Thermally Conductive Film Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441103 | Date : Feb, 2026 | Pages : 257 | Region : Global | Publisher : MRU

Thermally Conductive Film Market Size

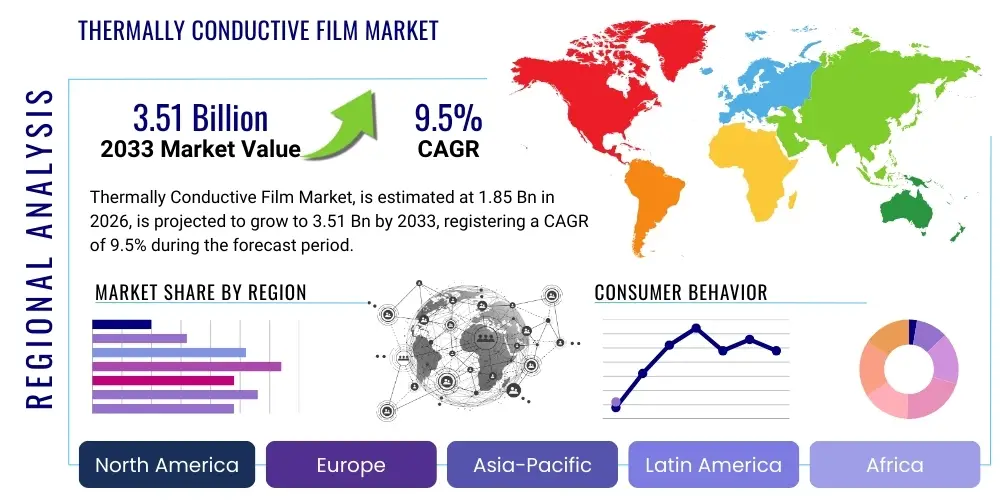

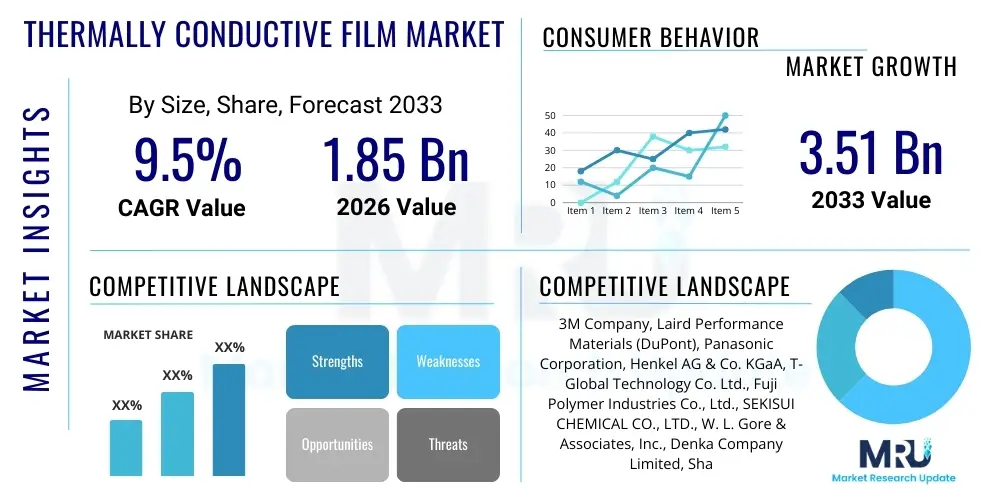

The Thermally Conductive Film Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.5% between 2026 and 2033. The market is estimated at USD 1.85 Billion in 2026 and is projected to reach USD 3.51 Billion by the end of the forecast period in 2033.

Thermally Conductive Film Market introduction

The Thermally Conductive Film Market encompasses specialized polymeric or composite sheet materials engineered to efficiently transfer heat away from sensitive electronic components or assemblies. These thin, flexible laminates are critical components in passive and active thermal management solutions, particularly in demanding environments where extreme space constraints, minimization of mass, or specific structural requirements prohibit the implementation of traditional bulkier thermal solutions such as extruded or stamped metallic heat sinks. The fundamental objective of these advanced films is to effectively bridge the micro-scale air gaps and surface imperfections naturally occurring between a high heat-generating source (like a semiconductor package) and an intended cooling mechanism (e.g., a metal casing or heat spreader), thereby ensuring optimal operational performance, extended lifetime, and adherence to safety certifications by proactively preventing critical component overheating. The exponential growth in demand for these specialized materials is directly and quantitatively correlated with two dominant global technology trends: the relentless push for electronic device miniaturization and the dramatic increase in power density (heat flux) observed across modern electronic architecture, spanning from compact consumer gadgets to massive scale high-performance computing (HPC) systems. The thermal efficiency of these films, measured by minimizing thermal impedance, is a crucial competitive differentiator that drives continuous investment in advanced material science R&D across the industry value chain.

Thermally conductive films typically leverage a sophisticated material structure utilizing various high-performance polymer matrix materials, which may include high-temperature polyimides, specialized silicone elastomers, flexible urethanes, or robust epoxies. These matrices are meticulously filled with highly conductive particulate or laminar fillers, such as high-purity aluminum oxide, proprietary synthetic graphite (known for excellent in-plane thermal conductivity), crystalline boron nitride (prized for high dielectric strength), or sometimes advanced metal powder composites. The careful selection, chemical treatment, and strategic volumetric loading of these conductive fillers rigorously dictate the film's overall thermal conductivity (the primary performance metric), its essential electrical insulation properties (dielectric breakdown voltage), and its long-term mechanical flexibility and environmental stability. A significant technical challenge involves managing the interface resistance between the polymer matrix and the filler particles, often referred to as interfacial thermal resistance, which can severely limit overall heat transfer; advanced surface functionalization techniques are deployed to minimize this effect. Major commercial applications are broad and sophisticated, focusing heavily on robustly insulating and effectively cooling massive prismatic or cylindrical cell arrays within electric vehicle (EV) battery packs, rapidly spreading and dissipating localized hot spots in cutting-edge flagship smartphones and high-resolution tablets, and reliably managing the significant thermal load generated by increasingly powerful solid-state LED lighting systems and complex industrial power supply units.

The inherent and significant benefits of implementing pre-formed thermally conductive films, contrasting sharply with traditional non-cured thermal interface materials such as thermal greases or gap fillers, include superior ease of high-speed automated application, exceptional repeatability due to precise, factory-controlled bond line thickness (BLT), complete elimination of the risk of 'pump-out' or material migration under thermal cycling, and superior long-term conformability to substrates with significant topology variations. These factors collectively result in a highly reliable, low-variability thermal interface, critical for mission-critical applications. The primary macroeconomic and technological driving factors underpinning the sustained, robust expansion of this specific market segment involve the continuous technological progression in advanced semiconductor manufacturing (Moore's Law implications), which invariably results in higher power dissipation requirements per square millimeter of chip area, thus demanding increasingly superior thermal dissipation solutions. Moreover, the urgent, global industrial and governmental pivot towards achieving net-zero emissions and promoting widespread electric mobility necessitates the development and mass deployment of extremely robust, lightweight, and thermally efficient management systems for high-energy density battery storage units. Beyond performance requirements, regulatory mandates focusing rigorously on electronic device safety, fire mitigation (especially concerning lithium-ion batteries), and global energy efficiency standards also act as powerful, indirect catalysts, accelerating the mass adoption of high-performance, safety-certified thermal films across industrial and consumer sectors. These compounded and interrelated drivers collectively ensure a foundation for substantial market capitalization growth throughout the defined 2026–2033 forecast period.

Thermally Conductive Film Market Executive Summary

The global Thermally Conductive Film market is undergoing a period of intense technological disruption and competitive re-alignment, characterized by relentless R&D efforts aimed at simultaneously maximizing bulk thermal conductivity and optimizing interfacial heat transfer efficiency, all while meticulously maintaining critical electrical isolation and meeting increasingly demanding mechanical robustness specifications. Major business trends defining the competitive landscape include significant consolidation through mergers and acquisitions, particularly as larger specialty chemical and advanced materials conglomerates seek to integrate smaller, innovative film specialists to secure proprietary technology and key intellectual property related to nano-filler dispersion and advanced coating techniques. Furthermore, a foundational shift toward collaborative R&D is evident, with established film manufacturers forming exclusive, strategic partnerships and joint development agreements with leading Original Equipment Manufacturers (OEMs) in specialized sectors like autonomous driving hardware and medical diagnostics. These deep collaborations facilitate the co-engineering of bespoke, performance-guaranteed thermal solutions tailored specifically for proprietary component geometries and novel cooling requirements, often involving customized dielectric properties to manage electromagnetic interference (EMI) simultaneously with heat. The overarching technological directive currently defining market competition is the successful development and mass-production scaling of extremely thin (less than 100 microns), highly compliant, and robustly high-dielectric strength films, positioning material science supremacy as the core determinant of market leadership and competitive advantage.

From a geographic perspective, the Asia Pacific (APAC) region continues to exert massive influence, holding an overwhelming share of both production capacity and global consumption, largely due to its entrenched position as the global hub for complex electronics assembly, including the manufacture of servers, high-volume consumer gadgets, and, critically, the majority of the world's Lithium-ion batteries and Electric Vehicle (EV) systems. This regional market is characterized by fierce price competition and an imperative for hyper-efficient high-volume production of specific film types, often graphite-based solutions. Conversely, North America and Western Europe represent sophisticated, high-value markets where the demand is driven primarily by specialized, mission-critical applications in sectors like high-security defense systems, next-generation telecommunications infrastructure (e.g., advanced antenna arrays), and hyperscale computing facilities. These Western markets require films optimized for ultra-stability under extreme operational conditions, strict adherence to certifications (e.g., MIL-SPECs, UL 94 V-0 flame rating), and robust traceability, commanding premium pricing. The current geopolitical and macroeconomic climate is prompting significant strategic restructuring, driving a notable trend toward nearshoring or reshoring manufacturing operations in both North America and Europe to bolster supply chain resilience and mitigate reliance on long, complex overseas logistics networks for specialized thermal materials.

Segmentation analysis clearly indicates that the market expansion is highly stratified. In terms of material composition, high-performance films utilizing synthetic graphite—valued for their lightweight nature and anisotropic heat spreading ability—continue their dominant trajectory, particularly in devices where minimal added mass is a design prerequisite. However, ceramic-filled silicone and non-silicone polymer films are experiencing accelerated growth due to their superior capability to handle high electrical voltages while maintaining impressive thermal conductivity, making them indispensable for power electronics, industrial motor controls, and high-voltage battery modules. Focusing on the application spectrum, while volume consumption in Consumer Electronics remains robust, the Automotive/Electric Vehicle segment is unequivocally positioned as the principal growth accelerator, driven by the massive capital investments and regulatory pressure concerning battery safety and performance optimization. This segment demands not just thermally conductive properties but also advanced adhesion systems, vibrational dampening capabilities, and certified flame retardancy properties, leading to highly specific product development strategies tailored solely for the rigorous requirements of Battery Thermal Management Systems (BTMS). The technological arms race among manufacturers is now focused on multi-functional films that concurrently address thermal, electrical, and mechanical challenges within one unified material solution, ensuring diversification and continued segment specialization.

AI Impact Analysis on Thermally Conductive Film Market

User queries regarding the intersection of Artificial Intelligence (AI) and the Thermally Conductive Film Market predominantly focus on optimizing material design, predicting thermal performance under varied operational loads, and enabling faster failure analysis in complex electronic assemblies. Key themes include whether AI can dramatically accelerate the discovery of novel filler materials with unprecedented thermal properties, how advanced machine learning (ML) algorithms are being utilized to enhance manufacturing precision for ultrathin films and complex composite structures, and the immense potential for AI-driven simulation tools to replace costly, time-consuming physical prototyping cycles. Users are also deeply concerned with the specialized thermal management needs of emerging, high-density AI hardware, specifically powerful GPUs, customized AI accelerators, and high-TDP (Thermal Design Power) TPUs used extensively in advanced data centers and burgeoning edge computing deployments, recognizing that these components generate significantly higher, localized thermal loads than traditional processors, thereby serving as a powerful, non-negotiable driving force for the development and adoption of ultra-advanced, high-conductivity film solutions capable of handling extreme heat fluxes.

- AI algorithms enable sophisticated material informatics, drastically accelerating the rational discovery, virtual screening, and preliminary development of novel, high-conductivity polymer matrices and optimized filler combinations, thus dramatically reducing traditional research and development cycles from years to months.

- Advanced Machine Learning models are extensively employed for real-time predictive maintenance, continuous process optimization, and micro-level quality control during complex film manufacturing (e.g., compounding and coating), allowing manufacturers to instantly identify and correct minute defects and inconsistencies at micron scales, which critically improves overall product reliability, performance consistency, and manufacturing yield rates.

- AI-driven, high-fidelity simulation and digital twin tools precisely optimize the geometric placement, ideal thickness, and material composition of thermally conductive films within highly complex electronic devices (e.g., multi-layered PCBs or constrained modules), ensuring maximum thermal efficiency and optimal heat flow pathways long before any costly physical prototyping or product assembly commences.

- The relentless and continuous expansion in high-performance computing infrastructure (driven by the computational demands of large-scale AI model training and inferencing) directly results in higher thermal density per server rack, thus necessitating and fueling exponential demand for ultra-high-conductivity and specialized dielectric films in hyperscale data centers and critical server farms worldwide.

- AI systems assist operational teams in analyzing vast amounts of real-time thermal performance data gathered from complex, high-reliability electronic devices (e.g., active EV battery packs or industrial power converters), allowing film manufacturers and system integrators to meticulously refine film specifications for superior long-term performance, enhanced safety margins, and optimized energy efficiency under dynamic loads.

DRO & Impact Forces Of Thermally Conductive Film Market

The overall market dynamics for the Thermally Conductive Film sector are determined by a complex and often conflicting interplay of rapid technological evolution in end-use applications, increasingly demanding regulatory safety requirements, and significant, volatile material supply chain constraints stemming from global specialty chemical market fluctuations. Drivers include the rapidly accelerating and globally subsidized growth of electric vehicle (EV) production across all major economic geographies, coupled with the relentless, consumer-driven pursuit of electronic devices that are simultaneously smaller, significantly lighter, yet vastly higher-performing, both of which fundamentally require highly advanced, reliable, and exceptionally space-saving thermal dissipation solutions. The massive global expansion of cloud computing infrastructure and the synchronized deployment of next-generation 5G/6G network technologies worldwide also mandate the widespread adoption of high-capacity, high-stability thermal interface materials. Restraints primarily focus on two crucial technical and economic hurdles: first, the exceptionally high and volatile cost associated with the secure sourcing, precise processing, and sophisticated integration of advanced conductive fillers (such as highly refined graphene derivatives, custom-sized synthetic graphite flakes, and high-purity nano-ceramic additives), which significantly elevates unit manufacturing costs; and second, the inherent technical difficulty in scientifically formulating these complex composites to achieve peak thermal conductivity without fundamentally compromising other essential, non-negotiable material properties like tear strength, mechanical flexibility, long-term electrical isolation, or shear stability under aggressive thermal cycling stress.

Opportunities for specialized and technologically advanced market participants are exceptionally robust and are largely concentrated in the burgeoning, high-growth application fields of next-generation flexible electronics (wearable devices and rollable displays), sophisticated industrial Internet of Things (IoT) sensors deployed in harsh environments, the extensive build-out of high-frequency 5G/6G telecommunication infrastructure, and complex, high-reliability medical diagnostics and surgical robotics. All these application sectors urgently demand customized, ultra-high-reliability, and often intricately custom-die-cut thermal interface materials (TIMs) specifically engineered to their unique operating conditions. Furthermore, the strategic development of multi-functional films that integrate both superior thermal performance characteristics and essential electromagnetic interference (EMI) shielding capabilities presents an exceptionally lucrative, synergistic opportunity, particularly vital for sensitive and critical aerospace, defense, and advanced medical monitoring applications where signal integrity is paramount. These combined, pervasive forces collectively shape and influence the market trajectory, persistently driving innovation toward further minimized thicknesses, significantly lighter material compositions, and ultimately, the most effective possible thermal management solutions that can seamlessly and reliably integrate into highly constrained, high-power density electronic architectures.

The primary, influential impact forces stem fundamentally from the relentless competitive pressure mandating component miniaturization across every segment of the electronics industry, thereby demanding specialized TIMs that can effectively manage extreme localized heat fluxes within the most minimal volume and mass constraints available. This non-negotiable design mandate necessitates continuous and substantial capital investment in fundamental material science research and advanced, precision manufacturing processes aimed at achieving near-perfect, micro-level uniformity in conductive filler dispersion. Furthermore, stringent regulatory mandates concerning proactive fire safety and preventative measures against potential battery thermal runaway events, particularly pronounced in the high-volume automotive and consumer energy storage sectors, exert enormous market influence. These complex regulations force film manufacturers to not only achieve exemplary thermal performance but also to successfully integrate highly reliable, inherently non-flammable, and extremely thermally stable films, often requiring substantial upfront capital expenditure to acquire the necessary certifications and comply with rigorous third-party testing protocols. These complex regulatory drivers represent powerful commercial barriers to entry for low-quality or non-compliant material providers and dramatically underscore the necessity for rigorous, globally standardized testing, qualification, and international certification across all product lines destined for mission-critical or safety-critical applications. Successfully navigating this sophisticated compliance environment and proactively mitigating the intrinsic material supply chain complexities—specifically ensuring a stable and reliable supply of high-purity conductive inputs—is absolutely vital for securing and maintaining market leadership and ensuring competitive, economically sustainable pricing structures over the long-term forecast horizon.

Segmentation Analysis

The Thermally Conductive Film market is meticulously segmented based on the fundamental material type utilized, the specific application domain where the film is deployed, and the geography of consumption, precisely reflecting the highly specialized and nuanced nature of thermal management requirements across a vastly diverse range of industrial sectors. Material composition remains the most crucial segmentation axis, differentiating films based on their base polymer matrix and the specific conductive filler incorporated, which directly determines the film's maximum achievable thermal conductivity, its required dielectric properties, and its final cost structure. Application segmentation carefully separates high-volume, cost-sensitive consumer goods usage from the high-reliability, long-lifecycle demands of automotive, aerospace, or industrial machinery deployment, with each segment requiring rigorously distinct performance metrics and certification levels. Understanding these granular segments is entirely paramount for specialized manufacturers to accurately tailor their product development efforts, optimize their material sourcing strategies, and deploy targeted marketing approaches effectively, thereby successfully addressing the specific technological pain points related to localized heat density, required electrical isolation, and expected mechanical stresses inherent in diverse and demanding end-use environments.

- By Material Type:

- Graphite Films (Anisotropic High-Purity Synthetic and Natural)

- Silicone-Based Elastomer Films (Often ceramic-filled for high dielectric strength)

- Non-Silicone Polymer Films (e.g., Polyimide, Polyurethane, Acrylic matrix)

- Advanced Carbon Fiber/Nanotube Reinforced Films (Emerging high-end sector)

- Ceramic-Filled Films (e.g., high-loading Boron Nitride, Aluminum Nitride, Aluminum Oxide)

- By Application:

- Consumer Electronics (Smartphones, Laptops, High-Performance Tablets, Wearables)

- Automotive and Electric Vehicles (Battery Packs/BTMS, On-board Chargers, Power Inverters)

- LED Lighting and Solid-State Lighting (High-Power Fixtures and Modules)

- Industrial Machinery and Heavy Equipment (Motor Controls, Power Supplies)

- Telecommunications and Data Centers (5G Base Stations, Servers, Network Switches)

- Healthcare and Medical Devices (Diagnostic Imaging Equipment, Portable Devices)

- By End-User Industry:

- Automotive (Tier 1 Suppliers and OEMs)

- Electronics (Semiconductor and Device Assemblers)

- Aerospace and Defense (Avionics and Mission-Critical Systems)

- Energy (Solar Inverters, Battery Storage Systems)

- Telecommunication (Infrastructure Providers)

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East and Africa (MEA)

Value Chain Analysis For Thermally Conductive Film Market

The value chain for the Thermally Conductive Film market initiates with the rigorous procurement, synthesis, and subsequent refinement of highly specialized chemical raw materials, placing critical focus on the conductive filler additives and the high-performance polymeric resins. Upstream analysis encompasses the sourcing, mining, and subsequent high-temperature synthesis of ultra-high-purity graphite, high-grade crystalline boron nitride, specialized aluminum oxide, and the production of high-performance polymer feedstocks such as specialized silicone elastomers or high-temperature polyimides. This initial stage is profoundly capital-intensive, necessitates sophisticated chemical engineering expertise, and demands rigorous, ongoing quality control, as the inherent purity, precise particle size distribution, and specific morphology of the conductive fillers directly and fundamentally determine the final film's thermal efficiency and longevity. Key suppliers in this foundational stage include highly specialized chemical companies and advanced synthetic graphite producers. Significant vertical integration strategies are frequently observed here, as several large, established film manufacturers actively seek to secure or internally develop proprietary filler supplies, aiming to stabilize material costs, mitigate supply chain dependency risks, and ensure precise adherence to stringent, self-defined material specifications that provide a competitive performance edge.

The complex middle segment of the value chain involves the highly specialized manufacturing processes, which typically include sophisticated material compounding, advanced extrusion or calendering, high-precision coating, and controlled curing/cross-linking steps. During this critical stage, the conductive filler particles must be uniformly and homogeneously dispersed within the selected polymer matrix and subsequently formed into ultra-thin, highly dimensionally stable sheets, often requiring specialized surface treatments for enhanced adhesion. This complex, proprietary manufacturing step fundamentally dictates the final film's precise thickness, its required mechanical strength (e.g., tensile strength, tear resistance), and its crucial dielectric properties. Distribution channels are highly specialized and often technical in nature; direct distribution involves dedicated sales teams targeting large-scale, high-volume Original Equipment Manufacturers (OEMs) in the automotive, cloud computing, and flagship consumer electronics sectors. These major clients typically require customized, application-specific film sizes, highly tailored adhesive backings, and extensive technical integration support for complex, high-speed automated assembly lines. Indirect distribution typically utilizes a global network of technical material distributors, specialized value-added resellers, and material brokers who cater primarily to smaller electronic assemblers, specialized industrial integrators, and the aftermarket applications, offering a range of standardized film sizes, moderate inventory levels, and enhanced volume flexibility for non-mass production needs.

Downstream analysis focuses intently on the final integration and sophisticated utilization of these thermally conductive films into complex final products by the end-users—specifically, high-volume electronic device assembly houses, specialized automotive battery pack integrators, telecommunication equipment manufacturers, and heavy industrial machinery producers. The long-term effectiveness, field reliability, and safety adherence of the film are critically validated at this final integration stage, requiring continuous and often proprietary collaboration between the film provider's technical support staff and the end-user's engineering teams to ensure that the initial thermal design goals and operational safety margins are consistently met. The entire value chain is characterized by exceptionally high technological dependency, the absolute necessity for certified and traceable product performance, and an inherent demand for rapid iterative improvement. This structure heavily emphasizes the ongoing necessity for substantial, continuous investment in fundamental R&D and process optimization throughout every single stage of material development and film production, ensuring consistent compliance with rapidly evolving global thermal, electrical, and safety standards, particularly the high-stakes demands of the Electric Vehicle and hyperscale computing sectors.

Thermally Conductive Film Market Potential Customers

Potential customers for thermally conductive films are highly diverse but are overwhelmingly concentrated within high-heat flux, performance-critical industries where extremely efficient and highly reliable heat dissipation is not merely desirable but absolutely paramount for device functionality, component longevity, and critical operational safety. The single largest purchasing segment comprises global manufacturers within the sophisticated consumer electronics space, particularly those engineering and mass-producing high-end flagship smartphones, powerful ultrabooks, advanced gaming consoles, and augmented/virtual reality (AR/VR) headsets. These thin architectures inherently demand superior planar heat spreading capabilities, predominantly utilizing advanced graphite-based and flexible hybrid solutions. These high-volume customers critically require a massive and consistent supply capability, extremely competitive unit pricing, and films that are rigorously optimized for enhanced flexibility and high shear strength to accommodate the intricate, multi-layered, and often bending or folding designs inherent in next-generation consumer gadgets.

A rapidly growing, high-value segment includes Original Equipment Manufacturers (OEMs) and Tier 1 suppliers in the global electric vehicle (EV) industry, encompassing manufacturers of passenger vehicles, commercial trucks, and specialized high-capacity energy storage systems (ESS). EV Battery Thermal Management Systems (BTMS) rely critically on thermally conductive films and specialized gap pads to meticulously manage the substantial, localized heat generated by thousands of lithium-ion cells, thereby ensuring optimal long-term cell longevity, consistent vehicle range estimation, and, most crucially, actively preventing catastrophic thermal runaway events. These high-reliability customers prioritize films that offer exceptionally high dielectric strength (to manage cell voltage differences), superior long-term stability under severe mechanical vibration and shock, robust chemical resistance to battery electrolyte components, and, most importantly, compliance with stringent, internationally recognized UL or equivalent safety certifications for flame retardancy. The standard product qualification cycles in this rigorous sector are typically prolonged, necessitating deep R&D partnership and involving extensive, iterative testing procedures that heavily emphasize verifiable material reliability and long-term performance assurance over immediate cost reduction.

Furthermore, global telecommunications service providers, network equipment manufacturers, and operators of hyperscale data centers represent another critically significant potential customer base, particularly with the sustained global deployment of high-frequency 5G and nascent 6G networks, coupled with the relentless, sustained expansion of global cloud computing infrastructure. High-density server racks, outdoor communication base stations, specialized microwave transmission hardware, and high-capacity network switches all generate intense, localized heat loads that must be managed passively. These specialized clients seek advanced ceramic-filled films that provide exceptional thermal conductivity while meticulously maintaining stringent electrical isolation necessary for high-voltage power components and high-frequency communication circuits. Consequently, they demand suppliers with demonstrated robust technical support capabilities, certified material quality control processes, and scalable, geographically distributed manufacturing capacity to meet rapid global infrastructure build-out schedules and maintain regional supply resilience.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.85 Billion |

| Market Forecast in 2033 | USD 3.51 Billion |

| Growth Rate | 9.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | 3M Company, Laird Performance Materials (DuPont), Panasonic Corporation, Henkel AG & Co. KGaA, T-Global Technology Co. Ltd., Fuji Polymer Industries Co., Ltd., SEKISUI CHEMICAL CO., LTD., W. L. Gore & Associates, Inc., Denka Company Limited, Shapal Ceramic Substrate (Tokuyama Corporation), Aavid Thermalloy (Boyd Corporation), Hitachi Chemical Co., Ltd., Chomerics (Parker Hannifin), KCC Corporation, SINO-TECH, Siga Composite, Thermal Materials Inc., Momentive Performance Materials, Shin-Etsu Chemical Co., Ltd., AET Flexible Space. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Thermally Conductive Film Market Key Technology Landscape

The technological landscape of the Thermally Conductive Film market is fundamentally centered on enhancing thermal conductivity metrics—quantified as Watts per meter Kelvin (W/mK)—without sacrificing crucial secondary performance characteristics such as dielectric strength, long-term flexibility, operational longevity, and robust resistance to harsh environmental factors like excessive humidity and aggressive chemical exposure. One major area of disruptive innovation is the widespread utilization of advanced, chemically engineered nano-fillers, particularly exfoliated graphene sheets, specialized carbon nanotubes (CNTs), and sub-micron ceramic particles. These advanced materials offer significantly higher intrinsic thermal conductivity compared to traditional macro-sized aluminum oxide or silica fillers. Integrating these sophisticated nano-materials effectively requires highly specialized, high-energy compounding and advanced extrusion techniques—such as closed-loop twin-screw extrusion or specialized high-shear solvent casting—to ensure absolutely uniform and stable dispersion within the high-viscosity polymer matrix, critically preventing particle aggregation which would otherwise introduce high thermal resistance and severely compromise the overall mechanical integrity and dielectric breakdown voltage of the final film. This intense focus on precision nano-material engineering and precise composite formulation is non-negotiably essential for successfully meeting the rapidly escalating and extraordinarily stringent thermal dissipation requirements of next-generation high-performance central processing units (CPUs), graphical processing units (GPUs), and compact, power-dense electronic modules operating at peak thermal efficiency.

Another critical technological pillar involves the targeted development and precise manufacturing scaling of anisotropic thermal management films. These specialized films are deliberately engineered, often using high-temperature processes, to transfer heat highly preferentially and extremely efficiently along the planar (X-Y) axis—parallel to the surface—rather than the thickness (Z) axis, thereby acting as highly effective heat spreaders. Highly oriented synthetic graphite films, meticulously created through extreme high-temperature graphitization and subsequent precision calendering under immense pressure, are the definitive archetype of this technology, providing exceptional lateral heat spreading capabilities essential for mitigating localized hot-spot formation in ultra-thin electronic devices, complex flexible circuits, and next-generation OLED/Micro-LED displays. Manufacturing processes, such as specialized rolling or chemical vapor deposition (CVD) adapted for film substrates, are meticulously employed to physically and structurally align the crystalline conductive filler particles, thereby creating the desired directional thermal flow and rapid heat spreading effect. This critical directional capability is paramount in numerous space-constrained applications, particularly where heat must be rapidly and laterally spread over a significantly larger surface area to dramatically reduce localized temperature spikes and successfully mitigate potential component damage or premature device failure.

Furthermore, the high-end industrial segment is witnessing the sophisticated evolution toward multi-functional hybrid film structures and the preliminary integration of dynamic or adaptive thermal interface materials. While full commercial mass-market adoption remains nascent, research and early commercialization efforts are intensely focused on developing composite films that can dynamically adjust their effective thermal conductivity or thermal capacity metrics in immediate response to changing operational temperatures or power cycles. This often entails integrating carefully selected phase-change materials (PCMs) within the internal film structure or ingeniously layering dissimilar functional materials—such as silicone matrices coupled with highly reflective metallic layers or integrated EMI shielding—to concurrently manage both conductive and radiative heat transfer mechanisms. While the majority of current thermally conductive films are passive materials providing a static dissipation path, future technological developments aim to offer semi-active or fully adaptive thermal regulation capabilities, optimizing overall system performance across an extremely wide and dynamic temperature range. This pivotal technological shift, combined synergistically with parallel advancements in automated, high-precision film dispensing, specialized die-cutting, and sophisticated robotic placement equipment, ensures that the film can be integrated seamlessly, cost-effectively, and with unparalleled reliability into advanced, high-volume electronic assembly lines, thus minimizing thermal resistance at the crucial interface and maximizing overall system thermal efficiency and long-term product reliability. The exploration of surface modification technologies, such as plasma etching or chemical grafting, to further reduce interfacial phonon scattering resistance is also a critical area of ongoing intense technological exploration.

Regional Highlights

The regional market dynamics for thermally conductive films exhibit significant structural and volume disparities, primarily driven by regional variances in electronics manufacturing capacity, the stringency of the regulatory environment, and the technological adoption rates across specific end-user industry segments in various geographies.

- Asia Pacific (APAC): APAC commands the dominant market share globally, a position secured by the colossal concentration of global consumer electronics and semiconductor manufacturing facilities (located notably in China, South Korea, Taiwan, and Southeast Asia) and its status as the world’s unequivocal leader in Electric Vehicle and battery production. The demand profile in this region is fundamentally volume-driven and fiercely competitive on pricing, focusing intensely on highly cost-effective, high-performance films, predominantly synthetic graphite solutions for consumer gadgets, alongside rigorous requirements for high-reliability, fire-retardant films essential for the enormous regional EV battery market. Active government incentives and favorable regulations supporting large-scale EV adoption and advanced manufacturing consistently reinforce APAC's leading market position.

- North America: This region is characterized by high-value demand for extremely specialized, ultra-high-reliability films utilized in demanding sectors such as hyperscale data centers, defense/aerospace programs, and sophisticated advanced medical devices. The market emphasis here shifts significantly from pure volume to achieving ultra-high performance, superior stability, and long-term durability, necessitating materials rigorously certified for military specifications, extreme operational temperatures, and guaranteed long-term operational guarantees. The rapid, widespread deployment of 5G/6G infrastructure and continuous expansion of enterprise-level High-Performance Computing (HPC) facilities ensures a sustained, specialized demand for high-dielectric and ultra-stable thermal interface solutions.

- Europe: The European market represents a substantial and technologically mature consumer base, driven largely by extremely stringent environmental regulations (e.g., REACH, RoHS compliance) and a powerful, deeply integrated automotive industry sector with a strong, government-backed focus on electric vehicle production, sustainable manufacturing practices, and advanced vehicle safety features. European OEMs prioritize sustainability and traceability in their material sourcing and demand films that strictly comply with regional environmental and chemical regulations. This region also exhibits robust, consistent demand from the critical industrial automation and machinery sector, where continuous, 24/7 operation necessitates exceptionally robust, durable, and highly reliable thermal management solutions to prevent unplanned downtime.

- Latin America (LATAM) and Middle East & Africa (MEA): These dynamic emerging markets currently show moderate, yet demonstrably accelerating, growth trajectories. Market expansion in LATAM is directly linked to growing regional consumer electronics consumption and increasing localized automotive assembly operations, particularly in Mexico and Brazil. Meanwhile, MEA market growth is increasingly fueled by significant regional investments in large-scale renewable energy infrastructure projects (solar inverters and regional battery storage) and the rapid, sustained expansion of regional cloud computing facilities and data center hubs, thereby creating specialized but increasingly important demand segments for robust, cost-effective thermal management materials that can withstand high ambient temperatures and aggressive environmental conditions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Thermally Conductive Film Market.- 3M Company

- Laird Performance Materials (DuPont)

- Panasonic Corporation

- Henkel AG & Co. KGaA

- T-Global Technology Co. Ltd.

- Fuji Polymer Industries Co., Ltd.

- SEKISUI CHEMICAL CO., LTD.

- W. L. Gore & Associates, Inc.

- Denka Company Limited

- Shapal Ceramic Substrate (Tokuyama Corporation)

- Aavid Thermalloy (Boyd Corporation)

- Hitachi Chemical Co., Ltd.

- Chomerics (Parker Hannifin)

- KCC Corporation

- SINO-TECH

- Siga Composite

- Thermal Materials Inc.

- Momentive Performance Materials

- Shin-Etsu Chemical Co., Ltd.

- AET Flexible Space

Frequently Asked Questions

Analyze common user questions about the Thermally Conductive Film market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference in application suitability between thermally conductive films and traditional thermal pastes?

Thermally conductive films are pre-cured, solid, highly robust materials offering precise, consistent thickness control (BLT), superior ease of automated handling, and guarantee zero risk of material pump-out or contamination, making them ideal for high-volume automated manufacturing, vibration-prone environments, and applications critically requiring long-term mechanical stability, unlike liquid thermal pastes which are applied manually and are susceptible to migration under severe thermal cycling.

Which application segment currently holds the highest growth potential for thermally conductive films through 2033?

While the high-volume consumer electronics sector currently commands the largest volume share of the market, the Automotive and Electric Vehicle (EV) segment is unequivocally projected to experience the fastest, highest-value growth due to the non-negotiable and safety-critical need for advanced, highly reliable thermal management solutions within high-capacity battery packs to rigorously ensure cell longevity, consistent vehicle range, and crucial prevention of thermal runaway.

How is the crucial thermal conductivity of a film primarily determined and controlled?

Thermal conductivity is primarily determined and precisely controlled by the specific chemical nature, morphology, high loading percentage, and uniformity of dispersion of the conductive filler particles (e.g., highly aligned graphite, specialized boron nitride, nano-ceramics) embedded within the polymer matrix. High purity and deliberate structural alignment of these fillers, particularly critical in anisotropic graphite films, are maximized to ensure peak heat transfer efficiency (W/mK) while reducing interfacial resistance.

What specific performance characteristics are essential for films used in high-voltage EV battery applications?

Films utilized in high-voltage Electric Vehicle battery thermal management systems (BTMS) require an exceptional combination of extremely high thermal conductivity, robust electrical isolation (dielectric strength), superior mechanical resilience to vibration and shock, and, critically, strict certification for flame retardancy (e.g., UL 94 V-0) to prevent cell-to-cell fire propagation.

How do advanced nano-fillers like graphene impact the technological trajectory of the Thermally Conductive Film market?

Advanced nano-fillers such as graphene and carbon nanotubes (CNTs) offer significantly higher intrinsic thermal conductivity than traditional materials, pushing the technological boundary by enabling the development of ultra-thin, highly flexible films that can manage extreme heat fluxes in confined spaces, thus driving innovation in next-generation high-power density electronics and flexible circuits.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager