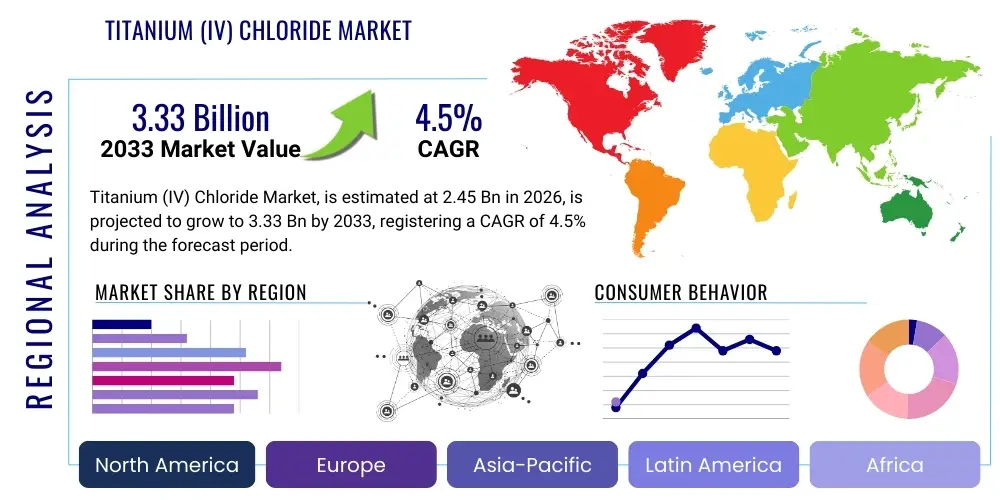

Titanium (IV) Chloride Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441609 | Date : Feb, 2026 | Pages : 258 | Region : Global | Publisher : MRU

Titanium (IV) Chloride Market Size

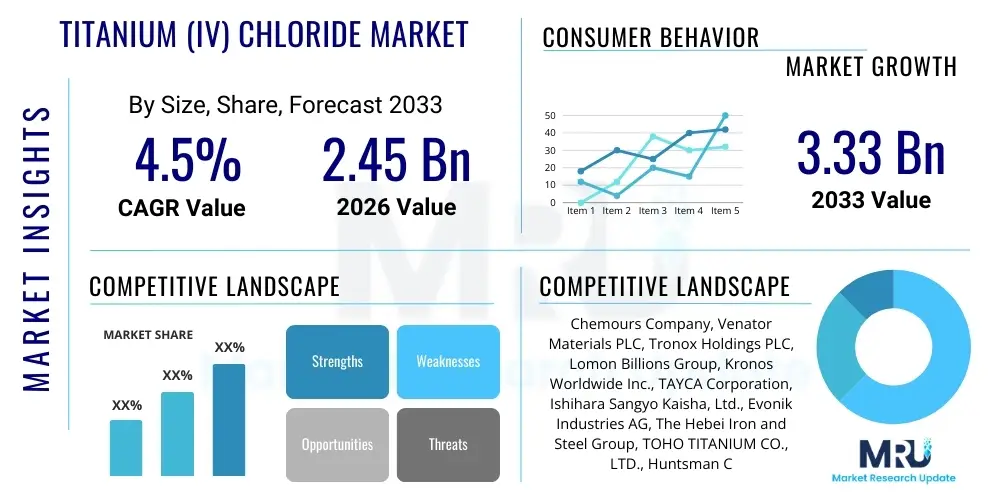

The Titanium (IV) Chloride Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.5% between 2026 and 2033. The market is estimated at $2.45 Billion in 2026 and is projected to reach $3.33 Billion by the end of the forecast period in 2033. This robust growth trajectory is fundamentally underpinned by the surging demand for titanium dioxide (TiO2) pigments across various end-use industries, particularly in construction and automotive sectors globally. Titanium (IV) Chloride (TiCl4) serves as the primary intermediate in the production of high-purity TiO2 via the chloride process, which is favored for yielding superior pigment quality compared to the older sulfate process.

Market expansion is also significantly influenced by the increasing utilization of TiCl4 in producing titanium metal sponges, crucial components for aerospace, defense, and specialized industrial applications requiring high strength-to-weight ratios and corrosion resistance. Emerging economies, especially those in the Asia Pacific region, are exhibiting high rates of industrialization and urbanization, leading to unprecedented construction activity and corresponding demand for high-performance coatings and paints, thereby boosting the consumption of TiCl4 intermediates. Furthermore, the specialized application of TiCl4 as a catalyst component in the manufacturing of polyethylene (PE) and polypropylene (PP) polymers adds another substantial layer to its market demand, connecting the TiCl4 sector directly to the booming global petrochemical industry.

Titanium (IV) Chloride Market introduction

Titanium (IV) Chloride (TiCl4), often referred to as 'Tetrachloride,' is a colorless to pale yellow, fuming liquid characterized by its highly reactive and corrosive nature. It is produced primarily through the chlorination of titanium-containing minerals such as rutile and ilmenite. Its unique chemical properties, including high volatility and reactivity, make it an indispensable intermediate chemical. The product is fundamentally essential for two major downstream industries: the production of titanium dioxide pigments, which account for the vast majority of consumption, and the manufacturing of pure titanium metal. The purity of the TiCl4 feedstock directly dictates the quality of the final pigment or metal product, emphasizing the importance of sophisticated purification technologies within the value chain.

Major applications of TiCl4 include its use as a feedstock in the chloride process for TiO2 production, where it is oxidized to form pigment-grade titanium dioxide, widely utilized in paints, coatings, plastics, and paper. Additionally, it is used in the Kroll process to produce titanium sponge metal, a vital material for the aerospace and defense sectors. Benefits associated with TiCl4 consumption are tied to the superior properties it imparts to downstream products, such as the exceptional opacity and brightness of chloride-route TiO2. Driving factors for the market include rapid infrastructural development worldwide, increasing demand for lightweight materials in transportation, and sustained growth in the packaging and plastics industries that rely heavily on TiO2 pigments for coloring and UV protection.

Titanium (IV) Chloride Market Executive Summary

The Titanium (IV) Chloride market is characterized by intense integration within the chemical and metallurgical industries, with global business trends showing a strategic shift toward establishing production facilities near mineral rich regions to optimize supply chain logistics and reduce raw material costs. Capacity expansion, particularly in China and India, reflects the regional dominance of the Asia Pacific in both production and consumption. Business strategy increasingly focuses on vertical integration, where major pigment producers secure long-term TiCl4 supply, often through captive production, to ensure quality control and supply stability amidst volatile raw material markets. Furthermore, sustainability pressures are driving research into efficient chlorination methods and byproduct (e.g., iron chloride) utilization to minimize waste and environmental impact, although the corrosive and hazardous nature of TiCl4 remains a significant regulatory hurdle.

Regional trends indicate that the Asia Pacific (APAC) region leads the global market in terms of volume consumption, driven by massive construction projects and a burgeoning automotive industry, particularly in emerging economies. North America and Europe, while mature markets, sustain stable demand due to specialized applications in aerospace (titanium metal) and high-performance industrial coatings. Segment trends reveal that the TiO2 pigment manufacturing application segment maintains overwhelming market share due to the widespread use of pigments globally. However, the titanium metal production segment, while smaller in volume, is projected to exhibit a slightly higher growth rate driven by increasing investments in aerospace and defense technologies requiring high-grade titanium alloys. Grade trends show a growing preference for high-purity TiCl4 feedstock suitable for producing ultra-high-performance pigments and specialized fine chemicals.

AI Impact Analysis on Titanium (IV) Chloride Market

Common user questions regarding AI's impact on the Titanium (IV) Chloride market frequently revolve around how artificial intelligence and machine learning can mitigate the inherent production challenges—namely, managing the highly corrosive nature of TiCl4, optimizing complex chlorination reactor conditions, and ensuring consistent high purity levels required for downstream processes. Users are also concerned about AI's role in predictive maintenance for specialized equipment and optimizing global logistics for this hazardous material. The consensus theme is that while AI will not replace the fundamental chemistry, it is poised to significantly enhance operational efficiency, safety protocols, and supply chain predictability. The primary expectation is that AI algorithms will analyze vast datasets relating to temperature, pressure, and feedstock impurities in real-time to automate process adjustments, thereby reducing waste, minimizing downtime due to equipment failure, and consistently achieving stringent product specifications necessary for high-value applications like titanium metal production.

- AI-driven optimization of chlorination reactor kinetics to maximize yield and minimize energy consumption.

- Implementation of machine learning models for predictive maintenance of highly corrosive TiCl4 handling equipment, reducing catastrophic failure risks.

- Enhanced quality control systems utilizing computer vision and AI for real-time impurity detection in the purification stage, guaranteeing pigment-grade or metal-grade feedstock purity.

- Optimization of complex, hazardous material logistics and supply chain routing to ensure compliant and cost-effective distribution.

- AI-assisted simulation and modeling for safer process design and scaling of new production technologies.

DRO & Impact Forces Of Titanium (IV) Chloride Market

The Titanium (IV) Chloride market dynamics are governed by a complex interplay of Drivers, Restraints, and Opportunities, shaping its growth trajectory and resilience against external economic factors. The overwhelming demand for titanium dioxide (TiO2) pigment stands as the single most critical driver, given that approximately 90% of all TiCl4 produced is channeled into this application. This demand is intrinsically linked to global population growth, urbanization, and continuous infrastructure development, particularly in Asia. The specialized requirement for titanium metal in high-end industries like aerospace and medical devices provides a stable, high-value demand niche, bolstering the market's long-term outlook. Furthermore, technological advancements in the chloride process itself, aiming for higher efficiency and lower environmental burden, encourage sustained investment.

However, significant restraints temper the market's explosive growth potential. Foremost among these is the highly corrosive and hazardous nature of TiCl4, which necessitates stringent safety regulations, specialized high-cost handling infrastructure, and complex disposal processes, substantially increasing operating expenses. The market's heavy reliance on the price and consistent supply of raw materials, primarily ilmenite and rutile ores, introduces volatility, as geopolitical factors or mining disruptions can directly impact production costs. Opportunities are centered on developing advanced methods for recycling TiCl4 from waste streams, particularly in the titanium metal production cycle, thereby improving sustainability. Moreover, the exploration of novel applications in specialized chemical synthesis, such as in the creation of advanced materials and solar cell components, presents avenues for diversification beyond the dominant TiO2 segment. These forces combine to create an environment where process innovation and vertical integration are essential for competitive advantage.

Impact forces in the TiCl4 market are primarily driven by regulatory frameworks, particularly those governing hazardous substance transportation and emissions. Shifts in global construction activity, often correlated with macroeconomic stability, exert immediate pressure on TiO2 demand. The structural forces are also defined by the oligopolistic nature of the TiO2 industry, where a few global players dictate the bulk of TiCl4 consumption, creating intense supplier-buyer dependence. The technological imperative to move toward high-purity, environmentally friendly production methods also constitutes a major transformative force, rewarding companies that invest heavily in process safety and waste minimization technologies. Overall, the market remains cyclical, responding strongly to GDP growth and infrastructural investment cycles.

Segmentation Analysis

The Titanium (IV) Chloride market is comprehensively segmented based on its primary application, the grade of purity required, and the geographic regions where it is produced and consumed. Application segmentation is crucial as it reflects the varying volume and purity requirements of downstream industries, with titanium dioxide production dominating the landscape. Grade segmentation delineates products suitable for standard pigment manufacturing versus those required for high-performance applications like titanium metal and specialized catalysts. Understanding these segments is key for manufacturers to align production capabilities with specific market needs, focusing on either high-volume commodity supply or low-volume, high-purity specialty chemicals. The geographic segmentation highlights the critical shifts in manufacturing capabilities and end-user demand centers, with the center of gravity increasingly moving toward the industrialized nations in Asia.

- By Application:

- Titanium Dioxide (TiO2) Pigments Production (Dominant Segment)

- Titanium Metal Production (Titanium Sponge)

- Catalyst Manufacturing (Ziegler-Natta Catalysts)

- Fine Chemical Synthesis and Other Applications

- By Grade:

- Standard Grade (Suitable for most pigment applications)

- High Purity Grade (Required for titanium metal, specialized chemicals, and high-performance pigments)

- By Region:

- North America (U.S., Canada, Mexico)

- Europe (Germany, UK, France, Italy, Rest of Europe)

- Asia Pacific (China, Japan, India, South Korea, Rest of APAC)

- Latin America (Brazil, Argentina, Rest of Latin America)

- Middle East and Africa (Saudi Arabia, UAE, Rest of MEA)

Value Chain Analysis For Titanium (IV) Chloride Market

The Titanium (IV) Chloride value chain is complex, starting with the mining and concentration of titanium-bearing ores, primarily ilmenite (FeTiO3) and rutile (TiO2). Upstream analysis involves securing a stable supply of these raw materials, which are then processed, often involving beneficiation to increase the titanium content. The core manufacturing step is the high-temperature chlorination of these refined ores in the presence of carbon, yielding crude TiCl4. This crude product then undergoes rigorous purification steps, including distillation and chemical treatment, to remove contaminants like vanadium and iron chlorides, ensuring the final product meets the high-purity standards required by downstream industries. Securing reliable and cost-effective access to these critical mineral inputs is a defining factor in the competitive landscape, often prompting major chemical producers to enter into long-term supply agreements or engage in captive mining operations to mitigate supply chain risks.

The distribution channel for TiCl4 is highly specialized due to its classification as a hazardous and corrosive material. Transportation relies on specialized rail tank cars, ISO tanks, and dedicated pipelines, necessitating strict adherence to international regulations (e.g., ADR, RID, IMO). Direct sales dominate the market, particularly between large TiCl4 producers (often integrated chemical companies) and major downstream buyers like TiO2 pigment manufacturers and titanium metal sponge producers. Indirect channels, involving specialized chemical distributors, are typically utilized for smaller volumes or sales to fine chemical synthesis companies and research laboratories where logistical complexity requires localized expert handling. The efficiency of the distribution system, centered around safety and regulatory compliance, significantly impacts the total cost of the product.

Downstream analysis focuses on the utilization of TiCl4 in its primary applications. The vast majority of the product flows into the chloride process for TiO2 production, where it is oxidized at high temperatures. The demand stability and growth projections of the market are thus inextricably linked to the performance of the paints, coatings, plastics, and paper industries. Furthermore, the titanium metal sector, requiring extremely high-purity TiCl4 for the Kroll process, acts as a niche market demanding premium pricing. Overall, the value chain demonstrates a strong producer-to-consumer integration, driven by the need to manage the risks and costs associated with handling and transporting this highly reactive intermediate.

Titanium (IV) Chloride Market Potential Customers

The primary customers in the Titanium (IV) Chloride market are global chemical corporations that operate large-scale manufacturing facilities for titanium dioxide (TiO2) pigments. These customers, including major players in the coatings, plastics, and paper industries, require consistent, high-volume supply of TiCl4 feedstock to sustain their pigment production via the chloride route. Given the significant operating costs and the high demand for product consistency in end-user applications like automotive finishes and exterior architectural paints, these customers prioritize long-term contractual agreements and quality assurance over short-term price fluctuations. The health of the construction and consumer goods sectors directly dictates the purchasing volume of these pigment producers, making them the most critical segment of the TiCl4 customer base.

A second, highly strategic group of customers comprises aerospace, defense, and specialized metallurgical firms engaged in the production of titanium metal sponge. These entities utilize TiCl4 as a precursor in the Kroll or Hunter processes. This customer base, while requiring lower volume relative to pigment producers, demands ultra-high-purity TiCl4 because even trace contaminants can compromise the mechanical integrity and corrosion resistance of the resulting titanium metal. Their purchasing decisions are driven by strict regulatory requirements, material specifications (particularly for aircraft and military components), and technological expertise. Growth in this segment is tied to global defense spending, commercial aircraft manufacturing cycles, and the expansion of specialized industrial machinery requiring lightweight, high-strength materials.

Finally, a smaller but specialized customer segment includes manufacturers of chemical catalysts and fine chemicals. TiCl4 is a critical component in Ziegler-Natta catalysts used in the polymerization of olefins (ethylene and propylene) to produce commodity plastics like PE and PP. These customers operate within the petrochemical industry and require reliable supply for their continuous polymerization processes. Additionally, research institutions and specialty chemical synthesis labs use TiCl4 as a Lewis acid or chlorinating agent. While their order sizes are minimal, they often drive demand for specialized, smaller packaging and technical support, contributing to market diversification and innovation.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $2.45 Billion |

| Market Forecast in 2033 | $3.33 Billion |

| Growth Rate | 4.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Chemours Company, Venator Materials PLC, Tronox Holdings PLC, Lomon Billions Group, Kronos Worldwide Inc., TAYCA Corporation, Ishihara Sangyo Kaisha, Ltd., Evonik Industries AG, The Hebei Iron and Steel Group, TOHO TITANIUM CO., LTD., Huntsman Corporation, Cristal Global (part of Tronox), OSAKA Titanium technologies Co., Ltd., Henan Billions Chemical Co. Ltd., Ningxia Jiahua Titanium Chemical Co., Ltd., Panzhihua Iron and Steel Vanadium Titanium & Resources Co., Ltd., Anhui Annada Titanium Industry Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Titanium (IV) Chloride Market Key Technology Landscape

The core technology underpinning the Titanium (IV) Chloride market is the high-temperature carbo-chlorination process. This technology involves reacting titanium-containing feedstocks, such as upgraded ilmenite, rutile, or synthetic rutile, with chlorine gas and a carbon source (usually petroleum coke) inside a fluidized bed reactor at temperatures exceeding 900°C. The efficiency and selectivity of this initial reaction are critical, as the output is crude TiCl4 contaminated with various metallic chlorides (e.g., FeCl3, VCl4, SiCl4). Recent technological focus has been placed on improving reactor design to handle lower-grade, cheaper feedstocks more efficiently while minimizing the formation of undesirable byproducts. Innovation also targets heat recovery systems within the chlorination unit to enhance overall energy efficiency, a significant operating cost factor.

Following the chlorination step, purification technology becomes paramount, especially for producing high-purity TiCl4 essential for titanium metal and premium TiO2 grades. The standard purification methodology relies on complex, fractional distillation processes under controlled atmospheric conditions to sequentially separate the TiCl4 from less volatile metal chlorides and highly volatile impurities like silicon tetrachloride. Advances in this area include utilizing specialized catalytic reduction techniques, often involving copper or iron powder, to chemically convert difficult-to-separate impurities like vanadium oxychloride (VOCl3) into non-volatile compounds that can be easily removed through distillation. Continuous investment in advanced analytical instrumentation, such as highly sensitive gas chromatography, is also integral to maintaining real-time quality control and optimizing purification parameters.

A crucial technological area emerging in the landscape is the development of robust, corrosion-resistant materials for handling and storage. Given TiCl4's highly corrosive nature, specialized high-nickel alloys and advanced ceramic linings are necessary for reactor vessels, piping, and storage tanks. Furthermore, environmental technology related to byproduct management is gaining importance. Companies are increasingly investing in sophisticated treatment facilities to neutralize or convert hazardous liquid byproducts, such as iron chlorides and spent chlorination residue, into usable industrial materials (e.g., iron oxide pigments or flocculants), thereby improving both environmental compliance and resource utilization. This shift towards circular economy practices is becoming a critical differentiator for leading producers.

Regional Highlights

- Asia Pacific (APAC): APAC is the dominant region in the global Titanium (IV) Chloride market, accounting for the largest share in both production capacity and consumption volume. This leadership is fundamentally driven by the robust manufacturing base for TiO2 pigments, particularly in China and India, which cater to enormous domestic demand generated by unparalleled construction and infrastructure spending. The availability of raw materials (ilmenite and rutile), coupled with lower operating costs and governmental support for industrial expansion, encourages major global and regional players to concentrate production here. High growth is expected in this region due to continued urbanization and the expanding automotive sector.

- North America: North America represents a mature yet strategically important market, characterized by high demand for specialized, high-purity TiCl4 primarily utilized in the aerospace and defense sectors for titanium metal production. The market here is driven less by volume growth and more by technological superiority and strict quality adherence. Key players focus on process efficiency and integration to serve captive demand within their TiO2 and titanium metal operations. Environmental regulations are exceptionally stringent, necessitating high investment in safety and waste management technologies.

- Europe: Europe maintains a strong presence, driven by established chemical and automotive industries, demanding high-quality pigments for premium coatings and plastics. The European market focuses heavily on innovation, particularly in sustainable production practices and the utilization of byproducts. While consumption growth is steady, it is regulated by strict environmental policies, pushing manufacturers toward adopting best available technologies (BAT) and optimizing existing production lines rather than large-scale new capacity additions.

- Latin America: This region exhibits moderate growth potential, tied primarily to regional infrastructure investments in Brazil and Mexico. Demand is largely met through imports or local production from global players with strategic facilities. The market is primarily focused on serving the paints and coatings segment for residential and commercial construction, with smaller niche demand for catalysts and specialized chemicals.

- Middle East and Africa (MEA): The MEA region is emerging as a significant area due to investments in petrochemical facilities and infrastructure projects, particularly in the Gulf Cooperation Council (GCC) countries. The market potential is boosted by the potential for local raw material sourcing (heavy mineral sands) and strategic governmental initiatives aimed at diversifying industrial output, supporting demand for both coatings and catalyst applications.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Titanium (IV) Chloride Market.- Chemours Company

- Venator Materials PLC

- Tronox Holdings PLC

- Lomon Billions Group

- Kronos Worldwide Inc.

- TAYCA Corporation

- Ishihara Sangyo Kaisha, Ltd.

- Evonik Industries AG

- The Hebei Iron and Steel Group

- TOHO TITANIUM CO., LTD.

- Huntsman Corporation

- Cristal Global (part of Tronox)

- OSAKA Titanium technologies Co., Ltd.

- Henan Billions Chemical Co. Ltd.

- Ningxia Jiahua Titanium Chemical Co., Ltd.

- Panzhihua Iron and Steel Vanadium Titanium & Resources Co., Ltd.

- Anhui Annada Titanium Industry Co., Ltd.

- Sichuan Lomon Titanium Industry Co., Ltd.

- Kemetyl Group

- Rutile and Zircon Mines (RZM)

Frequently Asked Questions

Analyze common user questions about the Titanium (IV) Chloride market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary driver of demand for Titanium (IV) Chloride?

The primary driver is the massive global demand for Titanium Dioxide (TiO2) pigments, which utilize TiCl4 as the essential intermediate feedstock in the high-efficiency chloride process, serving the paints, coatings, plastics, and paper industries worldwide.

How is Titanium (IV) Chloride typically produced commercially?

Commercially, TiCl4 is produced via the carbo-chlorination of titanium-bearing minerals like rutile or ilmenite, involving high-temperature reaction with chlorine gas and carbon in a fluidized bed reactor, followed by meticulous purification via fractional distillation.

Which geographical region dominates the Titanium (IV) Chloride market consumption?

The Asia Pacific (APAC) region, led by China and India, dominates consumption due to intense construction activity, rapid industrialization, and significant expansion of its domestic TiO2 manufacturing capacities.

What are the key risks associated with handling Titanium (IV) Chloride?

TiCl4 is highly reactive, corrosive, and toxic; it reacts violently with water and moisture, producing corrosive hydrochloric acid fumes. Key risks include severe corrosion of equipment, stringent regulatory compliance costs, and high safety requirements for transportation and storage.

Beyond pigments, what is the major high-value application of TiCl4?

The major high-value application is its use as a precursor in the Kroll process for manufacturing high-purity titanium metal sponge, which is critical for the aerospace, defense, and specialized medical device industries.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager