Tailoring and Alteration Services Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442493 | Date : Feb, 2026 | Pages : 241 | Region : Global | Publisher : MRU

Tailoring and Alteration Services Market Size

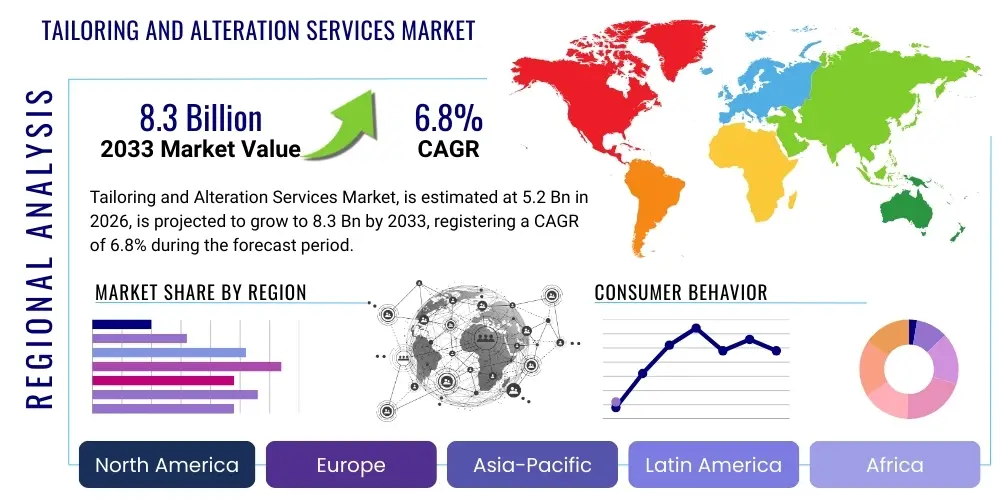

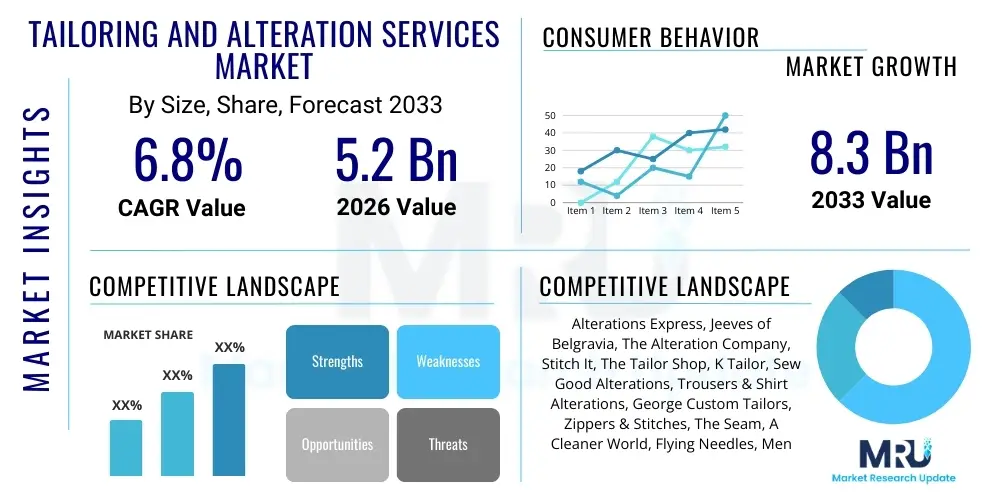

The Tailoring and Alteration Services Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 5.2 Billion in 2026 and is projected to reach USD 8.3 Billion by the end of the forecast period in 2033.

Tailoring and Alteration Services Market introduction

The Tailoring and Alteration Services Market encompasses a wide range of services focused on modifying, repairing, and customizing garments and textile products to ensure optimal fit, extend product lifespan, or align with specific aesthetic preferences. This market is experiencing robust growth driven by the burgeoning popularity of e-commerce, which often results in poorly fitting standardized clothing requiring post-purchase adjustments, and a significant societal shift toward sustainable fashion practices where repairing and reusing garments is prioritized over disposable consumption. The traditional function of tailoring—creating bespoke garments—is merging with modern logistical demands, offering quick, convenient, and technologically assisted alteration services to both individual consumers and large commercial entities, including major retailers and corporate uniform providers. This convergence of craft and convenience is positioning the industry as a vital component of the global apparel lifecycle management.

Key applications of tailoring services extend beyond basic hem adjustments, including complex restyling, resizing vintage wear, garment recovery from minor damage, and specialized custom fittings for formal wear and business attire. Major applications are prominently seen within the luxury retail sector, which mandates precision fitting for high-value items, and the burgeoning rental clothing market, which requires continuous repair and precise adjustment between users. The inherent benefit of these services lies in enhancing customer satisfaction with apparel purchases, promoting longevity of textile investments, and addressing the fundamental human requirement for personalized comfort and presentation. Furthermore, the market is structurally important for brand loyalty, as retailers increasingly rely on seamless fitting services to complete the customer journey, mitigating returns and improving perceived quality.

The primary driving factors fueling this expansion include globalization of apparel production leading to inconsistent sizing standards, the rapid adoption of online shopping platforms, and a strong cultural movement advocating for environmental responsibility through reduced textile waste. Technological advancements, such as digital body scanning and automated cutting systems, are beginning to optimize back-end operations, enhancing efficiency and reducing turnaround times, making professional alterations more accessible and cost-effective for the mass market. This blend of necessity—driven by ill-fitting clothes—and consumer choice—driven by sustainability and desire for unique personalization—solidifies the long-term growth trajectory of the tailoring and alteration sector across all major geographic regions.

Tailoring and Alteration Services Market Executive Summary

The Tailoring and Alteration Services Market is undergoing significant evolution, transitioning from a localized, artisanal trade to a globally integrated service sector characterized by increased professionalization and digital integration. Business trends are dominated by the rise of B2B partnerships, where specialized alteration chains contract with major apparel retailers (both brick-and-mortar and e-commerce giants) to offer seamless post-sale fitting solutions, thereby expanding their service reach far beyond traditional storefronts. Simultaneously, direct-to-consumer models are leveraging mobile apps for booking, digital measurements, and on-demand pickup/delivery services, catering to time-constrained, urban populations. The focus is shifting towards operational efficiency, sustainability certifications, and the implementation of technologies like RFID tracking for complex alteration orders, ensuring reliability and transparency throughout the process. This shift towards enterprise-level service provision indicates a maturation of the market structure.

Regionally, the market presents a dichotomy: mature markets in North America and Western Europe exhibit high consumer spending on alterations, driven primarily by luxury item maintenance and the circular economy initiatives, focusing on high-quality repair and restyling. These regions are characterized by a high penetration of tech-enabled, high-cost services. Conversely, the Asia Pacific (APAC) region, fueled by rapid urbanization, a surging middle class, and explosive growth in local e-commerce markets, is emerging as the fastest-growing geographical segment. Here, market expansion is primarily driven by affordability, volume of standard alterations, and a cultural affinity for custom-fit traditional and modern apparel. Latin America and the Middle East and Africa (MEA) are developing markets, showing localized growth tied to economic stability and the establishment of formal retail infrastructure, often prioritizing specialized services for formal wear and professional uniforms.

Segmentation trends highlight the increasing demand for complex, major alteration services over minor repairs, signaling that consumers are willing to invest more in preserving and customizing high-value garments. The commercial segment (B2B) is outpacing the individual consumer segment (B2C) in terms of revenue growth, as retailers seek outsourced solutions to manage returns and ensure customer satisfaction with online purchases. Furthermore, the rise of niche segmentation based on specialization—such as services exclusively for denim, leather, or bridal wear—demonstrates market maturity and the consumer demand for specialized expertise. Overall, the market's executive performance is characterized by resilient demand, professional consolidation, and strategic integration with the broader retail ecosystem to address the inherent fit challenges posed by standardized, mass-produced clothing.

AI Impact Analysis on Tailoring and Alteration Services Market

Users frequently inquire whether Artificial Intelligence will render traditional tailors obsolete, focusing on concerns about job security and the viability of bespoke craftsmanship in an increasingly automated world. Common questions revolve around the accuracy and reliability of AI-powered digital measurement tools, specifically "Can AI accurately predict the necessary alterations from just a photograph?" and "How can AI optimize fabric cutting to minimize waste?" The thematic consensus among user concerns centers on balancing the efficiency gains offered by AI—such as faster scheduling, inventory management, and personalized size recommendations—with the crucial human element of subjective fit, texture assessment, and artistic customization. Expectations are high for AI to reduce operational errors and speed up turnaround times, but there remains a strong sentiment that the final, critical assessment of fit must involve skilled human expertise.

The direct impact of AI is primarily concentrated in the pre-alteration and operational efficiency stages, rather than the manual sewing process itself. AI algorithms are significantly enhancing customer acquisition and retention by analyzing purchasing patterns and body metrics to offer highly personalized recommendations, preemptively suggesting potential alterations at the point of sale, which improves conversion rates for retail partners. Furthermore, AI-driven scheduling software optimizes the workload distribution among tailors, predicting demand fluctuations based on seasonal trends, promotional cycles, and historical data, thereby ensuring efficient utilization of specialized labor and reducing bottlenecks, especially during peak formal wear seasons like spring and summer. This optimization directly translates into improved customer experience through faster service delivery.

Moreover, AI is pivotal in supply chain integration for large-scale commercial tailoring operations. Machine learning models analyze defect patterns in mass-produced garments, feeding critical quality control data back to manufacturers, effectively bridging the gap between factory output and end-user fit requirements. This data-driven approach allows alteration services to become consultative partners to retail brands, not just repair services. For instance, AI-assisted visual recognition systems can rapidly categorize garments needing repair or alteration, streamlining the intake process and automatically generating preliminary pricing estimates, contributing to the professionalization and standardization of pricing across different service providers, addressing a key consumer pain point regarding inconsistent costs.

- AI-driven virtual fitting rooms reduce return rates by accurately predicting garment fit prior to purchase.

- Machine learning algorithms optimize cutting patterns, minimizing material waste in custom projects (Sustainable Design).

- Automated scheduling and inventory systems enhance operational efficiency and reduce customer waiting times.

- Digital body scanning and 3D modeling, utilizing AI interpretation, provide highly precise measurements, minimizing human error in initial data collection.

- AI analyzes historical alteration data to improve pricing consistency and service standardization across service locations.

DRO & Impact Forces Of Tailoring and Alteration Services Market

The market dynamics are governed by a complex interplay of strong external drivers and inherent industry restraints, balanced by transformative opportunities. Key drivers include the exponential growth of e-commerce, which necessitates post-purchase adjustments due to lack of physical try-on; the global emphasis on environmental sustainability, promoting repair, reuse, and restyling as part of the circular economy; and increased consumer disposable income coupled with a growing demand for luxury and bespoke apparel customization. These forces collectively push market valuation upwards by ensuring a constant volume of garments requiring professional intervention. However, the market faces significant structural restraints, notably the critical shortage of skilled professional tailors globally, as traditional craftsmanship struggles to attract new generations, and the relatively high cost and time commitment associated with quality alterations compared to the immediate, low-cost appeal of fast fashion replacements. This creates tension between consumer necessity and immediate purchasing convenience.

Opportunities for growth are largely centered on technological integration and expanding service accessibility. Implementing mobile service models, developing franchise networks, and securing long-term B2B contracts with major national and international retailers present scalable avenues for market penetration. The opportunity to leverage 3D body scanning and digital measurement technologies not only addresses the scarcity of specialized labor by streamlining the measurement process but also appeals to a tech-savvy consumer base expecting rapid, accurate service. Furthermore, integrating tailoring services directly into the rental and resale apparel sectors—which require continuous upkeep and adjustment—offers a recession-resilient revenue stream that aligns perfectly with sustainable fashion trends and the shifting landscape of apparel ownership.

The impact forces within the market are predominantly high-to-moderate. The switching cost for consumers is relatively low, but the value derived from a perfect fit is extremely high, creating strong brand loyalty when quality service is achieved (customer stickiness). The primary external force is the regulatory environment promoting textile recycling and waste reduction, which strongly favors alteration services over disposal. The bargaining power of customers is moderate; while they can choose low-cost alternatives, they are often dependent on specialized expertise for complex alterations, limiting their negotiating leverage on specialized pricing. The threat of new entrants is moderate, typically limited to small local shops, but large-scale, tech-enabled startups pose a higher threat due to their ability to raise capital and standardize operations rapidly, leveraging centralized processing facilities and sophisticated logistical networks to offer competitive turnaround times and prices.

Segmentation Analysis

The Tailoring and Alteration Services Market is comprehensively segmented based on the type of service provided, the end-user demographic or commercial application, and the specific material handled. This multi-faceted segmentation helps companies precisely target their marketing and resource allocation efforts, recognizing that the demands of a high-end bridal alteration differ fundamentally from those of a corporate uniform repair contract. Understanding the nuances within these segments is crucial for strategic planning, particularly in identifying which service models—such as mobile vs. physical storefront, or specialized vs. general repair—will yield the highest margins and market share in specific geographic regions. The analysis reveals a pronounced shift toward the commercial segment and major alteration services due to the prevailing challenges in mass-market sizing and the retail sector's necessity to manage customer returns effectively.

- By Service Type:

- Minor Alterations (Hems, Seam Adjustments, Button Replacement)

- Major Alterations (Resizing, Restyling, Complex Garment Reconstruction)

- Custom Tailoring (Bespoke Garments, Made-to-Measure Services)

- Repair Services (Mending, Darning, Specialty Repairs)

- By End-User:

- Individual Consumers (B2C)

- Commercial/Retail (B2B - Partnerships with retailers, rental companies, hotels)

- Corporate/Uniform Providers (Airline, Hospital, Military Uniforms)

- Healthcare and Institutional (Medical scrubs, specialized protective gear)

- By Application/Garment Type:

- Clothing and Apparel (Casual wear, Formal wear, Denim, Outerwear)

- Home Furnishings and Textiles (Drapery, Upholstery, Specialty Linens)

- Accessories and Leather Goods (Bag repair, Strap adjustment, Specialty leather alteration)

- By Operating Model:

- Physical Storefronts/Boutiques

- Mobile/On-Demand Services (Pickup and Delivery)

- In-House Retail Alteration Departments

Value Chain Analysis For Tailoring and Alteration Services Market

The value chain for tailoring and alteration services begins with upstream activities focused on securing high-quality materials and technological infrastructure. Upstream analysis involves the procurement of specialized sewing equipment, high-grade threads, complementary textiles (linings, interlinings), and increasingly, advanced technologies like 3D body scanners and CAD/CAM software for pattern adjustment. The efficiency and quality of these foundational resources directly impact the service provider's capability and profitability. Strong relationships with equipment suppliers that offer reliable maintenance and training are crucial, especially for specialized services like leather or complex bridal alterations, which require proprietary machinery and high-precision tools. A critical challenge upstream is ensuring consistent access to skilled, certified technicians capable of operating and maintaining technologically advanced sewing and measuring apparatus.

The core midstream activity involves the actual service provision: customer intake, precise measurement (manual or digital), detailed technical consultation, pattern adjustment, cutting, and the various stages of sewing and finishing. This stage is where the primary value is added through skilled labor and domain expertise. Operational efficiency here is critical; businesses are increasingly implementing digital workflow management systems to track orders, manage tailor assignments, and ensure stringent quality checks. Successful midstream operations depend heavily on the availability of a skilled workforce and adherence to standardized quality protocols, ensuring that the final output meets or exceeds customer expectations for fit and finish, regardless of whether the order is direct-to-consumer or part of a large commercial contract.

Downstream activities center on distribution channels and customer delivery. Direct distribution involves traditional physical storefronts and bespoke boutiques, relying on high foot traffic and localized reputation. Indirect channels, which are rapidly gaining prominence, involve strategic partnerships with major retailers and e-commerce platforms, where the alteration service provider functions as a fulfillment partner, managing the logistics of pickup, service execution, and final delivery back to the customer. Mobile and on-demand services represent a key innovation in indirect distribution, leveraging sophisticated scheduling software and localized delivery fleets to bring the service to the customer’s doorstep. Optimization of these downstream logistics is essential for scalability, especially in dense urban areas where convenience and rapid turnaround time are paramount competitive differentiators.

Tailoring and Alteration Services Market Potential Customers

Potential customers for tailoring and alteration services span a diverse range of consumers and commercial enterprises, united by the need for precise fit, garment longevity, and personalized style. Individual consumers constitute the largest, most fragmented segment, primarily driven by post-purchase adjustments of ready-to-wear clothing, especially following online purchases where standardized sizing proves unreliable. This group also includes high-net-worth individuals requiring bespoke tailoring and maintenance for luxury items, and consumers focused on sustainability who prioritize repairing and restyling existing wardrobes rather than purchasing new items. Targeting these consumers requires convenience-focused models, such as mobile services and streamlined booking interfaces, emphasizing quality and speed.

The commercial sector represents a significant growth segment, encompassing major apparel retailers, especially those operating high-volume e-commerce platforms. These retailers utilize alteration services as a critical element of their post-sale customer service strategy, reducing product returns and enhancing brand loyalty. Additionally, the corporate uniform sector, including airlines, hospitality groups, healthcare providers, and military organizations, requires large-scale, ongoing alteration and repair services to maintain professional standards and accommodate employee size fluctuations. These B2B clients prioritize operational consistency, volume discounts, and robust logistical capabilities for managing inventory and multi-location pickups and deliveries, often seeking long-term, exclusive service contracts.

Emerging potential customer segments include the booming rental fashion market and the second-hand or vintage apparel industry. Rental companies, which rely on the pristine condition and adjustability of their inventory, require continuous high-quality repair and minor alteration services between rentals. Vintage and resale shops often partner with specialized tailors to restore and adjust unique, high-value garments to modern specifications, appealing to a niche consumer base seeking sustainable and distinctive clothing options. Successfully engaging these varied customer bases requires service providers to offer segmented expertise, from high-volume, standardized processing for corporate accounts to meticulous, specialized craftsmanship for luxury and vintage clientele.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 5.2 Billion |

| Market Forecast in 2033 | USD 8.3 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Alterations Express, Jeeves of Belgravia, The Alteration Company, Stitch It, The Tailor Shop, K Tailor, Sew Good Alterations, Trousers & Shirt Alterations, George Custom Tailors, Zippers & Stitches, The Seam, A Cleaner World, Flying Needles, Mendip Alterations, In-Stitches, Tide Cleaners, M&S Alterations, Love Your Clothes, The Groomsmen Suit Alterations, The Modist. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Tailoring and Alteration Services Market Key Technology Landscape

The technological landscape in the tailoring and alteration market is rapidly evolving, moving beyond traditional hand-held tools toward integrated digital solutions designed to increase measurement precision, streamline workflow, and enhance customer experience. Key technological advancements include 3D body scanning devices and sophisticated photogrammetry applications that allow service providers to capture hundreds of highly accurate body measurements in seconds, minimizing the risk of errors inherent in manual measurement. These digital measurements are instantly fed into Computer-Aided Design (CAD) systems, which automatically adjust existing garment patterns or create new bespoke patterns, optimizing fabric utilization and significantly speeding up the initial preparation phase of complex alterations. This integration of scanning and CAD software is critical for supporting high-volume commercial contracts and ensuring consistency across various service outlets.

Beyond measurement and pattern generation, operational technology is crucial for modern service management. Advanced Point-of-Sale (POS) systems are now integrated with specialized Customer Relationship Management (CRM) software tailored for the alteration industry. These systems manage appointment scheduling, track the status of individual garments using barcoding or RFID tags throughout the alteration process, handle complex pricing structures based on fabric type and complexity, and facilitate automated communication with customers regarding completion and delivery. The adoption of robust inventory management and supply chain software ensures that specialized materials (e.g., custom threads, specific linings) are available precisely when needed, preventing service delays that frustrate customers and disrupt tight operational schedules, particularly for wedding or seasonal formal wear demands.

Furthermore, the emergence of mobile technology platforms is redefining the market’s accessibility. Mobile apps enable customers to book services, arrange for home pickup and delivery, and even submit basic measurements or photographs for preliminary consultation. On the processing floor, sophisticated, specialized sewing machinery, including automated pocket setters, industrial embroidery machines, and computer-controlled buttonholers, enhances the quality and speed of routine tasks, freeing up highly skilled tailors to focus exclusively on complex structural adjustments and unique craftsmanship. These technological investments are essential for scaling the business model beyond single-location operations and meeting the demand for quick turnaround times in the competitive retail ecosystem.

Regional Highlights

- North America: This region holds a dominant share of the market, driven by high consumer spending, a strong influence of fashion trends, and a deeply entrenched culture of post-purchase alteration, particularly in urban centers. The rapid expansion of e-commerce necessitates reliable alteration services to manage fitting issues for online purchases. Market growth is further stimulated by sophisticated B2B partnerships between large alteration chains and national retail brands, focusing heavily on technology adoption like digital measurement tools and on-demand mobile services. Demand is polarized toward specialized, premium alterations for designer and luxury goods.

- Europe: Europe is characterized by a strong emphasis on sustainability and the circular economy, particularly in Western European countries (UK, Germany, France). This region sees substantial growth in repair and restyling services aimed at extending garment life. The European market maintains a high value for traditional bespoke tailoring and craftsmanship, coexisting with new, digitally enabled repair networks. Regulatory initiatives promoting waste reduction further solidify the foundational demand for high-quality alteration and mending services. The luxury segment remains particularly important, demanding extremely high standards of precision and material handling.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing region, fueled by demographic shifts, rising disposable incomes, and explosive growth in local and international retail sectors. The cultural value placed on perfectly fitted garments, especially formal and wedding attire in countries like India and China, drives massive demand for both custom tailoring and complex alterations. While traditional, localized tailors still dominate, the region is rapidly adopting organized, professional service chains and digital booking models to cater to the speed and convenience demanded by the expanding urban middle class.

- Latin America (LATAM): The LATAM market is characterized by localized growth and emerging professionalization. Market expansion is closely tied to the formalization of retail infrastructure and increasing access to international apparel brands. Alteration services are primarily focused on standard fit adjustments and repair, with gradual adoption of B2B models as large retailers enter the region. Economic volatility remains a potential constraint, but the long-term trend points towards increased demand for professionalized, affordable services.

- Middle East and Africa (MEA): Growth in the MEA region is segmented, driven heavily by high-net-worth consumers demanding luxury bespoke services in the Middle East and the need for standardized uniform alteration in large industrial and governmental sectors. In parts of Africa, the market is highly fragmented, yet urban centers are seeing the rise of professional alteration chains catering to the rapidly growing consumer base interested in contemporary fashion and accessible repair services, often prioritizing convenience and quick service turnaround.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Tailoring and Alteration Services Market.- Alterations Express

- Jeeves of Belgravia

- The Alteration Company

- Stitch It

- The Tailor Shop

- K Tailor

- Sew Good Alterations

- Trousers & Shirt Alterations

- George Custom Tailors

- Zippers & Stitches

- The Seam (Technology-focused Platform)

- A Cleaner World

- Flying Needles

- Mendip Alterations

- In-Stitches

- Tide Cleaners (Offering Alteration services)

- M&S Alterations (Retailer-linked Service)

- Love Your Clothes

- The Groomsmen Suit Alterations

- The Modist

Frequently Asked Questions

Analyze common user questions about the Tailoring and Alteration Services market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the current growth of the Tailoring and Alteration Services Market?

The market growth is primarily driven by the exponential expansion of e-commerce, leading to increased demand for post-purchase fit adjustments, and a strong global consumer shift toward sustainable fashion practices that prioritize repairing and extending the life of existing clothing over purchasing new fast fashion items. B2B partnerships with large retailers also fuel expansion.

How is technology, specifically 3D scanning, impacting the traditional tailoring process?

3D body scanning and photogrammetry are revolutionizing the measurement process by providing highly accurate, digital data points instantly. This technology reduces measurement errors, streamlines pattern adjustments via CAD software, and allows tailoring services to scale efficiently, appealing to consumers demanding rapid, consistent service quality.

What are the primary challenges facing the alteration services industry?

The most significant challenges include the severe global shortage of skilled professional tailors due to a lack of vocational interest in younger generations, and the operational difficulty of maintaining fast turnaround times and competitive pricing against the low cost of mass-produced, ready-to-wear clothing.

Which geographical region exhibits the highest growth potential for tailoring services?

The Asia Pacific (APAC) region demonstrates the highest growth potential, fueled by robust urbanization, rapid growth of the middle class with increasing disposable incomes, and high cultural demand for perfectly fitted apparel, supported by fast-growing local and international e-commerce penetration.

Are alteration services shifting towards B2B commercial contracts or remaining focused on individual consumers?

While individual consumers remain a core segment, the market is increasingly shifting towards high-volume B2B commercial contracts. Strategic partnerships with major apparel retailers, uniform providers, and apparel rental companies offer scalable revenue streams and operational stability, positioning B2B as the fastest-growing revenue segment.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager