolution of the Tactical Eyewear Market is primarily concentrated on three critical areas: advanced materials science, coating technologies, and digital integration. Material innovation focuses on producing lenses that not only meet extreme ballistic resistance standards (such as U.S. MIL-PRF-32432A for fragmentation) but also provide exceptional optical clarity without distortion, essential for precision tasks. High-grade polycarbonate remains the industry standard due to its balance of impact resistance and cost, but newer materials like Trivex are gaining traction, offering superior clarity and lower specific gravity, reducing user fatigue. Frame technologies incorporate proprietary polymers designed for high impact absorption and chemical resistance, coupled with ergonomic designs that distribute pressure evenly across the face.

Coating technology represents a vital battleground for differentiation, primarily through anti-fog and anti-scratch applications. Fogging remains one of the greatest operational impediments, particularly in high humidity or rapid temperature changes. Manufacturers utilize sophisticated hydrophobic and hydrophilic chemical treatments, often paired with advanced ventilation systems in goggles, to maintain clear vision. Furthermore, hard coatings based on advanced ceramics or siloxane compounds dramatically increase resistance to scratching and abrasion, extending the service life of expensive tactical lenses. Specialized coatings for glare reduction and enhanced contrast in low-light conditions are also increasingly demanded by military and special forces units.

The newest technological frontier involves the integration of smart electronics. This includes miniaturized sensors, heads-up display (HUD) technology, and connectivity modules compatible with military communication networks. These smart capabilities transform the eyewear into a visual communication and information tool, projecting mission-critical data such as GPS coordinates, biometric status, and thermal imagery directly onto the lens periphery. While full-scale AR integration is still developing, the shift towards modular platforms that allow future electronic upgrades highlights the industry's commitment to creating dynamic, multi-functional protective systems capable of adapting to the rapid pace of modern warfare and security operations.

Regional Highlights

North America is the undisputed leader in the Tactical Eyewear Market, commanding the largest market share due to the immense procurement capacity of the U.S. Department of Defense (DoD), Department of Homeland Security (DHS), and various federal and local law enforcement agencies. The region benefits from stringent regulatory environments that mandate the use of MIL-PRF-compliant eyewear for military personnel and ANSI Z87.1+ standards for other governmental security operations. Furthermore, North America houses leading global manufacturers and R&D centers dedicated to ballistic protection, fostering continuous innovation in materials and integration technologies, ensuring that the domestic market receives the latest and most advanced protective gear rapidly. The substantial defense budget allocated for soldier modernization programs further guarantees sustained, high-volume demand.

Europe represents a mature market characterized by diverse national defense procurement strategies and a strong focus on interoperability within NATO forces. Countries such as the UK, Germany, and France are significant contributors, driven by counter-terrorism initiatives and border protection requirements necessitating high-quality tactical spectacles and goggles. European demand is heavily influenced by CE standards and specialized EN standards for protective equipment, often preferring suppliers who can provide customized solutions for different environmental conditions across the continent, from maritime operations to mountain warfare. The integration of advanced features like laser protection filters is a key driver in this region, particularly for units operating sophisticated electronic equipment.

Asia Pacific (APAC) is projected to be the fastest-growing region, fueled by massive military modernization efforts in countries like China, India, and South Korea, which are rapidly upgrading their conventional forces and special operations units. Escalating geopolitical tensions across the South China Sea and the Indian subcontinent necessitate increased spending on personal protective equipment. While price sensitivity remains a factor, the focus is shifting towards domestically manufactured, high-quality, and cost-effective alternatives. The growing number of regional suppliers entering the market, often leveraging technological transfer or joint ventures, is driving rapid market expansion and increasing competitive intensity across the region.

- North America (USA, Canada): Market leader; driven by massive DoD procurement and MIL-PRF standards compliance; focus on advanced smart integration and domestic manufacturing.

- Europe (UK, Germany, France, Italy): Mature market; driven by NATO interoperability, counter-terrorism needs, and adherence to CE/EN standards; high demand for laser protective solutions.

- Asia Pacific (China, India, South Korea, Australia): Fastest growth rate; propelled by military modernization, increasing defense budgets, and rising regional security threats; emerging domestic manufacturing base.

- Latin America (Brazil, Mexico): Moderate growth; driven by internal security needs and police force equipment upgrades; price sensitivity dictates procurement decisions.

- Middle East & Africa (MEA): Significant growth potential in defense sector; driven by regional conflicts and high military expenditure in Gulf Cooperation Council (GCC) countries; emphasis on heat resistance and specialized anti-sand features.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Tactical Eyewear Market.- Revision Military

- ESS (Eye Safety Systems, a subsidiary of Oakley, Inc.)

- Oakley Standard Issue

- MSA Safety

- Pyramex Safety Products

- 3M

- Honeywell International

- Bollé Safety

- Wiley X

- Uvex Safety Group

- Edge Tactical Eyewear

- Smith Optics Elite

- MTEK

- Ops-Core (Gentex Corporation)

- Tifosi Optics

- Fobus International

- Valken Tactical

- Z87 Safety Gear

- Kimber Tactical

- Voodoo Tactical

Frequently Asked Questions

Analyze common user questions about the Tactical Eyewear market and generate a concise list of summarized FAQs reflecting key topics and concerns.What distinguishes tactical eyewear from standard safety glasses?

Tactical eyewear, especially military-grade products, must meet stringent ballistic fragmentation standards (like MIL-PRF-32432A or MIL-V-43511D) involving high-velocity impact resistance, significantly exceeding the requirements of standard industrial safety glasses (ANSI Z87.1+). They also incorporate superior anti-fog/anti-scratch coatings and enhanced optical clarity for mission-critical use.

Which standards are most important for ballistic protection in tactical eyewear?

The most critical standards are the U.S. Military Performance Specification MIL-PRF-32432A (for fragmentation protection) and MIL-V-43511D. For civilian and law enforcement use, the American National Standards Institute (ANSI) Z87.1+ provides the baseline for high-impact protection, but high-end tactical gear typically surpasses this baseline significantly.

How is anti-fog technology improving in modern tactical goggles?

Modern anti-fog technology utilizes advanced hydrophilic chemical coatings that actively absorb moisture rather than allowing it to condense. These are often combined with sophisticated frame ventilation systems and thermal lens designs (double-paned) to regulate the temperature differential and ensure sustained, clear vision in challenging humid or cold environments.

What is the role of Trivex material compared to Polycarbonate in tactical lenses?

Both Trivex and Polycarbonate offer excellent ballistic protection. However, Trivex generally provides superior optical clarity with less distortion and is often lighter than standard polycarbonate. While polycarbonate is widely used and highly cost-effective, Trivex is increasingly utilized in premium tactical eyewear where maximum visual acuity is paramount.

Are smart features, like augmented reality (AR), becoming standard in tactical eyewear?

While full AR integration is not yet standard across all tactical eyewear segments, the trend toward smart features is rapidly accelerating, especially in military and high-tier law enforcement procurement. Manufacturers are focusing on modular systems to integrate miniaturized HUDs and communication sensors, transforming the eyewear into an interconnected digital component of the soldier's overall combat system.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager