Time Delay Switches Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441449 | Date : Feb, 2026 | Pages : 242 | Region : Global | Publisher : MRU

Time Delay Switches Market Size

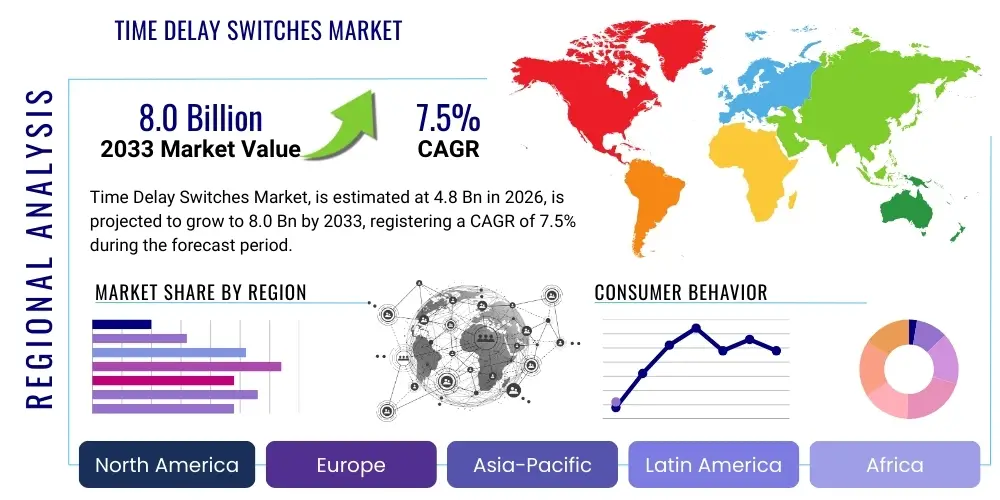

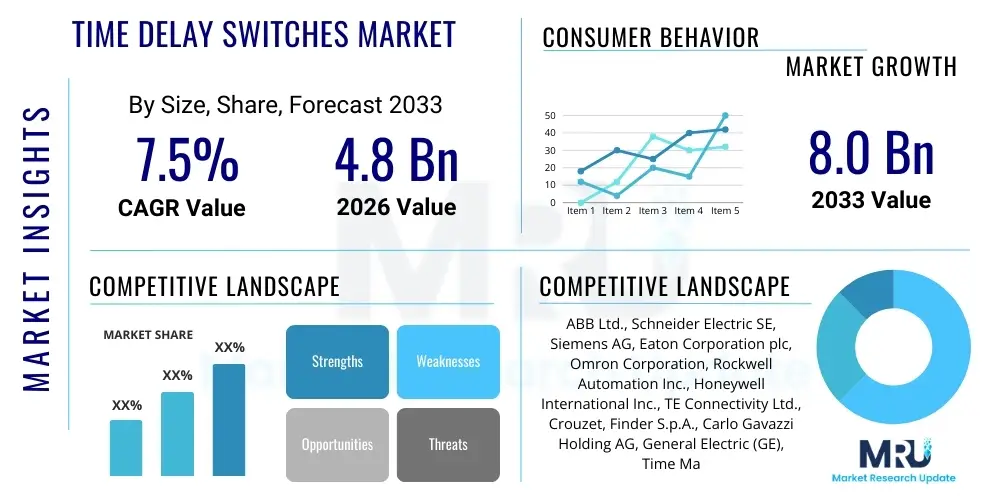

The Time Delay Switches Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.5% between 2026 and 2033. The market is estimated at USD 4.8 Billion in 2026 and is projected to reach USD 8.0 Billion by the end of the forecast period in 2033.

Time Delay Switches Market introduction

The Time Delay Switches Market encompasses devices designed to control the flow of electrical current based on a predetermined timing sequence, serving essential functions in automation, safety, and energy management across diverse industries. These devices, often known as timing relays, are crucial components in control systems, ensuring that processes are initiated or terminated only after a specified time interval has elapsed. Products range from simple thermal timers used in household appliances to highly sophisticated solid-state electronic timers integrated into complex industrial machinery and Building Management Systems (BMS). The core mechanism involves storing energy or using electronic circuitry to measure time accurately before activating or deactivating an output circuit. The increasing global focus on optimizing energy consumption, coupled with the rapid expansion of industrial automation and smart infrastructure, is fundamentally driving the demand for reliable and precise time delay switches.

Major applications of time delay switches are pervasive and highly critical, spanning industrial automation where they manage motor startup delays and conveyor system sequencing, lighting control systems where they facilitate automatic turn-off features in public spaces or residential settings for energy conservation, and HVAC systems for controlling compressor cycle times and fan operations. The tangible benefits derived from their implementation include enhanced system reliability by preventing premature component wear, significant energy savings through optimized operational schedules, and improved safety protocols by allowing necessary time buffers for mechanical systems. The product diversity, categorized mainly into solid-state (electronic), pneumatic, thermal, and motor-driven types, caters to varying requirements concerning timing accuracy, operational environment robustness, and cost efficiency.

Driving factors propelling the market forward include the stringent regulatory mandates globally aimed at improving energy efficiency in commercial and residential buildings, particularly in developed economies. Furthermore, the burgeoning demand for highly automated production lines, especially in the automotive, pharmaceutical, and food and beverage sectors, necessitates the precise timing capabilities offered by these switches. The continuous technological advancements in solid-state electronics are leading to the development of highly accurate, miniaturized, and feature-rich timing devices that offer multi-functionality and easier integration into modern Programmable Logic Controllers (PLCs) and Distributed Control Systems (DCS). These factors collectively underscore the vital role of time delay switches in the contemporary electrical and mechanical infrastructure landscape.

Time Delay Switches Market Executive Summary

The Time Delay Switches Market exhibits robust growth driven primarily by technological advancements in solid-state electronics and the increasing global emphasis on energy efficiency and industrial automation. Business trends indicate a strong shift towards multi-functional, programmable timers that offer enhanced accuracy and connectivity, particularly those compatible with IoT and smart grid infrastructure. Key players are focusing on miniaturization, modular design, and robust construction to meet the demanding requirements of harsh industrial environments, while also developing user-friendly interfaces for simpler programming and maintenance. Merger and acquisition activities remain steady, centered around acquiring niche technology providers specializing in high-precision timing mechanisms or specific application segments like smart lighting controls, aimed at expanding product portfolios and geographical reach across both established and emerging markets.

Regional trends reveal that Asia Pacific (APAC) is the fastest-growing market, largely fueled by aggressive industrialization, rapid infrastructure development, and substantial governmental investments in smart city projects across countries like China, India, and South Korea. North America and Europe, while mature, maintain significant market share, characterized by high adoption rates of sophisticated, high-end electronic timing relays, driven by strict energy performance codes and advanced building automation standards. Specific segment trends highlight the dominance of solid-state time delay switches due to their superior accuracy, longevity, and versatility compared to traditional electromechanical and thermal variants. Furthermore, the market for switches utilized in HVAC systems and industrial machinery sequencing is showing accelerated expansion, directly correlated with the global push towards automated and precise operational control.

The segmentation based on end-user shows the Industrial sector retaining the largest market share, leveraging time delay switches for complex sequencing and machinery protection. Conversely, the Commercial sector, specifically driven by retail, office buildings, and hospitality, is exhibiting the highest growth trajectory, primarily due to the widespread integration of automatic lighting controls (e.g., occupancy sensors coupled with time delay switches) designed to comply with evolving green building certifications. The market outlook is overwhelmingly positive, projecting sustained demand underpinned by the necessary integration of reliable timing controls into nearly every facet of modern electrical engineering, necessitating strategic supply chain resilience to manage potential volatility in raw material costs for complex electronic components.

AI Impact Analysis on Time Delay Switches Market

User queries regarding the impact of Artificial Intelligence (AI) on the Time Delay Switches Market often revolve around obsolescence, integration capabilities, and the potential for predictive maintenance. Users frequently ask if AI-driven systems, particularly those using advanced algorithms for real-time optimal control (e.g., in smart HVAC or lighting), will entirely replace fixed-function time delay switches. Another significant theme is how AI can enhance existing switch functionality, specifically through predictive analytics that anticipate component failure or optimize timing schedules dynamically based on real-time operational variables (like occupancy patterns or energy pricing). Users are also keen on understanding the development of "smart" timing relays that can communicate with larger AI-managed Building Management Systems (BMS), moving beyond simple predetermined time functions to complex, responsive logic.

The consensus suggests that while AI may not render the physical switch obsolete, it is fundamentally transforming the control logic layer above it. AI is enabling the transition from static, fixed-time delays to dynamic, adaptive timing mechanisms. These AI-enhanced systems utilize sensor data and machine learning models to determine the optimal moment to activate or deactivate systems, making traditional time delay switches a functional endpoint rather than the primary decision-maker. This necessitates the development of advanced electronic time delay switches equipped with communication interfaces (like Modbus or Ethernet) to seamlessly integrate into sophisticated supervisory control and data acquisition (SCADA) systems and AI-powered operational dashboards, allowing for remote parameter adjustment and data logging crucial for algorithm refinement.

Consequently, the market emphasis is shifting towards modularity and data acquisition capabilities within the switches themselves. Manufacturers are embedding microprocessors capable of handling localized data processing and communication protocols, transforming simple switches into network-enabled components that feed rich operational data back to central AI platforms. This symbiotic relationship—where AI provides the intelligence for dynamic optimization and the time delay switch provides reliable, physical actuation at the specified moment—drives higher energy efficiency and better asset utilization. The increasing adoption of predictive maintenance powered by AI is leading to a demand for highly reliable, self-diagnostic time delay switches capable of reporting operational anomalies before catastrophic failure occurs, thereby increasing the effective lifespan of interconnected systems and reducing unplanned downtime across industrial complexes and commercial facilities.

- AI drives the transition from static time functions to dynamic, adaptive timing mechanisms based on real-time data inputs.

- Integration of smart timing relays with embedded communication protocols (e.g., Modbus, Ethernet/IP) to feed data to AI-managed BMS platforms.

- Enabling predictive maintenance capabilities by utilizing AI to analyze operational data collected by smart timing relays, reducing component failure rates.

- AI optimizes system timing in complex applications (HVAC, smart lighting) for peak energy efficiency beyond human-programmed schedules.

- Development of localized edge computing capabilities within switches to execute AI-determined logic swiftly without reliance on continuous cloud connectivity.

DRO & Impact Forces Of Time Delay Switches Market

The Time Delay Switches Market is primarily driven by the imperative for enhanced energy conservation, particularly mandated by evolving governmental regulations and green building standards worldwide, compelling residential, commercial, and industrial entities to adopt automated controls like timing switches. Restraints largely center on the perceived complexity and higher initial cost associated with advanced solid-state electronic timers compared to simpler, cheaper mechanical alternatives, alongside the continuous challenge of ensuring high reliability and longevity in harsh industrial environments exposed to extreme temperatures and vibrations. Opportunities abound in the burgeoning Industrial Internet of Things (IIoT) segment, where the integration of connectivity and smart functionality into timing devices allows for remote monitoring, dynamic scheduling, and seamless integration with broader factory automation systems, enhancing overall process efficiency and providing new service revenue streams for manufacturers.

The primary impact forces shaping the market are the accelerating pace of global industrial automation and the continuous need for equipment protection. Drivers such as the increasing deployment of complex sequencing machinery, especially in automotive assembly and robotics, rely critically on precise timing relays to ensure operational synchronization and prevent component damage during startup and shutdown cycles. Conversely, a significant restraint is the technological overlap and substitution threat posed by multifunctional PLCs and microcontrollers, which can often absorb basic timing functions, pressuring time delay switch manufacturers to specialize in highly reliable, dedicated, or application-specific timing solutions that outperform embedded general-purpose timing features. Furthermore, the rapid growth of renewable energy infrastructure, such as solar and wind farms, presents an immediate opportunity for high-durability time delay switches used in grid synchronization and safety cutout mechanisms, demanding stringent quality control and certification.

The market faces inherent vulnerability to global supply chain disruptions, particularly concerning essential semiconductor components required for high-accuracy electronic switches, leading to potential price volatility and extended lead times. However, this restraint is mitigated by strategic regional manufacturing diversification. The opportunity presented by the retrofit market in aging infrastructure, especially in North America and Europe, where old mechanical timers are being replaced by high-efficiency electronic units, remains substantial. The crucial impact forces include consumer and industrial demand for customization, necessitating highly modular and easily configurable timing switches, and the relentless pressure to reduce total cost of ownership (TCO) through switches that require minimal maintenance and offer robust diagnostic feedback, aligning with industry trends toward predictive and condition-based maintenance strategies.

Segmentation Analysis

The Time Delay Switches Market segmentation offers critical insights into product preferences and application dynamics across various end-user sectors. Segmentation is fundamentally based on the technology type (which determines accuracy and application suitability), the specific timing function (dictating the operational logic), and the primary end-user industry (reflecting volume and complexity requirements). The dominance of the electronic/solid-state segment is undeniable, driven by superior precision, broad timing ranges, and extended lifespan compared to traditional thermal or pneumatic methods. This transition highlights an industry-wide prioritization of operational reliability and sophisticated control capabilities, moving away from lower-cost but less accurate alternatives. Furthermore, the application segmentation reveals significant divergence in product needs, ranging from basic lighting controls demanding simple, inexpensive units to complex industrial automation systems requiring multi-mode, communication-enabled timing relays compliant with stringent industrial standards like IP67 ratings for environmental protection.

Analysis by function type further clarifies market requirements, distinguishing between "On-Delay" (most common, used for startup sequencing), "Off-Delay" (crucial for safety circuits and preventing immediate shutdowns), and "Interval" timers (used for controlling fixed-duration processes like mixing or heating cycles). The industrial end-user sector continues to be the largest consumer base, necessitating large volumes of highly durable and customizable units for machine tool controls, conveyor systems, and process monitoring. The commercial sector, particularly segments focused on energy management (e.g., smart buildings, retail lighting), shows the highest rate of adoption for newer, connected electronic timers that facilitate centralized control and reporting. Geographic segmentation reflects the maturity of automation standards, with established markets focusing on replacement and upgrade cycles, while emerging economies drive volume growth through greenfield industrial projects and foundational infrastructure build-out, prioritizing cost-effective and robust solutions.

The dynamic interplay between technological advancement and application necessity is evident across the segments. For instance, the growing need for high-speed sequencing in semiconductor manufacturing is driving innovation in ultra-precise, digital timing modules, while the residential sector focuses on aesthetics, ease of use, and integration with smart home ecosystems. This segmented view allows manufacturers to tailor their product offerings, whether focusing on ruggedized solutions for heavy industry or aesthetically pleasing, low-power modules for consumer-facing applications. The increasing complexity of modern systems ensures that the market for specialized timing switches remains resilient, despite potential encroachment from general-purpose controllers, provided the switches offer specific advantages in terms of reliability, cost-per-function, or dedicated regulatory compliance required for specific operational environments or safety certifications.

- By Type:

- Thermal Time Delay Switches (Simpler, cost-effective, lower accuracy)

- Pneumatic Time Delay Switches (Robust, suitable for hazardous environments)

- Motor-Driven Time Delay Switches (High-timing range, used in historical applications)

- Solid State/Electronic Time Delay Switches (Dominant, high precision, multi-functional, connectivity features)

- By Timing Function:

- On-Delay Timers

- Off-Delay Timers

- Interval Timers

- Repeat Cycle Timers

- Star-Delta Timers (Specific motor control applications)

- By Application:

- Industrial Automation and Control (Machine Sequencing, Motor Protection)

- HVAC Systems (Compressor cycling, Fan operation control)

- Lighting Control Systems (Stairwells, Corridors, Public areas)

- Telecommunications Equipment

- Security and Access Control Systems (Door lock delays, Alarm system timing)

- By End-User:

- Industrial (Manufacturing, Oil & Gas, Power Generation)

- Commercial (Office Buildings, Retail, Hospitality)

- Residential (Smart Homes, Appliance timing)

Value Chain Analysis For Time Delay Switches Market

The value chain for the Time Delay Switches Market begins with the upstream suppliers providing essential raw materials and components, including specialized plastics and metals for housing, and crucial electronic components like microcontrollers, capacitors, resistors, and semiconductors for solid-state timers. The quality and availability of these electronic components, especially microprocessors and advanced integrated circuits (ICs), significantly impact the manufacturing cost and performance characteristics of the final product. Fluctuations in semiconductor supply chains, especially post-2020, have put immense pressure on manufacturers, necessitating strategic long-term sourcing contracts and dual-sourcing strategies to maintain production stability. The efficiency and precision of the switches are fundamentally dependent on the sophistication of the electronic components procured in this upstream phase, making strategic vendor relationships vital for competitive advantage.

The core manufacturing stage involves design, assembly, and rigorous testing. Manufacturers invest heavily in R&D to enhance timing accuracy, miniaturize components, improve robustness (IP ratings), and integrate communication capabilities (IIoT readiness). Fabrication involves high-precision assembly lines, especially for solid-state switches, requiring stringent quality control and calibration processes to ensure compliance with international standards (e.g., UL, CE, RoHS). The downstream segment involves distribution, sales, and post-sales support. Distribution channels are typically categorized into direct sales (for large industrial OEMs or strategic infrastructure projects) and indirect channels, which include electrical wholesalers, distributors, system integrators, and specialized automation suppliers. System integrators play a crucial role by packaging time delay switches into broader control panel solutions for end-users, requiring close technical collaboration with manufacturers.

The differentiation between direct and indirect distribution channels is critical for market penetration. Direct channels allow manufacturers tighter control over pricing, technical support, and product feedback, often targeting major industrial clients or government contracts that require highly customized timing solutions. Indirect channels, particularly through large global electrical distributors, offer vast geographical reach and immediate availability to smaller contractors and maintenance, repair, and operations (MRO) buyers. The effectiveness of the indirect channel relies heavily on the distributor’s technical expertise and inventory management. Ultimately, the downstream customer interface also includes specialized aftermarket services, where technical support and warranty fulfillment for complex electronic switches contribute significantly to brand reputation and customer loyalty, especially in mission-critical applications where device failure incurs high operational costs and safety risks.

Time Delay Switches Market Potential Customers

The primary potential customers and end-users of Time Delay Switches span a broad spectrum, unified by the requirement for automated, timed control of electrical circuits. The largest segment remains the Industrial sector, encompassing heavy manufacturing facilities, oil and gas operations, process control plants (chemical, pharmaceutical), and power generation utilities. These customers utilize time delay switches for critical functions such as motor start/stop sequencing (preventing mechanical stress), controlling sequential operations in assembly lines, ensuring safety interlocks, and managing complex industrial processes where precise timing is essential for product quality and equipment longevity. Industrial OEMs (Original Equipment Manufacturers) who build machinery like packaging equipment, machine tools, and industrial robotics represent a consistently high-volume purchasing segment, demanding robust, high-durability, and often multi-functional electronic timers compliant with harsh operational standards.

The second major group includes the Commercial and Institutional sectors, driven heavily by energy management initiatives. This category comprises commercial building operators, facility managers, and construction contractors responsible for offices, hospitals, universities, and retail complexes. These customers primarily procure time delay switches for optimizing energy usage through intelligent lighting controls (e.g., controlling lights in stairwells or conference rooms after occupants leave), automated ventilation and exhaust fan management in restrooms, and precise control over HVAC system cycling to improve efficiency and reduce peak load demands. The increasing adoption of smart building technologies means these customers are progressively demanding switches that offer seamless integration with BACnet or Modbus communication protocols, enabling centralized monitoring and dynamic adjustment of timing schedules based on building occupancy patterns or external environmental factors.

A rapidly growing customer segment is the Residential sector, stimulated by the proliferation of smart home technology and regulatory requirements for household energy efficiency. While traditionally using simple thermal or mechanical timers in appliances, the trend is shifting towards electronic, aesthetically pleasing switches for residential lighting, garage door openers, and integration into consumer-grade smart electrical panels. Finally, the infrastructure sector, including telecommunications, utilities (water and sewage treatment), and transportation (traffic signals, railway signaling), represents a critical customer base requiring highly reliable, often redundantly designed time delay switches for operational safety, synchronization, and equipment sequencing. These customers place a premium on reliability, longevity, and resistance to environmental factors, often leading to the selection of specialized, ruggedized electronic timing relays.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.8 Billion |

| Market Forecast in 2033 | USD 8.0 Billion |

| Growth Rate | 7.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | ABB Ltd., Schneider Electric SE, Siemens AG, Eaton Corporation plc, Omron Corporation, Rockwell Automation Inc., Honeywell International Inc., TE Connectivity Ltd., Crouzet, Finder S.p.A., Carlo Gavazzi Holding AG, General Electric (GE), Time Mark Corporation, Macromatic Industrial Controls, Inc., Phoenix Contact GmbH & Co. KG, Legrand, Panasonic Corporation, Mitsubishi Electric Corporation, Hella GmbH & Co. KGaA, and Altech Corporation. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Time Delay Switches Market Key Technology Landscape

The technology landscape of the Time Delay Switches Market is undergoing a rapid evolution, moving away from bulky, less precise electromechanical and pneumatic designs toward advanced solid-state electronic solutions. The core technology involves the use of highly integrated microcontrollers and sophisticated semiconductor circuitry to manage timing functions with exceptional accuracy, often down to milliseconds, irrespective of environmental fluctuations like temperature or voltage variability. Crucial advancements include the proliferation of Multi-Function Timers (MFTs) that consolidate numerous timing modes (e.g., On-Delay, Off-Delay, Interval) into a single, user-configurable device, significantly reducing inventory complexity for distributors and end-users. Furthermore, the integration of advanced human-machine interfaces (HMIs), such as digital displays and intuitive programming buttons, enhances ease of setup and diagnostic capabilities, moving beyond simple analog potentiometers for time setting.

A paramount technological trend is the adoption of connectivity standards to enable participation in the Industrial Internet of Things (IIoT). Modern time delay switches are increasingly being embedded with communication capabilities such as Modbus RTU, Ethernet/IP, or IO-Link, allowing them to report status, log operational hours, and receive timing adjustments remotely from a centralized control platform or SCADA system. This connectivity facilitates crucial features like predictive maintenance, where the switch can report internal degradation or operational anomalies before a total failure occurs, drastically improving system uptime. The shift towards higher voltage ratings and enhanced noise immunity (Electromagnetic Compatibility, EMC) in electronic timers is also a critical development, ensuring reliable performance in electrically noisy industrial environments and compatibility with larger, more powerful industrial motors and equipment.

Material science innovation also plays a role, specifically in developing robust, flame-retardant, and highly resilient plastic enclosures (high-grade polycarbonates) that meet rigorous safety standards (e.g., UL 94 V-0) and environmental protection ratings (e.g., IP67) for outdoor and washdown applications. Power supply technology within the switches is also improving, allowing for universal voltage compatibility across different global electrical standards, simplifying procurement and deployment. Lastly, the adoption of specialized timing chipsets that utilize high-stability crystal oscillators ensures long-term timing accuracy and drift minimization, which is mandatory for sensitive applications such as grid synchronization and railway signaling. This collective technological momentum solidifies the role of advanced electronic time delay switches as crucial, intelligent components within sophisticated automation architectures.

Regional Highlights

- Asia Pacific (APAC): APAC is the epicenter of growth in the Time Delay Switches Market, characterized by high rates of industrial expansion and unprecedented infrastructural development, particularly in manufacturing hubs like China, India, and Southeast Asian nations. The region’s trajectory is driven by large-scale government investments in smart city projects, significant build-out of renewable energy capacity, and the continuous establishment of new manufacturing facilities requiring robust automation controls. While cost sensitivity remains a factor, the rapid adoption of international quality standards is driving demand for sophisticated solid-state switches, especially within high-growth sectors such as automotive manufacturing, electronics assembly, and consumer goods production.

- North America: This region holds a substantial market share, defined by the mature automation industry and stringent regulatory frameworks focused on energy efficiency (e.g., ASHRAE standards). The demand here is centered on high-precision, network-enabled electronic timers required for integration into advanced Building Management Systems (BMS) and sophisticated HVAC controls. The market is largely driven by replacement cycles and the modernization of existing infrastructure across commercial and industrial sectors, with strong emphasis on products certified for high safety and reliability standards (e.g., UL Listing).

- Europe: Europe represents another mature market, characterized by early adoption of sophisticated automation technologies and extremely rigorous energy consumption mandates (e.g., EU EcoDesign Directives). Western European countries exhibit high demand for premium, multi-functional electronic switches featuring IIoT compatibility, crucial for highly automated manufacturing processes (Industry 4.0 initiatives). The focus is heavily on sustainability, driving the adoption of switches that contribute demonstrably to verifiable energy savings in commercial, public, and residential buildings, often requiring compliance with multiple international certification bodies.

- Latin America (LATAM): The LATAM market is exhibiting moderate growth, primarily driven by expanding infrastructure projects and increasing foreign investment in manufacturing sectors, particularly in Brazil and Mexico. Demand is dual-faceted: simple, robust, and cost-effective switches are favored for basic machinery and electrical distribution, while sophisticated electronic switches are increasingly required in the automotive and high-tech manufacturing segments entering the region, leading to a fragmented demand structure that necessitates a diverse product portfolio from suppliers.

- Middle East and Africa (MEA): Growth in MEA is concentrated in the Gulf Cooperation Council (GCC) nations, fueled by massive construction booms, investments in non-oil economic diversification (e.g., tourism, logistics), and major utility infrastructure projects. Time delay switches are essential in controlling lighting, ventilation, and air conditioning systems in large commercial complexes and residential developments, often requiring robust designs capable of withstanding extreme ambient temperatures. Market expansion is closely tied to the execution timeline of national development visions and smart energy efficiency mandates across key economies.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Time Delay Switches Market.- ABB Ltd.

- Schneider Electric SE

- Siemens AG

- Eaton Corporation plc

- Omron Corporation

- Rockwell Automation Inc.

- Honeywell International Inc.

- TE Connectivity Ltd.

- Crouzet

- Finder S.p.A.

- Carlo Gavazzi Holding AG

- General Electric (GE)

- Time Mark Corporation

- Macromatic Industrial Controls, Inc.

- Phoenix Contact GmbH & Co. KG

- Legrand

- Panasonic Corporation

- Mitsubishi Electric Corporation

- Hella GmbH & Co. KGaA

- Altech Corporation

Frequently Asked Questions

Analyze common user questions about the Time Delay Switches market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the demand for solid-state time delay switches over electromechanical types?

The primary factor is the superior accuracy, extended lifespan, and multi-functionality of solid-state electronic switches. These devices offer high precision timing across broad ranges and are more easily integrated with modern digital control systems and network connectivity protocols essential for industrial automation and smart building management systems, outweighing the initial lower cost of electromechanical units.

How are time delay switches contributing to energy efficiency in commercial buildings?

Time delay switches are crucial for energy efficiency by ensuring that electrical loads, especially lighting and HVAC components, are deactivated automatically after a set period or when unnecessary. They work in conjunction with occupancy sensors and control systems to optimize operational schedules, significantly reducing wasted electricity usage in areas like stairwells, restrooms, and automated ventilation systems, thereby complying with green building standards.

Which application segment accounts for the largest market share in the Time Delay Switches Market?

The Industrial Automation and Control segment commands the largest market share. This sector relies heavily on time delay switches for critical functions such as motor sequencing, preventing mechanical overload during startup and shutdown, synchronizing complex assembly line operations, and ensuring safety interlocks across diverse manufacturing, processing, and heavy machinery operations globally.

What are the key technological advancements expected to shape the future of timing relays?

Future advancements focus heavily on IIoT integration, enabling remote diagnostics, real-time data logging, and dynamic timing adjustments via centralized platforms (SCADA/BMS). Key trends include miniaturization, enhanced electromagnetic compatibility (EMC) for harsh environments, and the development of self-diagnostic capabilities to facilitate AI-powered predictive maintenance strategies.

Is the Asia Pacific (APAC) region expected to maintain its status as the fastest-growing market?

Yes, APAC is projected to maintain its position as the fastest-growing market. This sustained growth is attributed to ongoing massive infrastructure projects, significant investment in industrial capacity expansion (especially in automotive and electronics), and the rapid implementation of national energy efficiency and smart city initiatives across key developing economies in the region.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager