Traditional Whiteboard Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442967 | Date : Feb, 2026 | Pages : 243 | Region : Global | Publisher : MRU

Traditional Whiteboard Market Size

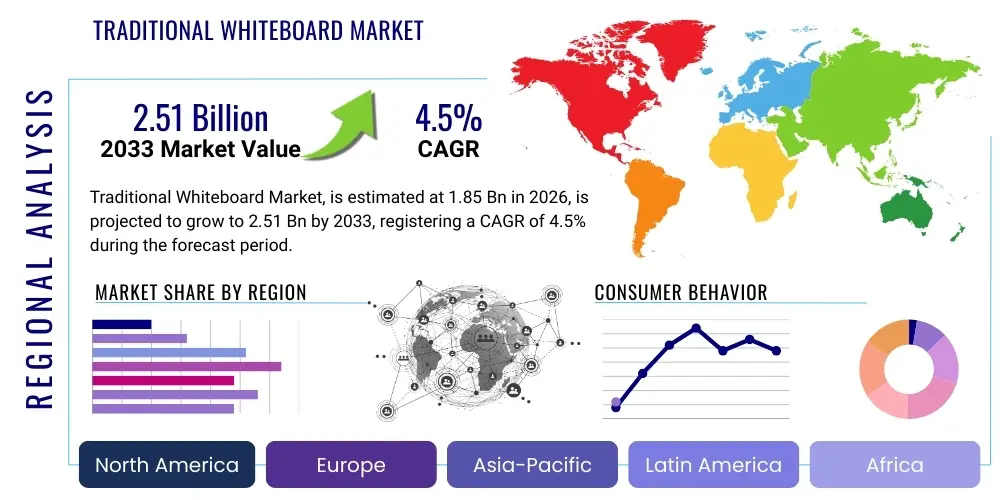

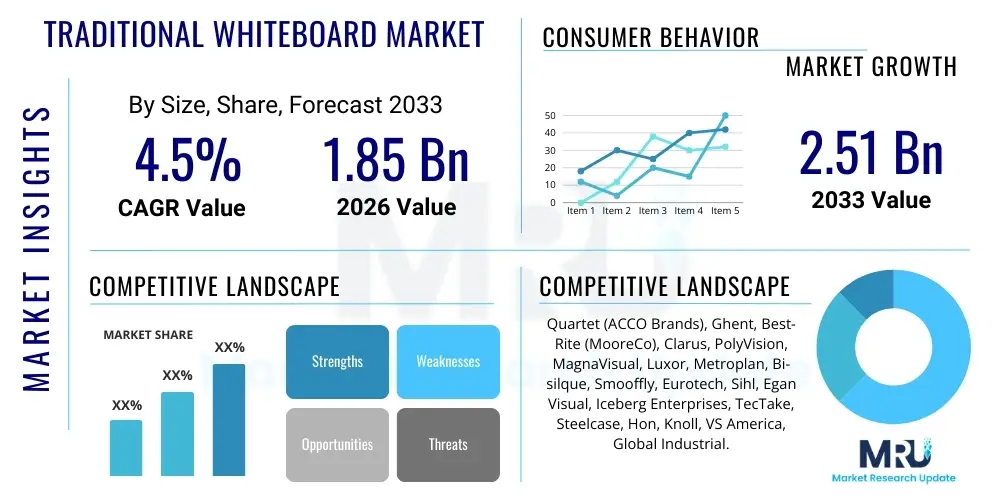

The Traditional Whiteboard Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.5% between 2026 and 2033. The market is estimated at USD 1.85 Billion in 2026 and is projected to reach USD 2.51 Billion by the end of the forecast period in 2033.

Traditional Whiteboard Market introduction

The Traditional Whiteboard Market encompasses standard, non-electronic writing surfaces primarily utilized for teaching, presentation, and collaborative idea generation. These products, historically displacing chalkboards, include dry-erase boards manufactured from materials such as melamine, porcelain steel (enamel on steel), and painted steel. The core value proposition of traditional whiteboards lies in their simplicity, durability, low maintenance cost, and ubiquitous adoption across diverse end-user sectors, including educational institutions, corporate offices, healthcare facilities, and government organizations. Despite the significant penetration of digital and interactive display technologies, the traditional whiteboard maintains a critical market presence, particularly in price-sensitive environments and for basic, quick-access communication needs.

Traditional whiteboards are categorized by their surface material and mounting mechanisms, ranging from small, handheld magnetic boards to large, wall-mounted fixture systems. Major applications revolve around brainstorming sessions, classroom instruction, operational planning in manufacturing settings, and simple meeting agendas. Their primary benefit is the ease of use—requiring only dry-erase markers—and their passive nature, which eliminates technology barriers, power consumption, and reliance on software updates. Key driving factors sustaining this market include the global expansion of educational infrastructure, the continued establishment of new commercial office spaces, especially in developing economies, and the inherent cost-effectiveness compared to advanced digital alternatives.

The market faces concurrent pressures from sustainability demands, favoring durable, high-quality porcelain surfaces, and rapid urbanization, which increases the need for functional office equipment. Furthermore, the simplicity of the product design allows for integration into modern, minimalist architectural trends prevalent in contemporary workplaces. While volume growth may be slower compared to digital markets, value growth is often driven by premiumization in surface materials that offer superior resistance to ghosting and scratching, ensuring longevity and a better return on investment for end-users seeking long-term solutions for static display and writing needs.

Traditional Whiteboard Market Executive Summary

The Traditional Whiteboard Market exhibits stability driven by consistent demand from foundational sectors like education and commercial real estate, characterized by incremental material innovation and fierce competition on pricing and distribution efficiency. Key business trends include the shift towards greener manufacturing processes and modular designs that facilitate easier installation and movement within dynamic office environments. Regional trends highlight robust demand in the Asia Pacific (APAC) region, fueled by massive infrastructure development and educational enrollment increases, contrasting with the relatively mature, replacement-driven markets of North America and Europe, where high-end porcelain and glass whiteboards are dominating corporate upgrades. Segment trends indicate porcelain steel whiteboards capturing significant market share due to their superior durability and longevity, appealing to institutional buyers focused on Total Cost of Ownership (TCO), while melamine boards remain popular in small businesses and temporary setups due to their low entry price point.

From a competitive standpoint, market participants are concentrating on optimizing supply chains, particularly sourcing raw materials efficiently to counter fluctuating commodity prices. Manufacturers are increasingly offering customizable sizing and specialized installation services to differentiate their offerings beyond basic product specifications. The sustained presence of traditional whiteboards in educational settings, especially K-12, underscores the resilience of this segment, acting as a crucial anchor for overall market volume. Moreover, the blending of traditional boards with light digital enhancement features, such as integrated charging stations or standardized measurements for graphic organizers, represents a minor but growing trend aimed at bridging the gap between analog simplicity and modern utility.

In terms of financial outlook, the market presents a low-risk, steady growth profile. The primary profitability levers are manufacturing scale and efficient inventory management, rather than rapid technological advancement. The institutional procurement cycles significantly influence regional sales peaks, particularly annual buying seasons tied to school budgets. The segment focused on magnetic whiteboards continues to demonstrate strong utility across various consumer and professional applications, driving accessory sales (markers, erasers, cleaning solutions), thus enhancing the ecosystem surrounding the core product. Overall, the market remains robust, sustained by essential communication needs that digital solutions have not fully displaced, particularly where durability and non-reliance on technology infrastructure are paramount requirements.

AI Impact Analysis on Traditional Whiteboard Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Traditional Whiteboard Market frequently center on whether AI-driven digital collaboration tools and enhanced Interactive Flat Panels (IFPs) will render traditional boards obsolete. Common themes include concerns about the viability of analog tools in a rapidly digitizing workplace, the potential for AI algorithms to automatically digitize and transcribe content written on traditional surfaces (hybrid solutions), and the expectation that AI integration in meeting environments will minimize the need for manual, real-time notation. Analysis indicates that while AI significantly drives the growth of competing digital display markets, its direct impact on the *traditional* segment is primarily indirect: it increases the pressure for cost optimization and fosters innovation in hybrid tools that attempt to merge the simplicity of dry-erase writing with basic capture capabilities, thereby extending the utility of the traditional medium rather than immediately replacing it.

- Increased Competitive Pressure: AI-enhanced digital tools, such as intelligent whiteboards that transcribe handwriting and automate meeting summaries, intensify the competition against purely analog solutions, demanding lower pricing and greater durability from traditional manufacturers.

- Hybrid Product Development: AI stimulates the development of specialized hardware (e.g., smart pens, camera systems) designed to capture and digitize content written on conventional whiteboards, creating a bridge product category.

- Minimal Direct Integration: Traditional whiteboards, by definition, lack the necessary hardware (sensors, processing units) for AI integration, limiting the direct transformative effects of AI to adjacent product categories.

- Workflow Displacement: AI-driven project management and documentation tools reduce the reliance on physical boards for static information display or manual tracking, potentially shrinking the overall install base in advanced corporate settings.

- Manufacturing Optimization: AI and machine learning techniques can be applied by manufacturers to optimize production schedules, manage complex supply chains for materials like steel and ceramic, and improve quality control in surface application, leading to marginal cost savings and improved product consistency.

DRO & Impact Forces Of Traditional Whiteboard Market

The Traditional Whiteboard Market is influenced by a dynamic interplay of factors. Key drivers include the consistent global investment in educational infrastructure, the inherent cost-effectiveness of these systems compared to digital displays, and their robustness in environments lacking reliable power or technical support. Restraints primarily involve the accelerating adoption of Interactive Flat Panels (IFPs) and smart boards in developed economies, which offer advanced features like connectivity and multimedia integration. Opportunities arise from expanding refurbishment projects in established commercial zones and untapped demand in emerging markets undergoing rapid urbanization and educational expansion. The primary impact force is the technological obsolescence pressure exerted by highly integrated digital collaboration tools, compelling manufacturers to focus rigorously on material quality, sustainability, and competitive pricing strategies to maintain relevance in non-premium segments.

Drivers are strongly anchored in demographic shifts, particularly the global increase in student populations necessitating more classroom infrastructure, and the recognition by many organizations that simple, analog tools facilitate clearer, less distracting collaborative interactions for certain tasks. Furthermore, the low environmental footprint associated with the use phase (zero power consumption) appeals to organizations prioritizing energy efficiency. However, regulatory constraints on volatile organic compounds (VOCs) found in certain dry-erase markers and surface coatings introduce minor manufacturing complexity. Restraints also encompass the cyclical nature of public sector procurement, which can cause demand volatility, and the negative perception in some high-tech industries that analog tools represent outdated technology, potentially limiting adoption in Silicon Valley-style office settings.

Opportunities are significant within specialized market niches, such as healthcare (for patient tracking boards and scheduling), logistics (for manual real-time manifest updates), and defense (for secured, non-networked planning). Manufacturers are also exploring opportunities in customizable, decorative whiteboards for home offices and retail display, adapting the traditional product for modern, flexible working models. The overall impact force matrix suggests that while digital technology presents a structural threat, the traditional whiteboard market possesses sufficient intrinsic utility and price advantage to ensure a long tail of demand, primarily shifting its sales focus from leading-edge corporate environments to foundational institutional and developing regional markets.

Segmentation Analysis

The Traditional Whiteboard Market is segmented primarily based on the surface material, which dictates quality, durability, and price point; the mounting type, determining installation complexity and portability; and the end-use sector, defining the volume and quality requirements. Surface materials are the most critical differentiating factor, ranging from the economical, low-durability melamine to the high-end, long-lasting glass and porcelain steel. Mounting types differentiate between fixed wall-mounted solutions, mobile rolling stands favored in flexible learning environments, and smaller, non-mounted personal boards. End-users determine the scale of purchase, with education and corporate sectors representing the highest volume segments globally, requiring robust, standardized products.

Detailed segmentation provides a clearer understanding of market dynamics. For instance, the distinction between porcelain steel (ceramic-on-steel) and painted steel is crucial, as porcelain boards command a significant premium due to superior resistance to ghosting and scratching, making them the preferred choice for high-frequency use areas like university classrooms and busy corporate training rooms. Conversely, painted steel offers a moderate quality solution suitable for administrative offices and areas with light usage. The rise of glass whiteboards, characterized by their ultra-modern aesthetic and exceptional longevity, targets premium corporate environments seeking design synergy, although their higher installation cost and weight restrict mass adoption.

Furthermore, segmentation by size is increasingly relevant as educational institutions adopt collaborative learning models that favor smaller, personal or group-sized boards over large, monolithic front-of-class installations. The mobile/rolling category is experiencing growth as organizations prioritize flexibility and modular design in meeting spaces. Understanding these segment trends allows manufacturers to tailor marketing efforts and optimize production lines—for example, focusing on melamine production for the low-cost small office/home office (SOHO) market, while dedicating capacity to high-pressure porcelain bonding for large institutional contracts.

- By Surface Material:

- Melamine Whiteboards

- Porcelain Steel (Ceramic) Whiteboards

- Painted Steel Whiteboards

- Glass Whiteboards

- By Mounting Type:

- Wall-Mounted

- Mobile/Rolling Stand

- Easels/Non-Mounted

- By End-User:

- Education (K-12, Higher Education)

- Corporate Offices

- Government and Public Sector

- Healthcare

- Industrial and Manufacturing

- By Size:

- Small (Under 3 ft x 2 ft)

- Medium (3 ft x 4 ft to 6 ft x 4 ft)

- Large (Over 6 ft x 4 ft)

Value Chain Analysis For Traditional Whiteboard Market

The Traditional Whiteboard market's value chain is characterized by relatively straightforward manufacturing processes, intense focus on raw material procurement, and a multi-tiered distribution network. Upstream analysis focuses heavily on raw materials, including steel sheets (for the backing and frame), enameling or coating chemicals (for the writing surface), and aluminum or wood for framing. Key upstream activities involve sourcing high-quality, corrosion-resistant steel and ensuring the consistent quality of the porcelain enamel application, which is crucial for surface durability and minimizing ghosting. Efficiency in this stage directly impacts the final product cost and competitive positioning, particularly for porcelain boards where the firing process is energy-intensive and critical to quality.

Downstream activities involve transforming the manufactured board components into finished goods, packaging, and transporting them to end-users. The distribution channel plays a vital role, often categorized into direct sales (large institutional contracts for education or government) and indirect sales. Indirect channels include office supply retailers (both physical and e-commerce platforms), specialized educational equipment suppliers, and wholesalers. E-commerce platforms are increasingly important for small and medium-sized businesses (SMBs) and SOHO customers, facilitating easier access to a wide variety of sizes and materials without the overhead of physical retail space. Direct sales strategies are essential for capturing high-volume contracts that often require customized sizing, installation, and ongoing maintenance support.

The margin pressure is high across the value chain, particularly at the manufacturing and retail levels, due to product standardization and intense price competition from both domestic and international manufacturers, especially those leveraging lower labor and material costs. Consequently, optimizing logistics—minimizing shipping costs for bulky items—is a major competitive advantage. Value addition primarily occurs through branding, offering enhanced warranties (especially on porcelain surfaces), and bundling the core product with high-quality accessories (markers, cleaning solutions, mounting hardware). The efficiency of inventory management and responsive order fulfillment are key determinants of success in the highly commoditized segments of the market.

Traditional Whiteboard Market Potential Customers

The primary consumers and buyers of traditional whiteboards span a broad spectrum of institutional and commercial entities, defined by their need for non-electronic, reusable writing and display surfaces. The largest segment remains the educational sector, encompassing K-12 schools, universities, and vocational training centers globally, where whiteboards are fundamental teaching tools required for every classroom. Corporate offices represent the second major customer base, utilizing boards in conference rooms, collaboration spaces, and departmental planning areas. These buyers prioritize aesthetics, often opting for glass or premium porcelain boards that align with modern interior designs and offer superior longevity for frequent use in dynamic business settings.

Other significant end-users include government organizations, such as military bases, municipal offices, and public libraries, which require durable, secure (non-digital) planning tools. The healthcare sector, including hospitals and clinics, constitutes a crucial segment for specialized use cases like patient status boards and scheduling, demanding easy-to-clean, non-porous surfaces, making glass or high-grade porcelain preferred choices for hygiene reasons. Industrial and manufacturing facilities also purchase whiteboards extensively for operational control, safety briefings, and process mapping, often favoring extremely durable surfaces that can withstand harsh environments and frequent cleaning, where melamine is often insufficient.

The purchasing decisions of these potential customers vary significantly: educational and government institutions are typically driven by large-scale tender processes focused heavily on long-term cost (TCO) and durability, favoring porcelain boards with 20+ year warranties. Conversely, SMBs and SOHO customers prioritize initial low cost and immediate availability, frequently opting for cheaper melamine or painted steel boards purchased through retail or e-commerce channels. Understanding these distinct procurement cycles and quality requirements is essential for market players to effectively target and service their diverse customer base, requiring tailored product lines and distribution strategies to meet the specific needs of institutional vs. commercial buyers.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.85 Billion |

| Market Forecast in 2033 | USD 2.51 Billion |

| Growth Rate | 4.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Quartet (ACCO Brands), Ghent, Best-Rite (MooreCo), Clarus, PolyVision, MagnaVisual, Luxor, Metroplan, Bi-silque, Smooffly, Eurotech, Sihl, Egan Visual, Iceberg Enterprises, TecTake, Steelcase, Hon, Knoll, VS America, Global Industrial. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Traditional Whiteboard Market Key Technology Landscape

The "technology" involved in the Traditional Whiteboard Market primarily relates to material science and specialized manufacturing processes, focusing on enhancing surface quality, durability, and sustainability rather than digital processing. The key technology centers on the application of porcelain enamel onto steel substrates. This process involves fusing powdered glass material onto steel at extremely high temperatures (700°C to 900°C), creating a highly durable, non-porous, and chemical-resistant writing surface. This ceramic-on-steel technology is critical because it prevents marker ink penetration, eliminates ghosting, and makes the surface highly resistant to abrasions, scratches, and common cleaning agents, thereby justifying the premium price point and long warranties offered by major manufacturers for institutional buyers.

Another area of focus is the development of advanced coating technologies for lower-cost boards, such as high-gloss painted surfaces or enhanced polymeric coatings for melamine. While these materials do not match the longevity of porcelain, continual improvements in surface chemistry aim to reduce ghosting and improve marker adhesion, extending their usable lifespan and making them more viable alternatives for light-use applications. Furthermore, the design and engineering of mounting and framing systems utilize precision metal forming (aluminum extrusion) and modular assembly techniques to ensure easy, secure installation and aesthetic integration into modern architectural environments, including frameless or edge-to-edge glass designs that rely on advanced tempered glass manufacturing.

In addition to surface and structure, technology extends to accessories and hybrid solutions. Manufacturers are continually innovating markers to improve ink flow and color vibrancy while minimizing odor and optimizing removability without harsh chemicals. Furthermore, the market for supplementary technology includes advanced rolling stand designs with integrated cable management or storage solutions, optimizing the product’s utility in flexible spaces. While purely traditional boards avoid digitization, there is significant cross-pollination with capture technology—such as specialized scanning apps or overhead cameras—that leverage basic visual technology to digitize content written on any flat surface, effectively extending the functional ecosystem around the traditional, passive whiteboard structure.

Regional Highlights

Regional dynamics play a crucial role in shaping the Traditional Whiteboard Market landscape, influenced by economic development, infrastructure spending, and technological adoption rates. North America and Europe represent mature markets characterized by replacement demand and a strong preference for high-quality, long-life products like porcelain steel and glass whiteboards, particularly in corporate and higher education segments. Market growth in these regions is stable but slow, focused on premiumization and customization services. High labor and material costs necessitate localized manufacturing efficiency and strong brand positioning to maintain profitability, with environmental certifications and sustainability often influencing procurement decisions in the public sector.

Asia Pacific (APAC) stands out as the fastest-growing region, driven by explosive population growth, rapid expansion of educational institutions (K-12 and vocational training), and massive urbanization projects leading to the construction of new commercial spaces. Demand here is high-volume, spanning the entire quality spectrum, from inexpensive melamine boards fulfilling basic needs in emerging educational centers to high-end porcelain boards required for multinational corporate offices in major metropolitan hubs like Shanghai, Mumbai, and Jakarta. Government investment in public education infrastructure is the primary catalyst for market volume growth across developing APAC countries, often prioritizing bulk purchasing and price competitiveness.

Latin America, and the Middle East and Africa (MEA), exhibit significant growth potential but face greater volatility influenced by economic instability and variable public spending on education. In MEA, particularly the Gulf Cooperation Council (GCC) countries, significant investment in high-tech educational complexes and business parks drives demand for premium, modern aesthetic whiteboards. Latin American demand is often segmented, with private institutions opting for better quality while public schools rely heavily on budget-conscious options. Overall, regional success requires localized distribution networks capable of handling logistical complexities and meeting specific regulatory standards for school and office equipment.

- North America: Mature market, driven by replacement cycles, strong demand for durable porcelain and glass whiteboards in corporate sectors, focus on premium quality and sustainability standards.

- Europe: Stable market with stringent regulatory standards (e.g., EU safety and environmental regulations), high adoption rates in public education refurbishment projects, emphasis on long-term investment (TCO).

- Asia Pacific (APAC): Highest growth market globally, fueled by rapid educational infrastructure development, urbanization, and high-volume demand across all quality grades, especially in emerging economies like India and China.

- Latin America: Growth tied to national education budgets; fragmented market with growing commercial demand in major economic centers like Brazil and Mexico, price sensitivity is high in public sector procurement.

- Middle East and Africa (MEA): Varied growth rates; significant governmental investment in infrastructure (especially GCC) drives demand for high-end products, while broader African regions focus on foundational, cost-effective solutions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Traditional Whiteboard Market.- Quartet (ACCO Brands)

- Ghent

- Best-Rite (MooreCo)

- Clarus

- PolyVision

- MagnaVisual

- Luxor

- Metroplan

- Bi-silque

- Smooffly

- Eurotech

- Sihl

- Egan Visual

- Iceberg Enterprises

- TecTake

- Steelcase

- Hon

- Knoll

- VS America

- Global Industrial

Frequently Asked Questions

Analyze common user questions about the Traditional Whiteboard market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between a porcelain and a melamine whiteboard?

Porcelain (ceramic-on-steel) whiteboards are significantly more durable, resistant to scratching, and guaranteed not to ghost, making them ideal for heavy use in classrooms and conference rooms. Melamine boards are lower cost and suitable only for light, infrequent use, as they are prone to ghosting and wear rapidly over time.

Is the Traditional Whiteboard Market declining due to the adoption of Interactive Flat Panels (IFPs)?

While the growth of IFPs impacts the high-end corporate segment, the overall Traditional Whiteboard Market remains stable and shows steady growth. This resilience is driven by the cost-effectiveness, simplicity, zero maintenance, and non-reliance on technology infrastructure, maintaining strong demand in education and cost-sensitive organizations globally.

Which surface material offers the best long-term return on investment (ROI)?

Porcelain steel whiteboards offer the best long-term ROI, especially in high-use institutional environments. Although they have a higher initial cost, their exceptional durability, resistance to wear (often guaranteed for 50+ years), and ease of cleaning minimize replacement frequency and maintenance costs.

How is the Traditional Whiteboard Market adapting to modern flexible office designs?

Manufacturers are adapting by focusing on highly aesthetic products like frameless glass boards, mobile rolling stands, and modular, easily reconfigurable systems. This shift supports dynamic meeting spaces and collaboration zones that prioritize mobility and modern design aesthetics over traditional, fixed wall installations.

What is the biggest driver of market growth in the Asia Pacific region?

The largest driver in the Asia Pacific region is the substantial governmental and private investment in educational infrastructure, coupled with rapid urbanization and the corresponding construction of new schools and commercial office buildings, creating large-volume demand for foundational classroom and office equipment.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager