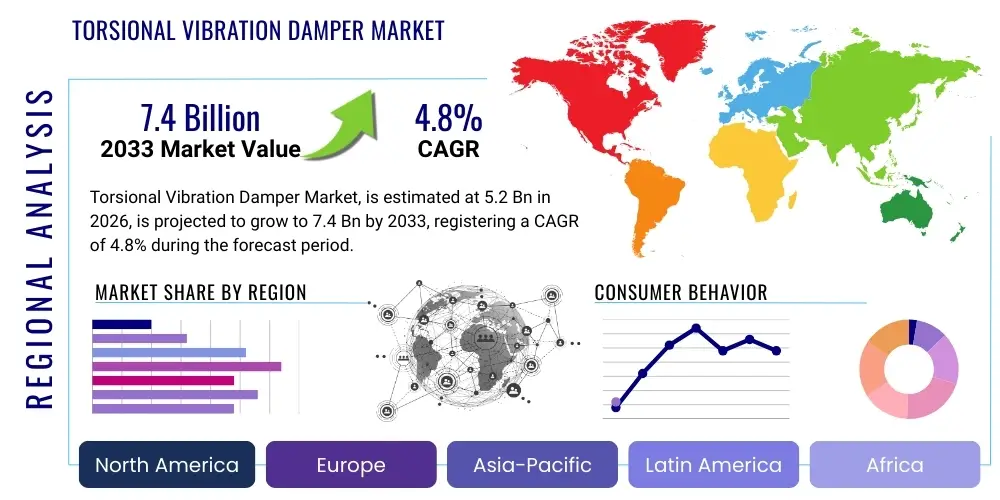

Torsional Vibration Damper Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443385 | Date : Feb, 2026 | Pages : 257 | Region : Global | Publisher : MRU

Torsional Vibration Damper Market Size

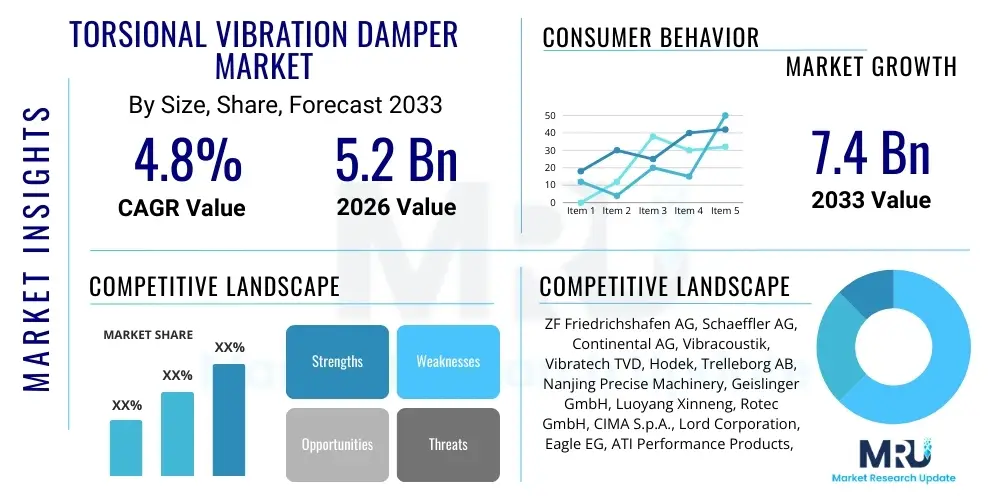

The Torsional Vibration Damper Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at USD 5.2 Billion in 2026 and is projected to reach USD 7.4 Billion by the end of the forecast period in 2033.

Torsional Vibration Damper Market introduction

The Torsional Vibration Damper Market encompasses the design, manufacturing, and distribution of mechanical devices engineered to absorb and dissipate torsional vibrations generated primarily by internal combustion engines (ICEs), rotating machinery, and power transmission systems. These critical components are essential for protecting drivetrain components, improving operational efficiency, and extending the lifespan of high-value machinery. Torsional vibrations occur due to the cyclic nature of torque delivery in engines, which can lead to fatigue failures, excessive noise, and poor performance if left undamped. The market's stability is historically linked to the automotive and heavy machinery sectors, where high power density and stringent reliability requirements necessitate advanced vibration control solutions.

Torsional Vibration Dampers (TVDs), often mounted on the crankshaft or propeller shaft, function by utilizing various mechanisms, predominantly viscous fluid resistance, rubber deformation, or tuned mass principles, to counteract and neutralize resonant frequencies. Major applications span across passenger vehicles, commercial trucks, marine engines, aerospace propulsion systems, and large industrial installations such as power generation turbines and oil & gas compressors. The inherent benefit of using TVDs lies in reducing peak torques and angular accelerations, thereby ensuring smoother operation, minimizing component wear, and meeting stringent noise, vibration, and harshness (NVH) standards globally. As engine downsizing and turbocharging become more prevalent, the complexity and necessity of high-performance TVDs increase dramatically.

Driving factors propelling market growth include the continuously increasing global production of vehicles, particularly in emerging economies, the rising adoption of sophisticated turbo-diesel engines requiring enhanced vibration control, and the persistent need for efficiency improvements in industrial machinery to comply with environmental regulations. Furthermore, the integration of hybrid and complex powertrain architectures, though challenging traditional ICE-centric damper designs, is simultaneously driving innovation towards advanced, highly customized damping solutions capable of managing transient load conditions and the specific vibration signatures of electrified drivetrains. The emphasis on component longevity and maintenance reduction across all end-use sectors further reinforces the demand for high-quality, durable torsional vibration damping solutions.

Torsional Vibration Damper Market Executive Summary

The Torsional Vibration Damper Market is poised for stable expansion, driven fundamentally by the automotive sector’s constant pursuit of fuel efficiency, noise reduction, and durability, alongside robust demand from the industrial machinery segment, particularly in power generation and large marine applications. Current business trends indicate a strong shift towards specialized and custom-engineered damper solutions, moving away from generic components, particularly in high-performance and heavy-duty segments. Key manufacturers are investing heavily in material science—exploring high-performance silicone fluids and advanced elastomer compounds—to develop lighter, more effective, and environmentally resilient damping solutions. The rise of hybrid electric vehicles (HEVs) presents a bifurcated trend: while pure battery electric vehicles (BEVs) diminish the need for traditional crankshaft dampers, HEVs often require specialized damping to manage the complex coupling of ICE and electric motor vibrations, creating new market niches.

Regionally, the Asia Pacific (APAC) stands out as the primary growth engine, fueled by massive vehicle production bases in China, India, and Southeast Asian nations, coupled with rapid industrialization increasing the deployment of large machinery. North America and Europe, characterized by stringent emission standards and a high concentration of premium and heavy-duty vehicle manufacturing, represent mature markets focusing on technological sophistication and component replacement cycles. Segment-wise, viscous dampers are gaining traction in heavy-duty applications due to their superior performance and durability under extreme conditions, whereas rubber dampers maintain dominance in the volume-driven passenger vehicle segment owing to their cost-effectiveness and proven reliability in standard operating environments. The underlying trend across all segments is the increasing requirement for integrated NVH solutions where the damper acts as part of a larger system, demanding closer collaboration between damper manufacturers and original equipment manufacturers (OEMs).

Overall market dynamics are characterized by intense competition among specialized component providers and large Tier 1 automotive suppliers. Strategic acquisitions aimed at consolidating technical expertise, expanding geographical footprint, and securing long-term OEM contracts define the competitive landscape. Furthermore, regulatory mandates concerning engine efficiency and durability are creating opportunities for innovative damper designs that can handle higher engine torques generated by downsized, turbocharged powertrains. The aftermarket remains a significant revenue stream, driven by the replacement cycles of dampers in older vehicles and industrial equipment, ensuring sustained demand even if new ICE vehicle production plateaus in certain advanced economies due to electrification initiatives.

AI Impact Analysis on Torsional Vibration Damper Market

Common user questions regarding AI's impact on the Torsional Vibration Damper market generally revolve around predictive maintenance capabilities, optimization of damper design based on real-world operational profiles, and the automation of manufacturing quality control. Users are keen to know if AI can predict damper failure before critical damage occurs (a high concern given the component's protective function) and how machine learning algorithms might refine the complex non-linear models required for accurate torsional vibration analysis. There is significant interest in using AI-driven simulation tools to accelerate the design iteration process, especially for customized dampers needed in highly complex hybrid and specialized industrial machinery powertrains. Concerns often center on the computational cost, data privacy of operational telematics, and the reliability of AI models in predicting component lifespan under highly variable real-world conditions.

AI's initial impact is focused heavily on the design phase and manufacturing process optimization. Machine learning is being utilized to analyze vast datasets of engine operating conditions, stress levels, and material degradation over time, enabling engineers to create predictive models that inform the optimal stiffness, damping coefficients, and material choice for specific applications. This data-driven approach allows for the creation of "digital twins" of powertrain systems, significantly reducing physical prototyping time and cost. By simulating millions of duty cycles, AI can identify potential failure modes in new designs more efficiently than traditional finite element analysis (FEA) alone, thereby enhancing product reliability and performance guarantees, a major selling point in the OEM market.

Furthermore, AI algorithms are becoming instrumental in predictive maintenance and quality assurance. Integrating smart sensors into industrial engines and large marine applications allows for continuous monitoring of vibration signatures. AI analyzes these signatures in real-time, identifying subtle changes indicative of damper degradation (such as fluid viscosity breakdown in viscous dampers or elastomer fatigue in rubber dampers). This enables proactive replacement scheduling, minimizing costly unplanned downtime. In manufacturing, computer vision systems powered by AI are inspecting raw materials and finished components, ensuring dimensional accuracy and identifying microscopic flaws with unparalleled speed and consistency, thus guaranteeing the high precision required for these critical rotating components.

- AI-driven Predictive Maintenance: Enhancing asset uptime by forecasting damper failure based on real-time vibration data analysis.

- Optimized Design Parameters: Machine learning refines complex non-linear models to determine ideal material compositions and geometries for specific load profiles.

- Accelerated Prototyping: Utilization of digital twins and AI simulation reduces reliance on lengthy physical testing and speeds up time-to-market.

- Automated Quality Control: AI-powered computer vision systems ensure high precision and consistency in manufacturing processes, reducing defects.

- Customized Solution Development: Enabling rapid customization of dampers for complex hybrid and specialized industrial machinery applications.

DRO & Impact Forces Of Torsional Vibration Damper Market

The Torsional Vibration Damper Market is primarily driven by rigorous regulatory requirements for engine emissions, which necessitate highly efficient and durable engines capable of high power density, inevitably increasing torsional stress. The global surge in automobile production, particularly in Asia, acts as a quantitative driver, while the qualitative driver is the trend toward engine downsizing and turbocharging in developed economies, making effective damping solutions indispensable. Restraints include the shift toward Battery Electric Vehicles (BEVs), which lack the core vibration source (the ICE) and thus reduce the long-term potential for traditional damper types, alongside volatility in raw material prices, particularly for high-grade steel, silicone fluids, and specialty elastomers. Opportunities abound in the burgeoning hybrid vehicle segment, which requires highly specialized TVDs, and in expanding applications within renewable energy machinery and precision industrial equipment where vibration control is paramount for operational accuracy. The market is influenced heavily by Porter's Five Forces, specifically the bargaining power of powerful automotive OEMs (buyers) demanding lower cost and higher performance, and the threat of substitutes from alternative vibration mitigation technologies, though direct, perfect substitutes for crankshaft damping remain limited.

The impact forces are multifaceted, centered on technological substitution and regulatory adherence. The threat of new entrants is moderate; while manufacturing precision is a barrier, niche technological advancements, particularly in smart materials or active damping systems, could allow specialized firms to disrupt the market. The bargaining power of suppliers, especially those providing proprietary elastomer formulations or specialized high-viscosity silicone fluids, is moderate to high, influencing overall production costs. Competitive rivalry is high, driven by the limited number of major Tier 1 suppliers competing fiercely on price, performance, and long-term service contracts, especially within the critical automotive OEM supply chain. The overall environment favors suppliers who can innovate quickly, offering lightweight, customizable solutions that integrate seamlessly into complex modern powertrains, including those incorporating start-stop functions which introduce unique vibration challenges.

Ultimately, the market's trajectory is defined by the ongoing transition in transportation. While BEV adoption poses a long-term challenge to volume growth in passenger cars, the immediate need for enhanced damping solutions in HEVs, coupled with sustained, stable demand from heavy-duty commercial vehicles, marine, and industrial sectors, ensures robust market vitality. Manufacturers must strategically navigate material cost pressures while investing in R&D to develop future-proof products, such as intelligent or semi-active dampers that adapt to varying engine speeds and loads, securing resilience against inevitable shifts in powertrain technology and maintaining relevance in the evolving mobility landscape.

Segmentation Analysis

The Torsional Vibration Damper Market is rigorously segmented based on product type, application, and geography, reflecting the diverse technical requirements across different end-use industries. Segmentation by type differentiates the market primarily into viscous dampers, which use fluid shear resistance for damping and are favored in heavy-duty and high-performance applications; rubber dampers, which rely on elastomer deformation and dominate the mass-market passenger vehicle segment due to cost efficiency; dry friction dampers; and more complex tuned mass dampers (TMDs) utilized for specific, highly tuned frequency mitigation. These distinct product categories cater to vastly different operational environments, thermal constraints, and durability requirements. The choice of damper type is crucial, directly impacting engine efficiency, NVH characteristics, and overall system longevity.

Application segmentation reveals the core demand drivers, with Automotive (further split into Passenger Vehicles and Commercial Vehicles) representing the largest segment due to global vehicle production volumes. The Commercial Vehicle segment often requires more robust and durable viscous dampers to manage the high torques and extended operational hours typical of heavy-duty trucks and buses. Beyond automotive, the Industrial Machinery segment is crucial, encompassing applications in power generation (turbines, generators), oil & gas (pumps, compressors), and marine propulsion systems. This segment often demands custom-engineered, large-diameter dampers capable of handling extremely high inertia and power outputs, prioritizing absolute reliability over cost, thereby commanding higher average selling prices (ASPs).

Geographical segmentation highlights regional manufacturing and consumption patterns. Asia Pacific leads the market volume due to high automotive and industrial production rates, while North America and Europe lead in technological adoption and the demand for high-performance, complex damper systems used in premium vehicles and highly regulated industries. Analyzing these segments provides strategic insights for market participants, allowing them to tailor product development, pricing strategies, and distribution channels to maximize penetration within their targeted high-growth or high-value sub-markets. The inherent technical differentiation across segments ensures that no single product type can dominate the entire market landscape.

- By Type:

- Viscous Dampers

- Rubber Dampers

- Dry Friction Dampers

- Tuned Mass Dampers (TMD)

- Other Advanced Dampers

- By Application:

- Automotive

- Passenger Vehicles

- Commercial Vehicles (Light, Medium, Heavy-duty)

- Industrial Machinery

- Power Generation

- Oil & Gas

- Mining

- Construction

- Marine Engines

- Aerospace and Defense

- Automotive

- By Region:

- North America (US, Canada, Mexico)

- Europe (Germany, UK, France, Italy, Rest of Europe)

- Asia Pacific (China, Japan, India, South Korea, Rest of APAC)

- Latin America (Brazil, Argentina, Rest of LATAM)

- Middle East & Africa (UAE, Saudi Arabia, South Africa, Rest of MEA)

Value Chain Analysis For Torsional Vibration Damper Market

The value chain for the Torsional Vibration Damper Market begins with the procurement of critical raw materials, primarily high-grade steels for the inertia ring and housing, specialized elastomers (natural rubber, EPDM, silicone) for rubber dampers, and high-viscosity silicone fluids for viscous dampers. Upstream analysis focuses heavily on material science, as the performance and durability of the damper are fundamentally dependent on the quality and formulation of these inputs. Suppliers of these specialized materials often possess significant bargaining power due to the technical specifications required, particularly concerning thermal stability and fatigue resistance, which necessitates rigorous material qualification and control. Efficiency in this stage is critical, as material costs represent a substantial portion of the final product's manufacturing cost.

The core manufacturing and assembly stage involves high-precision machining, casting, bonding (for rubber dampers), and sealing processes. Tier 1 component manufacturers dominate this stage, utilizing advanced manufacturing technologies and stringent quality control protocols to meet the tight tolerances required for rotating engine components. Research and Development (R&D) plays a pervasive role here, focusing on optimizing geometry for weight reduction (critical for automotive applications) and improving damping efficiency across a broad frequency spectrum. Distribution channels are predominantly direct, characterized by long-term strategic partnerships between damper manufacturers and major Original Equipment Manufacturers (OEMs) in the automotive, marine, and industrial sectors. These direct relationships involve co-development and highly customized supply logistics, ensuring the dampers integrate perfectly into the OEM's engine design and production schedule.

Downstream analysis includes the aftermarket, where indirect distribution through specialized automotive parts wholesalers, industrial suppliers, and service garages becomes more relevant. While new vehicle production drives the majority of high-volume sales (direct channel), replacement demand (aftermarket) provides stable, high-margin revenue through indirect channels. Furthermore, specialized engineering services, including torsional vibration analysis and system integration support, often accompany the sale of complex dampers, adding significant value and strengthening manufacturer-customer relationships. The overall trend emphasizes global sourcing flexibility and sophisticated logistics to support just-in-time delivery required by globalized OEM production lines.

Torsional Vibration Damper Market Potential Customers

Potential customers for Torsional Vibration Dampers are primarily large-scale equipment manufacturers and heavy-duty machinery operators whose products rely on robust internal combustion engines or rotating power transmission systems. The largest segment of end-users are global automotive Original Equipment Manufacturers (OEMs), including manufacturers of passenger vehicles (e.g., Volkswagen, Toyota, General Motors) and commercial vehicles (e.g., Daimler Trucks, Volvo, PACCAR). These buyers require high-volume, cost-optimized, yet reliable dampers for both mass-market models and high-performance, heavy-duty applications. Their procurement strategies are characterized by long-term contracts, stringent performance metrics, and global supply requirements, making them the cornerstone buyers for Tier 1 suppliers in this market.

The industrial sector represents the next critical customer group. This includes manufacturers of stationary power generation equipment (e.g., Wärtsilä, Siemens Energy, Caterpillar Power Systems), where large-bore engines and turbine systems necessitate extremely robust and custom-engineered viscous or tuned mass dampers to ensure operational stability and protect valuable infrastructure. Similarly, companies involved in oil and gas pumping, compression systems, and heavy construction equipment are significant end-users. These customers prioritize longevity, maintenance reduction, and reliable performance under continuous, heavy loads, often leading to the selection of specialized, high-cost, high-performance damping solutions.

Finally, the marine and aerospace sectors constitute highly specialized buyer segments. Marine engine manufacturers (for commercial shipping, naval vessels, and high-speed boats) require dampers designed to withstand harsh environments (salt, humidity) and manage the unique vibration profiles of large, slow-speed or medium-speed diesel engines. Aerospace customers, though smaller in volume, demand ultra-high reliability and often specialized lightweight materials for damping solutions used in propulsion systems or ground support equipment. Across all end-user sectors, the decision to purchase is driven by regulatory compliance (NVH standards), maximizing engine lifespan, and minimizing operational downtime associated with vibration-induced failures.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 5.2 Billion |

| Market Forecast in 2033 | USD 7.4 Billion |

| Growth Rate | 4.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | ZF Friedrichshafen AG, Schaeffler AG, Continental AG, Vibracoustik, Vibratech TVD, Hodek, Trelleborg AB, Nanjing Precise Machinery, Geislinger GmbH, Luoyang Xinneng, Rotec GmbH, CIMA S.p.A., Lord Corporation, Eagle EG, ATI Performance Products, S.H.M. Engineering, Shanghai Dongrui, Torsional Dynamics Inc., Kienle + Spiess, Metaldyne. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Torsional Vibration Damper Market Key Technology Landscape

The technological landscape of the Torsional Vibration Damper Market is characterized by continuous innovation focused on optimizing damping performance, reducing weight, and adapting to new powertrain architectures, particularly those incorporating electrification and start-stop functionality. Conventional technologies like rubber and viscous dampers are undergoing material science enhancements. Manufacturers are developing multi-stage or decoupled rubber dampers to manage broader frequency ranges and mitigate the complex transient vibrations introduced by modern downsized, highly torqued engines. For viscous dampers, advancements center on proprietary high-stability silicone fluids that maintain viscosity and damping characteristics across extreme temperature fluctuations, ensuring consistent performance in heavy-duty and motorsport applications.

A significant area of technological focus is the development of advanced mechanical damper concepts, such as Pendulum Absorbers and highly specialized Tuned Mass Dampers (TMDs). These technologies are often integrated into the flywheel assembly to neutralize dominant torsional orders efficiently, leading to quieter, smoother operation and improved fuel economy. Furthermore, the integration of torsional damping into the Dual Mass Flywheel (DMF) assembly is becoming standard in many passenger vehicles, allowing for enhanced NVH performance, particularly at low engine speeds. The complexity of these integrated systems requires manufacturers to employ sophisticated simulation tools, including Computational Fluid Dynamics (CFD) for viscous fluids and complex non-linear FEA for elastomeric components, to predict component behavior accurately under dynamic loads.

Looking ahead, the market is seeing nascent development in semi-active and active damping systems. Semi-active dampers utilize magnetic or electrorheological fluids whose viscosity (and thus damping coefficient) can be electronically controlled in real-time, adapting to changing engine speed and load conditions for optimal performance across the entire operational envelope. Although these technologies currently face cost and complexity barriers, their potential to offer superior, adaptive vibration control makes them the future benchmark for high-end automotive and specialized industrial applications. Material innovation, including the use of advanced composites and high-strength aluminum alloys, is also crucial for reducing the rotational mass of the damper, which directly improves engine responsiveness and overall efficiency.

Regional Highlights

The Torsional Vibration Damper Market exhibits distinct growth trajectories and technological focuses across major geographic regions, driven by varying regulatory environments, manufacturing bases, and end-user demands.

- Asia Pacific (APAC): APAC is the global leader in terms of volume demand, primarily fueled by the massive automotive manufacturing hubs in China, India, Japan, and South Korea. Rapid industrialization and infrastructure development, particularly in Southeast Asia, also drive strong demand for dampers in construction machinery, power generation, and commercial vehicles. The market here is characterized by a high volume of rubber dampers for mass-market vehicles, but there is an accelerating transition towards high-performance dampers driven by increasing domestic production of premium vehicles and compliance with Euro-equivalent emission norms.

- Europe: Europe represents a mature market focused on technological innovation and high-value applications. Stringent NVH standards and the dominance of sophisticated, downsized, turbocharged, and hybrid powertrains drive the demand for advanced dampers, including integrated DMF solutions and specialized viscous dampers. Germany, the UK, and France are hubs for R&D and manufacturing of premium automotive and specialized industrial dampers. The long-term trend of electrification poses a gradual deceleration risk for traditional damper types, but the short-to-medium term demand from HEVs remains strong.

- North America: This region is characterized by significant demand from the heavy-duty commercial vehicle (HDV) sector and the oil & gas industry, making it a crucial market for large, durable viscous dampers. In the automotive sector, the preference for large SUVs and pickup trucks, which often feature powerful V6 and V8 engines, ensures steady demand for robust torsional control solutions. High replacement rates in the aftermarket further solidify North America's position as a stable, high-value market segment.

- Latin America (LATAM): Market growth in LATAM is closely tied to domestic vehicle production, particularly in Brazil and Mexico, and infrastructure investment. The demand profile is generally cost-sensitive, favoring standard rubber dampers and localized manufacturing, although the expansion of commercial fleets necessitates more reliable viscous solutions.

- Middle East and Africa (MEA): Demand is driven by investments in the oil & gas and mining sectors, requiring specialized dampers for stationary engines and heavy machinery. Vehicle demand is stable, primarily relying on imported components, with growth potential linked to economic diversification and industrial project expansion, particularly in the UAE and Saudi Arabia.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Torsional Vibration Damper Market.- ZF Friedrichshafen AG

- Schaeffler AG

- Continental AG

- Vibracoustik

- Vibratech TVD

- Hodek

- Trelleborg AB

- Nanjing Precise Machinery

- Geislinger GmbH

- Luoyang Xinneng

- Rotec GmbH

- CIMA S.p.A.

- Lord Corporation

- Eagle EG

- ATI Performance Products

- S.H.M. Engineering

- Shanghai Dongrui

- Torsional Dynamics Inc.

- Kienle + Spiess

- Metaldyne

Frequently Asked Questions

Analyze common user questions about the Torsional Vibration Damper market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary function of a Torsional Vibration Damper (TVD)?

The primary function of a TVD is to absorb and dissipate torsional (twisting) vibrations and shock loads generated by the cyclic firing impulses of an internal combustion engine, protecting the crankshaft and other drivetrain components from fatigue failure and reducing noise, vibration, and harshness (NVH).

How will the rise of Electric Vehicles (EVs) impact the Torsional Vibration Damper market?

Pure Battery Electric Vehicles (BEVs) eliminate the need for traditional crankshaft dampers. However, the growth of Hybrid Electric Vehicles (HEVs) creates new opportunities for specialized, highly complex dampers designed to manage the combined vibration profiles and transient loads of both the electric motor and the intermittent operation of the ICE.

Which type of torsional damper is most commonly used in heavy-duty commercial vehicles?

Viscous Dampers are predominantly used in heavy-duty commercial vehicles, marine engines, and large industrial applications. This is due to their superior efficiency in dissipating high energy loads, exceptional durability, and consistent performance across a wide range of operating temperatures and extended service intervals compared to rubber dampers.

What are the key technological advancements driving innovation in the TVD market?

Key technological advancements include the development of multi-stage and decoupled damper designs, the integration of dampers into Dual Mass Flywheels (DMFs) for optimized NVH, and material science breakthroughs focusing on lighter weight alloys and high-stability silicone fluids. Furthermore, active and semi-active damping systems are being researched for high-end applications.

Which geographical region holds the largest market share for Torsional Vibration Dampers?

The Asia Pacific (APAC) region currently holds the largest market share in terms of volume, driven by high output in the automotive manufacturing sector, particularly in China and India, coupled with rapid industrial growth demanding large machinery applications.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager