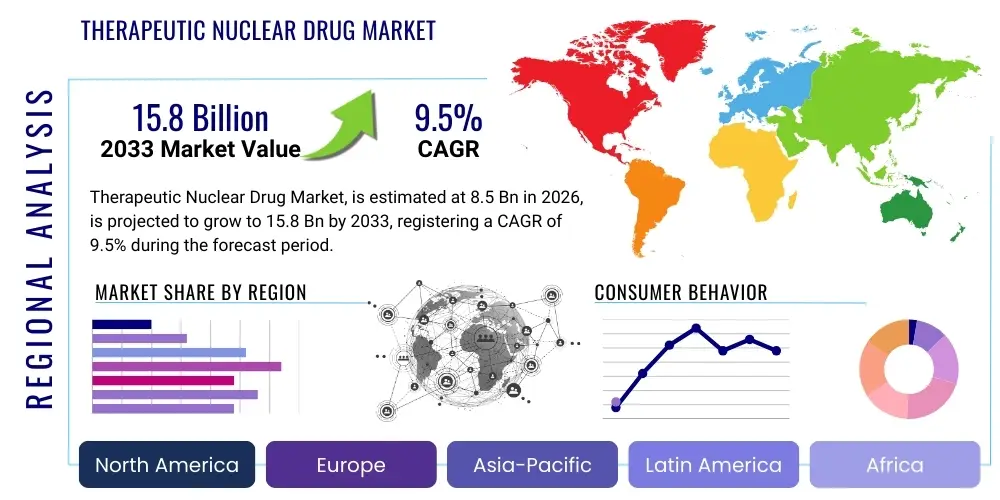

Therapeutic Nuclear Drug Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441690 | Date : Feb, 2026 | Pages : 241 | Region : Global | Publisher : MRU

Therapeutic Nuclear Drug Market Size

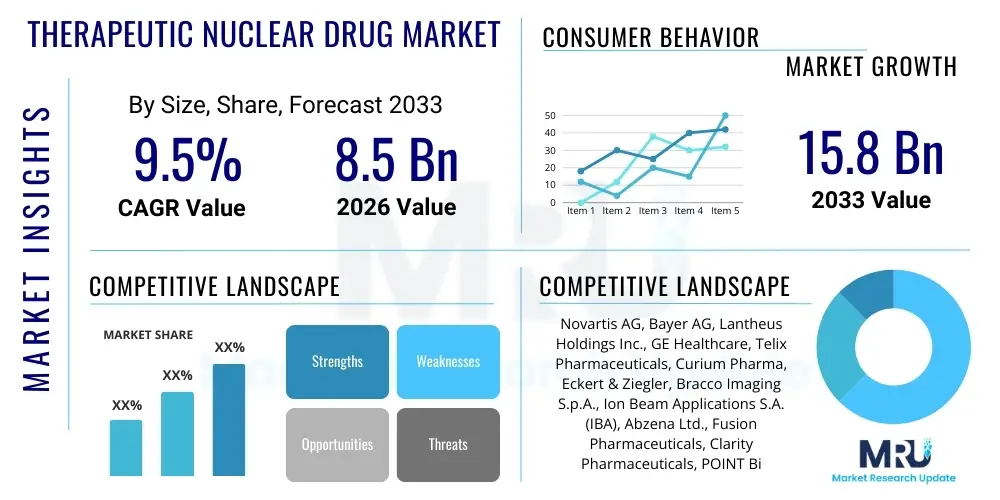

The Therapeutic Nuclear Drug Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.5% between 2026 and 2033. The market is estimated at $8.5 Billion USD in 2026 and is projected to reach $15.8 Billion USD by the end of the forecast period in 2033.

Therapeutic Nuclear Drug Market introduction

The Therapeutic Nuclear Drug Market, often referred to as the radiopharmaceuticals market for therapy, encompasses the development, production, and distribution of radioactive drugs used specifically for treating various diseases, primarily cancer. These specialized agents utilize targeted radionuclides to deliver high doses of radiation directly to diseased cells, minimizing damage to surrounding healthy tissue. This targeted approach significantly improves therapeutic efficacy and reduces systemic toxicity compared to conventional external beam radiation therapy or chemotherapy. The unique mechanism of action relies on linking a radioactive isotope (such as Lutetium-177 or Radium-223) to a targeting vector (like a peptide or antibody) that selectively binds to receptors overexpressed on tumor cells, facilitating precise internal radiation delivery.

The core product description revolves around two main types of isotopes: alpha-emitting isotopes, which offer high linear energy transfer and short range, ensuring highly localized cell destruction; and beta-emitting isotopes, which have a longer range suitable for larger, less defined tumors. Major applications driving market adoption include oncology (specifically prostate cancer, neuroendocrine tumors, and bone metastases), thyroid disorders, and emerging applications in cardiology and palliative care. The rise of personalized medicine and the increasing prevalence of cancer worldwide serve as foundational driving factors. Furthermore, the successful commercialization of theranostic pairs, which combine a diagnostic isotope and a therapeutic isotope targeting the same biological pathway, has fundamentally reshaped the landscape, offering a comprehensive solution from initial diagnosis to treatment monitoring.

Key benefits associated with therapeutic nuclear drugs include improved patient quality of life, enhanced survival rates in hard-to-treat cancers, and the ability to treat metastatic disease that is refractory to standard treatments. The driving factors sustaining market growth involve robust clinical trial pipelines demonstrating efficacy across novel indications, advancements in cyclotron technology enabling greater isotope availability, and supportive regulatory frameworks expediting the approval of breakthrough treatments. Continuous technological innovation focused on improving targeting specificity, enhancing radiochemistry techniques, and ensuring scalable manufacturing capacity are critical elements fueling the therapeutic nuclear drug market’s expansion across global healthcare systems.

Therapeutic Nuclear Drug Market Executive Summary

The Therapeutic Nuclear Drug Market is characterized by intense innovation driven by the theranostics paradigm, establishing targeted radioligand therapies (RLTs) as a cornerstone in precision oncology. Business trends indicate significant strategic partnerships and M&A activities focused on securing novel radionuclides, expanding global manufacturing footprints, and acquiring specialized expertise in complex radiochemistry and distribution logistics. Key investment areas include alpha-emitter technology due to its superior cytotoxic potential and the continuous development of novel tumor-targeting peptides and antibodies. The market exhibits high barriers to entry due to stringent regulatory requirements, the complexity of supply chain management (involving short half-life isotopes), and the need for highly specialized clinical infrastructure, leading to consolidation among established pharmaceutical and specialized radiopharmaceutical companies.

Regionally, North America maintains market dominance, propelled by substantial healthcare expenditure, early adoption of advanced treatments, and a mature regulatory environment supportive of cutting-edge clinical trials, particularly for prostate cancer and neuroendocrine tumor therapies. Europe follows, with increasing access programs and governmental support for nuclear medicine infrastructure, although reimbursement pathways remain varied across member states. Asia Pacific (APAC) is projected to register the fastest growth rate, fueled by rising cancer incidence, improving healthcare access in countries like China and India, and significant governmental investment in developing domestic radiopharmaceutical production capabilities. The focus in APAC is shifting from traditional diagnostics toward advanced therapeutic applications, supported by local manufacturing partnerships designed to stabilize the supply chain.

Segmentation trends highlight the dominance of the Oncology application segment, specifically driven by the success of therapies targeting Prostate-Specific Membrane Antigen (PSMA) and somatostatin receptor analogs. Technology-wise, Beta Emitters currently hold the largest market share due to their established safety profile and widespread use, but Alpha Emitters are poised for rapid acceleration, capitalizing on next-generation therapies promising higher potency. The End-User segment sees hospitals and specialized cancer centers retaining the primary share, yet the proliferation of dedicated outpatient nuclear medicine clinics is a growing trend, enhancing patient access and decentralizing therapy administration. Overall, the market trajectory is firmly upward, underpinned by undeniable clinical benefits and a sustained pipeline of therapeutic innovations.

AI Impact Analysis on Therapeutic Nuclear Drug Market

Analysis of common user questions related to the impact of Artificial Intelligence (AI) on the Therapeutic Nuclear Drug Market reveals core themes centered around enhancing precision, accelerating drug discovery, and optimizing logistical challenges. Users frequently inquire about how AI can improve the prediction of treatment response (patient stratification), shorten the complex radiopharmaceutical synthesis process, and manage the highly time-sensitive supply chain logistics associated with short-lived radionuclides. Specific concerns often focus on the validation of AI algorithms in clinical settings, data privacy when integrating vast patient imaging and genomic datasets, and the potential of machine learning to identify novel targets for radioligand therapies that current methods overlook. Users express high expectations regarding AI's ability to personalize dosimetry—calculating the exact radiation dose needed for an individual tumor while sparing healthy tissue—a critical step for maximizing therapeutic index and minimizing adverse effects.

AI's role is evolving beyond basic data processing to become an indispensable tool across the entire lifecycle of therapeutic nuclear drugs, from target identification to post-treatment evaluation. In the discovery phase, machine learning algorithms can rapidly screen vast databases of protein structures and genomic information to identify and validate novel biomarkers or surface receptors suitable for targeted radioligand binding, dramatically reducing the pre-clinical timeline. Furthermore, AI is increasingly utilized in clinical trial design and execution, optimizing patient selection criteria based on complex radiological and genomic markers, thereby increasing the probability of trial success and streamlining regulatory approval processes for novel radiopharmaceuticals.

The most immediate and impactful application of AI is in clinical practice and manufacturing optimization. AI-powered image analysis tools enhance the accuracy of quantitative imaging (e.g., PET scans) used for personalized dosimetry calculations, ensuring that radiation delivery is precisely tailored to the tumor volume and uptake characteristics of each patient. Moreover, given the delicate and time-critical nature of radiopharmaceutical logistics, AI is employed to optimize production schedules, manage complex international supply chains involving temperature-sensitive and decaying materials, and predict potential delays, thereby ensuring that patients receive their life-saving doses within the required short half-life windows. This integration of AI addresses long-standing bottlenecks related to manufacturing variability and logistical complexity, solidifying its essential role in the future of nuclear medicine.

- AI accelerates the identification of novel biomarkers and optimal targeting vectors for radioligands.

- Machine learning enhances personalized dosimetry and treatment planning through precise quantitative image analysis (PET/CT).

- AI optimizes complex, time-sensitive radiopharmaceutical supply chain management and logistics.

- Algorithms predict patient response to specific radioligand therapies (RLTs), improving patient stratification.

- AI assists in synthesizing and quality control testing of therapeutic nuclear drugs, reducing manufacturing variability.

- It facilitates high-throughput screening of radioisotopes and chelation chemistries in the pre-clinical phase.

DRO & Impact Forces Of Therapeutic Nuclear Drug Market

The Therapeutic Nuclear Drug Market's dynamics are shaped by a powerful confluence of enabling Drivers, structural Restraints, latent Opportunities, and critical Impact Forces. A primary Driver is the increasing global prevalence of cancer, particularly hard-to-treat solid tumors like metastatic prostate cancer and neuroendocrine tumors, where radioligand therapies (RLTs) offer superior outcomes compared to standard treatments. This clinical efficacy is supported by strong evidence from late-stage clinical trials, leading to favorable regulatory approvals and rapid commercial adoption across key markets. The paradigm shift towards theranostics—combining diagnostic and therapeutic agents—further accelerates growth by offering highly personalized treatment pathways, improving target visualization, and enabling real-time monitoring of therapeutic efficacy, thereby institutionalizing nuclear medicine as a standard oncology option.

However, significant Restraints challenge rapid market scaling, primarily revolving around the highly complex and fragile supply chain. The short half-lives of critical radioisotopes (e.g., Lutetium-177 or Actinium-225) necessitate highly efficient, decentralized, and specialized manufacturing and distribution networks, making the supply vulnerable to disruptions, geopolitical issues, and logistical delays. Furthermore, the high capital investment required for specialized cyclotrons, hot labs, and radiation safety infrastructure, coupled with the necessity for highly trained nuclear medicine specialists and radiation oncologists, limits the accessibility of these therapies, especially in emerging economies. Regulatory hurdles and complex reimbursement structures, particularly regarding novel alpha emitters, also contribute to market friction.

Opportunities for exponential growth are centered on the expansion of RLT applications into major indications beyond neuroendocrine tumors and prostate cancer, including breast cancer, lung cancer, and pancreatic cancer, utilizing novel targeting moieties. The development and large-scale manufacturing of next-generation alpha emitters, such as Actinium-225 and Thorium-227, represent a massive opportunity due to their unparalleled potency and precision in treating micro-metastatic disease. Technological advancements in automation and AI-driven logistics promise to mitigate existing supply chain restraints, enhancing scalability and reducing manufacturing costs. These internal dynamics, alongside external forces such as aging populations and increasing precision medicine investment (Impact Forces), collectively dictate the market trajectory, making timely regulatory alignment and infrastructure development crucial for sustained expansion.

Segmentation Analysis

The Therapeutic Nuclear Drug Market is comprehensively segmented based on Type of Isotope, Application Area, and End-User, reflecting the diverse landscape of radiopharmaceuticals and their clinical utility. Segmentation provides a granular view of specific therapeutic trends, revealing where innovation is concentrated and where market demand is highest. The Type of Isotope segmentation distinguishes between beta emitters, which historically dominate due to technological maturity and supply stability, and alpha emitters, which are rapidly gaining traction due to superior cytotoxic potential. Application segmentation clearly delineates oncology as the primary revenue generator, overshadowing other fields like cardiology and thyroid treatments, underlining the focus of therapeutic nuclear drugs in modern cancer management. Furthermore, understanding the End-User landscape allows stakeholders to optimize distribution and clinical infrastructure, recognizing the central role of hospitals and specialized cancer centers in treatment delivery.

- By Type

- Beta Emitters (e.g., Lutetium-177, Yttrium-90)

- Alpha Emitters (e.g., Actinium-225, Radium-223)

- Others (e.g., Iodine-131)

- By Application

- Oncology (Prostate Cancer, Neuroendocrine Tumors, Bone Metastases, Others)

- Thyroid Disorders (e.g., Hyperthyroidism, Thyroid Cancer)

- Cardiology

- Palliative Care

- By End-User

- Hospitals and Clinics

- Specialized Cancer Centers

- Ambulatory Surgical Centers (ASCs)

- Diagnostic and Imaging Centers

- By Region

- North America (U.S., Canada)

- Europe (Germany, U.K., France, Italy, Spain, Rest of Europe)

- Asia Pacific (Japan, China, India, South Korea, Rest of APAC)

- Latin America (Brazil, Mexico, Rest of LATAM)

- Middle East and Africa (GCC Countries, South Africa, Rest of MEA)

Value Chain Analysis For Therapeutic Nuclear Drug Market

The Therapeutic Nuclear Drug value chain is exceptionally intricate and highly time-sensitive, beginning with the upstream sourcing and production of high-purity radioisotopes, which is a significant bottleneck. Upstream activities involve complex processes such as using nuclear reactors (for neutron activation) or cyclotrons (for proton bombardment) to produce medically relevant isotopes. Key players in this stage are nuclear facilities, specialized isotope producers, and contract manufacturing organizations (CMOs) focused on radiochemistry. Securing reliable long-term supply agreements for critical isotopes like Actinium-225 or Lutetium-177 dictates the entire downstream capacity of the market, necessitating continuous investment in global isotope production infrastructure and regulatory compliance related to nuclear safety and security.

The middle segment involves radiolabeling, drug manufacturing, and quality assurance. This phase is characterized by sophisticated radiochemistry, where the therapeutic radionuclide is stably chelated to the tumor-targeting vector (peptide or antibody). Due to the short half-life of the product, manufacturing must often occur close to the point of use or utilize ultra-efficient logistics. Distribution channels are critical and are divided into direct and indirect methods. Direct distribution involves the manufacturer shipping the final, highly unstable product immediately to specialized hospital nuclear medicine departments. Indirect distribution might involve a specialized network of third-party logistics (3PL) providers trained in handling hazardous and time-critical nuclear materials, though this method is less common for short half-life therapeutic agents compared to long half-life products.

Downstream activities center on clinical administration and patient care, primarily performed within specialized hospital settings or dedicated oncology centers equipped with necessary radiation shielding and monitoring capabilities. The high cost and complexity of administration necessitate close collaboration between manufacturers, specialized distributors, and hospital pharmacies. The final consumption is driven by prescription from nuclear medicine physicians and oncologists. The efficiency of the distribution channel is directly proportional to the therapeutic efficacy, as delayed delivery due to logistical failure renders the product useless. This reliance on a highly synchronized "just-in-time" supply chain for often globally sourced isotopes distinguishes this market's value chain from traditional pharmaceuticals.

Therapeutic Nuclear Drug Market Potential Customers

The primary end-users and buyers of therapeutic nuclear drugs are highly specialized entities within the healthcare ecosystem, specifically institutions and practices dedicated to advanced oncology and endocrinology treatment. The most significant customer segment comprises large, academic teaching hospitals and comprehensive cancer centers. These institutions possess the requisite infrastructure—including specialized shielded rooms (hot labs), dedicated nuclear medicine imaging equipment (PET/SPECT/CT), and experienced personnel (nuclear pharmacists, physicists, and certified oncologists)—necessary to safely prepare, administer, and manage the radiation safety protocols associated with these high-potency drugs. Their potential for large patient volumes and participation in clinical trials makes them essential strategic partners for manufacturers.

Another crucial customer segment includes specialized, high-volume outpatient cancer clinics and standalone nuclear medicine centers. As therapeutic nuclear drugs transition from niche treatments to established standards of care, these specialized centers are increasingly investing in infrastructure to offer treatments like Lutetium-177 PSMA therapy in a more accessible, ambulatory setting. These customers prioritize ease of use, predictable supply chain reliability, and robust data management systems to handle the complex regulatory reporting associated with radiopharmaceuticals. Furthermore, governmental health agencies and procurement organizations, especially in national healthcare systems (like the NHS in the UK or centralized purchasing bodies in Europe), act as significant indirect customers by determining reimbursement and inclusion in standard care guidelines, thus influencing procurement decisions across entire regions.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $8.5 Billion USD |

| Market Forecast in 2033 | $15.8 Billion USD |

| Growth Rate | 9.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Novartis AG, Bayer AG, Lantheus Holdings Inc., GE Healthcare, Telix Pharmaceuticals, Curium Pharma, Eckert & Ziegler, Bracco Imaging S.p.A., Ion Beam Applications S.A. (IBA), Abzena Ltd., Fusion Pharmaceuticals, Clarity Pharmaceuticals, POINT Biopharma Global Inc., Advanced Accelerator Applications (AAA, a Novartis Company), Cyclopharm Ltd., ITM Isotope Technologies Munich SE, NorthStar Medical Radioisotopes, Actinium Pharmaceuticals. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Therapeutic Nuclear Drug Market Key Technology Landscape

The technology landscape for therapeutic nuclear drugs is intensely focused on advancing both the delivery mechanism and the production of the core therapeutic agents. A critical area of technological innovation is in Chelation Chemistry and Linker Technology. Stable chelation is essential to ensure that the radionuclide remains firmly bound to the targeting molecule until it reaches the tumor site, preventing systemic toxicity. Advances in macrocyclic chelators and bifunctional agents are improving the stability and pharmacokinetic profile of these drugs, especially for highly reactive alpha emitters like Actinium-225, where maintaining stability in vivo is paramount. Furthermore, the development of optimized linker technologies ensures efficient release of the isotope or stable binding to the target receptor, enhancing the therapeutic index and widening the scope of deliverable isotopes.

Another dominant technological trend is the industrialization and diversification of Radioisotope Production Methods. Traditionally, isotopes relied heavily on a small number of nuclear reactors; however, growing demand and supply vulnerabilities are driving a significant shift toward accelerator-based production. Cyclotron technology is increasingly utilized not just for diagnostic isotopes but also for therapeutic radionuclides like Copper-67 and Gallium-68 (used in theranostic pairs). Furthermore, technology focused on generator systems offers a crucial advantage by allowing long-lived parent isotopes (produced centrally) to decay into short-lived therapeutic daughter isotopes at the clinical site, simplifying logistics and extending product viability. Specialized companies are heavily investing in proprietary targetry and separation technologies to scale up the reliable and consistent supply of key alpha emitters, which are currently severely supply-constrained.

The theranostic approach represents the pinnacle of current technology adoption. This involves coupling a diagnostic radionuclide (e.g., Gallium-68 or Copper-64) and a therapeutic radionuclide (e.g., Lutetium-177 or Copper-67) to the same targeting ligand (e.g., PSMA or SSTR). This technological pairing ensures that only patients whose tumors demonstrate high uptake in the diagnostic phase receive the corresponding therapeutic agent, significantly enhancing treatment precision and reducing ineffective treatments. This technological integration demands highly sophisticated imaging capabilities (SPECT/PET) coupled with specialized software for quantitative dosimetry and treatment response assessment. The continuous refinement of these theranostic pairs, alongside the incorporation of artificial intelligence for dose calculation and imaging refinement, defines the forefront of the therapeutic nuclear drug technological landscape.

Regional Highlights

- North America (U.S. and Canada)

North America holds the largest share of the therapeutic nuclear drug market, driven by favorable regulatory pathways (e.g., FDA fast-track approvals for breakthrough therapies), substantial investment in oncology research, and high per capita healthcare spending. The U.S. market is characterized by rapid adoption of new, complex radioligand therapies, particularly for advanced prostate cancer (Lutetium-177 based treatments) and neuroendocrine tumors. A mature and sophisticated infrastructure of specialized cancer centers and commercial-scale cyclotron facilities ensures relatively consistent supply chain management, although securing alpha emitter supply remains a global challenge. The presence of major pharmaceutical innovators and specialized radiopharmaceutical companies dictates high levels of clinical trial activity and technological advancement.

The robust reimbursement framework in the U.S. encourages investment in novel therapies, minimizing financial barriers for patients accessing these high-cost treatments. Furthermore, the strong integration of academic medical centers allows for rapid translation of pre-clinical research into clinical practice, maintaining the region's leadership in nuclear medicine innovation. Canada also contributes significantly, benefiting from advanced healthcare systems and strong government support for nuclear research, particularly in isotope production technology.

- Europe (Germany, U.K., France)

Europe represents the second-largest market, with significant adoption driven by established nuclear medicine traditions, particularly in countries like Germany and Switzerland. European markets benefit from strong national healthcare systems and centralized regulatory bodies (EMA) that have streamlined the approval process for major radiopharmaceuticals. Germany, in particular, is a hub for nuclear medicine research and clinical application, boasting a high density of specialized treatment centers capable of administering complex RLTs.

However, the market growth in Europe is subject to variation based on country-specific reimbursement policies and infrastructure investment. While Western European countries demonstrate high penetration, Eastern European regions are still building the requisite infrastructure. The strategic focus across the continent is currently on securing stable isotope supply chains and investing in local manufacturing capabilities to reduce reliance on international imports and mitigate logistical risks associated with short half-life drugs.

- Asia Pacific (APAC: China, Japan, India)

The Asia Pacific market is projected to exhibit the fastest growth over the forecast period, primarily due to the rapidly increasing incidence of cancer across populous countries like China and India, coupled with significant improvements in healthcare infrastructure and rising disposable incomes. Japan maintains a mature nuclear medicine market with high technological standards, focusing on both diagnostics and therapeutic applications.

China and India are key emerging markets where governments are actively investing in domestic pharmaceutical manufacturing and promoting collaborations to establish local radiopharmaceutical production and distribution networks. While infrastructure development for specialized nuclear medicine administration is still catching up to Western standards, the sheer patient volume and growing clinical interest in targeted therapies are major drivers. Regulatory harmonization and greater access to advanced radiochemistry expertise are critical factors for sustained accelerated growth in this region.

- Latin America and Middle East & Africa (LAMEA)

The LAMEA region currently holds a smaller market share but offers substantial long-term growth potential. In Latin America, Brazil and Mexico lead the adoption due to established private healthcare systems and increasing government recognition of the value of nuclear medicine. However, reliance on imported isotopes and logistical hurdles often constrain market scaling.

The Middle East, particularly the GCC countries, shows growing adoption, supported by high healthcare expenditure and efforts to develop world-class specialized medical centers. Africa faces the greatest challenges, primarily relating to infrastructure limitations, training gaps, and cost constraints. Market growth in LAMEA is heavily dependent on overcoming supply chain fragility, securing dedicated funding for specialized equipment, and developing local human resources capable of managing therapeutic nuclear drugs safely and effectively.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Therapeutic Nuclear Drug Market.- Novartis AG (Advanced Accelerator Applications)

- Bayer AG

- Lantheus Holdings Inc.

- GE Healthcare

- Telix Pharmaceuticals

- Curium Pharma

- Eckert & Ziegler

- Bracco Imaging S.p.A.

- Ion Beam Applications S.A. (IBA)

- Abzena Ltd.

- Fusion Pharmaceuticals

- Clarity Pharmaceuticals

- POINT Biopharma Global Inc.

- ITM Isotope Technologies Munich SE

- NorthStar Medical Radioisotopes

- Actinium Pharmaceuticals

- Jubilant Pharma (Jubilant DraxImage Inc.)

- Nukem GmbH

- Algeta ASA (acquired by Bayer)

- Advanced Molecular Imaging (AMI)

Frequently Asked Questions

Analyze common user questions about the Therapeutic Nuclear Drug market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are therapeutic nuclear drugs and how do they work in cancer treatment?

Therapeutic nuclear drugs, or radiopharmaceuticals, are specialized drugs containing a radioactive isotope linked to a targeting molecule (like a peptide or antibody). They work through the principle of targeted internal radiation: the targeting molecule binds specifically to receptors on cancer cells, delivering high-energy radiation (alpha or beta particles) directly to the tumor site, minimizing damage to surrounding healthy tissues. This mechanism enables precise destruction of cancerous cells, particularly useful for treating metastatic disease.

What is the significance of the theranostics approach in this market?

Theranostics is a highly significant paradigm shift involving the coupled use of diagnostic and therapeutic radiopharmaceuticals. A diagnostic agent (often Gallium-68 or F-18) confirms the presence and location of the tumor targets via imaging (PET/SPECT), and if uptake is adequate, the corresponding therapeutic agent (often Lutetium-177) is administered. This ensures personalized treatment, reduces unnecessary radiation exposure, and confirms the patient’s suitability for radioligand therapy (RLT).

Which radioisotopes are driving the highest growth in therapeutic applications?

The highest growth is being driven by Lutetium-177 (a beta emitter), primarily used in treatments for metastatic prostate cancer (PSMA) and neuroendocrine tumors (SSTR). Furthermore, next-generation Alpha Emitters, particularly Actinium-225 and Radium-223, are showing immense promise. Actinium-225 is expected to revolutionize treatment due to its superior cell-killing potency and short path length, minimizing off-target effects.

What are the primary supply chain challenges facing the therapeutic nuclear drug market?

The primary challenges stem from the short half-lives of the radionuclides, which necessitate a highly complex, time-critical "just-in-time" supply chain involving specialized manufacturing (cyclotrons/reactors), rapid quality control, and secured, expedited distribution. Geopolitical issues affecting centralized reactor capacity and the extremely limited global supply of next-generation isotopes like Actinium-225 pose major logistical constraints that impact scalability and patient access.

How does Artificial Intelligence (AI) enhance the delivery of radioligand therapies?

AI plays a critical role in enhancing RLT delivery by optimizing personalized dosimetry, utilizing advanced algorithms to analyze quantitative imaging data (PET scans) to precisely calculate the required radiation dose for the tumor while protecting critical organs. Additionally, AI optimizes the highly complex logistics and manufacturing schedules, ensuring reliable and timely delivery of short half-life drugs from the production facility to the specialized hospital setting.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager