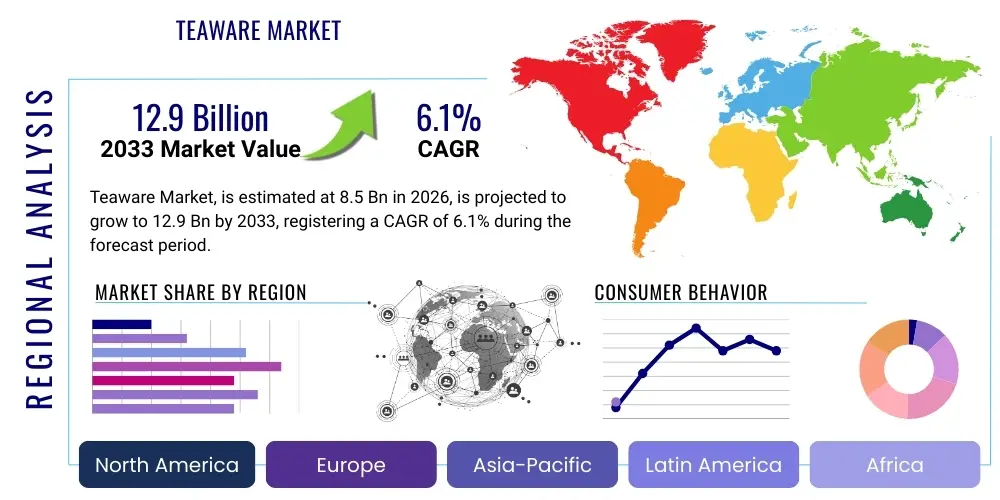

Teaware Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441643 | Date : Feb, 2026 | Pages : 249 | Region : Global | Publisher : MRU

Teaware Market Size

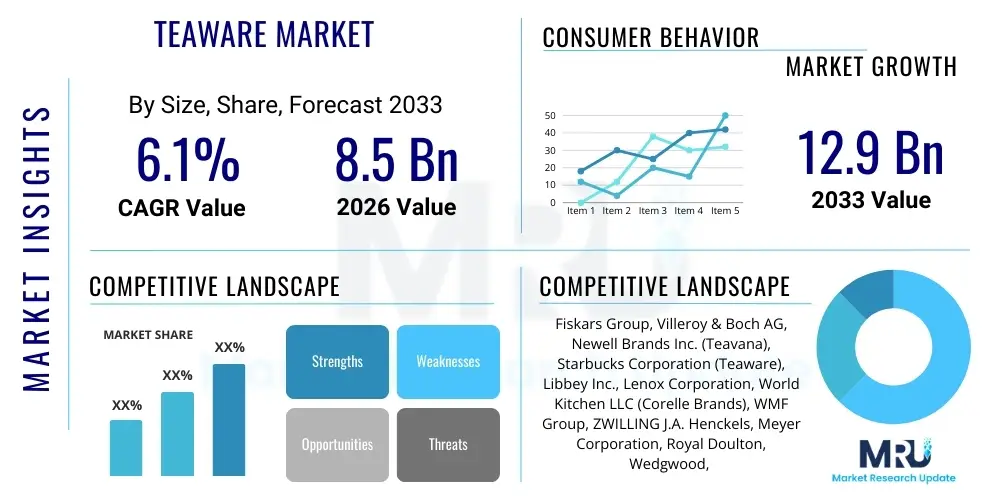

The Teaware Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.1% between 2026 and 2033. The market is estimated at USD 8.5 Billion in 2026 and is projected to reach USD 12.9 Billion by the end of the forecast period in 2033. This substantial growth is primarily fueled by the global resurgence in tea culture, increasing consumer preference for specialized brewing equipment, and the demand for premium, aesthetically pleasing teaware that aligns with modern interior design trends and lifestyle choices. The market valuation reflects strong underlying demand for functional and ornamental products across key regions, driven by both traditional tea-drinking populations and emerging consumer bases adopting tea as a health and wellness beverage.

Teaware Market introduction

The Teaware Market encompasses all utensils and vessels specifically designed and utilized for the preparation, serving, and consumption of tea. This includes a vast range of products such as teapots, cups, mugs, saucers, kettles, infusers, strainers, tea sets, and specialized ceremony accessories, manufactured using materials like ceramic, porcelain, glass, stainless steel, and cast iron. Modern product development focuses heavily on integrating convenience features, such as temperature control in electric kettles and ergonomic designs for teacups, alongside traditional craftsmanship to cater to diverse global consumer bases. The market segmentation addresses varying needs, from high-end luxury items utilized in formal settings and specialized tea rooms to durable, mass-market products suitable for daily home use, thereby establishing a broad commercial footprint.

Major applications for teaware extend beyond the traditional home setting into the booming HoReCa (Hotel, Restaurant, and Café) sector, specialized tea lounges, corporate offices, and gift markets. The functional application is centered on optimizing the brewing process, enhancing thermal retention, and improving the sensory experience of tea consumption, ensuring that the beverage maintains optimal flavor profiles and serving temperatures. Beyond function, teaware serves a significant ornamental purpose, often collected as artifacts or integrated into home decor, particularly in Asian and European cultures where tea tradition is deeply rooted. The increasing globalization of specialty tea consumption, including varieties such as matcha, oolong, and artisan blends, necessitates specialized teaware, driving demand for innovative and customized products that maximize the enjoyment of these premium beverages.

Key benefits driving market adoption include the enhancement of the overall tea experience, the promotion of sophisticated consumption rituals, and the offering of aesthetically appealing products that serve as status symbols or cherished household items. The market is propelled by several macro-environmental factors, notably the growing health consciousness globally, which positions tea as a healthier alternative to carbonated and sugary drinks. Furthermore, the rise of the ‘Third Wave of Coffee and Tea’ movement encourages consumers to invest in high-quality, specialized brewing apparatus. Economic factors, such as rising disposable incomes in developing regions and aggressive marketing strategies emphasizing the cultural and artisanal value of teaware, significantly contribute to the sustained expansion of the overall market landscape and consumer engagement.

Teaware Market Executive Summary

The Teaware Market is characterized by robust business trends centered on premiumization, personalization, and sustainability. Manufacturers are increasingly focusing on materials such as lead-free ceramic and sustainably sourced bamboo, aligning production with growing consumer ecological awareness. A significant trend involves the integration of technology, particularly in electric kettles and smart infusers, which offer programmable settings for various tea types, optimizing the brewing precision. E-commerce platforms have emerged as pivotal distribution channels, facilitating direct-to-consumer sales and allowing niche artisanal teaware producers to reach global audiences effectively. The competitive landscape is fragmented, featuring large multinational corporations alongside numerous heritage brands and independent craft studios, all vying for market share through design innovation and branding that emphasizes cultural authenticity and modern aesthetics.

Regionally, the Asia Pacific (APAC) region dominates the Teaware Market, underpinned by deep-rooted tea traditions in countries like China, Japan, and India, coupled with rapid urbanization and increasing consumer spending power. North America and Europe demonstrate dynamic growth, primarily driven by the specialty tea segment and the rising popularity of tea culture among younger demographics who view high-quality teaware as an essential lifestyle accessory. These Western markets show strong demand for contemporary, minimalist designs and multi-functional teaware designed for convenience and modern living spaces. Emerging markets in Latin America and the Middle East are exhibiting accelerated demand, spurred by cultural adoption and the expansion of global café chains that promote the consumption of diverse tea products, creating new avenues for premium teaware sales and market penetration strategies.

Segmentation trends indicate that ceramic and porcelain materials retain the largest market share due to their traditional appeal, versatility, and excellent heat retention properties. However, the glass segment is experiencing the fastest growth, driven by consumer preference for visually appealing brewing processes, especially for flowering and herbal teas. In terms of product type, complete tea sets and high-quality electric kettles are witnessing heightened demand. The end-user segment reveals strong growth in the commercial sector, primarily HoReCa, due to the rapid expansion of cafes and hotels prioritizing upscale presentation. Conversely, the residential segment remains foundational, driven by replacement cycles and the increasing trend of ‘at-home’ entertaining, prompting purchases of diverse and specialized teaware items catering to sophisticated home brewing needs.

AI Impact Analysis on Teaware Market

User inquiries regarding the impact of Artificial Intelligence on the Teaware Market frequently center on themes of customized design, supply chain optimization, and personalized consumer experiences. Consumers often question how AI can lead to more aesthetically pleasing, yet functionally superior, teaware that precisely matches individual tastes and brewing habits. Key concerns revolve around whether AI-driven manufacturing processes can maintain the authenticity and artisanal quality associated with traditional teaware production, which highly values hand-crafted elements. Expectations are high regarding predictive analytics; users anticipate AI being utilized to forecast demand for specific materials (e.g., bone china versus stoneware) and stylistic trends (e.g., Japanese minimalism versus European baroque), thereby reducing inventory waste and improving retail responsiveness. The intersection of smart home integration and teaware, enabled by AI, particularly concerning automatic temperature regulation and customized brewing profiles in smart kettles, is also a focal point of consumer interest and expectation.

For manufacturers, AI offers transformative potential in areas such as generative design, where algorithms can rapidly produce thousands of novel teaware designs based on specific material constraints, ergonomic requirements, and evolving aesthetic trends identified through social media and sales data analysis. This rapid prototyping capability dramatically shortens the product development lifecycle and increases the probability of launching market-successful designs. Furthermore, AI-powered quality control systems utilize computer vision to detect microscopic flaws in ceramic glazing or glass etching with far greater accuracy and speed than human inspectors, ensuring consistent product quality across large-scale manufacturing operations. This enhanced precision is crucial for maintaining the premium positioning of high-end teaware brands and reducing manufacturing defects, ultimately boosting operational efficiency and customer satisfaction levels.

In the realm of retail and consumer engagement, AI significantly enhances the shopping experience. E-commerce platforms use machine learning algorithms to analyze past purchases and browsing behavior to recommend personalized teaware sets or specific accessories that complement a user's existing collection or preferred tea types. This hyper-personalization drives higher conversion rates and customer loyalty. Additionally, AI-driven chatbots and virtual assistants provide instantaneous customer support, answering complex questions regarding material care, brewing instructions, and product specifications, further streamlining the pre-purchase information gathering process. The ability of AI to predict regional seasonal demand shifts for specialized teaware, such as iced tea pitchers versus insulated mugs, empowers retailers to optimize inventory management and promotional timing effectively, minimizing stockouts and maximizing sales potential across diverse geographical regions.

- AI-driven Generative Design for rapid prototyping and style customization based on emerging consumer aesthetics.

- Predictive analytics for optimizing material sourcing and forecasting demand for specific product segments (e.g., stoneware versus porcelain).

- Enhanced quality control through computer vision systems detecting subtle manufacturing defects in glazing and finishes.

- Personalized e-commerce recommendations for teaware based on user's tea preferences and existing kitchen aesthetic.

- Optimization of supply chain logistics and inventory management, reducing lead times and minimizing overstocking of slow-moving items.

- Development of smart teaware (kettles, infusers) utilizing AI for automated, precise temperature and timing control tailored to specific tea varietals.

DRO & Impact Forces Of Teaware Market

The Teaware Market is strongly influenced by a combination of key growth drivers, significant constraining factors, emerging opportunities, and competitive impact forces that collectively define its current trajectory. The primary growth driver is the global adoption of tea as a healthy beverage alternative, moving consumers away from high-sugar drinks, supported by scientific research highlighting the health benefits of various tea types. This trend is amplified by increasing disposable incomes, particularly in developing economies, which allow consumers to invest in aesthetic and high-quality non-essential household items like premium teaware. Furthermore, the burgeoning popularity of specialized tea ceremonies and ritualistic consumption, often promoted through social media and lifestyle influencers, creates sustained demand for authentic, high-quality, and often costly teaware sets, elevating the average transaction value within the segment.

However, the market faces significant restraints, including intense competition from generic, low-cost plastic and metal alternatives that offer utility at a fraction of the cost, especially in price-sensitive markets. The high fragmentation of the market, which includes numerous small-scale artisanal producers, often leads to inconsistent quality standards and challenges in establishing large-scale standardized distribution networks. Additionally, the manufacturing process for high-quality ceramic and porcelain teaware is energy-intensive and subject to stringent environmental regulations regarding kiln emissions and waste disposal. Economic volatility and fluctuating raw material prices, particularly for high-grade clay, bone ash, and specialized glass compounds, introduce cost pressures that can negatively impact profit margins, especially for mid-market producers who cannot easily pass increased costs directly onto consumers.

Significant opportunities are present in developing sustainable and eco-friendly teaware solutions, utilizing recycled or biodegradable materials, addressing the growing consumer demand for environmentally responsible products. The expansion into smart teaware—such as kettles and brewing systems integrated with IoT technology, offering connectivity and personalized brewing profiles—presents a high-growth technological niche. The strategic focus on expanding market presence in untapped regions, coupled with strong digital marketing campaigns emphasizing the cultural narrative and craftsmanship of premium products, offers avenues for accelerated revenue generation. Competitive forces, including product innovation (especially in thermal efficiency and non-drip spout design) and strategic brand acquisitions, dictate market leadership. The influence of distribution giants, particularly large e-commerce platforms, serves as a powerful impact force, controlling market reach and visibility for both established brands and emerging designers, making digital shelf placement a critical determinant of commercial success.

Segmentation Analysis

The Teaware Market is comprehensively segmented based on material, product type, application, and distribution channel, providing granular insight into consumer preferences and market dynamics across various categories. Material segmentation reflects the blend of tradition and modernity, with ceramics and porcelain dominating due to cultural significance and superior heat retention, while newer segments like borosilicate glass and stainless steel cater to contemporary demands for transparency, durability, and convenience. Product segmentation highlights the shift toward specialization, driven by the complex requirements of brewing different tea varietals, leading to strong growth in specialized infusers and temperature-controlled brewing systems designed for optimization.

- By Material:

- Ceramic & Porcelain (Traditional dominance, aesthetic value)

- Glass (Fastest growth, visual brewing experience)

- Metal (Stainless Steel, Cast Iron - Durability and heat retention)

- Plastic & Silicon (Utility, travel convenience, lower cost)

- By Product Type:

- Teapots & Kettles (Electric and Stovetop)

- Tea Cups, Mugs, & Saucers

- Infusers & Strainers

- Complete Tea Sets & Accessories

- By Application/End-User:

- Residential/Household

- Commercial (HoReCa, Corporate Offices, Tea Rooms)

- By Distribution Channel:

- Online Retail (E-commerce Platforms, Direct-to-Consumer Websites)

- Offline Retail (Supermarkets, Department Stores, Specialty Stores)

Value Chain Analysis For Teaware Market

The value chain for the Teaware Market begins with the upstream analysis, focusing on the sourcing and preparation of raw materials, which are critical determinants of final product quality and cost. This phase involves the mining and processing of high-grade clay, kaolin, feldspar, quartz sand for ceramics and porcelain, and specialized borosilicate glass manufacturing. Suppliers of metal components for electric kettles, handles, and hinges, particularly stainless steel, must meet stringent quality and safety standards. Efficiency in this upstream segment is vital, as material consistency directly impacts manufacturing yields. Strategic partnerships with reliable, certified material suppliers are essential for maintaining competitive pricing and ensuring the traceability of ethically sourced materials, which is a growing concern for consumers.

The subsequent phase involves manufacturing and processing, characterized by highly technical processes such as slip casting, molding, firing in kilns, glazing, and intricate finishing techniques, which often remain labor-intensive, especially for high-end artisanal pieces. Manufacturers invest heavily in machinery for mass production, utilizing automation for uniformity, while boutique producers rely on skilled artisans for unique designs and cultural detailing. Downstream analysis focuses on the distribution network, which is bifurcated into direct and indirect channels. Direct channels involve manufacturers selling through their own branded stores or dedicated e-commerce sites, allowing for greater control over pricing and brand messaging. Indirect channels leverage wholesalers, distributors, large retail chains, and international importers to achieve broad geographical penetration and scale.

Distribution channels are undergoing rapid transformation, heavily favoring online platforms due to the ease of displaying extensive product catalogs and reaching niche collector markets globally. E-commerce facilitates the growth of specialized teaware brands that emphasize storytelling and craftsmanship without the overhead of physical retail space. Offline distribution, however, remains crucial, particularly for high-touch segments like luxury teaware, where consumers prefer to inspect the weight, finish, and tactile quality of the product before purchase. Specialty stores and high-end department stores serve as important touchpoints for premium products. The final stage of the value chain involves marketing, sales, and post-sales services, where branding, cultural alignment, and warranties are leveraged to maximize customer loyalty and drive repeat business, ensuring sustained market viability.

Teaware Market Potential Customers

The potential customer base for the Teaware Market is highly diversified, spanning dedicated tea connoisseurs, health-conscious consumers, and individuals seeking stylish home décor and kitchen upgrades. The primary end-user/buyer segment comprises residential households, where teaware purchases are driven by daily utility, seasonal replacement, and the need for aesthetically pleasing items for personal use and entertaining guests. Within this segment, millennials and Generation Z are increasingly adopting tea culture, seeking out trendy, durable, and sustainable products, often valuing convenience features like travel mugs and quick-heating electric kettles. This demographic segment places a high premium on product design and ethical sourcing, influencing manufacturing trends towards minimalist styles and eco-friendly materials.

Another crucial customer segment is the commercial sector, predominantly encompassing the Hotel, Restaurant, and Café (HoReCa) industry. These buyers require durable, aesthetically consistent, and often branded teaware suitable for high-volume use. Hotels and fine dining establishments specifically demand high-end porcelain and bone china to elevate the customer experience and reflect luxury branding, focusing on sets that offer thermal insulation and chip resistance. Corporate offices and institutional buyers also constitute a steady customer base, prioritizing functionality, ease of cleaning, and bulk purchase scalability for staff breakrooms and client meetings, usually favoring simple, robust stainless steel or sturdy ceramic items for their longevity and reliability in demanding environments.

Furthermore, gift buyers and collectors represent a high-value, though less frequent, purchasing segment. The teaware market thrives on the cultural tradition of gifting tea sets for weddings, holidays, and housewarmings, driving demand for ornate, presentation-ready packaging and limited-edition or handcrafted artisan pieces. Collectors, often specialized in regional styles (e.g., Yixing clay teapots, Japanese Tetsubin cast iron), are willing to pay significant premiums for rarity, authenticity, and documented provenance. Targeting these specialized high-net-worth individuals requires niche marketing, often utilizing specialty auctions, dedicated collector platforms, and collaborations with renowned teaware masters to validate authenticity and inherent investment value.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 8.5 Billion |

| Market Forecast in 2033 | USD 12.9 Billion |

| Growth Rate | 6.1% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Fiskars Group, Villeroy & Boch AG, Newell Brands Inc. (Teavana), Starbucks Corporation (Teaware), Libbey Inc., Lenox Corporation, World Kitchen LLC (Corelle Brands), WMF Group, ZWILLING J.A. Henckels, Meyer Corporation, Royal Doulton, Wedgwood, T2 Tea, ForLife Design, Bredemeijer Group. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Teaware Market Key Technology Landscape

The Teaware Market, while traditionally reliant on established ceramic and glass manufacturing techniques, is increasingly incorporating advanced technologies to enhance functionality, sustainability, and user experience. In the realm of material science, significant technological advancements include the development of high-performance, non-porous ceramics that offer superior chip resistance and thermal shock durability, essential for commercial use. Borosilicate glass technology has improved, allowing for thinner yet more robust constructions that are dishwasher safe and optimized for thermal insulation, retaining the hot temperature of tea without becoming scalding to the touch. Furthermore, specialized glazing technologies now offer self-cleaning and antibacterial properties, reducing maintenance and enhancing hygiene, particularly important in public and high-traffic environments within the HoReCa sector globally.

The most transformative technology implementation is seen in the ‘smart’ category of electric teaware. Modern electric kettles and brewing machines integrate precise temperature control systems utilizing PID (Proportional-Integral-Derivative) controllers to maintain exact water temperatures tailored for specific tea types (e.g., green tea requiring lower temperatures than black tea). These devices often feature IoT connectivity, allowing users to control brewing cycles remotely via smartphone applications and integrate with smart home ecosystems. Advanced filtration mechanisms, using activated carbon or specialized mineral filters, are also being integrated into brewing devices to ensure water quality maximizes the flavor extraction from premium tea leaves, appealing directly to the discerning tea consumer seeking optimal brewing results consistently.

Manufacturing technology also benefits from sophisticated automation. Computer-Aided Design (CAD) and 3D printing are now widely used in the prototyping phase, allowing manufacturers to quickly test ergonomic designs and aesthetic variations before committing to expensive mold production. Large-scale production utilizes robotic arms for precision glazing and decorating, ensuring consistency and minimizing human error in complex patterns. Sustainable manufacturing technologies, such as energy-efficient kiln designs utilizing heat recovery systems and closed-loop water recycling, are being implemented to reduce the environmental footprint associated with ceramic and glass production. These technical investments not only improve process efficiency but also serve as key differentiators in a market where consumers increasingly value corporate social responsibility and environmentally conscious production methodologies.

Regional Highlights

- Asia Pacific (APAC): Market Dominance and Cultural Heritage

The APAC region holds the largest market share due to its deeply embedded tea culture, particularly in countries such as China, Japan, India, and South Korea. This region’s demand is driven by both traditional consumption patterns and the emerging middle class's increasing purchasing power, which fuels demand for premium, culturally relevant teaware. China, as the origin of tea, remains a manufacturing powerhouse and a crucial consumer market, specializing in materials like Yixing clay and intricate porcelain. Japan contributes significantly through its high-quality ceramic, minimalist designs, and the global spread of matcha culture, necessitating specialized teaware like Chawan bowls and bamboo whisks. The region also benefits from localized production reducing logistical costs and supporting a vibrant domestic market that prioritizes authentic, handcrafted items over imported generic products.

Rapid urbanization and the proliferation of specialty tea houses across countries like Vietnam and Indonesia are further accelerating demand. Regional trends showcase a blend of modern innovation in electric appliances and staunch preservation of traditional craftsmanship, leading to a dynamic market where both smart kettles and heirloom-quality tea sets coexist. Government initiatives supporting local artisans and promoting tea as a national cultural product also provide structural support to the regional teaware segment. Consumer education efforts focused on the art of tea preparation ensure sustained interest in specific, high-quality brewing apparatus.

- North America: Lifestyle and Health-Driven Growth

North America is characterized by robust growth, driven by the strong adoption of tea as a healthy beverage and a lifestyle accessory. Consumer demand focuses heavily on convenience, functionality, and modern design, favoring sleek, durable materials like stainless steel and temperature-resistant glass. The specialty tea segment (including loose-leaf, organic, and functional teas) has significantly fueled the requirement for advanced brewing systems, such as large-capacity infuser mugs and programmable electric kettles. The market is highly receptive to products that integrate technology and promote sustainability.

The US market, in particular, exhibits high purchasing power and a preference for branded, designer teaware that complements contemporary kitchen aesthetics. E-commerce penetration is extremely high, allowing specialized teaware companies to bypass traditional retail channels and market directly to niche consumer groups, particularly those interested in specific cultural tea practices like Gongfu Cha. Marketing strategies often focus on wellness benefits and the ritualistic aspects of tea consumption, successfully positioning teaware as an investment in personal health and sophisticated living. Canada follows similar trends, with a notable emphasis on eco-friendly and sustainably manufactured products, favoring brands committed to environmental stewardship.

- Europe: Heritage, Luxury, and Aesthetics

The European market, led by the UK, Germany, and France, is defined by a strong heritage in formal tea consumption and a high demand for luxury and bone china teaware. The region values craftsmanship, intricate detailing, and established brand legacy. High-end department stores and specialty boutiques remain vital distribution channels for premium products, particularly those from historic brands known for their quality and collectible value. The UK's enduring tea tradition ensures a constant, stable demand for traditional teapots, cups, and full tea services.

Alongside tradition, Northern and Western Europe show significant uptake of functional, minimalist teaware, aligning with Scandinavian design principles and modern kitchen environments. There is a burgeoning trend towards high-quality loose-leaf tea, driving the necessity for sophisticated filtering mechanisms and insulated vessels that maintain temperature during prolonged consumption periods. Regulatory standards concerning food contact materials (FCMs) are particularly strict in the EU, influencing manufacturers to invest heavily in lead-free and cadmium-free materials, ensuring consumer safety and quality compliance across the entire product line imported or produced within the bloc.

- Latin America (LATAM) & Middle East and Africa (MEA): Emerging Opportunities

The LATAM and MEA regions represent significant emerging market opportunities, characterized by growing urbanization, rising disposable incomes, and increasing Western influence on lifestyle choices. In the Middle East, traditional tea and coffee consumption rituals drive demand for opulent, highly decorated teaware, often featuring gold or intricate metallic detailing to signify wealth and hospitality. Demand here is strongly skewed toward ceremonial and display-worthy items, supporting the luxury segment of the market.

In Latin America, while coffee culture remains dominant, tea consumption is gaining traction, particularly among younger, health-conscious consumers. This shift drives the need for affordable, durable, and brightly colored teaware that aligns with regional aesthetic preferences. Market growth is dependent on improving infrastructure and expanding retail distribution networks. Challenges include price sensitivity and competition from globally sourced, mass-produced items, requiring brands to focus on localized aesthetic appeal and value proposition to effectively penetrate these rapidly developing markets.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Teaware Market.- Fiskars Group (Includes Wedgwood and Royal Doulton)

- Villeroy & Boch AG

- Newell Brands Inc. (Primarily focusing on home goods segment)

- Starbucks Corporation (Through their branded teaware and merchandise)

- Libbey Inc. (Glassware focus)

- Lenox Corporation

- World Kitchen LLC (Corelle Brands)

- WMF Group

- ZWILLING J.A. Henckels

- Meyer Corporation (Cookware and kitchen goods)

- T2 Tea (Specialty retail and branded teaware)

- ForLife Design

- Bredemeijer Group

- Teavana (Although largely dissolved, the market influence and brand recognition persist)

- Noritake Co., Limited

- Royal Selangor International Sdn Bhd

- IKEA Systems B.V. (Mass market segment)

- Muji (Minimalist lifestyle teaware)

- Le Creuset (Cast iron and ceramics)

- Konitz Porzellan GmbH

Frequently Asked Questions

Analyze common user questions about the Teaware market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the growth of the premium teaware segment globally?

The growth in the premium teaware segment is driven primarily by increasing consumer focus on health and wellness, which encourages investment in high-quality loose-leaf tea, requiring specialized, precision brewing equipment. Furthermore, rising disposable incomes in APAC and the resurgence of formalized tea rituals in Western markets elevate demand for luxury, artisanal, and aesthetically superior products made from materials like bone china and high-grade borosilicate glass.

Which material segment currently holds the largest market share and why?

The Ceramic and Porcelain material segment holds the largest market share. This dominance is due to their excellent heat retention capabilities, cultural significance across major tea-drinking nations, aesthetic versatility, and the wide price range availability, catering to both everyday utility and high-end collectible demands globally.

How is sustainability impacting product development in the teaware industry?

Sustainability is driving manufacturers to innovate by utilizing lead-free glazes, recycled or sustainably sourced materials (like bamboo and certain metals), and adopting energy-efficient production methods, such as eco-friendly kilns. Consumers are increasingly seeking transparency and are willing to pay a premium for teaware produced through environmentally responsible and ethical labor practices.

What role does e-commerce play in the distribution of teaware products?

E-commerce is a critical and rapidly expanding distribution channel, facilitating direct-to-consumer sales for niche, artisanal, and international brands. It allows companies to bypass traditional retail overheads, display a wider variety of specialized products, and leverage digital marketing to reach specific collector communities and global specialty tea enthusiasts effectively.

What are the key technological trends influencing the functional segment of the market?

Key technological trends include the integration of IoT and AI into smart teaware, such as electric kettles featuring programmable, precise temperature controls and smartphone connectivity for remote operation. Material innovations focusing on improved thermal shock resistance and non-drip spout technology are also crucial for enhancing user convenience and product longevity in high-use environments.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager