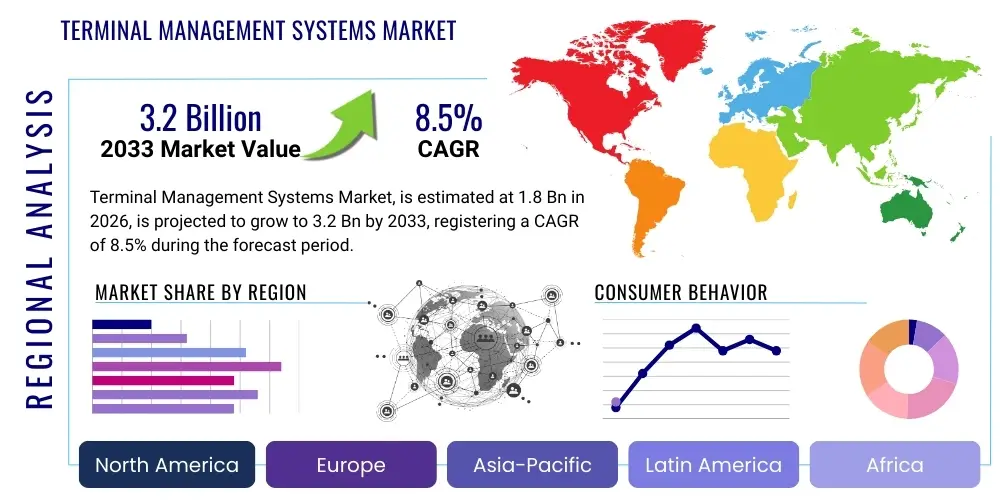

Terminal Management Systems Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441416 | Date : Feb, 2026 | Pages : 251 | Region : Global | Publisher : MRU

Terminal Management Systems Market Size

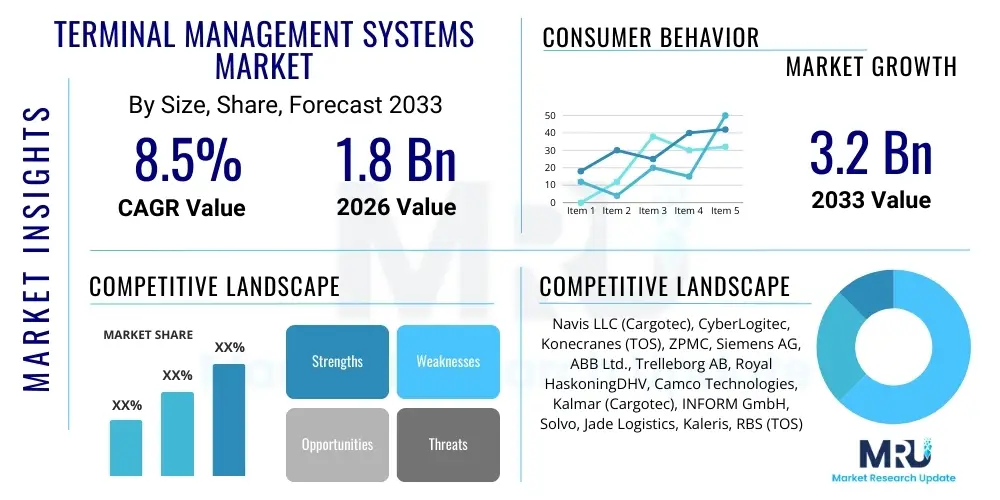

The Terminal Management Systems Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at $1.8 Billion in 2026 and is projected to reach $3.2 Billion by the end of the forecast period in 2033.

Terminal Management Systems Market introduction

Terminal Management Systems (TMS) are mission-critical software solutions designed to optimize and manage the complex operations within ports, rail yards, airports, and specialized freight handling facilities such as oil and gas terminals. These sophisticated platforms integrate various operational elements, including yard planning, vessel scheduling, gate management, equipment control, and documentation processing, ensuring the smooth, efficient, and secure flow of goods. The core function of TMS is to maximize throughput capacity while minimizing operational costs and turnaround times for vessels, trains, and trucks. Given the escalating global demand for faster logistics and the increasing complexity of international supply chains, the adoption of advanced TMS solutions is becoming indispensable for maintaining competitiveness and adhering to strict regulatory standards across the maritime and intermodal sectors. Furthermore, modern TMS platforms leverage real-time data integration capabilities, often connecting with physical assets via IoT sensors, to provide predictive analytics and foster proactive decision-making regarding resource allocation and potential bottlenecks.

Product descriptions of TMS extend beyond mere tracking systems; they encompass holistic operational control suites. Key features often include automated stacking algorithms that optimize yard utilization based on specific criteria like dwell time and destination, and advanced resource management modules that allocate cranes, internal transport vehicles, and labor efficiently. The major applications of TMS span various terminal types, including container terminals which require meticulous handling of thousands of standardized units, bulk terminals dealing with commodities like grain or ore, and liquid terminals focused on petroleum and chemical products, each requiring specialized operational modules tailored to the cargo's characteristics and handling requirements. The versatility of these systems allows for scalable deployment, accommodating small regional depots up to the world's largest mega-ports operating 24/7/365.

The primary benefits driving market expansion include significant operational cost reduction achieved through optimized equipment usage and reduced idle time, enhanced security via integrated monitoring and access control, and substantial improvements in customer satisfaction due to quicker turnarounds and accurate inventory reporting. Moreover, strict environmental regulations demanding reduced fuel consumption and optimized vessel movements are pushing terminals towards automated, data-driven management facilitated by TMS. Driving factors include the continuous growth in global seaborne trade, the rising trend of digitalization and automation within ports (often referred to as 'Smart Ports'), and the necessity for greater supply chain resilience following recent global disruptions. The migration towards cloud-based TMS deployment is also fueling growth, offering greater flexibility, scalability, and reduced upfront infrastructure investment for terminal operators globally.

Terminal Management Systems Market Executive Summary

The Terminal Management Systems market is undergoing rapid evolution, primarily driven by tectonic shifts in global business trends emphasizing end-to-end supply chain visibility and operational resilience. Key business trends include the convergence of Information Technology (IT) and Operational Technology (OT), leading to highly integrated systems that break down traditional data silos between planning and execution teams. Furthermore, there is a pronounced industry movement towards subscription-based software models (SaaS) for TMS deployment, which lowers the barrier to entry for mid-sized terminals and encourages quicker adoption of feature upgrades, including advanced analytics and Machine Learning modules. The necessity for seamless communication between port authorities, customs, and carriers is also fostering the development of highly interoperable TMS platforms capable of utilizing API connectivity and blockchain technology to secure data exchange and streamline complex procedural requirements, especially concerning regulatory compliance and cross-border trade documentation.

Regional trends indicate that Asia Pacific (APAC) remains the dominant region in terms of volume and new project implementations, spurred by massive investments in port infrastructure expansion, particularly in China, India, and Southeast Asian logistics hubs, which are critical nodes in global trade routes. However, North America and Europe are leading the adoption curve for sophisticated, highly automated TMS implementations, focusing intensely on efficiency gains through robotics, autonomous vehicles (AGVs), and fully automated stacking cranes (ASCs) integrated directly into the TMS control layer. These mature markets prioritize retrofitting existing infrastructure with smart technology to handle ultra-large container vessels (ULCVs) and mitigate severe labor shortages. The Middle East and Africa (MEA) region is emerging as a high-growth market, driven by ambitious diversification plans in oil-exporting nations that aim to transform into major logistical and transshipment hubs, requiring world-class TMS infrastructure to support these strategic national initiatives.

Segmentation trends highlight the increasing dominance of the software segment, specifically in the adoption of modules dedicated to advanced optimization, predictive maintenance, and cybersecurity. Within application segments, container terminals continue to be the primary revenue driver, but liquid and bulk terminals are showing accelerated growth due to stringent safety regulations and the inherent complexity of handling hazardous or volatile materials, necessitating specialized, data-driven management systems. The shift towards cloud-based deployment is accelerating across all market segments, facilitating decentralized management and real-time collaboration across geographically disparate terminal networks owned by major shipping lines or global logistics conglomerates. This deployment model offers robust disaster recovery capabilities and centralized data processing, which is crucial for maximizing efficiency in large-scale operations and leveraging real-time data feeds effectively.

AI Impact Analysis on Terminal Management Systems Market

User inquiries regarding Artificial Intelligence (AI) in Terminal Management Systems frequently center on whether AI will automate decision-making entirely, the reliability of AI-driven predictive maintenance, and the cybersecurity implications of integrating sophisticated AI models into critical infrastructure. Key themes revolve around maximizing terminal throughput under volatile conditions, optimizing resource allocation dynamically in response to unexpected delays (such as weather or equipment failures), and utilizing computer vision for highly accurate and secure cargo inspection and gate processes. Users seek confirmation that AI can handle the extreme combinatorial complexity of managing thousands of container moves daily while maintaining safety standards and mitigating human error. The consensus expectation is that AI will transform TMS from prescriptive planning tools into truly dynamic, self-optimizing operational platforms, significantly improving efficiency metrics.

The integration of AI into TMS is fundamentally shifting the paradigm of terminal operations from reactive management to proactive and predictive control. AI algorithms, particularly those based on reinforcement learning and deep learning, are proving highly effective in optimizing complex logistical puzzles, such as yard stacking optimization where millions of configurations are possible, or sequencing the movement of internal transport vehicles (e.g., AGVs or trucks) to eliminate congestion and reduce empty runs. This predictive capability extends into maintenance schedules, where AI analyzes sensor data (vibration, temperature, load cycles) from cranes and equipment to forecast failure points, allowing maintenance teams to intervene precisely before costly breakdowns occur, thereby significantly enhancing equipment uptime and overall terminal availability.

Furthermore, AI is instrumental in streamlining the labor force management within terminals. By analyzing real-time demand patterns, historical traffic data, and weather forecasts, AI can dynamically adjust labor shifts and assignments, ensuring that the right number of personnel are deployed at the correct locations, minimizing overtime expenses while ensuring service levels are maintained. The implementation of sophisticated computer vision systems, powered by AI, drastically improves security and accuracy at the gate and quay. These systems automatically read container codes (OCR), verify truck identification, and detect anomalies in cargo loading or sealing, reducing processing time at entry points from minutes to seconds and dramatically lowering the risk of manual data entry errors or security breaches.

- AI optimizes yard stacking and retrieval algorithms, boosting storage density and reducing re-handle counts.

- Predictive maintenance schedules driven by Machine Learning drastically cut equipment downtime and lifecycle costs.

- Computer vision and deep learning models accelerate gate automation and security inspections for faster truck processing.

- AI-driven dynamic resource allocation optimizes deployment of cranes, internal transport, and labor in real-time.

- Enhancement of simulated environments (Digital Twins) using AI facilitates better planning and scenario testing for expansion projects.

- Automation of documentation verification and customs clearance processes using Natural Language Processing (NLP) speeds up administrative throughput.

DRO & Impact Forces Of Terminal Management Systems Market

The Terminal Management Systems market is primarily driven by the increasing volume of global trade and the pervasive need for operational efficiency in complex logistical environments. Key Drivers include the exponential growth in containerization and the deployment of Ultra Large Container Vessels (ULCVs), which necessitate faster vessel turnaround times and highly coordinated quayside and yard operations to handle massive volumes simultaneously. Simultaneously, the imperative to digitalize traditional port processes to improve supply chain transparency and resilience serves as a potent growth catalyst, compelling terminal operators to upgrade legacy systems to modern, integrated TMS platforms. The strong impact force exerted by these drivers ensures continuous demand for sophisticated automation solutions capable of maximizing throughput within existing geographical constraints.

Restraints, however, temper the market's trajectory, particularly the substantial initial capital expenditure required for implementing advanced, fully integrated TMS solutions, coupled with the high costs associated with training personnel and integrating the new system with disparate legacy IT and OT infrastructure. Cybersecurity risks present a significant constraint; as terminals become more automated and interconnected, they expose themselves to advanced cyber threats, making operators hesitant to fully embrace cloud-based or highly integrated solutions without robust security assurances. Furthermore, the inherent organizational resistance to technological change and the necessity for significant re-engineering of existing operational processes pose substantial internal adoption hurdles, especially in regions with inflexible labor union structures.

Opportunities for market players are abundant, particularly in the development of modular, scalable TMS solutions tailored for mid-sized and regional ports that are just beginning their automation journey. The increasing adoption of 5G networks in port environments presents an opportunity to deploy real-time remote monitoring and control capabilities for automated equipment, enhancing both safety and productivity. The convergence of blockchain technology with TMS for secure documentation and cargo tracking offers a substantial opportunity to streamline customs and regulatory procedures, unlocking new efficiencies in global transshipment hubs. Moreover, the growing focus on environmental, social, and governance (ESG) factors drives demand for TMS modules that optimize energy consumption, reduce fuel emissions through smarter equipment routing, and improve overall ecological footprint reporting, creating a specialized niche for green TMS features.

Segmentation Analysis

The Terminal Management Systems market segmentation provides a comprehensive view of the diverse offerings and applications driving industry revenue across various sectors. The market is primarily segmented based on Component, Deployment Type, Terminal Type (Application), and End-Use Industry. Analyzing these segments reveals shifting preferences among terminal operators, particularly the move away from traditional monolithic software deployments toward flexible, cloud-native architectures that can integrate easily with auxiliary systems like Enterprise Resource Planning (ERP) and Customs Management Systems. The component breakdown highlights the increasing investment in specialized services, including consultancy, managed services, and system integration, necessary to maximize the ROI from complex TMS software purchases.

The increasing complexity of global supply chains and the heterogeneity of cargo handled across ports demand highly specialized TMS modules. For instance, the needs of a liquid bulk terminal, which prioritizes safety, spill prevention, and regulatory compliance regarding material purity, contrast sharply with those of a high-volume container terminal focused on rapid stacking and retrieval. This necessity for specialization ensures that vendors must offer adaptable and configurable solutions, leading to robust segmentation within the Terminal Type category. Furthermore, the End-Use segmentation reflects the differing levels of automation maturity and investment capacity across sectors, with the logistics and maritime sector consistently dominating due to its direct reliance on port efficiency, while sectors like Oil & Gas require highly specialized safety-critical TMS integrations.

- By Component:

- Software (Operations Management, Cargo Handling, Security & Access Control, Billing & Invoicing, Maintenance & Repair, Yard Management)

- Services (Consulting, Implementation & Integration, Maintenance & Support, Managed Services)

- By Deployment Type:

- Cloud-Based

- On-Premise

- By Terminal Type (Application):

- Container Terminals

- Bulk Terminals (Dry Bulk, Liquid Bulk)

- Break Bulk Terminals

- Ro-Ro Terminals (Roll-on/Roll-off)

- Cruise and Ferry Terminals

- By End-Use Industry:

- Maritime Logistics

- Rail Logistics

- Oil & Gas

- Chemicals

- Mining & Metals

Value Chain Analysis For Terminal Management Systems Market

The value chain for Terminal Management Systems begins upstream with research and development, where vendors invest heavily in developing sophisticated algorithms, integrating emerging technologies like IoT, AI, and blockchain, and ensuring compliance with evolving international shipping standards (e.g., IMO regulations). Key upstream participants include technology providers for specialized hardware components (e.g., RFID readers, crane sensors, DGPS systems) and foundational software providers (database management systems, cloud infrastructure providers). Success in the upstream segment relies heavily on securing patents for optimization logic and developing robust, scalable architecture capable of handling real-time data ingestion from thousands of assets simultaneously. Strategic partnerships with academic institutions specializing in logistics optimization and operational research are crucial for maintaining a competitive technological edge and ensuring the TMS remains at the forefront of operational efficiency.

The midstream of the value chain is dominated by TMS software vendors who specialize in integration, customization, and deployment. This phase is characterized by intense system integration work, connecting the core TMS platform with the terminal's specific Operational Technology (OT) layer, including crane PLC controls, automated gate systems, and surveillance cameras. Distribution channels involve both direct sales—where large vendors engage directly with major global terminal operators (like DP World, Hutchison Ports, or PSA)—and indirect sales through system integrators and regional distributors who specialize in implementing complex industrial IT solutions in specific geographic markets or specialized terminal types. The quality of technical consultancy and the ability to customize the TMS module set to the unique operating environment of the terminal are critical success factors in the midstream.

Downstream activities focus on the delivery of ongoing support, maintenance, and periodic upgrades, ensuring the TMS maintains peak performance and adapts to changing terminal volumes and cargo mixes. Direct and indirect support services are essential; direct support involves vendor-led 24/7 technical assistance for mission-critical systems, while indirect support is often handled by regional partners providing on-site hardware maintenance and localized troubleshooting. The ultimate downstream beneficiaries are the terminal operators themselves, who utilize the TMS to deliver services to shipping lines, freight forwarders, and BCOs (Beneficial Cargo Owners). The effectiveness of the TMS directly impacts the profitability and reputation of the terminal operator, making high-quality, continuous downstream service crucial for long-term contract retention and maximizing the lifespan and utility of the installed system.

Terminal Management Systems Market Potential Customers

The primary potential customers and end-users of Terminal Management Systems encompass entities responsible for the high-volume movement, storage, and transfer of goods across intermodal boundaries. The largest segment of buyers consists of major global port authorities and large-scale terminal operating companies (TOCs) who manage vast networks of container terminals worldwide. These customers require enterprise-level TMS solutions capable of handling massive throughput, offering centralized control across multiple locations, and integrating advanced automation technologies like Automated Guided Vehicles (AGVs) and Automated Stacking Cranes (ASCs). Their purchasing decisions are heavily influenced by proven ROI metrics, system resilience, and the vendor's ability to provide extensive global implementation and support services.

Secondary but rapidly growing customer segments include specialized facility operators such as rail yard management companies and inland waterway terminal operators. These customers often seek modular TMS solutions focused on optimizing intermodal transfers, enhancing track utilization, and managing complex rail schedules. For inland terminals, the focus often shifts towards efficient truck appointment systems and real-time inventory tracking to minimize localized congestion. Furthermore, companies involved in the Oil & Gas, Chemical, and Mining sectors, which operate their own dedicated bulk or liquid terminals, represent high-value potential customers who prioritize specialized TMS capabilities related to safety monitoring, regulatory reporting (e.g., environmental compliance), inventory measurement accuracy, and pipeline management integration, often necessitating intrinsically safe hardware and software solutions.

Additionally, small to medium-sized regional ports (often governmental or municipally owned) represent a significant untapped market segment. These buyers are typically sensitive to high capital expenditure but have an urgent need to modernize operations to remain competitive against larger, nearby hubs. They are increasingly drawn towards cloud-based or SaaS TMS offerings, which reduce the upfront financial burden and offer scalability as their volumes increase. System requirements for this segment emphasize user-friendliness, rapid deployment capabilities, and strong integration potential with regional logistical networks, often prioritizing core modules like gate management and yard planning over full-scale automation capabilities prevalent in mega-ports.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $1.8 Billion |

| Market Forecast in 2033 | $3.2 Billion |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Navis LLC (Cargotec), CyberLogitec, Konecranes (TOS), ZPMC, Siemens AG, ABB Ltd., Trelleborg AB, Royal HaskoningDHV, Camco Technologies, Kalmar (Cargotec), INFORM GmbH, Solvo, Jade Logistics, Kaleris, RBS (TOS) |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Terminal Management Systems Market Key Technology Landscape

The technological landscape of the Terminal Management Systems market is rapidly transitioning toward full integration of advanced industrial and digital technologies, fundamentally shifting how terminals operate. Central to this evolution is the pervasive adoption of the Internet of Things (IoT), where sensors, RFID tags, and telematics devices are embedded across all terminal equipment—from cranes and yard vehicles to containers themselves—to generate massive amounts of real-time operational data. This data forms the bedrock for advanced analytics and Machine Learning algorithms, enabling predictive maintenance, dynamic resource scheduling, and highly accurate operational visualizations. Furthermore, the shift to 5G connectivity within the terminal environment is crucial, providing the low latency and high bandwidth necessary to manage and control fully autonomous equipment (AGVs, automated rail-mounted gantry cranes) reliably and safely, moving core control functions toward the cloud or edge computing infrastructure.

Another pivotal technology is the development of Digital Twins, which are sophisticated virtual replicas of the physical terminal layout and operational flows. These Digital Twins, often integrated directly with the TMS, allow operators to simulate various scenarios—such as peak congestion, unexpected vessel delays, or equipment failure—without impacting real-world operations. This simulation capability is vital for optimizing yard configurations, testing new automation strategies, and training personnel in a risk-free environment. Coupled with this, Artificial Intelligence (AI) is being leveraged beyond simple predictive analytics, moving into complex decision-making processes, particularly in stack optimization and optimizing berth planning under highly volatile conditions, where human planners struggle to calculate the combinatorial possibilities in real-time. AI ensures that the TMS dynamically adjusts operational plans based on instantaneous data feedback.

Blockchain technology is emerging as a critical tool for enhancing security and transparency across the terminal and broader logistics chain. While not directly managing internal terminal operations, blockchain applications are being utilized to secure the transfer of critical trade documentation, such as bills of lading and customs declarations, between the terminal, carriers, and regulatory bodies. This eliminates the need for paper documentation, drastically reducing processing times, minimizing fraud risks, and providing an immutable audit trail for cargo movement and ownership. Finally, advanced cybersecurity defenses, including AI-based threat detection and Zero Trust architecture, are becoming integral components of modern TMS offerings, necessitated by the increasing threat landscape targeting critical national infrastructure and the transition of core systems onto public or private cloud environments.

Regional Highlights

Regional dynamics significantly influence the adoption and sophistication of Terminal Management Systems, largely correlating with global trade routes, investment in infrastructure, and the maturity of automation technologies within logistics sectors. Asia Pacific (APAC) stands out as the largest and fastest-growing market due to the massive scale of port operations in countries like China, Singapore, and South Korea, which handle the majority of global container traffic. Governments across APAC continue to invest heavily in modernizing port facilities, often prioritizing greenfield projects that incorporate the latest generation of fully automated TMS from the outset. The relentless expansion of trade volumes and the establishment of new intermodal hubs, particularly within the ASEAN bloc, ensure sustained demand for scalable and integrated TMS solutions to manage unprecedented logistical throughput and maintain regional competitiveness against established European and North American ports. The focus in APAC is primarily on volume management and rapid capacity expansion.

North America and Europe represent mature, high-value markets characterized by a strong focus on maximizing efficiency through deep automation integration and optimization rather than sheer capacity expansion. In these regions, the primary driver is the necessity to accommodate larger vessels (ULCVs) within existing port footprints and to mitigate rising labor costs and shortages through automation. Consequently, demand is high for sophisticated TMS modules that specialize in handling complex intermodal transfers (ship-to-rail, ship-to-barge), utilizing autonomous equipment, and leveraging AI for predictive decision-making. European ports, in particular, are leading in adopting advanced "smart port" concepts, where the TMS integrates seamlessly with broader city logistics and environmental monitoring systems, driving innovation toward highly interoperable, standards-compliant platforms that support strict EU regulations regarding data privacy and emissions control.

The Middle East and Africa (MEA) region is exhibiting accelerated growth, primarily driven by strategic infrastructure investments aimed at positioning countries like the UAE and Saudi Arabia as crucial transshipment hubs linking East and West. These investments are often large-scale, government-backed initiatives focused on establishing world-class, highly automated ports (e.g., Jebel Ali, King Abdullah Port), leading to significant demand for high-end TMS implementations. The African market, while varied, shows increasing demand for cloud-based TMS solutions in smaller, less developed ports seeking rapid digitalization and efficiency gains without committing to massive on-premise infrastructure. Latin America faces challenges related to infrastructure investment and regulatory fragmentation, yet major ports in Brazil, Mexico, and Chile are steadily adopting modern TMS platforms to enhance export capabilities and integrate better into global logistics networks, focusing on security and improved gate management efficiency.

- Asia Pacific (APAC): Dominates market volume; driven by infrastructure expansion in China, India, and Southeast Asia; high adoption in greenfield automated terminals; focus on maximizing throughput capacity.

- North America: High-value market focused on retrofitting legacy ports; driven by labor efficiency needs and ULCV accommodation; strong demand for AI-driven automation and intermodal optimization modules.

- Europe: Pioneers "Smart Port" concepts; emphasis on regulatory compliance (environmental/data), deep integration with city logistics, and advanced optimization of intermodal transport networks (rail and barge).

- Middle East and Africa (MEA): Emerging high-growth market; large strategic investment in new mega-ports (e.g., UAE, Saudi Arabia); increasing use of modular, cloud-based TMS in smaller African ports for rapid modernization.

- Latin America: Steady growth driven by modernization needs in key export hubs; focus on improving gate security, customs clearance efficiency, and enhancing integration with internal country logistics infrastructure.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Terminal Management Systems Market.- Navis LLC (Cargotec)

- CyberLogitec

- Konecranes (TOS)

- ZPMC (Zhenhua Port Machinery Company)

- Siemens AG

- ABB Ltd.

- Trelleborg AB

- Royal HaskoningDHV

- Camco Technologies

- Kalmar (Cargotec)

- INFORM GmbH

- Solvo

- Jade Logistics

- Kaleris (acquired Navis/TOS business units)

- RBS (TOS)

- TBA Group

- COSCO SHIPPING Ports Limited

- Terminal Systems Inc. (TSI)

- Identec Solutions

- Global Ship Management (GSM)

Frequently Asked Questions

Analyze common user questions about the Terminal Management Systems market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary role of AI in modern Terminal Management Systems?

The primary role of AI is to shift operations from manual or rule-based execution to dynamic, predictive optimization. AI algorithms are used for maximizing yard stack density, predicting equipment failures (predictive maintenance), and optimizing the real-time movement of autonomous vehicles and cranes to eliminate bottlenecks and minimize operational expenditure (OPEX).

What are the key differences between cloud-based and on-premise TMS deployment?

Cloud-based TMS offers lower initial capital expenditure (CapEx), high scalability, automatic updates, and enhanced data accessibility for remote management and collaboration, typically delivered as a Subscription-as-a-Service (SaaS) model. On-premise deployment requires significant upfront investment in hardware and infrastructure but offers maximum data control, lower dependency on internet connectivity, and deep customization potential for highly specific, complex operational environments, often preferred by mega-ports.

How does the Terminal Management System market address cybersecurity concerns?

To address escalating cybersecurity risks, modern TMS vendors integrate advanced security features including intrusion detection systems, role-based access controls, robust encryption protocols for data transmission, and compliance with industry standards like ISO 27001. The implementation of Zero Trust architectures and real-time monitoring of network traffic are becoming standard practices, especially for cloud-connected or highly automated terminals, to protect mission-critical OT systems.

Which geographical region is currently leading in the adoption of advanced TMS technology?

While the Asia Pacific region leads in overall market volume due to continuous infrastructure expansion and high throughput, North America and Europe are leading the adoption of highly advanced, deep automation TMS integrations, particularly those incorporating AI, machine learning, and comprehensive integration with autonomous material handling equipment to maximize operational efficiency within confined port boundaries.

What is the impact of ULCVs (Ultra Large Container Vessels) on TMS demand?

The introduction of ULCVs requires TMS to handle unprecedented volumes of containers during a single port call, necessitating highly sophisticated planning and execution capabilities. This drives demand for advanced optimization modules, quicker vessel scheduling tools, and seamless integration with high-speed automated quayside cranes to ensure faster vessel turnaround times and prevent crippling port congestion, making high-performance TMS essential.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager