Transparent ABS Plastics Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441140 | Date : Feb, 2026 | Pages : 246 | Region : Global | Publisher : MRU

Transparent ABS Plastics Market Size

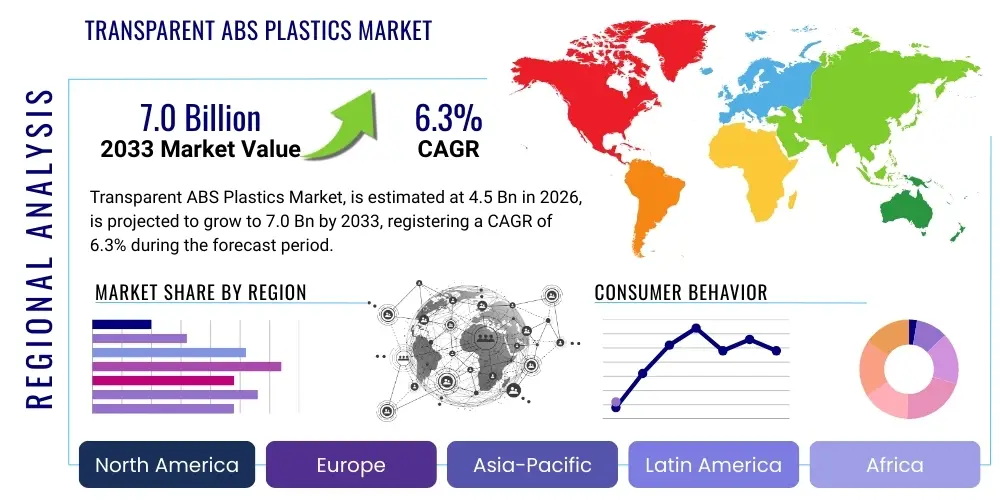

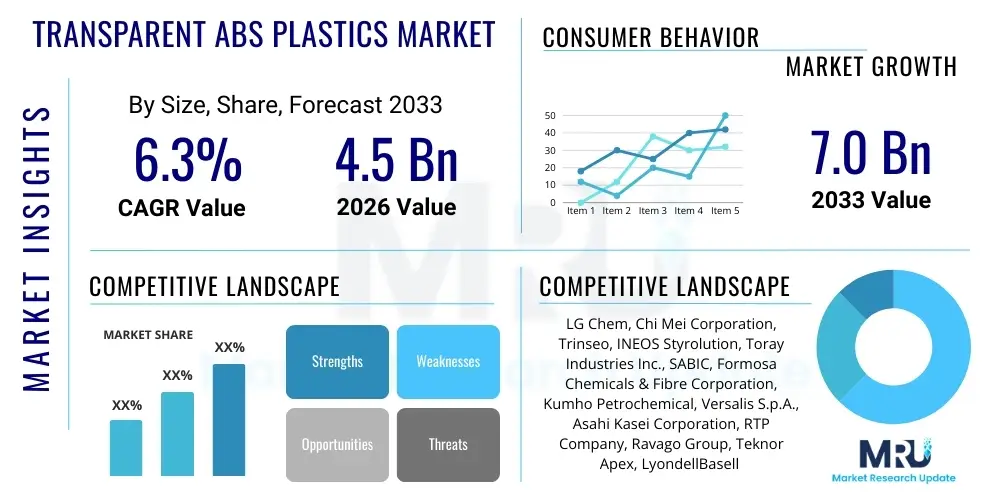

The Transparent ABS Plastics Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.3% between 2026 and 2033. The market is estimated at USD 4.5 billion in 2026 and is projected to reach USD 7.0 billion by the end of the forecast period in 2033.

Transparent ABS Plastics Market introduction

Transparent Acrylonitrile Butadiene Styrene (ABS) plastics represent a specialized segment within the broader engineering polymers market, designed to offer the superior mechanical properties of standard ABS—notably high impact resistance, excellent rigidity, and chemical resilience—while maintaining a high degree of optical clarity. This unique combination of attributes positions Transparent ABS as a critical material in applications where both aesthetics and performance are essential. Unlike opaque ABS, which derives its strength from rubber particles that typically scatter light, transparent variants often achieve clarity through careful manipulation of the polymer structure, often involving modifications or blending with materials like PMMA or specialty SAN, ensuring minimal light scattering and haze. The resulting material is highly valued across diverse industries for its versatility and functional superiority over general-purpose clear resins.

The product description highlights Transparent ABS as a high-performance thermoplastic that serves as a preferred substitute for standard polycarbonates (PC) or styrene-acrylonitrile (SAN) in specific demanding applications, particularly those requiring enhanced resistance to stress cracking and improved processing ease. Major applications driving market growth include high-end consumer electronics (such as clear casings, display frames, and internal components), automotive interiors and lighting systems where durability meets design requirements, medical devices (clear instrument housings, diagnostic components), and specific luxury packaging solutions. These applications leverage the inherent benefits of Transparent ABS, including its aesthetic appeal, excellent dimensional stability, and ability to withstand rigorous operating environments, offering manufacturers a premium material option for next-generation product development.

Driving factors for the accelerated adoption of Transparent ABS plastics include the growing miniaturization trend in electronics, necessitating durable yet aesthetically pleasing materials, and the increasing global focus on material safety and regulatory compliance, particularly in the medical and food contact sectors. Furthermore, continuous advancements in polymerization and compounding techniques are leading to the development of higher-clarity and higher-flow grades, expanding the material's feasibility in complex injection molding processes. The demand for lightweight and energy-efficient materials in the automotive industry also contributes significantly to market expansion, as Transparent ABS allows for the consolidation of parts and reduction of overall vehicle weight, aligning with global sustainability and performance mandates.

Transparent ABS Plastics Market Executive Summary

The Transparent ABS Plastics Market is characterized by robust growth, propelled primarily by escalating demand from the consumer electronics and automotive sectors. Business trends indicate a strong focus on sustainability, with leading manufacturers investing heavily in developing bio-based or recyclable Transparent ABS formulations to meet stringent environmental regulations and consumer preferences. Furthermore, strategic partnerships between material suppliers and Tier 1 product manufacturers are intensifying, aimed at co-developing customized grades optimized for specific end-use requirements, such as enhanced UV resistance for exterior applications or improved chemical resistance for medical environments. Technological innovation in compounding processes remains a key competitive differentiator, allowing companies to offer products that bridge the performance gap between conventional transparent plastics and engineering-grade polymers, thereby capturing high-value market segments.

Regionally, the Asia Pacific (APAC) stands as the dominant market, driven by its expansive manufacturing base for consumer electronics and automotive production, particularly in China, South Korea, and Japan. The rapid urbanization and increasing disposable incomes in emerging APAC economies fuel the demand for high-quality consumer goods, directly impacting the consumption of premium engineering plastics like Transparent ABS. North America and Europe, while slower in growth volume, command higher average selling prices due to stringent regulatory frameworks and a higher concentration of specialized, high-performance applications in the medical and aerospace sectors. Regional trends also show increasing localized production capabilities outside of Asia, driven by supply chain resilience strategies adopted post-2020, aiming to reduce dependence on single-region manufacturing hubs and ensuring quicker time-to-market for complex products.

Segment trends reveal that the Consumer Electronics application segment maintains the largest market share, driven by the persistent need for transparent components in smart devices, wearables, and large-format displays. However, the Medical segment is projected to exhibit the fastest growth rate, spurred by the global expansion of healthcare infrastructure and the mandatory requirement for sterilizable, durable, and chemically resistant transparent materials for surgical tools, monitoring equipment, and drug delivery systems. Segmentation by grade highlights a shift towards High Clarity and UV-Stabilized grades, reflecting the market’s premiumization trend where performance specifications often outweigh cost considerations. Manufacturers are increasingly differentiating their offerings based on technical specifications such as light transmittance percentage and Izod impact strength, targeting niche, high-margin applications.

AI Impact Analysis on Transparent ABS Plastics Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Transparent ABS Plastics market frequently revolve around themes of accelerated material discovery, optimization of complex manufacturing processes, and improvement in quality control metrics. Common questions include: "How can AI reduce the time required to formulate new high-clarity ABS grades?", "Can AI models predict the optimal processing parameters for injection molding Transparent ABS to minimize defects like haze or flow lines?", and "What is the role of machine learning in managing supply chain volatility for raw materials like acrylonitrile and styrene?" The overarching concern is how AI can be leveraged to maintain the delicate balance between transparency, mechanical performance, and cost efficiency that defines this specialty polymer. Users anticipate that AI integration will lead to quicker product cycles and higher yields, particularly in the difficult synthesis of truly clear, high-impact polymers.

The key influence of AI lies in its ability to analyze massive datasets related to material composition, synthesis conditions (temperature, pressure, catalyst concentration), and end-product performance characteristics. Traditional polymer R&D is highly iterative and time-consuming; AI-driven predictive modeling drastically shortens this cycle by simulating the outcome of thousands of potential formulations before laboratory synthesis is even initiated. For Transparent ABS, AI models can precisely predict the relationship between rubber particle size distribution, refractive index matching, and resultant light transmittance and haze, leading directly to optimized monomer ratios and compounding strategies. This capability significantly lowers R&D costs and accelerates the commercialization of specialized grades tailored for niche markets like ophthalmic devices or specialized security casings.

Furthermore, AI-powered systems are revolutionizing the manufacturing floor. In injection molding, deep learning algorithms analyze real-time sensor data—including mold temperature, injection speed, and pressure profiles—to identify minute deviations that could lead to optical defects or structural weaknesses in the transparent parts. By implementing predictive maintenance and closed-loop control, AI minimizes scrap rates, improves throughput, and ensures consistent quality control, which is paramount for high-tolerance components used in medical and automotive applications. The integration of computer vision systems, utilizing AI for automated defect detection (such as microscopic bubbles or discoloration), further enhances the efficiency and reliability of Transparent ABS production lines, solidifying AI's role as a core enabler of efficiency and precision in this market.

- AI drives material informatics, accelerating the discovery and optimization of new high-clarity ABS formulations.

- Predictive maintenance powered by machine learning minimizes downtime in compounding and molding operations, boosting manufacturing efficiency.

- AI enhances quality control by utilizing computer vision for real-time, automated detection of optical defects (haze, streaks, flow lines).

- Supply chain optimization through AI models improves forecasting of raw material prices and availability, stabilizing production costs for Transparent ABS.

- Simulation tools powered by AI enable virtual prototyping, reducing the need for expensive physical trials during product design.

DRO & Impact Forces Of Transparent ABS Plastics Market

The dynamics of the Transparent ABS Plastics Market are governed by a complex interplay of Drivers, Restraints, and Opportunities (DRO), which collectively shape the competitive landscape and future trajectory. The primary driver is the accelerating demand for visually appealing and highly durable materials across consumer electronics and automotive industries, seeking alternatives that offer better performance than traditional clear polymers without the cost penalty associated with specialty resins like high-grade polycarbonates. The increasing requirement for materials that combine high impact strength with excellent clarity—particularly in safety-critical and high-wear applications—continuously pushes manufacturers to innovate within the Transparent ABS segment. Simultaneously, the impact forces of technological advancements in polymerization techniques are enabling the creation of materials with enhanced optical and mechanical specifications, broadening the application scope significantly and sustaining market momentum.

However, the market faces significant restraints, most notably the inherent difficulty and high cost associated with manufacturing truly transparent ABS. Achieving clarity requires precise matching of the refractive indices of the polymer matrix (SAN) and the rubber phase (Polybutadiene), which is technically challenging and sensitive to minor variations in processing conditions, often resulting in higher production costs compared to opaque ABS or standard clear plastics like PMMA. Furthermore, competition from established, high-performance clear polymers such as Polycarbonate (PC) and various specialized acrylics remains a constant restraint, especially in applications where ultra-high heat resistance or intrinsic UV stability is mandated. The volatility of raw material prices, particularly acrylonitrile and butadiene, also introduces cost uncertainty for manufacturers, impacting pricing strategies and potentially slowing market adoption in cost-sensitive sectors.

Conversely, significant opportunities exist for market expansion and value capture. The emerging trend of smart home devices and advanced driver-assistance systems (ADAS) in vehicles presents new avenues for high-performance transparent materials, often requiring the specific balance of toughness and clarity provided by Transparent ABS. Developing sustainable and bio-based Transparent ABS variants addresses growing regulatory and consumer demands for environmentally friendly products, offering a premium differentiation strategy for leading players. Furthermore, focused research into hybrid materials and nanotechnology integration promises to enhance the material’s performance profile—specifically addressing current limitations such as surface hardness and UV degradation—thereby opening doors to applications currently dominated by glass or highly specialized engineering polymers. The successful navigation of these opportunities, coupled with the mitigation of inherent manufacturing complexities, will define the long-term success of stakeholders in this specialty market.

Segmentation Analysis

The Transparent ABS Plastics Market is segmented based on several key parameters including Grade, Application, and Manufacturing Process, reflecting the diverse requirements of end-user industries. This structured segmentation helps in understanding the varying demands for clarity, impact strength, and chemical resistance across different market verticals. Segmentation by Grade typically distinguishes between High Clarity Grade, often used in optical or display applications requiring minimal haze (less than 5%), and Standard Clarity Grade, sufficient for protective housings or non-critical cosmetic parts. Application segmentation is critical, showing distinct demand patterns from dominant sectors like Consumer Electronics (casings, light pipes) and the rapidly expanding Medical segment (diagnostic equipment components, clear packaging for sterilized goods), which have vastly different requirements regarding regulatory compliance and material purity.

The differentiation in manufacturing processes is also a crucial segmentation axis, mainly focusing on techniques used to achieve transparency, such as specialized compounding or blending with polymers like methyl methacrylate (PMMA) to form materials often referred to as MABS (Methyl Methacrylate-Acrylonitrile Butadiene Styrene). The choice of process impacts the final material properties, cost structure, and suitability for specific molding techniques. Geographic segmentation, detailed elsewhere, highlights the concentration of supply and demand, with Asia Pacific dominating consumption due to its role as the global manufacturing hub. These segmentations are vital for market participants to tailor their product offerings, marketing strategies, and R&D investments toward the most profitable and high-growth niches within the overall Transparent ABS ecosystem.

- By Grade:

- High Clarity Grade

- Standard Clarity Grade

- UV Stabilized Grade

- By Application:

- Consumer Electronics (Displays, Housings, Wearables)

- Automotive (Interior Trim, Lighting Components, Instrument Panels)

- Medical Devices (Clear Housings, Diagnostic Equipment, Syringe Components)

- Home Appliances (Blender Jars, Vacuum Cleaner Parts)

- Packaging (High-end Cosmetic and Luxury Packaging)

- Security and Safety (Clear shields, Protective Casings)

- By Manufacturing Process:

- Blending/Compounding (MABS)

- Specialized Mass Polymerization

Value Chain Analysis For Transparent ABS Plastics Market

The value chain for the Transparent ABS Plastics market begins intensely at the upstream level with the sourcing and synthesis of key petrochemical feedstocks: acrylonitrile (A), butadiene (B), and styrene (S). This upstream stage is characterized by high capital intensity and vulnerability to the volatility of crude oil and natural gas prices, directly influencing the cost structure of the final polymer. Key suppliers are major petrochemical companies and chemical producers who specialize in monomer production. The complexity arises in the intermediate polymerization stage, where manufacturers must carefully control the grafting of styrene and acrylonitrile onto the butadiene rubber matrix, followed by the specialized blending or polymerization processes (often involving PMMA or specialized SAN) necessary to achieve the requisite optical clarity while retaining core ABS toughness. Efficiency and proprietary technology at this stage are paramount for cost-effective production of premium Transparent ABS grades.

Moving downstream, the distribution channel for Transparent ABS is diverse, utilizing both direct and indirect sales models. Direct sales are predominant for high-volume, highly customized grades supplied to large original equipment manufacturers (OEMs) in the automotive and major consumer electronics sectors. This model facilitates close technical collaboration and long-term contracts. Conversely, indirect distribution, involving regional distributors, specialized compounders, and plastics resellers, caters to smaller volume purchasers, job shops, and diverse end-users in the medical and general industrial sectors. These distributors often provide value-added services such as smaller batch packaging, technical support, and localized inventory management, ensuring market penetration across fragmented application areas. The effectiveness of the distribution channel is crucial for maintaining competitive lead times and providing technical guidance on complex material processing requirements.

The final stage of the value chain involves the converters and end-users, where the raw Transparent ABS pellets are transformed, primarily through injection molding or extrusion, into finished components. Downstream profitability is heavily influenced by the conversion technology utilized and the precision required for the final product, especially for optical parts where dimensional accuracy and surface finish are critical. Efficient waste management and material recycling efforts within the downstream sector are increasingly important, driven by regulatory pressures and end-user demand for sustainable plastics. The success of Transparent ABS relies heavily on strong feedback loops within the value chain—from end-users detailing performance needs back to monomer producers—to ensure continuous material innovation tailored to evolving application demands, thus optimizing the entire sequence from feedstock to finished product.

Transparent ABS Plastics Market Potential Customers

The potential customer base for Transparent ABS plastics is broadly segmented by industry, focusing on sectors that demand a unique combination of high durability, impact resistance, and optical clarity, where failure of the component could lead to significant safety or functional issues. Primary end-users include major Original Equipment Manufacturers (OEMs) in the consumer electronics sector. These buyers utilize the material for premium casings for smart devices, clear protective layers, and internal light management components in tablets, smartphones, and wearable technology. The necessity for devices to be robust enough to withstand daily impacts while maintaining a sleek, aesthetic appearance makes Transparent ABS a preferred choice over standard glass or less impact-resistant polymers.

Another rapidly expanding customer segment is the automotive industry, specifically Tier 1 and Tier 2 suppliers involved in manufacturing interior components and advanced lighting systems. Customers here require materials that are lightweight, durable, and resistant to environmental stressors (such as temperature fluctuations and UV exposure), which is essential for instrument clusters, clear decorative trim, and specific internal lens applications. The shift towards electric and autonomous vehicles, demanding sophisticated, visually appealing interiors and sensor housing, further drives the consumption of high-specification Transparent ABS.

The third major group consists of manufacturers in the medical and healthcare sector. Buyers in this field, including producers of diagnostic equipment, surgical instruments, and laboratory consumables, prioritize materials that are chemically resistant, capable of enduring sterilization protocols (such as EtO or Gamma radiation), and possess the required optical transparency for monitoring and inspection. The demanding regulatory environment in healthcare ensures that these customers seek certified, high-ppurity grades of Transparent ABS, making them a high-value, albeit stringent, customer segment within the market ecosystem.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.5 billion |

| Market Forecast in 2033 | USD 7.0 billion |

| Growth Rate | 6.3% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | LG Chem, Chi Mei Corporation, Trinseo, INEOS Styrolution, Toray Industries Inc., SABIC, Formosa Chemicals & Fibre Corporation, Kumho Petrochemical, Versalis S.p.A., Asahi Kasei Corporation, RTP Company, Ravago Group, Teknor Apex, LyondellBasell Industries, Celanese Corporation, Mitsubishi Chemical Corporation, Sumitomo Chemical, TSRC Corporation, Denka Company Limited, Entec Polymers. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Transparent ABS Plastics Market Key Technology Landscape

The technological landscape of the Transparent ABS Plastics market is primarily defined by innovations in compounding, polymerization, and specialized blending techniques focused on optical property management. Achieving transparency in ABS is technically demanding because the rubber component (Polybutadiene, which provides impact resistance) naturally scatters light due due to differences in refractive index (RI) compared to the SAN matrix. The core technology involves highly precise synthesis methods that either modify the rubber structure or carefully match the RIs of the two phases. Specialized polymerization processes, such as continuous mass polymerization with specific catalysts, allow for fine control over particle size distribution and composition gradients, leading to optimized optical properties and minimal haze. Furthermore, the use of specialized co-monomers or additives to stabilize the RI difference across temperature ranges is critical, particularly for applications requiring performance stability in diverse environments like automotive interiors.

A prevalent and commercially successful technology involves the blending of standard ABS or SAN with clear polymers, most commonly Polymethyl methacrylate (PMMA), resulting in Methyl Methacrylate-Acrylonitrile Butadiene Styrene (MABS). This blending technology allows manufacturers to tune the balance between clarity, impact strength, and flow properties, offering a range of grades suitable for different applications. Recent technological advancements also involve the integration of nano-fillers and specialized compatibilizers to further enhance dispersion uniformity and surface properties without sacrificing clarity. These advancements are crucial for developing "high-flow" transparent grades essential for molding thin-walled, complex components common in consumer electronics, where processability is as vital as the final material performance.

Beyond material formulation, processing technologies are equally important. Sophisticated injection molding techniques, including gas-assisted injection molding and sequential molding processes, are employed to minimize internal stresses and flow lines that can compromise the optical quality of the final part. Furthermore, advancements in coating and surface treatment technologies are utilized to impart additional functionalities, such as enhanced scratch resistance (often a weakness of ABS compared to PC) and improved UV stability, particularly for exterior or long-life indoor applications. The continuous convergence of material science (optimized RI matching) and processing engineering (precise flow control) forms the backbone of the competitive technology landscape for high-performance Transparent ABS plastics, driving both yield rates and product quality in this specialized polymer market.

Regional Highlights

- Asia Pacific (APAC): APAC is the global leader in both consumption and production of Transparent ABS plastics, primarily due to the massive concentration of consumer electronics, automotive manufacturing, and rapidly expanding healthcare industries in countries like China, South Korea, Japan, and Taiwan. The region benefits from lower manufacturing costs, established petrochemical supply chains, and high demand for durable, aesthetically pleasing components in mass-market products. South Korea and Taiwan, in particular, host major petrochemical giants who are leading innovators in Transparent ABS technology. The urbanization trend and rising middle-class disposable income further solidify APAC's position as the primary growth engine for this market.

- North America: North America represents a mature, high-value market characterized by stringent regulatory requirements, particularly in the medical device and specialized aerospace sectors. The demand here is driven by advanced, niche applications that require certified, premium-grade Transparent ABS plastics. Innovation is focused on developing UV-stabilized and chemically resistant grades for high-end automotive safety systems and diagnostic equipment. While volume growth is slower than in APAC, the high average selling prices and focus on proprietary technology ensure profitability in this region.

- Europe: The European market is characterized by a strong emphasis on sustainability, circular economy principles, and high standards in automotive and luxury consumer goods design. Demand for Transparent ABS is fueled by the premium automotive sector (interior components and advanced lighting solutions) and the medical industry. European manufacturers are proactively seeking bio-based and recyclable Transparent ABS alternatives to comply with EU regulations (like REACH and upcoming plastics directives), driving research into sustainable material sourcing and end-of-life solutions.

- Latin America (LATAM) and Middle East & Africa (MEA): These regions are emerging markets for Transparent ABS, showing steady growth linked to increasing foreign direct investment in localized manufacturing and infrastructure development. LATAM demand is primarily centered on local automotive assembly and expanding household appliance markets, while MEA growth is concentrated in packaging and construction materials. Market maturity is lower, often relying on imported finished goods or standardized grades, but increasing industrialization is expected to fuel demand for specialized engineering polymers in the long-term forecast period.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Transparent ABS Plastics Market.- LG Chem

- Chi Mei Corporation

- Trinseo

- INEOS Styrolution

- Toray Industries Inc.

- SABIC

- Formosa Chemicals & Fibre Corporation

- Kumho Petrochemical

- Versalis S.p.A.

- Asahi Kasei Corporation

- RTP Company

- Ravago Group

- Teknor Apex

- LyondellBasell Industries

- Celanese Corporation

- Mitsubishi Chemical Corporation

- Sumitomo Chemical

- TSRC Corporation

- Denka Company Limited

- Entec Polymers

Frequently Asked Questions

Analyze common user questions about the Transparent ABS plastics market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is Transparent ABS and how does it achieve optical clarity?

Transparent ABS is an engineering thermoplastic offering high impact strength combined with optical clarity. Clarity is achieved through specialized polymerization or blending techniques (e.g., MABS) that ensure the refractive indices of the polymer matrix (SAN) and the rubber phase (butadiene) are precisely matched, minimizing light scattering.

How does Transparent ABS compare to Polycarbonate (PC) in application?

Transparent ABS generally offers superior stress-crack resistance and easier processing (flowability) compared to PC, often at a lower cost. However, PC typically has higher intrinsic heat resistance and superior long-term UV stability. Transparent ABS is preferred where impact resistance, flow, and cost are critical, such as in internal electronic components or consumer durable goods.

Which application segment drives the highest demand for Transparent ABS plastics?

The Consumer Electronics segment drives the highest current demand, utilizing Transparent ABS for clear protective housings, display components, and internal light pipes due to the material's excellent balance of durability, aesthetic appeal, and weight reduction capabilities essential for modern portable devices and wearables.

What are the primary restraints affecting the growth of the Transparent ABS market?

The key restraints include the technical difficulty and associated high cost of manufacturing grades with very high clarity and low haze, coupled with volatility in raw material prices (acrylonitrile and styrene), which introduces instability into the cost structure for manufacturers.

Are there sustainable or bio-based options available for Transparent ABS?

Yes, driven by global sustainability mandates and consumer demand, manufacturers are actively developing bio-based Transparent ABS alternatives, often utilizing bio-based monomers (like bio-styrene or bio-butadiene) or exploring chemical recycling processes to offer products with reduced environmental footprints.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager