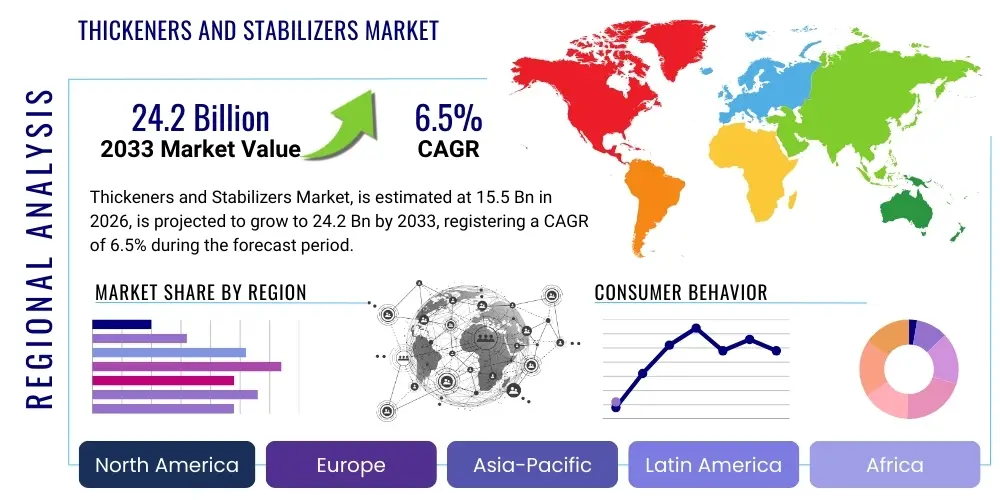

Thickeners and Stabilizers Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442166 | Date : Feb, 2026 | Pages : 258 | Region : Global | Publisher : MRU

Thickeners and Stabilizers Market Size

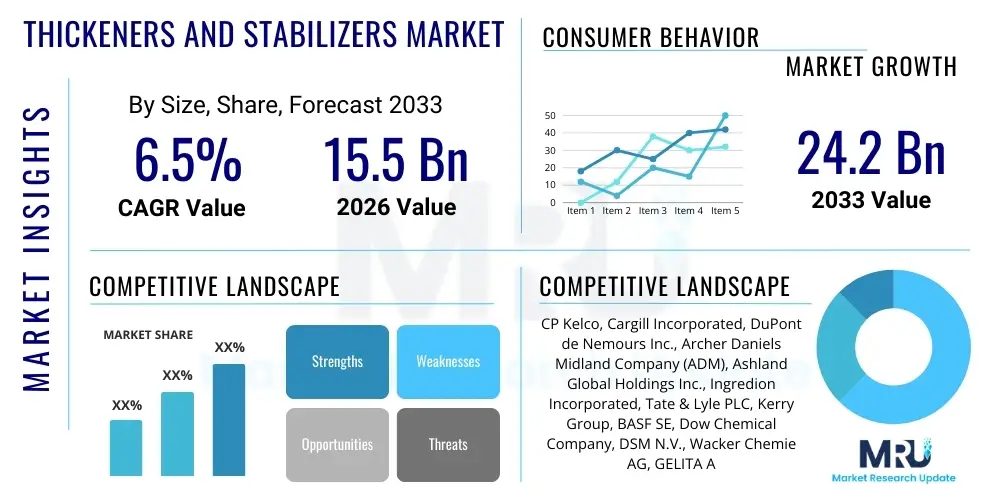

The Thickeners and Stabilizers Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 15.5 Billion in 2026 and is projected to reach USD 24.2 Billion by the end of the forecast period in 2033.

Thickeners and Stabilizers Market introduction

The Thickeners and Stabilizers Market encompasses a crucial segment of the specialty chemicals industry, primarily involving ingredients that modify the texture, viscosity, consistency, and stability of consumer and industrial products. These substances, predominantly hydrocolloids (such as guar gum, xanthan gum, carrageenan), modified starches, and synthetic polymers, are essential for maintaining the desired physical properties and extending the shelf life of formulations. In the food and beverage sector, they prevent phase separation in emulsions, enhance mouthfeel in dairy and confectionery, and provide structure in baked goods. Their functional versatility makes them indispensable across a spectrum of high-demand applications, driving sustained market expansion globally.

The core function of thickeners is to increase viscosity without substantially altering other properties of the solution, while stabilizers work to prevent sedimentation, coagulation, or separation of ingredients in heterogeneous mixtures, ensuring product uniformity over time. The primary driving factors for this market include the global surge in demand for processed and convenience foods, the accelerating adoption of clean label ingredients derived from natural sources, and rigorous regulatory requirements mandating product safety and consistency, particularly in the pharmaceutical and cosmetic industries. Furthermore, the rise of specialized dietary trends, such as gluten-free and vegan alternatives, necessitates innovative texturant solutions to mimic traditional textures and mouthfeel, thereby stimulating intense research and development activities across the industry value chain.

Major applications span diverse vertical markets, including food and beverage (where they are critical for sauces, dressings, and functional beverages), personal care products (improving texture and suspension in lotions and shampoos), and pharmaceuticals (acting as binders and controlled-release agents). The intrinsic benefits, such as improved rheology, enhanced palatability, and prolonged shelf stability, underscore their strategic importance. The market dynamics are highly influenced by the fluctuating supply chain of natural raw materials, the technological advancements in modifying traditional starches and gums, and the increasing consumer preference for transparent ingredient lists, compelling manufacturers to invest heavily in sustainably sourced and bio-engineered thickening and stabilizing solutions.

Thickeners and Stabilizers Market Executive Summary

The Thickeners and Stabilizers Market is currently experiencing robust growth, fueled by convergent business trends including heightened consumer focus on product quality and the rapid penetration of processed food categories in emerging economies. Key business trends indicate a definitive shift toward natural and bio-based stabilizers, largely driven by the clean label movement, pushing companies to substitute synthetic additives with highly functional natural hydrocolloids like pectin, guar gum, and alginates. Innovation in enzyme technology and fermentation techniques is enabling the production of novel texturants with superior functionality and stability profile. Furthermore, consolidation among key manufacturers and strategic partnerships focused on sustainable sourcing are defining the competitive landscape, aiming to mitigate raw material price volatility and ensure supply resilience.

Regionally, Asia Pacific (APAC) stands out as the primary growth engine, spurred by massive industrialization, rising disposable incomes, and the modernization of the food processing infrastructure, particularly in India and China. While North America and Europe remain mature markets, they are characterized by stringent regulatory environments that favor premium, certified organic, and non-GMO stabilizers, leading to higher average selling prices. The Middle East and Africa (MEA) are emerging as high-potential markets due to expanding dairy and convenience food sectors, though market penetration is often constrained by logistical challenges and varying regulatory standards across nations.

Segment trends highlight the dominance of hydrocolloids due to their broad applicability and the trend towards natural ingredients. Within applications, the Food and Beverage segment holds the largest market share, driven specifically by the bakery, dairy, and beverage sub-segments, which rely heavily on these ingredients for texture and structural integrity. Synthetic thickeners, while facing scrutiny, maintain niche dominance in high-performance industrial and construction applications dueessing stability and flow properties. The overarching industry trajectory is one of functional refinement, regulatory compliance, and increasing operational efficiency through technological integration.

AI Impact Analysis on Thickeners and Stabilizers Market

User questions concerning AI’s impact on the Thickeners and Stabilizers Market frequently revolve around efficiency improvements in R&D, enhanced predictive capabilities for formulation stability, and the automation of quality control processes. Consumers and industry professionals alike are keenly interested in how Artificial Intelligence and Machine Learning (ML) can accelerate the discovery of novel hydrocolloids, optimize ingredient ratios for specific textures (e.g., mimicking fat in low-fat products), and improve supply chain forecasting for volatile raw materials. A central theme is the expectation that AI will dramatically reduce the time and cost associated with developing new, customized texturant systems, while simultaneously guaranteeing higher levels of product consistency and compliance with complex global food safety standards. This technological integration promises greater precision in molecular modification and superior rheological design.

- Accelerated discovery of novel hydrocolloids and polysaccharides through high-throughput screening and predictive modeling.

- Optimization of complex ingredient interactions and formulation stability using Machine Learning algorithms, reducing physical prototyping cycles.

- Enhanced quality control and assurance by integrating AI-driven computer vision systems for real-time monitoring of viscosity and particle size distribution.

- Improved supply chain resilience and forecasting precision for highly variable natural raw materials, optimizing procurement and inventory management.

- Development of personalized nutrition products requiring AI-driven adjustments to texture and stability based on individual consumer preferences and dietary requirements.

- Automation of processing parameters (temperature, shear rate) in manufacturing to maintain consistent product rheology across large production batches.

DRO & Impact Forces Of Thickeners and Stabilizers Market

The market for thickeners and stabilizers is shaped by a powerful interplay of expansionary drivers, challenging restraints, and emerging opportunities, all collectively managed by significant impact forces related to regulatory shifts and consumer behavior. Key drivers include the overwhelming global demand for convenient, packaged, and highly processed food items, which intrinsically require sophisticated stabilization systems to ensure palatable texture and prolonged safety. Furthermore, the strong shift towards natural ingredient sourcing and clean label certifications acts as a major market accelerator, compelling manufacturers to innovate and expand their portfolios of gums, pectins, and starches derived from natural sources, particularly catering to the burgeoning market for vegan, plant-based, and functional food products that necessitate careful textural management.

Conversely, significant restraints hinder optimal market growth. The high volatility in the pricing and supply of natural raw materials, such as guar seeds, seaweed (for carrageenan), and citrus peels (for pectin), presents a persistent operational and financial challenge for processors. Furthermore, the complex and often lengthy regulatory approval processes for novel or chemically modified stabilizers across different geographical regions create barriers to rapid market entry and standardization. Consumer skepticism regarding synthetic additives, despite their functional superiority in some industrial applications, continues to pressure companies into expensive reformulations and transparency efforts, increasing overhead costs.

Opportunities for growth are abundant, particularly in the area of customized texture solutions for medical foods and personalized dietary supplements, which require precise rheological characteristics. The increasing exploration of novel microbial sources and sustainable agricultural waste streams for producing high-performance, bio-based texturants presents a viable path for diversifying the supply base and achieving sustainable growth. The dominant impact force remains evolving consumer health consciousness, which places regulatory bodies under pressure to increase scrutiny on artificial ingredients while simultaneously fostering innovation in naturally derived, high-functional substitutes, thereby continuously redefining the permissible landscape for market operations.

The convergence of increasing population density and urbanization, particularly in Asia, directly correlates with higher consumption of packaged goods, which inherently drives demand for stabilizers to maintain quality during extended supply chains. Simultaneously, the pharmaceutical industry’s growth, fueled by an aging global population, requires advanced excipients for controlled drug release and formulation stability, further solidifying the strategic importance of high-purity thickening agents. This structural demand across essential industries ensures that the market's foundational drivers outweigh short-term raw material restraints, propelling long-term market expansion.

Segmentation Analysis

The Thickeners and Stabilizers Market is comprehensively segmented based on the raw material source, functional type, application industry, and geographical region, providing a granular view of market dynamics and opportunity mapping. Segmentation by source includes Natural Hydrocolloids, Modified Starches, and Synthetic Chemicals, with Natural Hydrocolloids currently dominating the landscape due to overwhelming consumer and regulatory preference for clean label ingredients. Functionality is categorized into Gelling Agents, Viscosity Modifiers, Water Binders, and Emulsifiers, reflecting the diverse roles these additives play in end-product characteristics. The application segmentation, which covers Food and Beverage, Cosmetics and Personal Care, Pharmaceuticals, and Industrial sectors, is critical, as each sector mandates specific purity levels and functional attributes for the texturants utilized.

- By Type:

- Hydrocolloids (Gums: Xanthan, Guar, Arabic, Carrageenan; Pectin; Agar)

- Modified Starch (Maltodextrins, Modified Corn Starch, Potato Starch)

- Synthetic Polymers (CMC, HPMC, Carbomers, Polyacrylates)

- By Source:

- Natural (Plant-based, Seaweed-based, Microbial)

- Synthetic

- By Application:

- Food & Beverage (Dairy, Confectionery, Bakery, Sauces & Dressings, Beverages)

- Pharmaceuticals (Drug delivery, Excipients, Binders)

- Cosmetics & Personal Care (Creams, Lotions, Shampoos, Toothpaste)

- Industrial (Paints & Coatings, Oilfield Chemicals, Construction Materials)

- By Function:

- Viscosity Control Agents

- Stabilizers & Suspending Agents

- Gelling Agents

- Emulsifiers

- By Region:

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Value Chain Analysis For Thickeners and Stabilizers Market

The value chain for the Thickeners and Stabilizers Market begins with the upstream sourcing of raw materials, which is highly fragmented and dependent on agricultural yield and geopolitical stability, particularly for natural hydrocolloids like guar gum and carrageenan. For synthetic thickeners, the upstream involves specialized chemical synthesis and polymerization processes derived from petrochemical feedstocks. This initial stage defines the overall cost structure and sustainability profile of the final product. Key activities at this stage include cultivation, harvesting, chemical extraction, and primary purification, which require stringent quality control measures to manage contaminants and ensure material purity suitable for food or pharmaceutical grades. The variability in agricultural output for natural gums necessitates strategic procurement and risk hedging.

The midstream phase involves complex processing, modification, and formulation by specialty ingredient manufacturers. This includes enzymatic modification of starches to enhance freeze-thaw stability, fermentation processes for xanthan gum production, and advanced mechanical milling to achieve precise particle sizes. Processing firms invest heavily in R&D to tailor the functional properties—such as shear-thinning behavior, temperature stability, and pH tolerance—to meet diverse end-user specifications. Differentiation in the market is heavily achieved at this stage through proprietary modification techniques and quality certifications like kosher, halal, and non-GMO status. The transition from raw commodity to high-value functional ingredient occurs here, significantly boosting the product’s economic worth.

Downstream analysis focuses on distribution and integration into end-user products. Distribution channels are bifurcated: direct sales channels handle large volume orders to major multinational food and pharmaceutical corporations, ensuring technical support and direct quality traceability. Indirect channels utilize specialty chemical distributors and agents, particularly reaching smaller manufacturers and regional markets. These distributors often maintain regional warehousing and provide localized blending services. The end-user integration involves formulation expertise, where food technologists, cosmetic chemists, and pharmaceutical researchers incorporate the thickeners and stabilizers to achieve desired product rheology and stability. Success at the downstream level is contingent upon effective technical support, ensuring optimal application and performance of the ingredient in complex final formulations.

Thickeners and Stabilizers Market Potential Customers

The potential customers for thickeners and stabilizers are fundamentally defined by the requirement to manage viscosity, texture, suspension, and stability in consumer and industrial goods. The largest segment of buyers resides within the Food and Beverage industry, encompassing multinational conglomerates and regional producers specializing in dairy (yogurt, ice cream), processed meats, convenience meals, baked goods, and specialized functional beverages. These customers rely on thickeners to deliver mouthfeel, stabilize emulsions, prevent syneresis (weeping), and ensure consistent quality across product lines. The shift towards plant-based dairy and meat substitutes has intensified the demand from this segment, as new formulations critically depend on texturants to mimic the sensory experience of animal products.

A second major customer base is the Cosmetics and Personal Care industry. Manufacturers of high-end lotions, shampoos, gels, and decorative cosmetics utilize stabilizers to maintain the homogeneity of complex formulations, improve spreadability, and provide a luxurious tactile experience. Stability is paramount in this sector, ensuring that active ingredients remain uniformly suspended throughout the product's shelf life. Similarly, the Pharmaceutical industry forms a critical segment, utilizing these ingredients as essential excipients—serving as binders in tablets, suspension agents in liquid medications, and crucial components in controlled-release drug delivery systems, where purity and precise functional consistency are strictly regulated and non-negotiable.

The industrial sector, including producers of paints, coatings, oilfield drilling fluids, and construction chemicals, constitutes the third key group of buyers. In drilling operations, specialized thickeners control the flow properties of muds, while in construction, they enhance workability and reduce segregation in cement and mortars. These industrial customers prioritize robust performance under extreme conditions (high shear, temperature variations). The diversity of applications underscores that any manufacturer dealing with heterogeneous mixtures or requiring customized rheological properties in their end product represents a high-potential customer for thickeners and stabilizers.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 15.5 Billion |

| Market Forecast in 2033 | USD 24.2 Billion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | CP Kelco, Cargill Incorporated, DuPont de Nemours Inc., Archer Daniels Midland Company (ADM), Ashland Global Holdings Inc., Ingredion Incorporated, Tate & Lyle PLC, Kerry Group, BASF SE, Dow Chemical Company, DSM N.V., Wacker Chemie AG, GELITA AG, Akzo Nobel N.V., Fufeng Group, Nexira, Gelnex, RAHN AG, Novozymes, Hispanagar. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Thickeners and Stabilizers Market Key Technology Landscape

The technology landscape in the Thickeners and Stabilizers Market is rapidly evolving, driven primarily by the need for enhanced functionality, improved stability under harsh processing conditions (high heat, high shear, low pH), and sustainable sourcing methods. A critical area of innovation involves the enzymatic modification of starches and hydrocolloids. Enzymatic techniques allow manufacturers to precisely tailor the molecular structure of natural polysaccharides, optimizing properties such as water binding capacity, cold stability, and resistance to retrogradation, thereby extending the utility of conventional ingredients and providing superior performance compared to traditional chemical modification routes. This enzymatic approach is particularly valued in the clean label sector as it often allows the final product to be labeled without the E-number designation, meeting contemporary consumer demands for simplicity.

Another pivotal technological advancement is the use of microbial fermentation technology to produce high-value hydrocolloids, such as xanthan gum and gellan gum, and to explore novel bio-based stabilizers. Fermentation offers significant advantages over agricultural sourcing, including consistent quality, predictable supply chains independent of climate fluctuations, and the ability to produce unique, high-performance biopolymers that are difficult or impossible to obtain naturally. Companies are investing heavily in strain optimization and bioreactor technology to increase yield and reduce production costs, making fermentation-derived ingredients more competitive across various applications, from specialty food texture to pharmaceutical encapsulation.

Furthermore, nanotechnology and advanced processing technologies are making headway. Microencapsulation techniques are being employed to protect sensitive stabilizing ingredients, ensuring their functionality is released only at the optimal stage of product processing or consumption. High-pressure processing (HPP) and ultra-high temperature (UHT) sterilization processes demand thickeners and stabilizers that maintain their viscosity and structural integrity under extreme thermal and mechanical stress, pushing R&D towards hybrid and multi-functional stabilizers. The integration of high-resolution rheometers and sensory analysis technologies also enables precise measurement and correlation of physical properties with perceived mouthfeel, facilitating the formulation of highly customized texturant systems for specialized industrial applications.

Regional Highlights

- Asia Pacific (APAC): Dominates the market in terms of volume consumption and projected growth rate. This is attributed to massive population growth, rapid urbanization, expansion of the organized retail sector, and the proliferation of local and international packaged food manufacturers. China and India are the primary growth hubs, characterized by increasing demand for instant food mixes, sauces, and functional dairy products, demanding high volumes of cost-effective modified starches and hydrocolloids.

- North America: A mature market characterized by high regulatory standards and a strong consumer focus on health and wellness. Growth is driven primarily by the demand for clean label stabilizers, natural gums (like locust bean gum and guar gum), and texturants used in plant-based alternatives, gluten-free products, and specialized dietary supplements. Innovation is focused on high-purity, premium-priced ingredients for pharmaceutical and high-end cosmetic applications.

- Europe: Highly regulated market emphasizing sustainability and transparency (AEO focus on traceability). The European market is a key adopter of Pectin and Carrageenan, driven by the strong presence of the confectionery, dairy, and meat processing industries. Stringent EU directives regarding food additives continue to push demand towards natural, certified organic texturants, leading to continuous reformulation efforts across the region.

- Latin America (LATAM): Exhibits strong potential, driven by improving economic conditions, increased adoption of Westernized diets, and investment in local food processing capabilities, particularly in Brazil and Mexico. The market requires cost-effective and functionally robust solutions for beverages and ready-to-eat meals, primarily relying on modified starches and lower-cost hydrocolloids.

- Middle East and Africa (MEA): Emerging market exhibiting steady growth, particularly in the Gulf Cooperation Council (GCC) countries, fueled by rapid development of the cosmetics, personal care, and packaged food sectors. Demand is heavily influenced by import trends and the need for stabilizers that perform well under high ambient temperatures, essential for maintaining product integrity in challenging climate conditions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Thickeners and Stabilizers Market.- CP Kelco

- Cargill Incorporated

- DuPont de Nemours Inc.

- Archer Daniels Midland Company (ADM)

- Ashland Global Holdings Inc.

- Ingredion Incorporated

- Tate & Lyle PLC

- Kerry Group

- BASF SE

- Dow Chemical Company

- DSM N.V.

- Wacker Chemie AG

- GELITA AG

- Akzo Nobel N.V.

- Fufeng Group

- Nexira

- Gelnex

- RAHN AG

- Novozymes

- Hispanagar

Frequently Asked Questions

Analyze common user questions about the Thickeners and Stabilizers market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary factors driving the demand for natural thickeners and stabilizers?

The demand for natural thickeners and stabilizers, such as guar gum and pectin, is primarily driven by the global clean label movement. Consumers increasingly seek products with simple, recognizable ingredient lists, leading manufacturers to replace synthetic additives with naturally derived hydrocolloids to meet transparency and health preference trends.

How does the Thickeners and Stabilizers Market segment by material type?

The market is predominantly segmented into three material types: Natural Hydrocolloids (gums, pectins, alginates), Modified Starches (chemically or enzymatically altered starches for enhanced functionality), and Synthetic Polymers (such as carboxymethyl cellulose and carbomers), each serving specific requirements across food, pharma, and industrial sectors.

Which geographical region exhibits the highest growth potential for thickeners and stabilizers?

The Asia Pacific (APAC) region, specifically countries like China and India, is projected to show the highest growth rate. This surge is fueled by rapid urbanization, substantial growth in the processed food industry, and rising disposable incomes driving increased consumption of packaged goods requiring stabilization solutions.

What role does Artificial Intelligence play in the future of texturant formulation?

AI and Machine Learning are crucial for accelerating R&D by predicting optimal ingredient ratios and functional performance. AI helps model complex rheological properties, speeding up the discovery of novel stabilizers and customizing texture profiles for specialized dietary and medical food applications with greater precision.

What are the main regulatory challenges faced by thickener and stabilizer manufacturers?

Key regulatory challenges include the varying approval processes and permissible usage limits across different global jurisdictions (e.g., FDA, EFSA), particularly for novel or modified ingredients. Ensuring compliance with strict purity standards and securing "clean label" certification adds complexity and cost to market entry and operation.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager