Toilet Cabin Modular Structure Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442926 | Date : Feb, 2026 | Pages : 246 | Region : Global | Publisher : MRU

Toilet Cabin Modular Structure Market Size

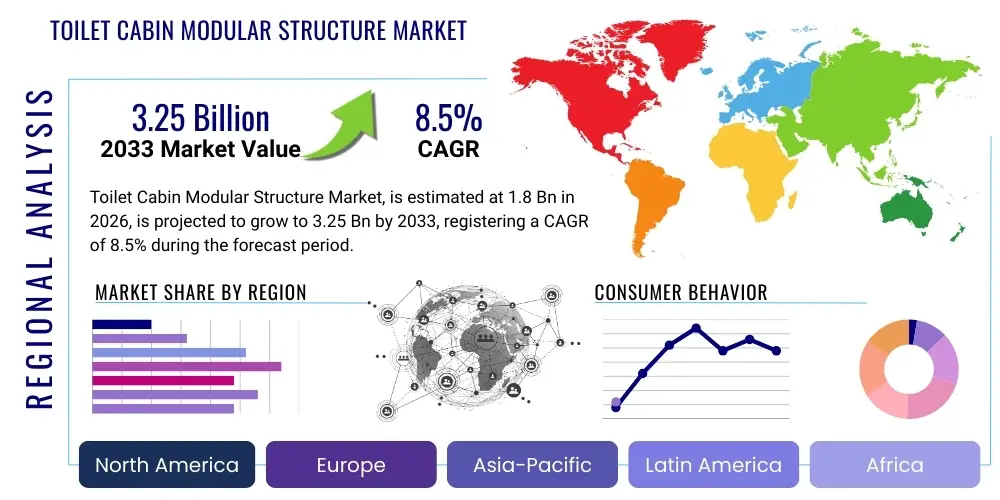

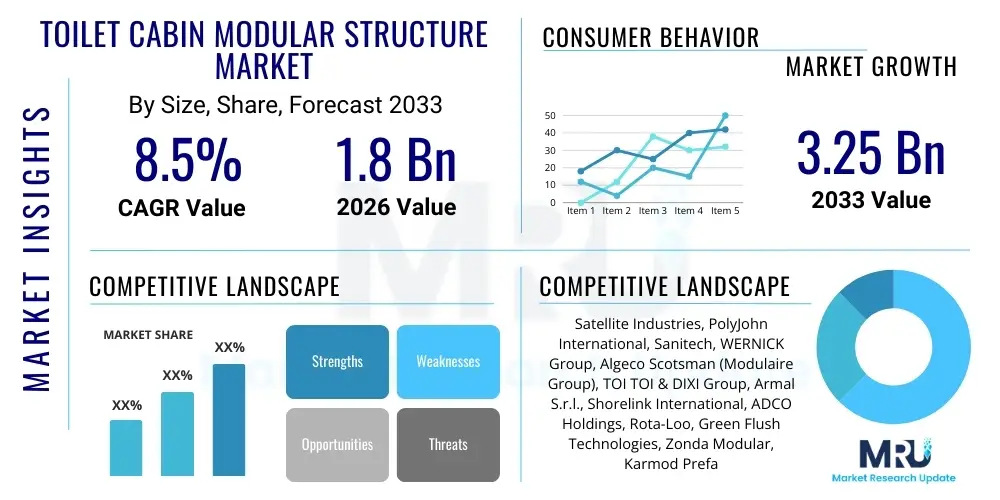

The Toilet Cabin Modular Structure Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at $1.8 Billion in 2026 and is projected to reach $3.25 Billion by the end of the forecast period in 2033. This substantial growth trajectory is underpinned by increasing urbanization globally, heightened focus on public health and sanitation infrastructure, and the inherent advantages of modular construction, including speed of deployment and cost-effectiveness compared to traditional construction methods.

The valuation reflects the growing adoption across diverse sectors, including large-scale infrastructure projects, emergency relief efforts, major public events, and permanent installations in remote or challenging terrains. Factors such as governmental initiatives promoting improved sanitation facilities in developing economies and the rising preference for sustainable building materials are crucial accelerators for market expansion. Furthermore, the capacity for manufacturers to customize modular units to specific regional standards and technological requirements, such as integration with smart systems for usage monitoring and maintenance scheduling, contributes significantly to market resilience and expansion.

Toilet Cabin Modular Structure Market introduction

The Toilet Cabin Modular Structure Market encompasses the design, manufacture, and deployment of prefabricated, self-contained toilet facilities constructed using modular building techniques. These structures are typically built off-site in factory settings under controlled conditions, ensuring high quality and consistent standards before being transported and rapidly assembled at the final location. The product range spans from basic portable restrooms used in construction sites to sophisticated, multi-unit public washrooms incorporating advanced features like water recycling, smart sensing technology, and accessibility compliance.

Major applications of these modular structures include providing temporary sanitation solutions for large outdoor events, festivals, disaster relief camps, and long-term semi-permanent facilities at governmental parks, highways, educational institutions, and remote industrial sites. The primary benefits driving market adoption are the reduced construction timelines, lower site disruption, superior material quality control inherent to factory production, flexibility in design configuration, and scalability to meet fluctuating demand. Driving factors include stricter public health regulations globally, the increasing pace of urban development requiring rapid infrastructure deployment, and the economic efficiency offered by standardized, repeatable modular construction processes.

The modular approach addresses several critical challenges faced by traditional construction, particularly the unpredictable nature of on-site labor and weather delays. By leveraging standardized dimensions and materials such as steel frames, composite panels, and engineered plastics, manufacturers can deliver durable, aesthetically pleasing, and highly functional sanitation units quickly. This adaptability makes modular toilet cabins an indispensable component of modern infrastructure planning, especially in scenarios demanding immediate and reliable public access to hygienic facilities.

Toilet Cabin Modular Structure Market Executive Summary

The Toilet Cabin Modular Structure Market is experiencing robust growth fueled by favorable macroeconomic and demographic trends, particularly concentrated urbanization and infrastructure investment across Asia Pacific and the Middle East. Business trends highlight a strong shift toward sustainable materials, integration of IoT for optimized operational efficiency, and a service-centric model where manufacturers offer full lifecycle management, including installation, maintenance, and decommissioning. Key industry players are focusing on vertical integration and strategic partnerships to secure material supply chains and expand distribution networks, targeting large governmental and municipal contracts which represent significant, stable revenue streams.

Regionally, Asia Pacific is anticipated to dominate market expansion, driven by massive public infrastructure projects in India and China, coupled with initiatives addressing sanitation shortages in densely populated urban and rural areas. North America and Europe maintain strong market share, characterized by high demand for high-end, customized modular units featuring advanced climate control, accessibility features (ADA compliance), and aesthetically superior finishes for luxury events and permanent public parks. Segment trends show significant uptake in steel-framed structures due to their durability and lifespan, while the application segment is increasingly dominated by demand from the construction and events industries, which require highly flexible and mobile solutions.

Furthermore, the competitive landscape is intensifying, pushing companies to invest heavily in design innovation, focusing on features that enhance user experience, such as touchless technology and self-cleaning mechanisms. The executive summary confirms that market resilience is tied directly to regulatory support for improved hygiene standards and the ongoing technological advancements making modular units smarter, more resource-efficient (e.g., composting or waterless solutions), and easier to deploy in various logistical settings, ensuring sustained profitability for stakeholders navigating these dynamic market conditions.

AI Impact Analysis on Toilet Cabin Modular Structure Market

User inquiries regarding AI's influence in the Toilet Cabin Modular Structure Market primarily revolve around three central themes: enhancing operational efficiency, predicting maintenance needs, and optimizing user experience through smart sanitation. Users frequently ask about how AI-driven sensors can monitor usage patterns to proactively signal when cleaning or restocking is necessary, reducing unnecessary labor costs. There is keen interest in predictive maintenance algorithms analyzing component wear (e.g., plumbing, ventilation systems) to minimize downtime, and how AI can optimize water and energy consumption based on real-time occupancy data. Furthermore, consumers inquire about AI-enabled interactive interfaces, accessibility features, and personalized environmental controls within the cabins, aiming for a truly modern, touchless, and hygienic public restroom experience.

The integration of Artificial Intelligence and Machine Learning (ML) transforms modular toilet cabins from static infrastructure into intelligent, responsive sanitation systems. AI algorithms process data streams from various sensors—including occupancy sensors, air quality monitors, water flow meters, and waste levels—to create predictive models for resource management and logistical planning. This capability allows operators to achieve unprecedented levels of efficiency, deploying cleaning crews only when threshold indicators are met, rather than relying on fixed schedules, significantly lowering operational expenditures and improving sanitation consistency across multiple deployed units in a network.

Beyond maintenance and resource optimization, AI plays a crucial role in design validation and structural integrity monitoring. ML models can simulate the performance of various modular designs under different environmental stresses (e.g., high wind, seismic activity, extreme temperature fluctuations) before physical construction begins, leading to faster prototyping and higher reliability. In the manufacturing phase, AI-powered robotics can improve precision and speed in the assembly of standardized components, reducing waste and further compressing time-to-market. Ultimately, AI fosters a shift towards 'Sanitation as a Service' (SaaS) model, where hygiene levels are guaranteed and automatically adjusted based on dynamic demand.

- Predictive Maintenance: AI analyzes sensor data to anticipate failures in plumbing or electrical systems, scheduling repairs proactively.

- Dynamic Cleaning Scheduling: ML algorithms optimize cleaning routes and frequency based on real-time usage and environmental factors (humidity, odor detection).

- Resource Optimization: AI controls water flushing volumes, lighting, and ventilation based on occupancy, minimizing utility consumption.

- Demand Forecasting: AI models analyze event schedules and historical usage to optimize the strategic placement and inventory levels of modular units.

- Quality Control in Manufacturing: AI vision systems monitor assembly lines for defects, ensuring structural integrity and component accuracy during off-site fabrication.

- Enhanced Accessibility: AI-powered voice commands and smart interfaces improve usability for individuals with disabilities, ensuring ADA compliance enforcement.

- Touchless Operation: Integration of AI for gesture recognition and automated controls minimizes physical contact points, increasing hygiene standards.

DRO & Impact Forces Of Toilet Cabin Modular Structure Market

The market dynamics are defined by robust Drivers such as increasing global health consciousness and regulatory pressures for improved public sanitation, alongside the intrinsic benefit of rapid deployment required by the booming construction and outdoor event sectors. Restraints primarily involve the high initial capital investment required for establishing efficient off-site manufacturing facilities and the logistical challenges associated with transporting oversized modular units, particularly across diverse geographical terrains with varying infrastructure quality. Opportunities abound in developing innovative, sustainable sanitation solutions like composting and water-recycling units, and expanding into untapped rural or emergency relief markets where immediate, reliable infrastructure is critical. These forces collectively dictate the strategic pathways for industry players, pushing for continuous innovation in material science and logistical efficiency to overcome market friction.

Key drivers include large-scale urban development projects in emerging economies, necessitating rapid deployment of temporary and permanent public facilities, and the inherent cost and time savings associated with modular fabrication compared to conventional construction. Furthermore, the rising awareness of environmental impact has accelerated the demand for eco-friendly modular cabins utilizing recycled materials and resource-efficient technologies. However, the market faces restraints related to the perception of modular structures lacking the durability or longevity of site-built facilities, although technological advancements are rapidly mitigating this concern. Another critical restraint is the reliance on efficient, standardized logistics and transportation infrastructure, which can be inconsistent globally, particularly in last-mile delivery to remote sites.

Impact forces emphasize the technological push towards integrating IoT and smart features, significantly improving the operational value proposition of modular units by offering remote diagnostics and usage monitoring. The regulatory environment acts as a strong impact force; stringent hygiene and accessibility standards (like ADA or equivalent regional standards) mandate specific features that favor the standardized, high-quality production achievable through modular techniques. The opportunity landscape is broad, focusing on diversification into specialized segments such as luxury portable restrooms for premium events, or robust, extreme-weather-proof units for mining and military applications, ensuring the market remains dynamic and responsive to differentiated consumer needs and large-scale industrial requirements.

Segmentation Analysis

The Toilet Cabin Modular Structure Market is segmented based on critical factors including the material used for construction, the type of structure (such as mobility and configuration), and the primary application industry. Material segmentation is crucial as it determines durability, aesthetic finish, weight, and cost, ranging predominantly across steel, high-density polyethylene (HDPE), and composite materials. Structure type categorizes units by their complexity and function, distinguishing between single-unit portable toilets, multi-unit restroom trailers, and complex, multi-story modular blocks. Application segmentation provides insights into end-user demand patterns, with construction sites and public events representing high-volume, temporary use, while government infrastructure and commercial facilities represent long-term, permanent deployment.

Analyzing these segments reveals that the steel-framed segment dominates in permanent and semi-permanent installations due to superior robustness and longevity, particularly favored by military and governmental sectors requiring secure and durable facilities. Conversely, HDPE and composite cabins lead in the temporary and events segment due to their lightweight nature, ease of relocation, and cost-effectiveness. Geographically, segmentation highlights a strong market preference in developed regions for high-end, customized restroom trailers that incorporate luxury finishes and advanced technology, contrasting with a foundational demand in emerging markets for robust, basic, and scalable portable units essential for improving immediate public health outcomes in high-density areas.

- By Material:

- Steel Frame Modular Structures

- High-Density Polyethylene (HDPE) Cabins

- Fiber Reinforced Plastic (FRP) Composites

- Wood/Timber Structures (Niche/Aesthetic Applications)

- By Structure Type:

- Single Portable Units

- Restroom Trailers (Mobile Units)

- Multi-Unit Modular Blocks (Stackable/Permanent)

- By Application:

- Construction and Industrial Sites

- Outdoor Events and Festivals

- Government and Public Infrastructure (Parks, Highways)

- Disaster Relief and Emergency Services

- Commercial and Retail Facilities

- By Technology:

- Standard/Basic Flush Systems

- Recirculating Chemical Systems

- Vacuum Toilet Systems

- Composting/Waterless Systems

- By End-Use Region:

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Value Chain Analysis For Toilet Cabin Modular Structure Market

The value chain for the Toilet Cabin Modular Structure Market begins with upstream activities involving the sourcing and processing of raw materials, primarily steel for framing, polymers (HDPE, FRP) for cabin shells, and components like plumbing fixtures, HVAC, and electrical systems. Raw material suppliers, particularly steel and composite manufacturers, significantly influence production costs and lead times. Midstream activities encompass the core process of design, engineering, and highly efficient off-site factory fabrication, where standardized modules are constructed and integrated with internal systems. This stage requires rigorous quality control and adherence to precise specifications to ensure compatibility during final on-site assembly. Manufacturers increasingly invest in advanced automation and digital twinning to optimize the production sequence and minimize material waste.

Downstream activities focus on the final deployment and service aspects. This includes transportation logistics, which often requires specialized heavy haulage for larger modular units, followed by rapid on-site assembly and connection to utility infrastructure (water, sewage, electricity). The final link in the chain is the distribution channel, categorized into direct sales (selling large contracts directly to governmental agencies, construction companies, or event organizers) and indirect sales (utilizing rental companies, distributors, and third-party logistics providers who maintain inventory and offer short-term leasing services). Rental services form a crucial part of the downstream market, especially for temporary applications like festivals and emergency relief, requiring substantial ongoing maintenance and cleaning support.

The efficiency of the value chain is largely dependent on the seamless coordination between manufacturing precision and logistical capabilities. Direct distribution channels offer higher margins and closer customer relationships, facilitating customized solutions, whereas indirect channels allow for broader geographic reach and faster deployment of standardized units. Strategic focus for market leaders involves securing reliable, cost-effective raw material supply (upstream) and developing robust, AI-supported maintenance and service frameworks (downstream) to ensure customer satisfaction and long-term contract renewal, creating a high barrier to entry for new competitors who lack the integrated operational scale.

Toilet Cabin Modular Structure Market Potential Customers

Potential customers for the Toilet Cabin Modular Structure Market are diverse, spanning both public and private sectors requiring scalable, hygienic, and rapidly deployable sanitation solutions. The largest segment of end-users includes major infrastructure development and construction companies, which mandate regulatory-compliant facilities for workers on large, long-duration project sites such as highways, railways, and commercial high-rises. Event organizers, ranging from music festivals and sporting events to corporate gatherings, constitute another significant customer base, demanding high-capacity, aesthetically pleasing, and often luxury-grade restroom facilities for peak temporary usage periods.

Government agencies represent critical long-term buyers, encompassing municipal bodies responsible for public amenities in parks and downtown areas, highway authorities requiring rest stop facilities, and military/disaster relief organizations needing immediate, robust sanitation infrastructure in challenging environments. Furthermore, industries operating in remote locations, such as mining, oil and gas, and agriculture, are frequent buyers due to the prohibitive cost and time involved in constructing traditional facilities far from conventional utility hookups. The demand from these end-users is characterized by requirements for extreme durability, low maintenance, and energy independence, often favoring advanced off-grid systems like solar power and composting toilets.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $1.8 Billion |

| Market Forecast in 2033 | $3.25 Billion |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Satellite Industries, PolyJohn International, Sanitech, WERNICK Group, Algeco Scotsman (Modulaire Group), TOI TOI & DIXI Group, Armal S.r.l., Shorelink International, ADCO Holdings, Rota-Loo, Green Flush Technologies, Zonda Modular, Karmod Prefabricated Technologies, Boxx Modular, Atco Ltd., Acton Mobile Industries, MSS Modular, Portakabin, Prefabulous Modular Construction, Kwikspace Modular Buildings. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Toilet Cabin Modular Structure Market Key Technology Landscape

The technology landscape for the Toilet Cabin Modular Structure Market is rapidly evolving, moving beyond basic chemical recirculation systems toward advanced, sustainable, and networked solutions. A primary focus is on efficient water management, leading to increased adoption of vacuum toilet systems and sophisticated waterless technologies, particularly composting and incinerating toilets, which are vital for remote locations where sewage hookups are impractical or impossible. Vacuum systems offer significant advantages in multi-story or large-scale temporary installations by minimizing water usage and simplifying waste transfer, using negative pressure instead of gravity, thereby providing flexibility in plumbing layout and site selection.

A second major technological trend is the widespread integration of Internet of Things (IoT) sensors and smart monitoring systems. These technologies enable real-time tracking of usage data, water tank levels, waste disposal status, air quality, and component health. Such connectivity facilitates remote diagnostics, predictive maintenance scheduling, and optimization of operational resources, allowing operators to transition from reactive service models to proactive, data-driven hygiene management. This shift is crucial for maintaining high sanitation standards under fluctuating demand, especially in high-traffic public areas or large event venues, enhancing the overall perceived value and reliability of modular units.

Furthermore, innovation in material science is driving the development of lighter, more durable, and sustainable construction materials, such as advanced composite panels with inherent antimicrobial properties and superior thermal insulation. These materials reduce transportation costs, improve energy efficiency (reducing reliance on external heating/cooling), and enhance hygiene. Rapid deployment technology, including standardized, quick-lock connection systems and integrated leveling mechanisms, further reduces on-site installation time from days to mere hours, which is a critical technological differentiator in competitive bidding processes for large infrastructure or emergency contracts.

Regional Highlights

The global market exhibits highly differentiated dynamics across major geographical regions, influenced by localized regulatory frameworks, infrastructure maturity, and rates of urban expansion. North America and Europe are characterized by mature markets emphasizing high standards, customization, and technological sophistication. Demand here is driven by specialized, luxury restroom trailers for high-end events, robust units compliant with stringent accessibility laws (ADA, DDA), and the integration of IoT for operational efficiency and sustainability measures, particularly water conservation and waste recycling. The stringent health and safety regulations in these regions mandate high-quality materials and rapid maintenance response, favoring established manufacturers with advanced service networks.

Asia Pacific (APAC) represents the fastest-growing region, driven by unparalleled infrastructure development and intense governmental focus on improving sanitation access, particularly in rapidly urbanizing areas and rural communities in China, India, and Southeast Asian nations. The high volume of construction activities and large-scale public initiatives are generating massive demand for cost-effective, durable, and highly scalable modular toilet cabins. While basic models dominate rural demand, rapidly expanding metropolitan areas are increasingly demanding advanced smart sanitation solutions to handle high user density, making APAC the primary engine for future capacity expansion and manufacturing investment.

The Middle East and Africa (MEA) region presents significant growth potential, particularly supported by massive infrastructure investment in the Gulf Cooperation Council (GCC) countries for tourism, entertainment complexes, and large construction projects related to mega-events. Demand in this area focuses on structures designed for extreme heat, requiring superior insulation and climate control features, often utilizing high-quality steel-framed modular buildings for durability. In Africa, the market is primarily driven by humanitarian, governmental, and mining sector needs, requiring rugged, easily transportable, and often off-grid capable units to address immediate sanitation gaps in challenging logistical environments, making robust design and autonomous operation key criteria for procurement.

- North America (US and Canada): Focus on ADA compliance, luxury restroom trailers for events, and advanced smart technology integration for fleet management.

- Europe (Germany, UK, France): Strong emphasis on sustainable materials, high aesthetic standards for urban parks, and compliance with strict environmental disposal regulations.

- Asia Pacific (China, India, Japan): Dominant region for sheer volume growth, driven by massive public infrastructure projects, urbanization, and basic sanitation provision initiatives.

- Latin America (Brazil, Mexico): Growing construction and resource extraction sectors driving demand for durable, portable units; increasing adoption of modularity in municipal public works.

- Middle East and Africa (KSA, UAE, South Africa): Demand centered on heat resistance, robust construction for industrial sites (oil & gas, mining), and major event infrastructure preparation.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Toilet Cabin Modular Structure Market, assessing their product portfolios, geographical presence, recent developments, and strategic focus on innovation and market consolidation.- Satellite Industries

- PolyJohn International

- TOI TOI & DIXI Group

- WERNICK Group

- Algeco Scotsman (Modulaire Group)

- Sanitech

- Armal S.r.l.

- Shorelink International

- ADCO Holdings

- Rota-Loo

- Green Flush Technologies

- Zonda Modular

- Karmod Prefabricated Technologies

- Boxx Modular

- Atco Ltd.

- Acton Mobile Industries

- MSS Modular

- Portakabin

- Prefabulous Modular Construction

- Kwikspace Modular Buildings

- Palmers Relocatable Buildings

- PKL Group

Frequently Asked Questions

Analyze common user questions about the Toilet Cabin Modular Structure market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the growth of the Toilet Cabin Modular Structure Market?

The primary factor is the increasing global need for rapid, scalable, and hygienic sanitation infrastructure driven by accelerated urbanization, booming construction activities, and stringent public health regulations. Modular structures offer speed and efficiency superior to traditional construction, meeting immediate infrastructure deficits.

How do modular toilet cabins contribute to sustainability compared to site-built facilities?

Modular cabins contribute significantly to sustainability through several mechanisms: off-site fabrication reduces construction waste; the use of durable, often recycled, materials prolongs asset life; and advanced models integrate water-saving technologies like vacuum flushing and composting systems, minimizing ecological footprint and utility consumption.

What key technological features define a modern, high-end modular toilet cabin?

Modern, high-end modular cabins are defined by advanced features such as IoT-enabled real-time monitoring for predictive maintenance, touchless operation (automatic flushing, smart sensors), integrated climate control systems, and high-quality, non-porous antimicrobial interior finishes for superior hygiene and user experience.

Which geographical region holds the highest growth potential for modular sanitation structures?

Asia Pacific (APAC) holds the highest growth potential due to massive investments in public infrastructure, large-scale construction projects, and governmental initiatives specifically targeting the improvement of public sanitation access in populous urban and rural areas across countries like India and China.

What are the main material types used in modular toilet construction and their typical applications?

The main materials are Steel Frames (used for durable, permanent, or semi-permanent multi-unit structures, favored by military/industrial sectors) and High-Density Polyethylene (HDPE) or Fiber Reinforced Plastic (FRP) Composites (favored for lightweight, mobile, and cost-effective single units used extensively in temporary events and construction sites).

How does the integration of AI impact the operational costs of a modular toilet fleet?

AI integration significantly lowers operational costs by optimizing maintenance schedules and resource use. AI algorithms analyze usage data to deploy cleaning staff only when needed and precisely manage water/energy consumption, dramatically reducing unnecessary labor hours and utility expenses associated with fixed scheduling.

What are the logistical challenges in the distribution of modular toilet structures?

Logistical challenges primarily involve the transportation of oversized modules, requiring specialized permits and heavy haulage equipment. Furthermore, access to remote or congested urban sites can be difficult, necessitating efficient last-mile logistics planning and specialized equipment for rapid on-site assembly and utility connection.

Are modular toilet structures viable for long-term, permanent urban public facilities?

Yes, modern modular toilet structures are highly viable for long-term, permanent use. Steel-framed modules manufactured to high engineering standards offer comparable, often superior, durability and lifespan to site-built facilities. They also allow for easier future expansion or reconfiguration compared to traditional construction.

What is the role of rental companies in the modular toilet cabin market value chain?

Rental companies are critical downstream distributors, primarily serving the temporary application market (events, short-term construction). They invest in large fleets, manage inventory, provide logistics (delivery/pickup), and handle the essential ongoing cleaning and maintenance services, facilitating broad market access for manufacturers.

What opportunities exist for manufacturers regarding off-grid capabilities in modular cabins?

Significant opportunities exist in developing fully autonomous, off-grid cabins, incorporating solar power systems, robust battery storage, and advanced composting or incinerating waste technologies. This is highly demanded by remote mining, military, and disaster relief sectors where conventional utility access is unavailable or unreliable.

How do regulatory standards, such as ADA compliance, influence modular design?

Regulatory standards strongly influence modular design by mandating specific features like ramp access, minimum interior dimensions, grab bars, and accessible fixtures. Modular construction is advantageous here because compliance can be standardized and certified during factory fabrication, ensuring consistent adherence across all produced units.

What is the significance of the shift toward a 'Sanitation as a Service' model in this market?

The 'Sanitation as a Service' (SaaS) model signifies a shift where the provider retains ownership and responsibility for the full operational lifecycle, including deployment, maintenance, cleaning, and smart monitoring. This model is attractive to customers as it offers guaranteed hygiene performance and predictable operational costs without capital expenditure risk.

Which application segment currently drives the highest volume demand for temporary modular cabins?

The Construction and Industrial Sites application segment currently drives the highest volume demand for temporary modular cabins, requiring reliable, durable facilities for large, temporary worker populations during project lifecycles, followed closely by the Outdoor Events and Festivals segment.

How are advancements in material science improving the hygiene of modular structures?

Advancements include the use of composite panels and plastics infused with antimicrobial agents, which actively inhibit bacterial growth on surfaces. Furthermore, non-porous, highly durable materials minimize water absorption and simplify high-pressure cleaning, significantly raising overall hygiene levels compared to older cabin materials.

What role does digital twinning play in the manufacturing process of these structures?

Digital twinning allows manufacturers to create a precise virtual replica of the physical cabin. This enables pre-fabrication simulations for structural integrity testing, system integration checks (plumbing, electrical), and optimization of the assembly sequence, reducing physical prototyping costs and accelerating time-to-market with fewer errors.

How does competitive intensity affect pricing strategies in the modular cabin market?

Intense competition forces pricing strategies to differentiate based on value, rather than cost alone. Manufacturers compete by offering superior lifecycle service packages, integrating advanced technology (IoT), and specializing in niche segments (e.g., luxury or extreme climate units) to justify higher margins over basic rental models.

What is the primary restraint related to initial capital investment in this market?

The primary restraint is the significant upfront capital required to establish state-of-the-art, automated off-site manufacturing facilities. These factories require specialized tooling, robotics, and efficient logistics systems to achieve the economies of scale necessary for competitive production costs, posing a high barrier to entry.

Why is the demand for multi-unit modular blocks increasing in urban areas?

The demand is increasing because multi-unit blocks offer scalable, space-efficient solutions for high-density public areas like transport hubs and downtown parks. Their ability to be stacked or combined quickly allows municipalities to rapidly deploy high-capacity, aesthetically superior restrooms that integrate seamlessly with existing urban infrastructure.

What distinguishes vacuum toilet systems from standard flush systems in modular cabins?

Vacuum systems use minimal water (typically 0.5 to 1.5 liters per flush) and utilize negative pressure to move waste, offering superior water conservation and flexibility in pipe routing (not relying on gravity). Standard flush systems require traditional gravity plumbing and significantly higher water volumes, limiting their application in water-scarce or remote locations.

How does the market address aesthetic concerns regarding modular structures for public spaces?

Manufacturers address aesthetic concerns by offering customizable external cladding (wood, metal panels), integrated landscaping features, and architectural designs that mimic traditional buildings. High-end modular units are designed with superior materials and finishes to enhance the visual integration into sensitive public and heritage environments.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager