Transformer Online Monitoring Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443164 | Date : Feb, 2026 | Pages : 246 | Region : Global | Publisher : MRU

Transformer Online Monitoring Market Size

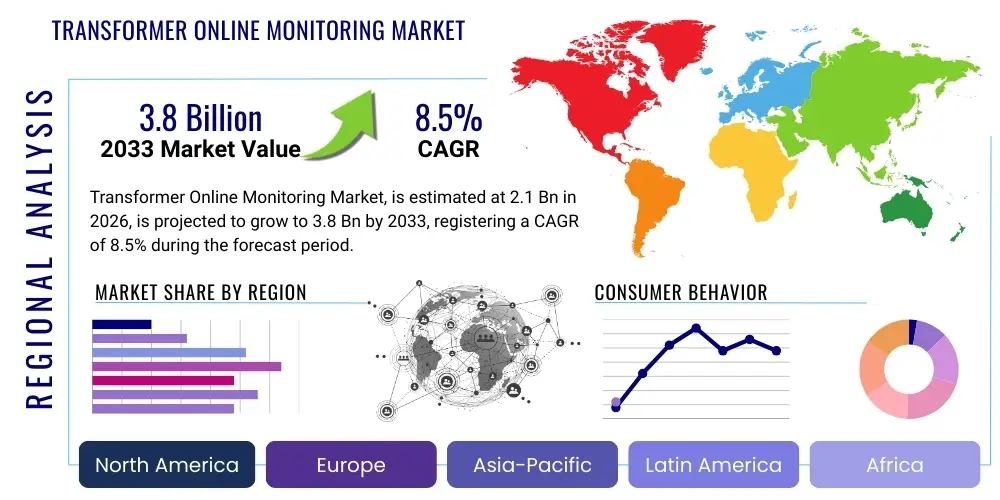

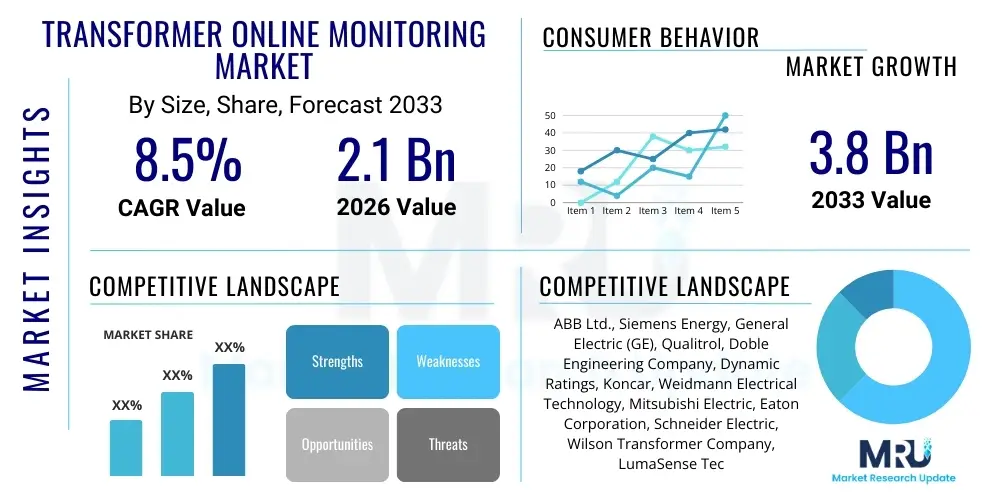

The Transformer Online Monitoring Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at $2.1 Billion in 2026 and is projected to reach $3.8 Billion by the end of the forecast period in 2033.

Transformer Online Monitoring Market introduction

The Transformer Online Monitoring Market encompasses advanced sensor and software solutions designed to continuously measure, analyze, and diagnose the operational health and performance of electrical power transformers in real-time. This technology is critical for utilities, industrial complexes, and renewable energy infrastructure operators seeking to transition from reactive maintenance schedules to predictive maintenance strategies, thereby maximizing asset lifespan, minimizing unplanned outages, and optimizing capital expenditure. Key products in this domain include systems for monitoring winding temperature, dissolved gas analysis (DGA), partial discharge detection, bushing health, and oil quality, all integrated via robust communication protocols into centralized asset management platforms. The primary applications span across transmission and distribution networks, large-scale industrial manufacturing, rail electrification, and power generation facilities, providing crucial insights into transformer insulation degradation and imminent failure risks, which are particularly relevant given the aging global transformer fleet and increasing power demands.

The core benefit driving the widespread adoption of transformer online monitoring systems is the significant improvement in operational resilience and safety. By providing continuous data streams, these systems enable operators to accurately assess the stress levels on high-value assets and intervene preemptively, which dramatically reduces the frequency and duration of catastrophic equipment failures. This predictive capability translates directly into lower maintenance costs, better resource allocation, and sustained service reliability, which is paramount in deregulated and highly competitive energy markets. Furthermore, the push towards smart grids and the integration of intermittent renewable energy sources necessitate reliable grid infrastructure that can handle fluctuating loads and bidirectional power flows, making real-time health monitoring indispensable for grid stability.

Major driving factors fueling this market expansion include stringent regulatory mandates concerning grid reliability, especially in developed economies, coupled with substantial investments in modernizing and expanding T&D infrastructure across rapidly industrializing regions like Asia Pacific. The necessity to extend the service life of aging infrastructure, often operating beyond its designed lifespan, further accelerates the demand for monitoring solutions. Technological advancements in sensor fidelity, wireless communication, and data analytics software, particularly the incorporation of sophisticated algorithms for fault prediction, are making these systems more cost-effective and accurate, facilitating broader market penetration across different voltage classes of transformers.

Transformer Online Monitoring Market Executive Summary

The Transformer Online Monitoring Market is characterized by robust growth underpinned by strong business trends centered on digitalization and the implementation of sophisticated predictive analytics platforms. Key business trends include the convergence of hardware manufacturers and software providers to offer integrated, end-to-end solutions, and a noticeable shift toward subscription-based, Monitoring-as-a-Service (MaaS) models, lowering the initial capital outlay for end-users and ensuring continuous software updates and support. Strategic mergers and acquisitions among traditional monitoring equipment manufacturers and specialized AI/ML analytics firms are reshaping the competitive landscape, aiming to deliver highly granular and actionable predictive maintenance recommendations, moving beyond simple data logging to true diagnostic intelligence.

Regionally, the market is demonstrating differential growth patterns. North America and Europe are leading in adoption rates due to strict asset management regulations, established smart grid initiatives, and high labor costs that incentivize automation, focusing heavily on integrating monitoring data into enterprise asset management (EAM) systems. Conversely, the Asia Pacific region, led by China and India, is projected to exhibit the fastest growth over the forecast period, driven by massive investments in new power generation and transmission infrastructure required to meet rapid urbanization and industrial growth, where the installation of monitoring systems is often mandated for new high-voltage transformers (HV and EHV classes). Latin America and the Middle East & Africa are showing nascent but accelerating growth, primarily focusing on managing asset health risks in remote or environmentally challenging operating locations.

Segment trends reveal that the Dissolved Gas Analysis (DGA) segment, particularly multi-gas DGA monitors, retains the largest market share due to its unparalleled effectiveness in detecting the incipient faults, such as overheating and partial discharge, which are critical indicators of transformer health. However, the Partial Discharge (PD) monitoring segment is rapidly expanding, fueled by technological improvements in non-intrusive sensor deployment and noise cancellation techniques, making PD monitoring viable for continuous online applications rather than just periodic testing. Furthermore, the software and services segment, which includes data hosting, cloud connectivity, and advanced analytics packages, is growing at the highest CAGR, reflecting the increased value placed by users on intelligent data interpretation rather than just raw hardware deployment, thus emphasizing the importance of sophisticated algorithms and human-machine interface (HMI) design.

AI Impact Analysis on Transformer Online Monitoring Market

Common user questions regarding the impact of Artificial Intelligence (AI) in the Transformer Online Monitoring Market often revolve around the efficacy of fault prediction, data security implications, and the ROI derived from integrating complex machine learning models. Users frequently ask: "How much more accurate are AI-driven predictions compared to conventional threshold alarms?" or "Will AI fully automate the diagnostic process, reducing the need for specialized human analysts?" and "What are the infrastructure requirements (data storage, computational power) for running these advanced models across a large fleet of transformers?" The core concern is centered on transitioning from descriptive analytics (what happened) to prescriptive maintenance recommendations (what action should be taken now), while ensuring that the algorithms can handle the high variability and noise inherent in operational transformer data without generating excessive false positives or missing critical events.

Based on these inquiries, the key themes summarizing AI's influence include the expectation of significant improvement in diagnostic precision through the correlation of multiple data streams (e.g., DGA, temperature, vibration, load history), the potential for deep learning models to identify subtle, multi-variable fault signatures that human experts or rule-based systems might overlook, and the necessity for robust, secure, and scalable cloud or edge computing infrastructure to process the enormous volume of time-series data generated. Users expect AI to not only predict failure but also to estimate the remaining useful life (RUL) of the asset with high confidence, thereby optimizing capital planning and scheduling maintenance windows during low-impact periods. There is also a strong expectation that generative AI capabilities will soon assist in summarizing complex fault data into easy-to-understand reports for non-technical management personnel, improving overall organizational visibility.

The primary concern remains the 'black box' nature of complex deep learning models; end-users require explainable AI (XAI) capabilities to validate the recommendations made by the system before taking costly assets offline. Furthermore, integrating legacy monitoring hardware that may not be designed for high-frequency data transmission poses a practical challenge that AI solutions must overcome. Ultimately, AI is expected to transform the role of the asset manager from reactive troubleshooter to strategic predictor, driving unparalleled efficiencies in global power grid operations and contributing significantly to minimizing transmission losses and enhancing environmental performance.

- Enhanced Predictive Accuracy: AI/ML algorithms dramatically improve the accuracy of fault prediction by analyzing correlations across diverse data sources (DGA, thermal imaging, load profiles).

- Remaining Useful Life (RUL) Estimation: Sophisticated AI models provide high-confidence estimates of asset longevity, optimizing proactive replacement cycles and capital expenditure.

- Automated Anomaly Detection: Machine learning identifies subtle deviations from normal operating conditions, catching incipient faults far earlier than traditional fixed-threshold alarms.

- Data Integration and Fusion: AI serves as the central intelligence layer, fusing data from various disparate sensors and monitoring devices into a unified diagnostic picture.

- Operational Efficiency: Reduction in unnecessary inspections and maintenance activities, leading to lower operating costs and minimizing human intervention risks in high-voltage environments.

- Cybersecurity Challenges: Integration of AI platforms requires robust security measures to protect sensitive operational data from sophisticated cyber threats targeting critical infrastructure.

DRO & Impact Forces Of Transformer Online Monitoring Market

The Transformer Online Monitoring Market is significantly shaped by a compelling combination of Drivers (D), Restraints (R), Opportunities (O), and potent Impact Forces. The primary driver is the accelerating global need for grid reliability and resilience, specifically the massive undertaking to integrate renewable energy sources which introduce volatility and necessitate robust, continuously monitored transmission infrastructure. This is coupled with the financial incentive derived from extending the operational lifespan of the vast, aging global transformer fleet, where online monitoring provides a critical cost-effective alternative to immediate, costly replacements. Restraints, conversely, include the high initial capital investment required for deploying comprehensive monitoring systems, especially for smaller utilities or older, decentralized assets, and the complexity associated with integrating heterogeneous monitoring data across different manufacturer platforms, demanding standardization and interoperability improvements.

The opportunities within this market are substantial, particularly in the rapid development and commercialization of next-generation sensor technologies, such as advanced fiber-optic sensing for partial discharge and specialized micro-electromechanical systems (MEMS) sensors for dissolved gas analysis, which offer higher sensitivity and reduced maintenance profiles. Furthermore, the expansion of Monitoring-as-a-Service (MaaS) models and cloud-based analytics platforms represents a key opportunity, democratizing access to high-end monitoring capabilities for smaller utilities by converting capital expenditure into operational expenditure. This shift also creates opportunities for specialized data science consulting firms focused exclusively on interpreting transformer health data and providing actionable prescriptive insights, moving beyond simple raw data provision.

The most significant impact forces acting on this market include regulatory pressure, forcing mandatory installation of monitoring systems for new high-voltage transformers and critical substations, particularly in regions prone to natural disasters or high-load environments. Technological convergence, specifically the integration of 5G networks, is a crucial impact force enabling high-speed, reliable data transmission from remote substation locations, which is essential for real-time diagnostic accuracy. Finally, the skilled labor shortage in high-voltage engineering and maintenance globally acts as a powerful accelerant for automation; as fewer experienced technicians are available, the reliance on automated, AI-driven diagnostics delivered by monitoring systems becomes a necessity rather than a luxury, ensuring that critical asset health assessments can be performed remotely and continuously.

Segmentation Analysis

The Transformer Online Monitoring Market is highly fragmented, segmented primarily across the type of monitoring component, the specific application or voltage class of the transformer, and the type of service provided. Component segmentation distinguishes between dedicated hardware devices, such as Dissolved Gas Analyzers (DGA), bushing monitors, and temperature sensors, versus the software platforms and communication modules required for data aggregation and interpretation. Application segmentation is crucial, differentiating solutions tailored for distribution transformers (lower cost, focusing on basic thermal data), power transformers (high-end, multi-parameter monitoring for critical grid assets), and specialized industrial transformers. This differentiation allows manufacturers to target specific utility needs based on asset value and operational criticality, ensuring appropriate feature sets and cost structures are applied across the diverse transformer population.

- Monitoring Component:

- Dissolved Gas Analysis (DGA) Monitors (Single-Gas, Multi-Gas)

- Bushing Monitors (Capacitance and Tan Delta)

- Temperature Monitors (Winding Hotspot, Oil Temperature)

- Partial Discharge (PD) Monitors

- Moisture in Oil Sensors

- Load and Voltage Monitors

- Application/Voltage Class:

- Power Transformers (HV and EHV)

- Distribution Transformers (MV)

- Specialty and Industrial Transformers

- End-User Industry:

- Power Utilities (Transmission and Distribution)

- Oil & Gas

- Mining and Metals

- Railways and Transportation

- Renewable Energy Generation (Wind and Solar Farms)

- Monitoring Type:

- Hardware Solutions

- Software and Service Solutions (Cloud Analytics, MaaS)

Value Chain Analysis For Transformer Online Monitoring Market

The value chain for the Transformer Online Monitoring Market begins with upstream activities focused on the sophisticated research, development, and manufacturing of highly specialized sensors, including micro-DGA sensors, high-precision optical sensors, and acoustic/UHF partial discharge detectors. These components require specialized materials, calibration capabilities, and deep expertise in high-voltage physics. Key upstream suppliers include manufacturers of electronic components, fiber optics, and analytical chemical sensors. Efficiency at this stage is crucial, as the reliability and longevity of the monitoring system directly depend on the sensor quality and environmental robustness. Innovation in upstream sensing technology is a primary determinant of system accuracy and cost.

Midstream activities involve the integration of these sensors into complete monitoring units, development of secure communication modules (like cellular, satellite, or proprietary radio systems), and the creation of edge computing hardware for local data processing and aggregation. This stage also includes the development of proprietary software algorithms for alarm generation and preliminary data filtering. Distribution channels are varied, incorporating direct sales to large, integrated utilities, partnerships with specialized engineering procurement and construction (EPC) firms for new substation projects, and utilization of indirect distributors or value-added resellers (VARs) who provide local installation, calibration, and support services. The effectiveness of the channel relies heavily on the technical proficiency of the partners to install and commission complex monitoring systems correctly in high-stress substation environments.

Downstream activities center on post-installation services, which are increasingly critical to market success. These include ongoing calibration, maintenance, data hosting (often cloud-based), advanced analytical services, and providing consulting expertise for interpreting diagnostic reports. Direct channels maintain control over intellectual property and ensure high quality of service for key clients, but require significant internal service infrastructure. Indirect channels, using VARs, allow manufacturers to achieve broader geographic reach, particularly in emerging markets, by leveraging local expertise for faster response times and localized technical support. The shift towards MaaS models further strengthens the importance of the downstream segment, transforming equipment vendors into long-term data partners, responsible for continuous software updates and performance assurance.

Transformer Online Monitoring Market Potential Customers

The primary consumers and end-users of Transformer Online Monitoring solutions are entities responsible for the generation, transmission, and distribution of electrical power, constituting the bulk of the market demand. Power utilities, including independent system operators (ISOs) and regional transmission organizations (RTOs), are the largest buyers, particularly those managing high-voltage transmission grids and essential substations where asset failure can cause widespread economic disruption and grid instability. These organizations prioritize multi-parameter, highly redundant monitoring systems integrated directly into their existing SCADA and EAM frameworks to adhere to strict regulatory reliability standards and optimize load management strategies, demanding solutions with high cybersecurity resilience.

Beyond traditional utilities, large industrial complexes, especially in sectors such as petrochemicals, mining, metals, and automotive manufacturing, represent significant potential customers. These industries often operate high-power specialty transformers critical to their production processes; an unexpected transformer failure can lead to millions in lost production time. Their purchasing decisions are driven by the need for continuous operation and safety compliance, favoring robust, localized monitoring systems that interface with industrial control systems. The rising adoption of renewable energy, particularly large wind and solar farms, also creates a growing customer base, as these facilities require reliable monitoring to manage the unique stresses placed on transformers due to intermittent power flows and remote operation, where physical inspection is difficult and costly.

The segment of potential customers is expanding to include rail infrastructure and metropolitan transit authorities, which rely on specialized traction transformers for high-speed and commuter rail systems, necessitating real-time health checks to ensure passenger safety and operational uptime. Furthermore, specialized providers like data centers and critical government facilities, where power reliability is non-negotiable, often invest in the highest tiers of transformer monitoring technology to maintain uninterruptible power supply (UPS) capabilities. The common denominator among all these customers is the high cost associated with downtime and the elevated risk profile of the transformers they operate, justifying the investment in predictive online monitoring technology.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $2.1 Billion |

| Market Forecast in 2033 | $3.8 Billion |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | ABB Ltd., Siemens Energy, General Electric (GE), Qualitrol, Doble Engineering Company, Dynamic Ratings, Koncar, Weidmann Electrical Technology, Mitsubishi Electric, Eaton Corporation, Schneider Electric, Wilson Transformer Company, LumaSense Technologies, Serveron, T&D PowerSystems, Maschinenfabrik Reinhausen (MR), Zensol, Omicron Electronics, Techimp, Vaisala |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Transformer Online Monitoring Market Key Technology Landscape

The technology landscape of the Transformer Online Monitoring market is marked by rapid evolution, moving toward highly integrated, non-intrusive, and digitized solutions. Dissolved Gas Analysis (DGA) remains foundational, but the technology is shifting from lab-based sampling to continuous, multi-gas online monitors using advanced spectroscopic techniques (like Photoacoustic Spectroscopy or Gas Chromatography) to provide real-time fault precursor identification with high specificity and low detection limits. This ensures immediate identification of gases indicative of partial discharge, overheating, and cellulosic insulation degradation, offering significant diagnostic advantages over single-gas monitors. Furthermore, advancements in sensor miniaturization and improved calibration stability are driving down the maintenance burden associated with DGA units.

Another crucial technological development is in Partial Discharge (PD) monitoring, essential for detecting insulation breakdown. Modern systems leverage a combination of ultra-high frequency (UHF) sensors, acoustic emission sensors, and transient earth voltage (TEV) sensors to triangulate and characterize PD activity without requiring the transformer to be taken offline. The challenge of environmental noise interference is being overcome through sophisticated digital signal processing (DSP) and AI-driven pattern recognition algorithms that accurately distinguish true PD signals from external noise, enabling reliable continuous monitoring even in noisy urban substations. The convergence of these multiple sensing methodologies provides a more complete and redundant diagnostic capability.

The most transformative technologies, however, lie in the software and communications layers. The shift to Industrial Internet of Things (IIoT) architectures is paramount, facilitating secure, reliable wireless communication (often leveraging LPWAN or increasingly 5G networks) from remote substations to central cloud platforms. These platforms utilize advanced predictive maintenance software incorporating AI and machine learning to analyze terabytes of historical and real-time data, moving beyond simple alarming to complex prescriptive analytics. Edge computing is also gaining traction, allowing initial data processing and critical alarm generation to occur locally at the substation, reducing latency and bandwidth requirements while maintaining high system responsiveness to rapid fault progression.

Regional Highlights

- North America: This region holds a significant market share, driven primarily by the critical need to modernize aging transmission and distribution infrastructure. Stringent NERC (North American Electric Reliability Corporation) standards mandate high levels of asset visibility and reliability, fueling demand. The focus here is on integrating DGA and bushing monitoring into comprehensive Enterprise Asset Management (EAM) systems and leveraging sophisticated cloud analytics, with robust adoption across both high-voltage utilities and large industrial consumers. The United States and Canada are prioritizing cybersecurity integration within monitoring systems due to the high-value nature of the grid assets monitored.

- Europe: Characterized by established smart grid initiatives and robust renewable energy integration targets, Europe is a mature but high-growth market. The transition toward centralized, highly efficient transmission systems necessitates continuous online monitoring to manage bidirectional power flows and fluctuating load conditions caused by wind and solar power. Germany, the UK, and France are leading in adopting sophisticated PD monitoring and fiber-optic sensing solutions. Regulatory frameworks, such as those promoting circular economy principles, also encourage utilities to invest in monitoring to extend the lifespan of existing transformers rather than replacing them prematurely, accelerating market uptake.

- Asia Pacific (APAC): APAC is the fastest-growing market, primarily due to unprecedented investment in new power infrastructure, transmission network expansion, and rapid urbanization, especially in China, India, and Southeast Asian nations. The region is seeing mass deployment of monitoring systems integrated into new substation builds to ensure grid stability from the outset. While cost sensitivity remains a factor, the massive scale of infrastructure deployment ensures high volume growth. China's ultra-high-voltage (UHV) projects, in particular, require the most advanced, multi-parameter monitoring systems available, significantly driving technological demand and localization efforts.

- Latin America: This region is characterized by volatile market conditions and a high proportion of remote and challenging operating environments, such as large hydro facilities or mining operations located far from urban centers. This remoteness makes continuous online monitoring highly valuable, reducing the need for expensive and difficult manual inspections. Brazil and Mexico are key markets, focusing on basic DGA and temperature monitoring initially, with increasing interest in affordable, resilient wireless connectivity solutions to ensure data transfer reliability from isolated substations.

- Middle East and Africa (MEA): Growth in MEA is fueled by large-scale oil and gas infrastructure projects and new smart city initiatives requiring reliable power supply under harsh environmental conditions (high heat, dust). Countries like the UAE, Saudi Arabia, and South Africa are investing heavily in advanced monitoring solutions to manage asset degradation caused by extreme ambient temperatures and high loading factors. The market emphasizes ruggedized hardware and systems capable of providing accurate diagnostics despite severe thermal stress on transformer components.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Transformer Online Monitoring Market.- ABB Ltd.

- Siemens Energy

- General Electric (GE)

- Qualitrol

- Doble Engineering Company

- Dynamic Ratings

- Koncar

- Weidmann Electrical Technology

- Mitsubishi Electric

- Eaton Corporation

- Schneider Electric

- Wilson Transformer Company

- LumaSense Technologies

- Serveron

- T&D PowerSystems

- Maschinenfabrik Reinhausen (MR)

- Zensol

- Omicron Electronics

- Techimp

- Vaisala

Frequently Asked Questions

Analyze common user questions about the Transformer Online Monitoring market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is Dissolved Gas Analysis (DGA) and why is it crucial for transformer health?

DGA is the process of extracting and analyzing gases dissolved in transformer oil to detect internal electrical or thermal faults. It is crucial because specific gas compositions (like acetylene, hydrogen, methane) indicate the type and severity of incipient faults (e.g., partial discharge or overheating) before they lead to catastrophic failure, making it the gold standard for predictive maintenance.

How does online monitoring compare to traditional periodic monitoring methods?

Online monitoring offers continuous, real-time data collection, enabling immediate fault detection and trending analysis, which traditional periodic methods (like manual oil sampling) cannot provide. This real-time visibility significantly reduces the risk of sudden, unplanned outages and optimizes asset scheduling based on actual condition rather than fixed time intervals.

What is the typical Return on Investment (ROI) for installing Transformer Online Monitoring systems?

The typical ROI is achieved through significant cost savings derived from preventing catastrophic transformer failures, extending asset useful life, reducing unnecessary routine maintenance inspections, and minimizing outage duration. For critical assets, the prevention of a single major failure often justifies the entire investment across multiple monitored units.

Are Transformer Online Monitoring systems compatible with all voltage classes of transformers?

While highly specialized, multi-parameter systems are predominantly installed on high-voltage (HV) and extra-high-voltage (EHV) power transformers due to their criticality and cost, simplified, cost-effective monitoring solutions focusing on core metrics like temperature and basic oil quality are increasingly available and economically viable for distribution and medium-voltage industrial transformers.

What role does Artificial Intelligence (AI) play in modern online monitoring solutions?

AI, specifically machine learning, analyzes large datasets from monitoring systems to establish sophisticated baseline profiles, identify complex fault patterns that exceed simple threshold limits, and accurately estimate the Remaining Useful Life (RUL) of the transformer, thereby transitioning diagnostic capabilities from simple data reporting to advanced prescriptive maintenance recommendations and enhancing predictive confidence.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager