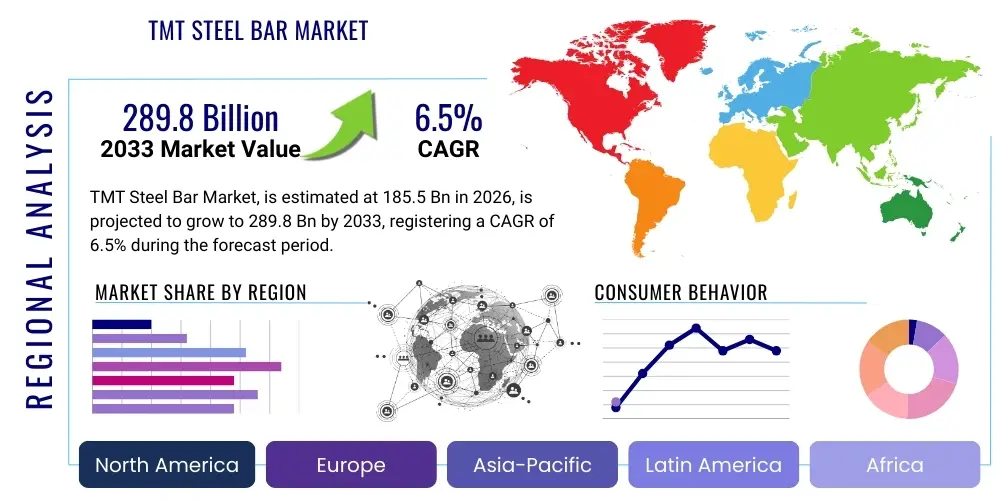

TMT Steel Bar Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442835 | Date : Feb, 2026 | Pages : 242 | Region : Global | Publisher : MRU

TMT Steel Bar Market Size

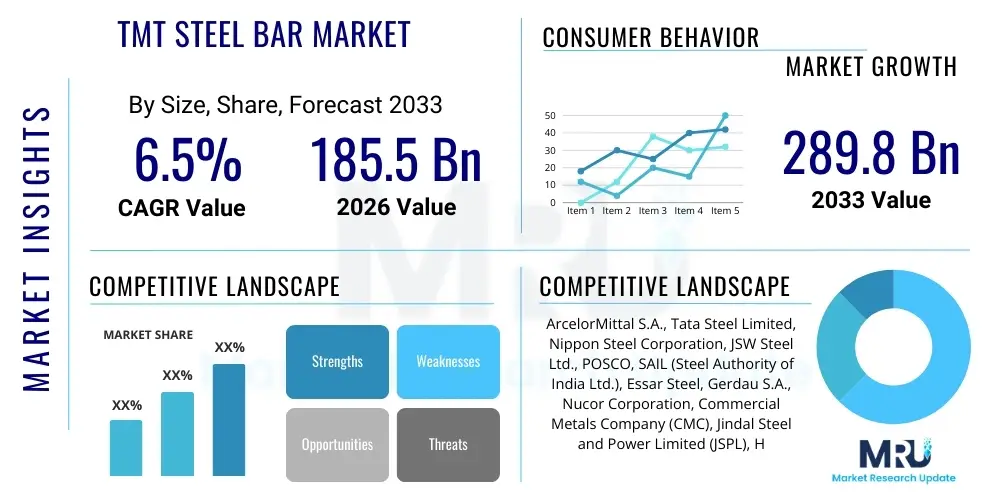

The TMT Steel Bar Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at $185.5 Billion in 2026 and is projected to reach $289.8 Billion by the end of the forecast period in 2033.

TMT Steel Bar Market introduction

The TMT (Thermo-Mechanically Treated) Steel Bar Market encompasses the global production, distribution, and consumption of high-strength reinforcement bars essential for modern construction and infrastructure projects. These specialized steel bars are manufactured using a sophisticated heat treatment process, typically involving rapid quenching followed by self-tempering, which imparts a hard outer surface (martensite structure) for high yield strength and a softer, ductile inner core (ferrite-pearlite structure) for excellent elongation and bendability. This unique microstructural configuration ensures superior earthquake resistance, enhanced thermal stability, and better bonding with concrete compared to traditional mild steel bars, positioning TMT bars as the industry standard for critical construction applications globally.

TMT steel bars are critical components in various sectors, primarily driven by large-scale infrastructure development and burgeoning residential and commercial real estate activities across developing economies. Major applications include the construction of high-rise buildings, bridges, dams, ports, tunnels, and other public infrastructure works where structural integrity and durability are paramount. The inherent benefits of TMT bars—such as high tensile strength, superior corrosion resistance (especially in coastal or high-humidity environments), improved weldability, and reduced consumption due due to higher load-bearing capacity—have solidified their dominance over conventional reinforcement materials. Furthermore, the standardization of TMT grades (e.g., Fe 500, Fe 550D, Fe 600) based on IS, ASTM, or equivalent international codes ensures consistent quality and performance essential for robust engineering projects.

Key driving factors accelerating the growth of this market include aggressive governmental investments in infrastructure projects globally, particularly in regions like Asia Pacific and the Middle East, aimed at urban renewal and connectivity enhancement. Rapid urbanization, necessitating extensive development of affordable and high-quality housing, further stimulates demand for reliable reinforcement materials. Technological advancements in steel production, focusing on energy efficiency and achieving higher-grade TMT bars (e.g., Fe 600) with superior properties, also contribute significantly to market expansion. Additionally, stricter building codes and seismic safety regulations following natural disasters mandate the use of high-strength, earthquake-resistant materials, directly favoring TMT steel bars over less resilient alternatives, thus ensuring continued market momentum throughout the forecast period.

TMT Steel Bar Market Executive Summary

The TMT Steel Bar Market is experiencing transformative business trends characterized by a dual focus on capacity expansion and sustainability integration. Leading steel producers are heavily investing in modernization of rolling mills and deploying advanced quenching technologies (like the TEMPCORE process) to optimize production efficiency and meet stringent quality specifications. A significant business trend involves strategic backward integration, securing captive sources of iron ore and coal/scrap, mitigating the impact of volatile raw material prices, and enhancing supply chain resilience. Regionally, the market is overwhelmingly dominated by the Asia Pacific, driven by the massive infrastructure pipelines in India and China, though emerging markets in Southeast Asia and the Middle East (GCC nations) are exhibiting the highest rates of growth due to large-scale urban development projects and preparations for global events, creating sustained demand for foundational construction materials.

Segment-wise, the market is primarily categorized by product grade (Fe 500, Fe 550, Fe 600) and application (Residential, Commercial, Infrastructure). The infrastructure segment currently holds the largest market share, bolstered by long-term government commitments to transportation networks (highways, rail) and energy infrastructure (power plants, transmission towers). However, the residential segment is projected to show robust growth, particularly the demand for high-strength, seismic-resistant Fe 550D and Fe 600 grades, reflecting consumer preferences for durability and safety in high-density urban housing. Furthermore, technological trends are steering the market toward greater adoption of 'Green Steel' production methods, utilizing electric arc furnaces (EAFs) fed by scrap metal rather than traditional blast furnaces (BFs), addressing mounting environmental pressures and carbon emission reduction targets imposed by global regulatory bodies.

Competitive dynamics within the market are characterized by intense rivalry among a few global giants and numerous regional players. Consolidation activities, including mergers and acquisitions, are common strategies employed by large corporations to expand geographical reach and secure access to advanced production capabilities. Successful market players are increasingly focusing on digital transformation, utilizing data analytics for demand forecasting and operational efficiency, and enhancing customer experience through robust distribution networks. The trajectory of the market remains highly correlated with global economic health and government fiscal policies concerning capital expenditure, but the long-term structural demand driven by global population growth and urbanization ensures a positive outlook, provided raw material supply chains remain stable and compliant with evolving environmental mandates.

AI Impact Analysis on TMT Steel Bar Market

Common user questions regarding AI's impact on the TMT Steel Bar Market center on three critical areas: optimization of the manufacturing process, quality control consistency, and supply chain predictability. Users frequently inquire about how machine learning algorithms can minimize energy consumption in electric arc furnaces (EAFs) or traditional rolling mills, specifically focusing on temperature control during the critical quenching phase to ensure precise metallurgical properties are achieved across every batch. There is also significant interest in leveraging computer vision and deep learning models for automated, real-time defect detection during rolling, aiming to reduce human error and guarantee adherence to high-strength grade specifications (e.g., Fe 550D). Key user concerns revolve around the high initial investment required for sensor deployment and AI integration, the necessity for retraining the existing workforce, and ensuring data privacy and security throughout the production lifecycle, particularly when integrating third-party logistics and demand forecasting platforms.

The application of Artificial Intelligence and advanced data analytics is fundamentally transforming the operational landscape of TMT steel bar manufacturing, moving it toward 'Smart Steel Production.' Predictive maintenance, powered by AI, is enabling manufacturers to forecast equipment failure accurately, minimizing unplanned downtime in critical, high-temperature processes such as continuous casting and rolling. By analyzing vast streams of sensor data related to vibration, temperature, and pressure, algorithms can determine the optimal time for maintenance, dramatically improving Overall Equipment Effectiveness (OEE) and ensuring consistent operational throughput, which is vital for meeting large infrastructure project deadlines and maintaining competitive pricing structures in the highly volume-driven steel sector.

Furthermore, AI significantly enhances supply chain management and demand forecasting within the TMT market. Given the volatility of raw material prices (iron ore, scrap) and fluctuating construction demand, machine learning models analyze macroeconomic indicators, governmental spending announcements, regional weather patterns, and historical sales data to generate highly accurate predictions of future TMT bar requirements. This predictive capability allows producers to optimize inventory levels, schedule procurement efficiently, and tailor production cycles to emerging market needs, thereby reducing holding costs and minimizing waste. The implementation of AI-driven logistics optimization also helps in selecting the most cost-effective and environmentally sound transportation routes, which is crucial for reducing the final delivered cost of bulky steel products.

- Enhanced quality control through real-time, AI-powered defect detection systems in rolling mills.

- Optimization of energy consumption and process variables (temperature, speed) in Thermo-Mechanical Treatment (TMT).

- Predictive maintenance schedules reducing unplanned downtime of critical steel manufacturing equipment (furnaces, rolling stands).

- Improved supply chain resilience and cost reduction via AI-driven demand forecasting and logistics optimization.

- Automation of inventory management and warehouse operations using robotic process automation (RPA) and computer vision.

DRO & Impact Forces Of TMT Steel Bar Market

The TMT Steel Bar Market is shaped by a confluence of powerful drivers, structural restraints, and emerging opportunities, collectively defining the market's impact forces. The primary drivers stem from unprecedented global infrastructure stimulus and sustained urbanization, especially across high-growth regions like Asia Pacific and the Middle East, where significant capital is allocated to build modern transportation, power, and utility networks, requiring high volumes of durable, high-strength reinforcement steel. This robust infrastructural demand, coupled with evolving seismic safety regulations mandating superior steel grades, creates a foundational, non-discretionary demand base for TMT products. These powerful drivers ensure that despite economic fluctuations, long-term market growth remains fundamentally strong, fueled by governmental planning cycles and demographic shifts.

Conversely, the market faces considerable restraints, primarily the extreme volatility and cyclical nature of raw material prices, particularly iron ore, coking coal, and steel scrap. These price fluctuations directly impact manufacturers' operating margins and necessitate sophisticated risk management strategies. Furthermore, stringent environmental regulations, particularly concerning carbon emissions from traditional steel production (Blast Furnace-Basic Oxygen Furnace route), pose a significant financial burden on manufacturers, demanding substantial investments in decarbonization technologies or a shift towards cleaner Electric Arc Furnace (EAF) production, which relies heavily on scrap availability. Geopolitical instability and trade protectionism (e.g., tariffs, anti-dumping duties) also act as restraining forces, disrupting established supply chains and limiting the seamless international flow of steel products.

Opportunities in the TMT steel market are concentrated in technological innovation and sustainability initiatives. The growing imperative for 'Green Steel' production, utilizing hydrogen technology or maximizing scrap use in EAFs, presents a major opportunity for producers to differentiate their products and attract environmentally conscious buyers, especially in developed markets like Europe. The adoption of advanced, higher-grade TMT bars (Fe 600 and above) for specialized construction (e.g., nuclear power, long-span bridges) offers higher revenue per unit. Additionally, the proliferation of digital tools for procurement, sales, and supply chain transparency presents opportunities for operational efficiency gains. The increasing emphasis on modular and prefabricated construction techniques also opens a niche market for specialized, precision-cut TMT bar components.

Segmentation Analysis

The TMT Steel Bar Market is intricately segmented across several dimensions, allowing for precise market tracking and strategic planning. The primary segmentation dimensions are based on Product Type (Grade), Diameter/Size, and End-Use Application. Grade segmentation is critical, ranging from Fe 415 to Fe 600 and beyond, with higher grades signifying superior yield strength and tensile properties, suitable for high-stress applications. The choice of grade is heavily influenced by regional building codes and the nature of the structure, such as whether it is a highly seismic zone or a massive infrastructure project requiring long-term durability. Understanding the demand distribution across these grades is essential for optimizing production portfolios.

Segmentation by diameter is equally important, directly correlating with the specific structural elements being reinforced. Common diameters range from 8mm to 32mm and even higher for specialized uses. Smaller diameters (8mm-12mm) are typically utilized for stirrups, residential slab reinforcement, and secondary structural components, while larger diameters (16mm-32mm) are mandatory for primary load-bearing structures like columns, beams, and heavy foundations in commercial high-rises and bridges. Production capacities often specialize in certain diameter ranges, impacting regional competitive landscapes and logistical considerations, as different sizes dictate distinct rolling mill configurations.

Finally, the market is structurally divided by its End-Use Application, predominantly split into Residential, Commercial, and Infrastructure sectors. The Infrastructure segment, encompassing roads, bridges, public transport systems, and utility networks, consistently represents the largest volume consumption globally due to the sheer material requirements of public works projects. However, the Residential segment provides a steadier stream of demand linked directly to population growth and housing starts, while the Commercial sector (office spaces, retail, hospitality) is highly sensitive to overall economic health. Analyzing these segments provides strategic insights into demand elasticity and resilience against economic cycles.

- By Grade: Fe 415, Fe 500, Fe 550, Fe 600, Others (Higher Grades like Fe 650)

- By Diameter: Below 12mm, 12mm to 20mm, Above 20mm

- By Process: Basic Oxygen Furnace (BOF), Electric Arc Furnace (EAF)

- By Application: Residential Construction, Commercial Construction, Infrastructure (Roads, Bridges, Dams, Power Plants)

Value Chain Analysis For TMT Steel Bar Market

The TMT Steel Bar value chain commences with the upstream acquisition of primary raw materials: iron ore, coking coal (for BF route), and steel scrap (for EAF route), alongside necessary additives like ferroalloys. This upstream segment is characterized by significant capital intensity and high supply risk due to the geopolitical concentration of mineral resources. The primary processing stage involves the conversion of these raw materials into crude steel, typically through integrated steel plants (BF-BOF) or secondary producers (EAFs). Following this, crude steel is cast into billets or blooms, which are then passed through sophisticated rolling mills for shaping and the critical thermo-mechanical treatment (TMT) process, ensuring the final product meets required strength and ductility standards.

The midstream process focuses on the manufacturing and quality assurance of the TMT bars. After the TMT process, bars are cut, bundled, and tested for compliance with national and international standards (e.g., seismic resilience, chemical composition). Distribution channels form the core of the downstream segment, involving both direct and indirect routes. Direct distribution channels are typically employed for large-scale infrastructure projects where manufacturers negotiate directly with government agencies or large engineering, procurement, and construction (EPC) firms, often supplying customized lengths or grades. This route ensures control over quality and logistics but requires significant dedicated sales and logistics infrastructure.

Indirect distribution relies heavily on a robust network of authorized distributors, dealers, and retail hardware stores, crucial for reaching smaller residential and commercial builders. These intermediaries provide essential warehousing, inventory management, and financing services, bridging the gap between high-volume manufacturing centers and fragmented consumer demand points. Efficient logistics management, especially optimizing transport costs for heavy, bulk materials, is a decisive factor in maintaining competitiveness. The efficiency and reliability of both direct and indirect channels ultimately determine the market penetration and geographical reach of a TMT steel bar manufacturer, making channel management a critical strategic lever in the market.

TMT Steel Bar Market Potential Customers

The potential customers for the TMT Steel Bar Market are concentrated within the expansive global construction ecosystem, primarily comprising entities responsible for conceiving, financing, and executing large-scale building and civil engineering projects. The largest segment of end-users consists of major Infrastructure Development Authorities and Government Public Works Departments (PWDs). These bodies are responsible for funding and overseeing critical national projects such as high-speed rail networks, national highways, major dams, power transmission corridors, and port developments. Their purchasing is characterized by high volume, stringent quality specifications (often demanding higher grades like Fe 550D or Fe 600), and reliance on competitive bidding processes that necessitate guaranteed supply consistency and quality certification.

Another crucial customer segment includes large Engineering, Procurement, and Construction (EPC) companies and general contractors. These firms act as immediate buyers, sourcing TMT bars for incorporation into the multitude of projects they execute across residential, commercial, and industrial domains. These companies prioritize reliable supply chains, on-time delivery, and technical support from manufacturers, often forming long-term relationships to secure predictable pricing and material availability. Their requirements span the full range of TMT grades and diameters, dictated by specific project blueprints and structural requirements. The decision-making unit in this segment focuses on material certification, compliance with structural engineering requirements, and overall cost-effectiveness.

Finally, the residential and commercial real estate developers, alongside small to medium-sized builders, constitute a decentralized but voluminous customer base. While individual purchases are smaller than those by government agencies, the collective demand from this segment drives a substantial portion of the retail market, often through indirect distribution channels (dealers and retailers). These end-users are highly sensitive to local market pricing, brand reputation, and the immediate availability of materials in standard sizes (e.g., 10mm and 16mm). For manufacturers, satisfying this segment requires strong brand visibility, effective channel management, and localized marketing efforts focusing on product benefits such as earthquake resistance and superior concrete bonding.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $185.5 Billion |

| Market Forecast in 2033 | $289.8 Billion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | ArcelorMittal S.A., Tata Steel Limited, Nippon Steel Corporation, JSW Steel Ltd., POSCO, SAIL (Steel Authority of India Ltd.), Essar Steel, Gerdau S.A., Nucor Corporation, Commercial Metals Company (CMC), Jindal Steel and Power Limited (JSPL), HBIS Group, China Baowu Steel Group Corp., Rizhao Steel, Jiangsu Shagang Group, Hyundai Steel Company, Gulf Steel Industries, Kamdhenu Limited, RINL, Sumitomo Metal Industries. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

TMT Steel Bar Market Key Technology Landscape

The technological evolution within the TMT Steel Bar Market is primarily centered around optimizing the core production process and enhancing product properties to meet increasingly demanding structural requirements. The foundational technology remains the Thermo-Mechanical Treatment (TMT) process, widely implemented through licensed technologies such as TEMPCORE, which involves specialized water cooling systems immediately after the final rolling stage. This critical quenching process controls the microstructure formation, creating the signature hard martensitic surface layer and the soft, ferrite-pearlite core. Recent advancements focus on refining the cooling parameters (water flow rate, pressure, and temperature) using highly automated controls and digital twin simulations to ensure metallurgical consistency across various bar diameters and to achieve superior grades like Fe 600, characterized by higher yield strength without compromising ductility, crucial for earthquake-prone regions.

Beyond the TMT process itself, sustainability and manufacturing efficiency drive current technological investments. There is a decisive global shift towards utilizing Electric Arc Furnaces (EAFs) over traditional Basic Oxygen Furnaces (BOFs) for steel production, particularly in regions with high scrap availability or favorable electricity prices. EAF technology significantly lowers the embedded carbon footprint of steel, aligning with global decarbonization goals. Innovations in EAF operations include oxygen lancing, advanced burner systems, and optimized scrap preheating, all aimed at reducing tap-to-tap time and minimizing energy consumption per ton of steel produced. Furthermore, advanced automation, leveraging Internet of Things (IoT) sensors and Artificial Intelligence (AI), is deployed across the rolling mill to monitor production parameters in real-time, drastically reducing material wastage and improving overall equipment effectiveness (OEE).

Material testing and quality assurance technologies have also seen significant advancements. Non-destructive testing (NDT) methods, such as ultrasonic testing and eddy current testing, are increasingly integrated into the production line to rapidly and accurately verify internal soundness, dimensional accuracy, and surface quality, ensuring that every batch meets stringent international standards. This move towards continuous, automated testing replaces reliance on periodic destructive batch testing, enhancing quality assurance speed and reliability. Furthermore, the development of specialized micro-alloyed steel compositions incorporating elements like vanadium, niobium, or titanium allows manufacturers to achieve ultra-high-strength properties (Fe 650 or higher) without sacrificing weldability or toughness, catering to niche, high-performance civil engineering applications such as high-stress bridge segments and specialized pre-stressed concrete structures, thereby continuously pushing the performance envelope of TMT steel bars.

Regional Highlights

-

Asia Pacific (APAC): APAC represents the undeniable epicenter of the global TMT Steel Bar Market, commanding the largest share in terms of both production capacity and consumption volume. This dominance is fundamentally driven by the enormous, sustained infrastructure development programs in countries like China and India, alongside accelerating urbanization in Southeast Asian nations (Indonesia, Vietnam, Philippines). China, despite facing structural slowdowns in its property sector, maintains monumental steel production capabilities, and its long-term strategy shifts focus towards high-quality, specialized steel for massive transport and utility projects. India is a key growth engine, fueled by massive capital expenditure on national highway expansion, affordable housing initiatives (PMAY), and industrial corridors, creating consistent and robust demand, particularly for Fe 500D and Fe 550D grades known for their superior seismic resistance. The region benefits from lower labor costs and the presence of integrated steel majors, though it also faces increasing pressure to adopt cleaner production methods to address severe pollution concerns.

The South Asian market, particularly India, is witnessing a competitive environment marked by aggressive capacity expansion by both domestic conglomerates (e.g., Tata Steel, JSW) and public sector enterprises. The emphasis here is on vertical integration and technological upgrades to manufacture higher-grade TMT bars efficiently. Government policies strongly favor domestic production, which shields local manufacturers but also mandates adherence to increasingly stringent quality and environmental standards. Furthermore, rapidly expanding urban centers necessitate substantial investments in multi-story residential and commercial complexes, which require reliable, certified reinforcement materials. This combination of government-led infrastructure spending and privately driven real estate buoyancy assures that APAC will remain the fastest-growing and largest regional market throughout the forecast period, continually shaping global price benchmarks and production trends.

-

North America and Europe: These regions are characterized by mature, replacement-driven demand, high regulatory oversight, and a strong focus on sustainability. North America's demand is stable, primarily driven by maintenance and rehabilitation of aging infrastructure (bridges, highways) and robust commercial construction, often utilizing locally sourced steel due to protectionist trade policies and Buy America/Buy European mandates. The market here relies heavily on Electric Arc Furnace (EAF) production, utilizing recycled scrap, making it highly dependent on scrap steel availability and utility costs. The preference is overwhelmingly for high-quality, certified products that comply with strict ASTM and CE standards.

In Europe, the market growth is moderate but exceptionally focused on decarbonization and achieving 'Green Steel' standards. Regulatory frameworks, such as the EU Emissions Trading System (ETS) and the emerging Carbon Border Adjustment Mechanism (CBAM), place significant financial penalties on carbon-intensive production, accelerating the industry's shift toward hydrogen-reduced iron and low-carbon EAF technologies. Demand is stable, supported by investments in renewable energy infrastructure and high-value building projects requiring premium-priced, traceable, and sustainable TMT products. Manufacturers in this region, such as ArcelorMittal, are pioneering sustainable steel production routes, aiming for market differentiation through environmental performance rather than purely cost competition.

-

Middle East & Africa (MEA) and Latin America: MEA is a region exhibiting high growth potential, propelled by massive oil-revenue-backed infrastructure projects, particularly in the GCC states (Saudi Arabia, UAE) for giga-projects, futuristic cities, and diversification initiatives away from fossil fuels. The harsh climatic conditions necessitate TMT bars with superior corrosion resistance and specific certifications, fueling demand for high-quality imports and boosting local capacity expansion. Investment in localized steel production is growing to enhance self-sufficiency and stabilize supply chains against geopolitical risks. In Latin America, market growth is often cyclical and sensitive to commodity price volatility and political stability. Key markets like Brazil and Mexico rely on infrastructure spending and housing demand, but logistics challenges and fluctuating domestic currencies can restrain sustained, large-scale growth. However, the long-term need for basic infrastructure development across the continent provides fundamental support for TMT bar consumption.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the TMT Steel Bar Market.- ArcelorMittal S.A.

- Tata Steel Limited

- Nippon Steel Corporation

- JSW Steel Ltd.

- POSCO

- SAIL (Steel Authority of India Ltd.)

- Essar Steel

- Gerdau S.A.

- Nucor Corporation

- Commercial Metals Company (CMC)

- Jindal Steel and Power Limited (JSPL)

- HBIS Group

- China Baowu Steel Group Corp.

- Rizhao Steel

- Jiangsu Shagang Group

- Hyundai Steel Company

- Gulf Steel Industries

- Kamdhenu Limited

- RINL (Rashtriya Ispat Nigam Limited)

- Sumitomo Metal Industries

Frequently Asked Questions

Analyze common user questions about the TMT Steel Bar market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving demand for TMT steel bars globally?

The primary factor driving global demand for TMT steel bars is the unprecedented scale of public and private investment in critical infrastructure projects, particularly in high-growth regions like Asia Pacific and the Middle East, coupled with rapid urbanization necessitating durable, high-strength reinforcement for seismic-resistant construction.

How do higher grades of TMT bars, such as Fe 550D and Fe 600, benefit construction projects?

Higher grades like Fe 550D and Fe 600 offer superior yield strength and enhanced ductility (as indicated by the 'D'), allowing for reduced steel consumption while maintaining structural integrity. This leads to lighter foundations, greater safety margins in seismic zones, and overall cost savings in material volume for large structures like high-rise buildings and bridges.

What impact does the shift towards Electric Arc Furnace (EAF) technology have on the TMT steel market?

The shift towards EAF technology, which uses recycled steel scrap, significantly reduces the carbon footprint associated with TMT bar production compared to traditional blast furnaces. This addresses stringent environmental regulations, appeals to sustainable building projects, and contributes to the long-term trend of 'Green Steel' in the market.

What are the main risks associated with the TMT steel bar supply chain?

The main supply chain risks include the extreme volatility and cyclical pricing of primary raw materials (iron ore, coking coal, and scrap metal), disruptions caused by geopolitical trade tensions (tariffs), and logistics complexities involved in transporting heavy, bulk construction materials across regional and international borders.

Which geographical region exhibits the fastest growth rate for TMT steel bar consumption?

The Asia Pacific (APAC) region, driven primarily by continuous, large-scale governmental investment in foundational infrastructure and housing in India and Southeast Asia, exhibits the fastest and most substantial growth rate for TMT steel bar consumption globally.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager