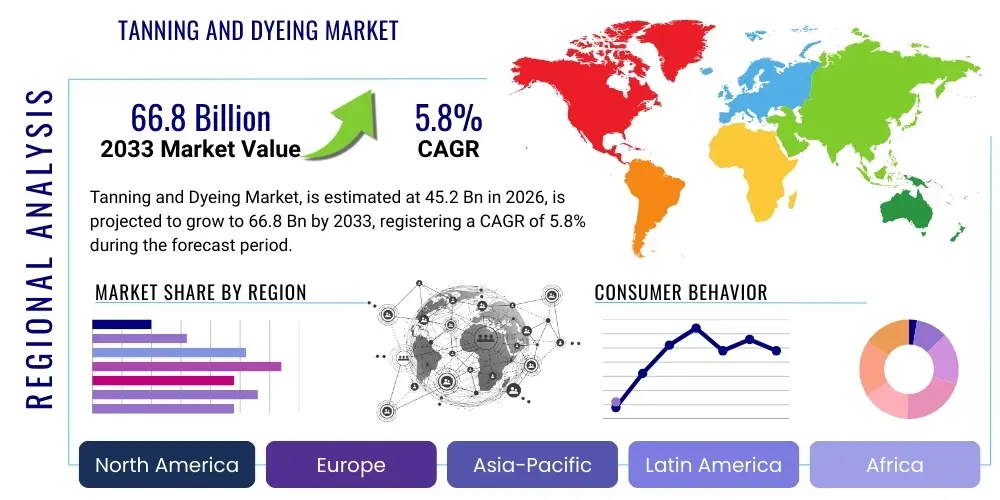

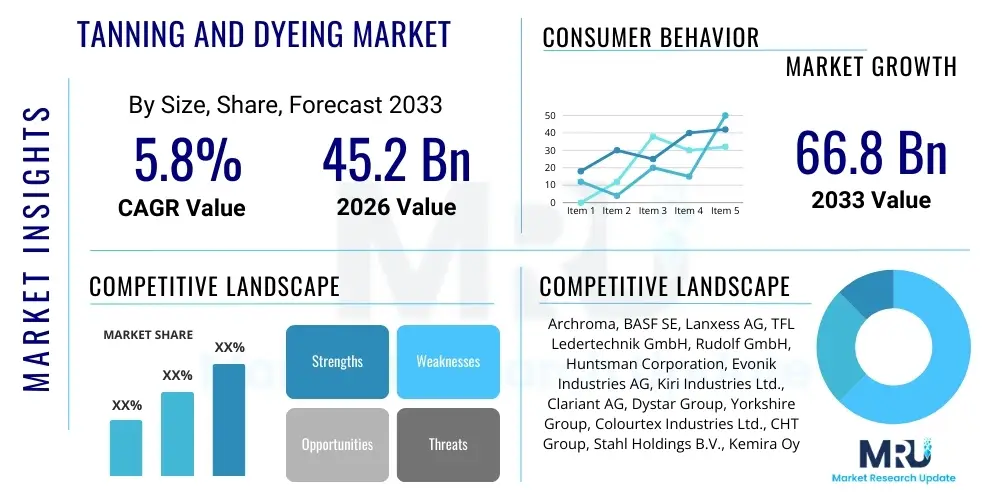

Tanning and Dyeing Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442529 | Date : Feb, 2026 | Pages : 257 | Region : Global | Publisher : MRU

Tanning and Dyeing Market Size

The Tanning and Dyeing Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 45.2 Billion in 2026 and is projected to reach USD 66.8 Billion by the end of the forecast period in 2033.

Tanning and Dyeing Market introduction

The Tanning and Dyeing Market encompasses the global trade and utilization of specialized chemical agents and processes essential for transforming raw hides into durable leather (tanning) and imparting color to textiles, leather, and other materials (dyeing). These processes are fundamental to the textile, apparel, footwear, and automotive industries, providing essential attributes such as durability, aesthetic appeal, and functional characteristics. Tanning, historically reliant on chromium compounds, is rapidly evolving toward sustainable alternatives like vegetable tannins and synthetic organic agents, driven by stringent environmental and health regulations, particularly concerning wastewater discharge and heavy metal toxicity.

Major applications span diverse industries, including high-fashion apparel requiring sophisticated color fastness and texture, automotive interiors demanding high durability and UV resistance, and general consumer goods like footwear and upholstery. The market is characterized by a high degree of technical specialization, where product quality is intrinsically linked to the chemical composition and application methodology. The increasing consumer preference for eco-friendly and sustainably manufactured products is positioning bio-based chemicals and waterless dyeing technologies as key growth areas, compelling established market players to invest heavily in Green Chemistry initiatives.

Key benefits derived from these market activities include enhanced material longevity, aesthetic diversity crucial for competitive product differentiation, and functional improvements such as water repellency and flame resistance. Driving factors for market expansion include the sustained growth of the textile industry in emerging economies, particularly across Asia Pacific; continuous technological advancements in pigment and dye molecule design for improved ecological profiles; and the relentless pressure from global regulatory bodies (like REACH in Europe and ZDHC standards) promoting the phase-out of hazardous substances. These factors necessitate continuous innovation in chemical synthesis and process engineering within the tanning and dyeing ecosystems.

Tanning and Dyeing Market Executive Summary

The Tanning and Dyeing Market is navigating a profound transformation, moving away from conventional, high-effluent processes toward sustainable, resource-efficient methodologies. Current business trends are dominated by consolidation among major chemical manufacturers seeking economies of scale and control over specialized intellectual property, particularly in bio-tanning agents and high-performance, low-impact dyes. Strategic investments are heavily skewed towards research and development aimed at compliance with increasingly severe global regulatory frameworks, especially those restricting the use of Azo dyes, specific heavy metals, and formaldehyde-releasing agents. This focus on sustainability is not merely regulatory; it is a critical competitive differentiator, as brand owners demand certified eco-friendly processing from their supply chain partners, driving the adoption of advanced water treatment and closed-loop systems.

Regionally, the Asia Pacific (APAC) stands as the dominant consumption and production hub, largely due to the concentration of textile manufacturing and leather processing capabilities in countries like China, India, and Vietnam. However, Europe maintains leadership in innovation, driving the adoption of premium, high-performance tanning and dyeing chemicals, primarily due to strict adherence to environmental safety protocols such as the European Union’s REACH regulation. North America and Europe are witnessing a niche market expansion for domestically sourced, ethically produced leather and textiles, which emphasizes low-impact processes and transparent supply chains, although bulk market growth remains centered in APAC due to volume demands from fast fashion and mass manufacturing sectors.

Segmentation trends highlight the rapid expansion of the Synthetic Dyes segment, particularly reactive and dispersed dyes suitable for modern synthetic fabrics and blends, coupled with an escalating demand for natural and bio-based dyes, though their market share remains smaller due to cost and performance limitations. In the tanning segment, chrome tanning, while still widely used due to its cost-effectiveness and performance, faces severe pressure. The most notable shift is toward Wet-White (chrome-free) tanning methods, utilizing titanium or organic syntans, reflecting the industry's commitment to reducing toxic waste streams. The end-use application segments showing the fastest growth are technical textiles (e.g., medical, protective gear) and performance apparel, which require specialized dyeing and finishing agents for enhanced functional properties beyond basic aesthetics.

AI Impact Analysis on Tanning and Dyeing Market

Users frequently inquire about how Artificial Intelligence (AI) can mitigate the high resource consumption and quality inconsistency inherent in traditional tanning and dyeing processes, often questioning its role in optimizing complex chemical formulations and meeting strict environmental standards. Key thematic concerns revolve around the integration cost of AI systems into legacy manufacturing infrastructure, the accuracy of predictive modeling for color matching under varying conditions, and AI’s capacity to revolutionize wastewater management and regulatory compliance reporting. The overarching user expectation is that AI and machine learning will significantly reduce the learning curve for new sustainable chemistries, enabling faster adoption and minimizing batch variation, thereby enhancing overall operational efficiency and sustainability profile.

AI’s influence extends into critical operational areas, offering solutions to challenges previously managed by manual expertise or rudimentary trial-and-error. For instance, sophisticated AI algorithms analyze vast datasets comprising factors like material porosity, water temperature, chemical concentration, and environmental humidity to predict the exact dosing requirements for perfect color yield and uniformity, drastically reducing the need for costly rework and chemical overuse. Furthermore, AI-driven sensor networks monitor effluent streams in real-time, instantly identifying chemical imbalances and optimizing wastewater treatment processes, which is crucial for meeting Zero Discharge of Hazardous Chemicals (ZDHC) mandates. This capability is instrumental in lowering the environmental footprint, which is a key driver for market transformation and a priority for corporate sustainability officers.

The implementation of AI is also accelerating innovation in material science within the sector. Machine learning models are being used to simulate and predict the performance characteristics of novel bio-based tanning agents or natural dye extracts before expensive physical testing, shortening the time-to-market for sustainable chemical alternatives. This predictive capacity allows companies to rapidly adjust their formulations based on changing fiber types or customer specifications, enhancing responsiveness and supply chain resilience. Despite high initial investment barriers, the long-term operational savings associated with reduced chemical waste, energy conservation, and improved product quality make AI a foundational technology for future competitive viability in the tanning and dyeing value chain.

- AI-driven optimization of dyeing recipes leading to precise color matching and reduced chemical usage.

- Predictive maintenance analytics for large-scale dyeing machinery, minimizing downtime and energy waste.

- Machine learning algorithms for real-time monitoring and optimization of wastewater treatment and effluent quality.

- Automated quality control systems using computer vision for detecting leather defects and dyeing irregularities.

- Enhanced supply chain transparency and regulatory compliance tracking via distributed ledger technology integrated with AI data analytics.

- Simulation models for testing new bio-based and chrome-free tanning agents, accelerating sustainable innovation.

DRO & Impact Forces Of Tanning and Dyeing Market

The Tanning and Dyeing Market is subject to complex dynamics driven by shifting consumer preferences for sustainable products, coupled with escalating global regulatory oversight. Key drivers include the robust demand from the fashion and apparel sector, especially in emerging economies, and continuous material science breakthroughs enabling highly efficient and eco-friendly chemical processes. Conversely, the market faces significant restraints, notably the increasing cost of raw materials derived from petrochemicals, the substantial capital expenditure required for advanced effluent treatment plants, and the competitive threat posed by synthetic leather and advanced textile alternatives that require less intensive chemical processing. Opportunities abound in the development of closed-loop water systems, the commercialization of bio-degradable tanning agents (like aldehydes and plant extracts), and the integration of digital technologies for process optimization and supply chain traceability. These factors create potent impact forces, pushing the industry toward a mandatory compliance model centered on reduced toxicity and minimized ecological impact, making sustainability not optional, but essential for survival.

Drivers

The primary driver for the Tanning and Dyeing Market remains the unyielding demand from global end-use industries, particularly fast fashion and high-end automotive leather interiors, which require vast quantities of colored and finished materials. Emerging markets, especially in Asia, are experiencing significant demographic shifts and economic growth, leading to higher disposable incomes and corresponding increased demand for clothing, footwear, and consumer goods, directly fueling the need for dyeing and tanning services. Technological innovation acts as a secondary but powerful driver; continuous advancements in chemical engineering have resulted in dyes with superior color fastness, reduced water solubility, and minimal environmental toxicity (e.g., low-salt reactive dyes), making them more appealing to environmentally conscious manufacturers and enabling compliance with modern standards without sacrificing performance.

Furthermore, the shift toward performance textiles and specialized technical applications contributes substantially to market growth. Materials used in medical textiles, protective wear, and high-performance athletic apparel often require complex finishing and dyeing processes to achieve functional properties such as antimicrobial resistance, UV protection, or moisture-wicking capabilities. This specialization creates premium market segments less susceptible to price volatility and requires specialized, high-value chemical inputs, driving research and development investment within the supply chain. The need for supply chain resilience and diversified sourcing strategies following global disruptions also prompts investments in state-of-the-art facilities capable of handling complex chemical processes efficiently and safely across different geographies.

Restraints

The most significant restraint is the stringent global regulatory environment, particularly mandates concerning water pollution and the restriction of hazardous substances. Regulations such as REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals) in the EU and the ZDHC (Zero Discharge of Hazardous Chemicals) Program impose substantial compliance costs, requiring significant investment in advanced primary, secondary, and tertiary effluent treatment plants. These costs often disproportionately affect small and medium-sized enterprises (SMEs), leading to market consolidation or forced closure, particularly in regions where regulatory enforcement is rigorous. The reliance of the industry on substantial quantities of fresh water and energy also presents a major operational bottleneck in regions facing water scarcity and rising energy prices.

Another key restraint is the cyclical nature of the raw material market, specifically the price volatility of petrochemical derivatives used in synthetic dyes and auxiliary chemicals. Fluctuations in crude oil prices directly impact the production costs of intermediates, creating instability in profit margins for dye and chemical producers. Furthermore, competition from synthetic alternatives, such as advanced polyurethane (PU) or PVC-based leather substitutes and digitally printed textiles, poses a threat by offering lower environmental impact profiles or reduced processing times, attracting customers seeking faster, cheaper, and less chemically intensive solutions, particularly in the mass-market footwear and upholstery segments.

Opportunities

Significant opportunities lie in the accelerating demand for sustainable chemical solutions. The market is ripe for the commercial scaling of bio-tanning agents derived from plant polyphenols (vegetable extracts), enzymes, and bio-based polymers, offering environmentally sound alternatives to conventional chrome tanning. Similarly, the development and mass adoption of innovative dyeing techniques such as supercritical CO2 dyeing (waterless dyeing) and digital textile printing present massive opportunities for resource conservation, drastically reducing water and energy consumption while lowering effluent discharge, appealing directly to sustainability-focused brands like those in the athletic and outdoor apparel sectors.

The integration of digital twin technology and the Industrial Internet of Things (IIoT) offers another powerful opportunity for operational excellence. Implementing IIoT sensors and data analytics allows for real-time monitoring of every stage of the tanning and dyeing process, enabling predictive quality management and dynamic optimization of machine cycles, energy use, and chemical consumption. This level of digitalization enhances process efficiency, minimizes waste, and provides comprehensive data for regulatory audits and sustainability reporting, offering a clear competitive edge to companies that embrace smart manufacturing paradigms. Moreover, the increasing focus on the circular economy creates opportunities for specialized services in recycling and repurposing colored waste materials and developing dyes that facilitate end-of-life recycling processes.

Impact Forces

The primary impact force shaping the market is the regulatory pressure to achieve ZDHC compliance, which mandates the elimination of harmful chemicals from the supply chain. This force drives the entire industry's investment decisions, favoring suppliers who can certify their chemicals are free from restricted substances, and compelling manufacturers to upgrade their facilities. Secondarily, the force of shifting consumer behavior, favoring transparency and ecological accountability, compels brands to enforce sustainability standards throughout their supply network, often resulting in premium pricing structures for certified "green" leather and textile products. Failure to comply with these twin forces of regulation and consumer demand results in loss of market access and severe reputational damage, making them foundational to strategic planning across the value chain.

Segmentation Analysis

The Tanning and Dyeing Market is typically segmented based on the type of chemical used (tanning agents versus dye types), the application material (leather, textile, paper), and the end-use industry (apparel, automotive, industrial). The chemical type segmentation provides insight into the shift from traditional hazardous substances toward sustainable alternatives. The dominance of synthetic dyes highlights the technical requirements of modern textiles for color depth and fastness, while the Tanning Agent segment reveals the crucial transition from chrome to eco-friendly, chrome-free options like vegetable and synthetic tannins. Application and end-use segmentation help identify high-growth niches, such as performance textiles and automotive leather, which demand specialized chemical formulations for extreme durability and specific functional characteristics (e.g., fire resistance, low fogging).

- By Chemical Type:

- Tanning Agents (Chrome-based, Vegetable-based, Synthetic Organic Tanning Agents (Syntans), Aldehydes)

- Dyes (Reactive Dyes, Disperse Dyes, Acid Dyes, Basic Dyes, Sulphur Dyes, Vat Dyes, Natural Dyes)

- Auxiliary Chemicals (Finishing Agents, Pre-treatment Chemicals, Effluent Treatment Chemicals)

- By Application/Substrate:

- Leather (Footwear, Apparel, Upholstery, Automotive)

- Textiles (Cotton, Wool, Silk, Synthetics - Polyester, Nylon)

- Paper & Pulp

- Others (Plastics, Inks)

- By End-Use Industry:

- Apparel & Clothing

- Footwear

- Automotive

- Home Textiles & Upholstery

- Industrial & Technical Textiles

Value Chain Analysis For Tanning and Dyeing Market

The value chain for the Tanning and Dyeing Market begins with upstream activities focused on the sourcing of raw materials, which are predominantly petrochemical intermediates for synthetic dyes and auxiliaries, or natural raw materials (plant extracts, animal hides) for vegetable tannins and raw leather. This upstream phase is highly sensitive to commodity price fluctuations and environmental regulations regarding chemical extraction and synthesis. Key players at this stage include major chemical producers and petrochemical firms that convert crude derivatives into specialized dye intermediates (e.g., anthraquinone, naphthol) and tanning precursors.

Midstream activities involve the production and formulation of the final tanning agents and dye products. This segment is characterized by intensive R&D to develop optimized, high-performance formulations that meet specific customer requirements (e.g., specific color indexes, environmental certifications). Distribution channels are critical, bridging the gap between specialized chemical manufacturers and thousands of geographically dispersed tanneries and textile mills. Distribution is often handled by specialized chemical distributors who provide technical support, inventory management, and ensure compliance with stringent transportation and handling protocols for hazardous materials. Direct distribution models are often employed for large, strategic accounts in the automotive or high-fashion sectors where proprietary formulations and technical consulting are essential components of the service offering.

Downstream activities involve the actual application of the chemicals in textile processing and leather manufacturing, which transforms raw goods into finished products. The efficiency and environmental impact of the entire value chain are ultimately determined at this stage, particularly concerning water usage, energy consumption, and effluent treatment. End-users (e.g., major fashion houses, automotive component suppliers) exert significant influence through demand for certified sustainable processing (pull strategy). Success in the value chain is increasingly dependent on the ability of upstream suppliers to provide full traceability and sustainability data for their chemical inputs, thereby enabling downstream manufacturers to comply with global brand commitments and regulatory requirements.

Tanning and Dyeing Market Potential Customers

Potential customers for the Tanning and Dyeing Market are diverse but fundamentally concentrated in sectors requiring surface finishing and color enhancement of natural and synthetic materials. The largest customer base includes large-scale textile mills and garment manufacturers, particularly those focusing on high-volume production for mass-market retailers and emerging middle-class consumers in Asia and Latin America. These customers prioritize cost-effective, high-yield dyes with excellent color fastness. The rapid shifts in fashion trends mean these customers demand short lead times and continuous availability of a wide spectrum of colors and chemical auxiliaries to adapt quickly to seasonal demands.

A high-value customer segment is the automotive leather industry. These buyers require specialized tanning and dyeing chemicals that offer superior performance metrics, including exceptional resistance to UV light, high temperatures, abrasion, and strict standards regarding volatile organic compounds (VOCs) and low fogging. Suppliers serving this segment must meet rigorous international quality management standards (like IATF 16949). The footwear sector, covering both leather and technical synthetic shoes, forms another major customer category, utilizing a blend of advanced tanning agents for sole and upper leathers and specialized textile dyes for inner linings and synthetic components, driven by durability and aesthetic demands.

Furthermore, specialized end-users, such as manufacturers of industrial and technical textiles (e.g., geotextiles, medical gowns, fire-resistant protective clothing), represent a growing customer base. These customers often seek niche, functional dyeing and finishing chemicals that impart specific properties rather than just color, making them less price-sensitive and more focused on performance and reliability. Ultimately, while bulk consumption remains high among textile manufacturers, the highest margin opportunities often reside with performance-critical and regulatory-intensive sectors like automotive, which demand certified sustainable and highly specialized chemical solutions.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 45.2 Billion |

| Market Forecast in 2033 | USD 66.8 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Archroma, BASF SE, Lanxess AG, TFL Ledertechnik GmbH, Rudolf GmbH, Huntsman Corporation, Evonik Industries AG, Kiri Industries Ltd., Clariant AG, Dystar Group, Yorkshire Group, Colourtex Industries Ltd., CHT Group, Stahl Holdings B.V., Kemira Oyj, Indulor Chemie GmbH, Pulcra Chemicals, Setas Kimya Sanayi A.Ş., Royce International, Senzo Colorants. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Tanning and Dyeing Market Key Technology Landscape

The technological landscape of the Tanning and Dyeing Market is rapidly pivoting toward efficiency, low environmental impact, and digitalization. A pivotal shift is seen in tanning through the adoption of chrome-free tanning methods, collectively known as "Wet-White" or "Wet-Blue Free" technologies. These methods utilize titanium salts, gluteraldehyde, or highly advanced synthetic organic tannins (Syntans) to achieve leather quality comparable to traditional chrome tanning while significantly reducing the heavy metal content in effluent. Furthermore, advanced mechanical technologies, such as vacuum drying and reversed-osmosis membrane filtration for chemical recovery, are being implemented to minimize the extensive water footprint traditionally associated with tanneries, thus enhancing operational sustainability and reducing overall chemical consumption.

In the dyeing sector, the most impactful technological advancements are centered around water reduction. Supercritical Carbon Dioxide (sc-CO2) dyeing, which uses pressurized CO2 as the solvent instead of water, is gaining traction, particularly for polyester materials, as it eliminates water waste entirely and drastically reduces drying time and energy costs. Although still facing high implementation costs, sc-CO2 technology represents a major leap toward zero-effluent processing. Complementary to this is the growth of digital printing and digital dyeing technologies, allowing for precise, on-demand color application, reducing the need for large dye baths and minimizing the generation of unused dye liquor, enabling faster response times for customized fashion runs and complex pattern designs.

The utilization of process optimization tools, often driven by the Industrial Internet of Things (IIoT) and sophisticated sensors, is becoming standard practice. These technologies allow for continuous, real-time monitoring of critical parameters such as pH levels, temperature, and residual chemical concentrations within the dyeing and tanning vessels. This continuous feedback loop ensures optimal chemical uptake, maximizes resource efficiency, and guarantees batch-to-batch consistency, which is crucial for high-quality production in both the leather and textile supply chains. The development of high-fixation, low-salt reactive dyes also plays a vital role by maximizing the percentage of dye absorbed by the fiber, consequently lowering the concentration of unexhausted dye chemicals released into wastewater streams.

Regional Highlights

Regional dynamics heavily influence the Tanning and Dyeing Market structure, driven by varying regulatory environments, labor costs, and the concentration of manufacturing hubs. Asia Pacific (APAC) currently dominates the global market both in terms of production volume and consumption value. Countries like China, India, and Bangladesh are global leaders in textile and apparel manufacturing, leading to immense demand for reactive and disperse dyes. Vietnam and Indonesia are major leather processing centers. This region benefits from lower operating costs and established supply chain infrastructure, though it is increasingly subject to intense pressure from international buyers to adopt stricter environmental standards (e.g., implementing ZDHC chemical compliance and modern effluent treatment facilities).

Europe represents the hub of innovation and high-value, specialized chemicals. Driven by the stringent mandates of REACH and the high consumer demand for eco-labeled products, European manufacturers (especially in Germany, Italy, and Spain) lead the development and application of advanced, chrome-free tanning agents and sustainable, highly concentrated liquid dyes. Although manufacturing volume has shifted eastward, Europe maintains a robust market share in premium chemicals and specialized leather finishing for high-end fashion and automotive sectors, characterized by a focus on sustainable sourcing, closed-loop systems, and high chemical performance requirements.

North America maintains a mature, demand-driven market focusing on technical textiles and specialized consumer goods. While domestic manufacturing is smaller than APAC, demand for imported dyed/tanned goods is massive, generating strong demand for compliance and certified sustainable chemical inputs from their global suppliers. The market here emphasizes rapid adoption of digital dyeing technologies and high-performance finishing chemicals for specific functional applications, such as military, industrial safety, and protective apparel. Latin America and the Middle East & Africa (MEA) are emerging markets, with countries like Brazil (leather) and Turkey (textiles) showing significant growth, driven by regional demand and export potential. These regions are rapidly upgrading facilities to meet international compliance standards to access global export markets.

- Asia Pacific (APAC): Dominates the market due to concentrated textile and leather manufacturing in China, India, and Vietnam; high volume consumption of reactive and disperse dyes; rapidly increasing environmental compliance investment driven by export demands.

- Europe: Leading innovator in sustainable chemistry; strong market for premium, specialized chemicals (chrome-free tanning, high-performance finishing); driven by strict regulatory standards (REACH) and demand from luxury automotive and fashion industries.

- North America: Significant consumer market driving global supply chain sustainability requirements; focused adoption of technical textiles and digital dyeing; strong demand for certified non-toxic and low-VOC chemical inputs.

- Latin America: Important region for raw leather processing (especially Brazil and Argentina); growing domestic demand for textiles; investment in modernizing tanneries to improve export competitiveness.

- Middle East and Africa (MEA): Emerging manufacturing hubs, particularly in textile production (Turkey, Egypt); focusing on infrastructure development to attract foreign investment and increase global export share; growth in specialty dyes for natural fibers.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Tanning and Dyeing Market.- Archroma

- BASF SE

- Lanxess AG

- TFL Ledertechnik GmbH

- Rudolf GmbH

- Huntsman Corporation

- Evonik Industries AG

- Kiri Industries Ltd.

- Clariant AG

- Dystar Group

- Yorkshire Group

- Colourtex Industries Ltd.

- CHT Group

- Stahl Holdings B.V.

- Kemira Oyj

- Indulor Chemie GmbH

- Pulcra Chemicals

- Setas Kimya Sanayi A.Ş.

- Royce International

- Senzo Colorants

Frequently Asked Questions

Analyze common user questions about the Tanning and Dyeing market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary factors driving the shift toward sustainable tanning and dyeing methods?

The primary drivers are stringent global environmental regulations, particularly the Zero Discharge of Hazardous Chemicals (ZDHC) program and the EU’s REACH legislation, alongside escalating consumer demand for ethically and sustainably produced textiles and leather goods. These pressures necessitate the adoption of chrome-free tanning and water-saving dyeing technologies like supercritical CO2 dyeing.

How do global supply chain disruptions affect the availability and pricing of key dyeing chemicals?

Dyeing chemicals, being largely derived from petrochemical intermediates, are highly sensitive to global oil price volatility and disruptions in chemical synthesis hubs (often in Asia). Supply chain instability leads to fluctuating raw material costs, forcing manufacturers to secure diversified sources and increase inventory, which ultimately results in higher product pricing for end-users.

What is Wet-White Tanning, and why is it preferred over traditional Chrome Tanning?

Wet-White tanning refers to chrome-free processes utilizing organic polymers, vegetable extracts, or synthetic tannins (Syntans). It is increasingly preferred because it eliminates the environmental hazard associated with carcinogenic chromium VI (Cr(VI)) found in some chrome tanning effluent, making the leather easier to recycle and safer for workers and consumers.

Which geographic region exhibits the highest growth potential in the Tanning and Dyeing Market?

The Asia Pacific (APAC) region, specifically emerging economies like Vietnam, Bangladesh, and India, shows the highest growth potential. This is driven by massive volume requirements from the fast-growing textile manufacturing sector, large populations, and increasing domestic and export demands for finished goods, despite ongoing challenges in meeting strict environmental compliance standards.

How is digital technology, such as AI and IoT, transforming quality control in dyeing operations?

Digital technologies implement real-time monitoring of dye bath parameters (temperature, pH, concentration) using IoT sensors, feeding data to AI algorithms. This enables predictive process optimization, minimizing batch-to-batch inconsistencies, ensuring precise color matching, and drastically reducing the need for costly manual rework and chemical wastage.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager