Telescopic Way Covers Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442991 | Date : Feb, 2026 | Pages : 245 | Region : Global | Publisher : MRU

Telescopic Way Covers Market Size

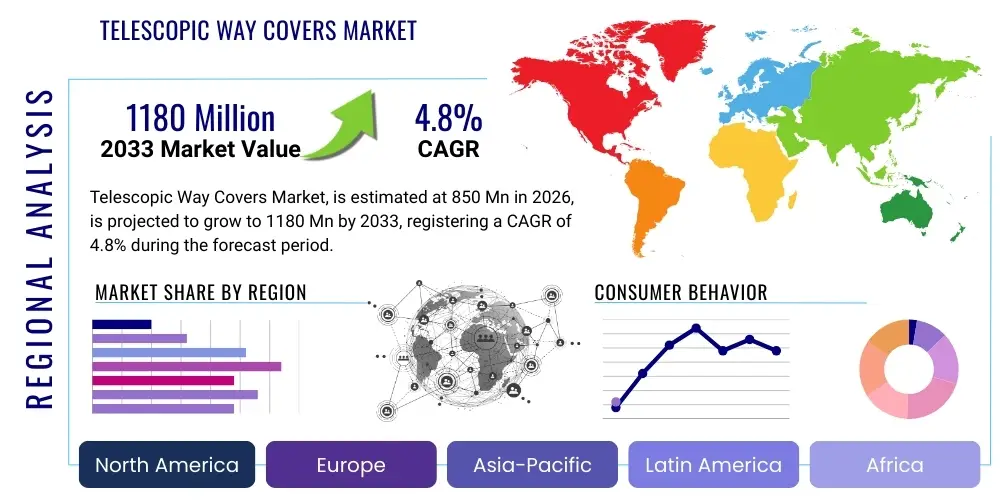

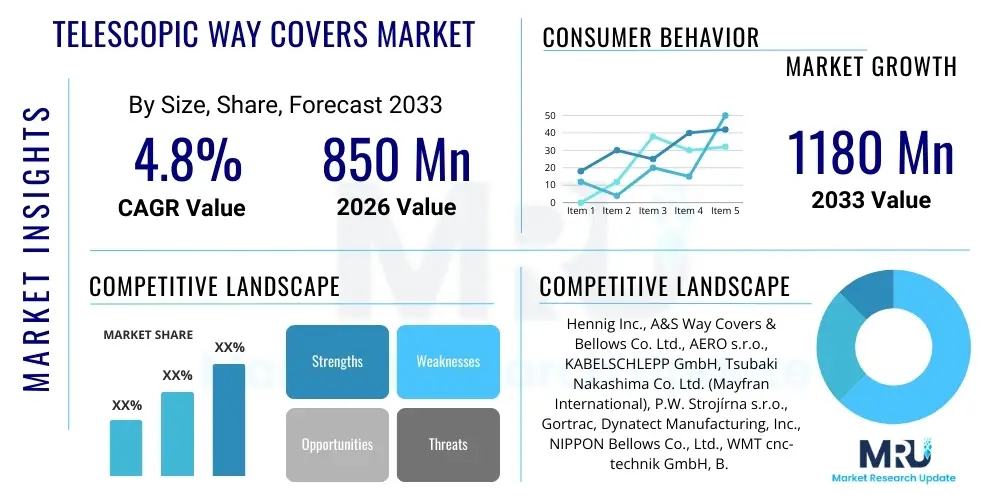

The Telescopic Way Covers Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at USD 850 Million in 2026 and is projected to reach USD 1180 Million by the end of the forecast period in 2033. This growth trajectory is fundamentally supported by the sustained expansion of the global machine tools industry, particularly the demand for high-precision Computer Numerical Control (CNC) machinery which necessitates superior protection systems to maintain operational integrity and dimensional accuracy under challenging industrial conditions. Furthermore, the increasing complexity and speed of modern machining processes require way covers engineered with advanced materials and optimized telescoping mechanisms to handle higher levels of mechanical stress and thermal variance. The robustness and longevity afforded by well-designed way covers directly translate into reduced maintenance costs and minimized downtime for end-users, thereby cementing their essential role in contemporary manufacturing ecosystems across diverse sectors, including automotive, aerospace, and general engineering.

Telescopic Way Covers Market introduction

The Telescopic Way Covers Market encompasses the design, manufacture, and distribution of protective shielding systems primarily utilized in machine tools and industrial automation equipment. These covers, often constructed from heavy-gauge steel, stainless steel, or aluminum sections, are engineered to protect critical machine components—such as guideways, ball screws, and linear scales—from chips, dust, coolants, and physical impact generated during machining operations. The telescoping design allows the cover to compress into a minimal space when the machine axes move, providing maximum protection during the full range of machine travel. Product descriptions typically emphasize features such as smooth movement, resistance to abrasion, efficient coolant drainage, and integrated wiper systems that ensure debris is kept out of the precision mechanisms, thereby extending the service life and operational reliability of expensive industrial machinery.

Major applications for telescopic way covers span high-precision industries, including automotive manufacturing for powertrain and chassis component production, aerospace for machining complex structural parts from demanding alloys, and mold and die making where extremely high accuracy and surface finish are paramount. They are indispensable in environments involving heavy chip loads, aggressive coolants, or high-speed axis movement, such as those found in 5-axis machining centers, vertical and horizontal turning lathes, grinding machines, and large gantry-style milling machines. The primary benefits derived from the adoption of high-quality way covers include enhanced machine longevity, reduced premature wear on critical components, maintenance of geometric accuracy, and substantial improvements in operator safety by containing machining byproducts, ensuring compliance with stringent industrial safety standards globally.

Key driving factors fueling the market growth include the continuous global investment in advanced manufacturing infrastructure, specifically the rise in demand for automated and high-speed CNC machines across emerging economies in Asia Pacific, which are transitioning from manual to automated processes. Technological advancements in material science, leading to lighter yet stronger cover materials, alongside innovations in damping and sealing technologies for quieter and more efficient operation, further propel market expansion. Furthermore, stringent quality control requirements in end-use industries like medical device manufacturing and precision optics necessitate the flawless functioning of machine tools, making reliable way cover protection an absolute prerequisite for achieving desired manufacturing tolerances and maintaining competitive production standards.

Telescopic Way Covers Market Executive Summary

The Telescopic Way Covers Market is characterized by steady, technology-driven growth, underpinned by resilient global capital expenditure in the factory automation sector. Current business trends indicate a shift towards customized, high-performance covers that integrate smart features, such as condition monitoring sensors for predictive maintenance, particularly in high-throughput environments like large automotive production facilities. Manufacturers are prioritizing solutions that offer optimized weight-to-strength ratios and superior chemical resistance to withstand modern synthetic coolants and aggressive cutting fluids, leading to increased adoption of specialized steel alloys and precision aluminum fabrication techniques. The competitive landscape is moderately fragmented, with specialized manufacturers focusing on niche, high-accuracy applications, while larger industrial suppliers compete on scalability and standardized product lines aimed at general engineering and machine tool OEMs globally. Mergers and acquisitions focusing on integrating material science expertise or broadening geographic distribution networks are observed as strategies to consolidate market position and penetrate untapped regional markets.

Regional trends highlight the Asia Pacific (APAC) region, led by China, Japan, and South Korea, as the dominant force in both consumption and manufacturing capacity, driven by massive domestic machine tool production and robust demand from the burgeoning electric vehicle (EV) manufacturing sector. North America and Europe demonstrate mature market characteristics, focusing on technological sophistication, replacement cycles, and the demand for high-end, customized way covers tailored for aerospace, defense, and high-precision medical applications, which command premium pricing. Segment trends show a significant uptick in demand for medium-duty and heavy-duty covers, reflecting the growth in large-scale machining centers and transfer lines used for producing large metallic components. Furthermore, the increasing popularity of high-speed machining (HSM) necessitates the development of covers capable of operating reliably at speeds exceeding 60 meters per minute (m/min), pushing innovation in roller and guide systems to mitigate vibration and noise generation effectively.

Overall, the market is poised for expansion due to favorable macro-economic factors, including government initiatives supporting industrial digitalization and automation across diverse economies. The primary opportunities lie in the adoption of lightweight materials, such as specific carbon fiber composites in specialized applications, and in leveraging digital simulation tools during the design phase to optimize cover geometry for specific machine kinematics. Challenges persist regarding the high initial investment required for heavy-duty custom covers and the competitive pressure from lower-cost manufacturers, necessitating a focus on total cost of ownership (TCO) benefits and verifiable performance metrics to sustain pricing power. The successful integration of advanced sealing materials capable of resisting micro-fines and aggressive chemical agents remains a core focus for technological differentiation within this mature yet evolving industrial component market segment.

AI Impact Analysis on Telescopic Way Covers Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Telescopic Way Covers Market often center on how digitalization and predictive maintenance systems will affect product design, manufacturing efficiency, and maintenance cycles. Key themes emerging from common user questions include the potential for AI-driven machine learning models to optimize cover material selection based on real-time operating conditions (e.g., thermal load, chip type, coolant pH), thereby improving longevity. Users are highly interested in how embedded sensors (IoT integration) combined with AI analytics can predict component failure, specifically concerning wiper degradation or mechanical wear on way cover segments, moving maintenance from reactive to proactive scheduling. Furthermore, questions address how generative design algorithms, powered by AI, could optimize the physical geometry of the telescopic segments to reduce weight, minimize noise, and enhance chip evacuation efficiency while maintaining structural rigidity. The overall expectation is that AI integration will primarily streamline the maintenance ecosystem and optimize the customization process for complex industrial machinery.

The integration of AI is not expected to change the fundamental mechanical function of the way cover but rather revolutionize its monitoring and design parameters. For manufacturers, AI-assisted quality control and automated optical inspection systems are reducing defects in the highly precise manufacturing process of cover segments, ensuring tighter tolerances and improved sealing capabilities. In the operational phase, AI is crucial for processing the large datasets generated by machine health monitoring systems. This capability allows end-users to precisely quantify the stress factors imposed on the way covers under various machining loads, which feeds back into better specification setting for future machine purchases. AI models can correlate variables such as axis acceleration, temperature fluctuations, and coolant flow rates with cover wear rates, providing actionable insights that significantly reduce unexpected machine downtime and enhance overall equipment effectiveness (OEE).

Concurrently, the adoption of digital twins for entire CNC machines means that telescopic way covers, as critical subsystems, are now being modeled and simulated with greater fidelity using AI-enhanced physics engines. This allows for virtual stress testing and optimization before physical prototyping, dramatically accelerating the time-to-market for specialized, high-performance covers required by industries like high-speed aerospace component manufacturing. The expectation of reduced unscheduled downtime through AI-driven maintenance scheduling is driving customers to favor way cover suppliers who offer integrated sensor packages and seamless data connectivity with existing plant maintenance platforms. This trend is pushing the market toward 'smart cover' solutions, where the protective shield becomes an active data-generating component contributing to the overall intelligence of the automated manufacturing cell.

- AI-driven Predictive Maintenance: Utilizing sensor data (vibration, thermal stress) embedded in covers to forecast wear and schedule proactive replacements, minimizing costly machine downtime.

- Generative Design Optimization: Employing AI algorithms to design lighter, stronger, and acoustically optimized cover segment geometries for high-speed applications.

- Automated Quality Control: AI-powered computer vision systems enhancing precision and defect detection during the fabrication of highly accurate sheet metal cover segments.

- Material Stress Analysis: Machine learning models analyzing operational data to recommend optimal material specifications (e.g., steel grade, coating) for extreme environments.

- Digital Twin Integration: Enhancing the fidelity of machine tool digital twins by accurately modeling the dynamic interaction and load placed on the way cover during complex movements.

DRO & Impact Forces Of Telescopic Way Covers Market

The Telescopic Way Covers Market is shaped by a confluence of accelerating industrial automation, material performance requirements, and regional manufacturing shifts. Primary market drivers include the persistent global growth in the sales of high-speed and multi-axis CNC machine tools, each requiring reliable way cover protection to safeguard precision components from chips and contaminants. Restraints principally revolve around the high initial cost of fully enclosed, heavy-duty custom covers, particularly those requiring specialized materials or complex installation procedures, which can deter adoption among smaller fabrication shops. Opportunities are substantial in integrating advanced smart technologies, specifically incorporating IoT sensors for condition monitoring and developing lightweight composite material covers for robotic and high-acceleration linear motion applications. The overall impact forces are moderate-to-high, driven significantly by the non-negotiable requirement for high accuracy in modern manufacturing, making way cover reliability a crucial factor in production yield and machine lifespan, ensuring continued investment in protective solutions across key industrial sectors.

The most significant market drivers are linked to the push for extreme manufacturing precision across aerospace and medical sectors, where geometric accuracy and repeatability are paramount. These sectors necessitate the highest grade of protection against micro-fines and corrosive coolants, driving demand for premium stainless steel covers with enhanced sealing technologies. Conversely, a major constraint is the lifecycle replacement complexity; replacing heavy-duty way covers often involves substantial machine disassembly and extended downtime, influencing end-users to seek out exceptionally durable designs, thereby elongating replacement cycles and potentially dampening volume growth. The market also faces technical restraints related to achieving superior dynamic damping properties in covers operating at very high speeds, preventing undesirable vibrations that could compromise machining quality. Overcoming these technical limitations through innovative material damping and roller system designs presents a clear opportunity for market leaders to secure technological competitive advantage and expand their market share globally.

Strategic opportunities include the expansion of aftermarket services, focusing on refurbishment and replacement of wiper systems and guide rollers, which are high-wear components, offering sustained revenue streams beyond initial equipment sales. Furthermore, the burgeoning demand for specialized automation equipment in industries like battery manufacturing and semiconductor production, which utilize large-format linear motion systems in cleanroom environments, provides fertile ground for developing bespoke, contamination-controlled way cover solutions. These sophisticated applications demand covers designed for zero particulate generation and superior chemical resistance, pushing innovation beyond traditional machine shop requirements. The impact forces are fundamentally sustained by regulation and quality standards; as certifications (like ISO 9001 or AS9100) demand consistent manufacturing quality, the role of protective components like way covers becomes critical to maintaining compliance, acting as a powerful, underlying market driver across all industrial regions.

Segmentation Analysis

The Telescopic Way Covers Market is systematically segmented based on material type, design configuration, movement type, end-use application, and duty cycle, allowing for precise market sizing and strategic targeting across diverse industrial landscapes. This multi-dimensional segmentation reflects the high degree of customization inherent in the product, as way covers must be engineered to match the specific geometry, speed, and environmental conditions of the host machine tool. The segmentation by material is crucial, as the choice between stainless steel, standard steel alloys, and specialty options dictates the cover's resistance to corrosion, impact, and heat. Furthermore, differentiating segments by end-use application—such as separating standard CNC milling from high-speed grinding or laser cutting applications—provides clarity on varying performance requirements, including sealing efficacy and thermal expansion management, which significantly influence product pricing and technical specifications, ensuring that market offerings align perfectly with industry-specific operational needs and safety standards.

- By Material Type:

- Stainless Steel Way Covers

- Standard Steel Alloy Way Covers (Black Oxide/Treated)

- Aluminum Way Covers (Light-duty/Specialty)

- Hybrid Covers (Steel with composite/polymer elements)

- By Design Configuration:

- Standard Box Type (Flat or Pitched Roof)

- Roofed Type (Walk-on Covers)

- Apron/Flexible Covers (Limited application)

- Customized Telescopic Designs

- By Movement Type:

- Horizontal Axis Covers

- Vertical Axis Covers (Including Hanging/Overhead Applications)

- Inclined Axis Covers

- By End-Use Industry:

- Automotive Industry (Powertrain, Body-in-White)

- Aerospace and Defense

- Heavy Machinery and Industrial Equipment

- Tool and Die Manufacturing

- Medical Device Manufacturing

- General Engineering and Job Shops

- By Duty Cycle:

- Light-Duty Covers

- Medium-Duty Covers

- Heavy-Duty Covers (High impact/High chip load)

Value Chain Analysis For Telescopic Way Covers Market

The value chain for the Telescopic Way Covers Market begins with the upstream procurement of high-grade sheet metals, including specialized stainless steel and cold-rolled steel alloys, often requiring specific surface treatments for enhanced corrosion and wear resistance, alongside the acquisition of specialized polymers for wiper and sealing systems. Key upstream activities involve meticulous quality control over raw materials, ensuring minimal inclusions and consistent thickness crucial for precision fabrication. Manufacturing involves highly technical processes such as precision laser cutting, advanced Computer Numerical Control (CNC) bending, specialized welding, and assembly of complex telescoping segment linkages. The high precision required, particularly for ensuring smooth operation at high speeds and maintaining effective sealing against fine particles, necessitates specialized tooling and experienced sheet metal fabricators capable of meeting tight tolerance specifications, forming the foundational core of the manufacturing segment's value addition.

The midstream involves the integration of mechanical components, such as guide rollers, damping systems (often incorporating shock absorbers or elastomer pads), and internal rail systems, followed by surface finishing treatments like black oxidizing or specialized paint application for chemical resistance. Distribution channels are bifurcated: direct distribution is common for large machine tool Original Equipment Manufacturers (OEMs), who require high-volume, customized way covers integrated directly into their assembly lines under strict quality agreements. Indirect distribution utilizes specialized industrial distributors and authorized service providers who cater to the aftermarket segment, offering replacement, repair, and customized solutions for older or unique machinery across geographically dispersed job shops and maintenance facilities. This indirect channel relies heavily on robust inventory management and technical support capabilities, often requiring distributors to maintain specialized engineering teams for complex installations and site measurements, adding significant logistical value.

Downstream analysis focuses on the end-users, primarily categorized into three groups: machine tool OEMs, end-users requiring replacement/refurbishment (MRO market), and system integrators specializing in automation cells. The purchasing decision for OEMs is driven by cost, standardization, and long-term supply reliability, whereas MRO customers prioritize rapid delivery, ease of installation, and durability in harsh environments. The role of the distributor is critical in the downstream, bridging the gap between highly specialized manufacturing expertise and the diverse, localized needs of machine shops and heavy industry. Successful participation in the downstream segment requires strong application engineering support, allowing suppliers to provide tailor-made solutions for the unique operational constraints of different machining technologies, thereby creating high customer lock-in and securing recurring aftermarket revenues based on product quality and technical service superiority.

Telescopic Way Covers Market Potential Customers

Potential customers for the Telescopic Way Covers Market primarily consist of entities that own, operate, or manufacture high-precision industrial machinery, focusing heavily on sectors requiring automated cutting and forming processes. The largest consumer segment is the global machine tool manufacturing base, encompassing major CNC machine OEMs that integrate these protective covers as standard components into their new milling, turning, and grinding centers before sale. This foundational segment demands high volumes and stringent technical conformity, driving innovation towards weight reduction and optimized mechanical performance to enhance the host machine's speed and efficiency. A second critical customer base includes large-scale manufacturing operations in the automotive and aerospace industries, which utilize vast fleets of machinery for continuous, high-volume production; these buyers prioritize covers offering maximum durability, extended life, and minimal maintenance requirements to maximize operational uptime across their assembly lines and specialized component manufacturing facilities.

Furthermore, significant demand originates from the Maintenance, Repair, and Overhaul (MRO) segment, where independent job shops, industrial maintenance departments, and specialized machinery repair services purchase replacement way covers or upgrade existing ones. These customers are highly sensitive to lead times and seek robust aftermarket support, often requiring custom-fitted solutions for legacy machinery or non-standard applications that necessitate precise on-site measurement and rapid fabrication turnaround. The growth in specialized manufacturing, particularly in the energy sector (e.g., turbine blade machining), semiconductor equipment fabrication (requiring cleanroom-compatible solutions), and advanced medical device manufacturing, also represents a high-value customer group. These niche applications demand way covers constructed from specialty materials that resist specific chemicals, maintain integrity under extreme thermal cycling, or meet exceptionally low particulate generation standards, positioning them as key drivers for technical innovation in materials and sealing technology, ensuring that the protective solution meets the unique environmental constraints of these highly regulated industries.

The purchasing decisions across these diverse customer segments are guided by different criteria. OEMs focus on cost efficiency and integration compatibility, aiming for a reliable supply chain partner. Aerospace and heavy industry customers emphasize total cost of ownership (TCO), prioritizing longevity and reliable performance over several years of intensive use in multi-shift operations. Conversely, small and medium-sized enterprises (SMEs) often weigh the balance between initial investment and projected machine lifespan extension, favoring standardized, modular designs that offer quick installation and proven protection in general machining environments. Therefore, successful market penetration requires suppliers to tailor their product offerings and distribution strategies to meet the distinct technical, logistical, and financial requirements of these varied buyer groups, ensuring that the protective solutions offered deliver measurable value in terms of asset protection and reduced operational expenditure.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 850 Million |

| Market Forecast in 2033 | USD 1180 Million |

| Growth Rate | 4.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Hennig Inc., A&S Way Covers & Bellows Co. Ltd., AERO s.r.o., KABELSCHLEPP GmbH, Tsubaki Nakashima Co. Ltd. (Mayfran International), P.W. Strojírna s.r.o., Gortrac, Dynatect Manufacturing, Inc., NIPPON Bellows Co., Ltd., WMT cnc-technik GmbH, B. H. J. D. INDUSTRIES PRIVATE LIMITED, Advanced Way Covers, Heimatec, Metalfab, Central Protection Systems Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Telescopic Way Covers Market Key Technology Landscape

The technology landscape for Telescopic Way Covers is primarily focused on enhancing durability, operational speed, and sealing efficiency through continuous refinement of material science and mechanical engineering principles. Key technologies revolve around the selection and treatment of high-tensile sheet metals, where specific grades of stainless steel (e.g., 304 or 316) are increasingly utilized in harsh environments requiring superior resistance to highly acidic or alkaline coolants prevalent in modern machining centers. Advanced fabrication techniques, particularly high-precision laser welding and optimized segment geometry using finite element analysis (FEA), are essential to minimize friction during high-speed axis movements and ensure perfect alignment of segments, which is critical for preventing internal wear and maintaining sealing integrity against fine metallic dust and abrasive particles generated during dry machining operations.

A critical technological area involves the development of specialized wiper systems and sealing materials. Modern way covers utilize polyurethane or fluorocarbon elastomers for wipers, specifically engineered to withstand aggressive chemicals and high temperatures, while providing optimal scraping action without damaging the surface of the cover segments. Innovations in guide systems are also paramount; instead of traditional sliding mechanisms, many heavy-duty and high-speed covers now incorporate precision linear guides or roller systems, often featuring low-friction, self-lubricating bearings. This shift significantly reduces the force required to move the cover (the push/pull force), enabling faster machine acceleration and deceleration, while simultaneously reducing noise and prolonging the mechanical lifespan of the cover assembly, addressing a major operational bottleneck in previous generations of way cover designs.

Furthermore, the incorporation of passive and active damping technologies is becoming a standard feature, especially for very long or high-velocity axis travels. Passive damping utilizes specially designed rubber or polymer pads placed between segments to absorb kinetic energy and minimize the 'clapping' noise inherent in telescoping motion, improving the overall workshop environment. Active technological integration involves the aforementioned IoT sensors (accelerometers, temperature probes) and magnetic encoders integrated into the cover's structure. These devices allow for real-time monitoring of cover condition, detecting anomalies such as premature roller failure or excessive vibration, thereby leveraging industrial Internet of Things (IIoT) capabilities to facilitate predictive maintenance routines and optimize machine utilization. This technology convergence transforms the way cover from a purely passive protective device into an active, data-generating component of the modern intelligent machine tool ecosystem, driving demand for technologically sophisticated and digitally enabled protection solutions.

Regional Highlights

- Asia Pacific (APAC): APAC is the global powerhouse for both consumption and production of Telescopic Way Covers, driven by the colossal manufacturing bases in China, Japan, South Korea, and India. China's rapid industrialization and focus on high-end manufacturing, particularly in electric vehicle component production and semiconductor equipment, fuel massive demand for high-quality protective solutions for newly installed CNC fleets. Japan and South Korea, mature manufacturing hubs, remain crucial markets focused on technological sophistication and high-accuracy covers for precision machinery exports. The region's competitive advantage is supported by substantial government investment in modernizing factory infrastructure and the presence of numerous large domestic machine tool OEMs that require specialized, high-volume cover manufacturing capabilities.

- North America: The North American market is characterized by high-value, low-volume production, primarily driven by the stringent demands of the aerospace, defense, and oil and gas sectors. Demand here focuses heavily on customization, heavy-duty covers, and systems built to withstand extreme mechanical and environmental stresses. The focus is less on sheer volume and more on integrated solutions, superior material quality, and reduced total cost of ownership (TCO). Renewed focus on domestic manufacturing, spurred by supply chain resilience policies, is leading to capital expenditure in advanced machining centers, ensuring stable, albeit moderate, growth in demand for premium way cover products that comply with strict performance specifications.

- Europe: Europe represents a mature, highly specialized market, particularly centered around Germany (the core of the European machine tool industry), Italy, and Switzerland. The region drives innovation in energy efficiency, noise reduction, and advanced sealing technologies, reflecting European industrial standards and environmental regulations. European manufacturers often lead in developing innovative guide systems and utilizing lighter, high-strength aluminum alloys for specific applications. The automotive industry, especially the shift towards electric vehicle platforms, continues to be a major consumer, requiring advanced way covers for specialized battery housing and structural component machining equipment across various production facilities.

- Latin America (LATAM) & Middle East and Africa (MEA): These regions are emerging and developing markets for telescopic way covers. Growth in LATAM is driven by automotive manufacturing (Mexico, Brazil) and resource processing industries, where durable, robust covers are needed for machinery operating in challenging industrial environments. The MEA region's growth is tied to investments in diversifying economies away from oil, focusing on infrastructure, manufacturing, and defense capabilities, necessitating the import of advanced CNC machinery and the associated protective equipment. These regions primarily rely on imported products from established European and APAC manufacturers, offering opportunities for strategic distribution partnerships and localized service capabilities to penetrate these geographically distinct and expanding industrial bases.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Telescopic Way Covers Market.- Hennig Inc.

- A&S Way Covers & Bellows Co. Ltd.

- AERO s.r.o.

- KABELSCHLEPP GmbH

- Tsubaki Nakashima Co. Ltd. (Mayfran International)

- P.W. Strojírna s.r.o.

- Gortrac

- Dynatect Manufacturing, Inc.

- NIPPON Bellows Co., Ltd.

- WMT cnc-technik GmbH

- B. H. J. D. INDUSTRIES PRIVATE LIMITED

- Advanced Way Covers

- Heimatec

- Metalfab

- Central Protection Systems Inc.

- Tecnoflex S.p.A.

- Nabell Corporation

- Zhongshan Waycover Technology Co., Ltd.

- Yantai Sanhe Machine Co., Ltd.

- PRIMA POWER

Frequently Asked Questions

Analyze common user questions about the Telescopic Way Covers market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the typical lifespan and maintenance requirement of a standard telescopic way cover?

The lifespan of a telescopic way cover typically ranges from 5 to 10 years, heavily dependent on the operational environment, axis speed, and chip load. Primary maintenance involves regular inspection and replacement of external wiper systems and internal guide rollers, which sustain the most wear from continuous operation and contact with abrasive materials and coolants, ensuring minimal internal mechanical friction.

How does high-speed machining (HSM) impact the design requirements for way covers?

High-speed machining necessitates way covers designed for high acceleration and velocity, requiring low-friction guide systems, optimized roller designs, and advanced damping materials to prevent noise, vibration, and mechanical fatigue. Specialized materials with low thermal expansion coefficients are also used to maintain structural integrity under increased thermal stress generated by rapid movement.

Which material type provides the best protection against corrosive synthetic coolants?

Stainless steel way covers, particularly 304 and 316 grades, offer superior chemical resistance against modern synthetic coolants, which often contain harsh chemical additives. When coupled with fluorocarbon elastomer (FKM) wipers, these systems provide maximum durability and longevity in chemically aggressive machining environments.

What are the key drivers for replacement demand versus new equipment demand in this market?

New equipment demand is driven by global capital expenditure in CNC machine tools across all industrial sectors. Replacement demand (MRO) is driven by aging machine fleets and the failure of existing covers due to wear, primarily sustained in heavy-duty or continuous multi-shift operations. Replacement is often prioritized by end-users seeking to extend the service life of high-value assets.

How are Telescopic Way Cover manufacturers addressing the demand for predictive maintenance features?

Manufacturers are integrating Industrial IoT (IIoT) sensors, such as vibration sensors and internal temperature probes, into the covers. This enables condition monitoring and allows for data aggregation and analysis, which, when combined with AI algorithms, facilitates accurate predictive scheduling for maintenance and component replacement, improving overall equipment effectiveness (OEE).

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager