Train Brake Pads Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442688 | Date : Feb, 2026 | Pages : 258 | Region : Global | Publisher : MRU

Train Brake Pads Market Size

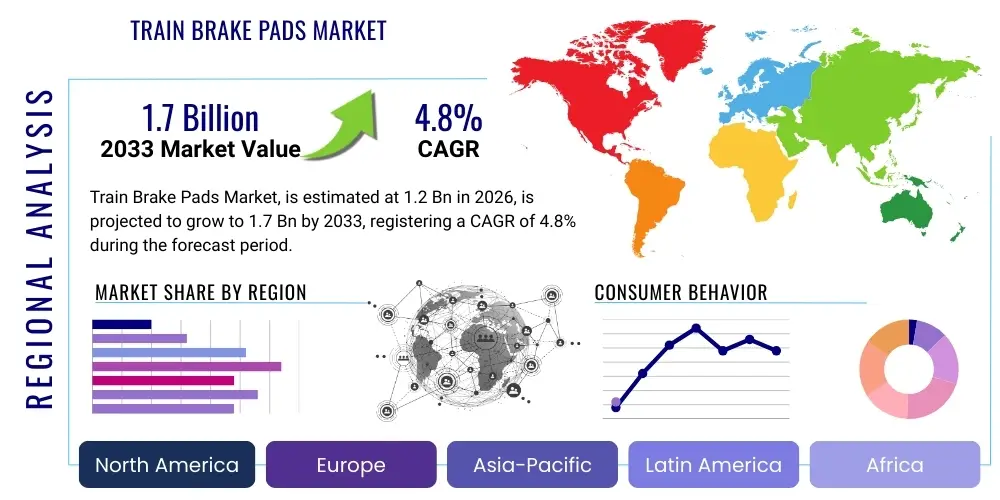

The Train Brake Pads Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at USD 1.2 Billion in 2026 and is projected to reach USD 1.7 Billion by the end of the forecast period in 2033.

Train Brake Pads Market introduction

The Train Brake Pads Market encompasses the manufacturing, distribution, and utilization of specialized friction materials used in railway braking systems. These components are essential for ensuring the safe deceleration and stopping of rolling stock, ranging from high-speed passenger trains to heavy-haul freight wagons. The market is defined by stringent safety regulations, demanding performance standards related to friction stability, wear resistance, noise reduction, and thermal resistance. The product types primarily include composite (organic), sintered (metallic), and ceramic brake pads, each tailored for specific operational environments and axle loads. Composite brake pads, offering optimal balance between performance and cost, dominate many segments, particularly commuter and metro rail systems, while sintered pads are often preferred in heavy-duty and high-speed applications due to their superior thermal management capabilities. The material science underlying brake pad technology is constantly evolving to meet requirements for increased service life and reduced environmental impact, especially concerning dust emissions and noise pollution.

Major applications of train brake pads span the entire railway industry ecosystem, including high-speed trains (requiring exceptional thermal stability), conventional passenger locomotives, metro systems (demanding high cycle fatigue resistance), and freight trains (necessitating robust performance under heavy load and harsh conditions). The immediate benefits of advanced train brake pads include enhanced operational safety, reduced track damage through smoother braking action, and significant savings in maintenance costs due to extended pad life. Furthermore, modern brake pads contribute directly to energy efficiency by reducing the required braking effort and facilitating faster operational speeds while maintaining safety margins. Key driving factors include global urbanization leading to the expansion of metro and commuter rail networks, significant investments in high-speed rail infrastructure, particularly in the Asia Pacific region, and the mandatory replacement cycles dictated by rigorous railway safety standards and operational protocols. The push towards lighter, more efficient rolling stock also drives demand for corresponding lightweight and high-performance braking solutions.

The operational environment for train brake pads is highly challenging, involving extreme temperature fluctuations, high kinetic energy dissipation, and exposure to various forms of environmental contaminants. Consequently, the design and selection of these components are highly specialized. The increasing emphasis on sustainability within the rail industry is also fostering innovation, leading manufacturers to develop next-generation materials that are asbestos-free and comply with tightening European and international REACH regulations regarding chemical usage. The transition toward electrically controlled pneumatic (ECP) braking systems, particularly in freight applications, necessitates brake pads optimized for responsiveness and precise modulation, further segmenting the market based on technological compatibility and system integration requirements. The lifecycle management of rail assets is deeply intertwined with the performance of brake components, making reliable, long-lasting brake pads a critical determinant of overall railway system reliability and operational expenditure.

Train Brake Pads Market Executive Summary

The Train Brake Pads Market is experiencing robust growth driven primarily by massive governmental investment in modernizing and expanding railway infrastructure globally, coupled with the critical need for routine maintenance and replacement of friction materials mandated by safety standards. Key business trends include a strategic shift among leading manufacturers toward R&D in advanced composite materials, specifically seeking improved performance characteristics such as higher friction coefficients at extreme temperatures and reduced wear rates, thereby lowering the Total Cost of Ownership (TCO) for railway operators. Consolidation within the supply chain is also evident, as major players acquire smaller, specialized technology firms to gain expertise in specific material formulations, particularly in specialized segments like high-speed rail. The market also observes an increasing demand for brake pads optimized for integration with advanced monitoring systems, enabling predictive maintenance schedules and minimizing unscheduled downtime, thereby adding significant value proposition beyond the material itself. Sustainability mandates are also reshaping manufacturing processes, favoring producers who utilize cleaner, energy-efficient production techniques and offer products with verifiable environmental benefits, such as reduced particulate emissions during braking.

Regionally, the Asia Pacific (APAC) stands out as the primary growth engine, fueled by extensive new high-speed and metropolitan rail construction projects in countries like China, India, and Japan. This region represents the largest deployment base for new rolling stock, translating directly into heightened demand for initial equipment installation (OE) brake pads and subsequent aftermarket replacement parts. Europe, characterized by mature railway networks and stringent safety and environmental regulations, represents a steady aftermarket segment, driven by mandatory compliance and replacement cycles, alongside incremental growth from cross-border high-speed rail expansions. North America remains a significant market, primarily driven by the heavy-haul freight sector, where demand focuses on durability and performance under extremely heavy loads and long-distance operations, favoring robust sintered and specialized metallic compounds. Conversely, Latin America and the Middle East & Africa (MEA) are emerging markets, showing considerable potential tied to specific localized infrastructure projects and modernization initiatives aimed at enhancing regional connectivity and transport efficiency.

Segment trends highlight the dominance of the aftermarket (MRO) segment, which accounts for the majority of revenue due to the inherent wear nature of the product and mandatory replacement schedules. However, the Original Equipment Manufacturer (OEM) segment is projected to grow faster, spurred by large-scale procurement of new rolling stock for high-speed and metro projects. By material, composite brake pads retain the largest market share owing to their versatility, favorable cost-to-performance ratio, and suitability across commuter and light rail applications. Conversely, sintered pads are gaining traction in premium, high-stress applications. The increasing adoption of disc braking systems over traditional tread brakes in modern rolling stock is simultaneously driving demand specifically for disc brake pads, gradually displacing traditional block brake pads in new installations. This technological migration necessitates substantial investment in advanced manufacturing techniques and rigorous testing procedures to ensure compliance with specialized railway operational safety standards, leading to higher barriers to entry for new market participants and favoring established, accredited suppliers.

AI Impact Analysis on Train Brake Pads Market

User inquiries regarding the intersection of Artificial Intelligence (AI) and the Train Brake Pads Market predominantly revolve around two major themes: predictive maintenance and optimization of material usage. Users frequently question how AI algorithms can predict brake pad failure or optimal replacement timing with higher accuracy than current scheduled maintenance practices, seeking quantification of the expected reduction in unscheduled downtime. A secondary cluster of inquiries focuses on using AI and machine learning (ML) in the material development phase, specifically asking whether algorithms can accelerate the discovery of novel friction material compositions or optimize existing formulations for specific operational requirements, such as high-altitude performance or resistance to specific climate conditions. Furthermore, there is significant interest in AI-driven inventory management, asking how real-time operational data combined with predictive models can optimize spare parts inventory across large railway networks to minimize storage costs while guaranteeing immediate availability for critical replacements. The overall expectation is that AI will transition brake pad management from a reactive or time-based approach to a highly efficient, condition-based predictive model.

The direct application of AI is primarily concentrated in enhancing the efficiency and longevity of the braking system lifecycle. AI algorithms, fed by vast datasets from trackside sensors, onboard telemetry (such as vibration, temperature, speed profiles, and braking frequency), and acoustic monitoring systems, can establish complex correlations between operational variables and the rate of brake pad wear. This sophisticated analysis allows for the accurate prediction of the remaining useful life (RUL) of individual brake pads and segments, enabling maintenance teams to replace components precisely when they approach their failure threshold, rather than prematurely or belatedly. This optimized scheduling significantly reduces operational waste and maximizes the asset utilization rate. Furthermore, AI contributes substantially to root cause analysis; if a particular batch of brake pads exhibits anomalous wear patterns, ML models can quickly identify the contributing operational variables or potential manufacturing defects, providing crucial feedback to both the railway operator and the brake pad manufacturer for immediate correction.

In the manufacturing and design phase, Generative AI and ML optimization techniques are beginning to revolutionize material science specific to friction compounds. By simulating millions of potential molecular structures and compositional ratios under simulated railway operational stress (thermal cycling, impact loading, shear forces), AI can rapidly identify promising new material candidates that meet stringent regulatory and performance criteria. This approach drastically cuts down the time and cost associated with traditional laboratory testing and iteration. For instance, AI can optimize the percentage mix of abrasive particles, binders, and fillers in composite pads to achieve maximum friction stability across a wide temperature range while minimizing dust particulate emission. This focus on data-driven material discovery ensures that new generations of train brake pads are not only safer and more durable but also inherently optimized for specific high-performance or sustainable operational goals, positioning AI as a crucial enabler for market innovation and competitive differentiation.

- AI-driven Predictive Maintenance: Utilizing ML models on real-time sensor data (temperature, vibration, acoustic signals) to accurately forecast the Remaining Useful Life (RUL) of brake pads, reducing unscheduled breakdowns by up to 30%.

- Optimized Inventory Management: AI algorithms predict fluctuating regional demand for specific pad types based on train schedules, weather patterns, and maintenance histories, minimizing logistics and storage costs.

- Material Science Acceleration: Machine learning facilitates the rapid discovery and optimization of novel friction material compositions, balancing high performance (friction stability) with regulatory compliance (low emission, no asbestos).

- Enhanced Manufacturing Quality Control: AI vision systems and data analytics monitor production lines to detect microscopic defects in pad batches in real-time, significantly improving quality consistency.

- Dynamic Braking System Calibration: Integration of AI allows the braking control system to dynamically adjust braking pressure based on current pad wear levels and environmental conditions, maximizing pad lifespan.

DRO & Impact Forces Of Train Brake Pads Market

The Train Brake Pads Market is powerfully influenced by a confluence of driving forces, inherent restraints, and compelling opportunities that shape its trajectory and competitiveness. The primary drivers include the mandatory and non-negotiable regulatory framework surrounding railway safety, necessitating periodic replacement of wear components, which guarantees a consistent aftermarket demand stream. Furthermore, global investment in infrastructure, particularly the rapid expansion of high-speed rail networks in Asia and modernization efforts in Europe, directly translates into increased demand for both OEM and MRO brake pads. The continuous push toward enhancing operational efficiency, requiring faster train turnarounds and higher average speeds, mandates the use of high-performance friction materials capable of reliable energy dissipation, thus driving innovation in material technology. The general economic shift towards rail transport as a sustainable and high-capacity freight and passenger solution further underpins the market's long-term stability and growth projections across all geographic regions.

However, the market faces significant restraints that necessitate strategic management by participants. Chief among these is the extremely long qualification and certification process required for new brake pad products, which can take several years and involve rigorous testing under various operational scenarios to meet stringent international standards (e.g., UIC, AAR). This high barrier to entry limits competition and slows the adoption of breakthrough technologies. Additionally, the fluctuating cost and constrained supply of raw materials, such as specific metallic powders (for sintered pads) or specialized resins and aramid fibers (for composites), pose challenges to manufacturing cost stability and pricing strategies. A technical restraint involves the ongoing challenge of balancing high friction coefficients with low wear rates and noise reduction requirements, demanding continuous, expensive R&D efforts. The extended service life achieved by newer, higher-quality brake pads, while beneficial for operators, can temporarily dampen aftermarket revenue growth rates, forcing manufacturers to focus on gaining market share in the OEM segment.

The market is rich with opportunities, particularly in the realm of material science and digital integration. A major opportunity lies in the development and commercialization of "smart" brake pads embedded with micro-sensors that provide real-time condition monitoring, enabling seamless integration with railway Internet of Things (IoT) platforms and AI-driven maintenance systems. Furthermore, the regulatory emphasis on sustainable transport creates a significant opening for manufacturers developing "green" brake pads—those that minimize particulate emissions and use environmentally benign composite formulations, offering a premium differentiation opportunity. Geographically, emerging economies in Southeast Asia, Africa, and Eastern Europe that are embarking on major railway modernization projects represent untapped or rapidly expanding OEM and aftermarket needs. Finally, the shift from traditional block brakes to disc brakes in new rolling stock provides a large-scale opportunity for specialized disc brake pad manufacturers to secure long-term supply contracts for next-generation rolling stock platforms.

Segmentation Analysis

The Train Brake Pads Market is meticulously segmented based on material composition, type of braking system, rail type application, and end-use demand (OEM vs. Aftermarket). This multi-dimensional segmentation is crucial for understanding the market dynamics, as performance requirements, regulatory compliance, and pricing structures vary significantly across different segments. The Material segment, covering composite, sintered, and ceramic pads, highlights the technological maturity and specific performance characteristics required for diverse operational environments, with composites dominating general applications and sintered materials specializing in high-stress environments. The End-Use analysis clarifies the stable, high-volume nature of the aftermarket segment versus the high-value, technology-intensive nature of the OEM segment, which is highly sensitive to railway infrastructure investment cycles.

Further analysis by Rail Type application (High-Speed Rail, Freight Rail, Metro/Commuter Rail) demonstrates distinct market drivers. High-Speed Rail necessitates premium, low-wear, high-thermal-resistance pads, often metallic or advanced ceramic composites, reflecting high per-unit cost but critical safety specifications. Conversely, the Metro/Commuter segment demands high cycle life and excellent performance in repetitive start-stop operations, favoring cost-effective, durable composite solutions with a strong focus on noise abatement due to urban operating environments. The Freight Rail segment, especially heavy-haul applications, prioritizes sheer strength, longevity under sustained heavy loads, and resistance to contamination, typically relying on specialized metallic or semi-metallic friction elements. Understanding these segmented performance envelopes allows manufacturers to target their R&D and marketing efforts precisely, ensuring product offerings align with the highly specialized needs of various railway operators globally.

- By Material:

- Composite/Organic Pads

- Sintered/Metallic Pads

- Ceramic Pads

- By Braking System:

- Disc Brake Pads

- Block Brake Pads (Tread Brakes)

- By Rail Type Application:

- High-Speed Rail

- Freight Rail

- Metro/Commuter Rail

- Locomotives (General Purpose)

- By End-Use:

- Original Equipment Manufacturer (OEM)

- Aftermarket (Maintenance, Repair, and Overhaul - MRO)

Value Chain Analysis For Train Brake Pads Market

The value chain for the Train Brake Pads Market begins intensely in the upstream segment with the sourcing and processing of specialized raw materials. This includes high-purity metallic powders (iron, copper, molybdenum) for sintered pads, various synthetic fibers (aramid, carbon), mineral fillers (barium sulfate, graphite), and high-performance thermoset resins for composite pads. The upstream phase is characterized by intense price volatility, supply chain risks, and the need for specialized chemical processing to achieve the required granularity and purity. Key upstream suppliers are often specialized chemical companies and metal powder producers who must comply with stringent quality controls as the quality of these raw inputs directly determines the final performance and safety certification of the brake pad. Manufacturers seek long-term, strategic partnerships with reliable suppliers to mitigate geopolitical and economic risks associated with material procurement and maintain consistency in their product lines.

The core manufacturing and assembly stage involves high-precision processes, including mixing, compression molding (for composites), or sintering (for metallics), followed by rigorous heat treatment and finishing. This stage requires significant capital investment in specialized hydraulic presses, sintering furnaces, and advanced quality assurance (QA) technology. Manufacturers must maintain ISO/TS certifications and often obtain railway-specific accreditations (e.g., AAR M-929 for North America, UIC standards for Europe). The distribution channel bifurcates based on the end-use segment. Direct distribution is common in the high-volume OEM segment, where brake pad manufacturers deliver products directly to rolling stock builders (e.g., Siemens, Alstom, CRRC) under long-term supply agreements. These contracts often involve close collaboration on design and material specifications early in the rolling stock development cycle.

For the aftermarket (MRO) segment, distribution is highly complex, involving a mix of direct sales to large, national railway operators (who operate extensive in-house maintenance facilities) and indirect sales through specialized railway parts distributors and authorized service centers. The downstream segment involves the installation, maintenance, and replacement services performed by railway operators or third-party maintenance providers. Due to the critical safety function of brake pads, the replacement process is heavily regulated and documented. The overall value chain is highly concentrated, with a few global manufacturers controlling proprietary friction material technologies, placing significant value capture at the manufacturing and specialized material sourcing stages. Efficiency in the value chain is increasingly measured by the ability to utilize digital tools for demand forecasting and inventory management, linking downstream consumption data back to upstream production planning to reduce lead times and optimize working capital.

Train Brake Pads Market Potential Customers

Potential customers for train brake pads are diverse yet highly centralized within the global rail industry ecosystem, primarily consisting of national and private railway operators, rolling stock manufacturers, and independent maintenance and repair organizations (MROs). National railway operators, such as Deutsche Bahn, SNCF, Indian Railways, and Amtrak, represent the single largest customer group, driving the majority of aftermarket demand due to their vast fleets and continuous requirement for mandatory replacements. These entities typically procure standardized brake pads in large volumes through competitive tenders, emphasizing long-term reliability, low wear rates, and adherence to specific national safety certifications. Their purchasing decisions are highly influenced by Total Cost of Ownership (TCO) assessments, where initial purchase price is balanced against expected service life and labor costs associated with replacement intervals. The procurement relationship with large operators is often highly regulated and necessitates localized supply chain presence.

The second major customer group is the Original Equipment Manufacturers (OEMs) of rolling stock, including global giants like Alstom, Siemens Mobility, CRRC Corporation, and Bombardier (now acquired by Alstom). These companies purchase brake pads for integration into new locomotives, passenger coaches, and freight wagons. The OEM segment is characterized by high-value, long-term contracts where technical specification compliance is paramount. Brake pad manufacturers must collaborate closely with rolling stock designers to ensure seamless integration with the bogie and braking system architecture, often resulting in customized friction material formulations optimized for the specific performance profile of the new train platform. Securing an OEM contract provides significant brand recognition and creates a captive aftermarket pipeline for years, as operators typically prefer to use the same certified supplier for replacements.

Furthermore, metropolitan transit authorities operating metro, subway, and light rail systems (e.g., MTA New York, London Underground, Shanghai Metro) constitute a specialized customer segment. Their needs are distinct, prioritizing noise reduction, rapid cycle capability, and resistance to environmental factors inherent in underground or densely populated urban operations. Lastly, independent MRO facilities and large-scale private freight operators (common in North America, such as BNSF Railway and Union Pacific) represent substantial aftermarket buyers. These private entities focus heavily on component durability and resistance to harsh environmental conditions, often dictating bespoke performance specifications to maximize uptime across their vast, geographically dispersed networks. These customers prioritize suppliers who offer robust logistics support and rapid component availability across multiple maintenance depots.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.2 Billion |

| Market Forecast in 2033 | USD 1.7 Billion |

| Growth Rate | 4.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Knorr-Bremse, Faiveley Transport (Wabtec Corporation), Federal-Mogul (Tenneco), Akebono Brake Industry, Nisshinbo Brake, R.H. Fiebiger GmbH, Shijiazhuang Guangning Brake Equipment, Escorts Group, Pintsch Bubenzer, Friction Material Co., LTD, Bremskerl Reibbelagwerke, ITT Corporation, Axtone Group, Hunan Sunward Industrial Co., Ltd., Railtech Company, Carlisle Brake & Friction, Jiangsu Tianli Group, Meritor, Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Train Brake Pads Market Key Technology Landscape

The technology landscape in the Train Brake Pads Market is centered on advanced material science, friction technology optimization, and digital integration capabilities. A significant area of focus is the continuous refinement of composite friction materials. Manufacturers are increasingly moving away from traditional organic composites toward high-performance, non-asbestos materials utilizing aramid fibers, carbon fibers, and specialized metal particles embedded in resin matrices. This shift is aimed at enhancing the thermal fatigue resistance of pads, crucial for maintaining friction stability during prolonged, high-speed braking events, while simultaneously reducing the production of harmful particulate matter, aligning with evolving environmental mandates globally, particularly in densely populated urban metro areas. Furthermore, advanced curing and molding technologies are being employed to ensure uniform density and homogeneity across the pad, which is vital for achieving predictable and consistent wear rates throughout the pad’s service life.

Another pivotal technological development involves the integration of sensor technology within the brake pad itself, giving rise to "smart" or "condition-monitoring" pads. These pads are fitted with embedded temperature sensors, wear indicators (often inductance or Hall-effect sensors), or even miniature acoustic emission transducers that continuously relay critical performance data to the train's central monitoring system via wireless communication protocols. This technological leap enables railway operators to transition from manual, visual inspections to highly accurate, data-driven predictive maintenance schedules. Such integration ensures that pads are replaced only when they approach a pre-defined wear limit, optimizing the asset life and preventing catastrophic failures associated with worn components. The underlying communication protocols and data processing algorithms utilized for these smart systems represent a key competitive differentiator, driving value beyond the physical friction material.

Furthermore, in the high-performance segment dominated by sintered metallic pads, metallurgical advancements are key. Researchers are developing new sintering processes and alloy compositions that enhance the pad's ability to operate efficiently at extremely high temperatures (often exceeding 600°C) without suffering from friction fade or thermal cracking. This includes the use of ceramic additives and specialized binders that improve the material’s thermal conductivity and reduce its susceptibility to structural degradation under intense thermal cycling. On the production side, manufacturers are leveraging simulation software and Finite Element Analysis (FEA) to model brake performance under virtual operating conditions, allowing for rapid iteration and optimization of pad geometry and backing plate design before expensive physical prototyping is initiated. This use of digital twins significantly accelerates the time-to-market for certified brake solutions and ensures that new products are optimized for compatibility with modern lightweight braking systems, contributing to overall train energy efficiency.

Regional Highlights

- Asia Pacific (APAC): APAC is projected to be the fastest-growing market due to unprecedented levels of investment in new railway infrastructure, particularly high-speed rail networks in China, Japan, and South Korea, and large-scale urban metro projects in India and Southeast Asian nations. The region represents the largest OEM market globally, driven by continuous procurement of new rolling stock. Stringent government mandates to expand and modernize existing rail transit systems to alleviate congestion and improve connectivity further solidify APAC's dominance in both production and consumption of train brake pads.

- Europe: Europe is characterized by a mature rail network, high safety standards, and strict environmental regulations. The market here is predominantly aftermarket (MRO), driven by mandatory replacement cycles and the expansion of transnational high-speed lines (like the Trans-European Transport Network). Innovation is focused on developing low-emission, low-noise composite and ceramic pads to comply with EU regulations (such as REACH) and urban operating noise limits. Germany, France, and the UK are key markets, focusing on technological upgrades and condition-based monitoring systems.

- North America: This region's demand profile is heavily skewed toward the heavy-haul freight segment, emphasizing highly durable and robust metallic or semi-metallic brake pads designed for extreme loads and long operational distances. The passenger rail segment, while smaller, is stable, driven by Amtrak's modernization efforts and major metropolitan transit authorities. Demand for specialized, heavy-duty block brakes remains strong in freight, although disc brake adoption is growing in new locomotives and passenger coaches.

- Latin America (LATAM): LATAM is an emerging market characterized by periodic, large-scale rail infrastructure projects, often focused on commodity transport (mining and agricultural freight). Market growth is volatile, highly dependent on government funding and economic stability. Brazil and Mexico are key regional contributors, showing increased interest in adopting advanced friction materials to reduce maintenance costs associated with their aging fleets.

- Middle East and Africa (MEA): Growth in MEA is project-based, fueled by high-profile investments in modern passenger and high-speed rail infrastructure, notably in Saudi Arabia, UAE, and Egypt, as part of national diversification strategies. These markets demand cutting-edge technology, often importing premium European or Asian friction solutions, leading to high-value, albeit less frequent, OEM opportunities. The aftermarket is growing alongside the installed base of modern trains.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Train Brake Pads Market.- Knorr-Bremse AG

- Wabtec Corporation (Faiveley Transport)

- Federal-Mogul (Tenneco Inc.)

- Akebono Brake Industry Co., Ltd.

- Nisshinbo Brake Inc.

- R.H. Fiebiger GmbH

- Shijiazhuang Guangning Brake Equipment Co., Ltd.

- Escorts Group

- Pintsch Bubenzer GmbH

- Bremskerl Reibbelagwerke Manufacturing & Sales GmbH & Co. KG

- ITT Corporation

- Axtone Group

- Miba AG

- Railtech Company

- Carlisle Brake & Friction

- Jiangsu Tianli Group Co., Ltd.

- Meritor, Inc.

- Hunan Sunward Industrial Co., Ltd.

- Friction Material Co., LTD

- TMD Friction Group

Frequently Asked Questions

Analyze common user questions about the Train Brake Pads market and generate a concise list of summarized FAQs reflecting key topics and concerns.What material types are commonly used for train brake pads and what are their applications?

The primary materials are Composite/Organic, Sintered/Metallic, and Ceramic. Composite pads are versatile and cost-effective, ideal for metro and commuter rail. Sintered pads offer superior performance under heavy load and high heat, primarily used in high-speed and heavy-haul freight applications. Ceramic pads are emerging for specialized, low-noise, and low-wear requirements.

How is AI influencing the maintenance and lifespan of train brake pads?

AI is primarily used for Predictive Maintenance (PdM). Machine learning algorithms analyze real-time operational data (temperature, speed, vibration) to accurately forecast the remaining useful life (RUL) of the pads, allowing operators to optimize replacement schedules and drastically reduce unscheduled downtime, moving away from time-based maintenance.

Which geographical region exhibits the highest growth potential in the Train Brake Pads Market?

The Asia Pacific (APAC) region, specifically countries like China and India, holds the highest growth potential. This growth is driven by massive government investment in expanding high-speed rail networks and urban metro systems, resulting in continuous high demand for both Original Equipment Manufacturer (OEM) installation and subsequent aftermarket parts.

What is the key difference between the OEM and Aftermarket segments?

The Original Equipment Manufacturer (OEM) segment involves supplying pads for new rolling stock assembly, characterized by high-value, technology-intensive contracts. The Aftermarket (MRO) segment involves replacement pads for existing fleets, representing the majority of the market volume and stable revenue stream due to mandatory safety replacement cycles.

What are the main regulatory constraints affecting the adoption of new brake pad technologies?

The main constraint is the extremely long and rigorous certification process mandated by national and international railway safety bodies (e.g., AAR, UIC). New materials must undergo extensive testing for safety, friction stability, and wear characteristics under diverse operating conditions, often taking several years, which slows the market entry of innovative solutions.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager