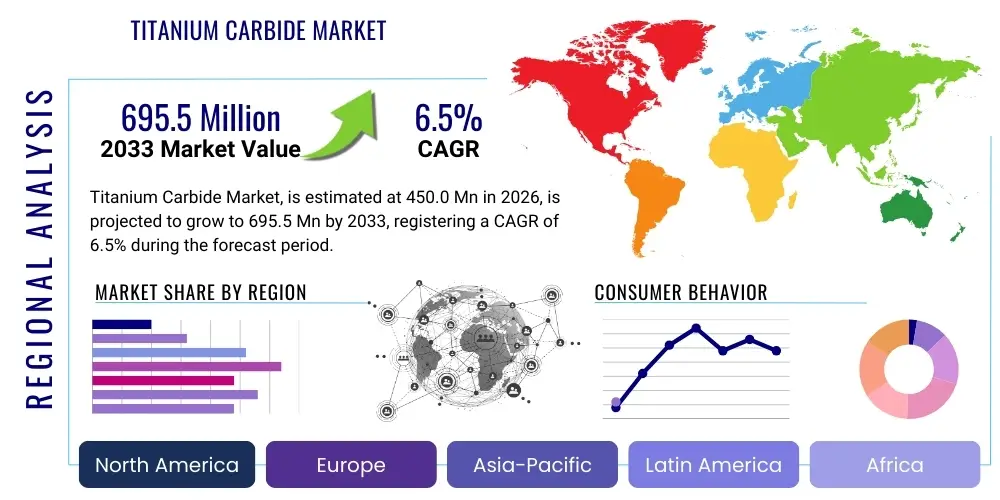

Titanium Carbide Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442556 | Date : Feb, 2026 | Pages : 249 | Region : Global | Publisher : MRU

Titanium Carbide Market Size

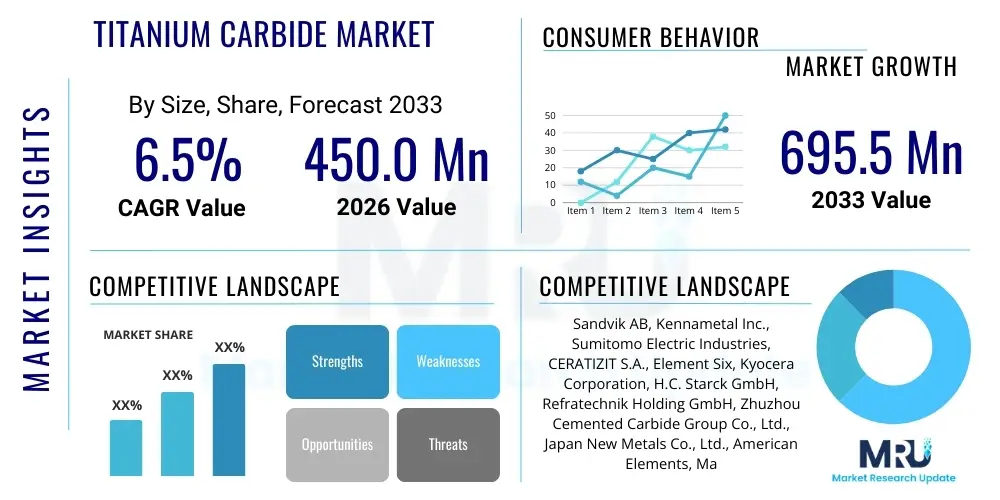

The Titanium Carbide Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 450.0 Million in 2026 and is projected to reach USD 695.5 Million by the end of the forecast period in 2033.

Titanium Carbide Market introduction

Titanium Carbide (TiC) is an extremely hard refractory ceramic material recognized for its outstanding properties, including high hardness, exceptional wear resistance, high melting point (3,160 °C), and good electrical conductivity. These characteristics make it invaluable in applications demanding robustness under severe conditions, such as high-speed cutting, aerospace components, and industrial wear parts. Produced primarily through carbothermal reduction or direct synthesis methods, TiC often functions as a crucial component in cemented carbides (cermets) and as a hard coating material, significantly extending the lifespan of tools and machinery.

The primary applications driving the Titanium Carbide market include its use in cutting tools and inserts, where it drastically improves efficiency and precision in machining hard metals. Furthermore, TiC finds extensive use in abrasive materials, specialized refractory linings, and as a hardening phase in metal matrix composites (MMCs) utilized in the aerospace and defense sectors for lightweight, high-performance structural parts. The material's unique combination of metallic conductivity and ceramic stability positions it favorably across various high-tech manufacturing processes.

Key driving factors for market growth involve the burgeoning demand from the automotive industry for durable tooling necessary to machine complex engine parts and composite materials, coupled with significant expansion in the global manufacturing sector, particularly in Asia Pacific. The ongoing technological advancements in coating technologies, such as Chemical Vapor Deposition (CVD) and Physical Vapor Deposition (PVD), are expanding TiC applications by enabling the creation of ultra-thin, high-performance protective layers on conventional tools, further solidifying its market position.

Titanium Carbide Market Executive Summary

The Titanium Carbide market is witnessing robust expansion, primarily fueled by persistent demand from high-precision engineering sectors, including aerospace, automotive, and general manufacturing. Business trends indicate a strong pivot towards advanced cermets and specialized composite materials where TiC acts as the foundational hardening agent, improving tool life and operational efficiency. The industry is characterized by strategic partnerships aimed at optimizing production costs through advanced synthesis techniques, such as plasma processing and nanotechnology-enabled powder preparation, catering to the need for ultra-fine, highly pure TiC powder.

Regional trends highlight the Asia Pacific (APAC) region, led by China, India, and Japan, as the dominant market, attributable to rapid industrialization, extensive automotive production, and massive investment in infrastructure and electronics manufacturing. North America and Europe maintain high market share in terms of value, driven by sophisticated aerospace and defense requirements, where stringent performance and quality standards necessitate premium TiC grades. Latin America and MEA are emerging as significant markets due to increasing foreign direct investment in manufacturing and energy sectors, boosting local demand for durable industrial tools and components.

Segmentation trends reveal that the Cutting Tools and Inserts application segment remains the largest consumer, benefiting directly from global factory automation and the shift towards hard-to-machine superalloys. The Powder form segment, particularly ultrafine and nanosized powders, is projected to register the fastest growth rate, reflecting the growing adoption of additive manufacturing (3D printing) and high-performance coating techniques. There is a perceptible trend toward integrating TiC into ceramic matrix composites (CMCs) and refractory linings for use in high-temperature industrial furnaces, signaling diversification away from traditional cemented carbide applications.

AI Impact Analysis on Titanium Carbide Market

User queries regarding the impact of Artificial Intelligence (AI) on the Titanium Carbide market frequently center on how AI can optimize manufacturing processes, predict material performance, and accelerate the discovery of novel TiC-based compounds. Common concerns include the cost efficiency of implementing AI-driven quality control systems and the potential for AI algorithms to design specialized tool geometries optimized for specific machining operations. Users are keen to understand how machine learning models can analyze complex synthesis data (e.g., temperature, pressure, precursor ratios) to enhance the purity and morphology of TiC powders, ensuring consistency required for high-precision applications like aerospace engine components.

The core expectation is that AI will revolutionize the R&D cycle for titanium carbide materials. Machine learning is increasingly being applied to High Throughput Experimentation (HTE) data, allowing researchers to quickly filter promising material combinations for cermets and composites, thus significantly reducing the time-to-market for new tooling products. Furthermore, predictive maintenance programs utilizing AI algorithms are being integrated into manufacturing lines that rely on TiC-coated tools, monitoring wear patterns in real-time to schedule replacements optimally, thereby minimizing downtime and maximizing the effective lifespan of the carbide tools.

Supply chain management is another critical area benefiting from AI integration. Sophisticated predictive analytics powered by AI can forecast raw material price volatility (e.g., titanium and carbon precursors), optimize inventory levels, and manage global logistics with greater efficiency, ensuring a stable and cost-effective supply of TiC products to end-users. While the direct manufacturing of TiC remains chemical and thermal, AI acts as a crucial layer of optimization, governance, and innovation acceleration across the entire value chain, transforming the market from a reactive supply model to a highly proactive, data-driven ecosystem.

- AI optimizes TiC synthesis parameters (temperature, stoichiometry) for improved powder quality and reduced energy consumption.

- Machine Learning (ML) accelerates the discovery and testing of novel TiC-based composite formulas, especially in cermets and MMCs.

- Predictive analytics enhance supply chain resilience, forecasting demand fluctuations and managing critical precursor material inventory.

- AI-driven quality control systems analyze microscopic images of coatings and tools, ensuring structural integrity and defect identification at high speed.

- Integration of AI into CNC machines facilitates real-time monitoring of TiC tool wear, optimizing machining parameters and extending tool life (Predictive Maintenance).

DRO & Impact Forces Of Titanium Carbide Market

The Titanium Carbide market is characterized by a dynamic interplay of Drivers, Restraints, and Opportunities, collectively forming the Impact Forces shaping its trajectory. The primary Driver is the escalating demand for high-performance and wear-resistant materials across critical industrial sectors, particularly in advanced machining operations where conventional steel tools are insufficient. Simultaneously, the inherent brittleness of pure ceramics and the high initial investment required for advanced TiC manufacturing techniques act as significant Restraints. Opportunities arise from technological advancements in additive manufacturing, enabling complex TiC component creation, and the development of cost-effective nanosized TiC powders, opening avenues for high-value composite applications.

Impact Forces are broadly categorized into supply-side and demand-side pressures. On the supply side, the rising cost and geopolitical instability related to key raw materials, such as titanium, exert pressure on pricing and production stability. However, continuous innovation in plasma-based synthesis methods is improving material yield and purity, mitigating some cost impacts. On the demand side, stringent performance requirements in aerospace and energy sectors (nuclear and oil & gas) mandate the use of TiC for its superior thermal and mechanical properties, ensuring sustained high-end market growth despite economic cyclicality in general manufacturing.

The market also faces environmental and regulatory scrutiny, particularly regarding energy consumption during the high-temperature synthesis process, pushing manufacturers toward cleaner, more efficient production methodologies (Opportunity). Conversely, the intense competition from alternative hard materials, such as specific grades of Tungsten Carbide or synthetic diamond coatings, presents a persistent challenge (Restraint). The overall impact assessment suggests that strong demand from high-growth engineering applications and continuous material science innovation will generally outweigh the restraints associated with production costs and material substitution, driving steady, long-term market expansion.

Segmentation Analysis

The Titanium Carbide market segmentation offers a granular view of consumption patterns, technological preferences, and end-use applications, which are crucial for strategic market positioning. The market is primarily segmented by Form (Powder, Coating, Sintered Parts), Application (Cutting Tools, Wear Parts, Abrasives, Refractories), and End-Use Industry (Aerospace & Defense, Automotive, Manufacturing, Energy). Analyzing these segments reveals that the mature segments, like cutting tools, dominate volume, while newer forms, such such as nano-sized powders used in advanced coatings and additive manufacturing, exhibit superior growth potential due to their high surface area and reactivity, enabling higher performance characteristics.

Within the Form segment, Powder accounts for the foundational requirement, serving both as a direct abrasive agent and as the precursor material for both sintered parts and coating application processes. The Sintered Parts segment is vital for structural components, particularly in high-wear environments like bearings, seals, and nozzles. The Coating segment, often using thin-film deposition techniques, is rapidly expanding as it offers a cost-effective method to impart TiC's hardness and wear resistance to conventional tool substrates, thereby democratizing its utility across various light and heavy manufacturing operations.

From an End-Use perspective, the Manufacturing & Fabrication sector maintains the largest consumption base due to the indispensable role of TiC in general-purpose machining and tooling across diverse industries. However, the Aerospace & Defense segment is characterized by the highest material value consumption, driven by extremely strict quality requirements for engine components, landing gear parts, and protective thermal barriers where component failure is catastrophic. The future market dynamics hinge significantly on the sustained growth of high-technology sectors requiring absolute material reliability and performance.

- Form: Powder (Micro, Nano, Ultrafine), Coating (CVD, PVD Films), Sintered Parts (Cermets, Composites)

- Application: Cutting Tools and Inserts, Wear Parts (Seals, Bearings), Abrasive Materials, Refractories and Crucibles, Structural Components, Jet Engine Components.

- End-Use Industry: Automotive, Aerospace & Defense, General Manufacturing & Fabrication, Energy (Oil & Gas, Nuclear), Electronics and Semiconductors, Medical and Dental.

Value Chain Analysis For Titanium Carbide Market

The Titanium Carbide value chain commences with Upstream Analysis, which involves the sourcing and refinement of key raw materials, predominantly titanium ore (ilmenite or rutile) and carbon sources (e.g., carbon black, graphite). The high energy intensity and technical complexity of the synthesis process—either carbothermal reduction or direct element reaction—define this initial stage. Efficiency and control over particle size distribution at this stage are paramount, as they directly influence the quality and performance of the final TiC product. Major players often integrate vertically into precursor processing to ensure quality consistency and manage input costs.

The Midstream phase involves the complex manufacturing of TiC powder, subsequent processing into intermediate products like cermet compositions or specialized coating targets, and finally, the production of Sintered Parts or final tools. This stage requires sophisticated equipment for high-temperature sintering (e.g., Hot Isostatic Pressing – HIP) and precise coating technologies (CVD/PVD). Distribution Channel analysis indicates a dual system: Direct channels are typically utilized for large, specialized orders (e.g., aerospace manufacturers requiring customized structural components), allowing for greater technical consultation and quality assurance.

Downstream Analysis focuses on the distribution and end-use applications. Indirect channels, involving specialized distributors, technical wholesalers, and tool supply houses, are crucial for reaching the broader general manufacturing market and SMEs who purchase standardized cutting inserts and abrasive products. Value addition is maximized when TiC manufacturers collaborate closely with end-users to design application-specific tooling, ensuring the material properties meet the demanding operational conditions, thus solidifying long-term customer relationships and premium pricing strategies across the highly technical, finished product segments.

Titanium Carbide Market Potential Customers

Potential customers for Titanium Carbide span diverse high-technology and heavy industrial sectors, fundamentally driven by the need for materials that can withstand extreme thermal, mechanical, and chemical stresses. The primary end-users are original equipment manufacturers (OEMs) specializing in precision machinery, particularly those involved in automotive engine production and aircraft component fabrication. These buyers prioritize materials with high abrasion resistance and thermal stability to ensure reliability and minimize maintenance cycles for their final products.

A major segment of buyers includes tooling and insert manufacturers who utilize TiC powder and cermet blanks to produce high-performance cutting tools, drills, and milling inserts. These manufacturers require consistent purity and defined particle morphology in their TiC inputs to achieve optimal sintering density and tool longevity. Furthermore, large industrial complexes, such as steel mills, chemical processing plants, and non-ferrous foundries, are key buyers of TiC-based refractories, crucibles, and specialized wear parts (e.g., pump seals and valve components) necessary for lining high-temperature process equipment.

Emerging buyer segments include additive manufacturing service providers and research institutions focused on novel material development. These customers are primarily interested in ultra-fine and nano-sized TiC powders suitable for advanced 3D printing techniques (like Binder Jetting or Laser Powder Bed Fusion) to create complex geometry components with enhanced strength-to-weight ratios. The consistent requirement across all buyer groups is reliability, performance certification, and specialized technical support regarding material integration and application optimization, driving demand for high-quality, certified suppliers.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450.0 Million |

| Market Forecast in 2033 | USD 695.5 Million |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Sandvik AB, Kennametal Inc., Sumitomo Electric Industries, CERATIZIT S.A., Element Six, Kyocera Corporation, H.C. Starck GmbH, Refratechnik Holding GmbH, Zhuzhou Cemented Carbide Group Co., Ltd., Japan New Metals Co., Ltd., American Elements, Materion Corporation, Nanodiamond Technology Co., LTD., Advanced Technology & Materials Co., Ltd. (AT&M), Höganäs AB, Saint-Gobain. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Titanium Carbide Market Key Technology Landscape

The Titanium Carbide market is highly dependent on sophisticated material synthesis and processing technologies that ensure high purity, controlled particle size, and desired morphological characteristics. The primary synthesis methods include the classic carbothermal reduction, where titanium dioxide is reacted with carbon at extremely high temperatures (over 2000°C), and the more modern methods like self-propagating high-temperature synthesis (SHS). SHS offers advantages in terms of energy efficiency and the ability to produce fine, uniform powders rapidly, though controlling the reaction kinetics remains a technical challenge that manufacturers are continuously addressing through proprietary reactor designs and process optimization.

Beyond powder production, the technological landscape is defined by advanced consolidation and coating techniques. Hot Isostatic Pressing (HIP) and Vacuum Sintering are essential for producing dense, non-porous TiC cermets and structural parts, improving mechanical reliability significantly over traditionally sintered parts. In the coating segment, Chemical Vapor Deposition (CVD) and Physical Vapor Deposition (PVD) remain the industry standards. CVD offers superior adhesion and thickness control, critical for high-load cutting tools, while PVD, including advanced arc evaporation and sputtering, is preferred for applications requiring lower processing temperatures to protect the substrate integrity, often used for fine precision tools and decorative components.

A crucial emerging technological trend is the utilization of TiC in Additive Manufacturing (AM). Binder jetting and laser-based AM techniques necessitate highly spherical, flowable TiC powders with tight particle size distributions, prompting significant research investment into specialized atomization and post-processing techniques. Furthermore, nanotechnology plays a key role, with the development of nano-sized TiC particles offering superior strengthening mechanisms when integrated into metal matrices, creating extremely hard and tough composites suitable for next-generation wear applications and defense technology platforms, ultimately driving the shift towards ultra-high performance materials.

Regional Highlights

- Asia Pacific (APAC): APAC represents the largest and fastest-growing market due to its overwhelming dominance in global manufacturing, automotive production, and electronics assembly. Countries like China and India are characterized by heavy investment in infrastructure and defense, driving robust demand for durable cutting tools and wear parts. The rapid expansion of local industrial bases necessitates constant upgrading of machinery and tooling, with a corresponding surge in TiC consumption, particularly for mass-market cermet inserts and abrasive applications.

- North America: North America holds a leading position in terms of value, primarily driven by the stringent quality and performance demands of the aerospace and defense sectors, coupled with advanced research and development activities in materials science. The region is a key adopter of premium, high-purity TiC powders for high-precision components and sophisticated PVD coatings. The focus here is on developing next-generation structural composites and high-temperature turbine components, often involving strategic material reserves and specialized manufacturing contracts.

- Europe: Europe exhibits mature consumption patterns, led by Germany and Italy, countries renowned for their high-end automotive engineering and precision machine tool industries. The European market emphasizes innovation in sustainable manufacturing and energy-efficient processing, leading to strong demand for specialized TiC coatings that enhance tool life and reduce material waste. Strict environmental regulations also push manufacturers toward cleaner production methods and advanced recycling processes for cemented carbides containing TiC.

- Latin America (LATAM): LATAM is characterized by moderate growth, primarily supported by mineral extraction, construction, and emerging automotive assembly industries (Brazil and Mexico). Demand for TiC is mainly concentrated in heavy-duty wear parts and drilling tools necessary for the regional mining and oil & gas sectors, requiring materials that can withstand severe frictional and corrosive environments encountered during extraction operations.

- Middle East and Africa (MEA): The MEA market is largely driven by massive investments in the oil & gas industry and infrastructure development. TiC is essential for downhole drilling tools, pump components, and severe-service valves where high erosion resistance is critical. Economic diversification efforts in the Gulf nations are also stimulating demand in nascent manufacturing and defense repair sectors, though the market remains highly dependent on energy sector capital expenditure cycles.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Titanium Carbide Market.- Sandvik AB

- Kennametal Inc.

- Sumitomo Electric Industries

- CERATIZIT S.A.

- Element Six

- Kyocera Corporation

- H.C. Starck GmbH

- Refratechnik Holding GmbH

- Zhuzhou Cemented Carbide Group Co., Ltd.

- Japan New Metals Co., Ltd.

- American Elements

- Materion Corporation

- Nanodiamond Technology Co., LTD.

- Advanced Technology & Materials Co., Ltd. (AT&M)

- Höganäs AB

- Saint-Gobain

- Admat Inc.

- Denton Vacuum LLC

- Treibacher Industrie AG

- GfE (Gesellschaft für Elektrometallurgie mbH)

Frequently Asked Questions

Analyze common user questions about the Titanium Carbide market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary applications driving the Titanium Carbide market growth?

The market growth is fundamentally driven by its use in high-performance cutting tools and inserts for machining hard alloys, specialized wear parts for industrial machinery, and advanced thermal barrier coatings necessary in the aerospace and defense industries, where extreme material durability is non-negotiable.

How does Titanium Carbide compare to Tungsten Carbide (WC) in industrial tooling?

Titanium Carbide (TiC) is typically harder, lighter, and more resistant to oxidation at high temperatures than Tungsten Carbide (WC). While WC cemented carbides offer higher fracture toughness, TiC-based cermets and coatings are preferred for applications demanding high speed machining with superior crater wear resistance, often used when machining steel and stainless steel.

Which geographical region dominates the consumption of Titanium Carbide?

The Asia Pacific (APAC) region currently dominates the consumption of Titanium Carbide, driven by vast manufacturing capacities in China and India, extensive automotive production, and rapid industrialization requiring large volumes of durable cutting tools and abrasive materials.

What is the significance of nano-sized Titanium Carbide powder in the current market?

Nano-sized TiC powder is significant as it enhances the mechanical properties of composites and coatings, providing increased hardness, fracture toughness, and superior performance in applications like high-density cermets and advanced additive manufacturing (3D printing), enabling the creation of stronger, lighter components.

What are the key technological restraints limiting market expansion?

Key technological restraints include the high initial capital investment required for advanced synthesis and sintering equipment (like HIP), the inherent brittleness of pure TiC ceramic parts, and the high energy consumption associated with achieving the extremely high processing temperatures required during production.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Smartwatch Ceramic Material Processing Market Statistics 2025 Analysis By Application (Android System Smartwatch, iOS System Smartwatch, Windows System Smartwatch, Others), By Type (Zirconium-oxide Processing, Titanium Carbide Processing, Others), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Titanium Carbide Tool Market Statistics 2025 Analysis By Application (Cutting, Chamfering, Drilling, Engraving, Grooving, Other), By Type (Steel-grade Carbides, Cast-iron Carbides), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Blade Coatings Market Statistics 2025 Analysis By Application (Brush, Roll, Spray Equipment), By Type (Titanium Nitrate (TiN), Titanium Carbide (TiC), Boron Carbide, Teflon), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Tungsten Titanium Carbide Market Statistics 2025 Analysis By Application (Automobile, Machine Tool), By Type (Tungsten/Titanium: 50/50, Tungsten/Titanium: 70/30), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager