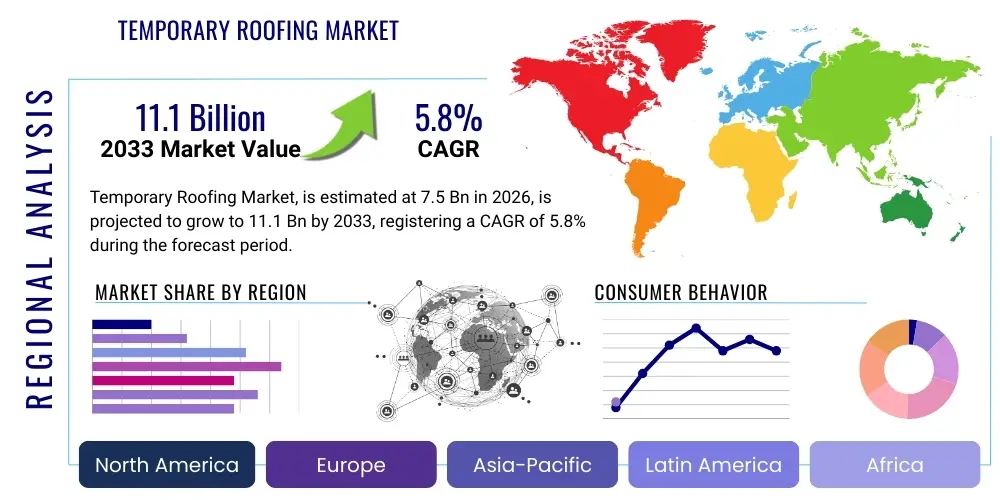

Temporary Roofing Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 440943 | Date : Feb, 2026 | Pages : 245 | Region : Global | Publisher : MRU

Temporary Roofing Market Size

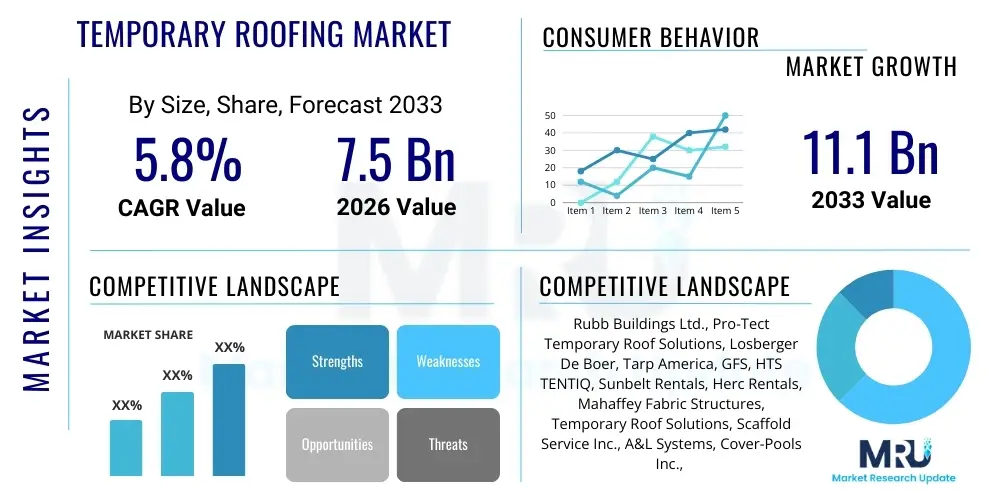

The Temporary Roofing Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at $7.5 Billion in 2026 and is projected to reach $11.1 Billion by the end of the forecast period in 2033.

Temporary Roofing Market introduction

The Temporary Roofing Market encompasses the supply and installation of protective barriers designed to shield construction sites, damaged buildings, and sensitive equipment from environmental elements such as rain, snow, and extreme heat for a defined period. This market is intrinsically linked to the construction, infrastructure repair, and emergency response sectors, offering crucial protection during repair, renovation, or full-scale construction phases where the permanent roofing structure is either removed or incomplete. Products range from heavy-duty engineered scaffold-supported systems capable of spanning large commercial structures to simpler, rapidly deployable polyethylene or polyvinyl chloride (PVC) tarpaulins used primarily for residential repair or immediate disaster relief efforts. The fundamental benefit provided by temporary roofing is the minimization of downtime, prevention of further structural damage, and ensuring a safe, dry working environment, thereby accelerating project completion times and reducing overall risk exposure.

Major applications of temporary roofing systems are diverse, extending across various end-use industries. In the commercial sector, these structures are essential during extensive facade restoration, historical building preservation, or complex industrial maintenance operations where keeping the internal processes dry is non-negotiable. Residential applications frequently involve roof replacements, attic conversions, or fire damage remediation, necessitating a watertight seal over the vulnerable structure while work progresses. Furthermore, the market sees significant demand surge in geographies prone to severe weather events, where rapid deployment of protective coverings is critical for business continuity and insurance claim mitigation. The inherent flexibility and scalability of modern temporary roofing solutions allow them to adapt to nearly any structural complexity, making them indispensable tools in modern construction and remediation practices.

Driving factors for market expansion include stricter building codes requiring weather protection during construction, increasing urbanization leading to a higher volume of construction and renovation projects, and the growing intensity and frequency of natural disasters globally. Technological advancements focusing on lighter, stronger, and more rapidly deployable materials, such as modular truss systems and specialized tensioned fabric structures, further enhance the market's appeal. Additionally, the increasing focus on worker safety and environmental protection mandates that construction sites minimize runoff and manage debris effectively, requirements that temporary roofing systems inherently address, positioning them as essential investments rather than optional expenditures within project budgets.

Temporary Roofing Market Executive Summary

The Temporary Roofing Market exhibits robust growth driven primarily by escalating global construction spending, particularly in infrastructure renewal and urban densification projects across North America and Europe. Business trends indicate a shift toward sophisticated, reusable modular scaffolding and sheeting systems, favoring long-term rental agreements over outright purchases, thereby enhancing asset utilization rates for major service providers. Regional trends highlight the Asia Pacific (APAC) region as a high-growth epicenter, propelled by massive industrial and commercial development in countries like China and India, coupled with increasing investments in disaster preparedness infrastructure, though this demand often favors cost-effective tarp solutions initially. Conversely, developed markets demand higher-specification systems emphasizing wind load resistance and fire safety compliance. Segmentation trends reveal that the specialized enclosure segment, utilizing engineered fabric structures over conventional tarpaulins, is witnessing the fastest adoption rate, particularly in high-value commercial and industrial maintenance applications where environmental control is paramount. The underlying market dynamic remains cyclical, closely tied to seasonal construction calendars and unpredictable weather patterns, yet the foundational necessity of weather protection ensures steady demand even during economic downturns, especially in repair and maintenance categories.

AI Impact Analysis on Temporary Roofing Market

User inquiries regarding the integration of Artificial Intelligence (AI) in the Temporary Roofing Market primarily revolve around operational efficiency, risk mitigation, and predictive maintenance scheduling. Users are keen to understand how AI can optimize the inventory and logistical management of temporary roofing materials, which are often bulky and required urgently across geographically dispersed sites. Key concerns focus on whether AI can accurately predict localized high-wind or heavy-snow events, allowing for proactive strengthening or removal of temporary structures, thus enhancing safety compliance and reducing catastrophic failure risks. Furthermore, there is significant interest in how computer vision, a subset of AI, can be utilized via drone surveillance to autonomously monitor the integrity of large temporary roof spans for material stress, water pooling, or seal breaches in real-time. The summarized user expectation is that AI will transition temporary roofing from a reactive deployment service to a highly predictive, precision-managed logistical operation, improving project margins and safety standards substantially.

- AI-driven Predictive Maintenance: Analyzing weather patterns and structural stress data from sensor-equipped temporary roofs to forecast required maintenance or reinforcement before failure occurs.

- Optimized Logistics and Inventory Management: Using machine learning algorithms to forecast regional demand fluctuations, optimizing the location and quantity of scaffolding and sheeting materials for rental fleets, minimizing transport costs and deployment delays.

- Enhanced Site Safety Monitoring: Implementing computer vision via drones to automatically inspect temporary roof installations for compliance with engineering specifications, identifying potential weak points or incorrect anchoring that pose safety hazards.

- Automated Project Scheduling: AI integration with broader Construction Management Software (CMS) to seamlessly schedule the deployment and removal of temporary roofing based on the critical path analysis of the overall construction timeline.

- Dynamic Pricing Models: Utilizing AI to analyze competitive pricing, regional supply constraints, and project duration risks to offer dynamic and optimized rental or leasing rates for specialized temporary structures.

DRO & Impact Forces Of Temporary Roofing Market

The Temporary Roofing Market is profoundly influenced by a complex set of drivers, restraints, and opportunities that collectively determine its trajectory and profitability. The primary driver is the accelerating frequency and intensity of severe weather events globally, necessitating rapid and robust protection solutions for damaged infrastructure and ongoing construction. Coupled with this is the continuous growth in renovation and refurbishment projects, particularly in mature markets like North America and Western Europe, where older building stock requires significant overhaul, often under strict regulatory deadlines. Conversely, major restraints include the high initial setup cost and complexity associated with engineered scaffolding temporary roofs, making them economically prohibitive for smaller projects or shorter durations. Additionally, regulatory hurdles concerning wind load standards and permissible materials vary significantly by jurisdiction, complicating standardization and cross-regional service provision, requiring companies to maintain varied inventories and obtain specialized regional certifications. These constraints often push smaller contractors toward less robust, conventional tarp solutions, which may not offer adequate protection.

Opportunities for market expansion are centered around material innovation and specialized service offerings. The development of lightweight, highly durable, fire-resistant fabric materials and standardized modular truss systems promises faster deployment times and greater structural stability, opening up applications in highly regulated industries such as energy and petrochemical maintenance. Furthermore, the disaster relief segment presents substantial opportunities, driven by government and NGO funding for post-calamity reconstruction efforts, requiring scalable, rapid-response temporary shelter and roofing solutions. The growing adoption of rental models is another significant opportunity, as it reduces capital expenditure for contractors and ensures they utilize the latest, safest equipment, thereby professionalizing the installation base and improving overall market reliability. Leveraging digital tools for rapid structural modeling and quotation generation represents a key competitive advantage in this service-heavy industry.

The impact forces within the market are predominantly driven by environmental volatility and regulatory compliance. The environmental impact force dictates demand surges following natural disasters and drives innovation toward weatherproof and UV-resistant materials. Regulatory impact forces, especially those concerning worker safety at height and structural integrity against extreme loads (e.g., snow and wind), exert pressure on manufacturers to invest heavily in engineering and certification, favoring large, well-capitalized providers over smaller operators. Economic impact forces, such as fluctuating material costs (steel, aluminum, PVC) and volatile interest rates affecting construction investment, influence pricing strategies and the financial viability of long-term rental contracts. Technological impact forces, particularly the integration of sensor technology for monitoring structural health and the use of drones for quick site surveys, enhance service quality and efficiency, solidifying the market's move toward highly engineered, temporary environmental control systems rather than simple coverage solutions.

Segmentation Analysis

The Temporary Roofing Market is comprehensively segmented based on material, application, and type, providing a detailed view of the varied demand profiles across the construction and maintenance sectors. This layered segmentation allows suppliers to tailor their offerings—ranging from basic, disposable protective sheets to highly engineered, reusable, and weather-tested truss systems—to specific end-user requirements regarding duration, load capacity, and budget. Analyzing these segments helps stakeholders understand which areas exhibit the highest growth potential, such as the adoption of advanced modular scaffolding systems over traditional methods in urban commercial environments, and where basic, cost-effective solutions remain dominant, typically in localized residential or agricultural applications. The market structure clearly differentiates between high-capital expenditure, long-duration industrial needs and low-cost, short-term emergency requirements.

- By Material

- Polyethylene (PE) Tarps

- Polyvinyl Chloride (PVC) Tarps

- Engineered Fabric Sheeting (e.g., Polyester coated PVC)

- Corrugated Metal Sheeting

- Plywood and Timber

- Modular Aluminum and Steel Truss Systems

- By Application

- Residential Renovation and Repair (e.g., roof replacement)

- Commercial Building Construction and Restoration (e.g., high-rise facade work)

- Industrial Maintenance (e.g., oil and gas refineries, power plants)

- Infrastructure Projects (e.g., bridge repair, rail maintenance)

- Disaster Relief and Emergency Shelter

- Historical Preservation Projects

- By Type of Structure

- Supported Temporary Roofs (Scaffolding dependent)

- Independent Free-Standing Temporary Roofs

- Tensioned Fabric Structures (Temporary Enclosures)

- Basic Ground-Level Protection (Tarpaulins only)

Value Chain Analysis For Temporary Roofing Market

The value chain for the Temporary Roofing Market begins with the Upstream Segment, focusing on the sourcing and manufacturing of raw materials. This segment includes suppliers of structural metals (aluminum and high-grade steel for modular truss systems), plastics (polyethylene and PVC resins for tarp and sheeting production), and specialized fabric manufacturers responsible for coating and weaving high-tensile architectural textiles. Innovation at this stage centers on developing lighter, more fire-resistant, and sustainable materials that offer enhanced UV stability and lifespan. Following material procurement, the fabrication stage involves specialized companies that design, engineer, and manufacture the temporary roofing components, including standardized modular scaffolding systems, custom-sized sheeting, and anchoring equipment, adhering strictly to regional structural codes and safety standards. Efficiency in manufacturing and standardized modular design are critical drivers of profitability in the upstream phase.

The central phase of the value chain involves the distribution, rental, and service provision aspects. Due to the high cost and temporary nature of the product, the Distribution Channel is dominated by Indirect methods, primarily through large equipment rental companies (ERCs) and specialized scaffolding contractors who maintain extensive, high-value inventories. Direct sales occur primarily for consumable items like basic tarpaulins or highly proprietary, large-scale engineered enclosures sold directly to government agencies or massive industrial complexes. Rental providers manage the complexity of logistics, installation, maintenance, and dismantling, which requires specialized labor and transport capabilities. The quality of installation and compliance with site-specific safety regulations are paramount here, distinguishing expert service providers from general equipment rental operations.

The Downstream Segment involves the End-Users, which are primarily construction companies, renovation contractors, industrial facility managers, and disaster relief organizations. The decision-making process at this stage is heavily influenced by project duration, necessary weather load capacity, regulatory requirements, and project budget. For high-stakes industrial maintenance, the reliability and speed of deployment are critical, favoring top-tier specialized service providers. The feedback loop from the downstream segment regarding material performance in adverse conditions is essential for informing upstream R&D and product improvement. The profitability in the temporary roofing value chain is often highest in the service and rental segment, capitalizing on high utilization rates and the technical expertise required for safe, compliant installation.

Temporary Roofing Market Potential Customers

The potential customer base for the Temporary Roofing Market is diverse, spanning various sectors that require reliable, temporary protection from environmental factors during construction, restoration, or crisis management. Construction firms form the largest group, routinely requiring temporary covers for ongoing projects like commercial high-rises, residential complexes, and infrastructure upgrades, aiming to keep internal works dry and accelerate project schedules. Specialized remediation and renovation contractors are also significant buyers, particularly those involved in water damage mitigation, fire restoration, and historical building preservation, where immediate and reliable temporary weatherproofing is mandatory before long-term repairs commence. These customers prioritize rapid response times and certification compliance.

Beyond traditional construction, the industrial sector represents a crucial high-value customer segment. Facilities such as power generation plants, petrochemical refineries, and manufacturing sites utilize temporary roofing during planned maintenance shutdowns (turnarounds) to protect sensitive machinery, controls, and work areas from rain or debris, ensuring that strict turnaround timelines are met. Furthermore, government agencies, municipalities, and Non-Governmental Organizations (NGOs) are critical customers within the disaster relief and emergency preparedness application areas. Following hurricanes, floods, or other major catastrophes, these entities require large volumes of rapidly deployable temporary roofing and sheltering systems for impacted communities and critical public infrastructure. The purchasing criteria for this segment prioritize rapid mobilization capability and durability under extreme conditions.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $7.5 Billion |

| Market Forecast in 2033 | $11.1 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Rubb Buildings Ltd., Pro-Tect Temporary Roof Solutions, Losberger De Boer, Tarp America, GFS, HTS TENTIQ, Sunbelt Rentals, Herc Rentals, Mahaffey Fabric Structures, Temporary Roof Solutions, Scaffold Service Inc., A&L Systems, Cover-Pools Inc., Aluflex, Shielding Solutions, Sarnafil, Layher, Ringer, Universal Scaffold & Equipment, Doka GmbH. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Temporary Roofing Market Key Technology Landscape

The technological landscape of the Temporary Roofing Market is increasingly focused on enhancing structural integrity, optimizing deployment speed, and improving material durability to meet stringent safety and longevity requirements. A primary technological focus is on modular truss systems, which utilize lightweight, high-tensile aluminum or galvanized steel components designed for quick, bolt-free assembly and disassembly. These systems employ advanced connection methodologies, often based on proprietary locking mechanisms, which significantly reduce installation time compared to traditional scaffolding and timber supports, while offering superior load-bearing capacity against heavy snow loads or high winds. Furthermore, computer-aided design (CAD) and building information modeling (BIM) software are now routinely used to model the temporary roof structure precisely over the existing building geometry, ensuring optimal fit, minimizing waste, and guaranteeing compliance with site-specific wind and snow load calculations before deployment even begins.

Material science is another critical area of technological advancement. Modern temporary roofing sheets are moving beyond standard PVC or polyethylene tarps towards high-performance architectural fabrics. These engineered fabrics are typically multi-layered, often PVC-coated polyester, treated for enhanced UV resistance, fire retardancy (meeting strict fire safety classifications), and superior tensile strength. The development of self-cleaning or anti-fungal treatments on the fabric surface extends the usable life of the rental inventory and maintains structural integrity over long-duration projects. Specialized tensioning systems, utilizing ratchets, wires, and hydraulic apparatus, ensure the sheeting remains taut across the truss structure, preventing water pooling—a common cause of temporary roof failure—and reducing flapping noise, which is crucial for urban projects.

Finally, digitalization and integration of Internet of Things (IoT) technologies are emerging as key competitive differentiators. Temporary roofs, especially those covering valuable assets or spanning long durations, are increasingly being fitted with integrated sensor packages. These sensors monitor key structural metrics such as stress points, accumulated snow load, and temperature differentials. Data gathered via IoT devices allows rental companies and site managers to remotely monitor the structure's health in real-time, enabling proactive intervention. This level of real-time monitoring not only enhances safety and compliance but also provides data that feeds back into AI optimization models for future design improvements and efficient fleet management, marking a significant step towards smart temporary structure management.

Regional Highlights

- North America: This region is characterized by high demand for sophisticated, engineered temporary roofing systems, driven by strict OSHA regulations concerning worker safety and high insurance standards requiring robust weather protection during construction and renovation. The market is mature, dominated by large equipment rental companies (e.g., Sunbelt, Herc) offering extensive, certified modular truss fleets. Demand is highly influenced by storm seasons (hurricanes on the East Coast) and severe winter conditions (snow loads in the North), necessitating high-spec, certified structures.

- Europe: The European market demonstrates strong growth, particularly in Western and Central Europe, focused on infrastructure repair, historic building preservation, and densely populated urban regeneration projects. Strict regulatory frameworks (e.g., Eurocodes) mandate rigorous structural testing and certification, favoring professional scaffolding and temporary structure specialists. The rental model is highly preferred due to the high cost of compliant equipment, with Germany and the UK leading in specialized temporary roof applications.

- Asia Pacific (APAC): APAC is the fastest-growing region, fueled by massive commercial and industrial infrastructure development, coupled with susceptibility to monsoon seasons and seismic activity. While cost sensitivity remains a factor, leading to widespread use of basic tarpaulin solutions in smaller projects, the need for large, complex enclosures for shipyard maintenance, factory construction, and major public works is rapidly increasing, driving demand for high-load, imported modular systems in economically advanced zones like Japan and Australia.

- Latin America (LATAM): The LATAM market is growing steadily, supported by urbanization and infrastructure improvements. Market adoption is segmented; while disaster relief often drives demand for basic, rapid-deployment solutions, major industrial projects (mining, oil and gas) increasingly require high-specification, imported temporary structures for maintenance turnarounds, prioritizing safety and durability.

- Middle East and Africa (MEA): Demand in the Middle East is primarily driven by mega-construction projects and oil and gas maintenance, where temporary roofing is vital for shade and dust control in arid conditions, alongside protection against rare but intense rainfall. The African market remains largely focused on rapid, cost-effective solutions for commercial construction and emergency shelter provision.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Temporary Roofing Market.- Rubb Buildings Ltd.

- Pro-Tect Temporary Roof Solutions

- Losberger De Boer

- Tarp America Inc.

- GFS (Global Fabric Solutions)

- HTS TENTIQ

- Sunbelt Rentals Inc.

- Herc Rentals Inc.

- Mahaffey Fabric Structures

- Temporary Roof Solutions (TRS)

- Scaffold Service Inc.

- A&L Systems

- Cover-Pools Inc. (Specialized Covers)

- Aluflex

- Shielding Solutions

- Sarnafil (Sika AG)

- Layher GmbH & Co KG

- Ringer GmbH

- Universal Scaffold & Equipment

- Doka GmbH

Frequently Asked Questions

Analyze common user questions about the Temporary Roofing market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary factors driving the demand for Temporary Roofing systems?

The primary drivers include increased global construction and renovation activities, the necessity of maintaining worker safety and productivity regardless of weather, and the escalating frequency and severity of natural disasters requiring rapid repair and protection of damaged structures.

How is the Temporary Roofing Market segmented by material?

The market is segmented by materials ranging from basic low-cost solutions like Polyethylene (PE) and Polyvinyl Chloride (PVC) tarps to advanced high-load systems utilizing Engineered Fabric Sheeting and sophisticated Modular Aluminum/Steel Truss Systems.

What are the critical safety considerations for installing temporary roofs?

Critical safety factors include adherence to strict wind and snow load engineering specifications, proper anchoring to the existing structure, compliance with regional scaffolding and working-at-height regulations, and using certified, fire-retardant materials.

Is renting or purchasing temporary roofing structures more cost-effective for construction projects?

Renting is generally more cost-effective for the majority of construction projects, as it eliminates high capital expenditure, inventory management, specialized installation labor costs, and the need for continuous maintenance and storage of bulky, specialized equipment.

How does technological advancement impact the structural stability of modern temporary roofs?

Technology impacts stability through the use of lightweight modular aluminum trusses, advanced tensioning systems to prevent water pooling, and the integration of IoT sensors for real-time monitoring of structural stress and external load conditions, leading to proactive safety management.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager