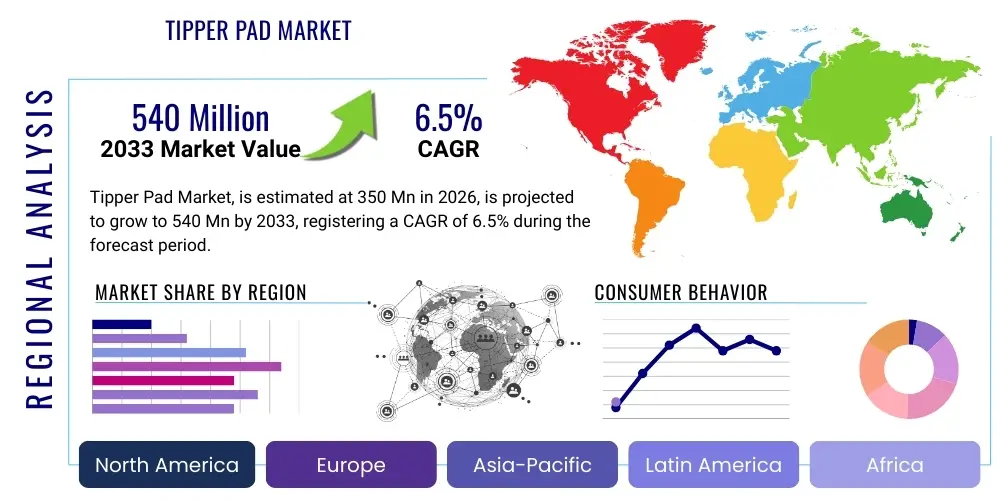

Tipper Pad Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443267 | Date : Feb, 2026 | Pages : 258 | Region : Global | Publisher : MRU

Tipper Pad Market Size

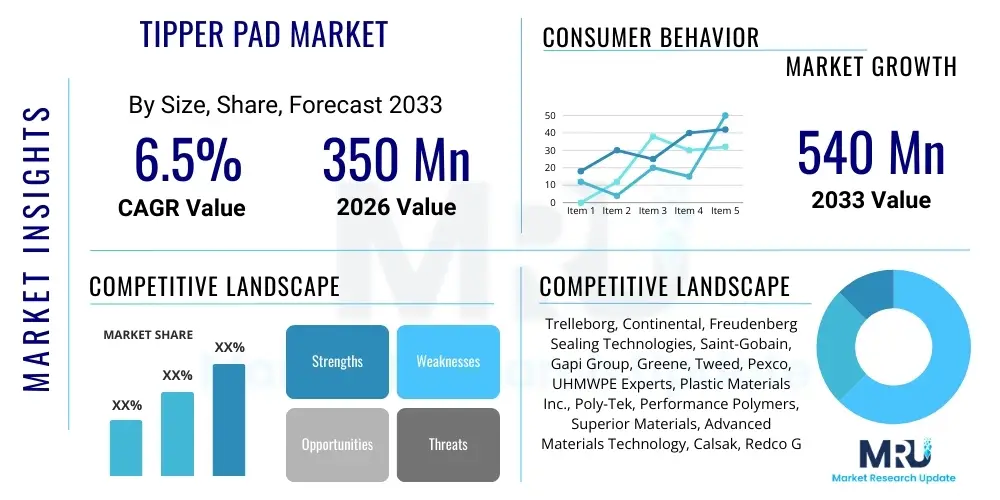

The Tipper Pad Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 350 Million in 2026 and is projected to reach USD 540 Million by the end of the forecast period in 2033. This substantial growth trajectory is attributed primarily to the accelerating pace of infrastructure development globally, particularly in emerging economies, which necessitates robust, high-performance components for heavy-duty hauling and construction vehicles.

The valuation reflects the increasing demand for specialized polymer and composite materials offering superior wear resistance, low friction, and chemical stability in harsh operating environments. Tipper pads, essential for dampening impact and enabling smooth, controlled movement during the tipping mechanism of dump trucks and trailers, are becoming indispensable components for enhancing operational safety and minimizing maintenance downtime across the construction and mining sectors. Market expansion is also being driven by stringent regulatory standards concerning vehicle safety and environmental compliance, pushing manufacturers toward advanced material solutions.

Tipper Pad Market introduction

The Tipper Pad Market encompasses the manufacturing, distribution, and utilization of specialized cushioning and friction-reducing components installed between the chassis and the tipping body of commercial vehicles, predominantly dump trucks and trailers. These pads are typically manufactured from high-performance polymers such as Ultra-High Molecular Weight Polyethylene (UHMW PE), Nylon, and Polyurethane, chosen for their resilience against heavy loads, abrasive materials, and extreme weather conditions. The primary function of a tipper pad is to absorb kinetic energy, minimize wear and tear on metallic components, and ensure smooth, reliable operation of the tipping mechanism, thus extending the overall lifespan of the vehicle and reducing operational noise.

Major applications for tipper pads span across diverse heavy industries including civil construction, surface and underground mining operations, waste management and recycling, and large-scale agricultural material handling. In construction, these pads are crucial for vehicles transporting aggregates, sand, and asphalt, ensuring consistent performance under demanding loading cycles. For the mining sector, the resistance to highly abrasive ore and rock fragments makes specialized pads a necessary expenditure to maintain fleet uptime. The benefits derived from deploying high-quality tipper pads include improved vehicle stability during tipping, reduced vibrational stress on the truck frame, enhanced safety for operators, and significant reductions in maintenance costs associated with structural failure or excessive friction wear.

The driving factors propelling the market forward include the rapid urbanization trends globally, necessitating extensive road, bridge, and housing construction; substantial investments in mining exploration and extraction projects, particularly in Asia Pacific and Latin America; and the growing replacement cycle of commercial vehicle fleets in developed regions adopting newer, high-spec components. Furthermore, technological advancements in polymer science, leading to the development of stronger, lighter, and more durable pad materials, are making premium tipper pads a more attractive investment for fleet managers focused on optimizing total cost of ownership (TCO).

Tipper Pad Market Executive Summary

The global Tipper Pad Market demonstrates strong resilience and steady growth, underpinned by consistent investment in global infrastructure and resource extraction industries. Key business trends indicate a shift towards customization, where manufacturers are offering application-specific materials tailored for extreme temperature variations, chemical exposure, or specialized abrasive loads, moving beyond standardized plastic or rubber components. Consolidation among mid-sized manufacturers is also evident, aiming to leverage economies of scale and integrate vertically, securing raw material supply chains and enhancing distribution network efficiency. The emphasis on sustainability is growing, with increasing research into recyclable polymer compounds and longer-lasting materials to reduce overall environmental footprint associated with heavy vehicle maintenance.

Regionally, the Asia Pacific (APAC) region is projected to remain the dominant market, driven by massive government expenditure on infrastructure projects in China, India, and Southeast Asian nations, coupled with robust growth in mineral resource extraction. North America and Europe, characterized by stringent safety regulations and high labor costs, prioritize high-performance, maintenance-free solutions, driving demand for premium UHMW PE and advanced composite pads. Latin America and the Middle East & Africa (MEA) represent significant growth opportunities as urbanization progresses and large-scale energy and construction projects—such as new port facilities, industrial parks, and oil & gas infrastructure—require large fleets of reliable tipper vehicles.

Segment trends reveal that the Material segment is dominated by UHMW PE due to its superior friction coefficient and exceptional wear properties, though polyurethane is gaining traction in niche applications requiring high elasticity and shock absorption. The Application segment sees construction and mining collectively accounting for the largest market share, with waste management showing the fastest adoption rate as municipal and industrial waste volumes necessitate more efficient and reliable refuse collection vehicles. Furthermore, the OEM channel remains highly critical, but the aftermarket segment is expanding rapidly, fueled by vehicle aging and the need for frequent replacement of wear parts, allowing specialized distributors and local manufacturers to capture significant value.

AI Impact Analysis on Tipper Pad Market

User questions regarding the impact of Artificial Intelligence (AI) on the Tipper Pad Market primarily center on how AI-driven predictive maintenance systems will affect replacement cycles, how manufacturing processes can be optimized using AI for material consistency, and whether integrated smart sensors can provide real-time performance data. Users are concerned about whether enhanced diagnostic capabilities will diminish the aftermarket replacement volume by accurately predicting component lifespan, thereby delaying necessary replacements. They also seek to understand how AI can assist in material selection optimization, ensuring the correct pad is used for specific load profiles and environmental conditions, moving beyond traditional, generalized material usage to highly specified, performance-matched components. The prevailing expectation is that while AI won't replace the physical product, it will fundamentally transform product lifecycle management, demanding smarter, data-reporting components and tighter integration into fleet telematics systems.

- AI-driven predictive maintenance systems extending pad lifespan and optimizing replacement intervals, leading to fewer unplanned failures.

- Integration of smart sensors (IoT) into advanced pads to monitor real-time temperature, load, and wear levels, feeding data into AI analytics platforms.

- AI-enhanced manufacturing process control, ensuring higher material consistency and reduced defects in polymer compound production.

- Optimization of supply chain and inventory management for replacement pads using AI forecasting based on aggregate fleet utilization data.

- Development of AI models for highly specific material recommendation based on complex operational parameters (e.g., abrasive index, temperature range, load velocity).

- Potential rise of 'smart' or 'connected' tipper pads that communicate their remaining useful life directly to fleet management software.

DRO & Impact Forces Of Tipper Pad Market

The dynamics of the Tipper Pad Market are shaped significantly by complex interplays between market drivers, necessary restraints, emerging opportunities, and disruptive impact forces. The primary drivers include robust infrastructure spending globally, rapid expansion of the logistics and transportation sectors, and increasing regulatory pressure demanding higher safety standards for heavy commercial vehicles. These factors collectively push fleet operators and OEMs towards high-durability, safety-compliant components. Conversely, restraints such as high raw material price volatility, particularly for petroleum-derived polymers like polyethylene, and the technical challenge of achieving standardized performance across wildly differing operational environments (e.g., arctic cold vs. tropical heat) tend to moderate market growth and increase production costs.

Significant opportunities exist in the development of specialized polymer blends, such as composites reinforced with ceramic fibers or carbon nanotubes, to achieve next-generation durability and wear resistance. Furthermore, the growing trend of vehicle electrification and the shift towards autonomous heavy machinery present opportunities for manufacturers to design pads tailored for different weight distribution and dynamic load profiles associated with electric drivelines. Geographical expansion into untapped markets in Africa and South Asia, alongside aggressive marketing strategies focusing on the TCO benefits of premium pads over cheaper, traditional rubber or low-grade plastic alternatives, also represent strong avenues for market penetration and revenue growth.

The impact forces currently influencing the market include the intensifying global focus on supply chain resilience following recent geopolitical and logistical disruptions, forcing regionalization of manufacturing capabilities. Additionally, the rapid advancement in additive manufacturing (3D printing) technologies poses a long-term impact force; while not yet feasible for mass production of large, dense polymer pads, 3D printing could revolutionize rapid prototyping, customization, and localized small-batch production for specialized applications or urgent aftermarket needs. The overall force vector points towards increased demand for technologically superior, verified, and sustainably produced products, favoring manufacturers capable of innovation in material science and process efficiency.

Segmentation Analysis

The Tipper Pad Market is comprehensively segmented based on Material Type, Application, and Vehicle Type, allowing for targeted analysis of market dynamics and consumer preferences across different operational requirements. Understanding these segments is crucial for manufacturers to align their product portfolios with specific end-user demands, such as prioritizing wear resistance for mining applications or emphasizing shock absorption for urban waste management vehicles. The sophistication of material science dictates that different polymeric compounds are optimal for varying environments, load profiles, and longevity expectations, leading to distinct pricing strategies and competitive landscapes across segments.

The Material Type segment highlights the transition from traditional, less durable materials to advanced engineered polymers that offer superior service life and performance characteristics. The Application segment demonstrates the market dependency on capital expenditure in infrastructure and resource industries, providing insight into where growth is most concentrated globally. Finally, segmentation by Vehicle Type distinguishes between the needs of heavy-duty, often custom-built machinery requiring extremely robust pads, and the higher volume, standardized requirements of medium-duty commercial fleets, influencing manufacturing scales and distribution channels.

- By Material Type:

- Ultra-High Molecular Weight Polyethylene (UHMW PE)

- Nylon (Polyamide)

- Polyurethane

- Rubber

- Other Advanced Composites

- By Application:

- Construction (Infrastructure, Residential, Commercial)

- Mining (Surface Mining, Underground Mining)

- Waste Management and Recycling

- Agriculture and Forestry

- General Logistics and Transportation

- By Vehicle Type:

- Heavy-Duty Trucks and Trailers (e.g., 6x4, 8x4 configurations)

- Medium-Duty Trucks and Dumpers

- By Sales Channel:

- Original Equipment Manufacturer (OEM)

- Aftermarket

Value Chain Analysis For Tipper Pad Market

The value chain for the Tipper Pad Market begins with the Upstream Analysis, focusing heavily on the sourcing and processing of core raw materials, predominantly high-density polyethylene (HDPE) pellets, polyols, and isocyanates for polyurethane, and various chemical additives required for UV resistance, thermal stability, and specific coloring. Key players in this stage are large chemical producers and specialized polymer compounders. Cost volatility in petrochemical markets directly impacts manufacturing margins, necessitating strong hedging and strategic long-term procurement contracts. Efficient polymerization and compounding processes are critical to ensure the uniform quality and mechanical properties required for the final product, such as achieving extremely high molecular weight in UHMW PE for optimal wear characteristics.

Midstream activities involve the conversion of raw polymers into finished tipper pads, including processes such as compression molding, extrusion, casting, and precision machining. Manufacturers invest heavily in sophisticated tooling and quality control systems to produce pads with exact dimensional tolerances, crucial for proper fitment and performance in heavy machinery. Distribution channels are segmented into direct and indirect routes. The Direct channel predominantly serves Original Equipment Manufacturers (OEMs), where pads are supplied just-in-time for assembly line integration, often requiring tailored specifications and quality audits. The Indirect channel, which services the significant Aftermarket demand, utilizes global and regional distributors, specialized heavy equipment parts retailers, and authorized service centers, focusing on efficient inventory management and rapid fulfillment of standard replacement parts.

Downstream analysis involves the installation and ultimate usage of tipper pads by end-users, encompassing large construction conglomerates, specialized mining operators, municipal waste service providers, and independent fleet owners. Customer satisfaction heavily relies on pad longevity, ease of installation, and consistent performance under extreme operating conditions. Feedback from the downstream users regarding wear patterns and failure modes is vital for manufacturers to continuously improve material formulations. The replacement cycle, typically determined by operational hours and environment severity, fuels the aftermarket sector, where brand reputation, product durability, and competitive pricing are critical determinants of purchasing decisions.

Tipper Pad Market Potential Customers

The primary potential customers and end-users of tipper pads are enterprises and governmental agencies operating large fleets of heavy commercial vehicles requiring reliable tipping functionality. These customers fall mainly within the Construction, Mining, and Waste Management sectors, where continuous, high-volume material handling is foundational to operational success. In the construction industry, customers range from multi-national civil engineering firms undertaking massive infrastructure projects (roads, ports, dams) to regional contractors engaged in residential and commercial building, all utilizing dump trucks for aggregate, soil, and debris transportation. These users prioritize durability and low maintenance to maximize vehicle uptime, making TCO a key purchasing metric.

Within the mining sector, customers include major global resource companies (e.g., coal, iron ore, copper) that operate specialized, often oversized, haul trucks in highly abrasive environments. For these critical applications, potential customers demand extreme wear resistance and chemical inertness to withstand exposure to dust, moisture, and processing chemicals. Procurement decisions in mining are heavily influenced by supplier certification, proven reliability in harsh conditions, and the capacity to supply custom-sized pads suitable for non-standard equipment. Maintenance departments in these organizations are significant buyers in the aftermarket, seeking parts that minimize catastrophic failure risks.

Furthermore, municipal and private waste management companies represent a rapidly expanding customer base. Refuse collection vehicles and specialized recycling transport units require tipper pads that can handle frequent, repetitive tipping cycles and corrosive leachate from organic materials. These customers often prioritize noise reduction capabilities alongside durability, particularly for vehicles operating in urban areas. Other potential buyers include large agricultural enterprises utilizing specialized tipping trailers for grain or feed handling, and large government bodies responsible for maintaining public works vehicle fleets, where compliance with standardized safety and environmental specifications drives procurement policies.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 350 Million |

| Market Forecast in 2033 | USD 540 Million |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Trelleborg, Continental, Freudenberg Sealing Technologies, Saint-Gobain, Gapi Group, Greene, Tweed, Pexco, UHMWPE Experts, Plastic Materials Inc., Poly-Tek, Performance Polymers, Superior Materials, Advanced Materials Technology, Calsak, Redco Group, T&D Materials, Polymer Industries, Plasticon, Gallagher Fluid Seals, Precision Polyurethane |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Tipper Pad Market Key Technology Landscape

The Tipper Pad Market’s technology landscape is primarily driven by continuous innovation in polymer science and advanced manufacturing techniques aimed at enhancing product performance and lifecycle predictability. Material technology is centered on optimizing the molecular weight, density, and formulation of Ultra-High Molecular Weight Polyethylene (UHMW PE) and other engineered plastics. Recent technological strides involve the integration of internal lubricants, such as silicone or specialized waxes, within the polymer matrix during compounding. This internal lubrication significantly reduces the static and dynamic friction coefficients, minimizing heat buildup and further extending the pad’s service life, particularly critical in high-cycle tipping operations where friction wear is a major concern.

Manufacturing advancements focus on precision engineering, particularly in compression molding and Computer Numerical Control (CNC) machining. Compression molding technology has improved to allow for the creation of larger, more complex geometries with zero internal voids and maximal material homogeneity, critical for structural integrity under multi-ton loads. Furthermore, specialized thermal treatment processes are being utilized post-molding to relieve internal stresses within the polymer structure, preventing premature cracking or warping when the pads are subjected to extreme temperature fluctuations in operational environments. The adoption of stringent quality control systems utilizing ultrasonic testing ensures that manufacturers can guarantee the internal uniformity and density required for reliable heavy-duty use.

A burgeoning technological trend is the early-stage integration of 'smart' elements into tipper pads. This includes embedding passive or active Radio-Frequency Identification (RFID) tags or low-power wireless sensors during the molding process. These smart features allow fleet managers to automatically track installation dates, verify material specifications, and potentially monitor structural integrity via specialized scanning devices without visual inspection. While still nascent, this technology aligns the Tipper Pad Market with the broader industrial shift towards Industry 4.0 principles, facilitating seamless integration with telematics and asset management systems, providing verifiable data essential for both warranty claims and predictive maintenance modeling.

Regional Highlights

The regional analysis of the Tipper Pad Market reveals significant heterogeneity in growth drivers, material preferences, and regulatory environments, reflecting the varying stages of industrialization and infrastructure maturity across the globe. Asia Pacific (APAC) stands out as the engine of market growth, primarily fueled by the substantial population growth and ensuing urbanization. Governments across China, India, and Southeast Asian nations are allocating unprecedented budgets toward constructing smart cities, transportation networks, and industrial corridors. This sustained construction boom creates massive, continuous demand for heavy vehicles and replacement parts, with material selection in APAC often balancing cost-effectiveness with acceptable durability.

North America and Europe represent mature markets characterized by strict environmental and safety regulations, high labor costs, and a strong preference for premium, high-performance materials. Fleet operators in these regions prioritize longevity and maintenance-free operation to reduce total ownership costs and minimize vehicle downtime. The demand here is driven by cyclical fleet modernization, the replacement of aging infrastructure, and strict adherence to mandated component specifications related to material toxicity and recycling compliance. The sophisticated logistics networks also sustain a healthy aftermarket for specialized, certified replacement pads.

Latin America and the Middle East & Africa (MEA) are emerging markets exhibiting high-potential growth. In Latin America, expansion is linked to substantial investments in mining infrastructure (especially in Chile, Brazil, and Peru) and large-scale agricultural operations. The MEA region is buoyed by massive oil & gas investments, diversification into non-oil sectors like tourism and construction (e.g., GCC nations), and rapid infrastructure development across sub-Saharan Africa. Market characteristics in these regions include a strong emphasis on robust, heat-resistant materials and a high reliance on the aftermarket sector for procurement due to lower OEM presence.

- Asia Pacific (APAC): Dominant market share due to rapid urbanization, massive government infrastructure spending (e.g., China's Belt and Road Initiative, Indian smart city projects), and robust mining output. Demand highly volume-driven.

- North America: High demand for premium, engineered materials (UHMW PE) driven by strict safety standards, focus on TCO minimization, and mature fleet replacement cycles. Strong OEM presence and highly structured aftermarket.

- Europe: Growth influenced by stringent EU regulations, focus on sustainable materials, and significant investments in urban waste management fleets. Demand concentrated on certified, durable, and environmentally compliant products.

- Latin America: High growth potential linked to expansion in the mineral extraction sector and large-scale agricultural material handling. Market characterized by resilience needed for rough terrain and diverse climatic conditions.

- Middle East and Africa (MEA): Emerging powerhouse supported by large-scale construction projects (e.g., Saudi Vision 2030), requiring high-temperature resistant and robust pads for desert environments.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Tipper Pad Market, encompassing global polymer giants and specialized component manufacturers focused on material handling and friction reduction technologies.- Trelleborg

- Continental

- Freudenberg Sealing Technologies

- Saint-Gobain

- Gapi Group

- Greene, Tweed

- Pexco

- UHMWPE Experts

- Plastic Materials Inc.

- Poly-Tek

- Performance Polymers

- Superior Materials

- Advanced Materials Technology

- Calsak

- Redco Group

- T&D Materials

- Polymer Industries

- Plasticon

- Gallagher Fluid Seals

- Precision Polyurethane

Frequently Asked Questions

Analyze common user questions about the Tipper Pad market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are tipper pads and why are they essential for dump trucks?

Tipper pads are specialized polymer components—often made of UHMW PE or Nylon—inserted between the truck chassis and the tipping body. They are essential because they absorb operational shock, minimize wear from friction, dampen vibration, and ensure smooth, controlled movement during the heavy-duty tipping process, thereby preserving the structural integrity and extending the vehicle’s lifespan.

Which material type offers the best performance in abrasive mining environments?

Ultra-High Molecular Weight Polyethylene (UHMW PE) is generally considered the best material for abrasive environments like mining. Its extremely low friction coefficient, coupled with exceptional impact strength and abrasion resistance, allows it to significantly outlast standard plastic or rubber pads when handling abrasive materials like ore, aggregate, and rock fragments.

How do OEMs and the aftermarket sales channels differ in the Tipper Pad Market?

The Original Equipment Manufacturer (OEM) channel supplies pads directly to vehicle manufacturers for integration into new dump trucks, focusing on high volume and custom specifications. The aftermarket channel focuses on replacement parts for vehicles already in operation, relying on distributors and retailers, where demand is driven by wear and tear and necessitates standard, readily available parts for various vehicle models.

What is the primary factor driving the high growth rate of the Tipper Pad Market in Asia Pacific?

The primary driver is the massive and sustained investment in civil infrastructure development and urbanization projects across major economies like China and India. This necessitates large-scale heavy vehicle utilization for material transportation, rapidly expanding the requirement for durable, reliable tipper pads to maintain construction fleet operational efficiency.

Are there environmentally sustainable options available in the tipper pad market?

Yes, sustainability is a growing focus. Manufacturers are increasingly developing tipper pads made from recyclable or bio-based polymers, and designing products with extremely long service lives to minimize waste. The focus is on reducing the environmental impact associated with polymer manufacturing and end-of-life disposal.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager