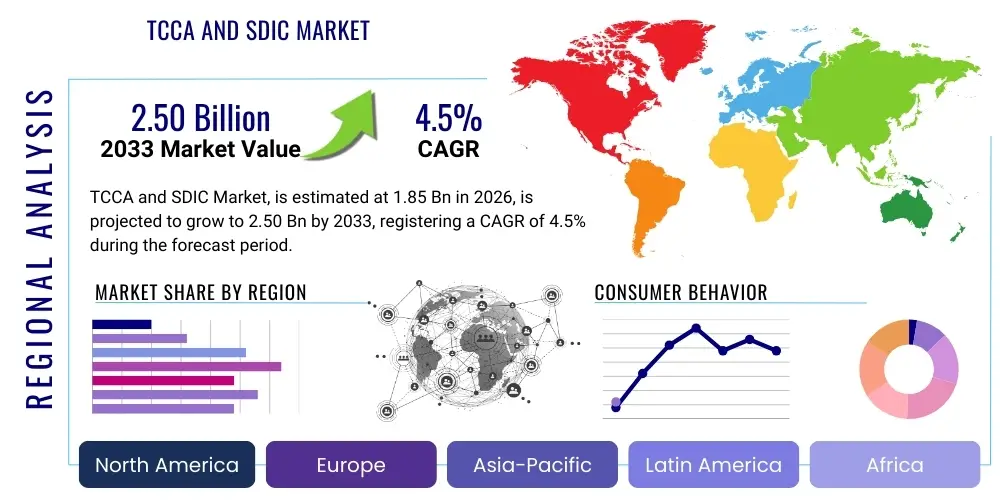

TCCA and SDIC Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442714 | Date : Feb, 2026 | Pages : 255 | Region : Global | Publisher : MRU

TCCA and SDIC Market Size

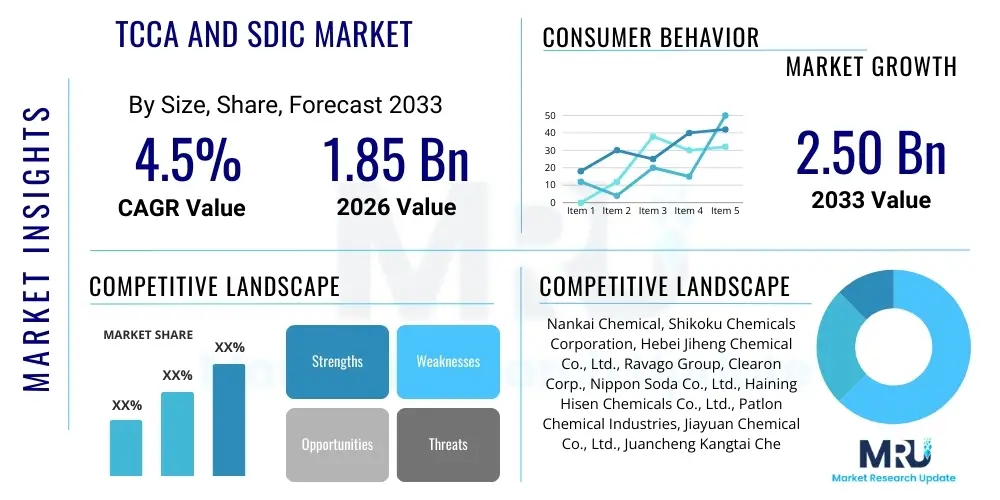

The TCCA and SDIC Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.5% between 2026 and 2033. The market is estimated at USD 1.85 Billion in 2026 and is projected to reach USD 2.50 Billion by the end of the forecast period in 2033.

TCCA and SDIC Market introduction

The global market for Trichloroisocyanuric Acid (TCCA) and Sodium Dichloroisocyanurate (SDIC) centers primarily around their indispensable role as effective chlorine-releasing agents, critical for robust disinfection and sanitation across diverse industries. TCCA, generally sold in granular or tablet form, offers high chlorine content (typically 90%) and stability, making it the preferred choice for large-scale, long-duration sanitation needs such as swimming pool disinfection and industrial water treatment. SDIC, often available as powder or granules, possesses rapid dissolution characteristics and a slightly lower chlorine concentration (60%-65%), optimizing its use in fast-acting applications like household bleach alternatives, food processing sanitizers, and preventative aquaculture treatments. These two chemical compounds derive their efficacy from the stable structure of the isocyanurate ring, which effectively prevents chlorine degradation due to UV light or heat, a major advantage over traditional chlorine sources like hypochlorites.

Key applications driving the demand for these compounds include municipal and residential water purification, where ensuring potable water supply remains a non-negotiable global priority, particularly in rapidly urbanizing regions. Beyond potable water, the recreational sector, encompassing millions of private and public swimming pools and spas globally, relies heavily on TCCA and SDIC to maintain hygienic conditions, mitigate pathogen spread, and comply with stringent public health regulations. The agricultural and livestock sectors also utilize these compounds extensively for sterilizing equipment and premises, thereby controlling disease outbreaks and improving overall operational hygiene. The fundamental benefits offered by TCCA and SDIC—namely high efficacy, ease of storage, convenient handling, and prolonged residual activity—continue to solidify their market dominance over alternative disinfectants.

The market expansion is fundamentally driven by escalating global standards for hygiene and sanitation, particularly following heightened awareness of infectious disease transmission. Furthermore, the persistent growth in recreational water infrastructure, especially in developing economies where disposable incomes are rising, directly translates into increased consumption of TCCA for pool maintenance. Regulatory mandates surrounding safe discharge and reuse of industrial wastewater also act as potent driving factors, forcing manufacturing facilities, especially in heavy industries like textiles and power generation, to adopt reliable chlorination systems utilizing isocyanurates. These factors, combined with continuous technological advancements in product formulation aimed at improving safety and stability, ensure sustained demand across the forecast period.

TCCA and SDIC Market Executive Summary

The TCCA and SDIC market exhibits robust growth characterized by strategic capacity expansions in the Asia-Pacific region, responding to surging domestic and export demands. Business trends indicate a shift towards specialized product forms, such as slow-dissolving multi-functional tablets incorporating stabilizers and clarifiers, catering to the premium segment of the pool and spa industry. Furthermore, supply chain optimization and backward integration, particularly among major Chinese and Indian manufacturers, are defining competitive strategies, aimed at mitigating raw material price volatility, specifically concerning chlorine and urea. Consolidation through mergers and acquisitions is less frequent, but manufacturers are heavily investing in green chemistry practices and effluent treatment solutions to address increasing environmental scrutiny regarding chlorinated byproducts and discharge standards.

Geographically, the Asia-Pacific region maintains its position as the largest market and the fastest-growing region, powered by rapid urbanization, substantial investment in public health infrastructure, and the massive scale of its aquaculture industry. North America and Europe, while being mature markets, demonstrate stable consumption driven by strict regulatory enforcement in swimming pool management and water treatment, alongside consistent demand from the institutional cleaning sector. A notable regional trend is the increasing regulatory divergence regarding the use of chlorine stabilizers; for instance, some European jurisdictions impose concentration limits on cyanuric acid in recreational water, potentially constraining TCCA uptake in favor of SDIC or alternative disinfectant systems, requiring manufacturers to tailor product portfolios specifically for these regional requirements.

Segment-wise, the Swimming Pool Disinfection application segment continues to command the largest market share, fueled by seasonal spikes in recreational activities and sustained residential pool ownership. By product type, granular and tablet forms of TCCA dominate due to their ease of metering and consistent release kinetics essential for continuous chlorination systems. A critical segment trend is the accelerating demand for industrial water treatment applications, particularly in cooling towers and industrial process water, where TCCA and SDIC are utilized to control biofouling and scale buildup, thereby ensuring operational efficiency and extending equipment lifespan. This diversification of industrial usage segments provides significant insulation against seasonality inherent in the recreational sector, contributing to overall market stability and consistent revenue streams for manufacturers.

AI Impact Analysis on TCCA and SDIC Market

User queries regarding AI's impact on the TCCA and SDIC market predominantly revolve around three core themes: optimization of manufacturing processes, implementation of smart water management systems that reduce chemical consumption, and the use of predictive analytics for supply chain stability. Users are keenly interested in how AI can enhance the purity and yield of the chemical synthesis process (chlorination and cyanuric acid reaction), thereby lowering operational costs and environmental impact. A primary concern is whether AI-driven, real-time dosing systems in smart pools and industrial plants will lead to a decrease in overall chemical usage volumes, potentially softening demand growth. Expectations center on AI tools providing superior inventory management, forecasting regional demand peaks (e.g., correlating weather patterns with pool chemical consumption), and developing highly personalized safety and handling protocols through automated risk assessment, thereby improving efficiency throughout the production and distribution cycles without fundamentally altering the chemical necessity of the products themselves.

- AI-driven Predictive Maintenance: Optimizing machinery uptime in TCCA/SDIC production plants, reducing unexpected stoppages and maintenance costs.

- Smart Water Quality Management: AI algorithms analyzing real-time sensor data (pH, temperature, free chlorine) to optimize TCCA/SDIC dosing in pools and industrial cooling towers, improving efficacy and potentially reducing excess chemical consumption.

- Supply Chain Optimization: Utilizing machine learning to forecast demand fluctuations based on seasonal climate data, regulatory changes, and economic indicators, leading to more efficient logistics and inventory management.

- Enhanced R&D and Formulation: AI modeling of chemical reaction kinetics to optimize TCCA/SDIC synthesis pathways for higher yield and purity, minimizing waste generation.

- Automated Quality Control: Implementing computer vision and sensor networks for instantaneous quality checks on manufactured tablets and granules, ensuring consistency in dissolution rates and chlorine content.

DRO & Impact Forces Of TCCA and SDIC Market

The market for TCCA and SDIC is characterized by a dynamic balance of growth drivers and significant regulatory restraints. Key drivers include the unrelenting global demand for hygienic water solutions, spurred by population growth and increased disposable income dedicated to recreational activities like swimming and spa use. The expansion of industrial sectors that rely on effective biocides, such as power generation (cooling water systems) and textile manufacturing (bleaching and disinfection), further solidifies consumption growth. The inherent stability and high chlorine content of these compounds offer a compelling cost-performance ratio compared to many liquid chlorine alternatives, ensuring their continuous adoption across diverse end-use segments. Furthermore, government initiatives in several developing nations focused on upgrading public sanitation infrastructure and reducing waterborne diseases significantly bolster the market outlook.

Conversely, significant restraints hinder market potential, primarily centered on increasing environmental scrutiny and evolving health safety regulations. The most critical restraint is the concern over Disinfection Byproducts (DBPs), such as trihalomethanes (THMs), which are formed when chlorine reacts with organic matter in water. Strict regulatory caps on DBP concentrations in potable water systems and even recreational waters necessitate advanced filtration and reduction techniques, adding complexity and cost to water treatment and potentially pushing some industrial users toward non-chlorine alternatives. Another restraint is the volatility in raw material pricing, particularly the cost of chlorine and cyanuric acid precursors, which directly impacts the profitability and competitive pricing strategies of manufacturers, leading to periodic margin erosion.

Amidst these challenges, substantial opportunities exist, particularly in the realm of specialized product innovation and geographic expansion. The development of encapsulated or modified TCCA/SDIC formulations that offer controlled, sustained release or reduced DBP formation presents a high-value opportunity for manufacturers seeking differentiation in a commoditized market. Furthermore, untapped markets in rural areas of developing countries, where access to basic sanitation chemicals is limited but critically needed, represent a significant avenue for volume growth, supported by global public health initiatives. The market also benefits from opportunities in process optimization, where advanced analytical techniques and process control can lead to more efficient synthesis pathways, reducing energy consumption and waste, thereby creating more sustainable and cost-effective production models.

Segmentation Analysis

The TCCA and SDIC market segmentation provides a critical lens through which to understand consumer behavior, application specificity, and regional demand dynamics, enabling targeted market strategies. The market is primarily segmented based on product type, application, and form, reflecting the highly versatile nature of these sanitizing agents. Product type differentiates between TCCA (Trichloroisocyanuric Acid), preferred for its high stability and slow-release chlorine, and SDIC (Sodium Dichloroisocyanurate), valued for its fast dissolution and rapid-acting disinfection properties. Analyzing these types reveals differing adoption rates across recreational and industrial settings, with TCCA dominating residential pools and large industrial cooling systems, while SDIC is prevalent in shock treatments and household cleaning products.

Segmentation by application further highlights the dominant end-use sectors, with swimming pool disinfection and industrial water treatment collectively accounting for the majority of the market share. Within the swimming pool segment, demand is influenced by seasonal factors and regulatory compliance requirements for public health. Conversely, the industrial segment, including applications in the food and beverage sector for sterilization, aquaculture for disease control, and textile processing for bleaching, provides steady, non-seasonal demand. The form segment—granules, tablets, and powder—reflects consumer preference for ease of use; tablets are highly favored in automated dosing systems for continuous operation, while powders and granules are essential for manual application and shock treatments across all relevant sectors.

- By Product Type:

- Trichloroisocyanuric Acid (TCCA)

- Sodium Dichloroisocyanurate (SDIC)

- By Application:

- Swimming Pool Disinfection

- Industrial Water Treatment (Cooling Towers, Wastewater)

- Potable Water Treatment

- Aquaculture

- Cleaning and Sanitation (Household & Institutional)

- Textile Bleaching

- Others (Medical, Agriculture)

- By Form:

- Granules

- Tablets (20g, 200g, etc.)

- Powder

Value Chain Analysis For TCCA and SDIC Market

The TCCA and SDIC value chain commences with the upstream acquisition and processing of crucial raw materials, primarily chlorine, urea, and sodium hydroxide. The cost and supply stability of these basic chemicals significantly impact the final product pricing and manufacturing margins. Highly integrated companies often possess their own chlor-alkali facilities, granting them a substantial competitive advantage by minimizing transportation costs and insulating them from external market price volatility for chlorine derivatives. The upstream segment is capital-intensive and subject to strict environmental regulations regarding the handling and transportation of hazardous materials, necessitating specialized infrastructure and rigorous safety protocols throughout the procurement and primary reaction phases where cyanuric acid intermediates are formed.

The manufacturing process itself, involving complex chemical reactions, drying, granulation, and tableting, forms the core midstream activity. Efficiency in this stage is key, focusing on optimizing yield, minimizing energy consumption, and ensuring the purity and standardized quality of the final TCCA and SDIC products, particularly regarding active chlorine content and dissolution characteristics. Distribution channels represent a critical downstream component. Due to the classified nature of these chemicals as regulated hazardous substances, distribution must adhere to stringent national and international guidelines for storage and transport, requiring specialized logistics providers. Distribution is typically hybrid, utilizing direct sales channels for bulk industrial buyers (e.g., municipal waterworks) and indirect channels involving large regional distributors, wholesalers, and specialized retail networks for the recreational pool and household markets.

The downstream market interface is characterized by segmentation between large-volume industrial consumers and decentralized retail purchasers. Direct sales channels are favored for predictable, large-volume orders, allowing manufacturers to maintain direct relationships, negotiate customized contract terms, and provide technical support for dosing systems. Indirect channels are crucial for reaching the fragmented recreational market, where retailers, pool service professionals, and mass-market stores act as the primary touchpoints for end-users. The final link in the chain involves technical support and after-sales service, particularly important for complex industrial applications where precise dosage control and safety training related to handling and storage of chlorinated isocyanurates are essential for customer retention and market reputation.

TCCA and SDIC Market Potential Customers

The primary purchasing entities in the TCCA and SDIC market are highly diverse, spanning governmental bodies, commercial enterprises, and millions of individual consumers. Municipal water treatment authorities and public utility companies represent cornerstone customers, utilizing these chemicals to ensure the disinfection of potable water and treat sewage effluent before discharge. These government-related entities often engage in long-term procurement contracts, valuing supply reliability, product standardization, and adherence to stringent quality certifications. The stable nature of this demand segment provides a reliable baseline revenue stream for major manufacturers, requiring competitive bidding and consistent product quality assurance.

Another major category comprises commercial and recreational facility operators, including hotels, resorts, health clubs, aquatic centers, and private pool maintenance service companies. These entities are characterized by seasonal demand patterns and a need for user-friendly, effective sanitation solutions that maintain water clarity and comply with local health department regulations regarding free chlorine levels. For this segment, the ease of application, especially using slow-dissolving TCCA tablets in automatic feeders, is a crucial purchasing criterion. Furthermore, industrial consumers, such as cooling tower management firms in the HVAC, oil & gas, and power generation sectors, rely on these chemicals as potent biocides to prevent biofouling, corrosion, and the spread of Legionella, making product efficacy and low operational cost key decision factors.

The fastest-growing segment of potential buyers includes the vast decentralized market of household consumers and small-scale operators. This includes owners of residential swimming pools, home spa systems, and those involved in small-scale agricultural and aquaculture operations. For residential buyers, convenience, clear instructional labeling, and availability through retail channels are paramount. Specifically in aquaculture, fish and shrimp farms utilize SDIC for pond water disinfection and equipment sanitization to mitigate pathogenic outbreaks, viewing the chemical as a cost-effective tool for maximizing yield and protecting livestock health. Targeting these various end-user profiles requires customized packaging sizes, safety communication, and tailored distribution strategies.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.85 Billion |

| Market Forecast in 2033 | USD 2.50 Billion |

| Growth Rate | 4.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Nankai Chemical, Shikoku Chemicals Corporation, Hebei Jiheng Chemical Co., Ltd., Ravago Group, Clearon Corp., Nippon Soda Co., Ltd., Haining Hisen Chemicals Co., Ltd., Patlon Chemical Industries, Jiayuan Chemical Co., Ltd., Juancheng Kangtai Chemical Co., Ltd., China Salt Jintan Co., Ltd., Olin Corporation, Chemi-Con Co., Ltd., Zibo Clean Water Chemical Co., Ltd., Industrias Quimicas del Valles, S.A. (IQV), Inner Mongolia Xingzheng Chemical Co., Ltd., Wuxi Ruixin Chemical Industry Co., Ltd., Cangzhou Xinchang Chemical Corp., Shandong Xinguang Chemical Co., Ltd., and United Initiators GmbH. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

TCCA and SDIC Market Key Technology Landscape

The fundamental chemical synthesis of TCCA and SDIC involves the chlorination of cyanuric acid (CA) in a highly controlled environment. The key technological differentiators in this mature market are centered less on breakthrough chemistry and more on optimizing process engineering, specifically in areas of crystallization, drying, and formulation stability. Manufacturers are heavily invested in advanced process control systems (PCS) utilizing distributed control systems (DCS) and Supervisory Control and Data Acquisition (SCADA) to maintain precise reaction temperatures and pressures, crucial for achieving high purity and consistent active chlorine yields. Techniques like fluidized bed drying (FBD) are often employed to ensure uniform moisture content, which is vital for the long-term stability and storage life of both TCCA and SDIC products, particularly in hot and humid storage conditions prevalent in high-growth regions.

Furthermore, technology related to product morphology and formulation is a significant competitive landscape. The market demands specialized forms, such as high-density, slow-dissolving tablets for TCCA, which require precision pressing and binding agent technology to ensure consistent erosion rates over extended periods (e.g., 5-7 days in a feeder). For SDIC, the focus is on achieving high solubility without clumping, which necessitates advanced powder technology and particle size distribution control. Recent innovations also include the microencapsulation of TCCA granules, designed to provide an extra layer of moisture protection or to incorporate secondary functional ingredients, such as enzymes or algaecides, creating multi-action pool treatment products that offer premium performance and convenience to the end-user market.

Regulatory technology, or the use of sophisticated analytical equipment, also defines the modern landscape. Leading manufacturers utilize high-performance liquid chromatography (HPLC) and titration automation to ensure precise measurement of free chlorine, combined chlorine, and most importantly, residuals like cyanuric acid (CA) in the final product. Compliance with international standards, such as those set by NSF International or specific regional regulatory bodies like the U.S. EPA, dictates the need for continuous technological upgrades in laboratory and quality assurance processes. Moreover, investments are increasingly being made in advanced effluent treatment technologies to neutralize and manage the chemical byproducts generated during synthesis, demonstrating a commitment to environmental stewardship and ensuring compliance with tightening global emission standards, which is a growing technological concern.

Regional Highlights

Regional dynamics play a crucial role in shaping the TCCA and SDIC market, with distinct growth patterns and consumption drivers observed across major geographies. Asia Pacific (APAC) stands out as the global production hub and the primary consumption market. China and India, in particular, possess large manufacturing capacities benefiting from favorable raw material access (especially urea and salt for chlor-alkali production) and lower operational costs, making them the leading global exporters. Consumption in APAC is driven not only by burgeoning urban populations requiring sanitation infrastructure but also by the extensive use of SDIC in regional aquaculture (shrimp and fish farming) for effective disease prevention, alongside rapid growth in residential and commercial pool construction.

North America and Europe represent mature, high-value markets characterized by stable, sustained demand and stringent regulatory environments. Consumption in these regions is heavily concentrated in swimming pool and spa maintenance, where high penetration of residential pools and meticulous public health regulations drive the consistent use of TCCA and SDIC. European demand, however, is subject to specific EU regulations, including REACH requirements for chemical registration and regional variations in acceptable cyanuric acid levels in pool water, prompting a slight preference for SDIC or alternative non-stabilized chlorine sources in certain jurisdictions. These regions are characterized by higher pricing power and strong brand loyalty for established suppliers.

Latin America, the Middle East, and Africa (LAMEA) are emerging markets experiencing accelerating growth rates. In Latin America, investment in tourism infrastructure and a growing middle class drive demand for recreational pool sanitizers. The Middle East, with its extensive resort industry and hot, arid climate necessitating cooling water systems, exhibits strong demand for industrial biocide applications. Africa’s market growth is slower but significant, fueled by international aid initiatives focusing on improving access to basic potable water disinfection chemicals and growing governmental emphasis on public health standards, making SDIC suitable for low-cost, decentralized water treatment solutions in remote areas.

- North America (U.S., Canada): Characterized by high penetration in recreational water treatment and strict public health regulations (NSF certified products preferred).

- Europe (Germany, France, UK): Stable demand influenced by seasonal tourism; facing tighter regulation on cyanuric acid residuals, impacting TCCA usage patterns.

- Asia Pacific (China, India, Southeast Asia): Global manufacturing base; massive consumption driven by aquaculture, rapid urbanization, and massive municipal water projects.

- Latin America (Brazil, Mexico): Growth linked to leisure infrastructure development and decentralized water treatment needs.

- Middle East and Africa (UAE, Saudi Arabia, South Africa): Strong demand from industrial cooling systems and resort tourism sectors; increasing focus on potable water sanitation.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the TCCA and SDIC Market.- Nankai Chemical

- Shikoku Chemicals Corporation

- Hebei Jiheng Chemical Co., Ltd.

- Ravago Group

- Clearon Corp.

- Nippon Soda Co., Ltd.

- Haining Hisen Chemicals Co., Ltd.

- Patlon Chemical Industries

- Jiayuan Chemical Co., Ltd.

- Juancheng Kangtai Chemical Co., Ltd.

- China Salt Jintan Co., Ltd.

- Olin Corporation

- Chemi-Con Co., Ltd.

- Zibo Clean Water Chemical Co., Ltd.

- Industrias Quimicas del Valles, S.A. (IQV)

- Inner Mongolia Xingzheng Chemical Co., Ltd.

- Wuxi Ruixin Chemical Industry Co., Ltd.

- Cangzhou Xinchang Chemical Corp.

- Shandong Xinguang Chemical Co., Ltd.

- United Initiators GmbH

Frequently Asked Questions

Analyze common user questions about the TCCA and SDIC market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference in application between TCCA and SDIC?

TCCA (Trichloroisocyanuric Acid) is generally preferred for long-term, continuous chlorination needs due to its high chlorine content (approx. 90%) and slow dissolution rate, making it ideal for standard maintenance of swimming pools and industrial systems. SDIC (Sodium Dichloroisocyanurate) is characterized by its rapid dissolution and lower chlorine concentration (60-65%), making it suitable for fast-acting applications such as shock treatment, rapid sanitization of equipment, and aquaculture treatments.

How do global raw material price fluctuations affect the profitability of TCCA and SDIC manufacturers?

Profitability is significantly impacted by the price volatility of key precursors, namely chlorine, urea, and sodium hydroxide. Since the manufacturing process is highly reliant on these commodity chemicals, sharp increases in their cost, often driven by energy prices or supply chain constraints, can compress profit margins, especially for non-integrated manufacturers who must purchase these raw materials at market rates. Effective risk mitigation often involves securing long-term supply contracts or backward integration.

Which geographical region exhibits the highest growth potential for the TCCA and SDIC market?

The Asia Pacific (APAC) region, led by China and India, demonstrates the highest growth potential. This is attributed to robust manufacturing capacity, massive investment in public and residential water sanitation infrastructure, rapid expansion of the recreational tourism sector, and the substantial, growing demand from the regional aquaculture industry for reliable biocides.

What regulatory concerns currently restrain the growth of the TCCA market, particularly in mature economies?

The primary regulatory restraint involves the accumulation and concentration limits of cyanuric acid (CA), a byproduct of TCCA/SDIC use, in recreational water. High CA levels can reduce the effectiveness of free chlorine, potentially leading to inadequate disinfection. Regulatory bodies in regions like Europe and parts of North America are enforcing stricter guidelines on maximum CA concentration, which necessitates advanced water management or encourages the use of non-stabilized chlorine alternatives.

What emerging technological trends are influencing the packaging and delivery of isocyanurates?

Emerging technology focuses heavily on enhancing product stability and user safety. This includes advanced formulation techniques for sustained-release tablets and microencapsulation of granules to improve moisture resistance and extend shelf life. Additionally, smart packaging solutions are being developed to include features like moisture indicators and optimized child-safety mechanisms, enhancing overall product integrity and adherence to consumer safety standards.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager