Telematics Solutions Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441517 | Date : Feb, 2026 | Pages : 249 | Region : Global | Publisher : MRU

Telematics Solutions Market Size

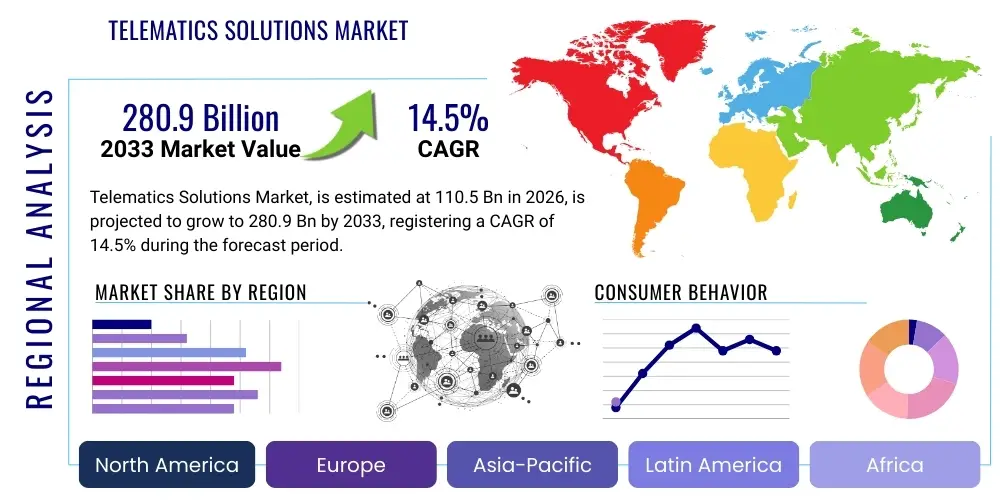

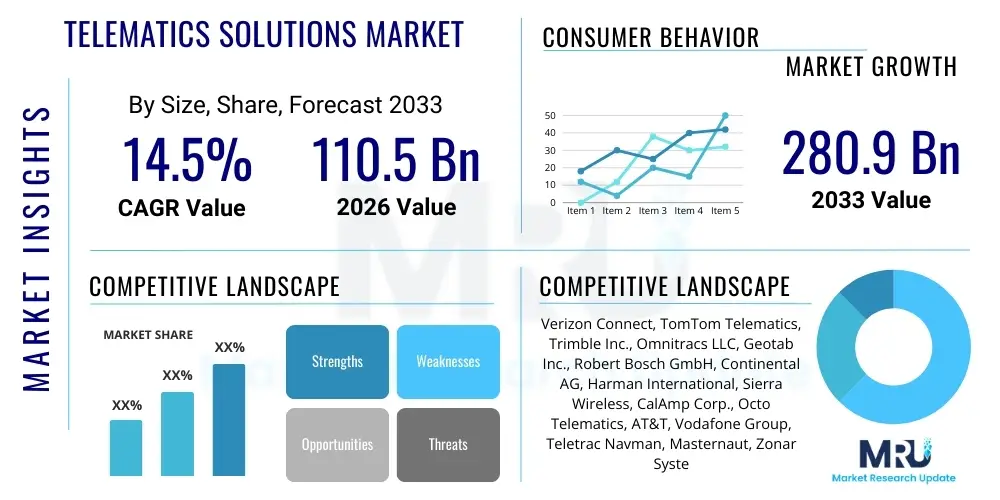

The Telematics Solutions Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 14.5% between 2026 and 2033. The market is estimated at USD 110.5 Billion in 2026 and is projected to reach USD 280.9 Billion by the end of the forecast period in 2033.

Telematics Solutions Market introduction

Telematics solutions encompass the integrated use of telecommunications and informatics for monitoring vehicles, assets, and personnel. These systems typically combine GPS technology, on-board diagnostics (OBD), and wireless communication to transmit data crucial for management, safety, and efficiency. The core product offering includes sophisticated hardware units installed in vehicles, proprietary software platforms for data analysis and visualization, and comprehensive support services covering installation, maintenance, and integration. Major applications span across fleet management, usage-based insurance (UBI), emergency services (eCall), navigation, and predictive maintenance.

The primary benefits derived from the adoption of telematics solutions include significant improvements in operational efficiency, enhanced driver safety through behavior monitoring, optimized route planning leading to reduced fuel consumption, and stringent regulatory compliance management, particularly concerning driver hours and vehicle maintenance schedules. Furthermore, telematics data facilitates rapid response in emergency situations and provides valuable intelligence for proactive diagnostic measures, thereby maximizing asset uptime and reducing overall operational costs for enterprises.

The market is predominantly driven by the surging need for efficient fleet management across the logistics and transportation sectors, rapid technological advancements in cellular networks (5G), and increasing regulatory mandates worldwide regarding vehicle safety and emissions monitoring. The proliferation of connected vehicles and the growing trend toward vehicle digitalization, alongside the increasing awareness of supply chain visibility benefits, are accelerating the deployment rates of advanced telematics systems across various end-use industries.

Telematics Solutions Market Executive Summary

The Telematics Solutions Market is witnessing robust expansion, characterized by a fundamental shift toward integrating predictive analytics and machine learning capabilities within standard platform offerings. Key business trends include the increasing collaboration between automotive OEMs and technology providers to embed telematics capabilities directly into new vehicles (factory-fitted solutions), thus driving standardization and lowering adoption barriers. Furthermore, the subscription-based service model (SaaS) is dominating the software segment, providing recurring revenue streams and scalable solutions tailored to the specific needs of diverse fleet sizes and operational requirements, focusing heavily on specialized applications like cold chain monitoring and heavy equipment management.

Regionally, North America maintains its dominance due to high technological readiness, stringent government regulations (such as ELD mandates in the US), and the presence of major telematics vendors and service providers. However, the Asia Pacific (APAC) region is projected to register the fastest growth rate, fueled by massive investments in infrastructure development, the rapid growth of e-commerce, and increasing road safety initiatives in emerging economies like India and China. Europe continues its strong adoption trajectory, driven by advanced regulatory frameworks like eCall and TACHO regulations, promoting widespread adoption across commercial and passenger vehicles. Strategic market penetration in MEA and Latin America is accelerating, focusing primarily on high-value segments such as mining and insurance telematics.

In terms of segment trends, the hardware segment is seeing modernization, moving from basic black boxes to advanced devices integrated with high-speed cellular modules and edge computing capabilities. The software segment is experiencing rapid innovation, particularly in data visualization, integration with Enterprise Resource Planning (ERP) systems, and real-time behavioral scoring tools. Application-wise, Fleet/Asset Management remains the cornerstone, but Usage-Based Insurance (UBI) is gaining significant traction globally as insurance providers seek more granular risk assessment data, transforming traditional actuarial models and offering personalized premium structures based on actual driving behavior and mileage.

AI Impact Analysis on Telematics Solutions Market

Common user questions regarding AI's impact on telematics revolve around how machine learning can transform raw vehicle data into actionable intelligence, specifically asking about predictive maintenance accuracy, optimization of complex logistical routes in real-time, and the automation of driver coaching processes. Users are keenly interested in the efficacy of AI in detecting nuanced driving patterns indicative of fatigue or distraction, moving beyond simple speed or harsh braking metrics. Concerns often center on data privacy, the computational requirements for processing vast telemetry datasets, and the ethical implications of using AI to monitor and influence driver behavior. Expectations are high for AI to deliver truly autonomous decision-making support, drastically reducing human intervention in fleet management and improving overall supply chain resilience against unforeseen disruptions.

The integration of Artificial Intelligence and Machine Learning (ML) is fundamentally redefining the capabilities of modern telematics platforms. AI algorithms are essential for processing the enormous volume of data generated by connected vehicles, transforming millions of data points on location, speed, engine health, and driver input into refined, predictive insights. This capability allows fleet managers to transition from reactive maintenance schedules to highly accurate predictive maintenance models, forecasting component failures long before they occur, thereby minimizing vehicle downtime and optimizing spare parts inventory management.

Furthermore, AI significantly enhances operational logistics. Advanced ML models are utilized to analyze historical traffic data, weather patterns, and delivery constraints in real-time, enabling dynamic route optimization that instantaneously adjusts to changing conditions. In the realm of safety, AI-powered computer vision and sensor fusion analyze driver behavior with unprecedented precision, identifying micro-expressions or subtle deviations that signal distraction or fatigue, leading to proactive alerts and automated, personalized coaching protocols aimed at improving overall road safety standards across the commercial vehicle sector.

- AI enables predictive maintenance by analyzing complex sensor data patterns to forecast equipment failure.

- Machine learning optimizes dynamic routing in real-time, significantly improving logistical efficiency and reducing travel time.

- AI algorithms power enhanced driver behavior scoring, identifying high-risk habits and enabling automated safety coaching.

- Computer vision and edge AI facilitate advanced collision avoidance and near-miss reporting accuracy.

- Automated incident reconstruction using aggregated telemetry data simplifies insurance claims and liability assessment.

- AI drives the efficacy of Usage-Based Insurance (UBI) models by providing highly precise risk profiling and personalization.

DRO & Impact Forces Of Telematics Solutions Market

The market dynamics are governed by powerful drivers such as escalating global regulatory requirements mandating safety features and emissions tracking, particularly in commercial transportation. Restraints primarily include high initial capital investment for hardware installation, challenges related to data security and privacy compliance, and system integration complexities with legacy IT infrastructure. Opportunities arise from the convergence of 5G and IoT technologies, leading to the development of highly reliable, low-latency telematics services and the expansion into niche markets like agricultural equipment tracking and micromobility solutions. These forces collectively exert significant pressure, pushing the market toward technologically advanced, highly integrated, and service-oriented offerings that leverage connectivity and sophisticated data analysis to deliver measurable ROI to end-users.

Drivers: The increasing penetration of smartphones and widespread availability of affordable high-speed internet infrastructure worldwide are fundamentally supportive drivers for telematics adoption, especially in emerging markets where smartphone integration offers a low-cost entry point. Moreover, the quantifiable benefits derived from telematics—including fuel savings, improved asset utilization, and reduced insurance liabilities—provide a compelling economic incentive for businesses across all scales. The necessity for real-time visibility into geographically dispersed assets and personnel, critical for modern supply chain management, further strengthens the demand for robust telematics platforms.

Restraints: Significant resistance to market growth stems from concerns over data ownership and the regulatory uncertainty surrounding cross-border data transfer, particularly in GDPR-sensitive regions. Additionally, securing buy-in from drivers and employees who may perceive monitoring as an invasion of privacy remains a persistent operational challenge. For smaller fleets, the complexity of choosing the right system, ensuring interoperability between different vehicle types, and the ongoing costs associated with data transmission and software licenses can act as substantial barriers to initial adoption, requiring providers to emphasize simplified user interfaces and clear ROI metrics.

Opportunities: The burgeoning electric vehicle (EV) market presents a unique opportunity for telematics providers to offer specialized services focused on battery health monitoring, charging infrastructure management, and range optimization, integrating these functionalities seamlessly with traditional fleet management tools. Furthermore, the expansion of commercial drone applications and specialized industrial IoT environments (e.g., ports, warehouses) necessitates bespoke telematics solutions for tracking and managing these new classes of mobile assets, opening new avenues for specialized hardware and customized software development.

Segmentation Analysis

The Telematics Solutions Market is comprehensively segmented based on its components, deployment type, primary application, and diverse end-use verticals. This segmentation is crucial for understanding the varied requirements across different operational landscapes and for tailoring technological solutions precisely. The market is transitioning toward integrated platforms, emphasizing the role of services (such as consulting and managed data services) as key differentiators, even as hardware becomes increasingly standardized. Analyzing these segments helps in identifying high-growth niches, such as insurance telematics and advanced remote diagnostics, which are currently benefiting from technological maturity and consumer acceptance.

The segmentation structure reflects the complexity and breadth of telematics utilization. Component segmentation highlights the division between the physical devices (Hardware) and the intellectual property (Software and Services) required to operate the system. The Type segmentation distinguishes between factory-fitted (Embedded) and aftermarket solutions (Tethered and Smartphone Integrated). The Application segment dictates the specific functional use case, ranging from routine fleet tracking to highly specialized areas like advanced crash reconstruction. Lastly, the End-Use segmentation categorizes demand based on the industry's operational environment, with Transportation & Logistics and Automotive OEM being the foundational segments driving mass adoption.

- Component: Hardware (OBD Devices, Sensors, GPS Trackers), Software (Fleet Management Software, Data Analytics Platforms), Services (Professional Services, Managed Services).

- Type: Embedded Telematics (Factory-fitted systems), Tethered Telematics (Aftermarket systems connected to external devices), Smartphone Integrated Telematics (App-based solutions).

- Application: Fleet/Asset Management (FMS), Navigation/Location-Based Systems, Infotainment & Connectivity, Insurance Telematics (UBI), Remote Diagnostics, Emergency Services (eCall).

- End-Use: Transportation & Logistics, Automotive OEM, Construction & Heavy Equipment, Healthcare, Government & Public Safety, Manufacturing.

Value Chain Analysis For Telematics Solutions Market

The value chain for telematics solutions begins with upstream activities involving the sourcing and manufacturing of critical components, including GPS modules, cellular communication chipsets, and sophisticated sensors. Key upstream suppliers include semiconductor manufacturers and specialized hardware assembly firms. Efficiency in this stage relies heavily on economies of scale and managing global supply chain risks, particularly concerning geopolitical instability impacting semiconductor availability. Standardization of hardware interfaces, such as CAN bus integration, is a crucial requirement for achieving wide market acceptance and reducing installation complexity.

Midstream activities encompass the core intellectual property development: the creation and maintenance of proprietary software platforms, data analytics engines, and user interfaces (UI/UX). This stage also includes the provision of connectivity services, often requiring partnerships with Mobile Network Operators (MNOs) to ensure robust, low-latency communication coverage. System integrators play a vital role here, ensuring seamless integration between the telematics platform and the client's existing enterprise resource planning (ERP), human resource management (HRM), and accounting systems, which is critical for maximizing data utility.

Downstream activities involve the distribution channel, dominated by direct sales to large enterprise fleets and indirect distribution through certified installers, authorized dealerships, and specialized telematics resellers. The service delivery component—including installation, ongoing technical support, and data interpretation consulting—is highly localized and crucial for customer retention. Direct channels are common for large OEM contracts and major logistics firms, while indirect channels serve small-to-midsize businesses (SMBs) effectively, leveraging local expertise and established maintenance networks. Customer value realization is achieved in the downstream, where actionable insights derived from the platform lead to measurable operational savings and safety improvements.

Telematics Solutions Market Potential Customers

Potential customers for telematics solutions span a broad spectrum of commercial entities and government organizations whose operations involve managing mobile assets, ensuring workforce safety, or requiring high levels of logistical efficiency and regulatory compliance. The primary buyers are concentrated in sectors where the cost of fuel, maintenance, insurance, and downtime significantly impacts profitability, necessitating robust data-driven management tools. These end-users typically prioritize solutions that offer scalability, deep integration capabilities, and proven expertise in handling large-scale data streams specific to their operational environment.

The largest group of buyers includes global and regional Transportation and Logistics companies, ranging from last-mile delivery services to international freight carriers, who utilize telematics primarily for real-time tracking, route optimization, and compliance with driver safety regulations (e.g., HOS/ELD). Automotive OEMs are also major customers, either integrating proprietary telematics services into new vehicle lines to generate recurring revenue or purchasing white-label solutions for enhanced customer service offerings like remote diagnostics and concierge services. Insurance providers represent a rapidly expanding customer segment, purchasing data aggregation and analysis services to power their usage-based insurance models.

Secondary but significant buyers include specialized verticals such as Construction and Mining, where telematics is essential for tracking high-value heavy equipment, monitoring asset utilization in remote areas, and ensuring equipment health in demanding conditions. Government agencies, including municipal fleets, public transit authorities, and emergency services, utilize these solutions for optimizing resource deployment, improving public safety response times, and ensuring efficient maintenance of publicly owned vehicle assets. These diverse customer needs necessitate a modular and highly customizable product portfolio from telematics providers.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 110.5 Billion |

| Market Forecast in 2033 | USD 280.9 Billion |

| Growth Rate | 14.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Verizon Connect, TomTom Telematics, Trimble Inc., Omnitracs LLC, Geotab Inc., Robert Bosch GmbH, Continental AG, Harman International, Sierra Wireless, CalAmp Corp., Octo Telematics, AT&T, Vodafone Group, Teletrac Navman, Masternaut, Zonar Systems, MiX Telematics, Cisco Systems, Pointer Telocation, Samsara |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Telematics Solutions Market Key Technology Landscape

The technological backbone of the Telematics Solutions Market is characterized by the convergence of high-speed wireless communication, precise global navigation systems, and advanced data processing capabilities, all increasingly leveraged by edge computing. The transition from 3G/4G to 5G connectivity is the most critical technological advancement, offering ultra-low latency and massive machine-to-machine communication capacity required for real-time applications such as autonomous vehicle support, immediate crash data transfer, and high-definition video streaming from in-cab cameras. This higher bandwidth facilitates the deployment of richer data streams, enhancing the accuracy of predictive models.

Global Navigation Satellite System (GNSS) technology, including GPS, GLONASS, Galileo, and BeiDou, provides the foundational data for location services. Recent advancements focus on enhancing positioning accuracy through techniques like Differential GPS (DGPS) and high-precision mapping, which are essential for applications demanding lane-level precision. Complementary technologies include sophisticated sensor integration, particularly Inertial Measurement Units (IMUs) that provide critical data on vehicle dynamics (acceleration, orientation, angular velocity), which is vital for accurate crash reconstruction and detailed driving behavior analysis independent of satellite signal availability.

Furthermore, On-Board Diagnostics (OBD-II) protocols and Controller Area Network (CAN bus) communication remain central to capturing vehicle health and operational data. The emerging trend is the decentralization of processing power via Edge Computing, where raw data is processed locally on the telematics device before transmission. This approach reduces data transmission costs, enhances data security by minimizing cloud exposure of sensitive information, and drastically speeds up decision-making processes, enabling instantaneous alerts for critical events such as engine malfunction or unauthorized vehicle use, moving intelligence closer to the point of origin.

Regional Highlights

- North America: This region dominates the market due to the high adoption rate in the logistics sector, strong government backing for safety mandates (e.g., Electronic Logging Device or ELD rule), and the presence of leading technological innovators. The US and Canada are mature markets characterized by sophisticated solutions emphasizing fleet efficiency, preventative maintenance, and strict regulatory compliance. The rapid commercialization of 5G infrastructure further solidifies its position as a key innovation hub for advanced telematics applications, including sophisticated insurance models and connected car services.

- Europe: Europe is a highly regulated market, where telematics adoption is strongly influenced by EU directives such as the mandatory implementation of the eCall system in new vehicles and adherence to stringent digital tachograph regulations. Germany, the UK, and France are leaders, primarily focusing on commercial fleet optimization, reducing carbon footprint through route efficiency, and pioneering usage-based insurance schemes (UBI). The region is characterized by strong OEM presence and deep integration of telematics data into mobility-as-a-service (MaaS) platforms.

- Asia Pacific (APAC): Expected to exhibit the highest growth rate, APAC is driven by massive infrastructure investments, the explosion of e-commerce necessitating efficient last-mile delivery solutions, and governmental focus on improving public safety and transportation efficiency in heavily congested urban areas. China and India represent enormous potential, characterized by large, unorganized logistics sectors rapidly transitioning to digital management tools. Key growth drivers include mass adoption of inexpensive smartphone-integrated solutions and government-led intelligent transportation system (ITS) projects.

- Latin America: This region shows robust demand, particularly driven by asset security concerns related to cargo theft and vehicle recovery, making security and tracking a primary use case. Telematics adoption is strong in Brazil and Mexico, focusing on high-value asset protection, insurance compliance, and basic fleet management to mitigate high operational risks associated with transportation in certain corridors.

- Middle East and Africa (MEA): Growth in MEA is concentrated in the GCC states (Saudi Arabia, UAE) due to high government spending on smart city initiatives and large-scale industrial projects (oil and gas, construction). Telematics is leveraged extensively for monitoring remote assets, ensuring high safety standards in hazardous environments, and optimizing the operational efficiency of large governmental and utility fleets.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Telematics Solutions Market.- Verizon Connect

- TomTom Telematics (Webfleet Solutions)

- Trimble Inc.

- Omnitracs LLC

- Geotab Inc.

- Robert Bosch GmbH

- Continental AG

- Harman International (A Samsung Company)

- Sierra Wireless

- CalAmp Corp.

- Octo Telematics

- AT&T

- Vodafone Group

- Teletrac Navman

- Masternaut

- Zonar Systems

- MiX Telematics

- Cisco Systems

- Pointer Telocation

- Samsara

Frequently Asked Questions

Analyze common user questions about the Telematics Solutions market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary differences between embedded and aftermarket telematics solutions?

Embedded telematics are factory-installed by the Automotive OEM, offering deep integration into the vehicle’s internal systems, higher reliability, and comprehensive warranty support. Aftermarket (tethered or smartphone-based) solutions are installed later, offering flexibility, lower initial cost, and ease of transfer between vehicles, making them popular for mixed or older fleets.

How is 5G technology specifically influencing the expansion of the telematics market?

5G provides significantly reduced latency and greatly increased bandwidth compared to 4G networks. This enables highly reliable, real-time data transmission crucial for advanced applications like predictive maintenance, high-definition video telematics, over-the-air (OTA) software updates, and supporting future autonomous driving functions that require near-instantaneous decision feedback.

What role does telematics play in Usage-Based Insurance (UBI)?

Telematics collects precise driving data (speed, braking, mileage, time of day) which insurance providers analyze to create highly individualized risk profiles. This allows for personalized insurance premiums that accurately reflect the driver's actual behavior, shifting away from generalized actuarial models and rewarding safer driving practices.

What is the main driver of telematics adoption in the Asia Pacific region?

The primary driver in APAC is the massive expansion of the e-commerce and logistics sectors coupled with large-scale governmental investment in Intelligent Transportation Systems (ITS). This fuels demand for efficient fleet management, asset tracking, and improved public transit operational transparency, especially in rapidly growing urban centers.

What are the major data security and privacy challenges associated with telematics?

The central challenges involve protecting vast amounts of personally identifiable information (PII) related to driver movements and behavior from cyber threats. Compliance with regional data protection laws, such as GDPR and CCPA, requires robust encryption, anonymization techniques, and secure cloud storage practices to ensure data integrity and user trust.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager