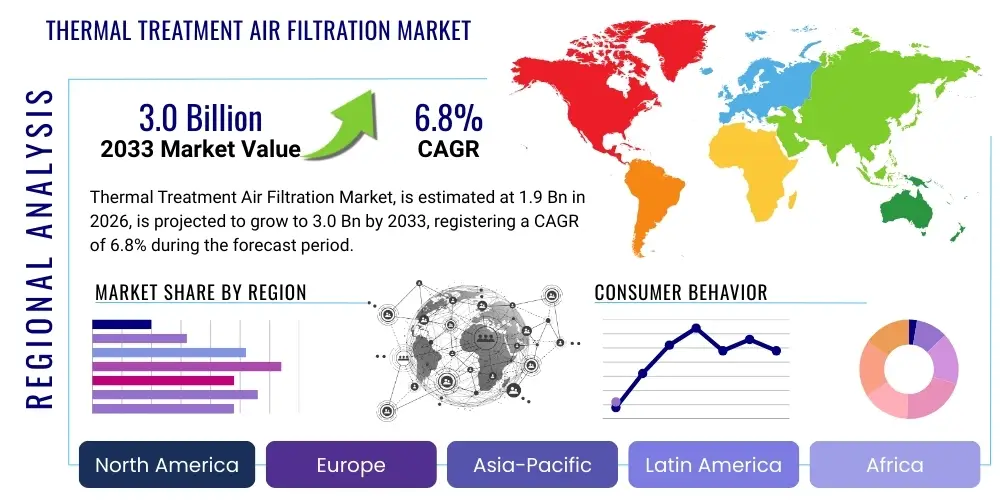

Thermal Treatment Air Filtration Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441283 | Date : Feb, 2026 | Pages : 257 | Region : Global | Publisher : MRU

Thermal Treatment Air Filtration Market Size

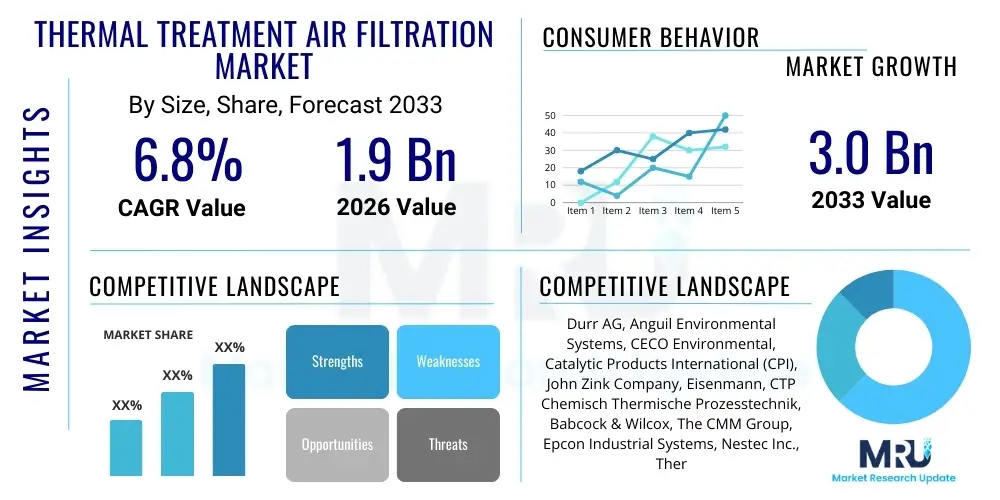

The Thermal Treatment Air Filtration Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 1.9 Billion in 2026 and is projected to reach USD 3.0 Billion by the end of the forecast period in 2033.

Thermal Treatment Air Filtration Market introduction

Thermal Treatment Air Filtration systems, primarily utilizing thermal oxidation processes, are specialized industrial equipment designed to eliminate Volatile Organic Compounds (VOCs), Hazardous Air Pollutants (HAPs), and other noxious fumes generated during manufacturing and industrial operations. These systems function by heating the contaminated air stream to extreme temperatures, typically between 1400°F and 1800°F, to initiate a chemical reaction that converts pollutants into benign components such as carbon dioxide and water vapor. The resulting clean exhaust air is then released into the atmosphere, ensuring compliance with stringent environmental regulations set forth by global bodies like the Environmental Protection Agency (EPA) and various regional environmental agencies.

The core product portfolio within this market includes Regenerative Thermal Oxidizers (RTOs), Catalytic Oxidizers (COs), Thermal Recuperative Oxidizers (TROs), and Direct-Fired Thermal Oxidizers (DFTOs). RTOs are the dominant technology, favored for their exceptional thermal efficiency—often exceeding 95%—achieved through the use of ceramic media beds that capture and reuse heat energy. Major applications span across petrochemical processing, pharmaceutical manufacturing, automotive coating and finishing, printing and packaging, and specialized waste incineration facilities where the reduction of toxic industrial off-gases is mandatory for operational licensure and environmental stewardship.

The market expansion is fundamentally driven by the escalating global focus on air quality improvement and industrial sustainability. As industrial activity intensifies, particularly in rapidly developing economies, the regulatory burden on emitters of industrial pollutants increases. Furthermore, the operational benefits derived from modern thermal treatment solutions, such as reduced energy consumption facilitated by high-efficiency heat recovery and modular designs that simplify integration, make these systems crucial infrastructure investments for enterprises striving to achieve both environmental compliance and operational cost optimization.

Thermal Treatment Air Filtration Market Executive Summary

The Thermal Treatment Air Filtration market is currently experiencing robust growth, primarily propelled by the worldwide tightening of environmental compliance standards, particularly those targeting industrial emissions of VOCs and HAPs. The key business trend dominating the market is the shift toward highly energy-efficient solutions, making Regenerative Thermal Oxidizers (RTOs) the segment cornerstone due to their superior heat recovery capabilities. Manufacturers are focusing heavily on integrating sophisticated monitoring systems and modular designs that allow for scalable deployment and predictive maintenance, enhancing the total cost of ownership proposition for industrial end-users. Strategic partnerships and acquisitions aimed at expanding geographical footprints and integrating specialized expertise in specific industrial applications, such as large-scale chemical processing and advanced materials production, are defining the competitive landscape.

From a regional perspective, Asia Pacific (APAC) is emerging as the most dynamic region, exhibiting the fastest growth trajectory, mainly spurred by rapid industrialization in countries like China and India coupled with a dramatic shift towards enforcing stricter environmental protocols. While North America and Europe remain mature markets, growth here is stable and driven by the replacement cycle of older, less efficient equipment and the demand for upgrades to comply with updated regulatory thresholds. Regional trends highlight a preference for RTOs in highly regulated Western markets, while a mix of cost-effective Thermal Recuperative Oxidizers and RTOs is observed in emerging APAC markets, depending on pollutant concentration and flow rates.

Segment-wise, the Oil and Gas and Chemical Manufacturing sectors continue to be the largest consumers of thermal treatment technology, requiring massive air flow capabilities and robust handling of diverse solvent streams. Technological segmentation underscores the dominance of RTOs, which account for the largest market share and are expected to maintain this leadership throughout the forecast period due to ongoing improvements in ceramic media efficiency and operational flexibility. Catalytic Oxidizers (COs) are gaining traction in applications where lower operating temperatures are sufficient, especially in the pharmaceutical and food processing industries where solvent loads are moderate and energy consumption minimization is a core objective.

AI Impact Analysis on Thermal Treatment Air Filtration Market

Common user questions regarding AI's influence on the Thermal Treatment Air Filtration Market frequently revolve around optimizing energy consumption, predicting equipment failures, and ensuring instantaneous regulatory compliance. Users inquire specifically about how Artificial Intelligence and Machine Learning (ML) can refine the combustion process in real-time, how AI-driven analytics can reduce downtime associated with ceramic media degradation or catalyst fouling, and the feasibility of implementing fully autonomous control systems. The primary concern is moving beyond reactive maintenance schedules to proactive, performance-based operations, minimizing the substantial energy expenditure involved in maintaining high thermal temperatures. There is a strong expectation that AI will deliver tangible reductions in operational expenditure (OPEX) and significantly enhance the longevity and reliability of expensive capital equipment like RTOs and COs, thereby justifying the substantial investment in smart sensors and data infrastructure required for AI integration.

The application of AI is poised to revolutionize the operational efficacy of thermal treatment systems by enabling highly granular control over critical process variables. ML algorithms can analyze massive datasets encompassing inlet VOC concentrations, flow rates, operating temperatures, fuel consumption, and stack emission data. This analysis allows the system to instantaneously adjust preheat temperatures and fuel input, ensuring complete destruction of pollutants while minimizing excess energy expenditure. For instance, in an RTO, AI can optimize the switching frequency of the valves and fine-tune burner operation based on anticipated load shifts, leading to substantial savings in natural gas consumption, which is typically the largest variable cost component in thermal oxidation.

Furthermore, AI-driven predictive maintenance represents a pivotal advancement. By continuously monitoring vibration, pressure drops, and temperature differentials across the ceramic media beds or catalytic converters, AI models can detect subtle anomalies indicative of performance degradation, such as fouling or thermal stress, long before they lead to catastrophic failure or non-compliance events. This predictive capability translates directly into higher uptime, fewer unplanned shutdowns, and optimized maintenance scheduling, allowing facilities to maximize operational efficiency and maintain continuous compliance with air quality permits, significantly mitigating regulatory risk and associated penalties.

- AI-Enhanced Combustion Optimization: Real-time adjustment of fuel-to-air ratio and temperature set points based on live inlet pollutant concentration, maximizing Destruction Removal Efficiency (DRE) while minimizing energy usage.

- Predictive Maintenance Protocols: ML algorithms analyze sensor data (vibration, temperature, pressure) to forecast potential equipment failure, such as valve failure or ceramic media degradation, reducing unplanned downtime by up to 30%.

- Automated Compliance Reporting: AI systems automatically generate comprehensive emission reports, cross-referencing operational data with regulatory limits, streamlining compliance documentation and reducing human error.

- Optimized Heat Recovery Strategy: AI dynamically manages the thermal energy cycling in Regenerative Thermal Oxidizers (RTOs), adjusting valve switching sequences to maintain optimal thermal energy efficiency (up to 98%).

- Digital Twin Simulation: Creation of virtual models of thermal treatment units that allow operators to simulate various scenarios (e.g., sudden load increase, fuel source change) to train control systems and optimize standard operating procedures.

- Energy Demand Forecasting: AI models integrate with facility-wide energy management systems to anticipate burner fuel requirements and coordinate energy sourcing, potentially utilizing off-peak pricing or intermittent renewable energy inputs.

- Remote Diagnostic Capabilities: Enabled by IoT and AI, experts can remotely diagnose complex operational issues, reducing the need for costly and time-consuming onsite visits by specialized engineers.

DRO & Impact Forces Of Thermal Treatment Air Filtration Market

The Thermal Treatment Air Filtration Market is strategically shaped by a complex interplay of Drivers, Restraints, and Opportunities (DRO), which collectively form the Impact Forces dictating market trajectory. The primary driver remains the global escalation of regulatory strictness concerning industrial air emissions, particularly the continuous updates to standards governing Volatile Organic Compounds (VOCs) and Hazardous Air Pollutants (HAPs). Environmental agencies across North America, Europe, and increasingly Asia Pacific are enforcing lower permissible emission limits, compelling industries such as petrochemicals, printing, and pharmaceuticals to upgrade or install advanced thermal oxidation technologies. This regulatory momentum acts as a consistent baseline demand for high-DRE (Destruction Removal Efficiency) systems.

However, the market growth is moderately constrained by the significant initial capital expenditure required for purchasing and installing advanced thermal oxidizers, particularly the high-volume RTOs. This cost barrier, coupled with the recurring operational expenses associated with fuel consumption (natural gas) and complex maintenance of ceramic media and high-temperature components, can deter smaller or financially constrained enterprises. Furthermore, technical challenges, such as handling air streams with fluctuating concentrations or corrosive elements, demand specialized engineering and design, adding to the complexity and cost of deployment, acting as a moderate restraint.

Opportunities for expansion are abundant, particularly in leveraging technological innovation and exploiting nascent markets. The integration of IoT and predictive analytics offers substantial opportunities for improving energy efficiency and reducing lifecycle costs, thereby mitigating the restraint of high OPEX. Geographically, emerging economies in Southeast Asia and Latin America represent untapped potential where industrial expansion is outpacing current environmental compliance infrastructure, creating a massive opportunity for new market penetration. Key impact forces, including regulatory pressure and energy cost volatility, dictate procurement decisions, favoring systems that offer maximum thermal efficiency and assured long-term compliance, thereby reinforcing the dominance of advanced RTO technology.

Segmentation Analysis

The Thermal Treatment Air Filtration Market is meticulously segmented based on technology type, application, and air flow capacity, reflecting the diverse requirements of industrial operations across the globe. Understanding these segments is crucial as industrial pollution control needs are rarely uniform; they vary significantly based on the chemical nature of the pollutants, the volume of air requiring treatment, and the specific operational environment. The segmentation analysis reveals distinct adoption patterns, with highly regulated industries favoring the most efficient technologies, while industries dealing with high, steady flow rates prioritize systems designed for maximum durability and throughput. This granular breakdown aids market participants in tailoring their technology offerings—be it high-efficiency RTOs or lower-temperature COs—to specific industrial process needs and regulatory environments.

- Technology Type:

- Regenerative Thermal Oxidizers (RTOs): Dominant due to high thermal efficiency (up to 97%) and low operational cost, suitable for high air volume and low-to-moderate VOC concentration.

- Catalytic Oxidizers (COs): Preferred for lower temperature operation and lower fuel usage, ideal for medium air volume and stable, moderate VOC concentration, often used in pharmaceuticals and food processing.

- Thermal Recuperative Oxidizers (TROs): Utilize a primary heat exchanger to preheat incoming air, offering better thermal efficiency than DFTOs but less than RTOs, used for applications with high solvent loading.

- Direct-Fired Thermal Oxidizers (DFTOs): Simplest design with high fuel consumption, used for low-volume, high-concentration streams or specialized applications requiring extreme temperatures.

- Application:

- Chemical Manufacturing & Petrochemicals: Largest segment requiring high capacity systems to handle complex and sometimes corrosive organic compounds.

- Automotive & Transportation: Focus on treating emissions from painting, coating, and finishing processes.

- Pharmaceutical & Life Sciences: Demand for systems ensuring sterile and compliant exhaust, often utilizing Catalytic Oxidizers.

- Printing & Packaging: Requires systems to manage solvent emissions from inks and adhesives.

- Food Processing: Focus on mitigating odors and low-concentration VOCs, demanding reliable, low-maintenance solutions.

- Electronics & Semiconductor Manufacturing: Requires ultra-clean systems for treating specific solvent vapors used in wafer cleaning and etching.

- Air Flow Capacity:

- Small (Under 5,000 SCFM): Typically utilized by smaller manufacturing facilities or specific process ventilation streams.

- Medium (5,000 – 30,000 SCFM): Standard for many mid-sized chemical or packaging plants, dominated by standard RTO units.

- Large (Over 30,000 SCFM): Essential for large petrochemical complexes, major refineries, and centralized waste treatment facilities, often requiring customized, multi-chamber RTO systems.

Value Chain Analysis For Thermal Treatment Air Filtration Market

The value chain for the Thermal Treatment Air Filtration Market begins with the upstream suppliers responsible for raw materials and highly specialized components, which include manufacturers of high-performance ceramic media (crucial for RTOs), specialized refractory materials, high-temperature alloys for internal combustion chambers, and high-precision sensors and control hardware necessary for monitoring and automation. The quality and longevity of these upstream inputs directly dictate the thermal efficiency and lifecycle cost of the final oxidizer unit. Strategic sourcing and establishing long-term relationships with reliable ceramic media suppliers are critical factors for major system integrators to ensure competitive pricing and consistent product quality, especially given the global volatility in commodity prices and specialized material availability.

Moving downstream, the core value-add activities are system design, engineering, fabrication, and integration. Leading companies in this market operate as Engineering, Procurement, and Construction (EPC) providers, handling the entire project lifecycle from initial process analysis and simulation (determining the optimal oxidizer type and capacity) through to custom fabrication and site installation. Specialized thermal and chemical process engineering expertise is the most significant differentiating factor at this stage. Post-installation, the value chain extends into after-sales services, including specialized maintenance contracts for ceramic media replacement, catalyst rejuvenation (for COs), technical support, and regulatory compliance assistance. This service segment provides a stable, high-margin revenue stream, reinforcing customer loyalty and extending the equipment's functional life.

Distribution channels are predominantly direct, given the custom, high-value nature of the equipment. Manufacturers engage directly with end-users (e.g., a pharmaceutical plant or a refinery) or through specialized, certified industrial sales representatives and engineering firms that possess deep technical knowledge of air pollution control regulations. Indirect channels, while less common for large RTOs, might involve partnerships with regional EPC contractors who integrate the oxidizer into a larger facility construction project. The trend toward digitalization is increasingly impacting distribution, allowing suppliers to use remote monitoring and IoT platforms to offer proactive, value-added services, effectively blurring the line between the product sale and ongoing operational partnership.

Thermal Treatment Air Filtration Market Potential Customers

The primary customer base for the Thermal Treatment Air Filtration Market consists of large industrial entities operating processes that generate significant volumes of gaseous pollutants, primarily Volatile Organic Compounds (VOCs) and Hazardous Air Pollutants (HAPs). These buyers are driven fundamentally by two factors: mandatory regulatory compliance and the desire for operational efficiency through advanced heat recovery. The buying decision process is typically long, involving detailed engineering evaluations, cost-benefit analyses over a 10-15 year lifecycle, and approval from environmental, safety, and capital expenditure departments. Key sectors demanding these solutions are those utilizing large volumes of solvents, such as coatings, inks, resins, and various petrochemical feedstock materials, necessitating robust and highly reliable treatment systems capable of handling intermittent or continuous high-flow streams.

Key potential customers include global players in the chemical processing and petrochemical industries, such as producers of polymers, specialty chemicals, and bulk commodities, where pollution control is intrinsic to their license to operate. Similarly, the automotive assembly and parts manufacturing sector—specifically facilities involved in e-coating, painting booths, and adhesive application—represent a crucial demand source, seeking reliable solutions to meet stringent automotive manufacturing standards and reduce energy consumption in large-scale ventilation systems. The complexity of the air stream and the required destruction efficiency often necessitate custom-engineered Regenerative Thermal Oxidizers (RTOs) tailored to specific facility layouts and flow characteristics, making these customers prime targets for market leaders offering advanced engineering capabilities.

Furthermore, emerging high-growth industries, such as battery manufacturing and semiconductor production, are rapidly becoming significant potential customers. The production processes in these sectors involve highly specific and sometimes toxic solvent vapors, demanding high-DRE thermal oxidation tailored for sensitive electronic environments. Pharmaceutical and API (Active Pharmaceutical Ingredient) manufacturers also constitute a high-value customer segment, often preferring Catalytic Oxidizers (COs) due to their lower operating temperatures, which is beneficial for managing specific, low-concentration pharmaceutical solvents while maintaining energy efficiency and stringent purity standards. These customers value long-term reliability and comprehensive service agreements that guarantee continuous regulatory adherence without operational disruption.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.9 Billion |

| Market Forecast in 2033 | USD 3.0 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Durr AG, Anguil Environmental Systems, CECO Environmental, Catalytic Products International (CPI), John Zink Company, Eisenmann, CTP Chemisch Thermische Prozesstechnik, Babcock & Wilcox, The CMM Group, Epcon Industrial Systems, Nestec Inc., Thermal Combustion Inc., Alliance Corporation, Global Technologies, Process Combustion Corporation (PCC), Ship & Shore Environmental, Bayeco Engineering, Advanced Combustion Technologies, Fives Group, Megtec Systems. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Thermal Treatment Air Filtration Market Key Technology Landscape

The technological landscape of the Thermal Treatment Air Filtration Market is predominantly defined by continuous innovation aimed at maximizing thermal efficiency, minimizing greenhouse gas emissions, and extending the operational lifespan of core components. Regenerative Thermal Oxidizers (RTOs) represent the pinnacle of current technology, with advancements focusing heavily on ceramic media engineering. Manufacturers are developing proprietary high-density, low-pressure drop ceramic media that increases the heat transfer area while reducing the energy required to push the air stream through the media beds. Furthermore, specialized valve designs, particularly zero-leak poppet valves and rotary valves, are critical technological improvements that minimize bypass leakage, ensuring greater than 99% Destruction Removal Efficiency (DRE) and minimizing auxiliary fuel consumption during operation.

In the Catalytic Oxidizer (CO) space, innovation centers on developing highly durable and efficient catalyst formulations that operate at significantly lower temperatures (often below 700°F) compared to thermal oxidizers. This allows for substantial energy savings and reduced nitrogen oxide (NOx) formation. Advanced catalysts are engineered to resist poisoning from common industrial contaminants such as siloxanes, sulfur compounds, and halides, which are prevalent in waste streams from silicone manufacturing, wastewater treatment, and certain chemical processes. The longevity and resistance of these catalysts are paramount, driving research into precious metal loadings and structured catalyst substrates that offer high surface area and mechanical strength.

Beyond the core combustion process, the integration of advanced control systems and digitalization is rapidly becoming a standard technology requirement. Modern oxidizers are equipped with sophisticated Programmable Logic Controllers (PLCs), Human-Machine Interfaces (HMIs), and IoT connectivity. This technology permits remote monitoring, real-time diagnostics, and data logging essential for regulatory compliance and proactive maintenance. The adoption of Variable Frequency Drives (VFDs) on the main fans further optimizes power consumption by precisely matching fan speed to the actual air flow requirements, contributing significantly to overall operational cost reduction. This continuous convergence of combustion science with digital engineering defines the competitive edge in the high-end industrial air pollution control sector.

Regional Highlights

The regional dynamics of the Thermal Treatment Air Filtration Market illustrate a divergence between mature regulatory landscapes and rapidly developing industrial centers. North America and Europe, characterized by highly stringent and long-established air quality regulations (such as the EPA’s standards in the U.S. and the EU’s Industrial Emissions Directive), represent mature but robust markets. Growth in these regions is driven primarily by mandatory replacements of aging, less efficient equipment and the necessary upgrade of existing systems to meet incrementally lower emission caps for VOCs and HAPs. The demand here is highly concentrated on premium, high-efficiency technologies like three-chamber and five-chamber RTOs, where system reliability and minimal fuel consumption are non-negotiable requirements due to high utility costs and stringent environmental auditing processes.

Conversely, the Asia Pacific (APAC) region is forecasted to experience the highest growth rate throughout the forecast period. This accelerated expansion is attributed to two major factors: unprecedented industrial build-out, particularly in China, India, and Southeast Asian nations, and the recent, aggressive adoption of Western-style environmental regulations aimed at combating severe urban air pollution. Governments in this region are actively moving towards enforcing permits and implementing penalties for non-compliance, creating a massive installed base requirement for thermal treatment solutions. While cost sensitivity is higher in APAC compared to Western markets, the increasing sophistication of local industries is driving demand toward reliable RTOs, gradually replacing older, less efficient systems.

Latin America and the Middle East & Africa (MEA) currently hold smaller, but strategically important, market shares. In MEA, growth is tied closely to the expansion of the oil and gas sector and petrochemical refinery operations, which require large, customized thermal oxidation solutions for handling specific process vents and flare gas minimization. Latin America's market development is more localized, relying on industrial growth in countries like Brazil and Mexico, where regulatory enforcement is increasing but remains variable. These regions offer substantial opportunity for market penetration by manufacturers capable of providing robust, easily maintainable, and cost-competitive solutions that address nascent but growing environmental compliance needs.

- North America: Stable growth driven by regulatory compliance maintenance, replacement of aging oxidizers, and strong demand from the automotive and petrochemical sectors, with a strong focus on advanced RTO technology utilizing AI-driven diagnostics.

- Europe: High focus on maximizing energy efficiency and minimizing NOx emissions, spurred by EU directives. Germany and the UK lead adoption, emphasizing modular, high-efficiency catalytic systems for pharmaceutical applications.

- Asia Pacific (APAC): Highest growth region, fueled by rapid industrialization and intensifying governmental enforcement of air pollution standards in China, India, and South Korea, leading to substantial new installation demand across all major application segments.

- Latin America: Moderate growth centered in industrial hubs (Brazil, Mexico), characterized by increasing adoption rates in the chemical and printing industries as local environmental regulations become more rigorous.

- Middle East & Africa (MEA): Growth primarily linked to large-scale infrastructure projects and capacity expansion in the oil, gas, and associated downstream chemical processing industries, requiring heavy-duty, customized thermal treatment systems.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Thermal Treatment Air Filtration Market.- Durr AG

- Anguil Environmental Systems

- CECO Environmental

- Catalytic Products International (CPI)

- John Zink Company

- Eisenmann

- CTP Chemisch Thermische Prozesstechnik

- Babcock & Wilcox

- The CMM Group

- Epcon Industrial Systems

- Nestec Inc.

- Thermal Combustion Inc.

- Alliance Corporation

- Global Technologies

- Process Combustion Corporation (PCC)

- Ship & Shore Environmental

- Bayeco Engineering

- Advanced Combustion Technologies

- Fives Group

- Megtec Systems

Frequently Asked Questions

Analyze common user questions about the Thermal Treatment Air Filtration market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary driver for the growth of the Thermal Treatment Air Filtration Market?

The market is primarily driven by increasingly stringent global environmental regulations, particularly those established by governing bodies like the EPA and the EU, which mandate the reduction of Volatile Organic Compounds (VOCs) and Hazardous Air Pollutants (HAPs) from industrial exhaust streams.

How do Regenerative Thermal Oxidizers (RTOs) achieve high energy efficiency?

RTOs achieve high thermal efficiency, often exceeding 95%, by utilizing specialized ceramic media beds that capture and reuse the heat generated during the combustion of pollutants, minimizing the need for auxiliary fuel input to maintain the required oxidation temperature.

What is the difference between Thermal and Catalytic Oxidizers, and when is each preferred?

Thermal Oxidizers destroy pollutants at extremely high temperatures (1400°F–1800°F), while Catalytic Oxidizers (COs) use a catalyst to facilitate oxidation at much lower temperatures (600°F–800°F). COs are preferred when fuel consumption is a primary concern and the air stream lacks catalyst-poisoning contaminants, often in pharmaceutical or lower concentration applications.

Which application segment accounts for the largest demand for thermal treatment solutions?

The Chemical Manufacturing and Petrochemical sectors represent the largest demand segment, requiring high-capacity, robust thermal oxidation systems to handle diverse and often complex streams of solvents and volatile compounds associated with their large-scale production processes.

How is AI technology impacting the operational efficiency of thermal oxidizers?

AI is significantly enhancing operational efficiency by enabling predictive maintenance, optimizing combustion control in real-time based on fluctuating pollutant loads, and reducing fuel consumption through dynamic adjustment of process variables, minimizing both operational costs and unplanned downtime.

This extensive market report on the Thermal Treatment Air Filtration industry provides deep insights into market dynamics, regulatory pressures, and technological innovations shaping the future of industrial air pollution control. The analysis encompasses key segments including Regenerative Thermal Oxidizers, Catalytic Oxidizers, and Direct-Fired systems, detailing their application across petrochemical, automotive, and pharmaceutical sectors. We explore the critical role of IoT and AI integration in achieving higher thermal efficiency and reliable compliance with global environmental standards. Key findings highlight the APAC region's accelerating growth due to rapid industrialization and stringent environmental enforcement, contrasting with the steady, replacement-driven market stability of North America and Europe. The report meticulously outlines the value chain, from specialized ceramic media suppliers to final engineering and installation firms, emphasizing the complexity and high-capital nature of this essential environmental technology market. Strategic intelligence on market size, growth rate, and competitive landscape is provided, positioning stakeholders to make informed decisions regarding investment, technological development, and geographic expansion within the high-stakes domain of industrial emission control and environmental sustainability.

The forecast period from 2026 to 2033 suggests a continued strong correlation between regulatory mandates and market expansion, solidifying thermal treatment as the gold standard for high-Destruction Removal Efficiency (DRE) applications. Understanding the drivers such as the escalating focus on VOC and HAP abatement is crucial for market participants. The restraints, primarily high upfront costs and fuel volatility, necessitate continued focus on technological breakthroughs like advanced heat exchangers and intelligent control systems that offer guaranteed lower total cost of ownership. Opportunities abound in modularization and standardization for mid-market applications, coupled with bespoke engineering for large, complex industrial sites, ensuring the market remains diversified and highly specialized. This comprehensive assessment underscores the importance of technological leadership and global service capability in securing a prominent position in this vital environmental technology sector.

Further deep dives into regional regulatory harmonization, particularly the adoption of EU and US standards globally, will influence future procurement cycles. The competitive landscape is characterized by major industrial solution providers and specialized environmental engineering firms, all vying to offer superior system reliability and maintenance efficiency. The increasing energy prices globally further intensify the demand for RTOs over less thermally efficient options. The segmentation by airflow capacity is significant, reflecting the economies of scale and custom engineering requirements specific to large refinery and chemical operations versus smaller printing or coating lines. Market penetration strategies must align closely with the maturity of regulatory enforcement in target geographies, focusing on education and demonstration of long-term compliance benefits. The report serves as a foundational resource for strategic planning, merger and acquisition assessments, and product development prioritization within the global thermal treatment air filtration ecosystem, emphasizing sustainability and compliance as core value propositions.

Advanced analysis of the segmentation reveals that the deployment of Catalytic Oxidizers is expected to see a rise in niche markets where lower solvent concentrations allow for their energy-saving capabilities to be maximized without compromising destruction efficiency. This contrasts with the enduring dominance of Regenerative Thermal Oxidizers, which are irreplaceable in high-volume, fluctuating load environments typical of large industrial complexes. The market growth is also intricately linked to global manufacturing trends, particularly the re-shoring or near-shoring of production capabilities which necessitate the construction of new, environmentally compliant facilities. The report details how the value chain is consolidating, with key players integrating backward to control critical component supply, especially high-purity ceramic media, to mitigate supply chain risks and ensure proprietary thermal performance characteristics. Customer needs are evolving towards demanding not just compliance, but verifiable data on emission reductions and energy savings, necessitating robust, connected industrial IoT platforms integrated with every new thermal oxidation installation. The future direction points toward carbon capture readiness and integration with facility-wide smart grid systems, enhancing the environmental profile of these essential industrial abatement technologies, cementing their long-term relevance in sustainable manufacturing practices globally.

The specific focus on technical attributes such as Destruction Removal Efficiency (DRE) and thermal efficiency ratings is crucial for end-users comparing vendor solutions. DRE ratings of 99% or higher are now standard requirements, pushing manufacturers to continuously refine design parameters, including residence time and turbulence management within the combustion chamber. The role of specialized engineering software for Computational Fluid Dynamics (CFD) analysis in the design phase is paramount, ensuring optimal airflow and heat transfer before physical fabrication. This upfront technological investment differentiates leading vendors capable of providing performance guarantees. Moreover, the long-term maintenance implications, specifically the durability and replacement cycle of the ceramic media and catalysts, significantly influence the total cost of ownership. This market is highly technical, and sales cycles are often characterized by extensive technical consultations and pilot testing to ensure compliance with specific process chemistry and regulatory specifications. The comprehensive regional analysis validates that while environmental priorities are universal, the pace of adoption and the preferred technology type are highly localized, demanding segmented marketing and tailored service delivery strategies from key market players. The ongoing pursuit of zero-emission manufacturing facilities will continually push the boundaries of thermal treatment technology, fostering innovations in hybrid systems that combine thermal oxidation with biofiltration or adsorption techniques for specialized streams.

Investment in research and development is primarily channeled into making the oxidation process more fuel-agnostic, exploring alternative energy sources such as hydrogen or biogas to power the preheating burners, reducing reliance on natural gas and mitigating price volatility risks. For the pharmaceutical industry, the need for validated systems that demonstrate continuous, reliable performance in compliance with cGMP (current Good Manufacturing Practice) guidelines adds another layer of complexity and opportunity for specialized providers. The increasing scrutiny on fugitive emissions across all industrial facilities further expands the addressable market for small-scale, decentralized thermal oxidizer units designed for specific point sources rather than just end-of-pipe treatment. The report forecasts that mergers and acquisitions will continue to be a dominant strategy for market leaders seeking to acquire specialized regional service networks and patented technology, especially in the growing APAC region. Stakeholders must monitor the shift towards carbon pricing mechanisms, which will fundamentally alter the economic viability calculations for high-efficiency versus low-efficiency thermal treatment systems, potentially accelerating the retirement of older, less efficient units globally.

The global market dynamics confirm that regulatory certainty is the single most powerful market driver, ensuring sustained capital investment in thermal treatment solutions despite high upfront costs. The emphasis on sustainability and ESG (Environmental, Social, and Governance) reporting mandates across corporate boardrooms further reinforces the market trajectory, making air pollution control a strategic imperative rather than merely a compliance cost. The technological competition among manufacturers is fierce, centered on achieving the highest possible Destruction Removal Efficiency (DRE) while minimizing energy consumption (OPEX). Key segments like the electronics industry, driven by the volatile nature of process solvents and ultra-strict requirements for atmospheric cleanliness, represent high-value, niche markets demanding precise and contamination-resistant catalytic oxidation solutions. The continuous refinement of ceramic material science, focusing on maximizing heat exchange efficiency and durability under extreme thermal cycling, remains a core area of innovation for RTO dominance. The integration of IoT and cloud-based analytics is transforming system operation, allowing for predictive maintenance models that dramatically reduce equipment downtime and service costs, addressing a major industry restraint. The strategic analysis provided in this report offers essential guidance for navigating the complex regulatory and technological landscape of the thermal treatment air filtration market, positioning companies for long-term growth and environmental leadership.

The forecasted CAGR reflects the non-discretionary nature of these environmental capital expenditures, driven by global consensus on air quality improvement. The segmentation by technology type clearly indicates the strategic advantage held by manufacturers specializing in advanced RTO systems, as they best address the twin demands of high DRE and low long-term operational costs. The regional analysis underscores the critical importance of localized knowledge regarding permitting processes and regulatory variances, particularly in emerging markets where compliance standards are rapidly evolving. End-user feedback consistently emphasizes the need for modular, scalable systems that can adapt to changing production volumes and chemical compositions without requiring complete system overhaul. This push for flexibility and adaptability is driving innovative engineering solutions across the supply chain, from burner technology to heat exchanger design. Furthermore, the role of independent engineering consultants in specifying and validating system performance remains highly influential, underscoring the necessity of technical credibility in securing large contracts. The future competitive advantage will increasingly depend on offering integrated service packages that combine hardware provision with comprehensive digital maintenance and compliance assurance, securing long-term recurring revenue streams.

The final analysis confirms that while the initial investment cost acts as a barrier, the regulatory imperative, combined with the substantial long-term operational savings derived from RTOs' thermal efficiency, provides a compelling economic justification for adoption across major industrial sectors. This report serves as an invaluable resource for assessing market opportunity, competitive positioning, and technological roadmaps within the critical field of thermal air pollution control, ensuring stakeholders remain at the forefront of environmental performance and industrial compliance globally.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Thermal Treatment Air Filtration Systems Market Statistics 2025 Analysis By Application (Auto Industry, Chemical Industry, Coating & Printing Industry, Electronics Industry, Food & Pharmaceutical Industry, Renewable Energy Industry), By Type (Thermal Oxidizer, Catalytic Oxidizer, Regenerative Thermal Oxidizer, Regenerative Catalytic Oxidizer), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Thermal Treatment Air Filtration Market Statistics 2025 Analysis By Application (Oil and Gas, Automotive, Chemical, Coating & Printing, Electronics, Food and Pharmaceutical), By Type (Thermal Oxidizer, Catalytic Oxidizer, Regenerative Thermal Oxidizer, Regenerative Catalytic Oxidizer), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Thermal Treatment Air Filtration Systems Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Thermal Oxidizer, Catalytic Oxidizer, Regenerative Thermal Oxidizer, Regenerative Catalytic Oxidizer), By Application (Auto Industry, Chemical Industry, Coating & Printing Industry, Electronics Industry, Other), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager