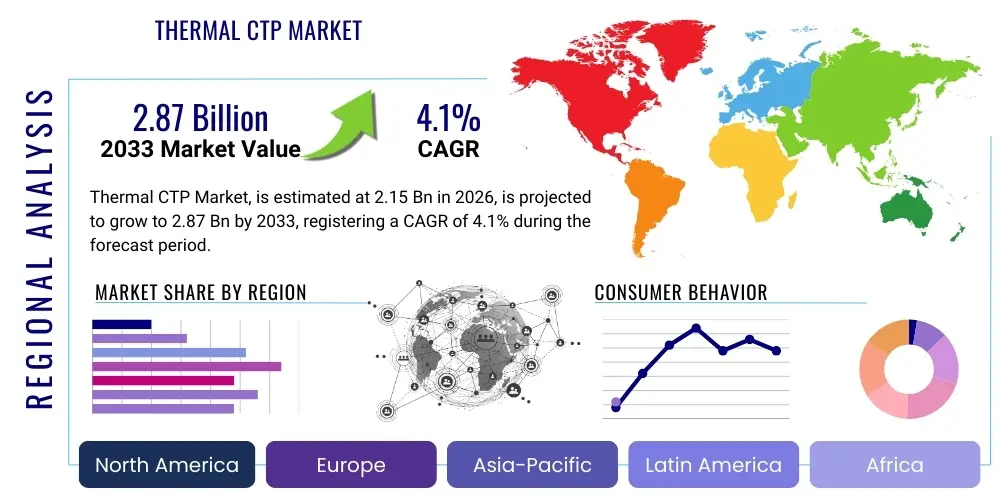

Thermal CTP Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442777 | Date : Feb, 2026 | Pages : 249 | Region : Global | Publisher : MRU

Thermal CTP Market Size

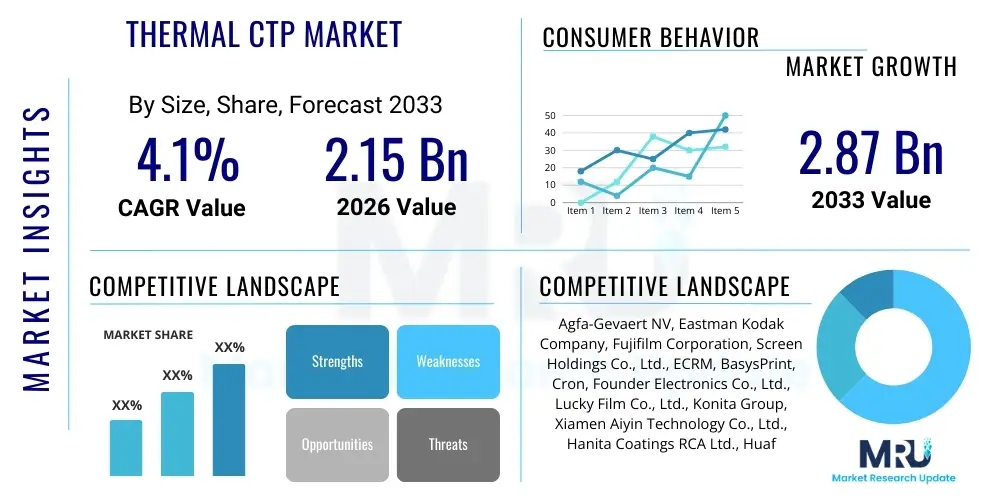

The Thermal CTP Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.1% between 2026 and 2033. The market is estimated at USD 2.15 Billion in 2026 and is projected to reach USD 2.87 Billion by the end of the forecast period in 2033. This growth trajectory, while moderate, underscores the continued reliance of the global offset printing sector on highly efficient and reliable plate-making technologies. Despite the ongoing transition towards digital printing for short-run jobs, Thermal CTP maintains a critical stronghold in medium-to-long run commercial, packaging, and newspaper applications where quality, consistency, and cost-effectiveness at volume are paramount.

The valuation reflects the sustained investment in next-generation CTP devices that offer enhanced automation, faster imaging speeds, and compatibility with eco-friendly processless plates. Market expansion is driven not only by volume growth in emerging economies but also by the cyclical replacement and technological upgrades in mature markets like North America and Europe. Printers globally are seeking solutions that minimize labor input and reduce chemical waste, making automated thermal CTP systems a core component of modern pre-press departments, ensuring the market remains stable and demonstrates resilient revenue streams.

Furthermore, the market size calculation incorporates the revenue derived from both hardware sales (CTP setters) and the highly crucial consumable component—the thermal printing plates. Consumables represent a significant portion of the total market value, providing consistent revenue flow and often dictating the long-term profitability and supplier loyalty within the printing industry. Technological advancements focusing on plate durability and run length optimization are key factors influencing the overall size and forecasting stability of this essential printing technology sector over the forecast period.

Thermal CTP Market introduction

The Thermal Computer-to-Plate (CTP) Market encompasses the technology and consumables used to produce printing plates for offset lithography directly from digital data, utilizing infrared laser diodes. Thermal CTP systems employ heat-sensitive plates that undergo a phase change upon laser exposure, offering exceptional image resolution, sharp edge definition, and outstanding repeatability compared to older conventional plate-making methods or even visible light CTP alternatives. This precision is vital for high-quality color reproduction and intricate graphic applications, positioning thermal CTP as the industry standard for demanding print jobs across the globe.

The core applications of Thermal CTP technology span commercial printing (magazines, catalogs, brochures), newspaper publishing (high-speed, high-volume production), and, increasingly, packaging printing (folding cartons, flexible packaging), which demands stringent color accuracy and registration. Key benefits driving the adoption of thermal CTP include unparalleled dot stability, reduced preparation time in the pressroom, lower error rates due to the elimination of traditional film processing steps, and significantly improved workflow efficiency through automation. The robust nature of thermal plates, coupled with their insensitivity to ambient light, contributes to a more reliable and streamlined pre-press environment.

Major driving factors sustaining the market include the continued global expansion of the packaging industry, which heavily relies on offset lithography for high-fidelity print quality; the persistent demand for shorter turnaround times necessitating rapid plate production; and the increasing adoption of processless (chemistry-free) thermal plates, which align with stringent environmental regulations and corporate sustainability mandates. While digital printing continues to capture the very short-run segment, Thermal CTP remains the most economically viable and technically superior solution for medium to long print runs, ensuring its sustained relevance in the modern printing landscape.

- Market Intro: Technology for direct digital plate creation using infrared lasers.

- Product Description: CTP devices using thermal imaging to expose heat-sensitive aluminum plates.

- Major Applications: Commercial printing, packaging production, newspaper publishing, security printing.

- Benefits: High image quality, excellent repeatability, fast turnaround, elimination of film processing, and light immunity.

- Driving factors: Growth in packaging demand, focus on pre-press automation, and demand for processless plate technologies.

Thermal CTP Market Executive Summary

The Thermal CTP market is characterized by mature technology undergoing continuous refinement, primarily driven by efficiency gains and environmental sustainability imperatives. Key business trends indicate a strong move toward high-speed, fully automated CTP systems integrated seamlessly into plant management software, minimizing human intervention and maximizing throughput. Consolidation among hardware manufacturers and plate suppliers is ongoing, leading to more comprehensive solutions and often proprietary consumables ecosystems. Investment priorities are shifting away from sheer speed increase toward improved uptime, reduced operational costs (especially electricity consumption), and robust data analytics capabilities for proactive maintenance and workflow optimization, ensuring competitive advantage for adopting firms.

Regionally, Asia Pacific (APAC) stands out as the primary growth engine, fueled by burgeoning industrialization, rapidly expanding consumer goods markets, and subsequent increases in print consumption for packaging and commercial materials, particularly in China and India. Conversely, North America and Europe demonstrate slow but stable growth, focusing intensely on high-value segments like specialized packaging and maximizing the adoption of processless thermal plates due to strict environmental policies and high labor costs. Latin America and the Middle East & Africa (MEA) are emerging regions showing sporadic investment driven by localized demand for newspaper and commercial print, often involving the import of refurbished or slightly older CTP equipment alongside new purchases to balance capital expenditure requirements.

Segment trends reveal that the Very Large Format (VLF) CTP segment, catering to large-scale packaging and book printing, is experiencing steady demand due to specialized high-volume requirements. However, the most dynamic trend is the rapid uptake of processless thermal plates across all formats. These plates significantly reduce the environmental footprint and complexity associated with traditional plate processing chemicals, offering a compelling operational advantage. While hardware sales exhibit cyclical patterns linked to capital investment cycles, the recurring revenue from thermal plate consumables provides market stability, reinforcing the dominance of established suppliers with integrated plate manufacturing capabilities.

- Business Trends: Shift towards higher automation, integrated workflow solutions, and emphasis on lower total cost of ownership (TCO).

- Regional Trends: APAC is the primary growth driver; North America and Europe focus on efficiency and sustainability via processless technology adoption.

- Segments trends: Robust growth in the processless thermal plate segment; VLF formats maintain steady demand in specialized long-run printing.

AI Impact Analysis on Thermal CTP Market

Common user questions regarding AI's influence on the Thermal CTP market primarily revolve around workflow automation, predictive maintenance, and quality assurance. Users frequently ask if AI can eliminate manual pre-press checks, how machine learning can predict CTP component failures to maximize uptime, and whether AI-driven imposition software can dramatically reduce plate wastage. There is a high expectation that AI will primarily enhance the efficiency of the CTP ecosystem rather than fundamentally change the core thermal imaging process itself. The key themes summarized are optimization (speed and material use), predictive reliability, and integration with broader Industry 4.0 initiatives within the printing plant.

The impact of Artificial Intelligence and Machine Learning (ML) is becoming increasingly evident in optimizing the CTP pre-press workflow, shifting the focus from manual setup to data-driven process control. AI algorithms are being deployed in pre-flighting software to instantly detect potential file errors (font issues, resolution mismatches, color space conflicts) that could lead to plate errors, thereby saving time and materials. Furthermore, ML models analyze plate consumption patterns and run-length requirements to optimize inventory management, ensuring plates are always available without incurring excessive holding costs, especially for proprietary plate types.

Beyond workflow optimization, AI provides critical advancements in equipment maintenance and calibration. Sensors embedded within modern thermal CTP devices collect vast amounts of operational data—laser diode temperature, rotation speed, plate handling mechanics, and vacuum pressure. ML models process this data to predict component failure probability long before conventional diagnostics, facilitating scheduled maintenance during planned downtime rather than costly, disruptive emergency stoppages. This predictive capability directly translates into higher productivity and reduced TCO for CTP users, reinforcing the value proposition of modern thermal CTP installations in highly demanding, 24/7 production environments.

- AI optimizes pre-flight checks, drastically reducing file error rates before plating.

- Machine Learning (ML) predicts CTP hardware failure, enhancing uptime through preventative maintenance scheduling.

- AI-driven imposition software improves plate utilization and reduces material waste by optimizing layout geometry.

- Smart workflow integration manages plate inventory based on real-time job queues and predictive consumption models.

- Advanced algorithms enhance quality control by ensuring minute dot gain consistency across large print runs.

DRO & Impact Forces Of Thermal CTP Market

The Thermal CTP Market dynamics are shaped by a complex interplay of high-demand drivers, significant competitive restraints, and emerging technological opportunities. Key drivers include the mandatory requirements for high-resolution printing in premium packaging and commercial sectors, coupled with the industry-wide push for maximum pre-press automation. Restraints primarily involve the substantial capital expenditure required for new CTP equipment, the ongoing threat of disruption from high-speed digital inkjet presses, particularly in personalized and very short-run markets, and the persistent reliance on specialized, often vendor-locked, consumables. Opportunities are concentrated around the burgeoning demand for eco-friendly, processless plate technologies and expanding market penetration in fast-growing Asian economies.

The primary impact forces acting on the market are the accelerating pace of technological substitution and intensifying regulatory pressures related to environmental management. The increasing quality and speed of digital printing technology, while not yet fully replacing offset in long-run applications, creates significant pricing pressure and limits growth potential in traditional markets. Simultaneously, stringent environmental regulations in Europe and North America compel printers to adopt processless or chemistry-free CTP solutions, which, while initially representing an investment cost, become a critical differentiator and compliance requirement, restructuring the competitive landscape based on sustainability credentials.

The balance of these forces dictates market trajectory. While drivers related to quality and long-run economy anchor the market, restraints related to capital cost and digital competition necessitate continuous innovation in TCO reduction and workflow streamlining. Opportunities in new plate chemistries, such as highly durable and environmentally benign options, offer pathways for established manufacturers to secure their market positions and expand revenue streams by aligning with global environmental governance trends, ensuring the technology's continued relevance despite surrounding industry shifts.

- Drivers: Demand for high-quality, long-run offset printing; necessity of rapid plate turnaround; improved workflow automation integration.

- Restraints: High initial investment cost of CTP systems; sustained threat from high-speed digital inkjet technology; proprietary consumables dependency (vendor lock-in).

- Opportunity: Widespread adoption of environmentally friendly processless and chemistry-free thermal plates; market expansion in packaging and emerging APAC economies.

- Impact forces: Accelerating technological substitution by digital methods; stringent environmental protection regulations favoring sustainable plate processing.

Segmentation Analysis

The Thermal CTP Market is analyzed across various parameters to understand market dynamics and growth potential within specific niches. The primary segmentation dimensions include the type of plate utilized (conventional vs. processless), the format size of the plate (categorized as VLF, Mid-Format, and Small Format), and the end-use application (such as packaging, commercial printing, and newspaper production). Analyzing these segments reveals diverse investment patterns, with significant heterogeneity in demands for speed, resolution, and sustainability based on the specific requirements of each segment. This granular analysis is crucial for manufacturers to tailor product development and strategic marketing efforts effectively across the global printing industry.

The Processless Plates segment is currently witnessing the highest growth rate, driven by the global environmental movement and the operational advantages of eliminating wet processing steps, including reduced water usage, chemical waste disposal costs, and overall complexity. While conventional thermal plates remain dominant in certain price-sensitive regions or high-volume newspaper applications, the long-term trend strongly favors processless technology due to its superior TCO over the lifecycle of the CTP system. Furthermore, segmentation by format indicates that Mid-Format CTP systems, typically used in high-volume commercial printing, hold the largest market share by volume, whereas Very Large Format (VLF) systems command a higher average selling price due to their specialized use in large-scale packaging and industrial applications.

Segmentation by End-Use highlights the resilience of the Packaging sector as a key driver for high-quality thermal CTP demand. Packaging requires extremely accurate color registration and durable plates capable of long runs and handling diverse substrates, qualities where offset printing, enabled by thermal CTP, excels. The Commercial Printing segment, although facing competitive pressure from digital presses, continues to be a substantial consumer, particularly for medium-to-long run catalog and magazine printing. Newspaper applications, while relatively mature, rely heavily on thermal CTP for the speed and cost-efficiency required for daily, extremely high-volume production cycles globally, ensuring this segment remains a foundational element of the market structure.

- By Plate Type:

- Conventional Thermal Plates (Require chemical processing)

- Processless Thermal Plates (Chemistry-free or low-chemistry)

- By Format Type:

- Very Large Format (VLF)

- Mid-Format

- Small Format

- By End-Use Application:

- Commercial Printing

- Packaging Printing

- Newspaper Printing

- Book and Publication Printing

Value Chain Analysis For Thermal CTP Market

The value chain for the Thermal CTP market is highly integrated, beginning with the upstream supply of raw materials, primarily high-grade aluminum sheets and specialized photo-sensitive/thermal coatings. Aluminum quality is crucial as it determines plate consistency and run length capabilities, making raw material sourcing a strategic component of plate manufacturing. Upstream suppliers often form long-term, specialized partnerships with major plate manufacturers, ensuring material specifications meet the demanding requirements of CTP exposure and high-speed press usage. These coating formulations, often proprietary, represent the technological differentiation between competing plate products, determining factors such as sensitivity, durability, and processing method (conventional vs. processless).

The midstream involves the manufacturing of CTP hardware and the transformation of raw aluminum into finished thermal plates. Hardware manufacturers specialize in high-precision engineering, particularly focusing on laser diode technology, plate handling automation, and integration software (workflow management systems). Downstream activities are dominated by distribution channels, which are typically segmented into direct sales models for large, strategic printing corporations and indirect distribution through regional dealerships and value-added resellers (VARs) for smaller commercial printers. Direct channels allow manufacturers to offer comprehensive service contracts and customized solutions, essential for major CTP equipment sales, while indirect channels provide localized support and access to consumables efficiently.

The final stage involves the integration of the CTP system into the end-user's pre-press workflow. This requires significant technical support and training, often bundled into the purchase package. The interaction between CTP hardware and plates is critical, leading to significant vendor lock-in, as printers often prefer to purchase plates from the same supplier as the machine to guarantee optimal performance and warranty coverage. This highly integrated downstream structure emphasizes the importance of robust service networks and continuous customer relationship management, securing recurring revenue from consumables sales long after the initial hardware purchase, thereby stabilizing the overall market profitability.

Thermal CTP Market Potential Customers

The primary consumers of Thermal CTP technology are entities within the commercial printing, packaging, and publishing sectors that rely heavily on offset lithography for medium-to-long run job production. Large-scale commercial printers, handling diverse jobs ranging from catalogs and brochures to direct mail, represent a vast and consistent market segment. These customers prioritize high throughput, exceptional plate consistency across numerous presses, and robust integration with existing workflow automation tools. Their buying decisions are heavily influenced by the TCO, including plate consumption rates and maintenance requirements, favoring systems known for durability and efficiency.

Packaging converters form another critical customer base, particularly those specializing in folding cartons, labels, and flexible packaging that require complex graphics and precise color matching across large volumes. The shift towards shorter runs even in packaging necessitates fast plate changes and high reliability, driving demand for automated CTP setters. For these customers, the quality and stability of the thermal dot structure are paramount, as slight imperfections can severely impact the visual appeal and brand integrity of packaged goods, leading to a strong preference for established, premium CTP solutions capable of high line screens.

Furthermore, newspaper publishers, despite global circulation challenges, remain high-volume users of thermal CTP due to the necessity of producing plates for multiple press lines rapidly, often under tight daily deadlines. While newspaper plates historically prioritized speed and affordability over ultra-high resolution, modern CTP systems designed for newspaper production offer an optimized balance of throughput, durability, and cost-effectiveness. This segment is highly sensitive to consumables pricing but necessitates systems capable of operating 24/7 with minimal downtime, making service and reliability key purchasing factors for these highly demanding end-users.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 2.15 Billion |

| Market Forecast in 2033 | USD 2.87 Billion |

| Growth Rate | 4.1% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Agfa-Gevaert NV, Eastman Kodak Company, Fujifilm Corporation, Screen Holdings Co., Ltd., ECRM, BasysPrint, Cron, Founder Electronics Co., Ltd., Lucky Film Co., Ltd., Konita Group, Xiamen Aiyin Technology Co., Ltd., Hanita Coatings RCA Ltd., Huafeng Group, Mitsubishi Paper Mills Limited, Southern Lithoplate, Inc., TechNova Imaging Systems (P) Ltd., Presstek LLC, Vianord Engineering Srl, Glunz & Jensen A/S, Zhejiang Aoneng Digital Technology Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Thermal CTP Market Key Technology Landscape

The technological landscape of the Thermal CTP market is defined by continuous evolution focused on increasing automation, enhancing sustainability, and improving imaging precision. The core technology, utilizing high-power infrared (IR) laser diodes, has matured significantly, offering faster output speeds and improved energy efficiency. A pivotal development is the transition from older, slower diode arrays to advanced, multi-beam laser heads that can image plates at extremely high resolutions (up to 4000 dpi) and speeds (over 50 plates per hour), addressing the ever-increasing demand for throughput from high-volume print shops. Furthermore, advanced plate transport mechanisms and integrated stackers minimize plate damage and labor requirements, making the CTP process almost entirely autonomous from file submission to output stacking.

The most transformative technical trend is the pervasive adoption of processless and low-chemistry thermal plate technologies. These plates eliminate or significantly reduce the need for conventional developers, fixers, and wash-out chemicals, allowing printers to remove costly and environmentally taxing processing equipment. Instead, the imaging process allows the exposed plate to be mounted directly onto the press where the non-image area coating is removed by the dampening solution and ink fountain, simplifying the pre-press room layout and dramatically reducing hazardous waste generation. Manufacturers are heavily investing in research to make these processless plates compatible with longer run lengths and a wider variety of press conditions, challenging the dominance of conventional plates even in high-durability segments.

Workflow integration and software intelligence also constitute a crucial technological differentiation. Modern CTP systems are no longer standalone devices but are deeply embedded within proprietary or third-party pre-press management software (Prinergy, Apogee, Esko). These software interfaces manage job queuing, imposition, calibration, and color management across the entire printing ecosystem. Key technological advancements include remote diagnostics capabilities, JDF/CIP4 connectivity for seamless communication with presses, and advanced screening algorithms (e.g., stochastic screening) that enhance the visual quality of the final printed product by managing subtle color transitions and fine detail reproduction, cementing the technological edge of thermal CTP over its competitors.

Regional Highlights

The global Thermal CTP market exhibits distinct growth patterns and maturity levels across key geographical regions, largely influenced by local economic conditions, environmental regulations, and the structure of the printing industry. North America and Europe represent mature markets characterized by high labor costs and stringent environmental legislation. In these regions, investment is heavily focused on replacing older equipment with high-automation, energy-efficient CTP devices and adopting processless thermal plates to achieve sustainability targets and reduce operational expenses. Growth here is primarily value-driven, centered on high-margin specialized print jobs like premium packaging and security printing, rather than sheer volume expansion.

Asia Pacific (APAC) stands as the undeniable growth engine for the Thermal CTP market. Countries like China, India, and Southeast Asian nations are experiencing massive growth in commercial printing, packaging, and infrastructure projects, leading to substantial volume demand for offset printing. This necessitates continuous investment in CTP hardware and consumables. While price sensitivity remains higher in parts of APAC, leading to strong demand for cost-effective systems, the accelerating adoption of international quality standards and environmental awareness, particularly in export-focused printing hubs, is beginning to drive demand for premium, processless thermal solutions, mirroring the trends seen in Western markets but on a larger scale.

Latin America (LATAM) and the Middle East & Africa (MEA) present fragmented but promising regional markets. LATAM's market stability fluctuates with economic cycles, yet regional demand for publication and basic commercial printing sustains a moderate level of CTP system procurement and plate consumption. In the MEA region, oil-rich nations and emerging economic centers are investing in modern printing infrastructure to support local industry growth, driving localized spikes in CTP adoption. However, these regions often rely heavily on international imports and regional distributors, leading to higher variability in pricing and service availability compared to established markets, making localized support a key competitive factor for suppliers.

- North America: Mature market, high adoption of automation and VLF systems; strong focus on reducing TCO and embracing processless technology due to high operational costs.

- Europe: Driven by strict environmental regulations (REACH compliance); leading region for processless thermal plate utilization; steady demand fueled by high-quality commercial and specialized packaging print.

- Asia Pacific (APAC): Highest volume growth region; strong investment in new CTP installations to support booming packaging and commercial printing industries, particularly in China and India.

- Latin America (LATAM): Moderate market, sensitive to economic volatility; steady demand for mid-format commercial and publication printing.

- Middle East & Africa (MEA): Emerging market, driven by specific industrial and governmental printing needs; often reliant on international imports and project-based capital investments.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Thermal CTP Market.- Agfa-Gevaert NV

- Eastman Kodak Company

- Fujifilm Corporation

- Screen Holdings Co., Ltd.

- ECRM

- BasysPrint (part of Krause Group)

- Cron (Hangzhou Cron Machinery & Electronics Co., Ltd.)

- Founder Electronics Co., Ltd.

- Lucky Film Co., Ltd.

- Konita Group

- Xiamen Aiyin Technology Co., Ltd.

- Hanita Coatings RCA Ltd.

- Huafeng Group

- Mitsubishi Paper Mills Limited

- Southern Lithoplate, Inc.

- TechNova Imaging Systems (P) Ltd.

- Presstek LLC (part of Mark Andy Print Products)

- Vianord Engineering Srl

- Glunz & Jensen A/S

- Zhejiang Aoneng Digital Technology Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Thermal CTP market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary advantage of Thermal CTP over other CTP technologies?

Thermal CTP offers superior resolution, exceptional dot stability, and high repeatability, which is critical for demanding, high-quality color reproduction and long print runs in commercial and packaging applications. Thermal plates are also immune to ambient light, simplifying pre-press operations.

How is environmental sustainability impacting the Thermal CTP market?

Sustainability is driving rapid adoption of processless (chemistry-free) thermal plates. These plates reduce chemical waste disposal costs, minimize water usage, and streamline workflow, aligning with global environmental regulations and corporate mandates for reduced environmental footprint.

Is Thermal CTP still relevant given the growth of digital printing?

Yes, Thermal CTP remains highly relevant and dominant for medium-to-long run offset lithography jobs, especially in packaging and high-volume commercial printing. While digital excels in short runs, thermal CTP provides the most cost-effective and highest quality solution for sustained volume production.

Which geographical region is showing the fastest growth in CTP adoption?

The Asia Pacific (APAC) region, particularly driven by China and India, exhibits the fastest growth due to expanding industrialization, surging consumer goods production, and resulting high demand for packaging and commercial print volumes.

What role does automation play in the future of Thermal CTP systems?

Automation is crucial; modern CTP systems feature auto-loading, inline punching, bending, and integrated workflow management. This automation significantly reduces labor costs, minimizes errors, and ensures seamless, high-speed plate production necessary for 24/7 printing environments.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Digital Offset Printing Plate Market Statistics 2025 Analysis By Application (Books, Magazines, Newspapers, Packaging), By Type (Thermal CTP Plate, UV-CTP Plates), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Thermal CTP Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Manual CTP, Fully automatic CTP, Semi-automatic CTP), By Application (Packaging, Newspaper, Business), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager