Timber plants Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443323 | Date : Feb, 2026 | Pages : 258 | Region : Global | Publisher : MRU

Timber plants Market Size

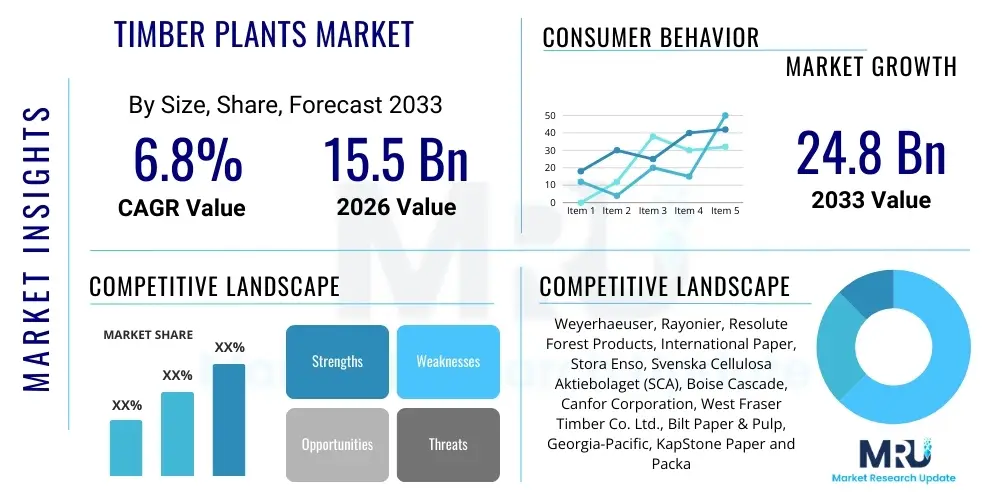

The Timber plants Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 58.5 Billion in 2026 and is projected to reach USD 86.8 Billion by the end of the forecast period in 2033.

Timber plants Market introduction

The Timber Plants Market encompasses the cultivation, harvesting, and trade of tree seedlings and saplings specifically intended for eventual timber, pulp, or biomass production. This market is intrinsically linked to the global forestry and construction industries, serving as the foundational element for sustainable wood supply chains worldwide. The increasing emphasis on certified sustainable forestry practices, coupled with rising global population and urbanization rates, drives consistent demand for robust and fast-growing timber species. Key products range from established hardwood varieties like teak and mahogany, valued for their durability and aesthetic appeal in high-end construction and furniture, to commercially important softwoods such as pine and spruce, which are indispensable for structural lumber, paper production, and mass-market construction applications.

Major applications of timber plants include establishing commercial plantations for large-scale wood harvesting, reforestation initiatives, and integration into agroforestry systems that balance ecological benefits with economic returns. The market is increasingly adopting advanced silviculture techniques, including genetic improvement and precision planting, to enhance yields, disease resistance, and shorten rotation periods. The primary benefit derived from this market is the provision of a renewable resource that acts as a vital carbon sink, positioning timber as an essential component in global climate change mitigation strategies. Furthermore, the economic benefits extend deeply into rural communities, providing employment and supporting local economies globally.

Driving factors for market growth include strong residential construction activity in developing economies, the burgeoning global demand for engineered wood products (like Glulam and CLT), which utilize timber efficiently, and supportive governmental policies promoting afforestation and sustainable forest management. The shift away from carbon-intensive materials like steel and concrete in favor of wood, often termed "green building," is a powerful macroeconomic trend bolstering the demand for reliable timber plant sourcing. Furthermore, technological advancements in seedling production, such as tissue culture propagation and cloning, are enabling the rapid deployment of high-performing genetic material, securing future raw material supply for the wood processing industry.

Timber plants Market Executive Summary

The Timber Plants Market demonstrates robust growth driven by accelerating demand from the construction and bioenergy sectors, necessitating a major focus on sustainable sourcing and high-yield genetic improvements. Business trends show significant consolidation among large plantation owners and timber investment management organizations (TIMOs), standardizing global practices and increasing the availability of internationally certified wood products (FSC, PEFC). There is a notable trend towards vertically integrated operations, where seed production, nursery management, plantation operations, and sawmilling are managed under one umbrella to optimize efficiency and ensure quality control throughout the supply chain. Market volatility, influenced by land use regulations and fluctuating commodity prices, remains a key challenge, pushing stakeholders towards long-term supply contracts and financial hedging mechanisms.

Regional trends indicate that the Asia Pacific (APAC) region, spearheaded by rapidly industrializing economies such as China and India, constitutes the largest consumer base, driven by massive infrastructure projects and expanding middle-class housing needs. However, Latin America, particularly Brazil and Chile, holds a dominant position in high-yield plantation forestry, particularly for eucalyptus and pine, serving as a critical global export hub for pulp and paper. North America and Europe emphasize certification and sustainable harvesting, with a rising focus on locally sourced wood and utilizing advanced wood processing technologies to manufacture high-value engineered wood products (EWPs), thereby maximizing the economic return from established forest assets and driving premium pricing.

Segment trends reveal that the Hardwood Timber Plants segment, while requiring longer rotation periods, commands higher value due to demand in premium furniture and architectural applications. Conversely, the Softwood Timber Plants segment dominates in volume due to its rapid growth cycle and widespread use in structural lumber and pulp. The application segment sees Construction and Infrastructure maintaining its lead, though the Bioenergy and Fuelwood segment is experiencing accelerated growth due to global decarbonization efforts and the increasing utilization of wood pellets and biomass for heat and power generation. The market is also witnessing specialized growth in Agroforestry Systems, providing diversification opportunities for farmers by integrating timber cultivation with traditional agricultural practices, enhancing land productivity and ecological resilience.

AI Impact Analysis on Timber plants Market

Users frequently inquire about how Artificial Intelligence (AI) and Machine Learning (ML) are transforming traditional forestry practices, specifically asking about yield forecasting accuracy, early disease detection, and optimizing harvesting logistics. Key themes revolve around the potential for AI to dramatically reduce waste, shorten time-to-market, and ensure regulatory compliance through enhanced monitoring. Concerns often focus on the required investment in drone technology and sensor deployment, the need for specialized data scientists in a traditionally manual sector, and how predictive models can effectively handle the variability introduced by climate change and localized weather events. Expectations are high that AI will move forestry into an era of precision agriculture, enabling data-driven decisions regarding species selection, fertilization schedules, and thinning operations, ultimately driving profitability and sustainability.

AI's influence is particularly strong in the field of precision silviculture. Using aerial imagery from satellites and drones, combined with ML algorithms, forest managers can map stand health at a tree-by-tree level, identifying nutrient deficiencies or pest infestations long before they become visible to human observation. This capability allows for targeted, localized intervention rather than broad-scale, resource-intensive treatments, leading to substantial cost savings and reduced environmental impact. Furthermore, AI models are now being trained to optimize planting density based on soil type, topography, and expected climate conditions, ensuring that initial plantation setup maximizes long-term yield and tree vigor.

In the downstream supply chain, AI is pivotal in logistics and inventory management. ML algorithms forecast timber demand with greater precision, enabling automated scheduling of harvesting and transportation operations to minimize idle time and fuel consumption. Predictive maintenance for logging equipment is also enhanced by AI, reducing unexpected breakdowns. Finally, for compliance and certification, AI can process vast amounts of data from monitoring sensors and drones to provide real-time audits on sustainable harvesting practices, facilitating faster certification processes and ensuring transparency for global buyers demanding traceability in their timber products.

- AI-powered predictive analytics enhance timber yield forecasting accuracy, reducing market uncertainty.

- Machine Learning algorithms analyze drone and satellite imagery for early detection of pests, diseases, and nutrient stress.

- Precision planting optimization through AI based on microclimate and soil parameters to maximize growth rates.

- Automated grading and sorting of harvested timber using computer vision systems improves efficiency at sawmills.

- AI streamlines supply chain logistics, optimizing transport routes and minimizing carbon footprint from harvesting to processing.

- Real-time forest inventory monitoring and carbon stock assessment utilizing deep learning models for compliance and carbon credit markets.

DRO & Impact Forces Of Timber plants Market

The Timber Plants Market is significantly influenced by a dynamic set of Drivers, Restraints, and Opportunities (DRO). Key drivers include rapid global urbanization, which consistently fuels demand for residential and commercial construction materials, and the accelerating acceptance of timber as a preferred, low-carbon building material under evolving green building standards. Supportive governmental policies promoting afforestation and financial incentives for sustainable forestry investment further amplify market growth. Conversely, significant restraints include the long cultivation cycles inherent in timber production, which necessitate high upfront capital investment and expose investors to long-term market volatility and policy risks. Furthermore, increasing public and regulatory scrutiny regarding illegal logging and deforestation places strict demands on certification and traceability, adding complexity and cost to the supply chain.

Opportunities for expansion are primarily centered on the booming global carbon credit market, where timber plantations function as significant verifiable carbon sinks, offering supplementary revenue streams to traditional wood sales. The advancement of engineered wood products (EWPs) like Cross-Laminated Timber (CLT) and Glued-Laminated Timber (Glulam) is opening new, high-value architectural applications previously dominated by concrete and steel, creating substantial demand for structural-grade timber plants. Additionally, the development and commercialization of genetically modified and climate-resilient tree species offer a path to mitigating risks associated with climate change and disease outbreaks, ensuring a more stable and higher-yielding future supply.

The impact forces within this market are substantial, originating from legislative shifts and evolving consumer demands. Environmental regulations compelling sustainable sourcing and reforestation are paramount, pushing the industry toward certified systems (FSC/PEFC). Economic fluctuations, particularly in the global housing and construction markets, directly impact timber pricing and investment cycles. Technologically, innovations in plant biotechnology and sensor-based monitoring are acting as strong forces that enhance operational efficiency and resource utilization. Socially, the growing awareness regarding climate change and responsible consumption dictates purchasing behaviors, favoring suppliers who demonstrate transparent and verifiable sustainability credentials, thereby reshaping competitive landscapes and requiring proactive corporate social responsibility initiatives.

Segmentation Analysis

The Timber Plants Market is segmented based on critical characteristics including Type, Application, and Cultivation Method, providing granular insights into demand patterns and supply chain specialization. Understanding these segments is vital for stakeholders to effectively target specific high-growth areas, whether focusing on high-value, long-rotation hardwoods for luxury furniture or high-volume, fast-rotation softwoods for pulp and construction. The dominance of a particular segment often correlates strongly with regional forestry traditions, climate suitability, and local industrial infrastructure, necessitating tailored strategies for market entry or expansion.

The segmentation by Type, distinguishing between Hardwood and Softwood, reflects fundamental differences in growth rate, density, and end-use properties. Hardwoods generally cater to premium markets and demand longer investment horizons, while softwoods satisfy mass-market construction and commodity production needs. Application segmentation highlights the diverse economic roles of timber, ranging from essential structural components in construction to specialized feedstocks in the rapidly evolving bioenergy sector. Lastly, the Cultivation Method segment, comparing dedicated Plantation Forestry with integrated Agroforestry Systems, underscores the operational models adopted by various producers, reflecting different scales of production and varying levels of ecological integration and biodiversity management.

- By Type:

- Hardwood Timber Plants (e.g., Teak, Mahogany, Oak, Walnut, Maple)

- Softwood Timber Plants (e.g., Pine, Spruce, Fir, Cedar)

- Exotic/Specialty Timber Plants

- By Application:

- Construction and Infrastructure (Structural Lumber, Beams, Framing)

- Furniture and Cabinetry Manufacturing

- Paper and Pulp Manufacturing

- Bioenergy and Fuelwood Production

- Specialty Products (Veneer, Musical Instruments, Cooperage)

- By Cultivation Method:

- Industrial Plantation Forestry (Monoculture)

- Agroforestry Systems (Integrated Farming)

- Community and Small-Scale Forestry

Value Chain Analysis For Timber plants Market

The value chain for the Timber Plants Market is extensive, starting from highly specialized genetic research and extending through complex international distribution networks. The upstream segment is characterized by intensive R&D focused on producing superior planting stock, involving advanced techniques such as cloning, tissue culture propagation, and genetic modification to ensure disease resistance, optimized growth rates, and desirable wood characteristics. Specialized nurseries and seed orchards form the critical first link, supplying certified, high-quality saplings to commercial plantation operators. Financing and land acquisition also dominate the upstream activities, requiring substantial, long-term capital commitments from TIMOs and large corporate entities, often necessitating risk management strategies to hedge against commodity price volatility and natural disasters.

The midstream process involves plantation establishment, rigorous silviculture management (including fertilization, pruning, and thinning), and eventual harvesting operations. This phase is increasingly mechanized and relies on sophisticated forest inventory management systems, often utilizing GIS and remote sensing technology to track asset growth and monitor health. Crucially, certification bodies like the Forest Stewardship Council (FSC) and the Programme for the Endorsement of Forest Certification (PEFC) intervene here, auditing and certifying sustainable management practices, which significantly enhances the market value of the harvested timber. Processing—sawmilling, peeling for veneer, and chipping for pulp—follows, transforming the raw material into marketable commodities like dimension lumber, pulpwood, and wood panels.

The downstream involves highly diversified distribution channels. Direct distribution occurs when large forestry companies supply directly to integrated manufacturing facilities (e.g., paper mills or large prefabricated housing producers). Indirect channels involve a complex network of regional timber merchants, brokers, wholesalers, and specialized retailers who manage logistics and provide services to end-users like smaller construction firms and furniture manufacturers. International trade is facilitated through major shipping hubs, often requiring specialized logistics to handle high volumes efficiently. The complexity of regulatory requirements across different countries for wood imports (e.g., phytosanitary regulations) further defines the downstream segment, emphasizing the role of intermediaries proficient in global customs and compliance.

Timber plants Market Potential Customers

The primary customers and end-users of timber plants span a wide range of industrial, governmental, and private entities, all requiring high-quality wood fiber for various transformative processes. Leading the consumption base are large-scale commercial plantation operators and Timber Investment Management Organizations (TIMOs) who acquire seedlings to establish or expand vast forest tracts for long-term harvest cycles. These entities require large volumes of genetically superior planting stock that promises high yield and resistance to regional pathogens. Government forestry departments and non-governmental organizations (NGOs) also constitute significant buyers, purchasing plants for reforestation, environmental rehabilitation projects, and managing public lands to enhance biodiversity and combat desertification.

The industrial sector represents the ultimate end-user of the harvested product, primarily construction companies utilizing lumber and engineered wood products for residential and commercial development, and pulp and paper manufacturers who depend on softwood and specific hardwood fibers for paper, packaging, and hygiene products. Furthermore, the burgeoning bioenergy sector, including pellet manufacturers and biomass power generation plants, requires dedicated high-yield timber plants optimized for energy content. Secondary customer groups include private landowners engaged in agroforestry, looking to integrate timber production with agriculture to diversify income, and specialized niche manufacturers requiring specific timber traits for high-value goods like musical instruments or architectural veneers.

For these diverse customers, the purchasing criteria vary significantly; commercial operators prioritize genetic purity, volume, and cost efficiency, while green builders and certified product manufacturers demand verifiable provenance and compliance with international sustainability standards (FSC/PEFC). The reliability and scale of the nursery supply chain are crucial for industrial customers, as planting operations often require millions of seedlings simultaneously to meet strategic rotation schedules. Therefore, the most successful suppliers are those that can provide not only high-quality plants but also comprehensive technical support regarding species selection, site preparation, and ongoing plantation management advice.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 58.5 Billion |

| Market Forecast in 2033 | USD 86.8 Billion |

| Growth Rate | CAGR 5.8% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Weyerhaeuser, Rayonier, Resolute Forest Products, Suzano, Stora Enso, International Paper, Domtar, West Fraser Timber Co., Ltd., Georgia-Pacific LLC, UPONOR, Metsä Group, SCA, Oji Holdings, Juken New Zealand Ltd., Timberlands Pacific, Green Resources, The R&R Group, Hancock Timber Resource Group, Brookfield Asset Management (Timber), PotlatchDeltic Corporation. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Timber plants Market Key Technology Landscape

The technological landscape of the Timber Plants Market is rapidly advancing, moving away from traditional methods toward data-intensive, biotechnological, and remotely managed operations. Central to this evolution is the utilization of advanced plant biotechnology, particularly somatic embryogenesis and tissue culture techniques, which allow for the mass propagation of genetically superior clones. This capability ensures uniformity, maximizes yield potential, and accelerates the deployment of disease-resistant or climate-adapted varieties across large plantation areas. These technologies significantly reduce the biological risk inherent in long-term forestry investments by providing reliable, high-performing planting material that can withstand increasing environmental pressures.

Furthermore, the integration of Information and Communication Technologies (ICT) is revolutionizing forest management. Precision forestry employs Remote Sensing (RS) and Geographic Information Systems (GIS), leveraging high-resolution satellite, LiDAR, and drone imagery to map forest assets, monitor growth progression, and calculate precise inventory volumes. These digital tools enable highly accurate site-specific treatments, such as targeted fertilization or pest control, minimizing waste and environmental impact while optimizing tree health. The use of robust, networked sensor systems in the field also provides continuous data streams regarding soil moisture, temperature, and nutrient levels, feeding into predictive models that guide managerial decisions throughout the rotation cycle.

In addition to biological and monitoring technologies, mechanical innovations are crucial, particularly in nursery operations and planting logistics. Automated planting systems, utilizing robotics and GPS guidance, are increasing the speed and precision of seedling placement, reducing labor costs, and improving survival rates. Similarly, sophisticated harvesting machinery, equipped with intelligent processing heads and optimization software, ensures that each tree is cut and processed to maximize its commercial value based on real-time log grading. These integrated technologies collectively drive efficiency, enhance sustainability credentials, and lower the overall cost structure of long-term timber production, making the sector more competitive against alternative construction materials.

Regional Highlights

- Asia Pacific (APAC): APAC represents the largest and fastest-growing market due to massive population density, rapid infrastructure expansion, and a burgeoning housing market, particularly in China, India, and Southeast Asia. The region is a net importer of high-quality timber, driving significant internal efforts towards establishing large-scale plantations, especially for species like Eucalyptus and Teak. Government policies promoting reforestation, coupled with the rising consumption of paper and packaging materials, ensures sustained high demand. However, the region faces challenges related to land scarcity and illegal logging concerns, pushing stakeholders toward certified imports and domestically grown, certified timber.

- North America: This region is characterized by mature, technologically advanced forestry sectors, dominated by large, integrated companies primarily in the US and Canada. North America leads in the production of structural lumber and wood panels, with a strong focus on sustainable management of vast softwood forests (Pine, Douglas Fir). The market is heavily influenced by the residential housing starts and the increasing adoption of high-performance engineered wood products (EWPs), which require standardized, high-quality timber inputs. Innovation in wood science and advanced manufacturing techniques are key regional drivers.

- Europe: Europe emphasizes environmental stewardship and the circular bioeconomy. Scandinavian countries (Sweden, Finland) and Central Europe are leaders in sustainable forestry, pulp production, and biomass energy. The region has highly strict regulations regarding harvesting and sourcing, driving near-universal adoption of FSC/PEFC certification. There is a strong regional trend towards substituting fossil fuel-intensive materials with wood in construction and utilizing wood waste for bioenergy, ensuring consistent demand for locally sourced timber plants and sustainable forest management practices.

- Latin America: This region is a global powerhouse in plantation forestry, particularly for fast-growing species like Eucalyptus and fast-rotation Pines, primarily serving the international pulp and paper industry. Brazil and Chile possess highly productive plantations supported by ideal climates and advanced silvicultural research. The region offers lower operating costs compared to North America and Europe, attracting significant international investment in large timberland holdings, though managing land rights and ensuring community engagement remain critical operational challenges.

- Middle East and Africa (MEA): The MEA market is largely dependent on imports, but growth is accelerating in reforestation and domestic plantation projects, particularly in South Africa and specific parts of West Africa, driven by the need for local building materials and addressing desertification. Investment is rising in fast-growing exotic species suitable for arid conditions. Political stability and water resource management are the primary limiting factors, though increasing urbanization in GCC nations drives demand for imported, high-grade finished wood products.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Timber plants Market.- Weyerhaeuser

- Rayonier

- Resolute Forest Products

- Suzano

- Stora Enso

- International Paper

- Domtar

- West Fraser Timber Co., Ltd.

- Georgia-Pacific LLC

- UPONOR (A key player in wood-based solutions, though not purely timber plants)

- Metsä Group

- SCA (Svenska Cellulosa Aktiebolaget)

- Oji Holdings Corporation

- Juken New Zealand Ltd.

- Timberlands Pacific

- Green Resources AS

- The R&R Group (Specialized Timber Consultants and Managers)

- Hancock Timber Resource Group (TIMO)

- Brookfield Asset Management (Timber and Forest Products)

- PotlatchDeltic Corporation

Frequently Asked Questions

Analyze common user questions about the Timber plants market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary factors driving the growth of the Timber plants Market?

The market growth is primarily driven by accelerating global urbanization, the strong governmental and corporate push towards adopting sustainable, low-carbon building materials (green building movement), and increasing demand for certified timber products across the construction and packaging sectors globally.

How is genetic improvement technology impacting timber plant cultivation?

Genetic improvement technologies, including cloning and tissue culture, are crucial for rapidly deploying high-performing, disease-resistant, and drought-tolerant tree varieties. This technology shortens the required rotation cycles, maximizes wood yield per hectare, and provides greater stability against environmental stresses, securing future supply.

Which geographical region dominates the global consumption of timber products derived from these plants?

The Asia Pacific (APAC) region currently dominates global consumption, fueled by massive infrastructure development and rapid growth in housing demands, particularly in high-growth economies like China, India, and Southeast Asian nations. APAC remains the largest importer and consumer of global timber resources.

What role do carbon credit markets play in the financial viability of commercial timber plantations?

Timber plantations serve as measurable and verifiable carbon sinks. Participation in voluntary and compliance carbon credit markets provides plantation owners with a significant supplementary revenue stream, improving the overall return on investment and helping to mitigate the financial risk associated with long-term forestry projects.

What is the main difference between Hardwood and Softwood timber plants in terms of market value and application?

Hardwood timber plants typically command a higher market value due to their density and suitability for premium applications like high-end furniture and architectural finishes, requiring longer growth cycles. Softwood timber plants dominate in volume and are used extensively for structural lumber, framing, and pulp production due to their faster growth rates and ease of processing.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Timber plants Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Timber Plants Market Statistics 2025 Analysis By Application (Residential Building, Commercial Building, Institutional Building, Industrial Facility), By Type (CLT, Glulam), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager