Travel Meta-search Engine Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442275 | Date : Feb, 2026 | Pages : 246 | Region : Global | Publisher : MRU

Travel Meta-search Engine Market Size

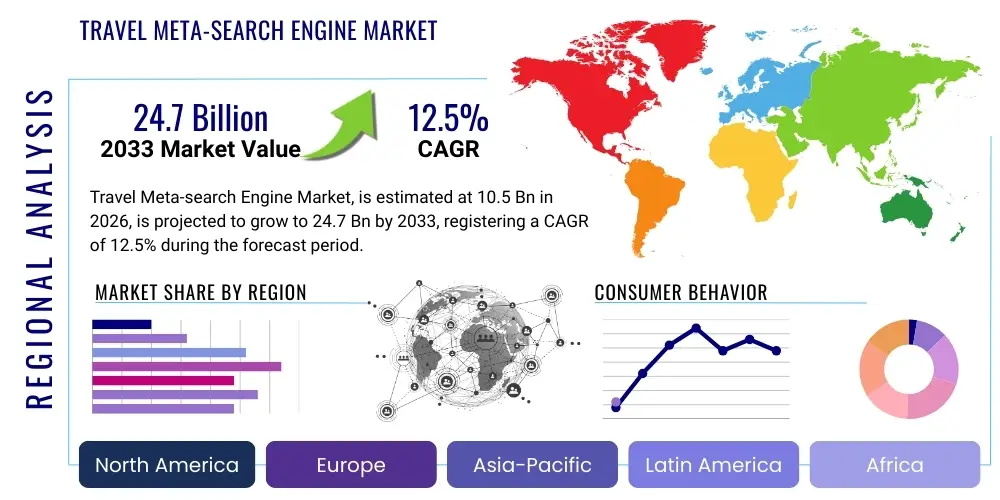

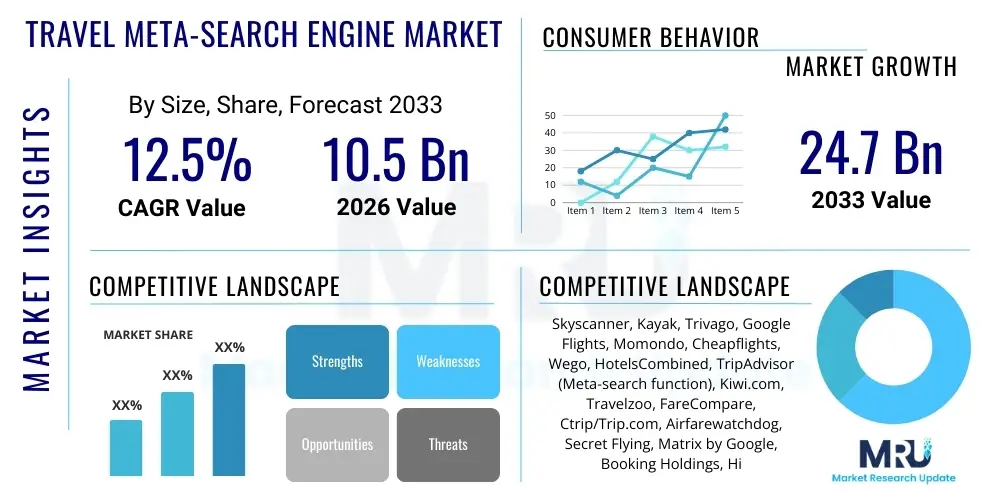

The Travel Meta-search Engine Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 12.5% between 2026 and 2033. The market is estimated at USD 10.5 Billion in 2026 and is projected to reach USD 24.7 Billion by the end of the forecast period in 2033. This substantial expansion is fundamentally driven by the increasing digital literacy among global consumers, the pervasive penetration of high-speed mobile internet, and the inherent convenience offered by meta-search platforms in comparing vast datasets from multiple Online Travel Agencies (OTAs) and direct suppliers simultaneously. The escalating desire for price transparency and optimized travel itineraries further solidifies the foundational demand structure supporting this robust market trajectory across developed and rapidly developing economies. Strategic investments in artificial intelligence and machine learning capabilities by key market participants are significantly enhancing personalization, thereby improving conversion rates and overall user engagement.

Travel Meta-search Engine Market introduction

The Travel Meta-search Engine Market encompasses digital platforms that aggregate real-time pricing and inventory data across numerous third-party sources, including OTAs, airlines, hotels, and car rental companies. These engines function as sophisticated intermediaries, providing users with a comprehensive, unbiased comparison view of travel options, significantly streamlining the complex planning and booking process. Unlike traditional OTAs that sell inventory directly, meta-search engines direct users to the original supplier or retailer's website to complete the transaction, generating revenue primarily through referral fees and contextual advertising. The core product offering is defined by efficient data aggregation, sophisticated filtering capabilities, and a commitment to displaying the most economical and suitable travel solutions based on user-defined parameters, thereby democratizing access to competitive travel pricing globally. The architecture relies heavily on robust API integrations and high-frequency data refreshing mechanisms to maintain pricing accuracy and timeliness.

Major applications of these platforms span across all core travel segments, fundamentally centered on Flight Search, Accommodation Booking, and Vehicle Rental comparison. Flight meta-search tools are perhaps the most widely adopted, offering complex routing comparisons and identifying optimal layover timings and airline combinations, often incorporating data from budget carriers and legacy airlines alike. Accommodation meta-search provides extensive filters related to amenities, location proximity, and pricing tiers across various hotel chains, independent properties, and short-term rental providers. Furthermore, the integration of package deal comparisons and activity booking is rapidly emerging as a critical application area, allowing users to build comprehensive trips entirely within the meta-search environment, significantly enhancing the value proposition beyond simple price comparison and transitioning these platforms into holistic trip planning tools.

The market benefits are multifold, addressing both consumer needs and industry requirements. For consumers, the primary benefit is unparalleled price transparency, time efficiency, and access to a massive database of options without the need to navigate multiple proprietary websites. For the industry stakeholders, meta-search platforms serve as powerful customer acquisition channels, driving qualified traffic and sales leads directly to their booking interfaces, thereby lowering overall marketing expenditures compared to proprietary pay-per-click campaigns. Key driving factors include the global shift towards mobile-first booking strategies, the rapid innovation in data processing technologies allowing for sub-second search results, and the growing consumer demand for personalized and localized travel content, making the meta-search model inherently scalable and globally relevant in the modern digital travel ecosystem.

- Market Definition: Aggregation platforms linking travelers to multiple direct suppliers and OTAs for price comparison and booking referrals.

- Core Product: Real-time comparative pricing data for flights, hotels, and car rentals.

- Major Applications: Global Flight Search Optimization, Multi-channel Hotel Price Comparison, Integrated Trip Planning Tools.

- Primary Benefits: Enhanced price transparency, significant time savings for consumers, and high-quality lead generation for suppliers.

- Driving Factors: Increased mobile usage, global expansion of low-cost carriers, and advanced API integration capabilities.

Travel Meta-search Engine Market Executive Summary

The Travel Meta-search Engine Market is undergoing accelerated evolution, characterized by intense competition among established players and disruptive innovations driven by adjacent technology giants and dedicated start-ups. Business trends indicate a strong move toward vertical integration, where leading meta-search providers are either acquiring niche comparison services or diversifying into related content areas, such as destination guides and user-generated reviews, to increase retention and expand their share of the traveler's journey beyond the transactional stage. Furthermore, the emphasis on direct booking integration is increasing, with some platforms enabling transactions directly within the meta-search interface while maintaining their referral business model, aiming to minimize user drop-off during the critical transition phase to the supplier's website. Strategic partnerships with emerging payment providers and fintech solutions are also becoming crucial for facilitating seamless cross-border transactions and loyalty program integration.

Regionally, the market dynamics reflect distinct growth patterns. North America and Europe remain the dominant regions in terms of market value, driven by high internet penetration, mature competitive environments, and sophisticated consumer engagement models. However, the Asia Pacific (APAC) region is projected to register the fastest growth rate, fueled by the burgeoning middle class in countries like India and China, rapid urbanization, and significant investments in travel infrastructure and digitalization. This APAC expansion necessitates localized content, support for diverse languages, and integration with regional mobile payment ecosystems. Conversely, growth in Latin America and the Middle East & Africa (MEA) is accelerating, largely influenced by rising outbound tourism and government initiatives aimed at promoting internal travel, though infrastructure and regulatory challenges still pose moderate hurdles to full market penetration and scaling.

Segment trends highlight the critical role of the Mobile App platform, which is rapidly outpacing web-based access in terms of booking volume and user engagement frequency, necessitating continuous optimization for smaller screens and location-based services. The Flight segment continues to dominate revenue generation due to high average transaction values and complex pricing structures that benefit most from comparison tools, though the Accommodation segment is gaining significant traction through advanced visual search and personalization algorithms. The Revenue Model segmentation emphasizes the ongoing shift towards referral fees (Cost Per Acquisition or CPA) as the primary revenue stream, reflecting the successful conversion of traffic into confirmed bookings, supplemented by high-yield, targeted advertising placements aimed at relevant travel products and services, ensuring monetized traffic quality and maximized yield per user session.

AI Impact Analysis on Travel Meta-search Engine Market

User queries regarding the impact of Artificial Intelligence on the Travel Meta-search Engine Market predominantly revolve around three key areas: hyper-personalization capabilities, the future of dynamic pricing and revenue management, and the potential displacement of human travel planners by generative AI tools. Consumers and industry professionals frequently question how AI algorithms will enhance the search experience beyond simple filtering, asking if AI can accurately predict ideal booking times, optimize complex multi-modal itineraries instantly, or suggest destinations based on nuanced behavioral data rather than explicit search inputs. There is also significant concern about the transparency of dynamic pricing models powered by machine learning and whether these tools maintain neutrality while optimizing results. The consensus expectation is that AI will fundamentally transform customer service through advanced chatbots and conversational commerce, while simultaneously driving operational efficiencies in data processing and fraud detection, making the search results faster, more relevant, and significantly more predictive of future pricing fluctuations.

- Hyper-Personalization: AI analyzes historical booking data and real-time behavioral signals to offer tailored recommendations, moving beyond basic demographic segmentation to predict user intent.

- Dynamic Pricing Algorithms: Machine Learning models forecast price volatility, providing users with predictive alerts (e.g., "Book now, price likely to rise") and optimizing supplier bid strategies.

- Conversational Commerce: Integration of generative AI chatbots and voice search capabilities allows users to interact naturally to plan complex trips, significantly improving the booking funnel efficiency.

- Data Processing Efficiency: AI accelerates the ingestion, normalization, and indexing of massive, disparate datasets from hundreds of suppliers, ensuring near-instantaneous and highly accurate search results.

- Fraud Detection & Security: AI enhances security protocols by identifying unusual transaction patterns and mitigating fraudulent activities in the referral and booking stages, protecting both users and suppliers.

DRO & Impact Forces Of Travel Meta-search Engine Market

The structural integrity and growth trajectory of the Travel Meta-search Engine Market are shaped by a complex interplay of Drivers, Restraints, and Opportunities, collectively forming the key Impact Forces. Primary drivers include the global penetration of affordable mobile devices and the increasing sophistication of data aggregation APIs, enabling platforms to provide comprehensive, timely, and integrated search experiences worldwide. Simultaneously, the persistent consumer desire for full transparency regarding pricing and availability, spurred by previous opaque booking practices, continues to push travelers toward comparison tools. Opportunities are substantial, centered on integrating non-traditional travel services such as insurance, local experiences, and sustainability ratings, transforming the meta-search engine into an indispensable ecosystem manager for the entire travel lifecycle. The strategic expansion into underserved geographical markets, particularly in emerging economies where digital infrastructure is rapidly maturing, also presents high-yield opportunities for early movers capable of successful localization.

However, the market faces notable restraints that temper growth, predominantly surrounding the intense operational and competitive landscape. The need for continuous technological investment to maintain real-time data accuracy is a significant cost factor, requiring substantial backend infrastructure maintenance and frequent updates to API integrations as supplier systems evolve. Furthermore, the aggressive competition from major tech giants, especially Google, which leverages its dominant search engine position to promote its own travel comparison products, presents a formidable constraint, potentially diverting traffic and increasing acquisition costs for independent meta-search operators. Regulatory uncertainties across different jurisdictions regarding data privacy and competitive practices (e.g., ensuring algorithm neutrality) also impose operational complexities and compliance expenditures that restrain rapid, unmitigated expansion into new territories.

The Impact Forces, therefore, create a high-stakes environment where innovation in user experience and data handling is paramount. The shift toward Generative Engine Optimization (GEO) in response to evolving search behaviors is driving core investment decisions, emphasizing the need for platforms to deliver contextual, summarized answers rather than just lists of links. Successful players must navigate the delicate balance between satisfying consumer demand for ultimate price efficiency and maintaining robust commercial relationships with OTAs and direct suppliers, who view meta-search engines as both essential partners and potential competitive threats. Strategic resilience in this market depends heavily on proprietary algorithms that provide genuinely differentiated value, moving beyond mere price comparison to offer genuinely optimized travel solutions based on complex constraint management and predictive modeling, ensuring long-term profitability amidst aggressive structural competition.

Segmentation Analysis

The Travel Meta-search Engine Market is fundamentally segmented based on the type of platform utilized, the specific service category being searched, and the revenue model adopted by the engine operators. This granular segmentation is essential for understanding the varying consumer preferences and the monetization strategies that drive market profitability across different channels and product lines. Analyzing these segments reveals that consumer engagement is migrating heavily toward mobile applications, demanding constant innovation in mobile user interface design and loading speed optimization. Furthermore, while flight comparison provides the highest initial average transaction value, the accommodation segment offers greater recurring revenue potential due to higher search frequency and the integration of value-added services such as personalized hotel recommendations and dynamic bundling. The continued dominance of the referral fee model underscores the market’s core value proposition: driving high-quality, pre-qualified traffic to conversion points. Understanding these segment dynamics is crucial for strategic resource allocation, particularly in targeting advertising spend and enhancing specific platform features to capture the highest yielding traffic segments efficiently.

- By Platform:

- Websites

- Mobile Applications

- By Service Type:

- Flights Comparison

- Accommodation Comparison (Hotels, Vacation Rentals)

- Car Rentals

- Holiday Packages & Cruises

- By Revenue Model:

- Referral Fees (Cost Per Click/Cost Per Acquisition)

- Advertising & Display Ads

- Subscription/Premium Features

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East & Africa (MEA)

Value Chain Analysis For Travel Meta-search Engine Market

The Travel Meta-search Engine Value Chain begins with the Upstream segment, dominated by content and data providers—primarily airlines, hotel chains, Global Distribution Systems (GDSs) like Amadeus, Sabre, and Travelport, and major Online Travel Agencies (OTAs) such as Booking Holdings and Expedia Group. These entities supply the necessary real-time inventory and pricing data through complex API integrations. Efficiency in this upstream phase is determined by the speed and reliability of data ingestion and normalization processes. Meta-search platforms must invest heavily in sophisticated middleware and data warehousing solutions to handle the immense volume and variety of data formats received from these diverse sources, ensuring that the displayed information is accurate and milliseconds fast. Maintaining strong, often proprietary, relationships with these key suppliers is crucial for securing preferred data access and ensuring comprehensive coverage necessary to compete effectively in the market.

The Midstream component constitutes the core operational activities of the meta-search engine itself. This involves the technological infrastructure for data processing, algorithmic optimization (ranking and filtering logic), and the development of the user interface (UI) and user experience (UX). Key midstream activities include implementing advanced machine learning models for personalization, managing large-scale server infrastructure for peak traffic handling, and continuously optimizing the platform for Answer Engine Optimization (AEO) to capture voice and complex natural language queries effectively. Revenue generation occurs here, primarily through sophisticated auction systems that manage bidding between suppliers for top placement (Cost Per Click model) or through tracking systems that confirm successful referral conversions (Cost Per Acquisition model).

The Downstream segment involves the Distribution Channel and the ultimate transaction fulfillment. Meta-search engines primarily utilize direct distribution through their proprietary websites and mobile applications. They function as a referral gateway, directing users to the supplier (OTA, airline, hotel website) where the actual booking and payment are completed. Direct revenue streams also incorporate indirect channels through affiliate marketing partnerships, search engine marketing (SEM), and strategic collaborations with travel bloggers or media outlets. Success in the downstream phase is measured by click-through rates (CTRs) to supplier sites and the subsequent conversion rates, emphasizing the platform’s ability to generate high-intent traffic. The seamless handover of user data and search context to the supplier's booking engine is a critical factor influencing conversion efficiency and overall value chain monetization.

Travel Meta-search Engine Market Potential Customers

The primary end-users and buyers of the services provided by the Travel Meta-search Engine Market are broadly categorized into two main groups: Individual Leisure Travelers and Small to Medium-sized Enterprises (SMEs) managing decentralized business travel. Individual Leisure Travelers represent the largest segment, characterized by high sensitivity to price fluctuations, extensive pre-booking research habits, and a strong reliance on mobile devices for planning. These customers seek convenience, comprehensive transparency, and the ability to compare diverse product types—flights, hotels, and increasingly, local experiences—in a single, unified interface. This segment values platforms that offer predictive insights, flexible booking options, and a trustworthy reputation for unbiased result presentation, frequently interacting with the platform multiple times before a final booking decision is made.

The secondary, yet rapidly growing, customer base includes Small to Medium-sized Enterprises (SMEs) and independent business contractors who prioritize cost control and efficiency but may not require the complex enterprise solutions offered by large corporate travel management companies (TMCs). These buyers utilize meta-search tools for quick, cost-effective bookings, relying on the platform's ability to swiftly identify the cheapest viable options without negotiating corporate rates. For this segment, the integration of itinerary management tools, expense reporting features, and the ability to easily track complex, multi-destination itineraries are critical differentiators, driving their reliance on meta-search engines as an effective, self-service alternative to traditional corporate booking channels.

Furthermore, niche potential customers include travel professionals, such as independent travel agents or boutique tour operators, who leverage meta-search engine APIs and wholesale access programs to source competitive pricing for their clients quickly and efficiently. These professional buyers require highly reliable data streams and advanced filtering options to construct customized packages. Serving these distinct customer groups necessitates platform design flexibility, ensuring the user experience is equally effective for the casual traveler seeking the lowest price and the sophisticated user requiring complex, data-driven itinerary optimization for business or specialized luxury travel planning.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 10.5 Billion |

| Market Forecast in 2033 | USD 24.7 Billion |

| Growth Rate | 12.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Skyscanner, Kayak, Trivago, Google Flights, Momondo, Cheapflights, Wego, HotelsCombined, TripAdvisor (Meta-search function), Kiwi.com, Travelzoo, FareCompare, Ctrip/Trip.com, Airfarewatchdog, Secret Flying, Matrix by Google, Booking Holdings, Hipmunk (Post-acquisition assets). |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Travel Meta-search Engine Market Key Technology Landscape

The technological infrastructure underlying the Travel Meta-search Engine Market is highly complex, relying heavily on cutting-edge data retrieval, processing, and delivery systems. At the core is the use of high-frequency application programming interfaces (APIs) and web scraping technologies to pull massive amounts of real-time data from hundreds of disparate supplier databases simultaneously. This requires highly efficient data normalization techniques to standardize varied pricing formats, currency conversions, and inventory codes into a single, cohesive result set deliverable in milliseconds. Furthermore, cloud computing infrastructure, leveraging providers like AWS, Azure, and Google Cloud, is indispensable for dynamic scalability, allowing meta-search engines to handle extreme fluctuations in search volume during peak travel periods without service degradation. Continuous integration and continuous deployment (CI/CD) methodologies are vital for the rapid iteration of features and maintaining competitive edge in user experience and data accuracy.

Advanced algorithmic science forms the second critical pillar of the technology landscape. Machine Learning (ML) and Artificial Intelligence (AI) are utilized extensively not only for predictive price modeling and identifying personalized deals but also for refining search result relevance. Natural Language Processing (NLP) is increasingly used to interpret complex, unstructured user queries (e.g., "Find me a cheap flight to a warm country in March that allows pets") and translate them into structured database requests, significantly enhancing the conversational aspect of search. This AI-driven optimization directly contributes to higher user retention and improved conversion rates by ensuring the returned results are not only comprehensive but also highly contextualized and prioritized based on inferred user intent, minimizing the cognitive load on the traveler during the decision-making process.

Finally, the front-end technology landscape is dominated by the necessity for mobile-first, lightweight design architectures. Progressive Web Applications (PWAs) and native mobile application development, utilizing frameworks that maximize speed and offline functionality, are crucial for capturing the majority of consumer traffic. Furthermore, the integration of secure payment gateways, adherence to global data privacy standards (like GDPR and CCPA), and the implementation of robust cybersecurity measures are essential technological prerequisites. The ongoing development in blockchain technology is being explored by some players, particularly for enhancing transparency in loyalty programs and streamlining cross-border financial transactions between the platform, the supplier, and the end customer, promising future efficiencies in commission reconciliation and real-time tracking of referral payments.

Regional Highlights

- North America: Characterized by high market maturity, significant investment in mobile application technology, and a competitive environment heavily influenced by major technology companies and established global players. Consumer base demands high transparency and rapid, personalized results.

- Europe: A highly fragmented market due to diverse languages and regulatory environments (e.g., EU-specific data privacy laws). Growth is steady, driven by strong intra-European travel and the success of local low-cost carrier aggregators, requiring platforms to excel at multi-currency and multilingual functionality.

- Asia Pacific (APAC): The fastest-growing region, powered by demographic expansion, increasing disposable incomes, and mobile-only internet usage, particularly in Southeast Asia and India. Localized partnerships with regional OTAs and integration with mobile wallets are critical success factors for market penetration.

- Latin America (LATAM): Growth is accelerating, focusing on outbound tourism and domestic travel digitalization. Market challenges include currency volatility and varying infrastructure quality, necessitating flexible payment options and robust mobile optimization for lower bandwidth environments.

- Middle East & Africa (MEA): Emerging market characterized by strong growth in luxury travel and government focus on tourism development (e.g., UAE, Saudi Arabia). Platforms must cater to specialized, high-yield segments and integrate complex international routing data effectively.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Travel Meta-search Engine Market.- Skyscanner (owned by Trip.com Group)

- Kayak (owned by Booking Holdings)

- Trivago (majority owned by Expedia Group)

- Google Flights / Google Hotel Search

- Momondo (owned by Booking Holdings)

- Cheapflights (owned by Booking Holdings)

- Wego

- HotelsCombined (owned by Booking Holdings)

- TripAdvisor (meta-search division)

- Kiwi.com

- Travelzoo

- FareCompare

- Ctrip/Trip.com

- Airfarewatchdog

- Secret Flying

- Matrix by Google

- Priceline.com (indirect meta-search presence)

- Lastminute.com (meta-search features)

- Liligo

- Jetcost

Frequently Asked Questions

Analyze common user questions about the Travel Meta-search Engine market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the fundamental difference between a Travel Meta-search Engine and an OTA?

A Travel Meta-search Engine aggregates price data from multiple sources, including Online Travel Agencies (OTAs) and direct suppliers, acting as a comparison tool. It generates revenue via referral fees (CPC/CPA) by directing users to the supplier's site to book. An OTA, conversely, sells inventory directly to the consumer and processes the booking transaction internally, operating as a retailer.

How is Artificial Intelligence (AI) influencing pricing transparency in the meta-search market?

AI models are primarily used to provide predictive pricing alerts, informing users of optimal booking times and anticipated price changes, which enhances transparency. However, these models also enable suppliers to utilize dynamic pricing, necessitating careful regulation to ensure meta-search platforms maintain neutrality and avoid algorithmic bias in result ranking, promoting fair comparison.

Which segment of the Travel Meta-search Engine Market is currently exhibiting the fastest growth?

The Mobile Application Platform segment is experiencing the fastest growth in terms of user engagement and transaction volume. Regionally, the Asia Pacific (APAC) market is projected to lead in revenue growth rate due to rapidly increasing internet penetration and rising middle-class travel propensity.

What are the primary revenue generation methods for Travel Meta-search platforms?

The dominant revenue mechanism is the Referral Fee model, encompassing Cost Per Click (CPC), where the platform is paid when a user clicks through to a supplier, and Cost Per Acquisition (CPA), paid upon confirmed booking. Secondary revenue streams include targeted display advertising and specialized premium subscription features.

What is the main challenge faced by smaller, independent meta-search engines?

The primary challenge is competing with the immense marketing and technological resources of giants like Google, Kayak (Booking Holdings), and Trivago (Expedia), particularly concerning search engine dominance (SEO/AEO) and securing high-speed, comprehensive API access to supplier data at competitive rates to maintain data parity and result accuracy against market leaders.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager