Thermal Incinerator Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441633 | Date : Feb, 2026 | Pages : 253 | Region : Global | Publisher : MRU

Thermal Incinerator Market Size

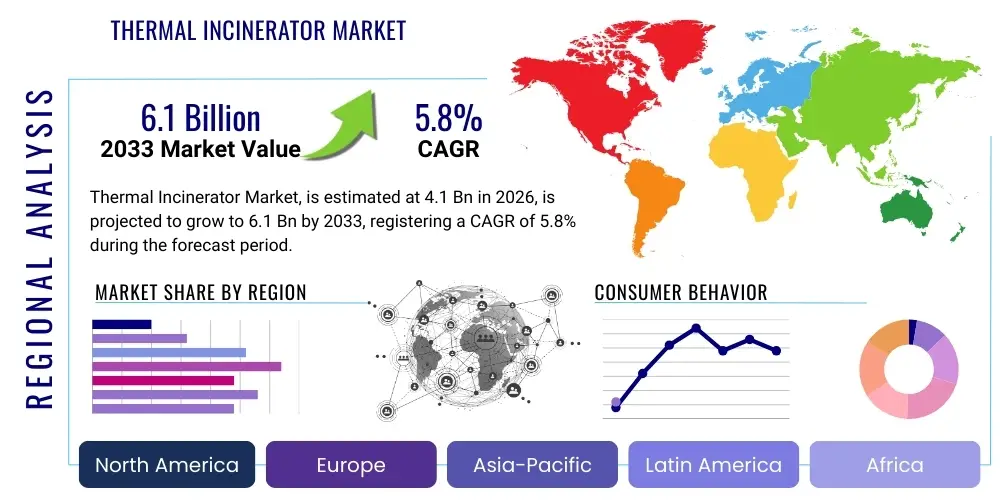

The Thermal Incinerator Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 4.1 Billion in 2026 and is projected to reach USD 6.1 Billion by the end of the forecast period in 2033. This consistent expansion is primarily fueled by stringent environmental regulations globally concerning proper waste disposal, particularly for hazardous and medical waste streams, coupled with the increasing necessity for sustainable waste-to-energy (WtE) solutions in densely populated urban centers where landfill capacity is rapidly diminishing. The growth trajectory reflects significant investment in modern, high-efficiency incineration facilities that incorporate advanced pollution control systems (APCS) to meet updated air quality standards, ensuring compliance while recovering valuable energy.

Thermal Incinerator Market introduction

The Thermal Incinerator Market encompasses the technologies and infrastructure dedicated to the controlled burning of various waste streams at high temperatures to reduce volume, neutralize pathogenic or toxic components, and recover energy. This essential component of integrated waste management is highly critical in regions lacking sufficient land for landfilling or requiring specialized treatment for complex wastes like chemical residues, pharmaceuticals, and infectious medical materials. The thermal process results in significant mass reduction (up to 95%) and complete destruction of organic matter, leaving inert ash which can often be repurposed in construction materials, thereby minimizing the overall environmental footprint associated with waste disposal. Furthermore, modern incinerators are sophisticated energy conversion facilities, integral to the shift toward circular economies.

Thermal incinerator products span several key types, including Rotary Kilns, highly versatile for hazardous and industrial sludge; Fluidized Bed Incinerators, excellent for homogeneous materials and energy recovery; and Grate Incinerators (like reciprocating grate systems), which are the workhorse for processing heterogeneous Municipal Solid Waste (MSW) streams. The primary applications involve Municipal Solid Waste (MSW) treatment, managing industrial hazardous waste, treating clinical and medical waste (which requires high-temperature sterilization), and specific applications in sewage sludge disposal. The operational efficiency, combined with mandated environmental compliance protocols, positions thermal incineration as an indispensable technology for global sanitation and waste safety, particularly in developed economies and rapidly industrializing nations.

Key benefits of adopting thermal incineration technology include substantial volume reduction, eliminating toxic substances (such as PCBs and pesticides), complete pathogen destruction, and the production of renewable energy (electricity or heat) through Waste-to-Energy (WtE) plants. Driving factors for market growth include accelerating urbanization, leading to higher waste generation rates; severe constraints on landfill capacity globally; and supportive government policies, especially in Europe and Asia Pacific, promoting WtE projects through incentives, subsidies, and favorable power purchase agreements (PPAs). The continuous improvement in pollution control technology, aimed at minimizing NOx, SOx, and particulate matter emissions, is also driving the adoption of next-generation thermal systems, making them environmentally viable and economically attractive alternatives to historical disposal methods.

Thermal Incinerator Market Executive Summary

The Thermal Incinerator Market is undergoing a transformation driven by global business trends focused on sustainability, digitalization, and regulatory adherence. A primary business trend involves the increased consolidation of the Engineering, Procurement, and Construction (EPC) sector, where major international players are acquiring smaller regional specialists to offer integrated, end-to-end WtE solutions. This vertical integration allows for standardized project delivery, optimized supply chains, and easier compliance with diverse international standards. Another significant trend is the increasing financial viability of projects due to improved energy efficiency and attractive feed-in tariffs for renewable energy generated from waste, shifting the perception of incineration from a mere disposal method to a valuable energy resource infrastructure.

Regionally, the market dynamics are highly fragmented. Asia Pacific (APAC) currently dominates growth, led by massive infrastructure development in China, India, and Southeast Asian nations that are rapidly abandoning legacy landfill practices due to scarcity of land and public health crises. Europe remains a mature yet crucial market, characterized by technological advancements focused on ultra-low emissions and Carbon Capture, Utilization, and Storage (CCUS) integration, primarily mandated by the European Green Deal. North America shows stable growth, driven largely by the high demand for hazardous waste incineration (especially in petrochemical and pharmaceutical industries) and continuous investment in aging MSW facilities requiring upgrades to comply with stringent EPA Maximum Achievable Control Technology (MACT) rules. These geographical variances necessitate customized market strategies focusing either on new build capacity (APAC) or retrofitting and modernization (Europe/North America).

Segment-wise, the Municipal Solid Waste (MSW) application segment holds the largest market share due to the sheer volume of waste generated worldwide, but the Hazardous Waste segment is projected to exhibit the highest Compound Annual Growth Rate (CAGR) owing to stricter global regulations on industrial byproduct disposal. Technology-wise, Reciprocating Grate Incinerators remain dominant for MSW, while Rotary Kilns maintain their supremacy in the highly profitable, technically demanding hazardous waste sector. The ongoing trend is toward modular and scalable incineration units, which reduce initial capital expenditure and enable decentralized waste processing, particularly beneficial for island nations or geographically dispersed industrial zones, ensuring market resilience against large-scale single-site failures and streamlining logistical costs.

AI Impact Analysis on Thermal Incinerator Market

Common user questions regarding AI in the Thermal Incinerator Market center on whether artificial intelligence can truly optimize the complex combustion process, reduce operational costs, and enhance environmental compliance simultaneously. Users frequently inquire about the reliability of AI-driven predictive maintenance for high-stress components like refractory linings, and how machine learning algorithms manage fluctuations in waste composition (calorific value variability). The key theme summarized from user concerns is the expectation that AI should provide real-time, autonomous adjustments to air flow, fuel injection (if supplementary fuel is used), and flue gas treatment systems, moving incinerator operations away from reliance on highly experienced human operators towards automated, consistently high-efficiency regimes that minimize both unplanned downtime and polluting emissions.

- AI-driven Predictive Maintenance (PdM) minimizes unplanned shutdowns by analyzing sensor data (vibration, temperature) to forecast equipment failure, particularly concerning boiler tubes and grate movement systems.

- Machine Learning (ML) algorithms optimize combustion efficiency by continuously monitoring and adjusting primary and secondary air distribution based on the heterogeneity of the incoming waste stream, ensuring stable furnace temperature.

- Enhanced Emissions Control Optimization involves using neural networks to predict pollutant formation (NOx, SOx) and automatically fine-tune pollution control reagent injection (e.g., lime slurry, activated carbon), ensuring instantaneous regulatory compliance.

- Automated Feedstock Management employs computer vision and AI to analyze incoming waste quality (Calorific Value, moisture content), allowing operators to blend wastes optimally before injection, maximizing energy recovery.

- Digital Twins and Simulation enable virtual modeling of incinerator performance under various load and waste conditions, facilitating rapid prototyping of operational changes and operator training without risking the physical plant.

DRO & Impact Forces Of Thermal Incinerator Market

The core dynamics shaping the thermal incinerator market are defined by a complex interplay of structural drivers, significant financial and environmental restraints, and burgeoning technological opportunities. A primary driver is the accelerating crisis of global waste generation, propelled by rapid population growth, industrialization, and changing consumption patterns, which mandate advanced solutions beyond conventional landfilling. Simultaneously, the regulatory landscape is applying forceful pressure, particularly in developed regions, demanding stricter emission controls (Dioxins, Furans, heavy metals) and higher energy recovery targets, necessitating investments in state-of-the-art facilities. These external forces generate continuous demand for thermal solutions that are compliant, safe, and integrated with energy infrastructure, ensuring market robustness despite cyclical economic fluctuations.

However, the market faces considerable constraints, primarily centered on the extremely high capital expenditure (CAPEX) required for constructing modern WtE plants, making financing a challenge, particularly in developing economies. Furthermore, social and political opposition, commonly termed the 'Not In My Backyard' (NIMBY) phenomenon, often delays or halts new project development, regardless of proven modern emission standards. The market also contends with the competition from alternative waste treatment technologies, such as advanced recycling, pyrolysis, and gasification, which, while still niche compared to mass-burn incineration, are gaining traction due to lower perceived environmental impact. These restraints necessitate innovative financing models and enhanced public engagement strategies to ensure project feasibility.

Significant opportunities exist, particularly in the integration of incineration technology with emerging environmental trends. The Waste-to-Energy (WtE) model provides a crucial opportunity to transition waste management into renewable energy generation, accessing substantial government incentives and carbon credits. Furthermore, the advent of Carbon Capture, Utilization, and Storage (CCUS) technologies offers a pathway for incinerators to achieve near-net-zero carbon footprints, addressing one of the technology’s central long-term environmental criticisms. Impact forces driving the market include regulatory pressure, which mandates minimum operational standards and drives technological upgrades; economic forces, dictated by energy market prices influencing WtE profitability; and social forces, demanding better public health and aesthetic outcomes from waste management infrastructure, pushing the industry toward enclosed, highly efficient, and transparent operations.

Segmentation Analysis

The Thermal Incinerator Market is comprehensively segmented based on technology type, the application or waste stream handled, and the end-user sector implementing the solution. Understanding these segmentations is crucial for identifying areas of highest growth potential and technological specialization. The market structure reveals a dominance of conventional mass-burn technologies within the municipal sector, while specialized, high-heat technologies, such as rotary kilns, command premium pricing and utility within the industrial hazardous waste sector. The ongoing technological evolution within these segments aims at optimizing efficiency, lowering operational expenditure (OPEX), and improving the environmental profile of each specific incinerator type to cater effectively to the unique characteristics and regulatory requirements of different waste streams globally.

- By Technology Type:

- Rotary Kiln Incinerators

- Fluidized Bed Incinerators

- Grate Incinerators (Reciprocating Grate, Vibrating Grate)

- Multiple Hearth Incinerators

- Specialized Incinerators (e.g., Starved Air Incinerators)

- By Application/Waste Stream:

- Municipal Solid Waste (MSW)

- Hazardous Waste (Chemical, Solvents, Refinery Sludge)

- Medical and Clinical Waste

- Industrial Non-Hazardous Waste

- Sewage Sludge

- By End-User:

- Government & Municipalities

- Industrial Sector (Chemicals, Petrochemicals, Metals, Manufacturing)

- Healthcare Providers (Hospitals, Clinics)

- Waste Management Companies (Third-Party Operators)

Value Chain Analysis For Thermal Incinerator Market

The value chain for the Thermal Incinerator Market is intricate, beginning with specialized upstream suppliers of high-grade construction materials and complex technological components. Upstream activities primarily involve the sourcing and manufacturing of critical items such as refractory materials (crucial for furnace integrity), heat-resistant alloys for boiler tubes, and highly specialized components for the Advanced Pollution Control Systems (APCS), including scrubbers, bag filters, and selective catalytic reduction (SCR) units. The efficiency and durability of these upstream components directly impact the overall lifecycle cost and operational stability of the incinerator plant. Major EPC (Engineering, Procurement, and Construction) firms form the core of the midstream, undertaking the detailed design, project management, system integration, and construction of the facility, often leveraging proprietary grate or kiln technology.

Downstream analysis focuses on the operation, maintenance, and monetization of the incinerated output. The immediate downstream activity involves the handling and disposal of inert ash (bottom ash and fly ash), often requiring stabilization before being reused or safely landfilled. Crucially, the major downstream value lies in the energy recovery aspect: converting the generated steam into electricity for grid connection or distributing heat for district heating networks. This integration with the energy sector transforms the incinerator into a power plant, generating revenue that stabilizes operational expenditure. Direct distribution channels involve public-private partnerships (PPPs) where municipal entities contract directly with EPC firms and specialized operators for turnkey solutions, ensuring long-term operational guarantees.

Indirect distribution channels often involve large international infrastructure funds, environmental service holding companies, and global waste management corporations that act as intermediaries, commissioning and operating multiple facilities across various jurisdictions. These indirect players drive standardization and economies of scale. The entire value chain is characterized by long project lifecycles (20+ years) and high regulatory oversight, necessitating continuous investment in skilled labor for maintenance and compliance monitoring. The shift toward digital operation and maintenance (O&M) services, often outsourced to specialized firms, represents a modern trend in the downstream segment, enhancing efficiency and asset performance management across the installed base.

Thermal Incinerator Market Potential Customers

The primary end-users and buyers in the Thermal Incinerator Market represent a diverse group characterized by high waste generation volumes, stringent disposal requirements, and mandates for environmental compliance. The largest and most consistent customer base is composed of Government and Municipalities, which are responsible for managing the vast volumes of Municipal Solid Waste (MSW) generated by urban populations. These entities often engage in large-scale public tenders or Public-Private Partnerships (PPPs) to procure WtE facilities capable of handling hundreds or thousands of tons of waste daily. Their procurement decisions are heavily influenced by regulatory pressures, long-term environmental planning goals, and the need for reliable energy infrastructure.

The second major segment encompasses the Industrial Sector, specifically focusing on complex sub-sectors like chemicals, petrochemicals, pharmaceuticals, and specialized manufacturing. These industries generate waste streams classified as hazardous, toxic, or difficult to treat (e.g., highly viscous sludges, corrosive residues, expired chemicals). For these customers, thermal incineration is not merely a disposal option but a mandatory regulatory step to neutralize danger and meet site closure requirements. These customers prioritize technologies like Rotary Kilns due to their ability to handle diverse and challenging feeds, and their purchasing decisions are dictated by compliance urgency, process security, and specialized technical capability rather than volume alone.

A rapidly growing customer segment includes Healthcare Providers and specialized third-party Waste Management Companies. Hospitals and large clinical facilities require immediate and complete destruction of infectious medical waste (sharps, pathological waste) to prevent the spread of disease, driving demand for dedicated medical waste incinerators, which often utilize compact, high-temperature combustion units. Meanwhile, third-party waste management firms serve as crucial consolidators, offering outsourced incineration services to multiple smaller generators (SMEs, remote facilities, small hospitals). Their purchasing strategy focuses on versatile, high-throughput incinerators that offer operational flexibility and can cater to diverse waste profiles under contractual agreements, maximizing asset utilization across a broad client base.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.1 Billion |

| Market Forecast in 2033 | USD 6.1 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Babcock & Wilcox Enterprises, Suez SA, Veolia Environnement S.A., Foster Wheeler AG, Mitsubishi Heavy Industries Ltd., Hitachi Zosen Corporation, Covanta Holding Corporation, Martin GmbH, Keppel Seghers, CECO Environmental, Thermax Ltd., Turboden S.p.A., Doosan Lentjes, TSK S.A., AECOM, TechnipFMC, ANDRITZ Group, Duro Felguera, China Everbright International, Zosco Industrial |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Thermal Incinerator Market Key Technology Landscape

The technological landscape of the thermal incinerator market is characterized by continuous innovation focused on maximizing energy recovery and minimizing stack emissions to ultra-low levels. The core technology, involving controlled combustion, is supplemented by advanced mechanical and digital systems. Modern incinerators rely heavily on robust grate systems (such as reciprocating or roller grates) engineered for effective agitation and complete burnout of heterogeneous municipal waste, ensuring thermal stability and high throughput. A key technological advancement is the integration of advanced heat recovery boilers that operate at higher steam parameters (pressure and temperature) compared to previous generations, significantly improving the net electrical efficiency of the Waste-to-Energy (WtE) process, often reaching 25-30% efficiency or more, making these plants highly competitive against traditional thermal power generation assets.

Equally important are the technologies employed in the Advanced Pollution Control Systems (APCS), which are mandatory for meeting stringent global air quality standards, notably those enforced by the EU and EPA. Typical APCS trains utilize multiple stages: selective non-catalytic reduction (SNCR) or selective catalytic reduction (SCR) for NOx reduction; acid gas removal using wet or dry scrubbers involving lime or sodium bicarbonate injection for SOx and HCl control; and high-efficiency particulate removal systems, such as fabric filters (baghouses) or electrostatic precipitators (ESPs). Recent developments include the use of activated carbon injection for capturing heavy metals and dioxins/furans, followed by specialized bag filters, ensuring that the final emissions profile is environmentally benign and often below mandated limits, addressing public health concerns effectively.

Digitalization represents a paradigm shift in operational technology (OT). The current generation of incinerators incorporates sophisticated supervisory control and data acquisition (SCADA) systems and Distributed Control Systems (DCS) that provide real-time monitoring and control. Furthermore, the integration of sensors, IoT devices, and cloud computing facilitates the application of advanced analytics, including AI and machine learning, for crucial functions like optimizing combustion air ratio, predicting refractory wear, and dynamically adjusting flue gas cleaning based on continuous emission monitoring systems (CEMS). This technological convergence enhances operational predictability, reduces maintenance expenditure, and ensures the facility operates in an optimal energy-producing and environmentally compliant state 24/7, solidifying the market’s reliance on intelligent, high-tech engineering solutions.

Regional Highlights

The Thermal Incinerator Market demonstrates significant regional variation in maturity, growth potential, and regulatory stringency, necessitating tailored strategies for market entry and expansion.

- Asia Pacific (APAC): APAC is the fastest-growing region, driven by explosive urbanization and the resulting waste crisis, particularly in countries like China, India, and Indonesia. These nations are aggressively investing in new WtE capacity to mitigate environmental degradation caused by massive, unregulated landfills. Government policy support, substantial financing through international development banks, and the sheer volume of waste generation make this region the primary driver of new facility construction. Technological adoption often focuses on high-throughput grate incinerators for MSW and robust rotary kilns for the expanding industrial base.

- Europe: Europe represents the most mature market, characterized by near-total diversion of recoverable waste from landfills, resulting in a high density of WtE plants, particularly in Scandinavia, Germany, and the Netherlands. Growth here is focused on technological retrofits, efficiency improvements (e.g., optimizing heat distribution through district heating networks), and pioneering the integration of advanced technologies like CCUS to decarbonize the process. Regulations (like the Industrial Emissions Directive) are the strictest globally, fostering continuous innovation in ultra-low emission control.

- North America (NA): North America exhibits stable, moderate growth. The market is defined by a mix of aging WtE facilities requiring refurbishment and a strong demand for specialized hazardous waste treatment, particularly in the Gulf Coast and industrial Midwest. Regulatory challenges, including complex permitting processes and public scrutiny, often make large-scale MSW projects difficult, focusing market efforts instead on optimizing existing assets, enhancing efficiency, and catering to high-value industrial and medical waste streams using specialized thermal processes.

- Latin America (LATAM): LATAM remains an emerging market characterized by significant potential but hindered by economic volatility and reliance on informal waste management sectors. Governments are showing increasing interest in WtE, particularly in major economies like Brazil and Mexico, but project execution often depends on stable public policy, international financing, and the successful navigation of complex local bureaucratic hurdles. Initial projects often involve smaller, decentralized facilities.

- Middle East and Africa (MEA): Growth in MEA is highly concentrated in the GCC (Gulf Cooperation Council) nations, where economic diversification and ambitious environmental goals (e.g., Saudi Vision 2030, UAE Net Zero 2050) drive investment in sophisticated WtE infrastructure to manage rapidly rising per capita waste generation. Africa presents long-term potential, largely relying on international aid and specific projects focusing on critical needs like medical waste incineration, though broad MSW incineration remains constrained by financial resources.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Thermal Incinerator Market.- Babcock & Wilcox Enterprises

- Suez SA

- Veolia Environnement S.A.

- Foster Wheeler AG (part of Amec Foster Wheeler/Wood Group)

- Mitsubishi Heavy Industries Ltd.

- Hitachi Zosen Corporation

- Covanta Holding Corporation

- Martin GmbH

- Keppel Seghers

- CECO Environmental

- Thermax Ltd.

- Turboden S.p.A.

- Doosan Lentjes

- TSK S.A.

- AECOM

- TechnipFMC

- ANDRITZ Group

- Duro Felguera

- China Everbright International

- Zosco Industrial

Frequently Asked Questions

Analyze common user questions about the Thermal Incinerator market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary role of thermal incinerators in modern integrated waste management systems?

The primary role of thermal incinerators is to significantly reduce waste volume (up to 95%), neutralize hazardous components (including pathogens and toxins), and recover energy (Waste-to-Energy or WtE). They serve as critical infrastructure in urban areas facing landfill constraints and for treating specialized hazardous and medical waste streams.

How do modern incinerators ensure compliance with stringent air quality regulations?

Modern incinerators utilize multi-stage Advanced Pollution Control Systems (APCS). These systems typically include Selective Catalytic Reduction (SCR) for nitrogen oxides (NOx), scrubbers (wet or dry) for sulfur dioxide (SOx) and acid gases, and high-efficiency fabric filters/baghouses coupled with activated carbon injection for capturing particulates, heavy metals, and persistent organic pollutants like dioxins and furans, ensuring ultra-low emissions.

Which geographical region is currently experiencing the fastest growth in the Thermal Incinerator Market?

The Asia Pacific (APAC) region, particularly China, India, and Southeast Asian nations, is driving the fastest market growth. This is attributed to rapid urbanization, increasing waste generation volumes, severe land scarcity for landfilling, and robust government initiatives promoting infrastructure development and Waste-to-Energy projects as sustainable alternatives.

What is the main difference between Rotary Kiln and Grate Incinerators?

Grate incinerators (like reciprocating grates) are primarily designed for high-volume, heterogeneous Municipal Solid Waste (MSW) streams, using a stationary or moving grate to manage fuel bed movement. Rotary Kilns, conversely, are rotating cylindrical furnaces preferred for their versatility in handling highly varied, difficult, or hazardous wastes, including industrial sludges, liquids, and bulk solid hazardous materials, ensuring complete combustion at very high temperatures.

What are the largest financial challenges facing new thermal incinerator projects?

The most significant financial challenge is the extremely high initial Capital Expenditure (CAPEX) required for planning, engineering, and constructing a state-of-the-art facility, often costing hundreds of millions of dollars. This necessitates long-term financing, reliable government support via Power Purchase Agreements (PPAs), and successful navigation of complex, protracted permitting processes.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager