Tour Guide System Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441030 | Date : Feb, 2026 | Pages : 246 | Region : Global | Publisher : MRU

Tour Guide System Market Size

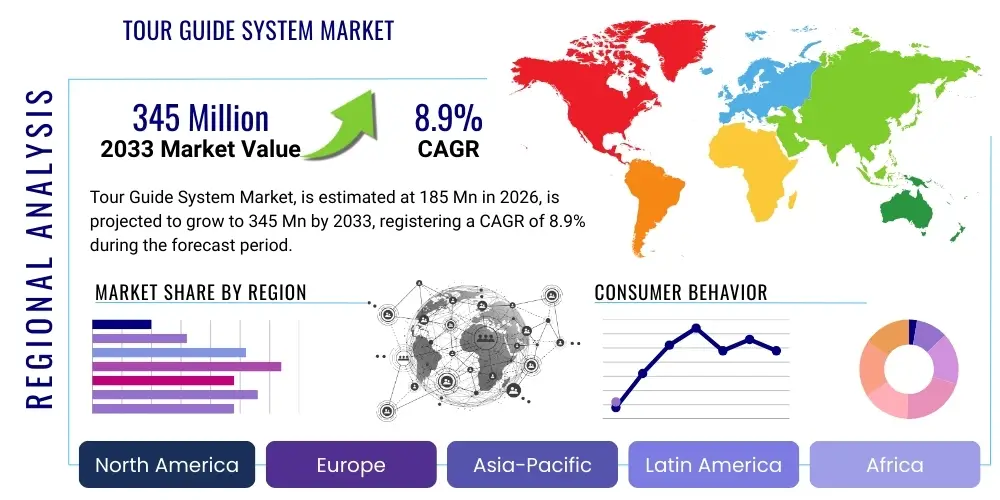

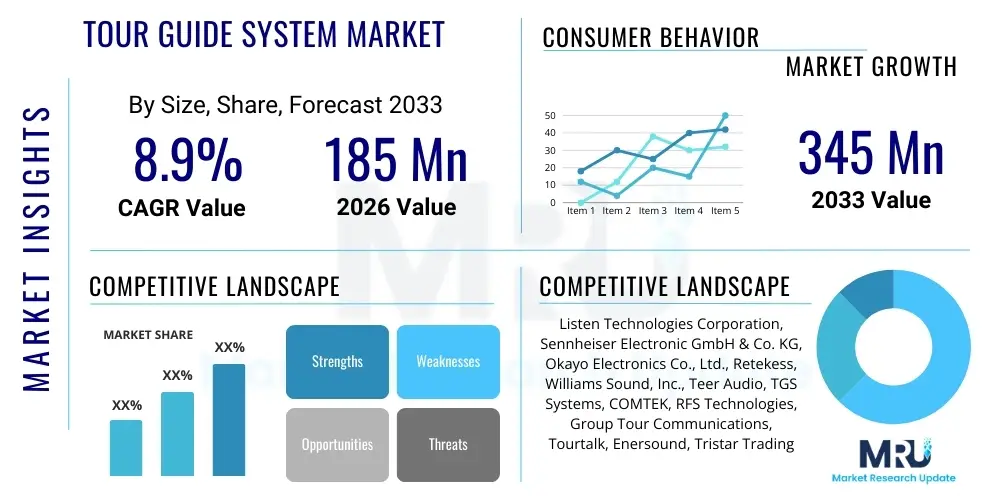

The Tour Guide System Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.9% between 2026 and 2033. The market is estimated at $185 Million USD in 2026 and is projected to reach $345 Million USD by the end of the forecast period in 2033.

Tour Guide System Market introduction

The Tour Guide System Market encompasses specialized wireless communication devices designed to enhance the guided tour experience, ensuring seamless audio transmission from the guide to all participants, regardless of group size or surrounding noise levels. These systems typically consist of a compact transmitter utilized by the guide and multiple receivers distributed to the tour members, often featuring lightweight headsets or earphones. Products range from basic analog radio frequency (RF) systems to advanced digital systems incorporating features like multiple channel support, noise cancellation, and integration with modern digital platforms. The fundamental purpose of these systems is to improve clarity, accessibility, and engagement, particularly in noisy industrial environments, expansive outdoor historical sites, museums, and educational settings where physical proximity or vocal projection alone is insufficient.

Major applications of tour guide systems span diverse sectors, including manufacturing facilities where safety regulations necessitate clear communication, cultural heritage sites requiring quiet yet detailed narration, conference simultaneous interpretation, and outdoor trekking or bus tours. The primary benefit derived from the adoption of these solutions is significantly enhanced visitor satisfaction and improved operational efficiency for tour operators. Clear communication mitigates confusion, allows groups to maintain desired pacing, and ensures that vital information, whether historical context or critical safety instructions, is delivered effectively. This technological shift is moving away from traditional megaphone or shout-based communication towards highly professional, discreet, and reliable audio delivery mechanisms.

Driving factors for market expansion include the burgeoning global tourism sector, particularly in experiential and niche travel segments, and the increasing standardization of workplace safety and training requirements across industries. Furthermore, the rising demand for multi-language interpretation services at international conferences and factory visits acts as a significant catalyst. Technological advancements, such as the miniaturization of components, improved battery life, and the transition towards crystal-clear digital transmission, are continually expanding the usability and appeal of these systems across a wider range of professional applications, solidifying their role as essential tools for organized group communication.

Tour Guide System Market Executive Summary

The Tour Guide System Market is experiencing robust growth driven primarily by a post-pandemic resurgence in global tourism and a renewed focus on structured communication in corporate and industrial settings. Business trends indicate a strong shift towards digital UHF and 2.4 GHz systems, favored for their interference resistance and superior audio quality over older analog VHF systems. Furthermore, market players are increasingly focusing on software integration, offering value-added services such as automated content delivery based on geolocation (beacons or GPS) and cloud-based management platforms for device inventory and charging logistics. Competition is intensifying, particularly among Asian manufacturers who offer cost-effective, high-quality digital solutions, challenging established European and North American premium brands.

Regionally, Asia Pacific (APAC) stands out as the fastest-growing market, propelled by massive investments in cultural tourism infrastructure, rapid urbanization requiring efficient visitor management in dense city environments, and booming industrial and manufacturing sectors that rely heavily on these systems for factory tours and worker training. North America and Europe maintain leading market shares due to high adoption rates in corporate training, large-scale conference interpretation, and established museum networks, showing a preference for high-end, digitally encrypted systems. Emerging markets in Latin America and MEA are beginning to adopt these systems, primarily driven by international business development and cultural site preservation initiatives funded through global partnerships.

In terms of segments, the market sees significant strength in the 'Application by Tourism and Travel' and 'Type by Digital Systems' categories. Digital systems dominate due to their clarity and multi-channel capabilities, essential for complex tours. Within the end-user spectrum, Corporate Training and Educational Institutions show the highest demand growth, recognizing the immediate Return on Investment (ROI) derived from standardized, clear, and focused information delivery. The increasing focus on hands-free operation and hygienic usage (disposable earpieces, easy-to-sanitize materials) is also shaping product development across all key segments, responding directly to post-health crisis operational requirements.

AI Impact Analysis on Tour Guide System Market

Common user questions regarding AI’s impact on the Tour Guide System Market center primarily on how Artificial Intelligence can automate content delivery, personalize the visitor experience, and potentially replace human guides. Users are highly concerned about the balance between technological efficiency and the irreplaceable value of human interaction and spontaneous engagement provided by traditional guides. Key themes include the feasibility of real-time, context-aware translation, the integration of AI-powered conversational interfaces (chatbots/voice assistants) into receiver units, and the utilization of machine learning to analyze visitor feedback, flow patterns, and engagement levels to dynamically optimize tour routes and narratives. There is a clear expectation that AI will transition tour guide systems from passive audio delivery tools into interactive, intelligent platforms capable of adaptive storytelling and highly customized experiences, simultaneously raising concerns about data privacy and the potential reduction in demand for human expertise.

- AI-Enhanced Real-Time Translation: Enables instant, high-fidelity language interpretation, significantly broadening market accessibility.

- Contextual Content Delivery: Utilization of AI algorithms combined with GPS or beacon technology to trigger specific audio segments based on location and real-time environmental factors.

- Predictive Maintenance and Analytics: AI monitors device health, predicts battery failure, and optimizes charging cycles, reducing operational downtime.

- Personalized Tour Narratives: Machine learning adapts the audio content's depth, tone, and focus based on the individual user's pre-selected interests or detected viewing habits.

- Voice Recognition and Interaction: Integrating conversational AI allows users to ask follow-up questions directly to the receiver, enhancing interactivity beyond passive listening.

- Dynamic Group Management: AI assists guides by tracking group dispersion and providing alerts or optimized routes to maintain cohesion and flow in complex environments.

DRO & Impact Forces Of Tour Guide System Market

The market dynamics are defined by robust driving forces centered on experiential tourism growth and industrial necessity, yet constrained by initial high investment costs and technological fragmentation. Opportunities arise from the convergence of digital systems with intelligent IoT platforms and expanding into niche markets like medical training and specialized industrial inspections. The key impact forces dictating market evolution include technological replacement cycles, where legacy analog systems are rapidly phased out, and the pervasive influence of connectivity standards (e.g., 5G integration), which promises greater data throughput and stability for advanced features like live video streaming alongside audio. These forces collectively propel the market towards advanced, integrated communication solutions that offer higher clarity and functional flexibility across diverse professional settings.

Drivers: Significant momentum is generated by the global proliferation of organized tours and the stringent requirements for safety communication in manufacturing and construction industries. As cultural institutions seek to maximize visitor engagement and minimize auditory pollution, high-quality, discreet wireless audio systems become indispensable. The global trend towards multilingualism in major business events further necessitates reliable interpretation systems, often leveraging the core technology of tour guide equipment. Additionally, the ease of use and rapid setup of modern digital systems reduce logistical burdens, making them attractive replacements for traditional, less flexible audio setups.

Restraints: The primary constraints include the relatively high initial capital expenditure required for purchasing extensive sets of high-end digital transmitters and receivers, which can deter smaller organizations or independent tour operators. Furthermore, spectrum crowding and regulatory hurdles concerning specific frequency bands (e.g., UHF in different regions) can create technical challenges and restrict seamless cross-border usage. Concerns related to the hygiene and maintenance of shared equipment, particularly post-pandemic, also pose a recurring logistical and perceptual challenge for operators, requiring continuous investment in sanitation protocols.

Opportunities: Strong opportunities lie in the development of specialized niche applications, such as silent discos for group fitness or museum events, and in providing solutions for high-security environments where encrypted, interference-free communication is essential. The integration of augmented reality (AR) and virtual reality (VR) headsets with tour audio streams presents a future growth avenue. Moreover, developing scalable, subscription-based rental models, particularly targeting the short-term conference and event market, reduces the capital burden for users and ensures consistent revenue streams for providers.

Segmentation Analysis

The Tour Guide System Market is highly fragmented and analyzed across several critical dimensions, including Type, Technology, Application, and End-Use, which collectively define the competitive landscape and pinpoint high-growth areas. The segmentation by Type delineates the fundamental design and frequency utilization, while the Technology dimension highlights the evolution from simple analog transmission to complex digital processing. Application segmentation demonstrates the sheer versatility of the systems, moving beyond traditional tourism into critical business and industrial domains. This structured breakdown allows stakeholders to accurately gauge demand specific to different user environments and invest strategically in product development tailored to clear communication needs, robust design, and frequency compliance.

- By Type:

- Single Transmitter/Multiple Receivers

- Multi-Transmitter/Multi-Channel Systems

- Bidirectional Communication Systems

- By Technology:

- Analog RF Systems (VHF/UHF)

- Digital RF Systems (UHF/2.4 GHz/5.8 GHz)

- Wi-Fi/IP-Based Systems

- Induction Loop (Hearing Assistance) Systems

- By Application:

- Museums and Historical Sites

- Factory and Corporate Tours

- Simultaneous Interpretation (Conferences)

- Educational Institutions and Training

- Travel and Outdoor Tours

- Assisted Listening/Hearing Aid Integration

- By End User:

- Tourism & Hospitality Sector

- Manufacturing & Industrial Sector

- Government & Public Sector

- Educational Institutions

- Event Management & Conference Organizers

Value Chain Analysis For Tour Guide System Market

The value chain of the Tour Guide System Market begins with upstream activities focused on the procurement of critical electronic components, including specialized high-frequency chipsets, advanced audio transducers (microphones and speakers), durable plastics, and long-lasting battery solutions. Key upstream suppliers include global semiconductor manufacturers and specialized audio component providers. Efficiency and cost optimization at this stage are crucial, as component quality directly dictates the reliability, audio fidelity, and miniaturization potential of the final product. Strong relationships with suppliers ensure a steady flow of innovative and reliable digital processing units necessary for next-generation, high-definition audio transmission systems.

Downstream activities involve the assembly, rigorous quality control testing, system integration (especially software and charging solutions), and packaging of the complete tour guide kits. Manufacturers must ensure system interoperability, particularly across various frequency standards and global regulations. Distribution channels are bifurcated into direct sales, favored for large-scale corporate or governmental contracts where customization is required, and indirect sales, which primarily rely on specialized audio equipment distributors, rental agencies, and e-commerce platforms. Rental agencies play a crucial intermediary role, reducing the upfront cost barrier for small users and generating high demand during peak conference seasons.

The direct channel ensures personalized technical support and maintenance contracts, establishing long-term relationships with institutional clients like major museums or multinational corporations. The indirect channel, managed by resellers and system integrators, is vital for penetrating geographically dispersed markets and catering to small and medium-sized enterprises (SMEs). Successful market players focus on creating modular systems that are easy to maintain, sanitize, and update, adding post-sale value through readily available accessories, warranty extensions, and specialized charging station solutions, thereby optimizing the total cost of ownership for end-users.

Tour Guide System Market Potential Customers

Potential customers for tour guide systems are highly diverse, spanning both the public and private sectors, with needs ranging from enhanced communication quality to strict regulatory compliance. The core end-users, or buyers of the product, are entities involved in structured group communication across different physical settings. Major segments include cultural institutions such as art galleries, historical complexes, and national parks that prioritize visitor experience and silent operation. Another crucial customer base is the industrial sector, including large manufacturing plants, refineries, and complex logistical hubs, where clear and immediate safety communication is mandatory and often mandated by occupational health and safety regulations.

Furthermore, the market relies heavily on the Meetings, Incentives, Conferences, and Exhibitions (MICE) sector, where simultaneous interpretation services are essential for global attendees. These customers typically require high channel count systems, robustness, and flexibility for deployment in diverse conference room layouts. Educational institutions, especially universities and specialized vocational schools, represent a growing segment, utilizing these systems for campus tours, laboratory demonstrations, and large lecture hall overflow management. The demand from these users is characterized by a need for durable equipment capable of withstanding daily student use and featuring secure, localized wireless connectivity.

In addition to direct purchases by institutions, rental houses and specialized event technology providers serve as significant buyers. They purchase systems in bulk to maintain a high-quality rental inventory, catering to short-term needs of corporate events, independent tour groups, and governmental delegations. These B2B customers prioritize device interoperability, ease of sanitation, quick turnover capabilities, and comprehensive technical support from the manufacturer. Understanding the varying acquisition models—outright purchase versus managed rental services—is critical for market vendors aiming to capture both institutional and event-based demand effectively.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $185 Million USD |

| Market Forecast in 2033 | $345 Million USD |

| Growth Rate | 8.9% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Listen Technologies Corporation, Sennheiser Electronic GmbH & Co. KG, Okayo Electronics Co., Ltd., Retekess, Williams Sound, Inc., Teer Audio, TGS Systems, COMTEK, RFS Technologies, Group Tour Communications, Tourtalk, Enersound, Tristar Trading, Shenzhen Rich Age Electronics Co., Ltd., AXIWI, Toursound, Mipro Electronics Co., Ltd., Guideport, Tour-Mate, Peak Audio |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Tour Guide System Market Key Technology Landscape

The technological landscape of the Tour Guide System Market is rapidly evolving, moving decisively away from legacy analog transmission toward highly resilient, high-fidelity digital systems. The dominant technology currently is Digital Radio Frequency (RF), primarily operating in the globally license-free 2.4 GHz band and various licensed or license-exempt UHF bands (e.g., 863-865 MHz in Europe, 900 MHz in specific regions). Digital systems offer significant advantages over analog, including enhanced noise reduction, greater security through digital encryption, and the capacity for multiple simultaneous channels, crucial for multi-language or multi-group scenarios within the same venue. The adoption of advanced digital signal processing (DSP) further refines audio clarity, even in environments characterized by high ambient noise, such as factory floors or crowded city streets.

Another emerging technology is the integration of Wi-Fi or IP-based solutions, which leverage existing network infrastructure within large venues like convention centers or university campuses. These systems allow participants to use their personal smart devices as receivers, downloading audio via a dedicated application. This model significantly reduces the capital expenditure on dedicated hardware receivers and addresses hygiene concerns related to shared equipment. However, the performance of IP-based systems is highly dependent on the stability and coverage of the local Wi-Fi network, posing potential reliability challenges in large outdoor or complex architectural spaces.

Future technological advancements are centered on improving battery technology (lithium-polymer for extended operational life), device miniaturization, and seamless integration with IoT devices. Near Field Communication (NFC) is being used increasingly for quick pairing and management of devices, streamlining the preparation process for tour operators. The development of bidirectional communication systems, which allow participants to send secure messages or pose questions back to the guide without disrupting the entire group, represents a significant functional enhancement, moving the technology toward a more collaborative and interactive model of group communication.

Regional Highlights

- North America: A mature market characterized by high demand from the corporate sector (factory tours, high-level business meetings requiring interpretation) and large-scale educational institutions. The region demonstrates a strong preference for digital, secure, and technologically advanced systems, often prioritizing brands that offer comprehensive service contracts and adherence to strict FCC regulations regarding frequency usage. The trend towards personalized and interactive visitor experiences in national parks and high-profile museums fuels steady demand.

- Europe: Leads the market in terms of simultaneous interpretation systems, driven by numerous international organizations (EU, UN agencies) and a dense schedule of global conferences. European adoption is highly sensitive to regional frequency harmonisation (e.g., CEPT recommendations) and shows a strong inclination towards premium, reliable German and Scandinavian-manufactured systems. Heritage tourism, particularly across UNESCO World Heritage sites, makes this a robust and historically stable market segment.

- Asia Pacific (APAC): Exhibits the highest growth potential, spurred by massive increases in both domestic and inbound tourism, coupled with rapid industrialization. Countries like China, India, and Japan are heavily investing in smart tourism infrastructure. The market here is highly competitive, characterized by a mix of affordable local manufacturers and premium international players. Adoption is strong in industrial zones for internal communications and in large cultural centers catering to diverse language groups.

- Latin America (LATAM): An emerging market where growth is uneven but accelerating, particularly in countries with significant natural and cultural tourism assets (e.g., Brazil, Mexico, Peru). The primary adoption drivers are eco-tourism and archaeological site preservation, often supported by international grants. Price sensitivity is high, leading to strong competition among mid-range and entry-level digital system providers.

- Middle East and Africa (MEA): Growth is primarily concentrated in the Gulf Cooperation Council (GCC) countries, driven by mega-events (like expos and international sporting events) and large-scale infrastructure projects requiring standardized communication. High-end museum and cultural development projects (e.g., UAE, Qatar) demand sophisticated, multi-channel interpretation systems. The African segment is developing slower but shows potential in safari tourism and governmental conferencing.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Tour Guide System Market.- Listen Technologies Corporation

- Sennheiser Electronic GmbH & Co. KG

- Okayo Electronics Co., Ltd.

- Retekess

- Williams Sound, Inc.

- Teer Audio

- TGS Systems

- COMTEK

- RFS Technologies

- Group Tour Communications

- Tourtalk

- Enersound

- Tristar Trading

- Shenzhen Rich Age Electronics Co., Ltd.

- AXIWI

- Toursound

- Mipro Electronics Co., Ltd.

- Guideport

- Tour-Mate

- Peak Audio

Frequently Asked Questions

Analyze common user questions about the Tour Guide System market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the typical range and battery life of a modern digital tour guide system?

Modern digital systems, particularly those operating on the 2.4 GHz band or digital UHF, typically offer a reliable operational range of 50 to 150 meters (164 to 492 feet) in open air, depending on power output and interference. Receiver battery life is commonly between 15 and 30 hours of continuous use, whereas transmitters, due to higher power draw, often provide 8 to 15 hours on a single charge.

Are tour guide systems regulated, and what frequencies are globally accepted?

Yes, tour guide systems are subject to regulatory bodies like the FCC (North America) and CEPT/ETSI (Europe). The most commonly accepted global, license-free frequency bands are 2.4 GHz (for digital systems) and certain segments of the UHF band, such as 863-865 MHz in Europe, specifically reserved for license-exempt wireless audio devices, though exact regional allowances vary significantly.

How do digital systems differ from analog systems in terms of performance and security?

Digital systems provide superior audio clarity by utilizing noise cancellation and offering interference resistance, essential in dense signal environments. Crucially, digital systems often incorporate encryption, making the communication secure and preventing eavesdropping, a feature largely absent in older, less secure analog (VHF/UHF) transmission methods.

What are the primary advantages of utilizing tour guide systems in an industrial or factory environment?

In industrial environments, these systems ensure that critical safety instructions and technical details are heard clearly by all personnel over machinery noise, minimizing risks and maximizing training effectiveness. They enable guides to speak at a normal volume, preserving vocal health while maintaining strict adherence to safety protocols across large, noisy production areas.

Can tour guide systems be integrated with simultaneous interpretation services for large conferences?

Absolutely. Multi-channel digital tour guide systems are fundamentally used for simultaneous interpretation. Conference organizers utilize dedicated transmitters for each language channel, allowing delegates to select their required language feed directly on their personal receivers, making the technology indispensable for multilingual events and global business forums.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager