Thermal Underwear Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442999 | Date : Feb, 2026 | Pages : 246 | Region : Global | Publisher : MRU

Thermal Underwear Market Size

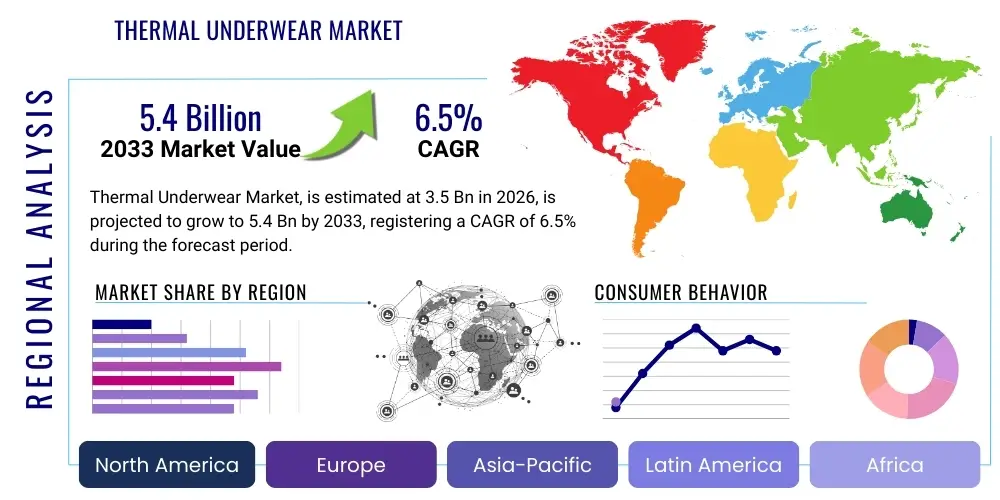

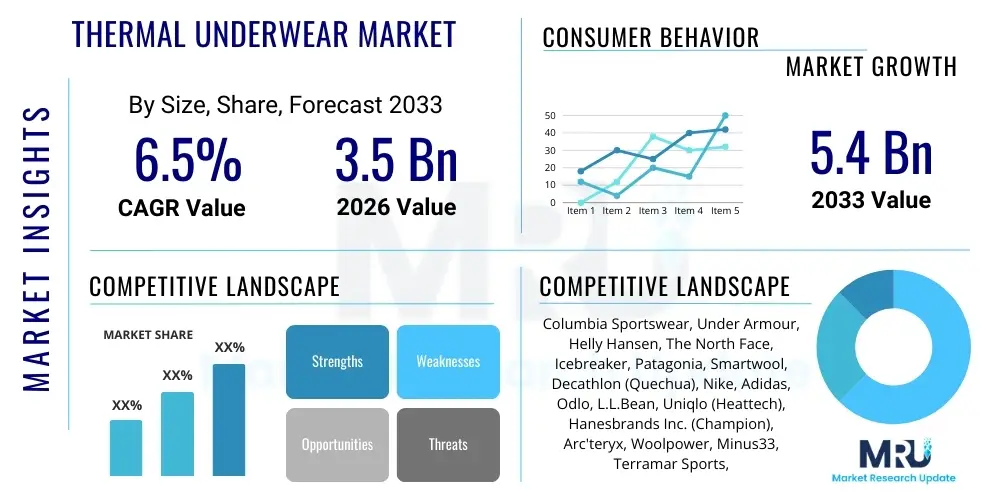

The Thermal Underwear Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 3.5 Billion in 2026 and is projected to reach USD 5.4 Billion by the end of the forecast period in 2033.

Thermal Underwear Market introduction

Thermal underwear, serving as the critical base layer in cold-weather apparel systems, forms the foundation of effective temperature regulation by managing the microclimate directly adjacent to the skin. These garments are meticulously engineered not just for insulation, but crucially for moisture management, actively transporting perspiration away from the body surface to prevent chilling through evaporative cooling. Modern innovations have transitioned thermal wear beyond basic cotton long johns to sophisticated technical fabrics, incorporating specialized natural fibers, primarily ultra-fine Merino wool, and advanced synthetic polymers such as hydrophobic polypropylene and structured polyester blends. The performance metric for these products is defined by the warmth-to-weight ratio, breathability, and quick-drying capabilities, making them indispensable for prolonged exposure to low temperatures.

The product portfolio within the thermal underwear market is highly specialized, addressing needs across various intensity levels and temperature zones, often categorized into lightweight, midweight, and heavyweight options. Lightweight thermal garments are tailored for high-output activities in moderately cold weather, emphasizing superior wicking capabilities and minimal bulk. Midweight layers represent the versatile standard, balancing warmth and breathability for general outdoor use. Heavyweight layers are purpose-built for extreme cold or sedentary activities in frigid environments, maximizing insulation through brushed interiors or composite fabric structures. Major applications span high-altitude mountaineering, military and tactical operations where consistent performance is life-critical, construction work in winter conditions, and the rapidly growing consumer segment of winter sports, including recreational skiing and snowboarding.

Market expansion is fundamentally driven by pronounced shifts in consumer behavior and technological leaps in textile manufacturing. The global rise in disposable income, particularly across Asia, facilitates greater investment in quality outdoor equipment and travel experiences that necessitate reliable thermal protection. Furthermore, increased environmental consciousness has spurred innovation in sustainable and performance-enhanced natural fibers, such as ethically sourced wool, providing a premium alternative to traditional synthetics. The benefits derived by consumers—improved comfort, enhanced athletic performance due to consistent body temperature, and reduced risk of hypothermia—solidify the product’s perceived value. These driving factors, combined with sophisticated digital marketing that targets specific end-user activities, ensure sustained market momentum and product diversification.

Thermal Underwear Market Executive Summary

The Thermal Underwear Market trajectory is characterized by fierce competition centered on technological superiority and sustainability credentials, moving beyond simple fabric composition to integrated smart textiles. A primary business trend involves the intensive integration of supply chain transparency, prompted by consumer demand for ethical sourcing, particularly concerning wool production and the environmental impact of synthetic dyes and finishing agents. Brands are leveraging innovative manufacturing techniques, such as seamless 3D knitting, to reduce waste and enhance garment fit, thereby improving end-user performance. Strategic partnerships between material science firms and apparel manufacturers are becoming commonplace, aimed at patenting novel thermal technologies and securing exclusive access to high-performance, cost-effective raw materials. Furthermore, the market structure is seeing a convergence of traditional athletic brands and dedicated outdoor specialists, intensifying the fight for premium shelf space and online visibility.

Regionally, the market presents a dichotomy of mature, high-value markets (North America and Europe) and high-growth potential markets (Asia Pacific). North America and Europe dominate in terms of technology adoption and average selling price (ASP), largely due to a well-established culture of winter leisure and the necessity of thermal protection across major cold-weather regions, coupled with the willingness of consumers to invest in expensive technical apparel systems. The APAC region, however, is emerging as the future growth nexus, driven by the expansion of the Chinese middle class and state investment in winter sports facilities. This segment growth is primarily fueled by mid-range synthetic blends initially, with a projected upward shift toward premium natural fibers as consumer sophistication increases. Emerging regions like Latin America and MEA show concentrated growth in occupational thermal wear, where extreme cold logistics and industrial safety standards necessitate specialized protective base layers.

Segmentation trends reveal a marked polarization in material preference: while synthetics maintain volume leadership due to superior moisture handling and economic accessibility, the natural fiber segment, dominated by Merino wool, commands the premium and luxury end of the spectrum. Within end-user segments, the "Women’s" category is experiencing disproportionately high growth, fueled by specialized design considerations focusing on tailored fit, aesthetic appeal, and multi-season functionality that integrates performance into casual wear (athleisure). Distributionally, the pivot toward e-commerce is accelerating, requiring manufacturers to master AEO/GEO strategies to connect specialized product descriptions with highly targeted user search intent, maximizing direct-to-consumer relationships and capturing higher profit margins compared to traditional wholesale channels.

AI Impact Analysis on Thermal Underwear Market

User queries regarding the intersection of Artificial Intelligence and the Thermal Underwear Market reveal significant interest in personalized thermal profiling and advanced operational efficiencies. Consumers are increasingly searching for information on how AI can analyze wearable data—such as heart rate, external temperature, and user activity—to recommend the precise weight and material of thermal layering necessary for optimal thermal comfort, essentially moving beyond generalized temperature ratings. Industry executives, conversely, focus on AI's ability to refine design through generative modeling, simulating complex fluid dynamics and heat transfer across various fabric architectures before physical prototyping. This shift allows for faster, more iterative product development and a significant reduction in material waste. Concerns typically revolve around securing supply chain data and ensuring that personalized recommendations are practical and accessible across various retail platforms. Ultimately, the market expects AI to transition thermal wear from static garments into predictive, high-efficiency personal climate control systems.

- Generative Design and Material Optimization: AI models simulate thermal properties of new textile structures, dramatically reducing the lead time for designing fibers that maximize warmth and minimize bulk, addressing core consumer pain points related to weight and performance.

- Hyper-Personalized Product Recommendation: AI platforms analyze purchasing history, geographical weather data, and stated activity goals to recommend the exact thermal weight and fabric blend, significantly enhancing the customer decision journey and minimizing returns.

- Wearable Tech Integration and Data Analysis: AI interprets physiological data collected from smart clothing (e.g., temperature sensors embedded in the fabric) to provide real-time feedback on thermal efficiency and hydration status, leading to smarter user choices during physical exertion.

- Quality Control and Defect Reduction: Machine vision systems powered by AI are deployed in manufacturing facilities to detect microscopic fabric defects or inconsistencies in knitting patterns, ensuring the highest quality standards and reducing operational waste.

- E-commerce Search and SEO Enhancement: AI analyzes search patterns and natural language queries related to "cold weather layering" or "wicking performance," optimizing product metadata and descriptions for maximum visibility under AEO/GEO strategies.

- Dynamic Pricing Strategy: AI algorithms continuously monitor competitor pricing, inventory levels, and real-time weather forecasts to dynamically adjust pricing, maximizing revenue capture during peak seasonal demand while remaining competitive.

- Automated Logistics and Inventory Management: AI forecasts local, micro-seasonal demand shifts with greater accuracy than traditional methods, optimizing inventory placement across global distribution centers to minimize shipping costs and maximize fulfillment speed for seasonal items.

DRO & Impact Forces Of Thermal Underwear Market

The foremost driver sustaining the Thermal Underwear Market's growth is the continuous innovation in polymer and fiber technology, which constantly raises the bar for performance metrics, compelling consumer replacement and system upgrades. Developments like seamless 3D knitting allow for targeted thermal zones and compression points, providing quantifiable performance advantages over older, conventionally cut and sewn garments. Furthermore, the global trend toward health, fitness, and outdoor adventure is structurally expanding the addressable market size, as more individuals engage in activities like trail running, trekking, and long-distance cycling year-round, regardless of local weather conditions. Government and industrial safety regulations in cold climates also mandate the use of high-quality thermal base layers for worker protection, establishing a non-cyclical, mandatory revenue stream, particularly in construction and oil & gas sectors. The pervasive influence of social media and digital influencers showcasing high-performance outdoor lifestyles further normalizes and promotes the necessity of technical base layers.

Restraints primarily revolve around macroeconomic instability and material cost volatility. The price of premium raw materials, particularly Merino wool, is heavily dependent on agricultural factors and global trade dynamics, leading to unpredictable input costs that challenge manufacturing margins. For synthetic materials, reliance on petrochemical derivatives links pricing to global oil market fluctuations. A significant market restraint is the seasonal nature of consumer demand, creating complex logistical and inventory holding costs; manufacturers must produce year-round to meet peak winter demand, leading to extensive off-season storage expenses and risk of obsolescence. Moreover, the increasing market saturation, coupled with the prevalence of low-quality fast fashion alternatives, pressures established premium brands to justify their higher price points through extensive, continuous technological differentiation and marketing efforts focused on long-term durability and performance.

Significant opportunities exist in diversification and market penetration. Geographically, aggressive expansion into underdeveloped consumer markets in Eastern Europe, Russia, and the rapidly modernizing urban centers of Asia offers unparalleled growth potential, particularly through localized product lines that address regional fit preferences and cultural sensitivities. Product diversification opportunities are centered on incorporating smart features, such as embedded sensors for physiological monitoring, creating high-value, highly differentiated products appealing to both performance athletes and health-conscious consumers. The strongest impact force driving the market's evolution is the environmental consciousness of the Millennial and Gen Z demographics, which demands verifiable sustainability in both sourcing (e.g., non-mulesed wool) and manufacturing processes (e.g., reduced water use, toxin-free dyeing). Capitalizing on these ethical demands provides a crucial leverage point against low-cost competitors and reinforces premium brand identity.

Segmentation Analysis

The segmentation of the Thermal Underwear Market provides a granular view of consumer preferences and operational focus areas for key industry players. The fundamental segmentation by material, differentiating between Natural (Merino wool, silk), Synthetic (Polyester, Polypropylene, Nylon), and Blended fabrics, dictates performance characteristics and price positioning. Natural fibers offer inherent advantages in thermal retention and odor management, appealing to premium, eco-conscious consumers willing to pay for comfort and sustainability. Synthetic materials, conversely, dominate the mid-to-high volume segment due to their rapid moisture transport, durability, and better scalability in production. Manufacturers continuously refine blend ratios to achieve optimal composite performance, such as combining the softness of wool with the fast-drying attributes of polyester, creating hybrid solutions for diverse activity levels.

Further critical segmentation occurs by product type (tops, bottoms, sets) and end-user demographics (Men, Women, Kids, and Industrial). The Men’s segment traditionally represents the largest volume, but the Women’s segment is demonstrating faster revenue growth, driven by specialized product lines that address anatomical fit and style integration into everyday activewear. The Kid’s segment is highly influenced by parental concerns regarding safety and durability, requiring thermal wear that is non-irritating and machine washable. Industrial segmentation, covering sectors like defense and cold-chain logistics, focuses exclusively on ruggedness, compliance with safety standards (such as flame resistance or high visibility), and long-term durability, requiring specialized material sourcing and certification processes distinct from the consumer market.

The evolution of distribution channel segmentation highlights the market's digital transformation. While traditional brick-and-mortar specialty outdoor retailers remain essential for providing expert consultation and high-touch customer service for technical garments, the E-commerce channel (both branded D2C and third-party platforms) has become the major revenue driver. Online retail offers unparalleled market reach, inventory flexibility, and the ability to rapidly leverage geo-targeted promotions based on real-time weather fluctuations. Successfully navigating this segmented landscape requires precise product positioning and a dual strategy: maintaining strong partnerships with physical retail for brand presence while optimizing digital content for visibility and conversion through effective AEO/GEO practices.

- By Material:

- Natural (e.g., Merino Wool, Silk, Alpaca)

- Synthetic (e.g., Polyester, Polypropylene, Nylon, Elastane)

- Blended (Composite structures combining natural and synthetic fibers for optimized performance)

- By Product Type:

- Tops (Crewnecks, Half-Zips, Hooded)

- Bottoms (Pants, Leggings, ¾ Length)

- Sets (Coordinated Top and Bottom Packages)

- By Weight/Insulation Level:

- Lightweight (150-200 GSM for high activity)

- Midweight (200-260 GSM for versatility)

- Heavyweight (260+ GSM for extreme cold)

- By End-User:

- Men (Largest Volume Segment)

- Women (Fastest Growing Segment, focuses on fit and style)

- Kids (Focus on safety, durability, and ease of care)

- Industrial/Occupational (Focus on FR, durability, and institutional compliance)

- By Distribution Channel:

- Online Retail (E-commerce D2C and Marketplace)

- Offline Retail (Specialty Sports Stores, Supermarkets/Hypermarkets, Department Stores)

Value Chain Analysis For Thermal Underwear Market

The upstream segment of the thermal underwear value chain is characterized by resource extraction and primary processing, placing immense pressure on sustainability and traceability. For natural fibers, this involves securing contracts with ethically certified wool farms (e.g., Responsible Wool Standard) to ensure animal welfare and sustainable land management practices. Synthetic production requires securing high-grade polymer resins from petrochemical suppliers, increasingly favoring suppliers that utilize recycled inputs (rPET). This phase dictates the fundamental cost structure and environmental footprint of the final product. Key activities include sophisticated quality grading, cleaning, and yarn spinning, often requiring high capital investment in machinery. Upstream strategic decisions heavily influence brand reputation, especially among consumers valuing ethical sourcing and reduced environmental impact, a crucial element for maintaining premium price positioning.

The midstream segment encompasses manufacturing, centered on converting specialized yarns into finished garments through knitting, dyeing, and assembly. This is the stage where technological differentiation is maximized, utilizing advanced machinery for seamless construction, body mapping, and application of specialized performance finishes. Dyeing and finishing processes must adhere to strict environmental guidelines (e.g., bluesign certification) to minimize water usage and chemical discharge, adding layers of complexity and cost. Direct manufacturing involves cutting and sewing panels, which requires skilled labor and precision to maintain fit consistency, particularly for high-stretch thermal garments. Effective midstream management requires robust process control to handle the varying properties of different fiber types, optimizing machine settings for ultra-fine Merino vs. structured polyester weaves, ensuring maximum product performance and longevity.

Downstream activities focus on bringing the product to the end-consumer through complex distribution channels. Distribution relies on streamlined logistics networks capable of handling highly seasonal inventory spikes, utilizing both traditional wholesale models and the rapidly expanding direct-to-consumer (D2C) e-commerce platforms. Direct channels allow brands to capture higher margins and collect invaluable consumer data necessary for future product development and marketing personalization. Indirect channels, through large outdoor chains and general merchandisers, provide broad market reach and volume sales. Successful downstream strategy requires expert marketing and content creation optimized for Answer Engine Optimization (AEO), ensuring that detailed product specifications (e.g., weight, activity rating, temperature suitability) are readily available and highly visible to users conducting highly specific, performance-focused searches, ultimately driving purchase conversion.

Thermal Underwear Market Potential Customers

The core potential customer base for thermal underwear is defined by individuals whose daily activities or recreational pursuits expose them to cold or fluctuating temperature extremes, demanding highly functional layering systems. This group is segmented into serious Outdoor Athletes and Adventure Tourists, who seek maximum performance and are willing to pay a premium for specialized, technical features such as zoned insulation, minimal seam construction, and exceptional breathability. These customers often participate in high-stakes activities like multi-day backpacking or alpine climbing, where the failure of base layers due to poor wicking or durability could compromise safety. Their brand loyalty is high, predicated on demonstrated product reliability and performance consistency under rigorous conditions, leading them to research technical specifications deeply before making a purchase decision.

A secondary, high-volume segment consists of Occupational and Industrial Users, whose purchasing behavior is driven by compliance, volume requirements, and product longevity rather than fashion. This includes employees in cold storage facilities, construction sites, and infrastructure maintenance crews in winter climates, as well as military or law enforcement personnel operating in cold theaters. These buyers require robust, often fire-resistant (FR) or high-visibility thermal base layers that comply with institutional safety mandates (e.g., OSHA standards). Procurement often involves large, multi-year contracts, making this a highly stable revenue stream for manufacturers capable of meeting stringent industrial specification and bulk pricing demands. Customer acquisition here relies heavily on B2B sales channels, quality assurance certifications, and proven product durability under strenuous daily use conditions.

The third significant customer category is the General Consumer and Athleisure Enthusiast. This group uses thermal wear for everyday comfort during cold winters, short commutes, or integrating technical fabrics into their casual wardrobe. They are highly responsive to convenience, price points, and aesthetic appeal. The rise of the athleisure trend has significantly expanded this market, where brands like Uniqlo (with Heattech) successfully market thermal properties as a lifestyle benefit, accessible through department stores and fast fashion outlets. Capturing this market segment requires mass-market accessibility, strong retail presence, and marketing that emphasizes comfort, softness, and easy care, broadening the appeal of thermal wear beyond specialized sports activities to become a cold-weather staple for the mainstream population.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 3.5 Billion |

| Market Forecast in 2033 | USD 5.4 Billion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Columbia Sportswear, Under Armour, Helly Hansen, The North Face, Icebreaker, Patagonia, Smartwool, Decathlon (Quechua), Nike, Adidas, Odlo, L.L.Bean, Uniqlo (Heattech), Hanesbrands Inc. (Champion), Arc'teryx, Woolpower, Minus33, Terramar Sports, Montane, Falke, Polartec LLC, X-Bionic, Rohan Designs, Black Diamond Equipment. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Thermal Underwear Market Key Technology Landscape

The current technology landscape in thermal underwear manufacturing is dominated by advancements in knitting and weaving techniques designed to create intelligent, multi-density fabrics tailored to the body’s physiological requirements. Seamless technology, utilizing sophisticated circular knitting machines, is paramount, allowing garments to be produced in one piece with varying zones of compression, ventilation, and insulation integrated directly into the structure. This 'body mapping' technology ensures that moisture-prone areas receive enhanced wicking capability, while cold-sensitive zones benefit from tighter, denser knits for maximum heat retention. This minimizes material waste and eliminates chafing associated with traditional seams, which is a critical performance factor for athletes and occupational users engaging in prolonged, high-friction activities.

Material science innovation centers heavily on optimizing fiber structures for superior thermal performance with minimal weight. Hollow-core synthetic fibers (e.g., specialized polyester) trap larger volumes of air relative to their mass, significantly increasing insulation without adding bulk, which is highly sought after by mountaineers and backcountry skiers. Furthermore, the application of Phase Change Materials (PCMs) represents an emerging frontier, where micro-encapsulated compounds are integrated into the fabric. These PCMs actively manage heat flow by absorbing excess body heat when the wearer is active and releasing it back when the body cools, effectively regulating skin microclimate and delaying the onset of both sweating and chilling. The adoption of these sophisticated materials transitions base layers from passive insulators to active thermal regulators, providing a significant competitive edge.

Sustainability technology has become a core competency, influencing manufacturing processes and material choices. Dyes and finishes are increasingly required to be PFAS-free and utilize low-impact, bluesign-approved chemicals. Furthermore, technological focus is on enhancing the performance of recycled materials (rPET), ensuring that the recycled synthetic fibers match or exceed the technical specifications of virgin materials in terms of durability and wicking ability. In the natural fiber sector, technology is centered on super-fine micron sorting and specialized yarn treatments that prevent shrinkage and pilling in Merino wool, maintaining the garment’s structure and soft hand-feel through repeated industrial washing cycles, thereby addressing long-term consumer satisfaction and product longevity—key AEO search factors related to durability and wash care.

Regional Highlights

North America maintains a powerful regional influence within the thermal underwear market, characterized by mature consumer purchasing habits and a high penetration of premium technical brands. The demand is heavily concentrated in the Northeast, Midwest, and Mountain regions, driven by necessary cold weather protection and extensive infrastructure supporting winter recreational sports. Consumers in this region are highly attuned to technical specifications, brand heritage, and environmental ethics, leading to strong sales of high-end Merino wool and proprietary synthetic blends from companies like Patagonia and Arc’teryx. Furthermore, the substantial presence of large-scale commercial and military procurement activities ensures a steady, high-specification B2B demand, requiring manufacturers to maintain stringent quality and performance standards for public sector contracts, contributing significantly to overall market stability and value.

Europe represents another cornerstone of the global market, particularly Western and Northern Europe, where cultural and geographical factors necessitate specialized thermal protection. Scandinavia, the Alpine countries (Switzerland, Austria, Italy), and Germany contribute significantly to the demand, fostering a strong market for European-based performance brands like Odlo and Falke. The European market distinguishes itself through its advanced sustainability mandates and consumer preference for traceable, environmentally sound products. This focus mandates stringent supply chain transparency, particularly concerning animal welfare in wool sourcing and chemical management in textile finishing, positioning sustainability as a fundamental competitive advantage rather than just an opportunity. The rapid growth in affordable winter travel and the expansion of intra-European outdoor tourism further supports year-on-year market stability.

The Asia Pacific (APAC) region is poised for explosive growth, shifting its role from primarily a manufacturing base to a massive consumer market. Key drivers include rising disposable incomes in economies like China, India, and South Korea, coupled with significant governmental focus on promoting winter sports as a national pastime. The region’s diverse climate means demand is bifurcated: heavy-duty thermal wear for northern China and specialized lightweight, high-wicking layers for cold-weather activities in regions with variable humidity. Localized demand requires international companies to adapt sizing and thermal weights specifically for the Asian consumer. Latin America and MEA, while smaller, offer strategic niche opportunities, focusing on high-altitude leisure (e.g., Andean regions) and specialized industrial application demand within logistics and resource extraction sectors where protection against environmental extremes is non-negotiable for operational safety.

- North America (Market Maturity and High ASP): Dominance in premium segment, strong consumer base for mountaineering and technical sports, large B2B segment from military and industrial applications.

- Europe (Sustainability and Regulatory Focus): High consumer demand across Alpine regions, stringent environmental standards driving innovation in eco-friendly textiles, strong presence of performance-oriented brands.

- Asia Pacific (Future Growth Engine): Driven by demographic shifts, expanding middle class, government investment in winter sports infrastructure, and increasing brand awareness in key markets like China, Japan, and South Korea.

- Latin America (Niche Market): Concentrated demand in high-altitude recreational areas and specific industrial segments (e.g., mining and cold storage logistics).

- Middle East and Africa (Emerging Industrial Demand): Growth primarily driven by occupational thermal needs in oil and gas fields, cold chain logistics, and specialized military procurement, rather than mass consumer leisure.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Thermal Underwear Market.- Columbia Sportswear

- Under Armour

- Helly Hansen

- The North Face (VF Corporation)

- Icebreaker (VF Corporation)

- Patagonia

- Smartwool (VF Corporation)

- Decathlon (Quechua)

- Nike

- Adidas

- Odlo

- L.L.Bean

- Uniqlo (Fast Retailing Co., Ltd.)

- Hanesbrands Inc. (Champion)

- Arc'teryx (Amer Sports)

- Woolpower

- Minus33

- Terramar Sports

- Montane

- Falke

- Polartec LLC (Material Science Supplier and Brand)

- X-Bionic (High-Tech Baselayer Specialist)

- Rohan Designs

- Black Diamond Equipment

Frequently Asked Questions

What is the primary difference between Merino wool and synthetic thermal wear?

Merino wool offers superior natural odor resistance, breathability, and warmth even when damp, making it ideal for multi-day use and sensitive skin. Synthetic thermal wear (polyester/polypropylene) excels in moisture wicking (quick drying) and durability, typically at a lower cost, best suited for high-output, short duration activities where rapid moisture evacuation is critical for maintaining performance and preventing chilling.

How will rising sustainable practices affect the pricing of thermal underwear?

The shift towards sustainable materials, such as ethically sourced wool (RWS certified) or recycled synthetics (rPET), initially increases raw material and certification costs. However, this is often necessary to meet consumer demand and allows brands to occupy the premium market segment, resulting in stable or moderately increased prices for verified, eco-conscious base layers, reflecting their enhanced ethical and environmental value proposition.

What is the optimal layering system recommended for extreme cold weather?

The optimal system follows the three-layer principle: (1) Base Layer (thermal underwear, mid-to-heavyweight Merino or synthetic) for wicking and primary insulation; (2) Mid-Layer (fleece, down, or synthetic insulation jacket) for heat retention; and (3) Shell Layer (waterproof/windproof hard or softshell) for environmental protection. Proper integration of these layers ensures adaptive thermal regulation and maximum protection against hypothermia risks.

Which geographic region demonstrates the highest growth potential for thermal underwear sales?

The Asia Pacific (APAC) region, driven primarily by increasing consumer wealth, significant urbanization, and rapid governmental and private investment in winter sports and outdoor recreational facilities in nations like China and South Korea, is projected to register the fastest market growth rate during the forecast period.

What technological feature is most critical for high-performance athletic thermal wear?

Seamless construction utilizing 'body mapping' technology is highly critical. This allows the garment to integrate varying knit patterns and densities (compression and ventilation zones) directly into the fabric without restrictive seams. This maximizes ergonomic fit, reduces the risk of chafing during intense movement, and optimizes thermal efficiency by targeting insulation precisely where the body needs it most.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager