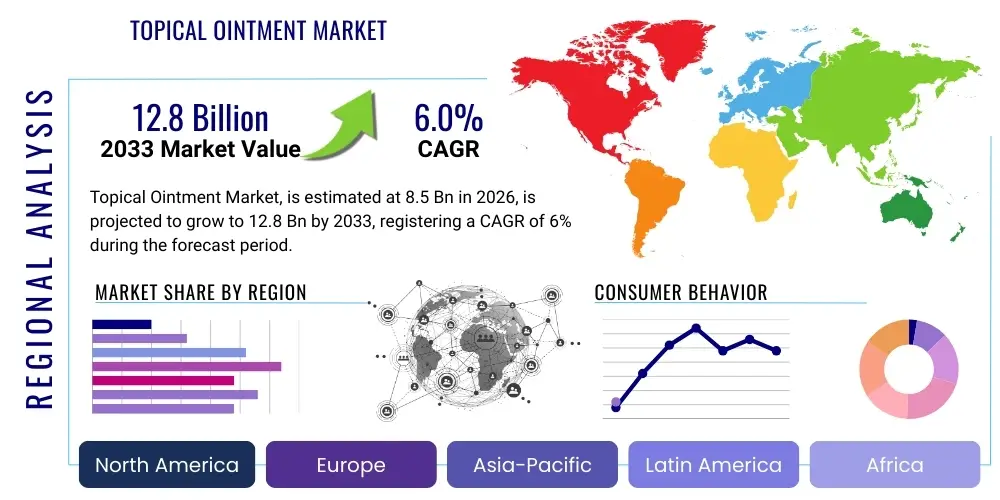

Topical Ointment Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442761 | Date : Feb, 2026 | Pages : 258 | Region : Global | Publisher : MRU

Topical Ointment Market Size

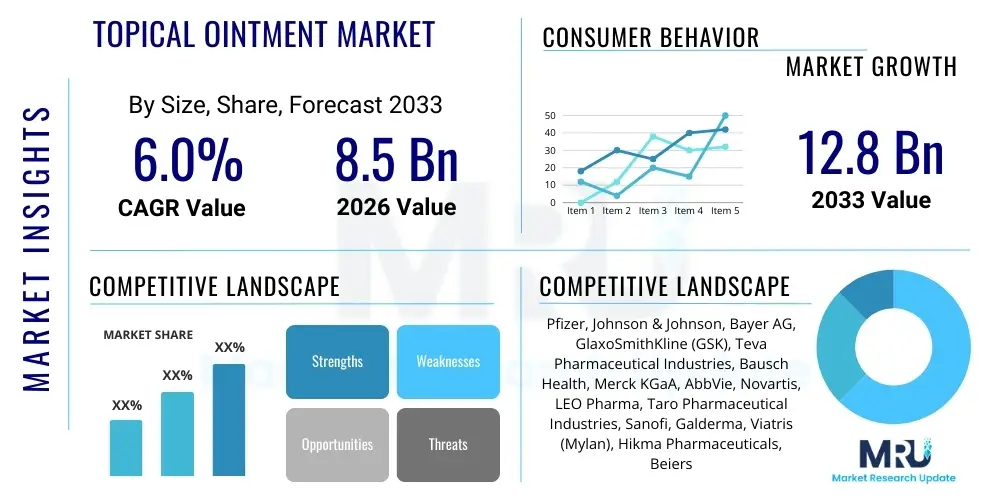

The Topical Ointment Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.0% between 2026 and 2033. The market is estimated at USD 8.5 Billion in 2026 and is projected to reach USD 12.8 Billion by the end of the forecast period in 2033. This growth trajectory is fundamentally underpinned by the escalating global prevalence of dermatological conditions such as psoriasis, eczema, and various forms of dermatitis, coupled with the increasing preference for localized drug delivery systems that minimize systemic side effects. Furthermore, the robust investment in pharmaceutical research and development, aimed at formulating enhanced ointment bases that optimize drug penetration and patient adherence, contributes significantly to market expansion. The mature markets in North America and Europe continue to adopt advanced prescription formulations, while emerging economies in the Asia Pacific are rapidly expanding their over-the-counter (OTC) segments, driving substantial revenue generation across different product categories.

Topical Ointment Market introduction

Topical ointments represent a critical category within the pharmaceutical landscape, defined as semi-solid preparations intended for external application to the skin or mucous membranes. They typically consist of an active pharmaceutical ingredient (API) dispersed or dissolved in an oleaginous base, such as petroleum jelly or anhydrous lanolin, which provides superior occlusive properties compared to creams or gels. These properties enhance the penetration of the active substance into the stratum corneum and underlying tissues, making ointments highly effective for conditions requiring prolonged contact and maximal hydration, including chronic inflammatory skin diseases, minor burns, and localized pain management. The primary function of an ointment base is not only to act as a vehicle for drug delivery but also to protect the treated area from environmental factors, thereby supporting the natural healing process and preventing moisture loss, which is crucial for conditions characterized by dryness and scaling.

The market encompasses a wide array of therapeutic classes, including corticosteroids, antifungals, antibiotics, analgesics, and emollients, catering to diverse medical needs ranging from acute infections to long-term management of chronic disorders. Major applications span clinical dermatology, wound care, and rheumatology, where the localized effect minimizes systemic exposure and subsequent adverse events often associated with oral medications. Key benefits driving the adoption of topical ointments include ease of application, targeted drug action at the site of pathology, and high concentration delivery in the localized area, leading to improved therapeutic outcomes for conditions like plaque psoriasis or severe contact dermatitis. Technological advancements, such as the incorporation of liposomal carriers and micro-emulsions within the ointment matrices, are consistently improving bioavailability and patient compliance.

Driving factors for sustained market growth are multifold. Firstly, the demographic shift towards an aging global population naturally increases the incidence of age-related dermatoses and chronic pain conditions requiring topical pain relief. Secondly, rising public awareness regarding skin health and the availability of sophisticated diagnostic tools contribute to earlier detection and subsequent prescription of specialized topical treatments. Finally, the strategic shift by pharmaceutical companies towards developing combination therapies—integrating anti-inflammatory agents with moisturizers or protective barriers—is broadening the therapeutic scope and effectiveness of topical ointments, thereby fueling both prescription and over-the-counter sales globally.

Topical Ointment Market Executive Summary

The Topical Ointment Market exhibits robust growth driven by escalating patient demand for non-invasive, localized treatment modalities and significant advancements in pharmaceutical formulation science. Global business trends indicate a strong focus on strategic mergers and acquisitions among large pharmaceutical players aimed at consolidating specialized portfolios, particularly in highly lucrative segments such as topical immunology and advanced wound care. Furthermore, intensified research and development activities are concentrated on improving the stability and penetration profile of complex APIs, including biologics and peptides, when delivered through semi-solid bases. The ongoing transition of several prescription-only topical agents to over-the-counter (OTC) status in regulated economies is expanding market accessibility and driving consumer-led purchasing decisions, necessitating sophisticated supply chain management and consumer marketing strategies.

Regionally, North America maintains its dominance in terms of market value, attributable to high healthcare expenditure, sophisticated regulatory frameworks supporting rapid product innovation, and established reimbursement policies for advanced prescription ointments. However, the Asia Pacific region is projected to register the fastest growth CAGR, fueled by massive untapped patient pools, improving healthcare infrastructure, and rising disposable incomes that enable greater access to specialized dermatological care. European markets show stable growth, primarily driven by strict quality standards and strong demand for specialized treatments for atopic eczema and chronic ulcers, often supported by public health systems prioritizing cost-effective topical interventions over systemic therapies.

Segment trends reveal that the corticosteroids segment, despite facing regulatory scrutiny regarding long-term use, maintains the largest market share due to their proven efficacy in managing inflammatory conditions. Nonetheless, the non-steroidal anti-inflammatory drugs (NSAIDs) and specialized emollient segments are witnessing accelerated growth, reflecting a market shift towards safer, chronic use options and preventative skin barrier repair solutions. In terms of application, the psoriasis and eczema segments remain paramount, demanding novel, high-potency formulations. The distribution channel landscape is evolving, with hospital pharmacies and institutional sales experiencing steady growth for specialized treatments, while e-commerce and retail pharmacies are rapidly dominating the high-volume OTC and general dermatology categories, optimizing convenience for the end-user consumer base.

AI Impact Analysis on Topical Ointment Market

Common user questions regarding the impact of Artificial Intelligence (AI) on the Topical Ointment Market frequently revolve around optimizing drug discovery timelines, personalizing dermatological diagnosis and treatment, and enhancing the efficiency of manufacturing processes. Key concerns center on whether AI can accurately predict the skin permeability and efficacy of novel excipients and APIs before extensive physical testing, thereby reducing R&D costs and accelerating time-to-market. Users also express interest in AI’s capability to analyze vast clinical trial datasets to identify optimal patient populations and dosing regimens for highly potent topical formulations, ensuring targeted therapeutic intervention and minimizing adverse reactions. The summarized key themes indicate that users expect AI to revolutionize the formulation stage by predicting material interactions and optimizing stability, thereby moving beyond traditional trial-and-error methods prevalent in semi-solid dosage form development. Furthermore, the integration of AI-powered dermatological imaging systems is highly anticipated to improve diagnostic precision, leading to more appropriate and timely prescription of specific topical ointments, enhancing overall patient care quality and adherence to complex treatment schedules.

AI’s influence is rapidly extending across the entire value chain, from initial conceptualization to post-market surveillance. In the research phase, machine learning algorithms are utilized to screen large libraries of chemical compounds, predicting their skin penetration characteristics, metabolic pathways, and potential toxicity when integrated into ointment bases. This predictive capability substantially narrows down the candidate pool for expensive laboratory synthesis and testing, allowing pharmaceutical companies to prioritize formulations with the highest probability of therapeutic success. Concurrently, Generative AI models are being deployed to suggest novel combinations of inactive ingredients (excipients) that can synergistically enhance the stability, texture, and patient acceptability of the final ointment product, addressing historical challenges related to product elegance and patient compliance, particularly important for long-term dermatological treatments.

In the clinical domain, AI algorithms analyze high-resolution images of skin lesions, correlating visual characteristics with patient history and genetic markers to achieve diagnostic accuracy comparable to or exceeding human specialists. This precise diagnosis is critical for selecting the correct topical ointment potency and type (e.g., distinguishing between fungal and bacterial infections requiring different treatments). Moreover, AI applications are emerging in manufacturing, where algorithms monitor continuous processing parameters, such as mixing speed, temperature, and homogenization consistency, in real-time. This monitoring ensures batch-to-batch consistency and regulatory compliance, optimizing yield, reducing waste in the production of semi-solid forms, and ultimately bolstering the supply chain reliability of essential topical medications globally.

- AI accelerates drug candidate screening and predicts API permeability through the skin barrier.

- Machine learning optimizes ointment formulation composition, predicting excipient compatibility and product stability.

- AI-driven image analysis enhances diagnostic accuracy for dermatological conditions, leading to personalized ointment prescriptions.

- Predictive modeling streamlines clinical trial design by identifying ideal patient cohorts for targeted topical therapies.

- Automation and robotic process control in manufacturing, guided by AI, ensure rigorous batch consistency and quality assurance.

DRO & Impact Forces Of Topical Ointment Market

The Topical Ointment Market is influenced by a dynamic interplay of Drivers, Restraints, and Opportunities (DRO), collectively forming impact forces that dictate its direction and speed of growth. Key drivers include the overwhelming global increase in chronic and acute skin diseases, such as acne, atopic dermatitis, and various fungal infections, coupled with the increasing preference among medical professionals and patients for non-systemic, localized treatments that circumvent gastrointestinal irritation and systemic toxicity often associated with oral administration. The expanding geriatric population, prone to conditions like xerosis and chronic ulcers requiring intensive topical moisturizing and antimicrobial care, further amplifies demand. However, these driving forces are counterbalanced by significant restraints, primarily revolving around patient adherence challenges due to the greasiness or texture of traditional ointment bases, potential localized side effects (e.g., skin thinning from prolonged corticosteroid use), and stringent regulatory requirements for demonstrating therapeutic equivalence of generic topical formulations, which slows market entry for cost-effective alternatives.

Opportunities within the sector are considerable, focusing predominantly on technological innovations aimed at overcoming current formulation limitations. The development of advanced drug delivery systems, such as nano-emulsions, micro-encapsulation, and lipid-based carriers integrated into ointment bases, presents significant avenues for improving API absorption, achieving sustained release profiles, and minimizing the adverse effects associated with high peak concentrations. Furthermore, the substantial and relatively untapped market potential in developing economies, coupled with increased healthcare investment in these regions, offers new geographic expansion opportunities for established market players. Strategic alliances between pharmaceutical manufacturers and specialized dermatological contract development and manufacturing organizations (CDMOs) also create opportunities to streamline production and accelerate the development cycle for novel topical drugs targeting specific, high-need indications like severe plaque psoriasis or chemotherapy-induced skin toxicity, addressing unmet clinical demands effectively.

The impact forces can be summarized as high-impact drivers pushing innovation in formulation elegance and efficacy, while moderate-impact restraints related to patient preference and regulatory hurdles necessitate continuous technological adaptation. Market penetration is significantly driven by the transition of effective prescription drugs to OTC status, democratizing access and boosting volume sales. Conversely, the rising cost of complex APIs and the need for specialized manufacturing facilities capable of handling sophisticated semi-solid formulations exert upward pressure on pricing and operational complexity. Overall, the market remains characterized by intense competitive pressure focused on incremental improvements in bioavailability and aesthetic properties, aiming to capture greater market share through superior patient experience and demonstrated clinical effectiveness over existing standard-of-care treatments.

Segmentation Analysis

The Topical Ointment Market is comprehensively segmented based on several key criteria, including Product Type, Application, and Distribution Channel, allowing for nuanced analysis of market dynamics and targeted strategic planning. Product Type segmentation differentiates formulations based on their active ingredients and therapeutic class, reflecting the underlying mechanism of action and the specific conditions they are designed to treat. This segmentation is crucial as it highlights the performance and growth trajectories of specialized compounds versus general-use formulations. Application segmentation delineates the specific medical indications for which these ointments are utilized, such as chronic dermatological diseases, pain management, and localized infections. This provides insight into which disease burden areas are generating the most significant demand and where future R&D efforts are likely to be concentrated. Finally, the Distribution Channel segmentation analyzes the various pathways through which topical ointments reach the end-user, illustrating the relative importance of institutional, retail, and online sales models in different global regions.

The classification by Product Type typically includes corticosteroids, which dominate the anti-inflammatory segment, followed by antibiotics and antifungals, essential for managing localized microbial infections. The non-steroidal segment, encompassing emollients, NSAIDs, and specialized biological components, is currently experiencing the fastest growth, reflecting increasing clinical and consumer interest in long-term, safer maintenance therapies that minimize systemic drug load. Within the Application segment, dermatology holds the largest share due to the high incidence and chronic nature of conditions like eczema, acne, and psoriasis, which require continuous or intermittent topical treatment. Other major applications include wound care (e.g., antibiotic ointments for abrasions and post-surgical sites) and the growing niche of rheumatology, utilizing topical NSAIDs and capsaicin-based formulations for localized musculoskeletal pain relief.

Understanding these segments is vital for stakeholders. For instance, manufacturers focusing on corticosteroids must navigate complex regulatory environments related to potency classification and usage limitations, while companies specializing in OTC emollients must focus heavily on brand recognition and mass-market distribution strategies. The robust growth observed in the retail pharmacy and e-commerce distribution channels underscores the market's increasing dependence on consumer convenience and self-medication trends, pushing companies to invest heavily in robust supply chain logistics and digital marketing capabilities. The interplay between therapeutic effectiveness (Product Type) and volume demand (Application) dictates pricing power and overall profitability across the diverse landscape of the topical ointment sector.

- By Product Type:

- Corticosteroids (Low, Medium, High, and Very High Potency)

- Antibiotics

- Antifungals

- Non-Steroidal Anti-Inflammatory Drugs (NSAIDs)

- Anesthetics

- Emollients and Protectants

- Combination Products

- By Application:

- Psoriasis

- Eczema and Dermatitis

- Infections (Fungal, Bacterial)

- Acne

- Wound Care and Burns

- Pain Management (Musculoskeletal)

- Others (Pruritus, Xerosis)

- By Distribution Channel:

- Retail Pharmacies

- Hospital Pharmacies

- Online Pharmacies/E-commerce

Value Chain Analysis For Topical Ointment Market

The value chain for the Topical Ointment Market is intricate, starting with the upstream sourcing of specialized raw materials and extending through complex formulation processes to the diverse distribution channels that reach the end-user. Upstream analysis focuses on the procurement of Active Pharmaceutical Ingredients (APIs), which can range from synthetic small molecules (e.g., corticosteroids, antibiotics) to more complex, often patented, bio-derived substances. Critical non-API components include the excipients, such as sophisticated petroleum bases, purified waxes, mineral oils, emulsifiers, and stabilizers, whose quality and purity significantly impact the final product's texture, stability, and drug release profile. Dependence on a stable supply of high-grade pharmaceutical petroleum derivatives and specialty chemicals subjects the upstream segment to volatility in commodity markets and stringent quality control requirements, necessitating long-term supplier partnerships and meticulous verification processes to ensure regulatory compliance and product consistency.

The manufacturing and formulation stage (midstream) represents the core value addition point, involving specialized machinery for high-shear mixing, homogenization, and temperature control to create the semi-solid matrix. This stage requires significant technical expertise to manage the delicate balance between the API, excipients, and the ointment base to achieve optimal therapeutic efficacy and shelf life. Downstream analysis focuses on the logistics, marketing, and distribution channels. Topical ointments are generally distributed through both direct and indirect channels. Direct distribution involves sales to large hospital systems, government agencies, or specialized dermatological clinics for institutional use, where volumes are high but pricing is often negotiated through tenders. Indirect channels, which account for the majority of the market volume, rely on wholesale distributors, retail pharmacy chains, and, increasingly, online pharmacy platforms and e-commerce sites to reach individual consumers and outpatient settings.

The differentiation between direct and indirect sales is critical for market profitability. Indirect distribution, while expanding market reach significantly, requires substantial investment in co-op marketing, trade allowances, and shelf placement visibility, particularly for over-the-counter (OTC) products where consumer branding is paramount. Furthermore, the specialized nature of some prescription topical drugs necessitates detailed engagement with dermatologists and primary care physicians through medical sales representatives (Direct), ensuring appropriate prescribing practices and product awareness. Overall, successful value chain management requires robust quality control at the manufacturing level and optimized logistics across diverse regional distribution networks, balancing the need for broad accessibility (indirect retail) with controlled, expert-driven access (direct institutional sales) for high-potency treatments.

Topical Ointment Market Potential Customers

The primary consumers and end-users of topical ointments span a broad spectrum, fundamentally categorized into institutional buyers, medical professionals, and direct consumers. Institutional customers include large public and private hospital networks, specialized wound care centers, dermatological clinics, and long-term care facilities. These entities typically purchase high volumes of both prescription and hospital-grade non-prescription ointments, such as those used for infection prophylaxis in post-operative care, management of pressure ulcers, or high-potency corticosteroid treatments for in-patients. Their purchasing decisions are often centralized, driven by efficacy data, formulary inclusion, overall cost-effectiveness, and established supplier reliability, making them a crucial segment for manufacturers focusing on clinical indications and specialized professional use products requiring institutional oversight.

Medical professionals, specifically dermatologists, general practitioners (GPs), pediatricians, and specialized nurses, act as key intermediaries and decision-makers. While they are not the ultimate consumers of the product, their prescription patterns and recommendations fundamentally dictate the flow of both prescription (Rx) and physician-recommended over-the-counter (OTC) ointments. Dermatologists, in particular, are intensive users of the product category, requiring a deep portfolio of formulations across various potencies and active ingredient classes to manage complex, chronic skin conditions. Manufacturers invest heavily in educating this segment regarding new formulation advancements, clinical data supporting efficacy, and best practices for minimizing adverse effects to secure their prescribing loyalty and drive demand for premium and novel topical products.

The final and fastest-growing segment consists of direct consumers who purchase OTC topical ointments for self-medication. This group includes individuals managing minor skin irritations, minor burns, localized pain, or chronic conditions like mild eczema or dryness that do not require a prescription. Accessibility, brand recognition, perceived efficacy, and product aesthetics (non-greasiness, scent) are the dominant factors influencing purchasing decisions in this segment. The increasing shift towards e-commerce platforms provides this customer base with greater convenience and information, driving demand for general-purpose emollients, antifungal treatments, and topical analgesic ointments. Catering successfully to this segment requires strong retail presence, effective consumer marketing, and competitive pricing strategies supported by extensive advertising campaigns.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 8.5 Billion |

| Market Forecast in 2033 | USD 12.8 Billion |

| Growth Rate | CAGR 6.0% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Pfizer, Johnson & Johnson, Bayer AG, GlaxoSmithKline (GSK), Teva Pharmaceutical Industries, Bausch Health, Merck KGaA, AbbVie, Novartis, LEO Pharma, Taro Pharmaceutical Industries, Sanofi, Galderma, Viatris (Mylan), Hikma Pharmaceuticals, Beiersdorf, Perrigo Company plc, Prestige Consumer Healthcare, Sun Pharmaceutical Industries Ltd., Almirall S.A. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Topical Ointment Market Key Technology Landscape

The Topical Ointment Market is being significantly reshaped by innovations in pharmaceutical technology, primarily focused on overcoming the biological barrier presented by the stratum corneum and enhancing the stability and patient acceptability of semi-solid bases. A major technological focus is the adoption of advanced carrier systems, such as microencapsulation and liposomal technologies. Microencapsulation involves enveloping the active drug molecule within microscopic polymer spheres, which protects the API from degradation and allows for controlled, sustained release kinetics once applied to the skin. This controlled release profile is critical for maximizing therapeutic windows and reducing the frequency of application, thus improving patient compliance for chronic conditions. Similarly, liposomes—small spherical vesicles made of lipid bilayers—are being incorporated into ointment bases to enhance drug solubility and facilitate deeper penetration of hydrophilic drugs across the lipid-rich skin barrier, leading to superior bioavailability compared to traditional formulations.

Another crucial area of innovation involves transdermal drug delivery systems and permeation enhancers. While traditional ointments rely on passive diffusion, modern formulations integrate chemical permeation enhancers (CPEs), such as specific solvents or fatty acids, which temporarily and reversibly disrupt the skin barrier structure, significantly boosting drug flux. Furthermore, advancements in specialized formulation techniques, including high-pressure homogenization and micronization, ensure extremely uniform particle size distribution within the ointment matrix. This uniformity is vital for consistency in dosing, especially for high-potency drugs like topical steroids, and contributes to the overall stability of the semi-solid emulsion or suspension throughout its shelf life, mitigating the risk of phase separation or crystallization often seen in older, simpler formulations.

The development of sophisticated analytical technologies also forms a foundational part of the technological landscape, particularly in quality assurance and regulatory compliance. Techniques like Attenuated Total Reflectance Fourier Transform Infrared (ATR-FTIR) spectroscopy and Differential Scanning Calorimetry (DSC) are increasingly used to analyze the physical state of the drug within the ointment and confirm batch-to-batch consistency. Furthermore, manufacturers are exploring the use of 3D printing and continuous manufacturing processes for semi-solids, which promise to move production away from traditional batch processes to more efficient, scalable, and quality-controlled continuous flows. This transition is expected to drastically reduce manufacturing costs and time, particularly for highly customized or niche topical formulations, ensuring that the technology landscape remains dynamic and responsive to both clinical needs and economic pressures.

Regional Highlights

- North America: This region dominates the Topical Ointment Market in terms of revenue share, primarily due to the high per capita healthcare spending, the presence of major global pharmaceutical companies, and established patient awareness regarding advanced dermatological care. The U.S. market is characterized by rapid adoption of novel prescription formulations, driven by sophisticated reimbursement models and a high prevalence of chronic conditions like psoriasis and atopic dermatitis. Stringent regulatory standards ensure high product quality, while vigorous R&D investment focuses on specialized, high-value products, including combination therapies and topical generics of complex molecules. Canada also contributes substantial revenue, supported by a universal healthcare system that prioritizes effective, localized treatments.

- Europe: The European market represents a mature, yet steadily growing segment, driven by robust healthcare systems in Western Europe (Germany, UK, France) and an aging population requiring frequent topical treatments for age-related skin disorders and chronic venous ulcers. Regulatory harmonization across the EU facilitates market entry for novel products, although price controls in key markets can limit premium pricing opportunities. There is a particularly strong emphasis on non-steroidal and natural ingredient-based emollients, reflecting high consumer preference for ‘clean label’ and minimally irritating products for sensitive skin conditions like infantile eczema.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing regional market globally. This rapid expansion is fueled by massive patient populations, particularly in India and China, experiencing higher incidences of infectious skin diseases and increasing urbanization-related dermatoses. Key growth drivers include improvements in healthcare infrastructure, rising disposable incomes leading to greater access to specialized treatments, and the increasing availability of affordable generic and OTC topical products. Market entry in APAC often involves navigating diverse regulatory landscapes, but the potential for volume sales offsets complexity, positioning this region as critical for long-term growth strategies.

- Latin America (LATAM): LATAM markets, including Brazil, Mexico, and Argentina, show moderate growth, supported by expanding public healthcare coverage and a growing middle class. The market focuses heavily on essential dermatological products, including antifungals and basic corticosteroids. Economic volatility and varying regulatory approval times remain persistent challenges, but the region offers opportunities for standardized, high-volume OTC topical applications focused on hygiene and common minor ailments.

- Middle East and Africa (MEA): This region is characterized by fragmented growth. The GCC countries exhibit high demand for premium and aesthetic dermatological treatments due to high per capita income and advanced medical tourism. Conversely, African nations focus primarily on essential medicines, including topical antibiotics and antifungals, driven by public health initiatives aimed at combating high rates of infectious skin diseases. Infrastructure development and regional trade agreements are critical factors influencing future market access and growth trajectory in MEA.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Topical Ointment Market.- Pfizer

- Johnson & Johnson

- Bayer AG

- GlaxoSmithKline (GSK)

- Teva Pharmaceutical Industries

- Bausch Health

- Merck KGaA

- AbbVie

- Novartis

- LEO Pharma

- Taro Pharmaceutical Industries

- Sanofi

- Galderma

- Viatris (Mylan)

- Hikma Pharmaceuticals

- Beiersdorf

- Prestige Consumer Healthcare

- Sun Pharmaceutical Industries Ltd.

- Almirall S.A.

- Dr. Reddy's Laboratories

Frequently Asked Questions

Analyze common user questions about the Topical Ointment market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the growth of the Topical Ointment Market?

The primary driver is the increasing global prevalence of chronic inflammatory skin disorders, such as psoriasis and eczema, coupled with patient and physician preference for localized, non-systemic drug delivery methods that minimize adverse effects.

How do advancements in drug delivery systems affect topical ointment efficacy?

Technological advancements, including microencapsulation and liposomal carriers, significantly improve efficacy by enhancing the stability of the active ingredient, ensuring targeted penetration through the skin barrier, and providing sustained release for prolonged therapeutic action.

Which geographical region holds the largest market share for topical ointments?

North America currently holds the largest market share, driven by high healthcare expenditure, established reimbursement frameworks, advanced dermatological practices, and a robust pipeline of specialized prescription topical products.

What are the main differences between topical ointments and topical creams?

Ointments are semi-solid preparations with an oleaginous, water-in-oil base (high oil content) that provides superior occlusion and hydration, making them ideal for dry, chronic conditions. Creams are oil-in-water emulsions (higher water content), offering better spreadability and cosmetic elegance, suitable for moist or weeping lesions.

What role does Artificial Intelligence (AI) play in the future of topical ointment development?

AI is crucial for accelerating research and development by predicting API skin permeability and optimizing complex formulation compositions. It also enhances diagnostic precision in dermatology, enabling more personalized and effective prescription of topical treatments.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager