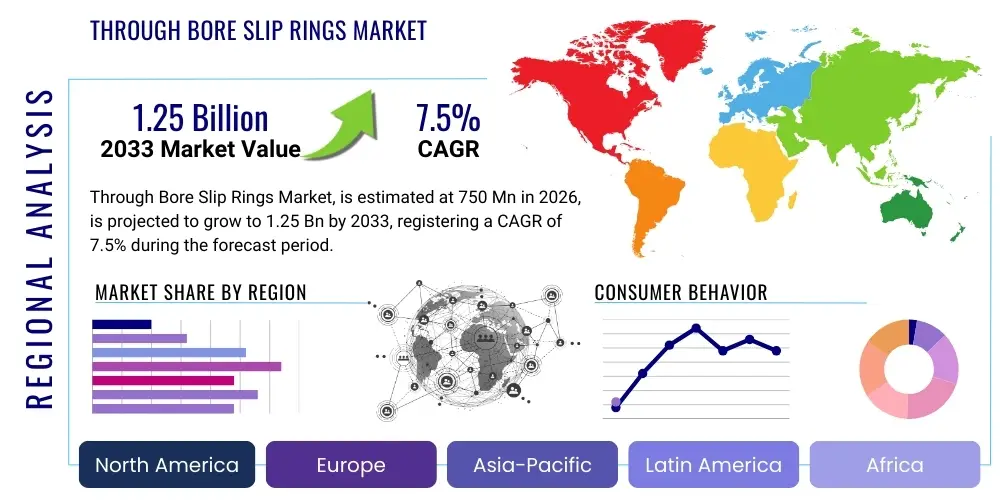

Through Bore Slip Rings Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442891 | Date : Feb, 2026 | Pages : 248 | Region : Global | Publisher : MRU

Through Bore Slip Rings Market Size

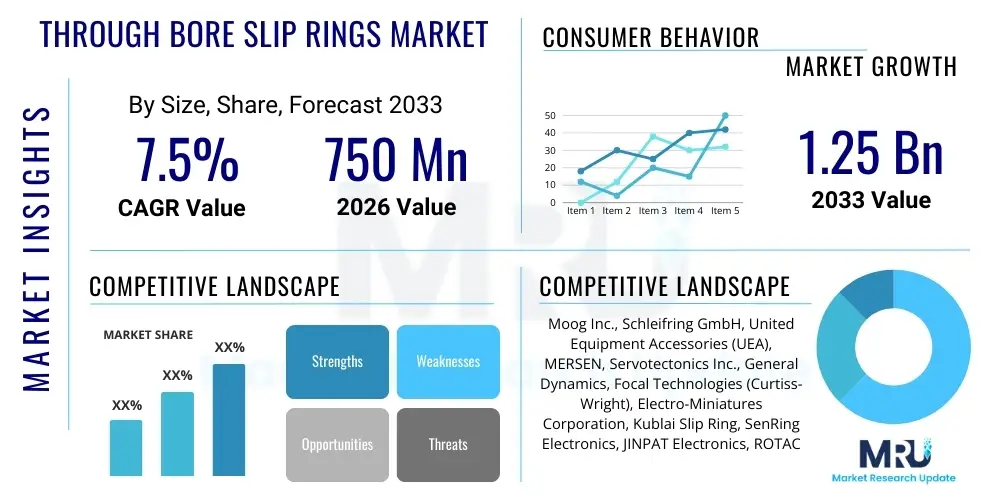

The Through Bore Slip Rings Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.5% between 2026 and 2033. The market is estimated at USD 750 Million in 2026 and is projected to reach USD 1.25 Billion by the end of the forecast period in 2033.

Through Bore Slip Rings Market introduction

The Through Bore Slip Rings Market encompasses devices designed to transmit power, electrical signals, or data (such as Ethernet, profibus, or fiber optic signals) from a stationary platform to a rotating platform. A critical distinguishing feature of the through bore design is the central aperture, which allows for the passage of cables, pipes, or shafts, making them indispensable in systems requiring both rotation and unobstructed central access. These components are essential for maintaining continuous connectivity in complex electromechanical assemblies, particularly those operating in harsh or continuous duty environments. They facilitate 360-degree rotation without tangling wires, thereby enhancing system reliability and operational efficiency across a multitude of high-stakes applications.

Through Bore Slip Rings (TBSRs) are fundamentally utilized in applications demanding high rotational freedom combined with the transmission of multiple media types. Major applications span industrial automation, including robotic arms and rotary tables; renewable energy, specifically in the yaw and pitch control systems of wind turbines; surveillance and defense systems, such as radar and pan-tilt units; and medical imaging equipment like CT and MRI scanners. The fundamental benefit of TBSR technology lies in its ability to ensure uninterrupted, high-integrity signal and power transmission, crucial for real-time control and data acquisition. Modern TBSR units often integrate advanced features like fiber optic rotary joints (FORJs) for high-speed data transfer and specialized sealing for environmental protection, reflecting the increasing demand for high-performance connectivity solutions across critical infrastructure.

The market growth is primarily driven by the exponential expansion of the industrial automation sector globally, fueled by Industry 4.0 initiatives and the widespread adoption of collaborative and articulated robotics. Furthermore, the sustained investment in renewable energy infrastructure, particularly large-scale offshore and onshore wind farms, heavily relies on robust through bore slip ring assemblies for operational stability and maintenance efficiency. The increasing complexity of modern machinery necessitates slip rings capable of handling higher data rates and greater power loads simultaneously, pushing manufacturers toward developing modular, hybrid solutions that integrate electrical power, control signals, and fluid transfer capabilities within a single, compact unit. This technological evolution, combined with growing defense expenditures worldwide focusing on advanced surveillance and radar systems, positions the market for substantial expansion over the forecast period.

Through Bore Slip Rings Market Executive Summary

The Through Bore Slip Rings Market is characterized by robust growth driven primarily by macro-level business trends emphasizing automation, high-speed data requirements, and renewable energy adoption. Key business trends include the shift toward miniaturization and modular design to facilitate integration into increasingly compact robotic and automated systems. Furthermore, demand is surging for hybrid slip rings capable of simultaneously transmitting high power (up to several hundred amps) and high-bandwidth data (multi-gigabit Ethernet or fiber optics), reflecting the complexity of industrial IoT (IIoT) infrastructure. Competitive differentiation is increasingly achieved through providing customized, high-reliability units with extended service lifetimes and features like predictive maintenance sensors integrated into the assembly.

Regional trends indicate that the Asia Pacific (APAC) region currently dominates the market in terms of volume and is projected to exhibit the highest growth rate, fueled by massive investments in manufacturing automation, especially in China, South Korea, and Japan, alongside significant renewable energy expansion. North America and Europe maintain strong positions due to robust defense and aerospace sectors, demanding highly specialized, ruggedized, and certified slip ring solutions. Europe’s prominence is further supported by its advanced wind energy sector and leadership in industrial machinery manufacturing, driving continuous demand for high-precision, reliable electrical rotary joints. Latin America, the Middle East, and Africa (MEA) are emerging as high-potential markets, particularly linked to oil and gas exploration, mining operations, and developing industrial infrastructure projects.

Segment trends reveal that the application segment related to industrial machinery and robotics is the largest consumer, benefiting from global manufacturing modernization efforts. Technologically, the segment focusing on high-speed data transmission, specifically Fiber Optic Rotary Joints (FORJs) and high-speed Ethernet slip rings, is experiencing the fastest acceleration in adoption, reflecting the ubiquity of real-time data processing in modern industrial settings. In terms of end-use material, the use of precious metal contacts (gold-to-gold alloy) continues to dominate high-reliability applications due to superior signal integrity and low electrical noise, even as carbon brush alternatives remain viable for high-current power transfer in applications like cranes and turntables.

AI Impact Analysis on Through Bore Slip Rings Market

User inquiries regarding AI's influence on the Through Bore Slip Rings Market frequently center on predictive maintenance capabilities, manufacturing optimization, and the integration of slip rings within autonomous systems utilizing advanced machine learning algorithms. Users are keen to understand how AI-driven diagnostics can extend the operational life of slip rings, a critical wear component, by detecting minor anomalies (such as slight increases in contact resistance or vibration) before catastrophic failure occurs. Furthermore, there is significant interest in how AI can optimize the manufacturing process itself, enhancing quality control and reducing production variability, especially for complex hybrid or multi-channel units. Finally, the role of high-bandwidth slip rings in enabling the massive data throughput required by autonomous vehicles, advanced robotics, and AI-powered surveillance systems is a core theme, highlighting the necessary evolution of slip ring performance to support AI-enabled applications.

The implementation of Artificial Intelligence within the operational lifecycle of Through Bore Slip Rings is transformative, primarily by shifting maintenance paradigms from reactive to predictive. AI algorithms, trained on vast datasets of vibration, temperature, current, and voltage fluctuations captured via integrated sensors, can accurately model the degradation curve of the slip ring contacts. This capability allows operators to schedule precise, condition-based maintenance interventions, drastically reducing unplanned downtime and lowering overall maintenance costs. This advanced monitoring requires slip rings to not only transfer the necessary operational power and signals but also to incorporate embedded or adjacent sensors and communication channels robust enough to handle the constant stream of diagnostic data essential for effective AI analysis.

In the realm of autonomous machinery and sophisticated data centers—key application areas for through bore slip rings—AI dictates new performance specifications. Robotics and autonomous inspection systems require extremely low latency and high bandwidth for real-time decision-making, compelling slip ring manufacturers to invest heavily in non-contact technologies and advanced FORJs that can transmit data reliably at 10 Gbps and higher, often through the central bore. AI systems rely on the integrity of the data stream provided by these rotary joints; thus, the market trend is toward ensuring superior EMI/RFI shielding and maximizing signal-to-noise ratio in physically demanding environments, thereby enabling the reliable operation of the next generation of AI-driven mechanical systems across industries ranging from deep-sea exploration to advanced manufacturing lines.

- AI-driven Predictive Maintenance: Extends slip ring life by modeling wear patterns and predicting failure points using sensor data.

- Manufacturing Optimization: AI is used for enhanced quality control during assembly and testing, minimizing defects in complex hybrid units.

- High-Speed Data Enablement: Slip rings must handle massive, real-time data streams (10G Ethernet, FORJ) required by AI-powered autonomous systems (robotics, surveillance).

- Anomaly Detection: Machine learning algorithms analyze electrical noise and vibration to detect subtle operational deviations invisible to conventional monitoring.

DRO & Impact Forces Of Through Bore Slip Rings Market

The dynamics of the Through Bore Slip Rings Market are shaped by a complex interplay of facilitating drivers, market limitations (restraints), and emerging opportunities, all subjected to internal and external impact forces. The dominant driver is the pervasive trend of industrial digitization and automation, where the integration of complex robotic and handling systems necessitates reliable, high-channel count rotary interfaces. Alongside this, significant investment in high-speed military and commercial radar systems and the expansion of the wind energy sector (especially multi-megawatt turbines requiring large bore slip rings) provide strong, continuous impetus for market expansion. However, restraints include the technical challenge of integrating high-data-rate signals (e.g., fiber optics) with high-current power in a compact package, high initial procurement costs for specialized, custom-engineered units, and the inherent wear-and-tear nature of contact-based technology, which demands regular maintenance and replacement, thus impacting total cost of ownership.

Opportunities for growth are predominantly found in the technological leap toward non-contact, inductive, and capacitive power and data transfer systems, which promise zero wear, higher speeds, and drastically reduced maintenance requirements, thereby offering a highly attractive proposition for high-duty cycle applications. Furthermore, the emerging market for advanced surveillance, satellite communication ground stations, and unmanned aerial and underwater vehicles (UAVs/UUVs) presents niche, high-value opportunities demanding ultra-reliable, environmentally sealed, and miniature through bore solutions. The development of standardized, modular designs that can be quickly adapted to diverse application requirements is also a critical opportunity for manufacturers to gain competitive advantage and penetrate smaller industrial segments more efficiently. Successfully navigating the balance between ruggedization, miniaturization, and high performance remains central to capitalizing on these emerging market spaces.

Key impact forces affecting this market include stringent regulatory requirements in the aerospace and defense sectors governing materials and performance standards, which raise the barrier to entry for new competitors. Economic fluctuations directly influence capital expenditure in manufacturing and infrastructure projects, causing cyclical volatility in demand. Technological innovation, specifically the ongoing push towards 400G and 800G data transfer rates, compels slip ring manufacturers to accelerate R&D efforts to keep pace with overall network speed improvements. Finally, supply chain robustness, particularly concerning precious metals (gold, silver) used for contact surfaces and high-precision machining capabilities, exerts a foundational influence on manufacturing costs and lead times, determining the overall efficiency and profitability of market operations.

Segmentation Analysis

The Through Bore Slip Rings market is meticulously segmented based on key structural, functional, and application characteristics to reflect the diverse needs of end-user industries. Primary segmentation revolves around the type of bore size, contact material, channel count, and the specific application sector they serve. This structural differentiation is essential because a slip ring designed for a small robotic arm (low current, high signal count, small bore) differs vastly from one used in a massive wind turbine (high current, large bore, harsh environment sealing). Analyzing these segments provides strategic insights into which product variations are experiencing the most rapid adoption and where future research and development resources should be concentrated to meet evolving industrial requirements. The complexity of modern machinery often necessitates hybrid configurations, which are now forming a distinct and rapidly growing sub-segment of the market.

By Contact Type, the market is primarily divided into three categories: precious metal contact slip rings, generally using gold-to-gold alloys for superior signal integrity in low-power/high-data applications; carbon brush or graphite contact slip rings, favored for high-current power transmission due to their robustness; and mercury-wetted contact slip rings (though facing environmental regulatory challenges), known for extremely low noise and resistance. Segmentation by Data Transfer Capacity is also critical, distinguishing between simple analog signal transmission, conventional industrial Ethernet/fieldbus systems, and high-bandwidth Fiber Optic Rotary Joints (FORJs) necessary for sophisticated sensor fusion and real-time processing in advanced systems like LiDAR-enabled robotics or high-definition surveillance. The fastest growth is observed within segments demanding high bandwidth and low maintenance, correlating directly with the push toward Industry 4.0 connectivity.

Application segmentation remains a vital dimension, with industrial automation (including packaging, material handling, and factory robotics), defense and aerospace (radar, fire control systems, ground vehicles), and renewable energy (wind turbine yaw and pitch mechanisms) representing the major consuming sectors. A detailed examination of these application areas reveals varying regional demand characteristics; for example, North America and Europe show high demand in defense and renewable energy, while APAC drives consumption primarily through high-volume factory automation. Furthermore, emerging applications in medical equipment (diagnostic imaging, surgical robots) and marine technology (ROVs, subsea tooling) are poised for significant expansion, necessitating TBSRs with superior sealing, sterilization capabilities, and resistance to extreme pressure or corrosive environments.

- By Type:

- Standard Through Bore

- Pancake Through Bore

- Capsule Through Bore

- Hybrid (Integrating electrical, data, and fluidic)

- By Contact Material:

- Precious Metal (Gold Alloy)

- Carbon/Graphite Brush

- Silver Graphite

- By Application:

- Industrial Automation and Robotics

- Renewable Energy (Wind Turbines)

- Aerospace and Defense (Radar, Satellite)

- Medical Imaging (CT, MRI)

- Marine and Oil & Gas (ROVs, Drilling Rigs)

- Construction and Heavy Equipment

- By Data Transmission:

- Electrical Signals and Power

- Ethernet (100Base-T, Gigabit)

- Fiber Optic Rotary Joints (FORJ)

Value Chain Analysis For Through Bore Slip Rings Market

The value chain for the Through Bore Slip Rings Market begins with the upstream suppliers of critical raw materials and components, which include specialized engineering plastics, high-conductivity copper and aluminum alloys, precision bearings, and, most crucially, precious metals such as gold, silver, and palladium required for contact surfaces. The quality and availability of these materials directly impact the final product's performance, cost, and reliability. Upstream analysis highlights that the volatility in precious metal prices and the requirement for highly specialized sourcing for low-noise, durable contact materials present inherent supply risks. Suppliers specializing in high-tolerance, miniature bearings and advanced elastomer seals are also vital, ensuring the longevity and environmental protection of the final assembled unit, particularly for defense and offshore applications.

The core manufacturing and assembly stage involves high-precision machining (CNC turning, grinding), specialized plating processes for contacts, and cleanroom assembly for sensitive signal rings or fiber optic components. This middle stage is highly technology-intensive, requiring expertise in rotary electrical engineering, electromagnetics, and mechanical design to optimize signal integrity (minimizing cross-talk and noise) while maximizing power density. Companies that integrate advanced testing and quality assurance procedures, often utilizing automated testing rigs to simulate operational load and environment, possess a distinct competitive advantage. The trend toward modular design helps streamline production, allowing manufacturers to combine various standardized elements—such as power rings, signal rings, and FORJs—into customized configurations rapidly.

The downstream distribution channels are multifaceted, comprising direct sales to large Original Equipment Manufacturers (OEMs) in sectors like wind energy, aerospace, and defense, where highly customized solutions and long-term supply contracts are standard. Indirect channels involve distributors, system integrators, and value-added resellers (VARs) who cater primarily to smaller industrial automation firms and the aftermarket segment. OEMs prefer direct engagement for technical consultation and integration support, while the replacement and maintenance market often relies on the broad inventory and logistical capabilities of specialized industrial distributors. The service component, including installation, commissioning, and predictive maintenance contracts (often tied to AI monitoring), is an increasingly important downstream activity, contributing significantly to revenue, especially for high-reliability applications where uptime is paramount.

Through Bore Slip Rings Market Potential Customers

The primary consumers, or potential customers, of Through Bore Slip Rings are large industrial entities and government organizations whose operations rely on continuous rotational machinery requiring concurrent data and power transmission. Key buyers include manufacturers of multi-axis robots and factory automation systems, who purchase high-channel, compact slip rings for articulated joints and rotary tables to ensure 24/7 operation on assembly lines. Another major purchasing group consists of global wind turbine manufacturers (e.g., Vestas, Siemens Gamesa), who procure high-current, large-bore units designed to withstand extreme weather conditions for pitch and yaw control systems critical to maximizing energy capture and maintaining structural integrity in vast wind farms, both onshore and offshore.

The defense and aerospace sectors represent high-value, stringent buyers. Defense contractors require ruggedized, environmentally sealed, and EMI-compliant through bore slip rings for use in ground-based radar systems, missile guidance platforms, and advanced surveillance vehicles. These customers demand adherence to specific military and aerospace standards (e.g., MIL-STD specifications) and typically prioritize reliability and signal integrity over cost, fostering a highly specialized, custom-engineered market segment. Similarly, producers of sophisticated medical diagnostic equipment, such as computed tomography (CT) scanners and magnetic resonance imaging (MRI) machines, are crucial customers, demanding extremely low-noise, high-speed rotary joints to ensure crystal-clear signal transmission necessary for accurate patient imaging.

Furthermore, the rapidly expanding marine and subsea industry, encompassing Remotely Operated Vehicles (ROVs), drilling platforms, and oceanographic research equipment, constitutes an important customer base. These applications necessitate TBSRs with superior pressure compensation, advanced fluid sealing mechanisms, and corrosion-resistant housings to operate reliably in deep-sea environments. The emerging segment of autonomous vehicle testing platforms and drone infrastructure also presents a growing customer segment, seeking standardized yet robust slip rings to handle the complex communication and power needs of rotating sensor clusters (like LiDAR) essential for navigational accuracy. These diverse end-user applications underscore the versatility and necessity of through bore slip ring technology across the global industrial and technological landscape.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 750 Million |

| Market Forecast in 2033 | USD 1.25 Billion |

| Growth Rate | 7.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Moog Inc., Schleifring GmbH, United Equipment Accessories (UEA), MERSEN, Servotectonics Inc., General Dynamics, Focal Technologies (Curtiss-Wright), Electro-Miniatures Corporation, Kublai Slip Ring, SenRing Electronics, JINPAT Electronics, ROTAC, BGB Technology, Rotacomp, Zhejiang Kaili Electric. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Through Bore Slip Rings Market Key Technology Landscape

The technological landscape of the Through Bore Slip Rings Market is marked by continuous innovation aimed at overcoming the limitations of traditional sliding contact technology, focusing primarily on achieving higher reliability, reduced maintenance, and superior data integrity at increasing rotational speeds. A dominant trend is the integration of Fiber Optic Rotary Joints (FORJs) into the central bore alongside traditional electrical rings. FORJs are indispensable for high-bandwidth, noise-immune communication (e.g., high-definition video, multi-gigabit Ethernet) required by modern sensor packages and communication systems, effectively replacing electrical connections where data rate or signal quality is paramount. This integration allows for true hybrid functionality, supporting both high-power transfer and ultra-fast data transfer within a single, space-efficient unit, a crucial requirement for advanced wind turbines and sophisticated radar arrays.

Another significant technological advancement involves the development and proliferation of non-contact slip ring solutions. Technologies such as inductive coupling for power transfer and capacitive or radio frequency (RF) coupling for data transmission are gaining traction. Inductive power transfer eliminates physical wear, drastically reducing maintenance cycles and enabling operation in extremely hostile or high-speed environments where contact wear would be prohibitive. While non-contact solutions currently face challenges regarding power density and channel count compared to physical contact methods, continuous improvements in magnetic materials and coil design are rapidly closing this gap, positioning non-contact technology as a major disruptive force in the market over the next decade, especially for applications demanding minimal downtime and maximum lifespan.

Furthermore, manufacturers are heavily investing in improving mechanical design aspects, including advanced sealing techniques and materials for environmental protection (IP68 and beyond), which are essential for marine, oil and gas, and outdoor defense applications. The adoption of robust encoder technology and digital communication protocols (e.g., EtherCAT, PROFINET) directly within the slip ring assembly is enhancing the unit's intelligence and interoperability within complex industrial networks. Material science research focuses on optimizing precious metal alloy compositions and surface finishes to further minimize contact resistance and electrical noise while extending the operational life of the contact brushes and rings, ensuring that physical contact slip rings maintain their performance advantage in high-channel density and critical power transfer roles.

Regional Highlights

- North America: This region represents a mature and high-value market, heavily influenced by the robust defense and aerospace sectors. Demand is characterized by a strong requirement for ruggedized, highly certified, and customized slip rings for military radar, surveillance aircraft, and ground vehicle platforms. Furthermore, substantial investment in advanced industrial automation, particularly in specialized manufacturing and high-tech sectors, ensures consistent demand for sophisticated, high-speed data transmission slip rings, including FORJs. The presence of leading technology developers and stringent quality standards (e.g., export compliance and MIL specifications) drives premium pricing and technological leadership in this region.

- Europe: Europe is a key market, distinguished by its leadership in the renewable energy sector and advanced industrial machinery manufacturing (especially Germany and Italy). The massive installed base of onshore and offshore wind farms creates persistent demand for large-bore, high-current slip ring assemblies for yaw and pitch control. The region also maintains a strong focus on industrial IoT and high-precision robotics, necessitating compact, high-channel density units with integrated sensor technology and robust communication protocols (like EtherCAT). Strict environmental and safety regulations also drive demand for reliable, long-life, and certified components.

- Asia Pacific (APAC): APAC is the fastest-growing and largest volume market, driven by expansive manufacturing bases, rapid urbanization, and extensive infrastructure development, particularly in China, Japan, and South Korea. The relentless expansion of factory automation, robotics adoption in diverse manufacturing fields, and large-scale wind energy projects fuel exponential growth. Demand here often favors a balance between cost-effectiveness and performance, although high-tech economies like Japan and South Korea demonstrate strong appetite for cutting-edge, high-bandwidth slip rings for consumer electronics manufacturing and specialized machinery.

- Latin America (LATAM): The LATAM market is growing steadily, primarily driven by resource extraction industries, including mining and oil & gas exploration. These sectors require durable, heavy-duty through bore slip rings capable of operating reliably in harsh environmental conditions, often prioritizing high-current and robust mechanical designs. Infrastructure projects and emerging industrialization efforts contribute to market expansion, albeit typically focusing on more conventional industrial-grade slip rings rather than highly specialized defense or aerospace units.

- Middle East and Africa (MEA): MEA presents a high-potential market linked to oil and gas infrastructure expansion, defense modernization programs, and developing logistics hubs. Significant defense spending in the Middle East drives demand for high-specification radar and surveillance slip rings. In Africa, growth is associated with large-scale mining, port crane operations, and nascent renewable energy projects, requiring slip rings with high resistance to dust, heat, and corrosive agents. Market penetration is often linked to major government investment cycles and foreign direct investment in core industrial sectors.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Through Bore Slip Rings Market.- Moog Inc.

- Schleifring GmbH

- United Equipment Accessories (UEA)

- MERSEN

- Servotectonics Inc.

- General Dynamics

- Focal Technologies (Curtiss-Wright)

- Electro-Miniatures Corporation

- Kublai Slip Ring

- SenRing Electronics

- JINPAT Electronics

- ROTAC

- BGB Technology

- Rotacomp

- Zhejiang Kaili Electric

- Cavotec SA

- Dynapar

- Slip Ring Technologies, Inc.

- DEHN Inc.

- Conductix-Wampfler

Frequently Asked Questions

Analyze common user questions about the Through Bore Slip Rings market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the demand for Through Bore Slip Rings?

The primary driver is the rapid global expansion of industrial automation and robotics, specifically driven by Industry 4.0 initiatives. This requires continuous power and high-speed data transfer across rotating joints without obstruction, making TBSRs indispensable for articulated machinery and rotary tables.

How are Fiber Optic Rotary Joints (FORJs) impacting the market?

FORJs are enabling the transfer of ultra-high-bandwidth data (multi-gigabit Ethernet, high-definition video) through the central bore, a critical requirement for advanced radar systems, medical imaging, and autonomous vehicles. Their integration into hybrid TBSRs is enhancing overall system performance and noise immunity.

Which application segment holds the largest share in the Through Bore Slip Rings Market?

The Industrial Automation and Robotics segment holds the largest market share, utilizing TBSRs extensively in complex assembly lines, packaging machinery, and automated material handling systems where 360-degree rotation capability is essential for maximized operational uptime and efficiency.

What are the main restraints affecting market growth?

Key restraints include the high initial cost of custom-engineered, specialized units (especially those incorporating FORJs or advanced sealing), and the inherent technical challenge of managing wear and tear associated with physical contact technology, necessitating periodic maintenance and component replacement.

How is AI technology influencing the future of slip rings?

AI is primarily used to enhance predictive maintenance capabilities by analyzing sensor data (vibration, temperature, resistance) to anticipate component failure. This shift extends the operational life of slip rings, reduces unscheduled downtime, and supports the reliability demands of autonomous systems.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager