Tankless Electric Water Heater Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443339 | Date : Feb, 2026 | Pages : 246 | Region : Global | Publisher : MRU

Tankless Electric Water Heater Market Size

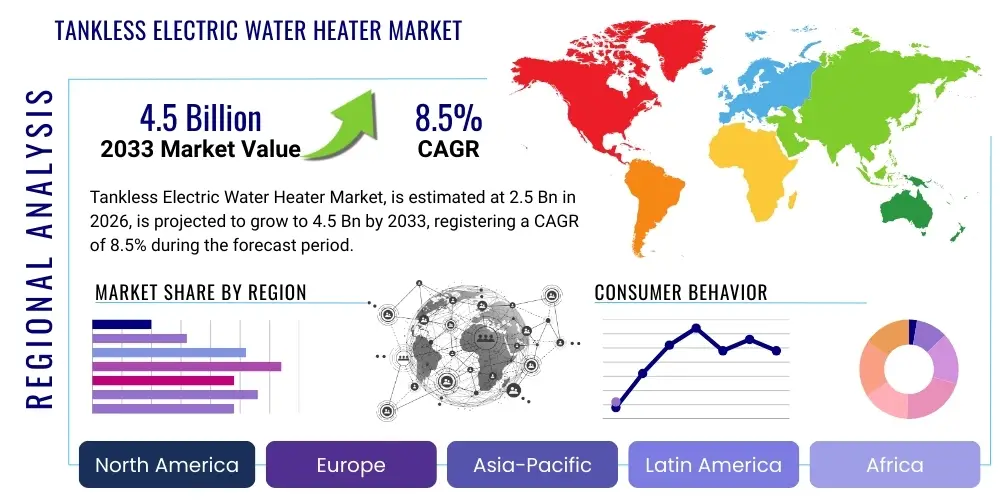

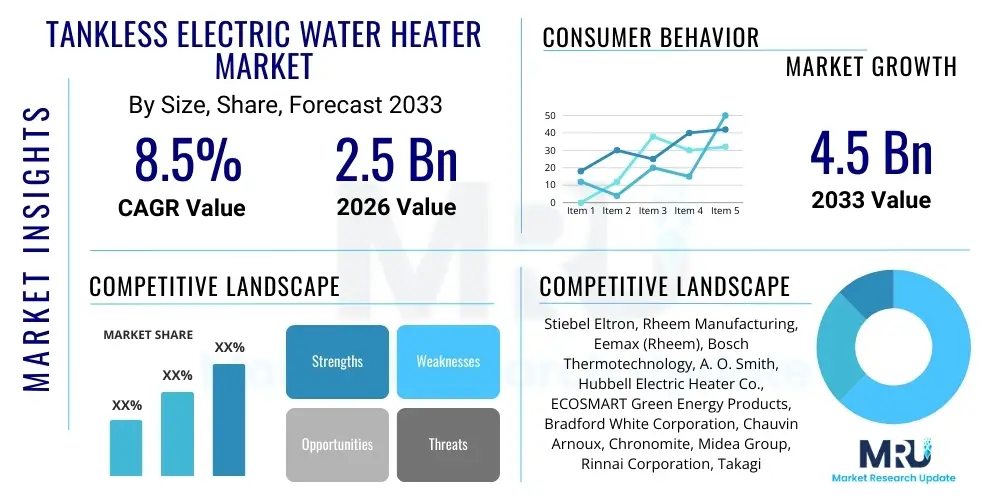

The Tankless Electric Water Heater Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at $2.5 Billion in 2026 and is projected to reach $4.5 Billion by the end of the forecast period in 2033.

Tankless Electric Water Heater Market introduction

The Tankless Electric Water Heater Market encompasses the global sales and distribution of heating systems designed to instantaneously heat water upon demand, eliminating the need for a storage tank. These devices, also known as on-demand or instant water heaters, employ high-power electric resistance heating elements activated by water flow sensors. The core product provides a continuous supply of hot water, contrasting sharply with traditional tank-based systems that are prone to standby heat loss. Key technological advancements center on miniaturization, energy efficiency improvements, and integration of digital controls for precise temperature regulation, making them increasingly viable for both residential and light commercial applications where space saving and energy conservation are paramount.

Major applications of tankless electric water heaters span across residential homes, apartments, small commercial settings like offices and retail spaces, and specialized point-of-use installations such as sinks and auxiliary bathrooms. Their compact design allows for installation directly where hot water is needed, minimizing pipe length and subsequent heat loss during transit. The primary benefits driving consumer adoption include significant energy savings—often quantified as 20% to 50% lower utility bills compared to tank models—a virtually endless supply of hot water, and a longer lifespan due to reduced corrosion risks associated with stored water. Furthermore, their small footprint is crucial for densely populated urban environments and smaller housing units.

Driving factors for this market expansion include stringent global energy efficiency regulations and building codes promoting sustainable infrastructure development. The rising cost of natural gas and growing consumer awareness regarding carbon footprint reduction have accelerated the shift towards electric alternatives, particularly in regions with robust renewable energy grids. Furthermore, continued innovation in heating element technology, flow sensing accuracy, and smart home integration features, allowing users to remotely monitor usage and adjust settings, are making tankless electric models more appealing and accessible to a broader demographic seeking modern, efficient home amenities. Government incentives and rebates supporting the replacement of old, inefficient tank heaters also play a substantial role in market stimulus.

Tankless Electric Water Heater Market Executive Summary

The Tankless Electric Water Heater Market is characterized by robust business trends focusing heavily on product digitalization and enhanced energy efficiency performance ratings. Manufacturers are investing heavily in R&D to develop ultra-compact units with sophisticated microprocessors capable of modulating power consumption in real-time based on fluctuating demand and incoming water temperature, thereby maximizing energy savings and user comfort. Competitive landscapes are shifting as key players establish partnerships with smart home ecosystem providers (e.g., Google Home, Amazon Alexa) to offer seamless integration, transforming the water heater from a passive appliance into an active component of a connected dwelling. Sustainability mandates are also fueling a trend towards modular designs that facilitate easier repairs and material recycling, extending product life cycles and addressing consumer demand for environmentally responsible products.

Regionally, the market exhibits divergent growth profiles. North America and Europe currently represent high-value markets, driven by aggressive replacement cycles for aging infrastructure and strong governmental policies favoring electrification over fossil fuels in residential heating. The Asia Pacific region, however, is projected to demonstrate the fastest growth rate, fueled by rapid urbanization, massive residential construction projects, and increasing disposable incomes in countries like China and India, where consumers are rapidly adopting Westernized, energy-efficient home appliances. Latin America and the Middle East and Africa (MEA) are emerging markets, primarily focusing on point-of-use applications in commercial sectors and high-end residential developments where instantaneous heating is valued for convenience and sanitary reasons.

Segment trends indicate that the point-of-use segment is gaining significant traction, particularly in commercial kitchens, restrooms, and locations requiring auxiliary hot water supply, owing to its superior efficiency in localized demand scenarios. Conversely, the whole-house segment continues to dominate market revenue, especially in developed economies, due to the replacement market and new constructions prioritizing centralized, high-capacity electric heating solutions. In terms of technology, advanced models featuring self-modulating temperature controls and integrated diagnostic systems are commanding premium prices, reflecting consumer willingness to pay for features that reduce operational complexity and enhance long-term reliability. The competitive strategy revolves around securing robust distribution networks, offering comprehensive warranties, and simplifying installation procedures to attract both professional plumbers and DIY enthusiasts.

AI Impact Analysis on Tankless Electric Water Heater Market

Common user questions regarding AI's impact on the Tankless Electric Water Heater Market frequently revolve around predictive maintenance capabilities, dynamic load balancing for peak energy management, and personalization of water temperature profiles. Users are concerned about whether AI integration will lead to increased upfront costs and data privacy risks, but simultaneously express high expectations for systems that can learn household usage patterns to preemptively adjust power draw, thereby optimizing energy consumption and utility costs, particularly during periods of high grid demand. The key themes summarized from user inquiries emphasize energy cost savings through intelligent optimization, enhanced reliability via real-time diagnostics, and seamless integration into existing smart home automation platforms, moving beyond simple scheduling to true adaptive heating control.

- Predictive Maintenance: AI algorithms analyze operational data (flow rates, temperature stability, element resistance) to predict component failure before it occurs, notifying users or service providers for preemptive repairs, drastically reducing downtime and prolonging unit lifespan.

- Dynamic Energy Load Management (DELM): AI dynamically adjusts the unit's heating cycle based on utility pricing signals and forecasted household demand, allowing the heater to shift heavy power usage to off-peak hours or reduce consumption during high-cost peak times, optimizing grid efficiency and consumer billing.

- Personalized Heating Profiles: Machine learning models analyze specific user habits (e.g., shower times, kitchen usage) across different days and seasons, automatically adjusting standby temperatures or flow rates to ensure hot water is instantly available at preferred temperatures without excessive energy expenditure.

- Fault Detection and Remote Diagnostics: AI systems enable sophisticated remote monitoring and troubleshooting, allowing manufacturers to diagnose performance issues, identify inefficient operation patterns, and even push firmware updates remotely, improving service quality and reducing technician visits.

- Optimized Flow and Temperature Modulation: AI enhances the accuracy of temperature regulation by learning the specific characteristics of the plumbing system and incoming water supply, minimizing temperature fluctuations ("cold sandwiches") during multiple simultaneous uses, improving user comfort significantly.

DRO & Impact Forces Of Tankless Electric Water Heater Market

The market dynamics of tankless electric water heaters are shaped by a powerful confluence of drivers and restraining factors, coupled with significant opportunities presented by technological advancements and policy shifts. The primary driver is the pervasive global trend towards energy conservation and governmental mandates focused on sustainable living, compelling consumers and builders alike to choose highly efficient heating appliances over outdated tank systems. Simultaneously, the persistent concern over high upfront installation costs, particularly the potential need for costly electrical panel upgrades to accommodate the high amperage requirements of whole-house electric units, acts as a significant restraint. These high installation barrier costs delay adoption, especially in retrofit scenarios where the existing electrical infrastructure is insufficient. However, the burgeoning opportunity lies in the development of modular and hybrid systems that utilize smaller, decentralized power requirements or integrate renewable energy sources, effectively mitigating the installation cost challenge and widening market accessibility. These impact forces collectively dictate the market trajectory, favoring innovative solutions that address both efficiency gains and infrastructural limitations.

Drivers contributing substantially to market expansion include favorable legislation such as tax credits and rebates for energy-efficient upgrades, particularly in regions like the European Union and certain US states, which incentivizes immediate consumer action. The inherent advantages of unlimited hot water supply and the considerable space savings offered by tankless designs are also powerful consumer attraction points, especially in increasingly compact urban housing. Furthermore, the enhanced durability and reduced maintenance requirements compared to tank heaters—which often accumulate sediment and suffer corrosion—make tankless units a compelling long-term investment. These systemic benefits reinforce the value proposition of tankless electric heaters, ensuring sustained demand across residential and light commercial sectors.

Conversely, beyond the initial cost constraint, market growth is often hampered by limitations in flow rate capacity for simultaneous, high-demand applications, occasionally resulting in insufficient hot water supply if the unit is undersized for the household’s peak demand. Consumer perception, often based on early-generation models, regarding the necessity of specialized, high-capacity wiring also restrains rapid uptake. Despite these hurdles, substantial opportunities exist in the commercial sector for highly reliable, redundant point-of-use systems, as well as in integrating tankless electric heaters with solar photovoltaic systems and smart grid technologies to maximize energy independence and grid interaction. Leveraging advanced diagnostics and IoT connectivity also opens new revenue streams related to subscription-based maintenance services, solidifying the market's long-term commercial viability.

Segmentation Analysis

The Tankless Electric Water Heater Market is systematically segmented based on application type, capacity, end-user industry, and distribution channel, providing a granular view of specific market dynamics and consumption patterns. This detailed categorization helps manufacturers tailor product offerings and marketing strategies to specific demand pockets. The segmentation by application, dividing the market into whole-house and point-of-use models, remains the most critical axis, reflecting significant differences in power requirements, installation complexity, and target consumer demographics. Whole-house units require higher amperage and sophisticated temperature controls to manage multiple fixtures simultaneously, while point-of-use models are compact, requiring minimal installation adjustments but are restricted to single-fixture service. Analyzing these segments is essential for understanding regional market maturity and technological preference.

Further segmentation by capacity (e.g., less than 6 GPM, 6–10 GPM, and above 10 GPM) directly correlates with the scale of the intended usage, distinguishing residential use from heavy-duty commercial applications. End-user segmentation reveals the dominance of the residential sector, driven by new construction and renovation activities, though the commercial sector (including hospitality, healthcare, and educational institutions) is accelerating due to regulations demanding reliable and sanitary hot water access. Distribution channels, split between online retail, specialized plumbing supply stores, and direct sales to builders, illustrate the shift towards digital purchasing platforms offering greater price transparency and direct-to-consumer delivery, although professional installers still prefer specialized wholesale channels for technical support and bulk purchasing. Understanding these segments allows for strategic capacity planning and targeted supply chain optimization.

- By Application:

- Whole-House Tankless Electric Water Heaters

- Point-of-Use (POU) Tankless Electric Water Heaters

- By Capacity (Gallons Per Minute - GPM):

- Less than 6 GPM (Primarily POU and small apartments)

- 6 GPM to 10 GPM (Standard whole-house residential)

- Above 10 GPM (Large residential or light commercial)

- By End-User:

- Residential Sector (Single-family, Multi-family)

- Commercial Sector (Hospitality, Offices, Healthcare, Retail)

- By Distribution Channel:

- Plumbing and HVAC Wholesale Distributors

- Retail Stores (Home Improvement Chains)

- E-commerce Platforms and Online Sales

- Direct Sales to Builders and Contractors

Value Chain Analysis For Tankless Electric Water Heater Market

The value chain for the Tankless Electric Water Heater Market begins with upstream activities centered around the procurement and processing of specialized raw materials, primarily focusing on advanced heating element components (like nickel-chromium alloys or specialized copper elements), corrosion-resistant casing materials (plastics or stainless steel), and high-precision electronic control boards (PCBs, microcontrollers, and flow sensors). Key upstream challenges involve maintaining a stable supply of high-grade copper and ensuring the quality and reliability of sophisticated electronic components, which are often sourced from specialized global suppliers. Efficiency and innovation at this stage directly influence the final product’s performance rating, durability, and manufacturing cost. Strategic partnerships with reliable component manufacturers are critical for mitigating supply chain risks and achieving cost efficiencies in mass production.

Midstream activities involve the design, assembly, and quality control processes undertaken by the core manufacturers. This stage focuses heavily on sophisticated manufacturing techniques, including robotic assembly and rigorous testing to meet global safety standards (e.g., UL, CE markings) and energy efficiency certifications. Manufacturers often seek integration in the supply chain by producing specialized components in-house, such as proprietary flow sensors or heating element configurations, to gain a competitive advantage in efficiency and footprint reduction. Effective logistics management and optimizing inventory levels are crucial midstream considerations, especially given the global nature of both component sourcing and final product distribution, necessitating efficient warehousing and international freight management.

The downstream segment encompasses distribution, installation, sales, and after-sales service. Distribution channels are typically bifurcated into direct channels (selling directly to large residential developers or major commercial contractors) and indirect channels (utilizing plumbing wholesalers, HVAC distributors, and major retail home improvement chains). The installer network—licensed plumbers and electricians—plays a paramount role, as complex electrical installation often dictates product preference. After-sales service, including warranty management and technical support, is a crucial value differentiator, highly impacting consumer satisfaction and brand reputation. Successful downstream strategy requires comprehensive training for installers and reliable inventory management across various retail and wholesale points to ensure product availability.

Tankless Electric Water Heater Market Potential Customers

Potential customers for tankless electric water heaters are diverse, spanning both large institutional buyers and individual homeowners seeking modernization. The primary segment comprises residential homeowners, particularly those undergoing renovation projects, new construction buyers, and owners of high-end or compact urban properties who prioritize energy efficiency, space saving, and continuous hot water supply. These customers are typically sensitive to long-term operational costs and value smart home integration features, looking for premium products with extended warranties. The need to replace aging, inefficient tank heaters often serves as a trigger point for these buyers, driving significant volume in established markets like North America and Europe.

A rapidly growing segment of potential customers includes multi-family housing developers and apartment building owners. For these large-scale buyers, tankless units offer centralized or localized point-of-use solutions that minimize common area space dedicated to utility rooms, reduce the risk of catastrophic tank failure and flooding, and allow for individual billing of hot water usage, aligning with modern building management efficiencies. Commercial end-users, such as hotels, hospitals, and food service establishments, represent high-demand, high-volume potential customers who require consistent, highly sanitized hot water on demand. The health sector, in particular, values the reduction in potential Legionella growth associated with stored water, making tankless electric systems a favored choice for safety and hygiene compliance.

Finally, niche segments include specialized governmental or institutional buyers, such as military bases, university dormitories, and public housing agencies, who are often mandated to meet strict energy performance contracting standards. These institutional buyers focus on durability, minimized long-term maintenance costs, and high-capacity performance. Manufacturers targeting these segments must prioritize technical compliance, robust product testing, and established supplier credibility, often requiring lengthy certification and bidding processes. The emphasis across all customer groups remains on minimizing the total cost of ownership (TCO) over the appliance's lifespan, offsetting the typically higher initial purchase price.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $2.5 Billion |

| Market Forecast in 2033 | $4.5 Billion |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Stiebel Eltron, Rheem Manufacturing, Eemax (Rheem), Bosch Thermotechnology, A. O. Smith, Hubbell Electric Heater Co., ECOSMART Green Energy Products, Bradford White Corporation, Chauvin Arnoux, Chronomite, Midea Group, Rinnai Corporation, Takagi, Titan Tankless, Noritz America. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Tankless Electric Water Heater Market Key Technology Landscape

The core technology landscape of the Tankless Electric Water Heater Market is defined by continuous innovation in heating element materials, flow sensing precision, and the integration of advanced digital control systems. Modern heating elements increasingly utilize self-cleaning or specialized mineral-resistant alloys to combat scaling and sediment buildup, a common challenge in hard water areas, thereby significantly extending the operational lifespan and maintaining efficiency over time. Furthermore, magnetic flow sensors and highly sensitive thermistors have replaced older pressure-activated switches, enabling instantaneous heating activation with minimal flow rates and providing more accurate real-time temperature feedback to the control board. This precision allows for energy modulation and prevents sudden temperature spikes, enhancing user safety and comfort.

A significant technological shift involves the transition toward highly sophisticated electronic temperature control systems. Current generation units employ modulating controls, which use pulse width modulation (PWM) or proportional-integral-derivative (PID) controllers to precisely adjust the power input to the heating elements based on the required temperature rise and measured flow rate. This modulation ensures that the unit only consumes the exact amount of electricity necessary to reach the setpoint, maximizing efficiency and preventing circuit overload. Furthermore, the integration of Wi-Fi connectivity and IoT capabilities is standardizing, allowing for remote monitoring, diagnostic reporting, and seamless integration with broader energy management systems and smart home platforms, offering users unprecedented control over their water heating schedules and energy usage analytics.

Emerging technologies include micro-channel heat exchange designs and sophisticated thermal insulation materials aimed at further reducing residual heat loss and improving overall thermal transfer rates within a smaller physical footprint. Research is also focused on developing true smart grid-ready heaters capable of bidirectional communication with utility providers, allowing the units to automatically participate in demand-response programs during grid stress periods, offering potential financial incentives to the end-user. The emphasis remains on developing reliable, maintenance-free systems that require minimal user intervention while delivering maximum energy savings and sustained, precise performance under varying environmental and usage conditions, ultimately positioning the electric tankless heater as a foundational component of the electrified, sustainable home.

Regional Highlights

- North America (U.S. and Canada): North America is a major revenue contributor, characterized by high consumer awareness regarding energy efficiency and robust governmental incentives (e.g., tax credits, utility rebates) promoting tank replacement. Demand is strong in both retrofit and new construction segments, particularly for high-capacity whole-house models capable of handling high flow rates typical of larger American homes. The market is highly competitive, driven by established international and domestic brands focusing on fast installation and long-term reliability. Regulatory pressures regarding appliance efficiency standards continue to tighten, accelerating the adoption of technologically advanced, modulating electric units.

- Europe (Germany, UK, France, Italy): Europe represents a high-growth market, heavily influenced by strict EU directives promoting decarbonization and phase-outs of fossil fuel-based heating systems. Germany and the UK lead in adoption, driven by strong environmental consciousness and the trend toward compact, high-density housing where space saving is crucial. The market is predominantly focused on point-of-use applications and highly efficient, electronically controlled units designed to optimize performance in varying hard water conditions. Manufacturers must ensure compliance with rigorous CE standards and regional plumbing codes, often focusing on aesthetically pleasing designs that integrate seamlessly into modern interiors.

- Asia Pacific (APAC - China, Japan, India, South Korea): APAC is anticipated to be the fastest-growing region, fueled by unprecedented growth in residential construction and rapid urbanization across major economies like China and India. The rising middle class, coupled with increased disposable income, is driving demand for modern, reliable home appliances. While initial penetration was slow, government support for electrification and improving grid infrastructure are mitigating previous concerns regarding power capacity. Japan and South Korea emphasize sophisticated, highly automated control systems, whereas China and India represent massive volume markets driven by competitive pricing and localized manufacturing capabilities, focusing heavily on basic and mid-range POU models.

- Latin America (Brazil, Mexico): The Latin American market exhibits steady growth, primarily focused on localized or point-of-use applications, particularly in commercial and multi-family residential units where immediate and reliable hot water is valued. Market expansion is closely linked to economic stability and infrastructural improvements. Brazil and Mexico are the key growth engines, where manufacturers are increasingly tailoring units to handle lower, fluctuating incoming water temperatures and pressure variations common in the region. Price sensitivity is higher here, necessitating a focus on value engineering and simplified installation.

- Middle East and Africa (MEA): The MEA region is an emerging market, with adoption concentrated in high-income urban centers, luxury residential developments, and the expanding hospitality sector (hotels and resorts). While gas heaters traditionally dominated, the shift toward electric tankless systems is motivated by energy diversification efforts and the need for highly reliable, low-maintenance units in arid climates. The focus is often on durability against high ambient temperatures and rapid heating capabilities, particularly in the Arabian Gulf countries. South Africa also shows significant potential due to energy efficiency goals and solar integration opportunities.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Tankless Electric Water Heater Market.- Stiebel Eltron

- Rheem Manufacturing

- Eemax (Rheem)

- Bosch Thermotechnology

- A. O. Smith

- Hubbell Electric Heater Co.

- ECOSMART Green Energy Products

- Bradford White Corporation

- Chauvin Arnoux

- Chronomite

- Midea Group

- Rinnai Corporation

- Takagi

- Titan Tankless

- Noritz America

- Marey Heater Corporation

- Kutai Electronics Industry Co., Ltd.

- Reliance Water Heater Company

- Linuo Paradigma

- ThermaFlow Tankless Water Heaters

Frequently Asked Questions

Analyze common user questions about the Tankless Electric Water Heater market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the typical lifespan and maintenance requirement for a tankless electric water heater?

Tankless electric water heaters typically have a lifespan of 20 years or more, significantly longer than standard tank heaters (10-15 years). Maintenance primarily involves periodic flushing (usually annually, depending on water hardness) to remove mineral scale buildup, which ensures optimal heating efficiency and sustained performance over the unit's long service life. Modern units often include self-diagnostic features simplifying maintenance identification.

How much energy can I realistically save by switching from a traditional tank heater to a tankless electric model?

The energy savings from transitioning to a tankless electric model can range from 20% to 50% compared to conventional storage tank models. The highest savings are realized because tankless units eliminate standby heat loss, only drawing power when hot water flow is detected. Actual savings depend on household size, regional climate, and current hot water usage patterns, but are substantial for households using 41 gallons or less per day.

Do tankless electric water heaters require a significant electrical service upgrade in older homes?

Whole-house tankless electric water heaters often require substantial electrical service upgrades, as they typically demand high amperage (100–200 Amps) on a dedicated circuit to heat water instantaneously. This can involve installing a larger circuit breaker panel and heavier gauge wiring, contributing significantly to the initial installation cost. Point-of-use models, however, usually require minimal or no electrical infrastructure modification.

What are the key differences between point-of-use and whole-house tankless electric units?

Point-of-use (POU) units are small, low-capacity heaters installed near a single fixture (like a sink or shower) to provide localized hot water, minimizing transit time and energy loss. Whole-house units are centralized, large-capacity heaters designed to supply the entire dwelling simultaneously, requiring significantly higher power input and flow rate capacity to meet multiple fixture demands efficiently.

Are tankless electric heaters suitable for cold climates or hard water regions?

Yes, modern tankless electric heaters are engineered for cold climates, utilizing advanced modulating technology to effectively heat incoming cold water to the required temperature. In hard water regions, they are suitable, provided the owner implements the recommended maintenance schedule, typically involving more frequent flushing using vinegar or specialized descaling solutions to prevent scale accumulation on the heating elements and ensure long-term efficiency.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager