Transformer Cooling System Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442975 | Date : Feb, 2026 | Pages : 248 | Region : Global | Publisher : MRU

Transformer Cooling System Market Size

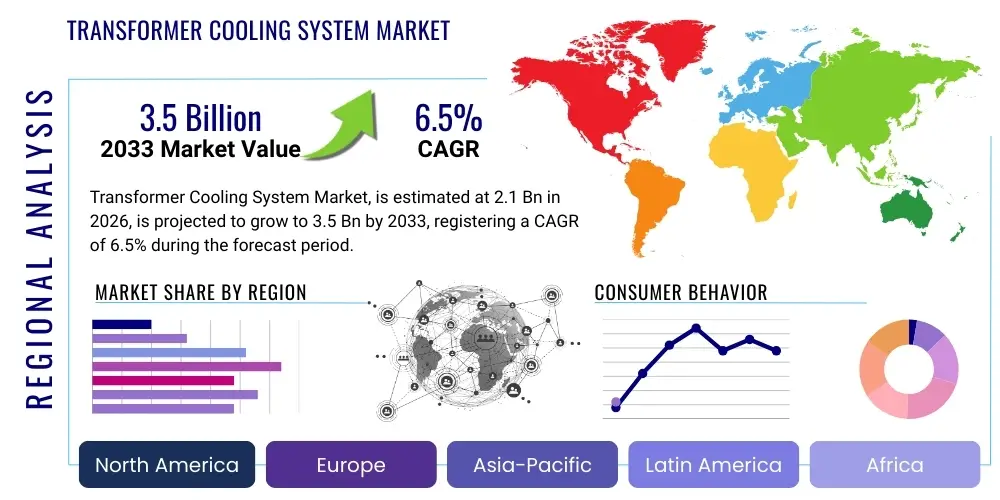

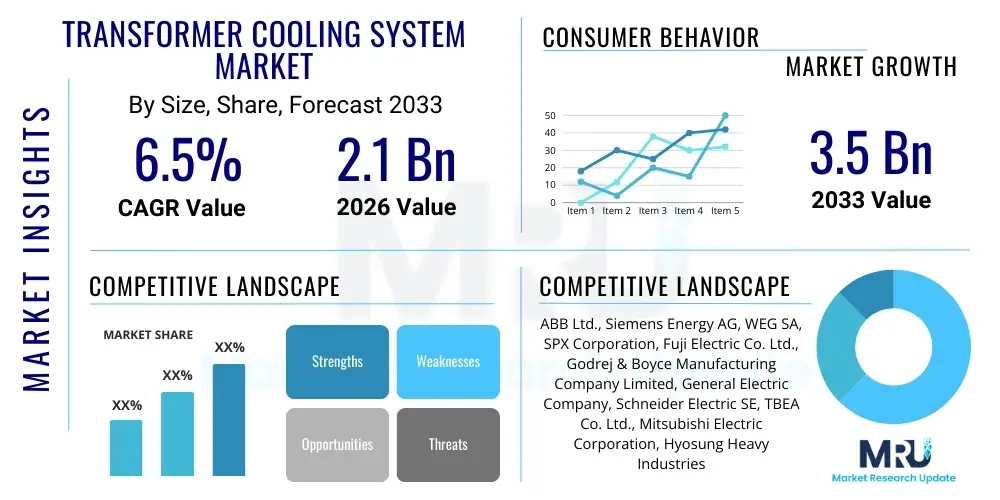

The Transformer Cooling System Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at $2.1 Billion in 2026 and is projected to reach $3.5 Billion by the end of the forecast period in 2033.

Transformer Cooling System Market introduction

The Transformer Cooling System Market encompasses the design, manufacture, and deployment of specialized equipment and methodologies essential for regulating the temperature of electrical transformers. Transformers, critical components in the power infrastructure for voltage conversion, generate significant heat during operation due to core and winding losses. Effective thermal management is paramount for ensuring operational efficiency, extending the transformer’s lifespan, and preventing catastrophic failure. These cooling systems, ranging from simple natural air circulation (AN) to complex forced oil circulation with directional water cooling (ODWF), are tailored based on the transformer's size, load profile, location, and required reliability standards. The continuous expansion of global electricity grids, coupled with the rising integration of renewable energy sources necessitating complex grid architectures, fundamentally drives the demand for highly efficient and robust cooling solutions.

Products within this market primarily include radiators, cooling fans, oil pumps, heat exchangers, valves, temperature monitoring systems, and sophisticated control units. Major applications span power generation facilities, transmission substations, distribution networks, high-speed rail infrastructure, and various heavy industrial operations requiring consistent, high-power supply. Key benefits derived from advanced cooling systems include minimized thermal degradation of insulation materials, optimized power throughput, reduced energy losses, and enhanced overall system resilience, particularly in regions experiencing extreme ambient temperatures or high-density urban environments where space constraints and noise levels are critical design factors. The optimization of these systems directly translates into lower total cost of ownership (TCO) for utility operators and industrial consumers alike.

Driving factors for market acceleration include increasing urbanization and industrialization, leading to escalating energy demand globally. Furthermore, the mandatory replacement of aging transmission and distribution infrastructure in developed economies, alongside the push for smart grid implementation, mandates the adoption of modern, high-efficiency transformers that require precise thermal control. Technological advancements in fluid dynamics and material science are leading to the development of more compact and energy-efficient cooling solutions, such as ester fluid-based systems, which offer superior fire resistance and environmental benefits compared to traditional mineral oil-based coolants, thereby stimulating market growth across environmentally conscious jurisdictions.

Transformer Cooling System Market Executive Summary

The global Transformer Cooling System Market is poised for substantial expansion, underpinned by crucial business trends such as intensified investment in smart grid technology and the global transition toward high-voltage direct current (HVDC) transmission lines, which necessitate specialized cooling apparatus for converter transformers. Equipment manufacturers are focusing intensely on integrating predictive maintenance capabilities, leveraging sensors and IoT connectivity to monitor coolant health, pump performance, and fan vibration in real-time, thereby shifting the industry paradigm from reactive repair to proactive system management. Furthermore, sustainability requirements are driving innovation toward non-fossil-fuel-based dielectric fluids and high-efficiency heat exchange designs, positioning environmentally friendly solutions as a core competitive advantage for key market players.

Regionally, the Asia Pacific (APAC) stands out as the primary growth engine, driven by massive infrastructure projects, rapid electrification in developing nations like India and Indonesia, and China’s continuous commitment to expanding its ultra-high voltage (UHV) transmission networks. North America and Europe, while possessing mature markets, are characterized by high replacement demand for aging assets and strict energy efficiency regulations, compelling utilities to adopt state-of-the-art forced-cooling methods like ONAF and OFAF. The Middle East and Africa (MEA) region shows accelerating potential, primarily due to large-scale power generation initiatives tied to oil & gas operations and solar energy projects, demanding cooling systems optimized for high ambient temperatures and desert conditions.

Segmentation analysis reveals a significant inclination towards forced cooling methods (ONAF and OFAF) over natural cooling (ONAN), particularly in high-power and distribution applications where compact design and high-efficiency heat dissipation are essential. The component segment sees robust growth in advanced heat exchangers and intelligent oil pump systems, reflecting the trend towards precision thermal management and energy savings. The Transmission & Distribution (T&D) application segment retains the largest market share, directly correlated with global electricity consumption growth and the necessity to stabilize grid reliability. This segment’s future growth is highly dependent on governmental policies related to infrastructure spending and grid modernization initiatives worldwide.

AI Impact Analysis on Transformer Cooling System Market

User inquiries regarding the influence of Artificial Intelligence (AI) on the Transformer Cooling System Market predominantly revolve around themes of predictive failure prevention, optimization of cooling energy consumption, and autonomous thermal regulation under dynamic load conditions. Key concerns center on the data security implications of integrating AI platforms with critical grid infrastructure and the necessary investment required for retrofitting existing systems with compatible IoT sensors. Expectations are high regarding AI’s ability to drastically reduce unscheduled downtime by forecasting component degradation (e.g., pump failure or oil contamination) months in advance. Users are also seeking validation that AI can intelligently adjust fan speeds and pump flow rates based on sophisticated algorithms that factor in load forecasts, ambient temperature trends, and historical performance data, maximizing energy efficiency while maintaining optimal winding temperature, thus transforming cooling from a reactive measure into a predictive, strategic asset management tool.

- AI enables highly accurate predictive maintenance by analyzing sensor data (temperature, flow, vibration) to forecast potential cooling system component failures, significantly reducing unplanned outages.

- Optimization algorithms utilizing AI dynamically adjust cooling intensity (fan speed, pump activation) based on real-time transformer load and external weather conditions, maximizing energy efficiency and minimizing auxiliary losses.

- AI facilitates enhanced thermal modeling and digital twinning of transformers, allowing operators to simulate the effect of different cooling strategies and environmental changes before physical deployment.

- Machine learning identifies subtle anomalies in cooling fluid quality or circulation patterns that traditional threshold alarms might miss, offering earlier detection of insulation breakdown risks.

- Autonomous cooling control systems driven by AI improve grid resilience by automatically initiating emergency cooling protocols or load shedding based on complex thermal constraints during extreme events.

DRO & Impact Forces Of Transformer Cooling System Market

The Transformer Cooling System Market is significantly driven by mandatory grid modernization efforts globally, fueled by rising electricity demand and the necessity to integrate intermittent renewable energy sources, which place fluctuating, high stress on transformers requiring superior thermal management. However, growth is restrained by the high initial capital expenditure associated with advanced forced-cooling systems and the complex regulatory landscape surrounding the deployment and disposal of dielectric fluids, particularly in highly regulated Western markets. Opportunities arise from technological shifts towards eco-friendly fluids and smart cooling solutions, coupled with untapped potential in rural electrification projects in emerging economies. These factors combine to create substantial impact forces: high switching costs due to infrastructure lock-in, intense competitive rivalry among established component manufacturers, and increasing pressure from end-users for customized, noise-reducing, and highly energy-efficient thermal solutions.

The primary driver remains the continuous expansion and upgrading of global power transmission infrastructure. As transformers become larger and operate at higher voltages, the heat generated increases exponentially, demanding more sophisticated and reliable cooling mechanisms beyond passive air or oil natural circulation. Furthermore, stringent global standards for operational efficiency (e.g., EU Ecodesign requirements) compel utilities to invest in forced cooling systems that can quickly and effectively manage temperature spikes, optimizing asset utilization. This demand is further amplified by the rapid build-out of data centers and specialized manufacturing facilities that require uninterrupted, high-quality power and operate heavy-duty transformers under continuous peak loads, making advanced cooling a prerequisite for operational stability.

Restraints largely center on supply chain complexities and the extended lifecycle of existing transformers. The procurement of specialized components like high-capacity oil pumps and bespoke heat exchangers involves long lead times and reliance on a limited number of specialized manufacturers, increasing logistical risks and installation costs. Moreover, the long operational life of transformers (often 30-40 years) means that replacement cycles for cooling systems are slow, unless mandated by failure or significant efficiency improvements. The industry also faces technical challenges in developing compact, high-efficiency cooling systems for highly confined installations (e.g., offshore platforms or underground substations) that must handle massive thermal loads within stringent space and noise limitations.

Opportunities are strongly linked to innovation in materials science and digitalization. The adoption of synthetic and natural ester liquids presents a dual opportunity: satisfying environmental mandates and improving fire safety, thereby opening up new market segments in sensitive urban or indoor installations. Simultaneously, the proliferation of Internet of Things (IoT) sensors and digital control systems allows manufacturers to offer Cooling-as-a-Service models, focusing on operational uptime and optimized efficiency rather than just component sales. Impact forces such as the increasing need for high-performance components in HVDC systems and the competitive pressure to offer integrated, turnkey cooling solutions are reshaping the competitive landscape, emphasizing R&D intensity and strategic partnerships between cooling specialists and transformer OEMs.

Segmentation Analysis

The Transformer Cooling System Market is comprehensively segmented based on the type of cooling medium and circulation mechanism, the specific components utilized, and the major end-user applications across the power infrastructure. Analyzing these segments provides deep insight into market dynamics, revealing where capital investment is concentrated and which technological pathways are gaining traction. The segmentation by cooling type (Air-cooled vs. Oil-immersed) reflects the fundamental design choices influenced by transformer size and operational environment, with oil-immersed systems dominating high-power applications due to superior dielectric properties and heat transfer capabilities. Component segmentation highlights the critical technologies that determine system efficiency and reliability, such as advanced pump and heat exchanger designs.

Further breakdown by application clearly delineates demand drivers, with the Transmission & Distribution (T&D) sector constituting the largest and most stable demand pool, driven by routine maintenance, grid expansion, and asset replacement programs. Industrial applications, encompassing sectors like mining, steel, and data centers, present a high-growth niche requiring ruggedized, high-duty-cycle cooling solutions. Geographic segmentation, detailed elsewhere, provides a crucial context for understanding regulatory and economic influences on adoption rates, noting significant variances in technology preference between highly electrified, developed markets and rapidly industrializing regions focusing on capacity build-out.

- By Cooling Type:

- Oil-immersed Cooling Systems (ONAN, ONAF, OFAF, ODWF)

- Air-cooled Systems (AN, AF)

- By Component:

- Radiators

- Heat Exchangers (Air-to-Air, Air-to-Water)

- Oil Pumps

- Cooling Fans

- Valves and Fittings

- Temperature Monitoring and Control Units

- Piping and Hoses

- By Application:

- Power Generation Stations

- Transmission & Distribution (T&D) Substations

- Industrial Applications (Manufacturing, Mining, Oil & Gas)

- Commercial Installations (Data Centers, Railways)

Value Chain Analysis For Transformer Cooling System Market

The Value Chain for the Transformer Cooling System Market begins with upstream activities focused on the procurement of critical raw materials, primarily high-grade metals such as copper, aluminum, and specialized steel alloys necessary for manufacturing radiators, heat exchangers, and pump housings, alongside the sourcing of dielectric fluids and insulating materials. This upstream phase is characterized by intense price sensitivity and quality control, as material properties directly impact heat transfer efficiency and system longevity. Key suppliers include specialized metallurgical firms and chemical manufacturers. R&D activities at this stage focus on lightweight, corrosion-resistant materials and next-generation biodegradable dielectric fluids, crucial for maintaining competitiveness and complying with evolving environmental regulations across major operational territories.

Midstream processing involves the core manufacturing and assembly of cooling components. Specialized manufacturers produce radiators (often utilizing finned tube designs), high-flow oil pumps, and robust cooling fans under strict quality assurance protocols. Integration with transformer OEMs is a critical aspect here, where cooling system designers must work closely with transformer engineers to optimize thermal interfaces and physical space utilization. The distribution channel is bifurcated: direct sales channels typically involve large cooling system manufacturers supplying major power utilities or transformer OEMs under long-term contracts, particularly for customized or large-scale projects. These direct relationships emphasize technical consultation, bespoke engineering, and post-installation service and maintenance support, often forming strategic partnerships.

The downstream sector focuses on installation, maintenance, and aftermarket services. Indirect distribution involves local distributors and third-party maintenance contractors who handle spare parts, minor component replacements (e.g., cooling fans, sensors), and routine oil checks for smaller distribution transformers and industrial customers. End-users, primarily electric utilities and large industrial consumers, drive demand for efficient operational services, emphasizing condition monitoring, predictive analytics integration, and rapid response maintenance. The overall value chain is highly integrated, with success often determined by the seamless collaboration between component suppliers, system integrators, and end-user maintenance teams to ensure peak system reliability and maximum asset uptime throughout the transformer’s extensive operational lifespan.

Transformer Cooling System Market Potential Customers

The primary consumers and end-users of transformer cooling systems are large electric utility companies involved in power generation, transmission, and distribution activities globally. These entities require robust, reliable cooling solutions for substations, power plants, and grid tie-in points, often demanding highly customized forced cooling systems (like OFAF and ODWF) for high-capacity power transformers operating under sustained stress. Their purchasing decisions are driven by regulatory compliance regarding grid stability, energy efficiency targets, and long-term reliability metrics, typically favoring established manufacturers with a proven track record of durability and comprehensive service agreements over the life cycle of the equipment. Investment cycles in this sector are often dictated by government infrastructure spending and large-scale power infrastructure renewal projects.

A rapidly expanding segment of potential customers includes operators of energy-intensive industrial facilities, such as large-scale data centers, metal processing plants, mining operations, and chemical manufacturing complexes. These industrial users operate medium to large distribution transformers constantly at or near peak load capacity, making efficient thermal management critical to prevent operational interruptions and protect expensive equipment. For this segment, ease of maintenance, compact design, and highly durable components suitable for harsh operating environments (e.g., high dust, corrosive atmosphere) are key purchasing factors. The rise of hyperscale data centers, in particular, drives demand for specialized, low-noise, and highly efficient cooling solutions due to immense power requirements within constrained urban or campus settings.

Furthermore, Original Equipment Manufacturers (OEMs) of transformers constitute a significant indirect customer base, as they integrate cooling systems as core components of the finished product. These OEMs require standardized, modular cooling components that can be efficiently scaled and integrated across various transformer models, prioritizing supply chain consistency and technical compatibility. Government agencies responsible for public transportation (e.g., railway electrification projects) and infrastructure development are also substantial buyers, often requiring specific safety certifications, particularly concerning fire resistance and environmental impact, driving demand for ester-fluid compatible cooling systems and specialized heat dissipation methods appropriate for railway tunnels and urban rail networks.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $2.1 Billion |

| Market Forecast in 2033 | $3.5 Billion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | ABB Ltd., Siemens Energy AG, WEG SA, SPX Corporation, Fuji Electric Co. Ltd., Godrej & Boyce Manufacturing Company Limited, General Electric Company, Schneider Electric SE, TBEA Co. Ltd., Mitsubishi Electric Corporation, Hyosung Heavy Industries, Crompton Greaves Power and Industrial Solutions Ltd., Delta Star Inc., Bharat Heavy Electricals Limited (BHEL), Kelvion Holding GmbH, THERMAX Ltd., EATON Corporation plc, Maschinenfabrik Reinhausen GmbH (MR), Power Engineers, P.C., C&S Electric Limited. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Transformer Cooling System Market Key Technology Landscape

The Transformer Cooling System Market is experiencing rapid technological evolution centered on achieving higher thermal efficiency, improved environmental sustainability, and enhanced digitalization for predictive maintenance. A major technological focus is the transition from conventional mineral oil to synthetic or natural ester fluids. These ester liquids offer higher fire points, minimizing fire risk in urban or critical substations, and are biodegradable, aligning with stricter environmental mandates. This shift necessitates corresponding changes in cooling system materials and design, particularly gaskets and sealants, to ensure compatibility and long-term reliability with the new fluid types, driving innovation in chemical resistance and material engineering across the supply chain.

Another significant technological advancement lies in the proliferation of forced cooling technologies, specifically the optimization of ONAF (Oil Natural Air Forced) and OFAF (Oil Forced Air Forced) systems. Manufacturers are utilizing computational fluid dynamics (CFD) modeling to design heat exchangers and radiator fins with optimized geometry, maximizing the surface area contact and improving thermal dissipation rates under forced air circulation, allowing for smaller, more efficient cooling units. Furthermore, the development of variable speed drive (VSD) technology for oil pumps and cooling fans is crucial. VSDs allow the cooling system to precisely match the cooling output to the instantaneous thermal load of the transformer, significantly reducing auxiliary power consumption and minimizing operational noise compared to traditional fixed-speed systems, which often run inefficiently at partial loads.

The integration of IoT and smart sensors forms the third pillar of the technological landscape. Modern cooling systems are equipped with high-precision sensors monitoring oil temperature, winding hotspots, pump vibration, flow rates, and ambient conditions. This data is fed into centralized asset management systems and AI-driven platforms to facilitate real-time condition monitoring and predictive analytics. Advanced control algorithms not only regulate cooling based on present temperature but also incorporate historical load data and short-term load forecasts to proactively adjust cooling levels, thereby preventing the transformer from entering critical thermal zones. This focus on intelligent monitoring transforms the cooling system from a passive accessory into an active, decision-making component of the smart grid infrastructure, requiring expertise in both mechanical engineering and complex data analytics for development and deployment.

Regional Highlights

- Asia Pacific (APAC): APAC represents the largest and fastest-growing market due to aggressive government investments in grid expansion and electrification across emerging economies like India, Southeast Asia, and robust growth in China's ultra-high voltage (UHV) transmission networks. The high demand for energy necessitated by rapid urbanization and industrialization drives the need for high-capacity power transformers, heavily utilizing forced oil cooling (OFAF and OFWF) systems to ensure stable power delivery under heavy load conditions. Regulatory focus is primarily on capacity addition and rapid deployment, though environmental concerns are slowly increasing the uptake of ester fluid solutions.

- North America: This region is characterized by high demand for asset replacement and modernization, driven by the aging infrastructure across the US and Canada. The market emphasizes energy efficiency and resilience against extreme weather events. Key drivers include smart grid initiatives and the integration of large-scale renewable energy projects (solar/wind), necessitating advanced, intelligent cooling systems with robust monitoring capabilities to manage fluctuating power inputs and high peak loads. Compliance with strict environmental standards pushes demand toward eco-friendly fluids and low-noise operational components, especially in densely populated areas.

- Europe: Europe is defined by stringent regulatory environments focusing on decarbonization, energy efficiency (driven by directives like Ecodesign), and environmental protection. This region shows a high adoption rate for natural ester liquids due to their superior fire safety and biodegradability. Market growth is stable, primarily focused on upgrading existing transmission networks, integrating cross-border energy flows, and supporting the massive build-out of offshore wind farms, which require highly reliable, specialized cooling systems for subsea and high-corrosion environments.

- Latin America (LATAM): Market growth in LATAM is variable, tied to major infrastructure projects in Brazil and Mexico, alongside efforts to improve grid coverage and reliability across less developed areas. Hydropower and renewable energy expansion are significant drivers. Cooling solutions must often be ruggedized to handle challenging operational conditions, including severe climate variations and remote installations, favoring dependable, low-maintenance component designs.

- Middle East and Africa (MEA): The MEA market, particularly the Gulf Cooperation Council (GCC) states, is experiencing significant investment in power generation and transmission to support economic diversification and cope with extreme summer temperatures. High ambient temperatures necessitate specialized cooling systems, often relying on high-efficiency water-cooling (ODWF) or complex air-forced systems specifically designed for desert conditions, with a strong focus on minimizing cooling auxiliary power consumption to maintain overall operational efficiency. Africa's market potential lies in extensive rural electrification projects, driving demand for robust, easily maintainable distribution transformer cooling components.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Transformer Cooling System Market.- ABB Ltd.

- Siemens Energy AG

- WEG SA

- SPX Corporation

- Fuji Electric Co. Ltd.

- Godrej & Boyce Manufacturing Company Limited

- General Electric Company

- Schneider Electric SE

- TBEA Co. Ltd.

- Mitsubishi Electric Corporation

- Hyosung Heavy Industries

- Crompton Greaves Power and Industrial Solutions Ltd.

- Delta Star Inc.

- Bharat Heavy Electricals Limited (BHEL)

- Kelvion Holding GmbH

- THERMAX Ltd.

- EATON Corporation plc

- Maschinenfabrik Reinhausen GmbH (MR)

- Power Engineers, P.C.

- C&S Electric Limited

Frequently Asked Questions

Analyze common user questions about the Transformer Cooling System market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary function of a transformer cooling system?

The primary function is to dissipate the heat generated by core and winding losses within the transformer to maintain its operational temperature within design limits. This prevents thermal degradation of insulation materials, extends the transformer's lifespan, ensures efficiency, and prevents catastrophic failure.

Which cooling type is dominant in high-capacity power transformers?

For high-capacity power transformers used in transmission, forced cooling mechanisms like ONAF (Oil Natural Air Forced) and OFAF (Oil Forced Air Forced) are dominant. These methods significantly enhance heat transfer rates compared to passive (ONAN) cooling, allowing for optimal performance and compact design under heavy loads.

How do smart grids impact the demand for advanced cooling systems?

Smart grid integration increases demand for advanced cooling systems by introducing dynamic load fluctuations from renewable energy sources. This necessitates the use of intelligent, sensor-equipped cooling systems capable of rapid, automated adjustment (using AI/IoT) to maintain stable temperatures and support grid reliability efficiently.

What are the key drivers for the adoption of natural ester fluids in cooling?

Key drivers include enhanced fire safety, as natural esters have a higher fire point than mineral oil, and environmental benefits due to their high biodegradability. This makes them increasingly favored in urban substations, critical infrastructure, and environmentally sensitive areas where regulatory compliance is paramount.

What components are most crucial for efficient forced-cooling systems?

The most crucial components are high-efficiency heat exchangers (radiators), robust, reliable oil pumps, and variable-speed cooling fans. These components determine the system's capacity to manage thermal loads quickly and efficiently while minimizing auxiliary power consumption.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager