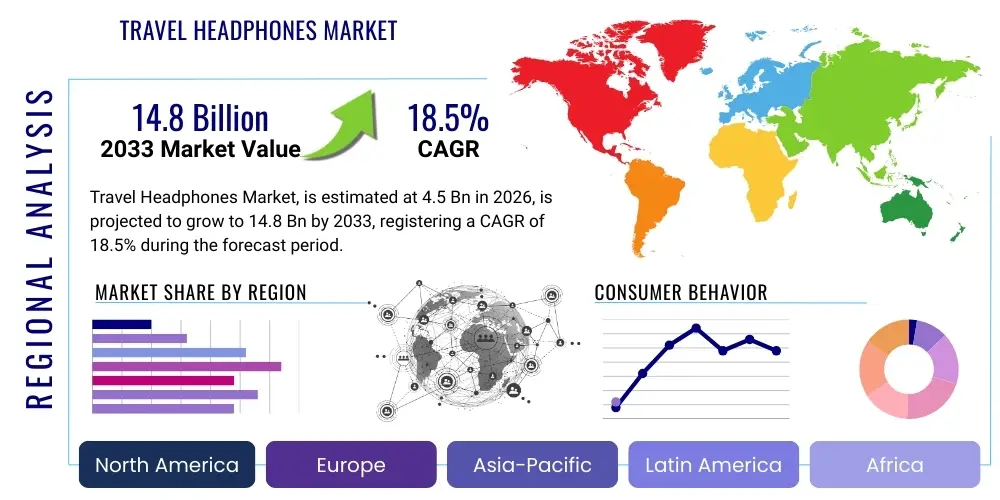

Travel Headphones Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443198 | Date : Feb, 2026 | Pages : 241 | Region : Global | Publisher : MRU

Travel Headphones Market Size

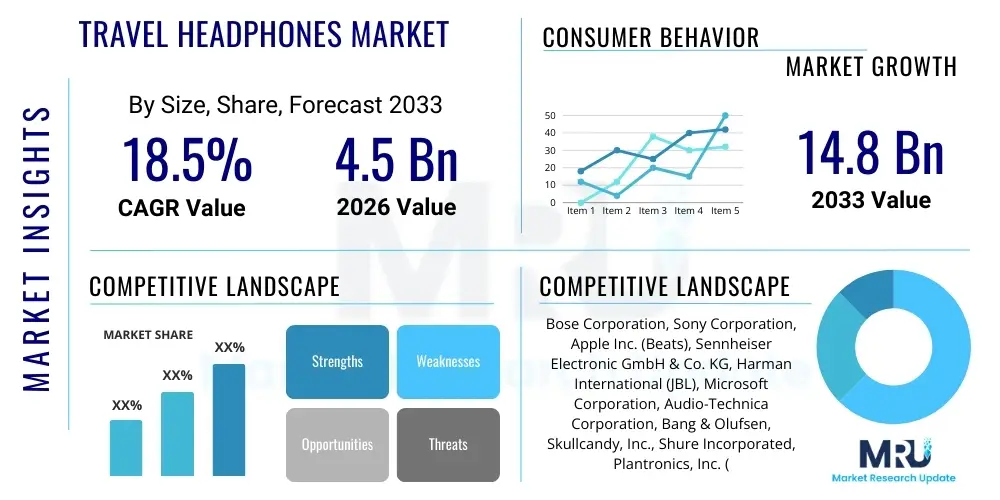

The Travel Headphones Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 18.5% between 2026 and 2033. The market is estimated at USD 4.5 Billion in 2026 and is projected to reach USD 14.8 Billion by the end of the forecast period in 2033.

Travel Headphones Market introduction

The Travel Headphones Market encompasses specialized audio devices engineered to enhance the listening experience during transit, characterized primarily by advanced noise cancellation capabilities, long battery life, and ergonomic, foldable designs. These products are crucial for reducing ambient noise in environments such as airplanes, trains, buses, and busy public spaces, providing users with high-fidelity audio consumption or necessary silence. The core value proposition of these devices is the combination of portability, durability, and superior acoustic performance optimized for noisy settings. Market growth is structurally linked to increasing global travel rates, rising disposable incomes facilitating premium electronics purchases, and the continuous technological advancements in Active Noise Cancellation (ANC) technology, making travel significantly more comfortable for frequent flyers and commuters.

The products within this market range from premium over-ear models, favored for their extensive battery life and superior noise isolation, to compact in-ear True Wireless Stereo (TWS) earbuds, preferred for their convenience and ultra-portability. Major applications span leisure travel, business commuting, and remote work scenarios where focus and auditory clarity are paramount. Benefits derived from utilizing high-quality travel headphones include improved sleep quality during long flights, reduced travel fatigue due to prolonged exposure to low-frequency engine noise, and enhanced privacy for media consumption or professional conference calls while in public. These factors collectively drive consumer interest and investment in advanced audio solutions.

Driving factors for the market include the exponential expansion of the global aviation sector and the increasing proliferation of personal media devices, such as smartphones and tablets, which necessitates high-quality portable audio accessories. Furthermore, consumer demand for sophisticated features, including spatial audio, seamless multi-device connectivity, and personalized sound profiles enabled by integrated sensors, is compelling manufacturers to innovate rapidly. Regulatory shifts promoting hearing health consciousness also influence product design, favoring volume limiting and safe listening features, thereby positioning travel headphones as essential components of modern mobility. The core objective of travel headphones—mitigating ambient noise in high-density travel environments—has never been more critical, positioning these devices as indispensable accessories for modern mobile professionals and leisure explorers alike. Market dynamics are heavily influenced by the speed of innovation in proprietary chipsets designed for highly efficient digital signal processing, which directly governs the performance and comfort level of the Active Noise Cancellation (ANC) features, considered the primary value differentiator. As air travel continues its recovery and long-haul commuting remains prevalent globally, manufacturers are strategically investing in materials research to reduce weight without compromising acoustic integrity or battery capacity, ensuring devices meet the rigorous demands of continuous, multi-day use away from conventional power sources.

Travel Headphones Market Executive Summary

The Travel Headphones Market exhibits robust expansion driven by converging business trends, intensified regional adoption, and critical segmental evolution. Business trends indicate a heightened focus on premiumization, where leading manufacturers are integrating sophisticated AI-driven ANC algorithms and sustainable material sourcing to justify higher Average Selling Prices (ASPs). Strategic partnerships between audio technology firms and major airlines or travel agencies for bundled offerings and exclusive product placements are shaping distribution dynamics. The competitive landscape is characterized by established audio giants leveraging brand loyalty and technology patents, while disruptive startups capitalize on niche segments, particularly in the lightweight TWS category optimized specifically for travel longevity and compact form factors.

Regional trends reveal Asia Pacific (APAC) as the fastest-growing market, primarily fueled by the burgeoning middle class, significant investments in transportation infrastructure, and the high adoption rate of portable electronics in countries like China and India. North America and Europe, while mature, maintain dominance in terms of overall market value due to strong early adoption of premium ANC technology and high consumer purchasing power focused on established luxury audio brands. The Latin America and Middle East & Africa (MEA) regions are showing accelerated growth, prompted by improving access to international travel and increasing digital literacy, although pricing sensitivity remains a key factor influencing product adoption in these areas. The expansion of the forecast period from 2026 to 2033 reveals a trajectory influenced significantly by infrastructural developments globally. As high-speed rail networks expand across Europe and Asia, and as air travel routes diversify, the potential addressable market for travel-specific audio solutions grows exponentially.

Segment trends underscore the dominance of the Wireless (Bluetooth) category, overwhelmingly replacing traditional wired models due to superior convenience and the decommissioning of headphone jacks in modern smartphones. Active Noise Cancellation (ANC) technology has transitioned from a high-end feature to a standard expectation, particularly within the over-ear segment, driving innovation towards hybrid ANC systems that optimize performance across a broader frequency spectrum. The in-ear segment, boosted by TWS form factors, is rapidly capturing market share, especially among younger, highly mobile demographics who prioritize minimalist design and portability over maximum battery duration, thereby diversifying product offerings across the market spectrum. A key trend driving market segmentation is the dual push towards extreme premiumization and highly functional portability. The premium over-ear segment continues to attract buyers willing to pay for maximum comfort, often integrating complex features like spatial audio, sophisticated touch controls, and personalized sound calibration.

AI Impact Analysis on Travel Headphones Market

Analysis of common user questions reveals significant interest in how Artificial Intelligence (AI) will redefine the core functionality and user experience of travel headphones. Key user concerns revolve around the efficacy of AI-enhanced noise cancellation—specifically, the ability to differentiate between critical human speech (e.g., flight announcements) and continuous background noise (e.g., engine hum). Users frequently inquire about personalized listening profiles, adaptive audio based on environmental detection, and the integration of sophisticated voice assistants that can operate reliably offline during travel. Expectations center on seamless, personalized, and context-aware audio performance that drastically improves both safety and comfort, moving beyond simple noise reduction to true intelligent acoustic management tailored to individual physiological and environmental demands. The summary of user expectations points toward a future where travel headphones serve as intelligent auditory interfaces rather than just passive listening devices, utilizing machine learning for predictive noise reduction and sound optimization.

The integration of AI is transforming travel headphones from mere noise blockers into intelligent audio companions capable of real-time environmental adaptation. Machine learning algorithms are crucial for developing next-generation Active Noise Cancellation (ANC) systems, enabling headphones to learn and predict specific noise patterns—such as the unique frequency signature of an aircraft cabin or a train carriage—to apply targeted, optimized phase inversion and achieve superior quietness compared to fixed-logic ANC. This predictive capability minimizes the common side effect of pressure build-up often associated with older ANC technologies, significantly enhancing user comfort during extended use in variable acoustic environments. Furthermore, AI facilitates selective noise transparency, allowing ambient sounds like safety announcements or conversations to pass through clearly while maintaining cancellation for disruptive background sounds, directly addressing user concerns about safety and situational awareness during transit. This intelligent audio management requires significant on-device processing power, driving demand for specialized, low-power AI chips integrated directly into the headphone architecture.

Beyond core noise reduction, AI is instrumental in personalizing the auditory experience. Advanced signal processing techniques, fueled by on-device AI chips, enable the headphones to perform rapid psychoacoustic analysis, tailoring the sound equalization (EQ) and noise reduction profile based on the user's unique ear canal geometry and perceived auditory sensitivity. This level of personalization ensures optimal sound quality and maximum effectiveness of the noise cancellation feature for every individual user, which is a major value differentiator in the premium segment. Moreover, the integration of AI-powered digital assistants is enabling advanced features such as real-time language translation for international travelers, hands-free operation for accessing flight information, and intelligent management of battery life based on anticipated usage patterns, thus fundamentally embedding the headphones into the traveler's digital ecosystem. The ability of AI to learn user habits and environmental contexts ultimately leads to a hands-off, highly optimized auditory experience, fulfilling the promise of true generative engine optimization (GEO) in consumer electronics.

- AI-Enhanced Adaptive ANC: Utilizes machine learning to dynamically adjust noise cancellation parameters based on real-time environmental input (e.g., engine noise vs. human chatter), significantly improving cancellation depth and comfort.

- Personalized Acoustic Profiles: AI algorithms analyze user ear geometry and auditory perception to create tailored sound equalization and cancellation curves, ensuring optimal individual performance.

- Contextual Awareness and Transparency: Enables selective audio pass-through for critical sounds (e.g., airport announcements) while maintaining strong background noise suppression.

- Smart Voice Assistant Integration: Facilitates offline access to travel information, navigation, and device control, often incorporating natural language processing for superior interaction quality.

- Predictive Battery Management: AI optimizes power consumption based on usage patterns and environmental conditions, extending travel-specific battery longevity.

- Real-Time Translation Capabilities: Integration of language models into high-end travel headphones assists international travelers by providing instantaneous communication assistance.

DRO & Impact Forces Of Travel Headphones Market

The Travel Headphones Market is significantly shaped by a confluence of accelerating drivers and constraining factors, balanced by emerging opportunities, all collectively influencing the intensity of market impact forces. Key drivers include the exponential increase in global leisure and business travel, necessitating devices that mitigate travel discomfort, coupled with continuous innovation in battery technology and Bluetooth connectivity standards, which make wireless solutions increasingly reliable for long journeys. The macroeconomic stability in key developed regions further supports consumer spending on high-value portable electronics, reinforcing the premium segment. Furthermore, increasing awareness about hearing health and the negative impacts of sustained noise exposure drive regulatory compliance and consumer preference towards certified noise-reduction products, acting as a structural market driver.

Conversely, restraints such as intense price sensitivity in emerging economies, coupled with market saturation in basic audio segments and the inherent high manufacturing costs associated with integrating complex, high-performance Active Noise Cancellation (ANC) circuitry, pose challenges to widespread adoption, particularly impacting smaller competitors vying for market share. The vulnerability of the supply chain to shortages of specialized semiconductor chips necessary for advanced ANC processing creates operational risks and inflationary pressures on component costs, potentially hindering pricing accessibility. Additionally, the rapid pace of TWS battery degradation over time, a fundamental concern for travelers relying on long-term performance, acts as a persistent consumer restraint that manufacturers must continuously address through improved material science and software optimization.

Opportunities for expansion are primarily concentrated around the development of specialized products tailored for niche markets, such as durable, water-resistant models for adventure travel or ultra-lightweight designs optimized for long-haul commuters prioritizing compactness. Furthermore, the integration of advanced health monitoring features, leveraging embedded sensors for tracking sleep quality or measuring atmospheric pressure changes during flights, presents a lucrative avenue for product diversification and value addition. These factors interact within a competitive landscape characterized by strong bargaining power of large consumer electronics retailers and the high threat of substitution from alternative portable audio devices, creating dynamic impact forces that compel continuous product iteration and strategic market positioning. The growing influence of corporate welfare programs providing travel accessories to employees also presents a scalable B2B opportunity for bulk procurement.

- Drivers: Growing global tourism and business travel; advancements in ANC technology; increased demand for personalized audio experiences; rapid expansion of the wireless audio segment (TWS); heightened consumer awareness of noise-induced travel fatigue and hearing health.

- Restraints: High Average Selling Price (ASP) of premium ANC headphones; market saturation in developed regions; intellectual property disputes surrounding core noise cancellation patents; concerns over electronic waste and sustainability; volatility and potential shortages in the supply of high-performance ANC chipsets.

- Opportunity: Integration of health and wellness features (e.g., biometric monitoring, altitude adjustment); expansion into underserved public transportation commuter markets; development of highly specialized, durable travel models; leveraging spatial audio technology for immersive travel entertainment; strategic entry into the corporate B2B travel accessories market.

- Impact Forces: High rivalry among existing competitors (established brands vs. disruptive TWS startups); high bargaining power of buyers due to product abundance and transparent pricing; moderate threat of substitution from lower-cost standard headphones; moderate supplier power for specialized ANC chipsets and acoustic components due to proprietary technology.

Segmentation Analysis

The Travel Headphones Market is meticulously segmented across several critical dimensions to capture the diverse requirements of modern travelers, ensuring manufacturers can target specific demographics with tailored features and pricing strategies. Key segmentation criteria include the device type, which defines the physical form factor and comfort level; the underlying technology, distinguishing between wired dependence and wireless freedom; the noise cancellation capability, which is often the primary purchase driver; and the distribution channel, dictating how consumers access the products. This comprehensive analysis allows for a granular understanding of consumer preferences, highlighting the shifts towards highly portable, feature-rich wireless earbuds and the continuous premium demand for full-sized, over-ear models offering unparalleled comfort and extended battery life for long-haul journeys. The successful navigation of these segment demands requires significant flexibility in manufacturing and product design.

The segmentation by Type, encompassing Over-ear, On-ear, and In-ear (Earbuds, including TWS), reflects a fundamental trade-off between noise isolation, comfort, and portability. Over-ear models typically dominate the long-haul travel segment due to their superior passive noise isolation and ergonomic designs suitable for many hours of continuous wear, often housing larger batteries and advanced audio components. In contrast, the exponential growth of the In-ear TWS segment is driven by urban commuters and light travelers who prioritize minimal footprint and ease of storage, with recent technological leaps ensuring their ANC performance increasingly rivals that of larger models. The On-ear segment, offering a balance between size and comfort, appeals to mid-range consumers but faces persistent pressure from advancements in both the Over-ear and In-ear categories. The segmentation by Noise Cancellation further differentiates products, where Active Noise Cancellation (ANC) systems, crucial for blocking low-frequency engine noise, command a significant price premium over basic passive noise isolation (PNC) solutions.

Segmentation based on Technology highlights the nearly complete transition to Wireless connectivity (primarily Bluetooth 5.2 and newer iterations), providing reliable range and stable connection quality, addressing past reliability concerns that once favored wired alternatives. While wired connections remain relevant in niche professional audio monitoring or for compatibility with older in-flight entertainment systems, wireless is the accepted standard for convenience and functionality in the travel sector. Furthermore, the segmentation by Distribution Channel emphasizes the critical role of E-commerce platforms, offering competitive pricing and vast product comparisons, alongside Specialty Electronics Stores and Airport Retail, where consumers frequently make impulse purchases of high-quality audio gear shortly before their journey commences, thus requiring distinct channel strategies from market participants. The End-User segmentation provides insight into feature prioritization, with business travelers demanding superior microphone quality and reliability, while leisure travelers prioritize pure comfort and multimedia consumption quality, necessitating targeted product feature sets.

- By Type:

- Over-ear: Preferred for maximum comfort, battery life, and superior noise isolation, highly utilized by long-haul travelers.

- On-ear: Mid-range offering, balancing portability and comfort, though market share is diminishing.

- In-ear (Earbuds/TWS): Dominating urban commuting and light travel segments due to ultra-portability and rapid technological advancements in miniaturized ANC.

- By Technology:

- Wired: Niche market, mainly for legacy compatibility and professional audio monitoring.

- Wireless (Bluetooth, RF): Standard market driver, emphasizing high-fidelity codecs, low latency, and energy efficiency.

- By Noise Cancellation:

- Active Noise Cancellation (ANC): Core feature defining the travel headphone segment, evolving towards adaptive and hybrid systems.

- Passive Noise Isolation (PNC): Basic physical barrier relying on ear cup or tip seal, utilized in entry-level products.

- By Distribution Channel:

- Online Retail (E-commerce platforms, Brand Websites): Key channel for price comparison, direct sales, and vast product availability.

- Offline Retail (Specialty Stores, Consumer Electronics Chains, Airport Retail): Critical for experiential purchasing, immediate needs, and premium product demonstrations.

- By End-User:

- Frequent Business Travelers: Prioritize microphone clarity, multi-device connectivity, and enterprise-grade reliability.

- Leisure Travelers: Focus on comfort, battery life, and robust multimedia consumption quality.

- Commuters: Value portability, fast charging, and moderate-to-high ANC performance for urban transit environments.

Value Chain Analysis For Travel Headphones Market

The Value Chain for the Travel Headphones Market is complex, beginning with highly specialized upstream activities centered around the design, sourcing, and fabrication of critical components, and concluding with sophisticated downstream processes involving distribution, marketing, and end-user support. Upstream activities are dominated by specialized suppliers of proprietary acoustic drivers, highly efficient battery cells, and, most critically, the semiconductor manufacturers that produce the specialized chipsets required for high-performance Active Noise Cancellation (ANC) processing and advanced Bluetooth connectivity (SoC solutions). The high cost and intellectual property surrounding these core technologies grant significant leverage to these component suppliers, influencing the overall production cost and technological capability of the final product. Manufacturers focus intensely on miniaturization and energy efficiency during the assembly phase to meet the portability demands of the travel segment, often requiring rigorous quality control to ensure component alignment does not compromise acoustic output.

Downstream activities are characterized by extensive logistical networks designed to move products efficiently across global markets, focusing particularly on high-traffic retail points relevant to travelers. Distribution channels are bifurcated into direct and indirect routes. Direct sales, typically via the brand's official e-commerce website, offer manufacturers higher margins and direct consumer data but require substantial investment in digital marketing and fulfillment infrastructure. Indirect channels, which include major global e-tailers (Amazon, eBay), large format consumer electronics stores (Best Buy, MediaMarkt), and crucial specialty retailers located in airports and high-end malls, account for the majority of sales volume. These channel partners manage localized inventory, offer face-to-face consumer demonstrations, and play a vital role in consumer education regarding complex features like advanced ANC and spatial audio, necessitating robust co-marketing efforts. Effective demand forecasting and inventory placement in high-yield airport locations are crucial for maximizing pre-travel purchase conversions.

The effectiveness of the value chain is increasingly determined by speed to market and the ability to manage complexity, particularly regarding global supply chain resilience in the face of geopolitical instability and component shortages. Quality control and rigorous testing are paramount, given the premium positioning and user expectation of durability and long-term reliability required for frequent travel use. Furthermore, post-sale services, including extended warranties and accessible customer support for troubleshooting connectivity issues or physical damage, are essential for maintaining brand reputation and driving repeat purchases in this competitive segment. The balance between maintaining quality, managing high component costs, and optimizing the multi-channel distribution strategy is critical for profitability, especially as consumer expectations around modular design and repairability continue to rise, adding complexity to the manufacturing and servicing phases.

Travel Headphones Market Potential Customers

The potential customer base for the Travel Headphones Market is highly diversified, spanning professionals whose productivity depends on auditory isolation during transit, luxury travelers seeking maximum comfort, and value-conscious commuters requiring reliable daily noise mitigation. The primary end-users are Frequent Business Travelers, who view high-quality travel headphones as essential professional tools. For this group, features such as superior microphone arrays for conference calls, simultaneous multi-device connectivity, and long-lasting, rapid-charging capabilities are prioritized, justifying investment in the highest-tier ANC models that maximize productivity and minimize distraction in unpredictable environments such as airports or hotel lobbies. These customers often base purchasing decisions on enterprise-grade reliability and integration with corporate IT infrastructure.

A second crucial customer segment comprises Leisure Travelers, particularly those undertaking long-haul international flights. This group emphasizes comfort, focusing on ergonomic design, premium materials, and maximum battery life to enjoy media or sleep undisturbed during extended journeys. While sensitive to price, this segment is increasingly willing to invest in recognized brands offering validated, high-performance ANC as a core element of a relaxed travel experience. Furthermore, the growing segment of Commuters forms a substantial potential market, especially those reliant on busy public transportation systems (subways, commuter trains). These buyers typically gravitate toward the compact, portable, and aesthetically pleasing TWS earbuds that offer effective, if sometimes less powerful, ANC at a slightly more accessible price point compared to premium over-ear systems, valuing minimal form factor and quick-access controls.

Finally, a niche but rapidly expanding segment includes Digital Nomads and Remote Workers who utilize various public spaces (cafes, co-working spaces) as temporary offices. For these customers, the travel headphone functions as a critical productivity tool, demanding reliable connectivity, exceptional clarity for video conferencing, and specialized features such as environmental awareness modes that facilitate quick, unintrusive interaction when necessary. The purchasing decision across all these segments is heavily influenced by verifiable performance metrics related to noise reduction (measured in decibels), weight, and integration capability with personal digital ecosystems (e.g., Apple ecosystem compatibility or Android fast pair features), indicating a sophisticated buyer demanding demonstrable technical value, coupled with high expectations for post-purchase customer service and warranty coverage.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.5 Billion |

| Market Forecast in 2033 | USD 14.8 Billion |

| Growth Rate | 18.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Bose Corporation, Sony Corporation, Apple Inc. (Beats), Sennheiser Electronic GmbH & Co. KG, Harman International (JBL), Microsoft Corporation, Audio-Technica Corporation, Bang & Olufsen, Skullcandy, Inc., Shure Incorporated, Plantronics, Inc. (Poly), Beyerdynamic GmbH & Co. KG, Philips (TP Vision), Anker Innovations (Soundcore), Jabra (GN Group), AKG Acoustics, Master & Dynamic, RHA Technologies, Marshall Group, Focal. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Travel Headphones Market Key Technology Landscape

The technological landscape of the Travel Headphones Market is defined by intense competition in Active Noise Cancellation (ANC) optimization, advancements in wireless connectivity, and the integration of highly efficient power management systems. The most critical technology remains ANC, which has evolved significantly from analog systems to sophisticated digital hybrid implementations utilizing multiple feedback and feedforward microphones coupled with proprietary Digital Signal Processing (DSP) chips. Modern travel headphones leverage advanced processing power to execute complex algorithms that not only cancel low-frequency drone but also effectively suppress mid-range transient noises, such as chatter, crucial for providing comprehensive acoustic isolation during travel. Furthermore, the development of lightweight, high-excursion dynamic drivers and planar magnetic technologies ensures that audio fidelity is not compromised by the extensive processing required for effective noise cancellation, meeting the high standards expected by audiophile travelers.

Connectivity standards are equally vital, with Bluetooth 5.2 and subsequent iterations driving market innovation. These latest standards offer enhanced stability, improved energy efficiency (critical for extending battery life), and support for advanced codecs (e.g., aptX Adaptive, LDAC, or LC3) that transmit high-resolution audio wirelessly, effectively closing the quality gap between wired and wireless listening experiences. The adoption of True Wireless Stereo (TWS) technology has also necessitated breakthroughs in miniaturization, requiring manufacturers to integrate all necessary components—battery, driver, ANC chip, and antennae—into incredibly small earbud housings without sacrificing performance or battery longevity. This miniaturization drive represents a significant engineering challenge and a core technological determinant of market success in the TWS segment. Security protocols and seamless integration across multiple devices are also critical connectivity features demanded by the contemporary traveler.

Beyond audio processing, key technologies include sensor integration and software intelligence. Features such as wearing detection, proximity sensors, and gyroscope/accelerometer integration facilitate smart pausing, adaptive EQ adjustments, and spatial audio capabilities, providing an immersive, three-dimensional soundscape crucial for movie consumption during flights. Power management technology, including rapid charging protocols (e.g., USB Power Delivery) and highly optimized battery chemistry, allows many travel headphone cases to hold multiple full charges, ensuring total operational time often exceeds 40 hours—a non-negotiable requirement for long international journeys. Continuous investment in materials science, particularly lightweight yet durable composites for headphone frames, contributes significantly to overall travel comfort and product longevity, thereby supporting premium pricing strategies. The future roadmap includes sensor fusion for pressure compensation and biometric monitoring capabilities, enhancing the value proposition beyond mere audio consumption.

Regional Highlights

- North America: This region maintains a strong market presence, driven by high disposable income, a culture of early technology adoption, and extensive air travel for both business and leisure. North American consumers exhibit a pronounced preference for premium brands known for robust ANC performance and seamless integration with established technological ecosystems (e.g., Apple). The mature market demands continuous innovation, particularly in AI-enhanced features, high-resolution audio support, and superior voice pick-up for remote working during travel. The regional market structure is characterized by intense competition between established US-based tech giants and specialized audio manufacturers, often leading innovation in digital sound processing.

- Europe: Characterized by a strong emphasis on quality, aesthetic design, and sustainability, the European market is a significant adopter of high-end travel headphones. Growth is fueled by extensive intra-European air and high-speed rail travel, which necessitates reliable noise mitigation solutions. Germany, the UK, and France are key contributors, favoring brands that offer a balance of exceptional audio fidelity and sophisticated noise reduction, often driven by a strong appreciation for established high-fidelity audio manufacturers. The market shows a growing preference for products complying with strict EU standards for environmental sustainability and data privacy.

- Asia Pacific (APAC): APAC is the fastest-growing region, marked by the booming middle class in China and India, rapidly improving domestic and international air connectivity, and a high mobile device penetration rate. The market here is highly diverse, ranging from extremely price-sensitive entry-level segments to robust demand for premium ANC TWS earbuds favored by young urban populations prioritizing portability and fast charging solutions suitable for dense city commuting and short-haul flights. Local manufacturers are rapidly closing the technological gap with international players, focusing heavily on TWS innovation and competitive pricing strategies.

- Latin America (LATAM): This region is an emerging market, showing steady growth propelled by improving economic conditions and increased accessibility to international travel. Adoption is gradually increasing, focusing mainly on mid-range wireless ANC products. Pricing and local distribution challenges often influence market penetration, although the demand for reliable audio isolation during long bus travel and domestic flights is substantial. Brazil and Mexico represent the largest market potential within LATAM, driven by increasing consumer electronics spending and improving retail infrastructure.

- Middle East and Africa (MEA): Growth in MEA is highly concentrated, specifically within the GCC countries, driven by significant business travel, luxury tourism, and the presence of major international airline hubs. High purchasing power in these centers translates to strong demand for ultra-premium, feature-rich travel headphones, often purchased through high-end airport retail outlets. The African sub-region shows nascent growth, largely concentrated in urban centers with increasing access to reliable consumer electronics distribution, though high import duties and fragmented logistics networks remain challenges.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Travel Headphones Market.- Bose Corporation

- Sony Corporation

- Apple Inc. (Beats)

- Sennheiser Electronic GmbH & Co. KG

- Harman International (JBL)

- Microsoft Corporation

- Audio-Technica Corporation

- Bang & Olufsen

- Skullcandy, Inc.

- Shure Incorporated

- Plantronics, Inc. (Poly)

- Beyerdynamic GmbH & Co. KG

- Philips (TP Vision)

- Anker Innovations (Soundcore)

- Jabra (GN Group)

- AKG Acoustics

- Master & Dynamic

- RHA Technologies

- Marshall Group

- Focal

Frequently Asked Questions

Analyze common user questions about the Travel Headphones market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected growth rate (CAGR) for the Travel Headphones Market?

The Travel Headphones Market is projected to experience robust growth, anticipating a Compound Annual Growth Rate (CAGR) of 18.5% between the forecast years 2026 and 2033, driven by advancements in Active Noise Cancellation (ANC) technology and increased global travel volumes.

Which technology segment dominates the travel headphone sector?

The Wireless technology segment, specifically utilizing advanced Bluetooth standards and TWS (True Wireless Stereo) formats, overwhelmingly dominates the travel headphone sector, valued for its superior portability, convenience, and extended battery life necessary for long journeys.

How is AI impacting the functionality of travel headphones?

AI is fundamentally enhancing travel headphones by enabling adaptive, real-time noise cancellation, personalized acoustic profiles tailored to individual users, and sophisticated contextual awareness features that allow critical announcements to be heard while maintaining primary noise suppression.

Which region shows the highest growth potential in the Travel Headphones Market?

The Asia Pacific (APAC) region is expected to demonstrate the highest growth potential during the forecast period. This acceleration is primarily fueled by rising disposable incomes, rapid urbanization, and significant increases in both business and leisure air travel across key developing economies like China and India.

What are the primary factors driving the demand for travel headphones?

Primary drivers include the exponential growth in global tourism and business travel, continuous technological improvements in battery efficiency and ANC performance, and increasing consumer awareness regarding the health benefits of reducing prolonged exposure to low-frequency ambient noise during transit.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager