TMJ Implants Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442250 | Date : Feb, 2026 | Pages : 246 | Region : Global | Publisher : MRU

TMJ Implants Market Size

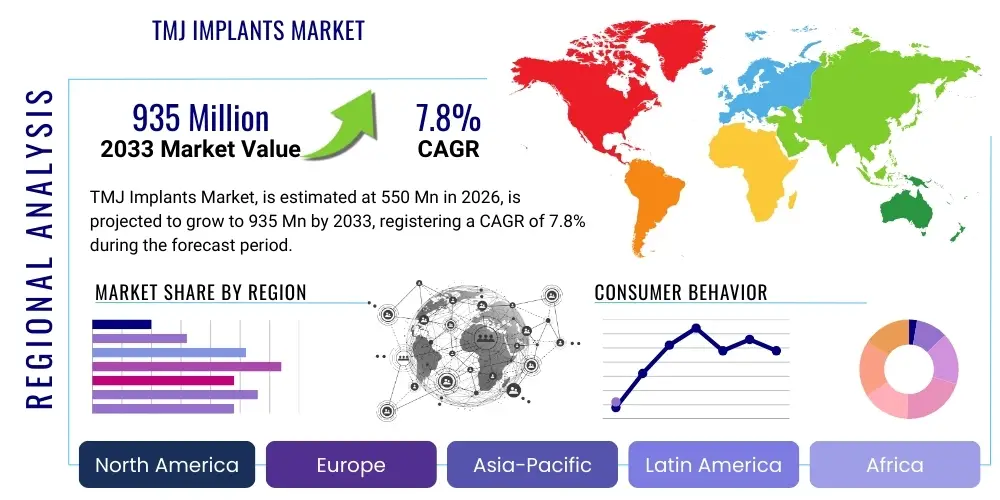

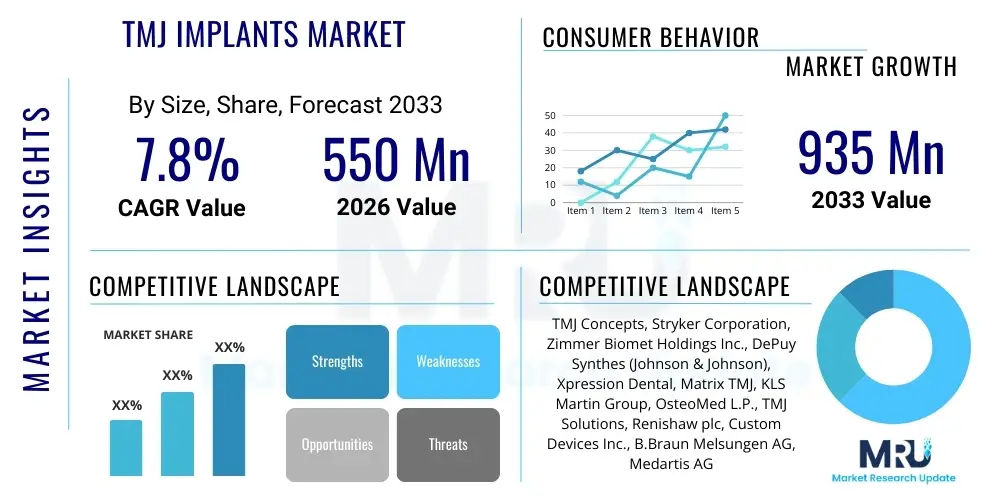

The TMJ Implants Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at USD 550 Million in 2026 and is projected to reach USD 935 Million by the end of the forecast period in 2033. This substantial expansion is primarily driven by the increasing global prevalence of temporomandibular joint disorders (TMDs) that necessitate surgical intervention, particularly for end-stage degenerative conditions, trauma, or congenital defects that fail conservative treatments. The adoption of custom-fitted, patient-specific implants is a major contributor to value growth, offering superior anatomical fit and functional outcomes compared to stock components, thereby justifying premium pricing and driving market value expansion.

The growth trajectory of the market is intrinsically linked to advancements in surgical techniques and biomaterials. Modern TMJ implants increasingly utilize high-performance materials such as Cobalt-Chromium (CoCr) alloys and ultra-high molecular weight polyethylene (UHMWPE) for articulating surfaces, enhancing durability and reducing wear debris. Furthermore, the integration of advanced digital workflow technologies, including Computer-Aided Design (CAD) and Computer-Aided Manufacturing (CAM), allows for rapid prototyping and production of complex implant geometries. These technological shifts are lowering surgical risks, improving patient recovery times, and expanding the eligible patient pool seeking definitive TMJ reconstruction solutions. The favorable outcomes associated with these newer-generation implants reinforce their clinical adoption globally.

Regional dynamics also play a critical role, with established healthcare economies in North America and Europe demonstrating high procedural volumes due to strong infrastructure, high public awareness of TMD treatments, and robust reimbursement frameworks. However, emerging economies, particularly in the Asia Pacific region, are rapidly adopting these sophisticated devices as disposable incomes rise and specialized surgical capabilities improve. This globalization of surgical proficiency and patient access ensures sustained market momentum. The focus remains on improving the long-term success rates and reducing the potential for complications associated with prosthetic joint replacement, which further fuels research and development efforts among key industry players to maintain high standards of patient care and market trust.

TMJ Implants Market introduction

Temporomandibular Joint (TMJ) implants are specialized medical devices designed for the surgical replacement of the natural temporomandibular joint, which connects the jawbone to the skull. These implants are utilized primarily in cases of end-stage joint disease, severe trauma, congenital anomalies, or when prior conventional treatments, such as arthrocentesis or arthroplasty, have failed to alleviate chronic pain and functional limitation. TMJ replacement products typically consist of a mandibular component (condyle) and a fossa component (glenoid fossa), engineered to mimic the complex mechanics of the natural joint, restoring chewing ability, proper jaw alignment, and eliminating debilitating chronic pain.

The major applications for TMJ implants are highly specific, focusing on patients diagnosed with conditions such as severe osteoarthritis, ankylosis (fusion of the joint), gross structural deformities resulting from tumor resection, or trauma-induced defects. The primary benefit derived from these devices is the significant improvement in the quality of life for patients, characterized by restored mandibular function, increased mouth opening capacity, and substantial reduction or elimination of chronic orofacial pain. The market is increasingly pivoting towards patient-specific, custom-made total joint replacement systems, which offer superior congruence with native anatomy, optimizing biomechanical stability and potentially extending the longevity of the implant construct compared to off-the-shelf or stock systems.

Driving factors for the growth of the TMJ Implants Market include the rising global incidence and recognition of severe TMD requiring surgical intervention, particularly within an aging demographic prone to degenerative joint conditions. Furthermore, continuous technological refinement, especially in additive manufacturing (3D printing) for custom components and the development of highly biocompatible materials like Polyether Ether Ketone (PEEK) for the fossa component, enhances implant performance and attracts greater surgeon confidence. Favorable clinical outcomes reported in peer-reviewed literature, alongside heightened patient awareness regarding definitive surgical solutions, further accelerate market adoption worldwide, solidifying the implant's role as a viable option for complex maxillofacial reconstruction.

TMJ Implants Market Executive Summary

The global TMJ Implants Market is exhibiting robust growth, propelled by strong business trends centered on personalization and digital integration. A dominant trend is the shift from standard stock systems to custom total joint replacement solutions, driven by their superior fit, reduced surgical time, and minimized risk of long-term complications, translating into higher average selling prices and improved profitability for manufacturers. Companies are investing heavily in establishing digital platforms that streamline the process from CT scan data acquisition to final implant design and manufacturing via 3D printing, creating a high barrier to entry for new competitors who lack comprehensive digital manufacturing capabilities. Consolidation among smaller custom implant providers by large orthopedic and maxillofacial conglomerates is another notable business trend aimed at expanding global distribution networks and accessing proprietary design technologies.

Regionally, North America maintains market leadership, primarily due to sophisticated healthcare infrastructure, high procedural volumes facilitated by specialized Oral and Maxillofacial Surgeons, and comprehensive insurance coverage for reconstructive procedures. However, the Asia Pacific region is forecast to experience the highest growth rate, fueled by improving access to specialized surgical training, rising healthcare expenditure, and a massive latent patient population in countries like China and India. European markets remain steady, characterized by stringent regulatory pathways but high standards of clinical acceptance. Geopolitical stability and rapid urbanization in key emerging markets are enabling the establishment of specialized surgical centers, further spreading the geographical footprint of TMJ implant procedures beyond traditional strongholds.

In terms of segmentation trends, the total joint replacement segment dominates the market volume, largely necessitated by end-stage ankylosis and severe degenerative disease where partial joint options are insufficient. Within material segmentation, the combination of Cobalt-Chromium (CoCr) for the condyle and Ultra-High Molecular Weight Polyethylene (UHMWPE) for the fossa remains the gold standard due to proven durability, though interest in advanced composite materials such as PEEK is growing, particularly for applications requiring reduced artifact in follow-up imaging. The end-user segment is dominated by specialized hospitals and dedicated surgical centers, which possess the necessary sterile environment, imaging capabilities, and multi-disciplinary teams (including maxillofacial surgeons, radiologists, and physical therapists) required for successful complex reconstruction surgery.

AI Impact Analysis on TMJ Implants Market

User queries regarding AI’s influence on the TMJ Implants Market frequently center on concerns about accuracy in diagnostic pre-planning, the potential for autonomous surgical execution, and the longevity prediction of custom implants. Patients and clinicians are keenly interested in how AI can enhance the personalization process, specifically asking about algorithmic assistance in determining optimal joint alignment, material selection based on patient-specific biomechanics, and identifying subtle predictors of implant failure. The key theme emerging from these inquiries is the expectation that AI should reduce human error in complex customization processes, minimize surgical invasiveness, and fundamentally improve long-term functional outcomes by delivering predictive maintenance insights, thereby driving the next generation of precision maxillofacial surgery.

The integration of Artificial Intelligence (AI) and Machine Learning (ML) algorithms is poised to revolutionize the TMJ Implants sector by significantly enhancing surgical planning, predictive modeling, and quality control during manufacturing. AI-driven image segmentation tools can rapidly analyze high-resolution CT and CBCT scans, accurately delineating bone boundaries and joint spaces, which is crucial for custom implant design. ML models, trained on vast datasets of previous implant geometries, patient demographics, and clinical outcomes, can recommend optimized design parameters that minimize stress shielding and maximize range of motion specific to an individual patient’s requirements. This computational efficiency reduces the turnaround time for custom manufacturing and increases the probability of first-time fit success, cutting down on expensive and time-consuming intraoperative adjustments.

Furthermore, AI is extending its influence into the operating room through advanced surgical navigation systems. These systems use computer vision and augmented reality overlays, guided by pre-operative AI planning, to assist surgeons in achieving highly precise osteotomies and accurate positioning of the implant components. Post-operatively, AI algorithms can monitor patient recovery trajectories, analyzing data from wearable sensors or periodic imaging to predict potential complications, such as loosening or infection, long before they become clinically apparent. This predictive capability shifts the clinical paradigm from reactive intervention to proactive management, improving patient safety and contributing valuable feedback to the design iteration cycle, ensuring that future implant models are continuously optimized for performance and longevity.

- AI-enabled Diagnostic Precision: Enhanced segmentation and volumetric analysis of TMJ anatomy from medical imaging (CT/CBCT) to inform patient-specific design.

- Predictive Biomechanics: Machine Learning models analyze biomechanical stress patterns to optimize implant material thickness and geometry, reducing failure risk.

- Custom Design Automation: Algorithms accelerate the Computer-Aided Design (CAD) process for patient-matched implants, significantly reducing design cycles.

- Surgical Navigation Enhancement: AI integration into augmented reality and robotic systems for ultra-precise implant placement and surgical pathway guidance.

- Outcome Forecasting: Use of clinical data and image analysis to predict long-term implant survival rates and identify early indicators of potential wear or loosening.

- Inventory Optimization: AI tools help manufacturers manage complex custom and stock implant inventories based on forecasted surgical demands and regional prevalence data.

DRO & Impact Forces Of TMJ Implants Market

The TMJ Implants Market is shaped by a powerful confluence of drivers, constraints, and opportunities that dictate its growth trajectory and structure. The primary driver is the accelerating prevalence of debilitating temporomandibular joint disorders, often refractory to conservative treatments, demanding definitive surgical solutions. This demographic push is synergized by continuous technological advancements in biomaterials (such as PEEK and advanced metallic alloys) and manufacturing techniques (3D printing and CAD/CAM), which consistently improve the functional lifespan and biocompatibility of implants. Simultaneously, the market faces significant constraints, most notably the extremely high cost of custom TMJ replacement procedures, often exceeding tens of thousands of dollars, coupled with complex and lengthy regulatory approval processes, especially in emerging markets. These high costs and regulatory hurdles limit accessibility, acting as natural restraints on universal adoption.

Opportunities within the market are predominantly concentrated in the field of personalized medicine. The continued refinement of patient-specific custom implant technology represents a significant avenue for high-value growth, appealing to patients and surgeons seeking optimal anatomical fit and reduced revision rates. Furthermore, expanding into underserved geographic markets, particularly Asia Pacific and Latin America, where healthcare infrastructure is rapidly developing, offers substantial untapped potential. The industry is also capitalizing on opportunities arising from enhanced clinical education and specialized training programs for oral and maxillofacial surgeons, which aim to broaden the pool of practitioners capable of performing these technically demanding procedures, thereby increasing overall market throughput. The impact forces indicate a strong positive momentum, where technological push and demographic need are currently outweighing the constraints posed by cost and regulatory complexity.

The impact forces driving the market can be categorized into four primary vectors: technological superiority, patient demand for quality of life improvements, economic pressures favoring long-term solutions, and robust regulatory oversight ensuring product safety. Technological superiority, particularly the move toward customized, digitally manufactured implants, is perhaps the strongest positive force, consistently elevating patient outcomes and generating clinical literature that supports broader adoption. Patient demand, fueled by increased awareness and unsatisfactory results from previous treatments, exerts significant upward pressure on market utilization. While economic constraints exist, the long-term cost-effectiveness of a successful total joint replacement, when compared to managing chronic pain and repeated failed surgeries, acts as a subtle economic driver. These combined forces ensure the market remains specialized yet highly progressive, requiring continuous investment in research and development to maintain competitive advantage.

Segmentation Analysis

The TMJ Implants Market is systematically segmented based on product type, material composition, design approach, and the end-user setting, allowing for granular analysis of market dynamics and competitive positioning. Product segmentation distinguishes between total joint replacement systems, which involve replacing both the mandibular and fossa components, and partial joint reconstruction systems, typically used for isolated condylar defects or localized trauma. The design approach is perhaps the most critical segmentation differentiator, dividing the market between highly profitable Custom/Patient-Specific implants, which dominate high-value procedures, and Stock/Off-the-Shelf implants, which offer quicker availability but often require more intraoperative adaptation. Understanding these segment dynamics is essential for strategic market penetration, as the custom segment commands significantly higher average selling prices and requires specialized manufacturing capabilities, contrasting sharply with the volume-driven potential of stock devices in certain trauma settings.

Material composition forms a fundamental segmentation criterion, focusing on the components’ long-term durability and biocompatibility. The dominant pairing involves metallic alloys, primarily Cobalt-Chromium or Titanium, used for the high-stress mandibular component, articulating against a bearing surface made of medical-grade polymers, typically Ultra-High Molecular Weight Polyethylene (UHMWPE), for the fossa component. Alternative materials, such as Polyether Ether Ketone (PEEK), are gaining traction due to their imaging compatibility and elasticity closer to natural bone, segmenting the market based on advanced material science adoption. Furthermore, the market is segmented by end-users, differentiating between procedures performed in specialized Hospitals that handle the majority of complex cases, and Ambulatory Surgical Centers (ASCs), which are increasingly equipped to handle less complex, elective TMJ procedures, particularly in North America where cost-efficiency is a driving factor.

The detailed segmentation structure reflects the clinical complexity inherent in TMJ reconstruction. The growth drivers within each segment vary; for example, the custom implant segment growth is driven by surgical precision and favorable clinical data, whereas the stock segment growth is more dependent on rapid response to trauma cases and cost containment initiatives. Geographical segmentation also influences product mix, with North America showing a strong preference for custom total joint systems, while regions with nascent healthcare infrastructure may initially prioritize more cost-effective stock solutions. Tracking the transition between these segments provides insight into the maturation of regional healthcare systems and the globalization of highly specialized surgical techniques.

- Product Type:

- Total Joint Replacement Implants

- Partial Joint Replacement/Reconstruction Implants (e.g., Condylar Replacement)

- Design Type:

- Custom/Patient-Specific TMJ Implants

- Stock/Off-the-Shelf TMJ Implants

- Material Composition:

- Metal Alloys (Cobalt-Chromium, Titanium)

- Polymeric Materials (UHMWPE, PEEK)

- Composite Materials

- End-User:

- Hospitals

- Ambulatory Surgical Centers (ASCs)

- Specialized Dental Clinics

- Geography:

- North America (U.S., Canada)

- Europe (Germany, U.K., France, Italy, Spain, Rest of Europe)

- Asia Pacific (China, Japan, India, Australia, Rest of APAC)

- Latin America (Brazil, Mexico, Rest of LATAM)

- Middle East & Africa (MEA)

Value Chain Analysis For TMJ Implants Market

The value chain for the TMJ Implants Market is characterized by a specialized, technologically intensive sequence, beginning with upstream activities focused heavily on raw material quality and digital data processing. Upstream analysis involves the procurement of high-grade biocompatible materials, such as certified medical-grade titanium, cobalt-chromium alloys, and specialized polymers like UHMWPE or PEEK. A crucial component of the upstream value chain is the acquisition and processing of patient data (CT/CBCT scans), which feeds directly into the Computer-Aided Design (CAD) stage. This data intensive step often involves proprietary software and specialized biomedical engineering expertise to design patient-specific components, followed by manufacturing, typically utilizing advanced additive manufacturing (3D printing) or precision CNC machining, ensuring the stringent ISO and ASTM standards for medical devices are met before sterilization and packaging.

The midstream and downstream phases focus on distribution and end-user adoption. The distribution channel is highly specialized, relying predominantly on indirect sales through experienced, dedicated orthopedic or maxillofacial surgical distributors who possess deep technical knowledge about the implant systems and surgical procedures. Due to the high-value, low-volume nature of these implants, direct sales by manufacturers are often limited to large teaching hospitals or key opinion leader institutions. Indirect channels ensure broader reach and provide essential logistical support, inventory management, and technical field assistance during complex surgeries. Strong relationships between manufacturers and maxillofacial surgeons are paramount, often built through extensive clinical training and continuous product support.

The final step involves the direct adoption by the end-user—the hospital or surgical center—where the procedure is performed. Success in the downstream market hinges not only on product quality but also on favorable reimbursement policies and seamless integration of the implant workflow (from scanning to surgery) into the clinical setting. The value chain is heavily weighted towards intellectual property, proprietary design algorithms, and precision manufacturing capabilities, making barriers to entry substantial. Continuous efforts are focused on optimizing the logistical flow of custom products to reduce lead times, a critical competitive advantage in high-demand surgical scheduling.

TMJ Implants Market Potential Customers

The primary customers and end-users of TMJ implants are patients suffering from end-stage temporomandibular joint disorders (TMDs) that necessitate total or partial joint reconstruction. Specifically, these are individuals diagnosed with severe debilitating conditions such as advanced degenerative joint disease (osteoarthritis), idiopathic condylar resorption, complex trauma resulting in irreversible joint damage, or failure of prior joint surgeries (e.g., failed arthroplasty or alloplastic replacements). These patients typically present with chronic pain, severe trismus (limited mouth opening), and functional impairments that significantly compromise their ability to eat, speak, and maintain quality of life, making them candidates for this specialized, definitive surgical solution.

From an institutional perspective, the direct buyers of TMJ implant systems are specialized healthcare facilities. These include large tertiary care hospitals, university teaching hospitals, and dedicated trauma centers that employ Oral and Maxillofacial Surgeons (OMS) and craniofacial surgeons. These institutions are equipped with the specialized operating room technology, high-resolution imaging capabilities (CT, MRI), and post-operative care infrastructure required for complex maxillofacial reconstructive surgery. The purchasing decisions within these settings are often influenced by the lead surgeon's preference, clinical data supporting the implant system's longevity and performance, and the hospital's procurement policies regarding high-cost custom devices.

A growing secondary customer base includes specialized Ambulatory Surgical Centers (ASCs), particularly in developed markets like the U.S., focusing on elective surgical procedures that offer cost efficiencies over traditional hospital settings. However, due to the complexity and required inpatient monitoring for many TMJ replacement procedures, hospitals remain the dominant end-user. Ultimately, success relies on convincing the specialized surgical community—the OMS and plastic/craniofacial surgeons—of the technological superiority, reliability, and optimal patient-specific customization features of a given implant system, as they are the key decision-makers driving clinical adoption and defining the standard of care.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 550 Million |

| Market Forecast in 2033 | USD 935 Million |

| Growth Rate | CAGR 7.8% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | TMJ Concepts, Stryker Corporation, Zimmer Biomet Holdings Inc., DePuy Synthes (Johnson & Johnson), Xpression Dental, Matrix TMJ, KLS Martin Group, OsteoMed L.P., TMJ Solutions, Renishaw plc, Custom Devices Inc., B.Braun Melsungen AG, Medartis AG, Anatomics Pty Ltd, Biomet Microfixation, Ossur Corporate, Medtronic plc, Ortho-Max, Straumann Group, Dentsply Sirona. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

TMJ Implants Market Key Technology Landscape

The technological landscape of the TMJ Implants Market is heavily influenced by digital manufacturing and advanced material science, moving rapidly toward complete personalization and superior long-term performance. The cornerstone technology is Computer-Aided Design and Manufacturing (CAD/CAM), which translates high-fidelity patient imaging (CT/CBCT data) into precise 3D models used for surgical planning and implant fabrication. This technology allows surgeons and biomedical engineers to simulate complex movements, assess optimal component positioning, and design implant surfaces that minimize stress on surrounding bone structures. The high resolution and precision offered by CAD/CAM are indispensable for producing patient-specific devices, differentiating leading manufacturers who have perfected the digital workflow from initial scan to final sterilization, often utilizing cloud-based platforms for secure data exchange and collaboration.

Additive Manufacturing, or 3D printing, represents the most significant manufacturing advancement, particularly Selective Laser Melting (SLM) for metallic components and specialized polymer printing techniques for the fossa component. 3D printing enables the creation of complex, customized geometries that are impossible to achieve through traditional subtractive manufacturing. Furthermore, it facilitates the incorporation of porous structures or textured surfaces on the implant components, intended to promote bone integration (osseointegration) and improve the long-term stability of the implant within the bone. The use of 3D printing allows for rapid prototyping and production, dramatically reducing the lead time for custom implants, which is a critical factor in trauma and time-sensitive reconstruction cases, solidifying its dominant position in the manufacturing phase of the value chain.

Material science innovation continues to focus on enhancing biocompatibility, mechanical endurance, and reducing wear debris. While the combination of CoCr (for the mandibular component) and UHMWPE (for the fossa bearing surface) remains the industry standard due to proven clinical history, there is growing exploration of novel materials. Polyether Ether Ketone (PEEK), a high-performance polymer, is increasingly used due to its radiolucency (reducing imaging artifact) and modulus of elasticity closer to natural bone, potentially minimizing stress shielding. Furthermore, surface modification technologies, such as plasma spraying of hydroxyapatite or specialized coating applications, are employed to improve tissue integration and potentially reduce the risk of late-stage complications, representing incremental but essential technological enhancements contributing to overall implant success rates and driving the continued premium valuation of these highly engineered devices.

Regional Highlights

- North America: Market Dominance and High Customization Adoption

North America, particularly the United States, represents the largest and most mature market for TMJ implants globally. This dominance is attributable to several key factors, including highly developed healthcare infrastructure, a large concentration of specialized Oral and Maxillofacial Surgeons trained in complex joint reconstruction, and favorable, albeit complex, reimbursement policies that cover high-cost custom total joint replacement procedures. The U.S. market is characterized by a strong preference for patient-specific implants, driven by surgical demands for precision and competitive pressure among manufacturers to offer the most technologically advanced and clinically supported devices. Regulatory pathways, while rigorous (FDA approval), provide clarity for novel product introduction, encouraging continuous innovation in both materials and surgical techniques, ensuring North America remains the primary epicenter for market growth and technological diffusion in the specialized field of maxillofacial surgery.

- Europe: Steady Growth and Stringent Quality Standards

The European market for TMJ implants demonstrates steady and sustainable growth, primarily fueled by advanced healthcare systems in Western European countries like Germany, the U.K., and France. Market expansion here is dictated by stringent quality control and high clinical evidence requirements enforced by regulatory bodies. European surgeons are often early adopters of proven technologies, showing a strong uptake of metallic alloys combined with UHMWPE for articulation. The focus is increasingly on standardizing surgical protocols across the continent to ensure consistent outcomes. While the market is highly competitive, the adoption of custom devices is somewhat more controlled than in the U.S., balancing personalization benefits against national healthcare cost containment strategies. The harmonization of medical device regulations across the EU facilitates market access but necessitates rigorous adherence to quality and clinical performance data.

- Asia Pacific (APAC): Emerging High-Growth Hub

The Asia Pacific region is projected to register the fastest growth rate during the forecast period. This rapid expansion is driven by massive improvements in healthcare infrastructure, increasing economic prosperity resulting in higher disposable incomes, and the swift modernization of surgical practices in key countries such as China, India, South Korea, and Australia. While the procedural volume is lower than in the West, the large patient pool suffering from TMDs and trauma, coupled with rising public and governmental investment in specialized medical facilities, creates unparalleled opportunities. Market access strategies in APAC often involve navigating diverse regulatory environments and focusing on establishing strong distribution networks and clinical training centers to educate local surgeons on complex TMJ reconstruction techniques, balancing the need for cost-effective stock solutions with the clinical demand for advanced custom devices.

- Latin America, Middle East & Africa (LAMEA): Nascent Potential and Infrastructure Challenges

The LAMEA region currently holds the smallest market share but possesses significant untapped potential. Growth is hampered by inconsistent reimbursement frameworks, lower public awareness, and variability in the availability of highly specialized surgical expertise and necessary infrastructure (e.g., advanced imaging equipment). However, key regional economies like Brazil, Mexico, and the UAE are investing heavily in medical tourism and improving domestic specialized care, leading to gradual market penetration. The adoption of TMJ implants in these regions is often concentrated in metropolitan centers and private hospital settings. Market strategies here focus on providing accessible training programs, ensuring regulatory compliance, and offering product portfolios that balance advanced custom technology with economically viable stock alternatives to accelerate institutional adoption.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the TMJ Implants Market.- TMJ Concepts

- Stryker Corporation

- Zimmer Biomet Holdings Inc.

- DePuy Synthes (Johnson & Johnson)

- Xpression Dental

- Matrix TMJ

- KLS Martin Group

- OsteoMed L.P.

- TMJ Solutions

- Renishaw plc

- Custom Devices Inc.

- B.Braun Melsungen AG

- Medartis AG

- Anatomics Pty Ltd

- Biomet Microfixation

- Ossur Corporate

- Medtronic plc

- Ortho-Max

- Straumann Group

- Dentsply Sirona

Frequently Asked Questions

Analyze common user questions about the TMJ Implants market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the average lifespan and durability of a TMJ implant?

The typical lifespan of a modern TMJ total joint replacement implant is generally estimated to be 10 to 20 years, though many exceed this duration. Longevity heavily depends on the implant material (e.g., CoCr/UHMWPE combination), surgical technique precision, patient adherence to post-operative care, and the patient's individual biological response and activity level. Success rates are significantly improved with custom-fitted implants.

Are TMJ implants considered a standard or last-resort treatment for TMJ disorders (TMD)?

TMJ implant surgery is considered a definitive, last-resort treatment reserved for patients with end-stage temporomandibular joint disease, severe trauma, or conditions like ankylosis where non-surgical methods or less invasive arthroscopic procedures have failed to provide adequate functional restoration or pain relief. It is not recommended for mild or moderate TMD cases.

What are the key benefits of using custom patient-specific TMJ implants over stock implants?

Custom implants offer superior anatomical fit and congruence, which minimizes the need for intraoperative adjustments, reduces surgical time, and optimizes biomechanical function. This precision leads to better long-term functional outcomes, decreased risk of complications such as loosening, and potentially improved longevity compared to standardized stock components.

What specialized materials are commonly used in the manufacture of TMJ implants?

TMJ implants primarily utilize high-performance, biocompatible materials. The mandibular component (condyle) is often made from robust metallic alloys like Cobalt-Chromium (CoCr) or Titanium, while the glenoid fossa component, which acts as the bearing surface, is typically fabricated from medical-grade polymers such as Ultra-High Molecular Weight Polyethylene (UHMWPE) or, increasingly, Polyether Ether Ketone (PEEK).

How long is the typical recovery period following TMJ total joint replacement surgery?

Initial recovery, including managing acute pain and swelling, typically lasts 2 to 4 weeks. However, functional recovery, involving physical therapy and restoration of full mouth opening and chewing ability, usually takes 3 to 6 months. Full adaptation and final results can often be assessed around 9 to 12 months post-surgery, emphasizing consistent rehabilitation efforts.

What role does 3D printing technology play in the modern TMJ Implants Market?

3D printing (Additive Manufacturing) is crucial for the customization segment. It allows manufacturers to rapidly produce complex, patient-specific geometries directly from CAD files, ensuring perfect anatomical matching. This technology is vital for fabricating the metal and polymer components with internal structures that enhance osseointegration and reduce manufacturing lead times.

Which geographical region holds the largest market share for TMJ Implants?

North America, particularly the United States, currently dominates the global TMJ Implants Market. This leadership is driven by high procedural volumes, advanced surgical expertise, technological leadership in custom manufacturing, and robust reimbursement systems for complex maxillofacial reconstructive procedures.

What are the main risks associated with TMJ replacement surgery?

While generally safe, risks include infection, nerve injury (potentially affecting sensation or facial movement), heterotopic bone formation, limited mouth opening post-operatively, and the eventual need for revision surgery due to implant wear, loosening, or failure over time. Careful patient selection and precise surgical technique mitigate these risks substantially.

How is Artificial Intelligence (AI) influencing the design and planning of TMJ implants?

AI is used in pre-operative planning to analyze patient imaging data, segment anatomical structures, and run simulations to predict optimal implant positioning and design parameters. This algorithmic assistance minimizes variability, enhances the accuracy of custom designs, and optimizes biomechanical performance before the implant is even manufactured.

What is the primary constraint hindering faster market adoption of TMJ implants globally?

The primary constraint is the significantly high cost associated with the complex surgical procedure and the specialized, custom nature of the implant devices. Coupled with often inconsistent or incomplete reimbursement coverage in less developed regions, the high economic barrier limits widespread accessibility despite proven clinical efficacy.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager