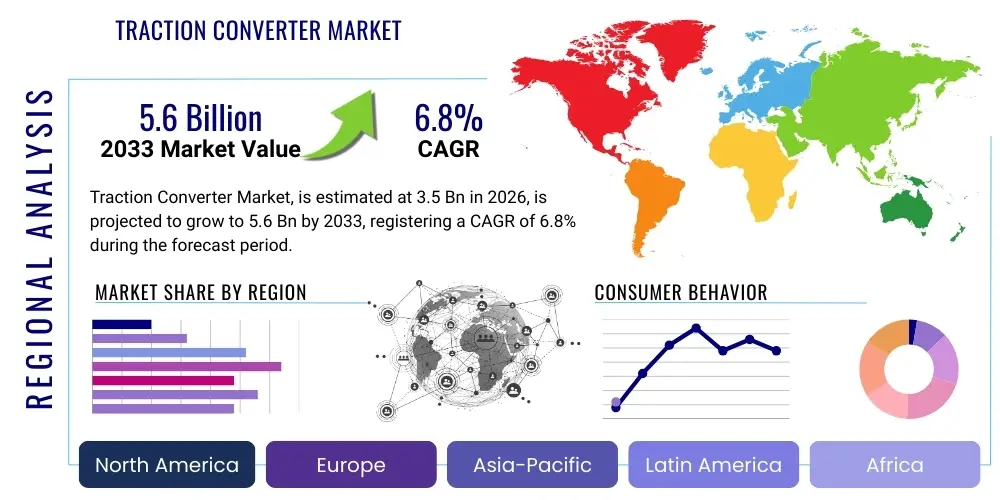

Traction Converter Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442865 | Date : Feb, 2026 | Pages : 245 | Region : Global | Publisher : MRU

Traction Converter Market Size

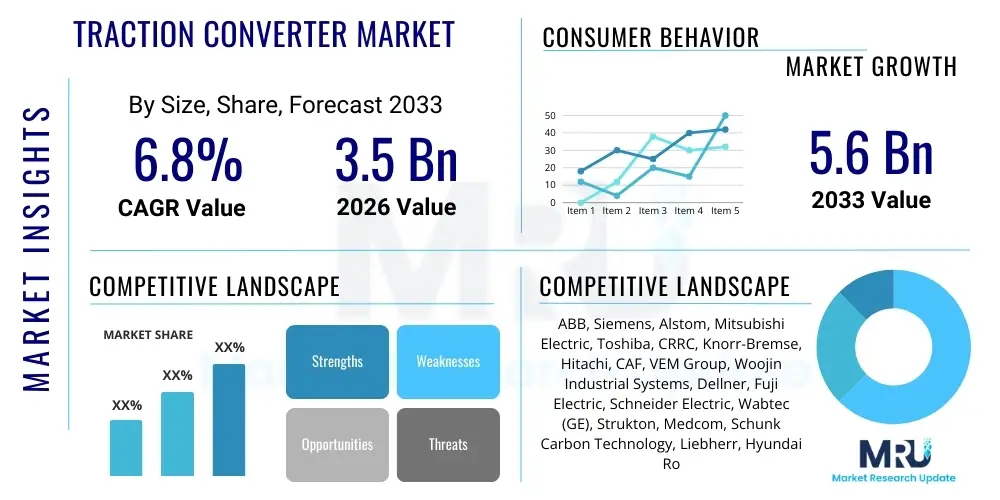

The Traction Converter Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 3.5 Billion in 2026 and is projected to reach USD 5.6 Billion by the end of the forecast period in 2033. This substantial expansion is fundamentally driven by global infrastructure investments in high-speed rail networks, modernization of existing urban transit systems, and the imperative for energy-efficient rolling stock solutions across developing and developed economies. The increased adoption of advanced power semiconductors, particularly Silicon Carbide (SiC) technology, is enhancing the efficiency and power density of these converters, making them crucial components in modern electric traction systems.

Traction Converter Market introduction

The Traction Converter Market encompasses the design, manufacturing, and distribution of sophisticated power electronic systems essential for controlling the speed and torque of electric motors in railway vehicles, including locomotives, metros, trams, and high-speed trains. Traction converters act as the critical interface between the overhead power supply (catenary or third rail) and the traction motors, converting fixed-frequency or DC input into variable voltage and variable frequency (VVVF) AC power required for propulsion. Key benefits include precise motor control, energy regeneration capabilities (recuperative braking), reduced maintenance due to brushless AC motors, and overall operational efficiency improvements in electric rail transport systems.

Product descriptions typically involve complex systems housed within robust enclosures, utilizing insulated-gate bipolar transistor (IGBT) or increasingly silicon carbide (SiC) modules, cooling systems (air or liquid), microprocessors for control, and filtering components. Major applications span urban mass transit, freight rail, and intercity passenger rail. The primary driving factors fueling market growth include stringent environmental regulations promoting electrification over diesel, massive governmental funding into infrastructure projects such as China's 'Belt and Road Initiative' and Europe's TEN-T network expansion, and the continuous technological evolution towards higher power density components and improved fault tolerance.

Traction Converter Market Executive Summary

The global Traction Converter Market is characterized by robust growth, propelled primarily by significant government spending on urban rail expansion and high-speed rail projects, particularly across the Asia Pacific region. Business trends indicate a strong shift towards modular converter designs and the widespread integration of SiC technology, which promises lighter weight, smaller footprint, and enhanced energy efficiency compared to traditional silicon-based IGBTs. Key industry players are focusing heavily on strategic mergers and acquisitions, coupled with rigorous R&D, to solidify their technological advantage and gain large governmental contracts for fleet modernization.

Regional trends highlight APAC as the most dynamic market due to massive urbanization and concurrent rail infrastructure development in China, India, and Southeast Asian nations. Europe maintains a strong presence, driven by network renewal, standardization efforts (e.g., interoperability mandates), and the replacement cycles of older rolling stock fleets. Segmentation trends show the propulsion converter segment retaining the largest market share owing to its fundamental role in vehicle movement, while the high-speed rail application segment is experiencing the fastest expansion, driven by continuous global investment in rapid transit solutions connecting major economic hubs.

AI Impact Analysis on Traction Converter Market

User inquiries regarding AI's role in the Traction Converter Market primarily center on predictive maintenance capabilities, optimization of energy consumption cycles, and enhancements in fault detection and diagnostics. Users are keen to understand how AI algorithms can leverage large datasets generated by modern rail systems (telemetry, voltage fluctuations, temperature profiles) to anticipate component failure in power electronics, thereby minimizing costly downtime and improving operational safety. Another critical theme is the integration of machine learning for real-time traffic management optimization, allowing converters to dynamically adjust power delivery profiles based on network conditions and schedules, maximizing regenerative braking efficiency and overall system resilience.

The implementation of AI/ML systems is revolutionizing the post-installation phase of traction converters, shifting maintenance schedules from time-based to condition-based. Advanced analytics deployed at the subsystem level can detect subtle anomalies in current waveforms or cooling system performance long before they lead to catastrophic failures. Furthermore, AI contributes significantly to the design phase by simulating complex operating environments and thermal stresses, enabling manufacturers to optimize material usage and cooling architecture for new generation SiC-based converters. This proactive approach ensures longer lifespan and greater reliability under diverse operational loads.

- AI enables predictive maintenance, anticipating IGBT or capacitor failures through continuous sensor data analysis.

- Machine learning optimizes energy consumption by dynamically adjusting converter switching frequencies based on real-time operational demands.

- AI-driven diagnostics accelerate fault detection and isolation, reducing vehicle downtime significantly.

- Data analytics enhance design iterations, optimizing thermal management and power density for future converter generations.

- Integration with fleet management systems allows for optimized regenerative braking strategies tailored by AI.

DRO & Impact Forces Of Traction Converter Market

The Traction Converter Market is significantly influenced by macro-economic factors and technological advancements, creating a complex interplay of Drivers, Restraints, and Opportunities. The primary drivers include government mandates supporting rail electrification, substantial investments in railway infrastructure expansion across emerging economies, and the inherent efficiency advantages provided by AC traction motors requiring these converters. However, market growth is often restrained by the high initial capital expenditure associated with modernizing legacy rail fleets and the complex regulatory landscape governing rail component certification and standardization across diverse global regions. Opportunities are primarily centered on the rapid adoption of advanced power semiconductor materials, such as SiC and GaN, and the massive scope for retrofitting older fleets with energy-efficient converters.

The impact forces influencing the market demonstrate a strong push towards technological modernization. While high capital costs for upgrading existing infrastructure present a short-term constraint, the long-term operational savings derived from enhanced energy efficiency and reduced maintenance due to advanced converters provide a compelling counter-driver. Furthermore, geopolitical stability and availability of public funding heavily impact the pace of large-scale railway projects, affecting converter demand. The competitive environment is characterized by large, established multinational corporations that leverage integrated supply chains and extensive R&D capabilities to dominate high-value contracts, forcing smaller players to focus on specialized retrofit markets or niche auxiliary converter solutions.

Segmentation Analysis

The Traction Converter Market is intricately segmented based on technology type, application, component composition, and voltage level, providing a detailed view of market dynamics and specialized demands. Understanding these segments is crucial for manufacturers and investors, as different rail types impose unique demands on converter size, power rating, redundancy levels, and cooling requirements. The market analysis reveals that propulsion converters, essential for motive power, constitute the dominant segment in terms of revenue, while auxiliary converters, which manage onboard services like HVAC and lighting, represent a stable, necessary revenue stream. Geographically, segmentation highlights the significant variance in technology adoption rates between established high-speed rail networks in Europe and Asia and the freight-dominated systems in North America.

Key technological differentiations lie in the semiconductor material utilized, with SiC modules rapidly gaining market share due to their superior performance characteristics—higher switching frequency, lower losses, and better thermal tolerance—which translate directly into reduced weight and volume for the overall converter system. This shift impacts component segmentation, favoring suppliers capable of high-volume production of automotive-grade and rail-certified SiC modules. The application segmentation clearly delineates the high-volume needs of metro and urban transit systems versus the high-power requirements of main-line locomotives and high-speed rail, dictating specific design topologies for each segment.

- By Type:

- Propulsion Converter (Main Converter)

- Auxiliary Converter

- By Application:

- High-Speed Trains

- Metro/Subway Trains

- Locomotives (Freight and Passenger)

- Trams and Light Rail Vehicles (LRV)

- By Component:

- Power Semiconductor Modules (IGBT, GTO, SiC)

- Capacitors and Inductors

- Microprocessors and Control Units

- Cooling Systems

- By Voltage Level:

- Low Voltage (<750V)

- Medium Voltage (750V–3kV)

- High Voltage (>3kV)

Value Chain Analysis For Traction Converter Market

The value chain for the Traction Converter Market begins with upstream analysis, focusing heavily on the specialized sourcing of critical components, predominantly high-power semiconductor modules, high-performance magnetics, and specialized thermal management systems. Key upstream suppliers include large multinational semiconductor manufacturers (e.g., Infineon, Fuji Electric, Mitsubishi Electric) that provide IGBTs and emerging SiC devices, which are essential inputs defining the converter's overall performance metrics. The complexity and criticality of these components necessitate long-term partnerships and rigorous quality assurance protocols between converter manufacturers and their core suppliers, establishing high barriers to entry for new market participants.

Midstream activities involve the design, assembly, testing, and system integration performed by major Original Equipment Manufacturers (OEMs) like Siemens, Alstom, and CRRC. This stage requires significant intellectual property related to power electronic topologies, sophisticated cooling techniques, and complex control software for VVVF operation and network compatibility. The downstream segment encompasses distribution channels, predominantly direct sales to railway operators, rail car manufacturers (rolling stock OEMs), and national rail infrastructure bodies. Indirect channels are less common but include specialized integrators or maintenance, repair, and overhaul (MRO) providers that handle fleet refurbishment projects involving converter retrofitting.

The efficiency of the value chain is largely dependent on the integration between converter manufacturers and rolling stock assemblers. Direct distribution channels dominate the market because traction converters are highly customized systems requiring deep technical collaboration during the specification and installation phases. The transition towards standardized, modular converter platforms aims to streamline this process, potentially opening avenues for slightly broader indirect distribution in the after-sales service and maintenance segments, although direct technical support from the manufacturer remains paramount for ensuring optimal performance and compliance with stringent rail safety standards.

Traction Converter Market Potential Customers

Potential customers in the Traction Converter Market are highly specialized entities deeply involved in the design, operation, and maintenance of electrified rail networks. The primary end-users are large public and private railway operating companies (ROCs) that require reliable propulsion systems for their existing fleets and expansion projects. These include national rail agencies managing intercity and freight lines (e.g., Deutsche Bahn, SNCF, Indian Railways) and metropolitan transit authorities managing urban rail, metro, and tram networks (e.g., New York MTA, London Underground). Customer decision-making is driven by total cost of ownership (TCO), reliability statistics, energy efficiency performance, and the ability to integrate seamlessly with existing or planned infrastructure.

Another significant customer segment comprises rolling stock manufacturers (OEMs) such as Stadler Rail, Bombardier Transportation (now Alstom), and Hyundai Rotem, who purchase converters as core sub-systems during the manufacturing of new locomotives and train sets. These manufacturers act as immediate buyers, integrating the converters into the vehicle's overall electrical architecture. Retrofit opportunities represent a growing customer base, consisting of MRO firms and rail operators looking to extend the service life and improve the efficiency of legacy rolling stock by replacing older GTO-based converters with modern IGBT or SiC units. This segment prioritizes compatibility, quick installation, and proven performance uplift.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 3.5 Billion |

| Market Forecast in 2033 | USD 5.6 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | ABB, Siemens, Alstom, Mitsubishi Electric, Toshiba, CRRC, Knorr-Bremse, Hitachi, CAF, VEM Group, Woojin Industrial Systems, Dellner, Fuji Electric, Schneider Electric, Wabtec (GE), Strukton, Medcom, Schunk Carbon Technology, Liebherr, Hyundai Rotem |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Traction Converter Market Key Technology Landscape

The technological landscape of the Traction Converter Market is undergoing a rapid transformation, driven primarily by innovations in power electronics and digital control systems. Historically dominated by Gate Turn-Off (GTO) thyristors and standard Insulated-Gate Bipolar Transistors (IGBTs), the market is aggressively pivoting towards Silicon Carbide (SiC) based MOSFETs and modules. SiC technology offers significantly higher switching frequencies, resulting in lower power losses (up to 50% reduction compared to silicon IGBTs), smaller heat sinks, and overall reduced weight and size of the converter unit. This reduction in volume is critical for modern rolling stock where space and axle load constraints are paramount. Manufacturers are investing heavily in improving the reliability and thermal management of these SiC modules to withstand the harsh operating environment of rail transport.

Beyond semiconductor materials, significant technological advancements are observed in cooling systems and control architectures. Liquid-cooled converters are becoming standard for high-power applications (locomotives and high-speed rail) as they provide superior thermal management necessary for maintaining the performance and lifespan of SiC modules. Control systems are integrating Field Programmable Gate Arrays (FPGAs) and high-speed digital signal processors (DSPs) to enable sophisticated algorithms for precise torque control, minimizing harmonic distortion injected back into the grid, and optimizing the energy recovery process during regenerative braking. Furthermore, modular design concepts are prevalent, allowing for easier maintenance, faster replacement of defective units, and scalability across different vehicle platforms.

The push for interoperability across international rail networks (especially in Europe) is also driving standardization in communication protocols and interface specifications for traction converters. Diagnostic capabilities are increasingly integrated, leveraging connectivity tools (IoT sensors and telematics) to provide real-time performance data and fault monitoring, a prerequisite for advanced predictive maintenance schemes. These technological shifts are lowering the total cost of ownership for rail operators, making the investment in advanced traction converters economically viable despite the initial high component cost associated with cutting-edge materials like SiC.

Regional Highlights

- Asia Pacific (APAC): Dominates the global market due to unprecedented investment in rail infrastructure, led by China's extensive high-speed rail construction and India's massive metro expansion and railway modernization programs. High population density and rapid urbanization make efficient mass transit solutions critical, driving continuous demand for both propulsion and auxiliary converters.

- Europe: Represents a mature but high-value market driven by the need for fleet replacement, adherence to strict EU energy efficiency and emission standards, and the implementation of pan-European interoperable rail networks (ERTMS). Western European countries focus on integrating advanced SiC technology and digitalization into rolling stock to maximize operational efficiency and reduce energy footprints.

- North America: Characterized primarily by a strong freight rail segment, requiring high-power locomotive converters. While passenger rail investment is growing (e.g., high-speed projects in California), the market emphasis remains on robustness, longevity, and high-power output for heavy-haul operations, leading to strong demand for customized, resilient converter solutions.

- Latin America: A nascent but rapidly developing market, fueled by metro line expansions in major cities (e.g., São Paulo, Mexico City). Growth is contingent on governmental stability and financing mechanisms, often relying on global OEM partnerships for technology transfer and local manufacturing partnerships.

- Middle East and Africa (MEA): Demonstrates significant potential due to large-scale, prestige infrastructure projects (e.g., Saudi Arabia's rail network, regional metro projects). The market is highly sensitive to external financing and focuses on converters designed to withstand extreme temperatures and environmental conditions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Traction Converter Market.- ABB

- Siemens

- Alstom

- Mitsubishi Electric

- Toshiba

- CRRC

- Knorr-Bremse (Selectron)

- Hitachi

- CAF

- VEM Group

- Woojin Industrial Systems

- Dellner

- Fuji Electric

- Schneider Electric

- Wabtec (GE Transportation)

- Strukton

- Medcom

- Schunk Carbon Technology

- Liebherr

- Hyundai Rotem

Frequently Asked Questions

Analyze common user questions about the Traction Converter market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the adoption of Silicon Carbide (SiC) in traction converters?

SiC technology is rapidly adopted primarily due to its ability to significantly reduce power losses and increase switching frequency, leading to smaller, lighter, and more energy-efficient converter systems with enhanced thermal performance compared to traditional IGBTs.

How do traction converters contribute to energy efficiency in modern rail systems?

Traction converters utilize sophisticated power electronics to enable precise control of AC motors, minimizing energy wastage. Crucially, they facilitate regenerative braking, converting kinetic energy back into electricity and feeding it into the grid or onboard storage, reducing overall system energy consumption.

Which application segment holds the largest share in the Traction Converter Market?

The Metro/Subway Trains segment and the Locomotives segment collectively hold the largest market share due to the high volume of urban rail projects globally and the continuous demand for high-power converters for freight and passenger main-line locomotives.

What are the main restraints impacting the growth of the Traction Converter Market?

Key restraints include the extremely high initial capital cost required for manufacturing and procurement of advanced power electronics, particularly SiC modules, and the long, rigorous process of obtaining mandatory rail safety certifications and standardization approvals across different regions.

How is predictive maintenance implemented in modern traction converter systems?

Predictive maintenance uses embedded sensors and integrated AI/ML algorithms to continuously monitor operational parameters such as temperature, current harmonics, and voltage stability. This data is analyzed in real-time to forecast potential component degradation or failure (e.g., in capacitors or IGBTs) before critical malfunction occurs.

The comprehensive analysis of the Traction Converter Market confirms its critical position within the global railway industry, driven by global commitments to sustainable and efficient transportation infrastructure. Technological advancements, particularly the shift to SiC power electronics and the integration of sophisticated AI-driven diagnostics, are shaping the competitive landscape, pushing manufacturers toward optimized designs that maximize energy recovery and minimize operational downtime. Regional disparities highlight distinct demands, with APAC focused on expansion and Europe emphasizing retrofit efficiency and standardization. The projected CAGR underscores sustained growth, ensuring that traction converters remain a high-value, high-tech component vital for the future of electric mobility and mass transit systems worldwide.

Further market assessment indicates that the supply chain risk associated with advanced semiconductor components, particularly SiC modules, presents a strategic challenge. Companies are increasingly diversifying their sourcing strategies and investing in vertical integration to secure the supply of these critical components. This structural shift is also influencing pricing dynamics and contract negotiations within the rail OEM segment, where reliability and guaranteed supply chains are often prioritized over marginal cost reductions. The long lifecycle of railway assets means decisions made today regarding converter technology will influence operational costs and maintenance expenditure for the next 30 to 40 years, solidifying the market's focus on long-term technological viability and robustness.

Market penetration of auxiliary converters is also rising proportionally with the increasing demand for enhanced passenger comfort systems, such as high-capacity HVAC units, advanced infotainment systems, and increased charging capabilities for passenger devices. These auxiliary systems demand reliable, often multi-output, isolated power supplies, thereby broadening the scope and complexity of the auxiliary converter segment. Manufacturers are responding by developing integrated auxiliary power units (APUs) that share common architecture with propulsion converters, simplifying maintenance logistics and leveraging economies of scale in component sourcing and production.

The transition toward greater digitalization across the railway sector ensures that future traction converters must possess high levels of connectivity and computational power. This enables real-time data exchange with centralized control centers, facilitating dynamic performance tuning and enhancing safety protocols through rapid fault reporting. Regulatory bodies, especially in safety-critical domains like high-speed rail, are continuously updating requirements, necessitating ongoing design adaptations to ensure compliance. The competitive edge is increasingly derived not just from the power electronics hardware, but from the embedded software and AI tools used to manage and optimize the converter's performance under dynamic operating conditions and varying input voltages.

The market for traction converters in hybrid and battery-electric locomotives, though smaller than traditional electric rail, is emerging as a niche growth area, particularly in regions where full electrification is impractical or financially burdensome. These specialized applications require bidirectional converters capable of managing both battery charging/discharging and propulsion, adding complexity to the design but offering significant market opportunities for companies specializing in battery management systems integration. This diversification ensures the market remains robust against short-term fluctuations in large-scale infrastructure spending, offering multiple pathways for revenue growth.

Investment into sustainable manufacturing practices for converters is also becoming a key differentiating factor. Railway operators are increasingly favoring suppliers who demonstrate commitment to reducing the environmental footprint of their products, encompassing everything from material sourcing to end-of-life recycling programs for complex electronic waste. This focus on circular economy principles is particularly strong in European tenders, aligning with broader governmental sustainability goals and influencing procurement decisions beyond mere technical specifications and pricing structures.

The development of standardized interfaces and communication protocols is crucial for reducing vendor lock-in and facilitating maintenance across mixed fleets utilizing converters from various manufacturers. Initiatives focused on open standards allow railway operators greater flexibility in sourcing components for repairs and upgrades, driving greater competition in the aftermarket sector. However, the proprietary nature of high-performance control software, a key differentiator for leading OEMs, continues to pose challenges to complete system interoperability, necessitating careful integration planning during fleet modernization projects.

In summary, the Traction Converter Market is characterized by high technological velocity and essential economic relevance. Its trajectory is defined by strategic infrastructure spending, continuous component miniaturization via SiC adoption, and the deepening integration of advanced digital tools for performance optimization and reliability enhancement. The market structure, dominated by a few integrated global players, emphasizes expertise in power electronics, systems integration, and long-term service agreements, projecting stable, high-value growth throughout the forecast period.

The financial stability and large contract capability of the key players allow them to absorb the substantial R&D costs required to develop converters compliant with the next generation of rail standards (e.g., increased power ratings and higher operational voltages). Small and medium enterprises (SMEs) often succeed by focusing on specialized components, retrofit kits, or niche geographical markets, leveraging agility over scale. The ability of companies to manage volatile raw material costs, particularly copper and specialized cooling materials, will be a determinant factor in maintaining profitability margins over the next decade. Furthermore, geopolitical tensions impacting global trade routes and critical component supply chains require companies to build robust, regionalized manufacturing and assembly capabilities to mitigate risk and ensure timely project delivery for large governmental contracts.

The evolving regulatory environment concerning electromagnetic compatibility (EMC) and strict harmonic distortion limits imposed by grid operators necessitate sophisticated filtering and design capabilities within the converter units. Non-compliance with these technical standards can lead to costly delays and project failures. Therefore, market leaders invest heavily in advanced simulation and testing facilities to ensure their products meet or exceed the rigorous international standards established by organizations like IEC and specific regional rail authorities. This emphasis on robust certification procedures further reinforces the barrier to entry for inexperienced manufacturers, cementing the position of established, globally certified vendors.

Final analysis of market demand confirms a sustained upward trajectory, driven primarily by the environmental necessity of replacing diesel rolling stock and the efficiency mandates imposed on electrified systems. The shift towards higher frequency switching converters also contributes to improved acoustic performance, a significant factor in urban environments where noise pollution regulations are becoming increasingly strict. This combination of technical efficiency, environmental compliance, and long-term economic viability positions the Traction Converter Market as a foundational element of future smart and sustainable global mobility networks.

The increasing prevalence of distributed power architectures in certain metro and light rail vehicles, where multiple smaller converters are strategically placed across the train set rather than one centralized unit, is influencing design trends. This allows for greater redundancy, improved weight distribution, and simplified cooling requirements for individual converter modules. Manufacturers are actively developing standardized, high-volume production lines for these modular, lower-power units, signifying a pivot in manufacturing strategy from highly customized, large assemblies to scalable, integrated modular solutions tailored for urban transit systems.

Another area of technological divergence is the integration of high-reliability storage elements, such as supercapacitors, directly alongside the traction converter. This hybrid approach enables rapid absorption and deployment of energy during acceleration and braking cycles, further enhancing the efficiency of regenerative braking and smoothing the power demand profile drawn from the grid. This integration requires careful thermal and electrical management, pushing the boundaries of power electronic integration within the compact envelope of the converter housing. This trend is particularly vital for maximizing energy harvest in stop-start urban rail environments.

The workforce requirements in the Traction Converter Market are shifting towards specialized engineering skills focused on SiC power electronics design, advanced simulation modeling, and AI/ML data analysis for condition monitoring. Companies are facing a global talent shortage in these niche areas, leading to increased efforts in internal training and strategic partnerships with academic institutions. The human capital dimension is thus becoming a critical non-price factor in maintaining technological leadership and securing future large-scale projects globally.

The future of the market is inevitably tied to macro-economic stability and continued governmental support for public transit. Any large-scale economic downturn or significant cuts to public works spending could temporarily slow down major infrastructure projects, impacting order volumes for new rolling stock and associated converters. However, the long-term necessity of reducing carbon emissions and alleviating urban congestion provides a structural resilience to the market, ensuring that modernization and fleet expansion projects will continue, albeit potentially at a varied pace depending on regional fiscal health.

This detailed market segmentation reveals that while the primary market revenue is concentrated in high-power propulsion converters for main-line and high-speed applications, the stability and growth rate of the auxiliary converter market provide essential revenue diversification. Furthermore, the voltage level segmentation directly reflects infrastructure differences; the high voltage segment (e.g., 25kV AC systems) dominates long-haul and high-speed rail, requiring highly complex, multi-level converter topologies to handle extreme power demands safely and efficiently. Conversely, the low-to-medium voltage segments are driven by standardized metro and tram systems.

The increasing complexity of modern converter systems necessitates stringent intellectual property (IP) protection strategies. Manufacturers rely on proprietary control algorithms and thermal management designs to maintain a competitive edge. Patent litigation concerning high-efficiency semiconductor packaging and thermal interfaces is becoming more frequent, underscoring the high-stakes nature of technological innovation in this specialized sector. Maintaining a robust IP portfolio is paramount for ensuring long-term contractual dominance and protecting investment returns on R&D expenditure.

Finally, the growing trend of 'platformization' in rolling stock manufacturing—where multiple vehicle types share common sub-systems—is amplifying the demand for modular, standardized traction converter units that can be scaled up or down based on specific rail application requirements. This reduces development time and procurement costs for Rolling Stock OEMs, simultaneously creating opportunities for converter manufacturers capable of delivering highly flexible and configurable product platforms that integrate seamlessly across various rail types, from LRVs to heavy locomotives.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager