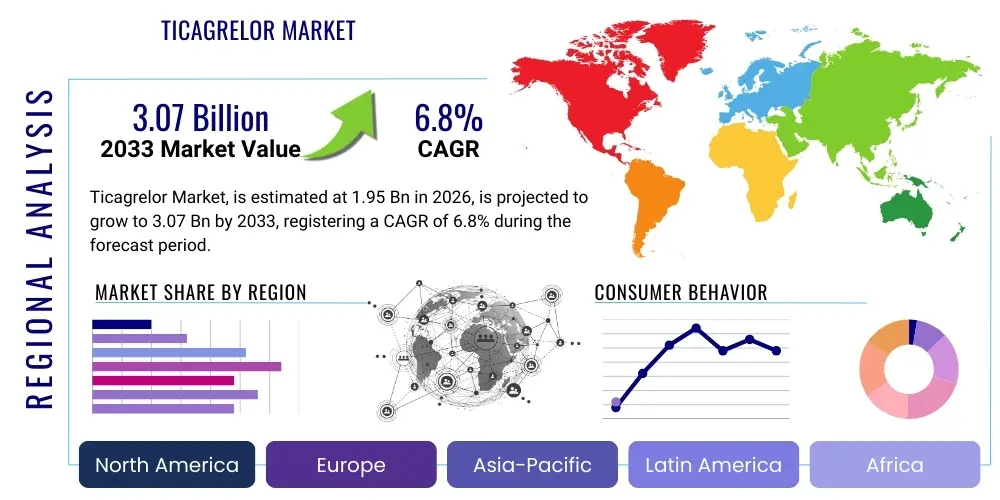

Ticagrelor Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441122 | Date : Feb, 2026 | Pages : 241 | Region : Global | Publisher : MRU

Ticagrelor Market Size

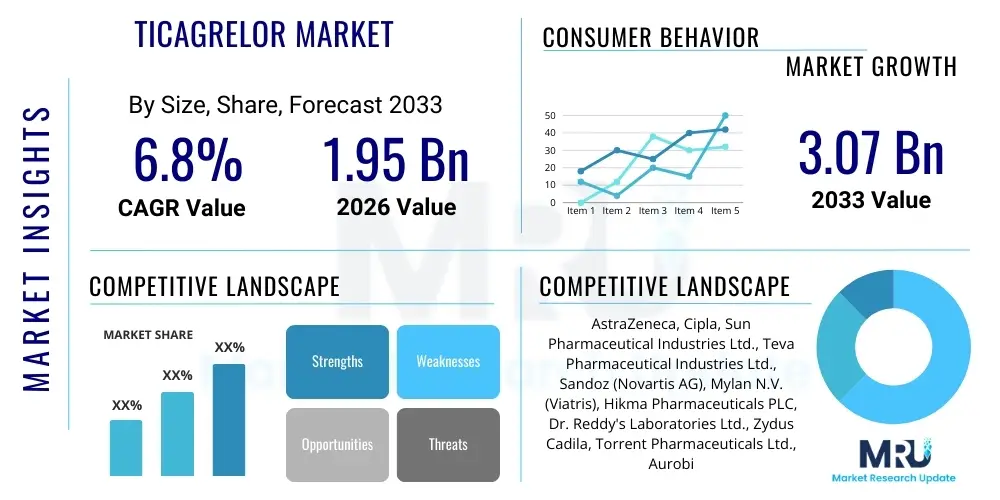

The Ticagrelor Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at $1.95 Billion in 2026 and is projected to reach $3.07 Billion by the end of the forecast period in 2033.

Ticagrelor Market introduction

The Ticagrelor Market encompasses the global commercial landscape for the reversible P2Y12 receptor antagonist used primarily in the management of Acute Coronary Syndromes (ACS) and preventing recurrent atherothrombotic events. Ticagrelor, often marketed under the brand name Brilinta or Brilique, represents a significant advancement in antiplatelet therapy due to its unique mechanism of action compared to older generation thienopyridines. This mechanism allows for faster onset and offset of antiplatelet activity, which is crucial in acute clinical settings like myocardial infarction (MI) and unstable angina. The drug is typically administered as part of a dual antiplatelet therapy (DAPT) regimen, often combined with aspirin, following percutaneous coronary intervention (PCI) or for patients with a history of MI.

Major applications of Ticagrelor extend beyond acute care to long-term secondary prevention strategies. Clinical trials, notably the PLATO study, established its superiority in reducing the rate of cardiovascular death, MI, or stroke compared to clopidogrel in certain patient populations. Key benefits driving market adoption include its potent efficacy, reversible binding capability, and demonstrated clinical advantages in high-risk patients. Furthermore, the expansion of its indications to include patients with a high risk of stroke following an acute ischemic event, often in combination with aspirin for a short duration, has broadened its therapeutic scope and commercial potential across various cardiovascular care pathways globally. The increasing prevalence of cardiovascular diseases (CVDs) worldwide, coupled with improved diagnostic capabilities and standardized treatment protocols, significantly fuels demand for highly effective antiplatelet agents like Ticagrelor.

Driving factors for the market growth are multifaceted, including the global rise in sedentary lifestyles, obesity, and diabetes, which collectively increase the incidence of coronary artery disease (CAD). Technological advancements in interventional cardiology, such as the frequent use of PCI, necessitate reliable and fast-acting antiplatelet support. Furthermore, increasing awareness among healthcare providers regarding evidence-based guidelines recommending Ticagrelor for specific ACS cohorts, alongside improving access to specialized cardiac care centers in emerging economies, are pivotal in sustaining the market's positive growth trajectory. Patent expiration and the subsequent introduction of generic versions also play a critical role, potentially increasing accessibility and volume sales, though impacting overall average selling prices (ASPs) in the long term.

Ticagrelor Market Executive Summary

The Ticagrelor market is characterized by robust business trends driven by expanding therapeutic indications and the transition towards biosimilars and generics following key patent expirations. A critical trend involves pharmaceutical companies focusing on life cycle management, including developing lower-dose formulations (e.g., 60 mg) for extended secondary prevention, thereby expanding the duration of treatment and total patient pool. Furthermore, strategic collaborations between drug manufacturers and cardiovascular device companies (e.g., stent providers) are becoming prevalent to integrate comprehensive care solutions, emphasizing the importance of DAPT adherence post-procedure. The market exhibits high competition, necessitating aggressive promotional strategies and rigorous post-marketing surveillance to maintain efficacy and safety profiles against established and emerging antiplatelet competitors, including new oral anticoagulants (NOACs) that sometimes intersect in patient management protocols.

Regional trends highlight significant growth opportunities in the Asia Pacific (APAC) region, particularly in China and India, driven by rapidly increasing healthcare expenditure, improving medical infrastructure, and a substantial, aging population facing a rising burden of CVD. While North America and Europe remain the primary revenue generators due to established treatment protocols and high per capita spending on specialty pharmaceuticals, these regions are increasingly facing pricing pressure and generic erosion. Conversely, Latin America and the Middle East and Africa (MEA) are seeing accelerated adoption, often led by government initiatives aimed at reducing cardiovascular mortality and integrating global clinical guidelines into local practices. The implementation of favorable reimbursement policies in developed markets continues to stabilize demand, counteracting the downward pressure from generic competition.

Segment trends indicate that the major revenue source continues to be the management of acute coronary syndromes, yet the secondary prevention segment, characterized by prolonged, lower-dose therapy, is poised for the fastest volumetric growth. By route of administration, the oral solid dosage form dominates the market, being the standard and most convenient method for chronic use. The institutional segment, comprising hospitals and specialized cardiac centers, accounts for the largest share of procurement due to initial loading doses and immediate post-procedure prescriptions, although the retail pharmacy segment is expanding rapidly as patients transition to long-term outpatient management. Focus is also shifting towards personalized dosing strategies, potentially creating new segmentation based on patient characteristics and risk stratification tools, often leveraging advanced genetic testing or pharmacogenomics.

AI Impact Analysis on Ticagrelor Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Ticagrelor market frequently center on three core themes: enhancing drug discovery and repurposing efforts for novel P2Y12 inhibitors, optimizing clinical trial design and patient recruitment efficiency, and developing personalized medicine approaches for antiplatelet therapy. Users are particularly keen on understanding how AI can predict patient response variability to Ticagrelor, identify non-responders or those prone to bleeding complications, and ultimately guide optimal dosing strategies. Concerns often revolve around the validation of AI-derived predictive models in real-world clinical settings and the integration of AI tools into standard cardiology workflows. Expectations are high regarding AI's ability to minimize adverse events associated with DAPT and maximize therapeutic benefit, moving beyond the current one-size-fits-all approach to platelet inhibition.

AI is transforming the pharmacovigilance and adherence aspects of the Ticagrelor market. Machine learning algorithms are increasingly utilized to analyze vast amounts of electronic health record (EHR) data to monitor real-time safety signals, identify potential drug interactions, and assess patient adherence patterns post-discharge. This proactive approach allows healthcare systems and manufacturers to intervene earlier, reducing complications and improving overall treatment efficacy. For manufacturers, AI-driven analysis of competitive landscapes, including the performance data of generic equivalents, helps refine marketing strategies and anticipate shifts in prescriber behavior based on real-world evidence (RWE) generation. This deep data analytics capability provided by AI fosters a more responsive and data-driven market environment.

Furthermore, the integration of AI into companion diagnostics development promises significant market evolution. AI algorithms can analyze complex genetic and metabolic profiles to predict an individual's metabolism of Ticagrelor, guiding the selection between Ticagrelor and other P2Y12 inhibitors like clopidogrel or prasugrel, thereby supporting precision cardiology initiatives. The use of natural language processing (NLP) and image recognition in analyzing patient imaging data (e.g., cardiac CT or angiography) combined with clinical biomarkers can refine patient risk stratification for ACS recurrence, identifying the specific cohort most likely to benefit maximally from Ticagrelor, thus optimizing resource allocation and patient outcomes globally.

- AI-driven drug repurposing accelerates identification of potent, next-generation P2Y12 inhibitors.

- Machine learning optimizes clinical trial design, improving patient selection and trial efficiency for new indications or formulations.

- Predictive analytics enhance personalized dosing and risk stratification, minimizing bleeding risks and maximizing efficacy.

- AI improves pharmacovigilance by analyzing RWE for faster detection of adverse event patterns and safety signals.

- NLP and data mining analyze prescribing trends and physician feedback to inform commercial strategies and market penetration.

- Integration of AI with genetic data facilitates companion diagnostics for optimal antiplatelet regimen selection.

DRO & Impact Forces Of Ticagrelor Market

The dynamics of the Ticagrelor market are governed by a complex interplay of Drivers, Restraints, and Opportunities (DRO). Key drivers include the escalating global prevalence of cardiovascular diseases, the definitive clinical evidence supporting Ticagrelor's superior efficacy in reducing major adverse cardiovascular events (MACE) compared to older alternatives in high-risk patients, and the rapid expansion of invasive cardiology procedures such as PCI globally. Simultaneously, the market faces significant restraints, primarily the cost associated with branded Ticagrelor (though mitigated by generic entry), the risk of major bleeding events requiring careful monitoring, and compliance issues related to the mandatory twice-daily dosing regimen, which is often cited as a barrier compared to once-daily alternatives. The main opportunities lie in expanding therapeutic applications into non-ACS patient populations (e.g., peripheral artery disease, long-term secondary prevention), penetrating underserved emerging markets, and capitalizing on fixed-dose combination therapies that enhance patient adherence.

Impact forces acting on the market are centered around regulatory, technological, and competitive pressures. Regulatory scrutiny ensures high manufacturing standards and demands extensive post-marketing studies to confirm long-term safety, impacting development costs. Technological advancements in stent technology require continuous adjustment of DAPT duration and strategy, creating specialized market niches. The competitive landscape is intensely shaped by the introduction of generic versions following patent expiration in major markets like the US and EU, which significantly impacts pricing power and market share distribution among manufacturers. Furthermore, the development pipeline for alternative P2Y12 inhibitors and non-P2Y12 antiplatelet/antithrombotic agents poses a continuous threat, forcing branded manufacturers to innovate in formulations and expand indications to maintain market relevance and premium positioning.

The societal shift towards preventive healthcare and the increased emphasis on reducing recurrence of cardiovascular events provide strong underlying support for the market growth. However, healthcare system budget constraints, particularly in emerging economies and payer-driven healthcare models, necessitate strong pharmacoeconomic data to justify the continued high usage of Ticagrelor over lower-cost generic alternatives like clopidogrel. The successful navigation of these forces—leveraging clinical superiority while addressing cost and safety concerns—will determine the long-term profitability and overall penetration of the Ticagrelor market globally. Strategic management of intellectual property disputes and timely generic launches are crucial tactical elements defining the near-term competitive environment.

- Drivers: Rising incidence of ACS and MI; established clinical superiority in high-risk populations; increased adoption of PCI procedures; guideline recommendations.

- Restraints: Risk of bleeding complications; high cost of therapy (prior to genericization); compliance challenges due to twice-daily dosing; presence of established, lower-cost alternatives.

- Opportunities: Expansion into long-term secondary prevention (lower dose); potential for fixed-dose combinations (FDCs); market penetration in underserved APAC and LATAM regions; use in acute ischemic stroke prevention.

- Impact Forces: Generic erosion and pricing pressure; stringent regulatory requirements; intense competition from other antithrombotic classes (e.g., Factor Xa inhibitors); advancements in precision medicine for antiplatelet selection.

Segmentation Analysis

The Ticagrelor market segmentation provides a granular view of revenue generation across different therapeutic applications, dosage strengths, and distribution channels. The market is primarily segmented based on indications, where ACS management (including MI and unstable angina) historically accounts for the dominant share, given the critical need for aggressive platelet inhibition immediately following an event. However, the segmentation is rapidly evolving with the growing importance of the secondary prevention segment, which involves the long-term use of lower-dose Ticagrelor (60 mg) to prevent future ischemic events in patients with a history of MI. Further segmentation by dosage strength highlights the contrast between the standard 90 mg dose used for loading and maintenance in the acute phase, and the 60 mg dose for extended maintenance, reflecting differing patient needs and treatment protocols over time. Analyzing distribution channels, the split between institutional sales (hospitals, cardiac clinics) and retail/online pharmacies demonstrates the shift from acute care to outpatient management, revealing key procurement patterns and logistical complexities within the pharmaceutical supply chain.

Segmentation by route of administration remains focused almost exclusively on the oral route, reflecting patient convenience and standard practice for antiplatelet therapy. Geographical segmentation is vital for understanding regional growth disparities, with developed markets stabilizing due to generic entry, while developing markets offer higher volumetric expansion potential due to improving healthcare infrastructure. The future of segmentation is likely to incorporate pharmacogenomic sub-groups, allowing for targeted marketing and prescription based on patient genetic profiles that influence drug metabolism and efficacy, aligning with the broader trend of precision medicine in cardiology. This refined segmentation helps market participants tailor commercial strategies, including pricing and marketing efforts, to specific high-value patient groups and regions, optimizing overall market penetration and revenue capture amidst rising competition.

Understanding the interplay between these segments is crucial for accurate forecasting. For instance, the growth rate of the 60 mg secondary prevention segment is inherently tied to the initial volume of the 90 mg ACS treatment segment, creating a predictable pipeline of patients transitioning to long-term therapy. Manufacturers must therefore ensure seamless logistical supply across both institutional and retail channels to support this continuum of care. The evolving guidelines by bodies such as the European Society of Cardiology (ESC) and the American Heart Association/American College of Cardiology (AHA/ACC) continuously influence which segments experience the most rapid growth, driving demand fluctuations across different dosage strengths and treatment durations. This reliance on guideline updates ensures that clinical evidence remains a paramount factor dictating market segment performance and strategic planning.

- By Indication:

- Acute Coronary Syndrome (ACS) Management

- Secondary Prevention of Atherothrombotic Events (Post-MI)

- Acute Ischemic Stroke or Transient Ischemic Attack (TIA)

- By Dosage Strength:

- 90 mg (Standard Loading and Maintenance)

- 60 mg (Extended Maintenance Therapy)

- By Distribution Channel:

- Institutional Sales (Hospitals, Cardiac Centers)

- Retail Pharmacies

- Online Pharmacies

- By Geography:

- North America (US, Canada)

- Europe (Germany, France, UK, etc.)

- Asia Pacific (China, Japan, India)

- Latin America (Brazil, Mexico)

- Middle East and Africa (MEA)

Value Chain Analysis For Ticagrelor Market

The value chain for the Ticagrelor market begins with extensive upstream activities centered on Research and Development (R&D) and active pharmaceutical ingredient (API) manufacturing. The R&D phase involves complex clinical trials (Phase I-III) necessary to establish efficacy, safety, and gain regulatory approvals for both the primary drug and any subsequent new formulations or indications (e.g., 60 mg dose, stroke prevention). API synthesis, a highly specialized chemical process, constitutes a significant cost component, and key manufacturers often rely on internal capacity or strategic outsourcing to specialized contract manufacturing organizations (CMOs). Upstream analysis reveals critical dependencies on securing high-quality raw materials and managing the complex chemical synthesis pathways, especially as generic manufacturers enter the market and seek to optimize production costs without compromising bioequivalence and stability, which often leads to intense negotiation pressures on raw material suppliers.

Midstream activities involve formulation, manufacturing of the finished dosage form (tablets), quality assurance, packaging, and regulatory filing/compliance across multiple jurisdictions. Once manufactured, the downstream distribution network becomes crucial. This channel relies on a mix of direct and indirect distribution strategies. Direct channels involve manufacturers shipping directly to large institutional buyers, such as major hospital systems or government procurement bodies, allowing for better control over inventory and pricing, which is crucial for managing initial loading doses in acute settings. Indirect channels involve utilizing wholesalers, distributors, and third-party logistics (3PL) providers to reach smaller hospitals, retail pharmacies, and ultimately, the end patient. This multi-layered distribution ensures broad market access, especially important for the long-term maintenance therapy segment handled predominantly by retail outlets.

The success of the downstream component hinges on effective inventory management, cold chain logistics (though not strictly necessary for Ticagrelor, robust security and anti-counterfeiting measures are required), and strong relationships with key stakeholders, including cardiologists, specialized prescribers, and pharmacy benefit managers (PBMs) in markets like the US. PBMs and insurance providers hold substantial power in determining formulary placement and patient access, heavily influencing indirect channel performance. Generic entry intensifies the need for distribution efficiency, as generic manufacturers typically compete solely on price and volume. Overall, efficient coordination across the R&D, manufacturing, and complex global distribution networks is essential to maintain supply integrity and ensure timely availability of this critical cardiovascular drug in both acute and chronic care settings globally.

Ticagrelor Market Potential Customers

The primary potential customers and end-users of Ticagrelor are patients requiring potent and rapid antiplatelet therapy, specifically those experiencing or at high risk of acute atherothrombotic events. The direct institutional buyers are specialized cardiac care centers, general hospitals with cardiology departments, and outpatient clinics that manage high-risk cardiovascular patients. These institutions are the procurement points for the high-dose Ticagrelor used immediately following diagnoses such as unstable angina, NSTEMI, or STEMI, often facilitated by centralized procurement departments responding to formulary decisions made by hospital pharmacy and therapeutics (P&T) committees. Cardiologists and interventional cardiologists act as key influencers and prescribers, driving the initial demand and selection of antiplatelet agents based on clinical guidelines and patient risk profiles.

A second major customer segment includes retail pharmacies and mail-order pharmacy services, which cater predominantly to patients requiring long-term, chronic management with Ticagrelor, including the lower-dose 60 mg option. These retail channels interface directly with the patients and are heavily influenced by payer reimbursement decisions and patient out-of-pocket costs. Pharmacy benefit managers (PBMs) are thus indirect but immensely powerful customers, as their decisions regarding formulary tiers and preferred drug status dictate the market share distribution between the branded drug and its generic counterparts, influencing pharmacy stock decisions and patient fulfillment rates. Government healthcare programs, particularly those focused on chronic disease management and subsidies, also represent large-scale institutional buyers, especially in markets like the UK (NHS) or countries with centralized national health services.

The third tier of potential customers includes specialized research centers and academic institutions that purchase Ticagrelor for use in ongoing Phase IV clinical trials or observational studies aimed at expanding its clinical utility or comparing its performance against novel anticoagulants and antiplatelet drugs. Manufacturers also focus on payers (insurers and government bodies) as critical stakeholders, recognizing that favorable reimbursement status is mandatory for sustained market success and broad patient access. The overall market strategy must therefore target prescribers with clinical evidence, institutions with cost-effectiveness data, and payers with pharmacoeconomic justifications to ensure robust uptake and inclusion in national treatment guidelines, securing the long-term customer base across the entire continuum of cardiovascular care.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $1.95 Billion |

| Market Forecast in 2033 | $3.07 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | AstraZeneca, Cipla, Sun Pharmaceutical Industries Ltd., Teva Pharmaceutical Industries Ltd., Sandoz (Novartis AG), Mylan N.V. (Viatris), Hikma Pharmaceuticals PLC, Dr. Reddy's Laboratories Ltd., Zydus Cadila, Torrent Pharmaceuticals Ltd., Aurobindo Pharma, Hetero Labs, Lupin Limited, Amgen Inc., Bristol-Myers Squibb Company, Eli Lilly and Company, Pfizer Inc., Johnson & Johnson, Bayer AG, Sanofi S.A. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Ticagrelor Market Key Technology Landscape

The key technology landscape surrounding the Ticagrelor market is primarily centered on advancements in cardiovascular diagnostics, pharmacogenomics, and drug delivery systems designed to enhance therapeutic efficacy and safety. A major technological focus involves the development and application of Point-of-Care (POC) antiplatelet response assays. These assays, such as VerifyNow, are crucial for assessing the individual patient's response to Ticagrelor, ensuring adequate platelet inhibition, and identifying potential hypo-responders who might be at higher risk of thrombotic events, or hyper-responders who face increased bleeding risks. While Ticagrelor generally provides consistent inhibition, continuous research in genetic testing technologies, specifically analyzing CYP450 enzyme variants and other metabolic pathways, is essential for truly personalized antiplatelet therapy selection, differentiating patient cohorts who might benefit more from alternative P2Y12 inhibitors.

Furthermore, technology is playing a vital role in formulating next-generation antiplatelet agents and improving the stability and bioavailability of generic Ticagrelor. Advanced manufacturing techniques, including crystalline polymorphism control and specialized excipient use, are employed by generic entrants to ensure robust bioequivalence and long shelf-life, critical factors for regulatory approval and market trust. In the sphere of patient management, digital health technologies, including smart adherence monitoring devices and telemedicine platforms, are being leveraged to improve patient compliance with the twice-daily dosing regimen, addressing a significant constraint of the drug. These technologies provide real-time data to healthcare providers, enabling timely intervention to prevent treatment cessation or incorrect dosing, thereby enhancing overall therapeutic success in the long-term secondary prevention segment.

Another crucial technological element is the use of high-throughput screening and computational chemistry in pre-clinical research. Although Ticagrelor is an established drug, research pipelines are continuously seeking P2Y12 inhibitors with even more favorable pharmacokinetic profiles—perhaps once-daily dosing or reduced off-target effects. Computational modeling is essential for rapidly synthesizing and testing novel compounds that might offer advantages in terms of reduced side effects, particularly dyspnea, which is a common, dose-dependent adverse effect of Ticagrelor. This ongoing technological push, supported by AI-driven predictive modeling, ensures the competitive pressure remains high, driving continuous refinement of antiplatelet strategies, potentially impacting the standard positioning of Ticagrelor in clinical guidelines over the long term, especially if superior therapeutic alternatives emerge from these advanced research endeavors.

Regional Highlights

North America, particularly the United States, represents the largest revenue share in the Ticagrelor market. This dominance is attributed to high healthcare spending, early and widespread adoption of clinical guidelines that favor potent antiplatelet agents in ACS management, and a high volume of complex cardiovascular procedures like PCI. However, the market dynamics here are rapidly shifting due to the entry of multiple generic versions following patent expiration. This generic competition is leading to significant price erosion, shifting the focus of original manufacturers towards maximizing volume through expanded indications and aggressive defense of the remaining market segments, particularly the extended secondary prevention dose (60 mg), which may have longer exclusivity periods or be supported by strong brand loyalty and physician familiarity. Regulatory environment favoring accelerated approval of generics also contributes to the rapid evolution of market share distribution.

Europe holds the second-largest market share, exhibiting heterogeneity across its member states. Countries like Germany, the UK, and France maintain high per capita drug expenditure and standardized national treatment protocols that strongly incorporate Ticagrelor. Generic uptake, while significant, varies based on national tendering processes and reimbursement policies. Eastern European countries are demonstrating accelerated growth, driven by investments in modernizing cardiology infrastructure and increasing affordability of treatment due to generic availability. The European Medicines Agency (EMA) guidelines heavily influence prescribing patterns, and regional clinical data from large observational studies often inform local prescribing habits, reinforcing the market presence of high-efficacy antiplatelet agents.

The Asia Pacific (APAC) region is forecasted to be the fastest-growing market globally. This exponential growth is fueled by the massive patient pool, increasing elderly population, improving economic conditions leading to higher disposable income, and the rapid expansion of private and public healthcare facilities. China and India are the dominant engines of growth in APAC, driven by the increasing incidence of lifestyle-related cardiac events. While branded Ticagrelor faced pricing hurdles, the introduction of local and international generics has dramatically increased access and affordability, significantly boosting volume sales. Investment in clinical trial infrastructure in APAC also positions the region as a critical area for future R&D activities and market expansion, leveraging lower operational costs and large patient cohorts for real-world evidence generation. Latin America and MEA, while smaller, are showing steady growth due to global standardization of care and increased government focus on reducing non-communicable disease burden, often through bulk procurement tenders.

- North America (US & Canada): Mature market characterized by high consumption, stringent DAPT guidelines, but facing immediate, significant generic erosion and pricing competition.

- Europe (Western & Eastern): Stable, large market with national variations in reimbursement; strong reliance on ESC guidelines; accelerating generic penetration across key territories.

- Asia Pacific (APAC - China, India, Japan): Highest growth potential driven by population size, rising CVD burden, and increasing accessibility due to favorable generic pricing and healthcare infrastructure investment.

- Latin America (LATAM): Moderate growth market, influenced by public sector procurement, increasing adoption of modern cardiology standards, and demand for cost-effective treatment options.

- Middle East and Africa (MEA): Emerging market with growth concentrated in high-income Gulf Cooperation Council (GCC) nations, driven by rising chronic disease prevalence and specialized healthcare capabilities.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Ticagrelor Market.- AstraZeneca

- Cipla

- Sun Pharmaceutical Industries Ltd.

- Teva Pharmaceutical Industries Ltd.

- Sandoz (Novartis AG)

- Mylan N.V. (Viatris)

- Hikma Pharmaceuticals PLC

- Dr. Reddy's Laboratories Ltd.

- Zydus Cadila

- Torrent Pharmaceuticals Ltd.

- Aurobindo Pharma

- Hetero Labs

- Lupin Limited

- Amgen Inc.

- Bristol-Myers Squibb Company

- Eli Lilly and Company

- Pfizer Inc.

- Johnson & Johnson

- Bayer AG

- Sanofi S.A.

Frequently Asked Questions

Analyze common user questions about the Ticagrelor market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary clinical advantage of Ticagrelor over Clopidogrel?

Ticagrelor is a non-thienopyridine P2Y12 inhibitor that provides faster, more potent, and reversible platelet inhibition compared to Clopidogrel, particularly beneficial in acute coronary syndromes (ACS) as demonstrated by reduced rates of major adverse cardiovascular events (MACE) in specific high-risk patient populations.

How is the market for Ticagrelor impacted by patent expiration and generic entry?

Generic entry significantly increases market competition, leading to substantial price erosion and a shift in revenue share from the branded product to generic manufacturers. This transition boosts volume sales by improving affordability and market access, particularly in emerging economies, while forcing branded manufacturers to focus on extended indications and specialized formulations.

What are the key growth segments for Ticagrelor through 2033?

The fastest-growing segment is projected to be the secondary prevention indication, utilizing the lower 60 mg dose for extended chronic use in patients with a history of myocardial infarction (MI). The geographic regions of Asia Pacific (APAC), specifically China and India, are also key growth accelerators due to expanding patient bases and improved healthcare access.

What role does Artificial Intelligence (AI) play in the future of Ticagrelor therapy?

AI is crucial for enhancing personalized medicine by analyzing patient pharmacogenomics and clinical data to predict individual responses to Ticagrelor, optimizing dosing strategies, and minimizing associated bleeding risks. AI also supports advanced pharmacovigilance and drug adherence monitoring programs.

What are the main risks or restraints affecting the Ticagrelor market growth?

Major restraints include the inherent risk of major bleeding associated with potent antiplatelet therapy, the compliance challenge of the twice-daily dosing regimen, and increasing pricing pressure from well-established, lower-cost P2Y12 inhibitor generics and emerging novel antithrombotic agents that offer alternative treatment mechanisms.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager