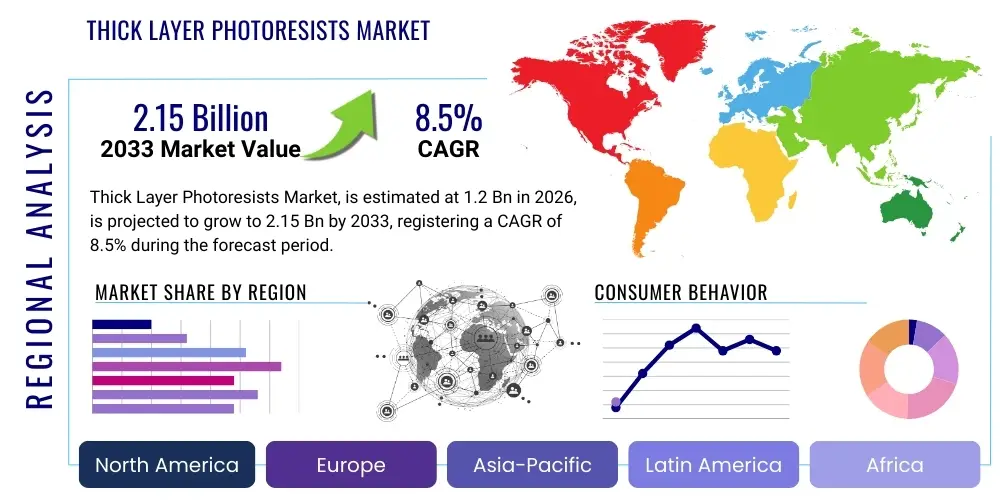

Thick Layer Photoresists Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442106 | Date : Feb, 2026 | Pages : 258 | Region : Global | Publisher : MRU

Thick Layer Photoresists Market Size

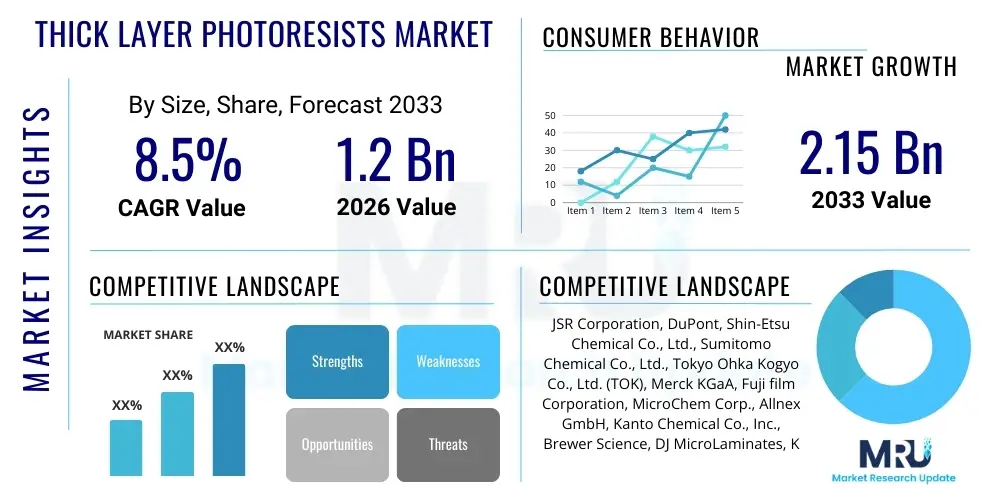

The Thick Layer Photoresists Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at USD 1.2 Billion in 2026 and is projected to reach USD 2.15 Billion by the end of the forecast period in 2033.

Thick Layer Photoresists Market introduction

The Thick Layer Photoresists Market encompasses specialized polymeric materials utilized primarily in microfabrication processes to create highly defined patterns with thicknesses typically ranging from 10 micrometers up to several hundred micrometers. Unlike standard thin-film photoresists used in conventional integrated circuit manufacturing, these thick layers are critical for advanced applications requiring high aspect ratios, deep etching, or permanent structural components. Key examples include the fabrication of microelectromechanical systems (MEMS), advanced packaging technologies such as 3D integration and wafer-level packaging (WLP), and microfluidic devices.

Thick layer photoresists are distinguished by their chemical compositions, which often include epoxy-based polymers (like SU-8) or specialized Novolac-based negative and positive resists engineered for high viscosity and uniform coating across larger substrate areas. The primary function of these materials is to serve as masking layers during dry or wet etching, or to act as structural components in processes like LIGA (Lithographie, Galvanoformung, Abformung). The market growth is intricately linked to the burgeoning demand for highly miniaturized, high-performance sensors and actuators across the automotive, consumer electronics, and healthcare sectors, where precise structural fidelity over significant vertical dimensions is non-negotiable.

The core benefit of utilizing thick layer photoresists lies in their ability to achieve high resolution and vertical sidewall profiles (high aspect ratio patterning), which is essential for creating deep trenches, pillars, or molds required for micro-bump formation, optical components, and complex MEMS structures. Driving factors include the increasing complexity of semiconductor packaging, the rapid expansion of the Internet of Things (IoT) necessitating compact sensor integration, and continuous technological advancements in photolithography equipment that enable processing of these thicker films with high throughput and precision.

Thick Layer Photoresists Market Executive Summary

The Thick Layer Photoresists Market is exhibiting robust growth, propelled primarily by significant business trends such as the escalating adoption of advanced packaging methods, notably fan-out wafer-level packaging (FO-WLP) and 2.5D/3D integration. These packaging technologies inherently rely on thick resist layers for temporary bonding, permanent dielectric spacers, and redistribution layers (RDL) fabrication, driving increased consumption of high-performance resists. Key industry players are focusing on developing novel chemically amplified resists (CARs) that offer enhanced thermal stability and reduced material stress, addressing the demanding operational environments within modern electronic devices. Furthermore, sustainability trends are subtly influencing material innovation, with a growing emphasis on low-toxicity formulations and improved stripping processes to reduce environmental impact during manufacturing.

Regional trends indicate that the Asia Pacific (APAC) region maintains market dominance due to its concentrated semiconductor manufacturing base, particularly in Taiwan, South Korea, China, and Japan. This dominance is further amplified by significant government investments in domestic chip production and advanced foundry expansions. North America and Europe, while smaller in volume, represent key centers for high-value applications, including specialized aerospace MEMS, medical devices, and high-precision sensors, favoring highly customized and niche resist products. The rapid industrialization and digitization across emerging economies are also contributing to the global demand trajectory, albeit focusing initially on standard, high-throughput resist types for mid-range consumer electronics.

Segment trends reveal that the permanent photoresist segment, often used as structural materials or insulators in MEMS and advanced packaging, is experiencing faster growth compared to temporary/sacrificial resists. By application, the MEMS fabrication sector holds a substantial market share, driven by the proliferation of gyroscopes, accelerometers, and pressure sensors in automotive safety systems and mobile devices. Concurrently, the 3D IC and Advanced Packaging segment is forecasted to demonstrate the highest CAGR, reflective of the industry's pervasive shift toward greater interconnect density and smaller form factors. Innovation in polymer chemistry, focusing on achieving superior adhesion properties and higher processing temperatures, remains a critical differentiating factor among competing products.

AI Impact Analysis on Thick Layer Photoresists Market

Common user questions regarding AI's impact on the Thick Layer Photoresists Market primarily revolve around how AI and machine learning (ML) can optimize lithography processes, enhance material quality control, and accelerate new material development. Users are keen to understand if AI can reduce defects associated with thick film processing (such as standing waves or stress-induced cracking), predict optimal exposure doses and development times, and automate complex metrology tasks. A central theme is the expectation that AI integration will lead to increased manufacturing yields, faster R&D cycles for next-generation resist formulations, and more precise process control crucial for high aspect ratio structures.

The integration of artificial intelligence is fundamentally transforming the manufacturing landscape for thick layer photoresists by enabling sophisticated predictive modeling and real-time process adjustments. AI algorithms can analyze vast datasets collected from scanners, track systems, and metrology tools to identify subtle process variations that impact resist performance, particularly concerning critical dimension uniformity (CDU) and side-wall profile fidelity in deep trenches. This predictive capability allows fabs to proactively adjust coating speeds, soft bake temperatures, and post-exposure bake (PEB) times, minimizing the reliance on costly and time-consuming manual optimization loops inherent in thick resist lithography.

Furthermore, AI significantly aids in the material informatics aspect, accelerating the discovery and formulation of new photoresist chemistries. By simulating the molecular interactions and predicting performance attributes (e.g., contrast, sensitivity, thermal stability) before physical synthesis, ML models drastically reduce the experimental overhead required to develop high-performance materials like low-stress epoxy resists or novel dry-film photoresists suitable for large-area advanced packaging. This ability to speed up R&D directly influences the market by bringing superior, highly specialized resist products to market faster, thereby meeting the stringent requirements of applications like next-generation neuromorphic computing and high-frequency communication devices.

- AI optimizes lithography process parameters (dose, focus, bake times) to minimize thick film defects.

- Machine learning enhances real-time critical dimension uniformity (CDU) control in high aspect ratio patterning.

- Predictive maintenance using AI reduces downtime for coating and developing equipment specific to viscous thick resists.

- AI-driven material informatics accelerates the R&D cycle for novel, high-performance photoresist formulations (e.g., low-stress polymers).

- Automation of complex metrology and inspection for deep trenches and micro-structures utilizing computer vision.

DRO & Impact Forces Of Thick Layer Photoresists Market

The dynamics of the Thick Layer Photoresists Market are governed by a complex interplay of drivers, restraints, and opportunities (DRO), which collectively shape the market's trajectory and profitability. The primary driver is the pervasive demand for miniaturization and enhanced functionality across multiple electronic applications, especially in the automotive sector (autonomous driving sensors) and healthcare (advanced diagnostic microfluidics). This demand fuels the need for sophisticated semiconductor packaging, where thick resists are indispensable for creating robust Redistribution Layers (RDLs) and under-bump metallization structures. However, the market faces significant restraints related to the complexity of processing thick films, including challenges with high internal stress accumulation, long exposure times, and difficulties in achieving uniform development across extremely high thicknesses, which can lead to yield losses and increased manufacturing costs. These processing challenges necessitate continuous investment in specialized equipment and highly skilled labor.

Opportunities in the market primarily stem from emerging technological shifts and expansion into new applications. The transition towards 5G and 6G communication technologies is driving the need for high-frequency integrated passive devices (IPDs) and antennas, which often require high-aspect-ratio patterning achievable only with advanced thick resists. Furthermore, the growth of heterogeneous integration and 3D stacking mandates novel sacrificial and permanent thick materials that offer superior planarization and thermal budget compatibility. The development of dry film photoresists (DFPR) customized for advanced packaging offers a compelling opportunity to simplify processing, reduce material waste, and improve coat uniformity on warped or non-standard substrates, thus addressing existing manufacturing bottlenecks and offering higher throughput solutions, particularly for high-volume applications.

The impact forces influencing the market are high, driven by technological volatility and stringent application requirements. The bargaining power of buyers (large foundries and IDMs) is moderate to high, as they often dictate specific performance metrics and push for cost optimization, given the volume usage. The threat of substitutes is relatively low in specific high-aspect-ratio applications, as few materials can match the resolution and structural integrity offered by specialized photoresists, though alternative patterning techniques like laser ablation or inkjet printing pose a distant threat in less critical domains. Supplier power is concentrated among a few key chemical manufacturers, allowing them some leverage over pricing and innovation cycles, making strategic partnerships essential for continuous supply and co-development efforts.

Segmentation Analysis

The Thick Layer Photoresists Market is strategically segmented based on crucial attributes including type, application, and end-user industry, enabling manufacturers and end-users to focus on highly specialized product requirements. Segmentation by type differentiates between permanent resists, which become integral structural components or insulating layers (e.g., in RDLs or MEMS structural layers), and sacrificial/temporary resists, which are removed after the patterning or bonding process (e.g., temporary bonding layers or molds). This distinction is vital as their chemical compositions and processing characteristics are vastly different, directly impacting the complexity and cost of the final manufacturing step. Understanding these segments is key to addressing the specific demands of miniaturization and integration in modern electronics.

Segmentation by application reveals the core utilization areas driving market demand. MEMS fabrication remains the largest application segment, requiring high-resolution, deep-etch capabilities for components like accelerometers and mirrors. Advanced Packaging, encompassing 2.5D/3D ICs, WLP, and FOWLP, represents the fastest-growing segment, driven by the need for superior thick dielectric layers and precise micro-bumping. Other critical applications include microfluidics (for lab-on-a-chip devices) and optical components, where extreme aspect ratios and specific optical properties are mandatory. The diversity across these applications underscores the versatility and critical nature of thick layer photoresists in enabling next-generation hardware.

The end-user segmentation further clarifies consumption patterns, identifying key vertical markets such as Consumer Electronics, Automotive, Industrial, and Healthcare. The Consumer Electronics sector, driven by smartphones and wearables, is a volume driver for standard thick resists in power management ICs and sensors. Conversely, the Automotive and Healthcare sectors demand resists with stringent reliability, thermal stability, and biocompatibility, often commanding premium pricing for specialized, high-specification products. This detailed segmentation aids in market sizing, competitive analysis, and strategic product development aimed at addressing niche application requirements across the global technological landscape.

- By Type:

- Permanent Photoresists (e.g., SU-8, High-performance Polyimides)

- Sacrificial/Temporary Photoresists (e.g., materials for temporary bonding or lift-off processes)

- Dry Film Photoresists (DFPR)

- Liquid Photoresists

- By Application:

- MEMS Fabrication (Micro-mirrors, Sensors, Actuators)

- Advanced Packaging (2.5D/3D ICs, Wafer Level Packaging, RDLs)

- Microfluidics and Bio-MEMS

- Optical Components and Integrated Photonics

- Printed Circuit Boards (PCBs) and Interposers

- By End-User:

- Consumer Electronics

- Automotive & Transportation

- Industrial & Telecommunications (5G/6G Components)

- Healthcare & Medical Devices

- Aerospace & Defense

Value Chain Analysis For Thick Layer Photoresists Market

The value chain for the Thick Layer Photoresists Market begins with upstream activities involving the sourcing of highly specialized raw chemical materials, primarily polymers, sensitizers, solvents, and cross-linking agents. These materials, often proprietary or requiring high purity, are supplied by specialized chemical manufacturers. The synthesis and formulation stage, dominated by a few global photoresist manufacturers, involves rigorous R&D to blend and process these raw materials into highly viscous, stable, and photo-sensitive liquid or dry film products. Quality control at this stage is paramount, focusing on viscosity, molecular weight distribution, and purity to ensure optimal lithographic performance, which directly impacts the high-cost downstream manufacturing processes.

Midstream activities focus on the delivery and integration of the photoresists into the fabrication process. Distribution channels are highly controlled and often direct, involving close technical collaboration between the photoresist supplier and the semiconductor foundry or MEMS manufacturer. Direct distribution is favored due to the need for specific storage conditions, just-in-time delivery, and specialized technical support for application troubleshooting. Indirect channels may involve specialized chemical distributors for smaller players or standard applications, but high-volume, advanced packaging applications almost always utilize direct supply chains to maintain material integrity and process control.

Downstream activities involve the actual utilization of the photoresists in complex microfabrication processes, primarily within integrated device manufacturers (IDMs), pure-play foundries, and outsourced semiconductor assembly and test (OSAT) firms. These end-users perform the core lithography, etching, plating, and stripping steps. The successful outcome of these expensive processes heavily relies on the consistent quality and performance of the thick layer resists. The final stage involves the assembly of the finished component (MEMS sensor, advanced packaged IC) into final electronic devices across the consumer, automotive, and medical sectors, completing the value cycle where the high aspect ratio structures enabled by the thick resists deliver enhanced functionality.

Thick Layer Photoresists Market Potential Customers

The primary end-users and potential buyers of thick layer photoresists are large-scale semiconductor manufacturers and specialized microfabrication foundries that require precise, high-aspect-ratio patterning capabilities crucial for advanced device architectures. This includes leading global pure-play foundries (such as TSMC and Samsung Foundry) and IDMs (like Intel and Micron) engaged in advanced logic, memory, and specialized sensor production. These customers require photoresists for manufacturing sophisticated interposers, robust dielectric layers in 2.5D/3D stacks, and RDLs in high-density fan-out packaging, demanding high thermal stability and chemical resistance from the materials.

A second significant customer segment comprises manufacturers focused specifically on Microelectromechanical Systems (MEMS) and sensor production. Companies specializing in automotive sensors (pressure, inertia), industrial actuators, and consumer electronics components (micro-mirrors, microphones) are heavy consumers of thick photoresists, particularly SU-8 and specialized negative resists. For these customers, the key purchasing criteria include superior resolution for high-aspect-ratio features, low internal stress characteristics to prevent device failure, and consistency in batch-to-batch material performance, often prioritizing product reliability over marginal cost savings due to the critical nature of the final components.

Furthermore, specialized end-users in the medical and aerospace sectors represent high-value potential customers. Medical device manufacturers utilize thick resists for fabricating microfluidic channels, bio-MEMS devices, and drug delivery platforms, necessitating biocompatible and low-leaching formulations. Aerospace and defense contractors require robust, radiation-hardened photoresists for specialized, high-reliability sensors and components used in extreme environments. These smaller, niche customers drive innovation toward custom formulations and specialized packaging formats, often procured through direct, highly specialized distribution channels ensuring traceability and compliance with stringent industry standards.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.2 Billion |

| Market Forecast in 2033 | USD 2.15 Billion |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | JSR Corporation, DuPont, Shin-Etsu Chemical Co., Ltd., Sumitomo Chemical Co., Ltd., Tokyo Ohka Kogyo Co., Ltd. (TOK), Merck KGaA, Fuji film Corporation, MicroChem Corp., Allnex GmbH, Kanto Chemical Co., Inc., Brewer Science, DJ MicroLaminates, Kemira, Nissan Chemical Corporation, Eternal Chemical Co., Ltd., Huntsman Corporation, Dow Inc., Mitsui Chemicals, Hitachi Chemical, Jiangsu Changjiang Electronics Technology Co., Ltd. (JCET) |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Thick Layer Photoresists Market Key Technology Landscape

The technological landscape of the Thick Layer Photoresists Market is defined by continuous innovation aimed at overcoming the intrinsic challenges associated with high-aspect-ratio lithography, primarily stress, adhesion, and processing speed. A key technological focus remains on improving the chemical amplification mechanism in deep UV (DUV) and broadband I-line resists to achieve higher sensitivity, thereby reducing exposure times and increasing throughput, which is vital for high-volume manufacturing environments. Furthermore, advances in polymer science are driving the development of specialized epoxy-based resists, such as enhanced SU-8 variants, that exhibit extremely high thermal and chemical stability post-cure, making them ideal for permanent structural applications in harsh environments like automotive under-the-hood sensors or high-power electronics modules.

Another pivotal technological development involves the optimization of coating techniques to ensure uniform thickness and minimize edge bead formation on complex or large-area substrates, a persistent challenge when working with highly viscous materials. Spin coating remains dominant, but equipment advancements, including specialized coating heads and optimized exhaust systems, enhance precision. Concurrently, Dry Film Photoresists (DFPR) are emerging as a transformative technology, particularly for advanced packaging applications (like wafer bumping and redistribution layers) where they offer superior uniformity and reduced material consumption compared to their liquid counterparts. The lamination process associated with DFPR inherently mitigates some of the stress and defect issues common in thick spin-coated layers, leading to greater interest from leading OSATs and foundries.

Furthermore, lithography tool advancements, particularly high-intensity UV light sources and specialized steppers/scanners designed for thick resist processing, play a supportive role in market evolution. Advanced metrology and inspection techniques, often leveraging high-resolution scanning electron microscopy (SEM) and focused ion beam (FIB) tools, are essential for characterizing the complex 3D structures created by thick resists. The integration of process simulation software is also crucial, allowing engineers to accurately model exposure, development, and stress profiles before committing to expensive fabrication runs, thereby accelerating process transfer and optimizing yield for novel device designs requiring extremely high aspect ratio features.

Regional Highlights

- Asia Pacific (APAC): APAC is the global epicenter for the manufacturing and consumption of thick layer photoresists, primarily driven by China, South Korea, Taiwan, and Japan. This dominance is attributed to the presence of the world's largest semiconductor foundries, vast outsourced semiconductor assembly and test (OSAT) infrastructure, and high concentration of consumer electronics manufacturing. The rapid adoption of 5G infrastructure, coupled with massive investments in advanced packaging (FOWLP, 3D stacking) to support regional electronics giants, ensures that APAC remains the fastest-growing and largest volume market globally.

- North America: North America represents a crucial market for high-value, specialized thick layer photoresists, particularly those targeting niche applications in aerospace, defense, and high-end medical devices (Bio-MEMS). The region benefits from strong R&D capabilities and a focus on cutting-edge technology such as integrated photonics and specialized sensors for autonomous systems. While volume consumption is lower than APAC, the demand for high-specification, low-stress, and thermally stable resists commands premium pricing and drives material innovation in this region.

- Europe: Europe holds a strong position in the Thick Layer Photoresists Market, largely centered around automotive electronics, industrial automation, and specialized MEMS production. Countries like Germany, France, and Switzerland are hubs for automotive sensor manufacturing and precision microfabrication. European manufacturers emphasize environmental compliance, leading to higher demand for low-toxicity, environmentally friendly photoresist formulations and advanced processing techniques that reduce chemical waste.

- Latin America (LATAM) and Middle East & Africa (MEA): These regions currently represent nascent but rapidly growing markets. Demand is primarily focused on supporting local electronics assembly and telecommunications infrastructure build-out. While not major centers for high-end semiconductor fabrication, the increasing industrialization and localization of manufacturing, particularly in countries like Brazil and UAE, suggest a moderate long-term growth trajectory for standard-grade thick photoresists used in basic packaging and PCB fabrication.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Thick Layer Photoresists Market.- JSR Corporation

- DuPont

- Shin-Etsu Chemical Co., Ltd.

- Sumitomo Chemical Co., Ltd.

- Tokyo Ohka Kogyo Co., Ltd. (TOK)

- Merck KGaA

- Fuji film Corporation

- MicroChem Corp.

- Allnex GmbH

- Kanto Chemical Co., Inc.

- Brewer Science

- DJ MicroLaminates

- Kemira

- Nissan Chemical Corporation

- Eternal Chemical Co., Ltd.

- Huntsman Corporation

- Dow Inc.

- Mitsui Chemicals

- Hitachi Chemical (Showa Denko Materials)

- Jiangsu Changjiang Electronics Technology Co., Ltd. (JCET)

Frequently Asked Questions

Analyze common user questions about the Thick Layer Photoresists market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between thin layer and thick layer photoresists?

Thick layer photoresists typically range from 10 micrometers up to several hundred micrometers, enabling high-aspect-ratio structures required for MEMS and advanced packaging. Thin layers are generally less than 5 micrometers and are used for high-resolution patterning in conventional integrated circuit logic manufacturing.

Which application segment drives the highest demand for thick layer photoresists?

The MEMS (Microelectromechanical Systems) fabrication segment currently accounts for the largest volume consumption due to the widespread need for deep trenches and structural components in sensors and actuators. However, Advanced Packaging (2.5D/3D ICs and WLP) is the fastest-growing segment.

What challenges are associated with processing extremely thick photoresist films?

Key processing challenges include managing high internal film stress which can cause cracking, ensuring uniform exposure dose penetration across the depth (especially for SU-8), minimizing bubble formation during coating, and achieving consistent development uniformity for high aspect ratio features.

How is the market influenced by the shift to advanced semiconductor packaging?

Advanced packaging, specifically Fan-Out Wafer Level Packaging (FOWLP) and 3D stacking, heavily relies on thick photoresists to create robust Redistribution Layers (RDLs), interposer structures, and temporary bonding layers, making this technology transition a fundamental driver of market growth.

Are Dry Film Photoresists (DFPR) replacing liquid thick layer resists?

DFPRs are gaining significant traction, particularly in advanced packaging due to their superior uniformity and reduced material waste compared to liquid resists. While not a complete replacement, DFPR offers compelling advantages for non-planar and large-area substrates, making them a high-growth alternative in specific high-throughput applications.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager