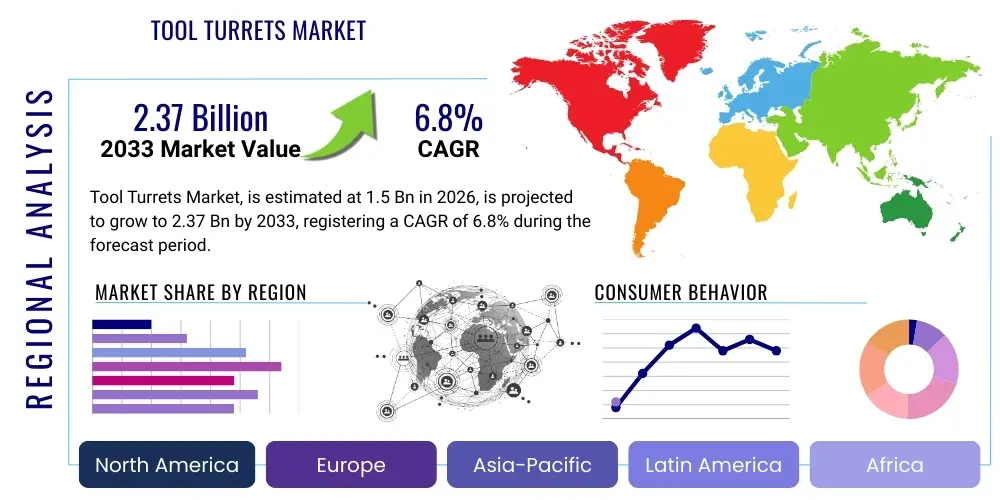

Tool Turrets Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441717 | Date : Feb, 2026 | Pages : 245 | Region : Global | Publisher : MRU

Tool Turrets Market Size

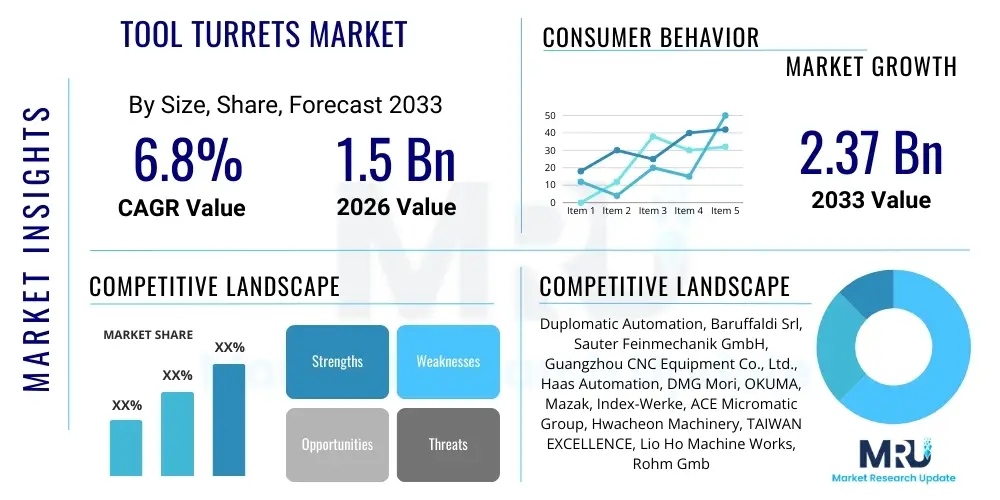

The Tool Turrets Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 1.5 Billion in 2026 and is projected to reach USD 2.37 Billion by the end of the forecast period in 2033.

Tool Turrets Market introduction

Tool turrets are essential mechanical subsystems utilized primarily in Computer Numerical Control (CNC) machine tools, such as turning centers and multi-tasking machines. Their core function is to hold various cutting tools and rapidly index or position the required tool relative to the workpiece, enabling automated and continuous machining operations. These devices are critical components that directly influence the productivity, precision, and versatility of modern manufacturing systems. The effectiveness of a tool turret, characterized by its indexing speed, positioning accuracy, rigidity, and clamping force, is paramount for achieving high-quality surface finishes and tight dimensional tolerances in complex part production.

The product portfolio encompasses several key types, including hydraulic, electric, and high-performance servo motor-driven turrets. Servo-driven turrets, in particular, are experiencing heightened adoption due to their superior speed, enhanced flexibility in tool configuration, and energy efficiency, aligning perfectly with Industry 4.0 demands for rapid, flexible manufacturing. Major applications span high-volume production environments like the automotive and general machinery sectors, as well as high-precision sectors such as aerospace and medical device manufacturing, where reliability and repeatable accuracy are non-negotiable requirements.

Key benefits derived from utilizing advanced tool turrets include minimized non-cutting time, significantly reduced tool changeover duration, improved thermal stability, and enhanced machine uptime. The driving factors behind current market expansion are robust global investment in advanced manufacturing infrastructure, the increasing complexity of manufactured components necessitating multi-axis machining capabilities, and the pervasive need across all industries to improve operational efficiency and reduce labor costs through higher levels of automation. The push towards electric vehicle (EV) production and renewed focus on domestic supply chains also fuels demand for high-performance CNC machinery equipped with sophisticated turret systems.

Tool Turrets Market Executive Summary

The Tool Turrets Market is characterized by accelerating technological advancements, moving swiftly toward highly dynamic, servo-controlled indexing systems that offer optimal efficiency and precision. Current business trends indicate a strong preference for high-speed, non-lifting turret designs capable of handling demanding continuous operations, particularly within the competitive environments of Asia Pacific manufacturing hubs. The convergence of hardware mechanics with sophisticated software controls, enabling predictive maintenance features and seamless integration into Manufacturing Execution Systems (MES), defines the competitive edge in this market. While the automotive industry remains the primary revenue contributor, the aerospace and precision component sectors are driving demand for specialized, high-rigidity turrets capable of processing exotic materials like titanium and nickel alloys effectively.

Regionally, Asia Pacific, spearheaded by robust industrial growth in China, Japan, and South Korea, maintains its dominance, driven by massive investments in capital equipment necessary for mass production and export-oriented manufacturing. North America and Europe, conversely, are focusing on replacement cycles and the adoption of premium, sophisticated turrets that support advanced machining strategies required for high-value applications such as complex tooling and medical implants. This regional dichotomy highlights a market segment split: volume growth concentrated in APAC, and value-added, high-technology growth centered in the mature Western economies.

Segment trends reveal a significant shift away from traditional hydraulic turrets towards servo motor-driven units, which provide better control over indexing profiles and substantially reduce energy consumption and maintenance overhead. Furthermore, the application landscape is increasingly dominated by integrated multi-tasking machines that combine turning and milling capabilities, requiring more complex, live-tooling turret configurations. Suppliers focusing on modularity and smart functionality, including integrated sensing technology for vibration and temperature monitoring, are best positioned to capture market share across these rapidly evolving end-use segments.

AI Impact Analysis on Tool Turrets Market

Common user questions regarding AI's influence on the Tool Turrets Market revolve predominantly around real-time operational efficiency, the feasibility of predictive failure detection, and the integration of autonomous decision--making into the machining process. Users are keen to understand how AI algorithms can optimize indexing sequences, minimize tool change time based on workpiece complexity, and, crucially, predict mechanical failures such as bearing wear or clamping force degradation before they lead to catastrophic machine downtime. There is significant interest in using machine learning to analyze the vast datasets generated by modern CNC machines, allowing turrets to dynamically adjust their operational parameters (speed, acceleration, deceleration curves) to maximize throughput while preserving component lifespan. The overarching theme is the transformation of the turret from a passive mechanical component into an active, intelligent subsystem of the smart factory, reducing reliance on manual oversight and scheduled maintenance.

The integration of artificial intelligence enhances the performance envelope of tool turrets by enabling adaptive control strategies. AI systems can process vibration data, acoustic emissions, and motor current signatures in real-time, identifying subtle deviations indicative of wear or misalignment. This capability shifts maintenance practices from time-based scheduling to condition-based monitoring, dramatically improving the Mean Time Between Failures (MTBF) for these high-stress components. Furthermore, advanced algorithms can optimize tool selection and path planning in multi-tool operations, reducing cycle times by dynamically adjusting for thermal drift or minor irregularities in the raw material.

AI also plays a critical role in quality control, utilizing sensor fusion to correlate turret performance metrics with final part geometry and surface finish. By learning the correlation between specific turret operating states (e.g., clamping pressure, indexing backlash) and resulting product quality, AI can preemptively flag potential defects or instruct the CNC controller to adjust machining parameters automatically. This sophisticated level of self-optimization solidifies the turret's status as a key data node within the digital thread of the manufacturing process, contributing substantially to improved resource utilization and reduced scrap rates.

- AI-driven predictive maintenance scheduling based on sensor data analysis.

- Optimization of turret indexing speed and acceleration profiles for minimum cycle time.

- Real-time dynamic adjustment of clamping force based on cutting conditions and tool weight.

- Integration into digital twin models for simulation and performance benchmarking.

- Autonomous fault detection and diagnostic capabilities, minimizing human intervention.

- Enhanced tool life management through learning-based tool wear prediction associated with indexing frequency.

DRO & Impact Forces Of Tool Turrets Market

The Tool Turrets Market dynamics are shaped by a complex interplay of strong market drivers, inherent operational restraints, and substantial technological opportunities, all moderated by significant external impact forces. Key drivers include the global expansion of the precision manufacturing sector, particularly the rapid modernization of CNC machine tool fleets in developing economies, coupled with relentless demand from the automotive industry for faster, more reliable component production systems. However, the market faces restraints such as the relatively high initial capital investment required for advanced servo-driven turrets and the technical complexity involved in integrating these sophisticated devices into legacy or diverse machine platforms. Opportunities emerge from the potential integration of turrets with modular manufacturing concepts and advanced sensing technologies, paving the way for fully autonomous machining centers. The most significant impact forces relate to global supply chain volatility affecting specialized components like high-precision bearings and motors, alongside increasing regulatory pressure concerning energy efficiency and sustainability in manufacturing equipment.

Specific drivers fueling market demand include the continuous trend toward multi-tasking and multi-axis machining, which necessitates turrets capable of holding both static and live tools with high repeatability and torque transmission capacity. Furthermore, the proliferation of composite materials and challenging superalloys in aerospace and energy sectors mandates extremely rigid and durable turrets capable of withstanding high cutting forces without compromising positional accuracy. The pursuit of lights-out manufacturing and fully automated production lines mandates turrets with exceptional reliability and extended service intervals, further stimulating demand for premium, servo-controlled models that require minimal human intervention for calibration or maintenance.

Conversely, market growth is hampered by the substantial lifecycle cost, which includes not only the purchase price but also specialized maintenance and proprietary parts often required by leading turret manufacturers. Economic downturns in key industrial sectors, such as temporary slowdowns in automotive capital expenditure, can immediately restrain market purchasing decisions for new CNC machinery. Key opportunities lie in the development of standardized communication protocols (like OPC UA) for turret integration, enabling faster adoption into diverse digital factory environments. Moreover, the lightweighting trend in manufacturing creates an opportunity for developing turrets utilizing advanced material composites, reducing inertia and allowing for even faster indexing speeds. Impact forces, such as geopolitical instability affecting trade flows of essential electronic components, and the intense competitive pressure from APAC-based manufacturers offering cost-effective, high-volume turret solutions, continue to influence pricing and competitive strategies across the globe.

Segmentation Analysis

The Tool Turrets Market is comprehensively segmented based on the mechanism type, the specific machine application, and the diverse end-use industries it serves. Analyzing these segments provides critical insights into purchasing patterns and technological preferences across the global manufacturing landscape. The primary segmentation by type differentiates between hydraulic, electric, and servo-driven systems, reflecting a clear industry shift towards precise, energy-efficient servo technology. Application segmentation focuses on whether the turret is deployed in CNC turning centers, which are the traditional deployment base, or in more complex multi-tasking machines (MTMs) that require live tooling capabilities. The end-use segment highlights the market's dependence on capital expenditure cycles in the Automotive, Aerospace & Defense, and General Machinery sectors.

- Type:

- Hydraulic Tool Turrets

- Electric Tool Turrets

- Servo Motor Driven Tool Turrets

- Application:

- CNC Turning Centers

- Multi-Tasking Machines (MTM)

- Machining Centers (Limited Application)

- End-Use Industry:

- Automotive Industry

- Aerospace and Defense

- General Machinery and Fabrication

- Medical Devices and Precision Instruments

- Electronics and Semiconductors

Value Chain Analysis For Tool Turrets Market

The value chain for the Tool Turrets Market initiates with the upstream analysis, focusing heavily on sourcing specialized, high-quality raw materials and components. This stage involves procuring high-grade steel alloys for turret housing and disc construction to ensure rigidity, along with highly precise mechanical components such as angular contact bearings, clutches, and sophisticated hydraulic or servo drive systems. Reliability and precision in raw material preparation—including specialized heat treatments and high-tolerance machining—are foundational, as turret performance is directly linked to the quality of its internal components. Key upstream suppliers include specialized bearing manufacturers, motor/drive producers, and advanced forging/casting companies, often concentrated in Germany, Japan, and Switzerland due to their expertise in precision engineering.

The middle segment of the chain is dominated by Tool Turret manufacturers who focus on design, assembly, and rigorous quality assurance. This stage involves complex R&D to optimize indexing speed, tool clamping force, and thermal stability. Manufacturers often differentiate themselves through proprietary locking mechanisms (e.g., curvic couplings) and advanced drive technologies. Distribution channels play a vital role, often categorized as direct sales to large, captive machine tool manufacturers (Original Equipment Manufacturers or OEMs) like Mazak or DMG Mori, and indirect sales through specialized distributors and integrators who serve the aftermarket and smaller job shops. The relationship with OEMs is critical, as turrets are frequently integrated during the initial machine tool build process.

Downstream analysis focuses on end-user deployment, after-sales service, and maintenance. Tool turrets require specialized technicians for setup, calibration, and long-term servicing, particularly for complex live-tooling systems. Direct distribution ensures tight control over quality and service for major global customers, while indirect channels provide localized support and easier market penetration in emerging regions. Customer relationship management and rapid access to spare parts are essential, as turret failure can halt an entire production line. Continuous feedback from end-users regarding operational performance and feature requests drives the next generation of product innovation, completing the value cycle.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.5 Billion |

| Market Forecast in 2033 | USD 2.37 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Duplomatic Automation, Baruffaldi Srl, Sauter Feinmechanik GmbH, Guangzhou CNC Equipment Co., Ltd., Haas Automation, DMG Mori, OKUMA, Mazak, Index-Werke, ACE Micromatic Group, Hwacheon Machinery, TAIWAN EXCELLENCE, Lio Ho Machine Works, Rohm GmbH, Schunk GmbH, Kennametal, Sandvik Coromant, Atlas Copco, Siemens, FANUC. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Tool Turrets Market Key Technology Landscape

The contemporary tool turrets market is increasingly defined by the transition from conventional hydraulic and electric systems to sophisticated servo motor-driven technologies. Servo turrets offer unparalleled advantages in terms of indexing speed and positioning accuracy, minimizing non-cutting time and significantly boosting overall machine productivity. Key technological advancements include the development of non-lifting turret mechanisms, which eliminate the hydraulic piston lift required during indexing, thereby increasing speed and reducing mechanical complexity. These systems often employ high-precision radial and axial couplings (such as Hirth couplings) for robust locking and superior rigidity, essential for heavy-duty cutting operations, especially when using live tooling for milling or drilling operations on a lathe.

Another crucial technological frontier involves the integration of advanced sensors and controls to support smart manufacturing initiatives. Modern turrets are frequently equipped with embedded sensors for monitoring temperature, vibration, and motor load in real-time. This sensor data feeds directly into the CNC control system, allowing for continuous performance optimization and facilitating condition-based monitoring programs. The goal is to maximize the utilization of live tooling by ensuring thermal stability and minimizing the impact of frictional heat generated during rapid indexing. Furthermore, enhanced torque transmission systems within live tool holders are being developed to cope with the increasingly demanding requirements of power-intensive machining processes required for modern superalloys.

The future technology landscape emphasizes modularity and seamless digital integration. Tool turret manufacturers are working on standardized interfaces and modular designs that allow end-users greater flexibility in configuring tool stations and accommodating diverse tool shank sizes (e.g., BMT, VDI, Capto). Furthermore, the connectivity of the turret system to the overarching Industrial Internet of Things (IIoT) platform is becoming mandatory. This includes developing turrets capable of transmitting performance and diagnostic data using open standards, facilitating their participation in digital twin models and providing robust data streams necessary for advanced AI-driven maintenance and optimization algorithms that define the future of automated production environments.

Regional Highlights

- Asia Pacific (APAC): Dominates the global market, primarily driven by massive governmental and private sector investments in manufacturing infrastructure, especially in China, India, and South Korea. This region serves as the global hub for high-volume automotive and electronics production, creating insatiable demand for reliable, cost-effective CNC machine tools and associated components, including high-speed tool turrets. The competitive landscape here often focuses on achieving optimal performance-to-cost ratios.

- Europe: Characterized by a strong focus on high-precision, technologically advanced machinery. European demand centers around replacement cycles and the adoption of premium, high-rigidity servo turrets used extensively in the aerospace, medical technology, and high-end automotive segments (e.g., Germany, Italy). Strict standards regarding energy efficiency and operational safety drive innovation toward electric and advanced hydraulic systems.

- North America: Driven by technological leadership and defense spending, the North American market exhibits strong demand for turrets capable of handling complex materials and multi-axis operations, particularly within the aerospace and oil & gas equipment manufacturing sectors. Investment is concentrated on optimizing existing machine fleets using highly accurate, sophisticated components capable of seamless integration into digital factory ecosystems.

- Latin America (LATAM): Represents an emerging market focused primarily on basic manufacturing and resource extraction machinery. Growth is steady but slower, depending heavily on foreign direct investment in manufacturing facilities, particularly in Brazil and Mexico, creating moderate demand for standard-grade hydraulic and electric turrets.

- Middle East and Africa (MEA): This region is heavily reliant on infrastructure, energy (oil & gas), and defense industries. Demand is highly localized and often met through imported machinery, focusing on robust and reliable turrets capable of withstanding challenging operating environments, although the overall market share remains the smallest globally.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Tool Turrets Market.- Duplomatic Automation

- Baruffaldi Srl

- Sauter Feinmechanik GmbH

- Guangzhou CNC Equipment Co., Ltd.

- Haas Automation

- DMG Mori

- OKUMA

- Mazak

- Index-Werke GmbH & Co. KG

- ACE Micromatic Group

- Hwacheon Machinery Co., Ltd.

- TAIWAN EXCELLENCE (Various Manufacturers)

- Lio Ho Machine Works Co., Ltd.

- Rohm GmbH

- Schunk GmbH & Co. KG

- Kennametal Inc.

- Sandvik Coromant

- Atlas Copco AB

- Siemens AG (Control Systems)

- FANUC Corporation (Control Systems)

Frequently Asked Questions

Analyze common user questions about the Tool Turrets market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary technical advantage of Servo Motor Driven Turrets over Hydraulic Turrets?

Servo motor driven turrets offer superior indexing speed, programmable acceleration/deceleration profiles, higher positioning accuracy, and improved energy efficiency compared to traditional hydraulic systems. They eliminate the need for hydraulic fluid maintenance and provide faster tool change cycles, significantly reducing non-cutting time.

How does the integration of live tooling impact tool turret market demand?

Live tooling integration, which allows turrets to hold rotating tools for milling, drilling, and tapping operations, drives demand for high-rigidity, multi-tasking capable turrets. This functionality transforms a lathe into a full machining center, requiring robust servo systems and enhanced power transmission capacity in the turret head.

Which end-use industry is the largest consumer of tool turrets globally?

The Automotive Industry remains the largest consumer segment for tool turrets, driven by high-volume production requirements for engine, powertrain, chassis, and increasingly, electric vehicle components, demanding reliable and highly automated CNC turning systems.

What role does Industry 4.0 play in the innovation of tool turret technology?

Industry 4.0 mandates the development of smart turrets equipped with integrated sensors for condition monitoring, real-time data transmission, and predictive maintenance capabilities. This enables seamless integration into digital factory ecosystems, optimizing operational uptime and reducing unscheduled maintenance through data analytics.

What are the critical factors determining the selection of a tool turret for a new CNC machine?

Critical selection factors include the required indexing speed, static and dynamic rigidity for cutting forces, the number and type of tools (static vs. live), positional repeatability accuracy, and compatibility with the machine's control system and overall capacity.

How do global economic trends, specifically trade policies, affect the Tool Turrets Market?

Global trade policies, particularly tariffs and import restrictions on machinery and key components (like precision bearings and specialized motors), directly impact the manufacturing costs and pricing strategies of tool turret manufacturers. Furthermore, geopolitical tensions can disrupt highly specialized international supply chains, leading to procurement delays and increased operational risks for vendors and OEMs.

What advancements are being made in tool clamping mechanisms within modern turrets?

Modern turrets are focusing on faster and more robust clamping mechanisms, often utilizing high-precision curvic or Hirth couplings, which ensure maximum rigidity and repeatability under heavy cutting loads. Hydraulic clamping systems are being refined for quicker activation and higher force consistency, crucial for precision machining tasks.

Is thermal stability a major concern for high-speed tool turrets?

Yes, thermal stability is a significant concern. High-speed indexing and continuous live tooling operation generate heat that can cause thermal expansion, leading to positional errors and reduced machining accuracy. Advanced turrets incorporate optimized cooling systems and specialized materials to mitigate thermal drift and maintain precision during extended operation cycles.

What is the competitive landscape like among the top tool turret manufacturers?

The market is highly competitive, dominated by a few established European and Asian players known for precision engineering (e.g., Sauter, Baruffaldi, Duplomatic). Competition centers on indexing speed, rigidity, technological integration (live tooling capacity), and securing major OEM contracts. Asian manufacturers often compete effectively on volume and cost-efficiency.

How are tool turrets evolving to support additive manufacturing processes?

While traditionally focused on subtractive processes, tool turrets are being adapted to multi-tasking hybrid machines that integrate additive capabilities (like directed energy deposition). This involves designing turret stations capable of holding specialized nozzles or laser heads alongside traditional cutting tools, demanding higher load capacity and robust power/data lines through the turret body.

Define the term 'non-lifting turret' and its market significance.

A non-lifting turret indexes the tool disk without hydraulically lifting the disk off the coupling face during rotation. This design minimizes movement, increases indexing speed dramatically, and reduces wear on critical components, making it crucial for high-production environments where cycle time reduction is paramount.

What are the maintenance requirements for servo motor driven turrets?

Servo-driven turrets typically require less routine maintenance than hydraulic units, mainly focusing on monitoring the condition of the servo motor, gearbox, and ensuring the cleanliness and integrity of the locking coupling (e.g., Hirth coupling). Lubrication schedules for bearings and the occasional calibration check are also standard procedures.

What impact does the growth of the aerospace sector have on turret design specifications?

The aerospace sector requires turrets with extreme rigidity, high precision, and compatibility with superalloys like Inconel and titanium. This necessitates turrets with high torque transmission capacity for powerful live tooling and enhanced thermal management systems to handle prolonged, heavy-duty cutting operations typical in aerospace component manufacturing.

How is tool standardization (like VDI or Capto) influencing turret manufacturers?

Tool standardization, particularly the adoption of common interfaces like VDI (Verein Deutscher Ingenieure) and Capto, forces turret manufacturers to ensure compatibility and offer modular tooling solutions. While providing flexibility for end-users, it increases complexity in turret design to accommodate various tool holder sizes and clamping requirements effectively.

What is the typical lifespan of a high-quality tool turret under normal operating conditions?

The typical operational lifespan of a high-quality, well-maintained tool turret is often aligned with the useful economic life of the CNC machine tool itself, typically ranging from 8 to 15 years, provided that critical components like bearings and drives are replaced or serviced as required based on condition monitoring data.

In the Value Chain, why are OEM relationships critical for turret suppliers?

Relationships with OEMs (Original Equipment Manufacturers, i.e., CNC machine builders) are critical because tool turrets are often sold as integral components during the initial construction of a new machine tool. Securing long-term supply agreements with major global OEMs guarantees large, consistent volume orders and establishes the turret supplier's technology as an industry standard.

How is environmental sustainability impacting the demand for different turret types?

The push for environmental sustainability favors servo-driven electric turrets over hydraulic systems. Electric systems consume less power, eliminate the use and disposal of hydraulic oils, and generally offer cleaner operation, aligning with increasing regulatory demands for reduced energy consumption in industrial machinery.

What are the main challenges associated with installing and calibrating a new turret?

The main challenges involve achieving precise alignment of the turret axis with the machine spindle, calibrating the indexing mechanism to ensure high positional repeatability (often requiring micro-level adjustments), and correctly integrating the electrical and data communication interfaces with the complex CNC controller logic.

How do different turret designs manage chip evacuation and coolant delivery?

Advanced turret designs often incorporate through-the-turret and through-the-tool coolant delivery capabilities, essential for high-performance machining. Furthermore, their design must ensure adequate clearance and sealing to prevent ingress of chips and coolant into the internal mechanical components, maintaining long-term reliability.

What are the emerging market opportunities in retrofitting older CNC machines with new turrets?

Retrofitting older machines presents a significant opportunity, allowing manufacturers to upgrade capabilities (e.g., adding live tooling or replacing slow hydraulic systems with fast servos) without incurring the cost of a full machine replacement. This is highly attractive in cost-conscious markets seeking performance improvements through component modernization.

What specific concerns do manufacturers have regarding backlash in tool turrets?

Backlash, or clearance, in the indexing and locking mechanism reduces the static and dynamic rigidity of the tool, leading to vibration, poor surface finish, and tool wear, particularly during heavy roughing cuts. Manufacturers invest heavily in precision gear trains and robust locking couplings (like Hirth) to eliminate measurable backlash.

How does the medical device industry influence turret requirements?

The medical device industry demands exceptionally high precision, flawless surface quality, and often involves machining expensive, specialized materials (e.g., titanium, stainless steel). This requires turrets with the absolute highest positional accuracy and excellent vibration damping characteristics to maintain tight tolerances over long production runs.

Are modular tool turrets gaining traction in the market?

Yes, modularity is gaining significant traction. Modular turrets allow for quick adaptation of the tool disc or head to different tooling systems or specific job requirements, greatly increasing machine versatility and reducing the downtime associated with comprehensive setup changes between different production batches.

Describe the primary functions of the control system component within a modern tool turret.

The control system manages the indexing sequence, controls the speed and torque of the servo motor during rotation, initiates the clamping and unclamping cycles, and communicates its status (tool position, lock confirmation, fault codes) back to the main CNC controller, ensuring synchronized and safe operation.

How is the market addressing the need for faster tool-to-tool indexing times?

The market addresses faster indexing through several innovations: adopting high-speed servo motors, utilizing non-lifting turret designs, optimizing software control algorithms to create smoother acceleration and deceleration curves, and engineering lighter but rigid tool discs to reduce rotational inertia.

What is the distinction between a static tool holder and a live tool holder in a turret?

A static tool holder is fixed and holds standard cutting tools used for turning operations. A live tool holder includes an internal mechanism (often gear-driven) that rotates the cutting tool, allowing the machine to perform secondary operations like milling, drilling, or tapping while the workpiece is stationary or rotating slowly.

Which geographical region is expected to exhibit the highest CAGR growth during the forecast period?

Asia Pacific (APAC) is projected to exhibit the highest Compound Annual Growth Rate (CAGR), driven by the continued rapid industrialization, the expansion of local manufacturing capabilities, and massive ongoing investments in infrastructure and capital equipment across key nations like China and India.

What constitutes the 'upstream' segment in the tool turrets market value chain?

The upstream segment involves the procurement and processing of fundamental, high-quality inputs, including specialized steel alloys, high-precision bearings, servo motors, hydraulic components, and advanced electronic controls necessary for the construction of the complex turret mechanisms.

How are environmental factors like temperature and humidity managed for turret reliability?

Turrets are designed with robust sealing against coolant and chips (IP ratings). Internal temperature fluctuations are managed through sensor monitoring and often active cooling or optimized lubrication to ensure consistent performance, as extreme temperature can compromise positional accuracy and component lifespan.

What potential challenges arise from the shift towards multi-tasking machines regarding turret design?

Multi-tasking machines require turrets to handle a wider range of forces and speeds, necessitating heavier-duty construction, the ability to accommodate both static and live tools simultaneously, and enhanced thermal and vibrational stability to manage combined turning and milling stresses effectively.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager