Triamcinolone Acetonide Nasal Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441197 | Date : Feb, 2026 | Pages : 258 | Region : Global | Publisher : MRU

Triamcinolone Acetonide Nasal Market Size

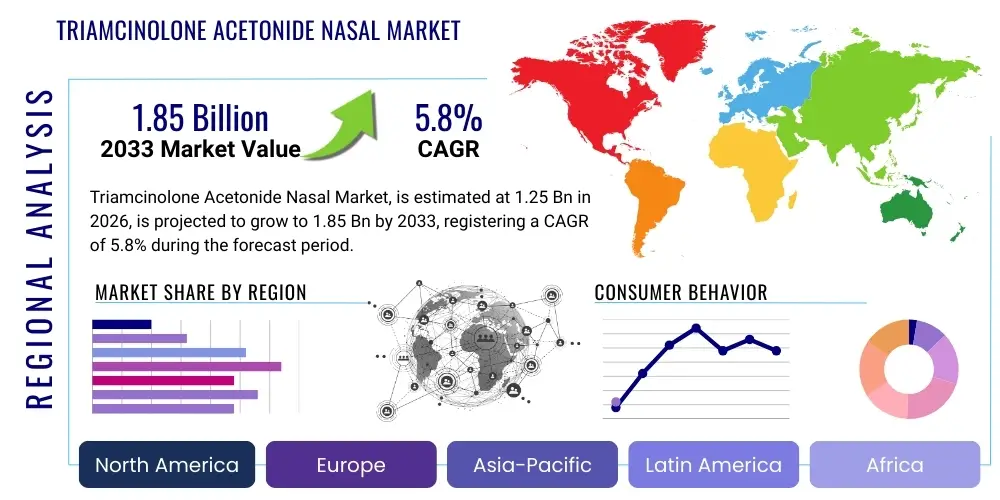

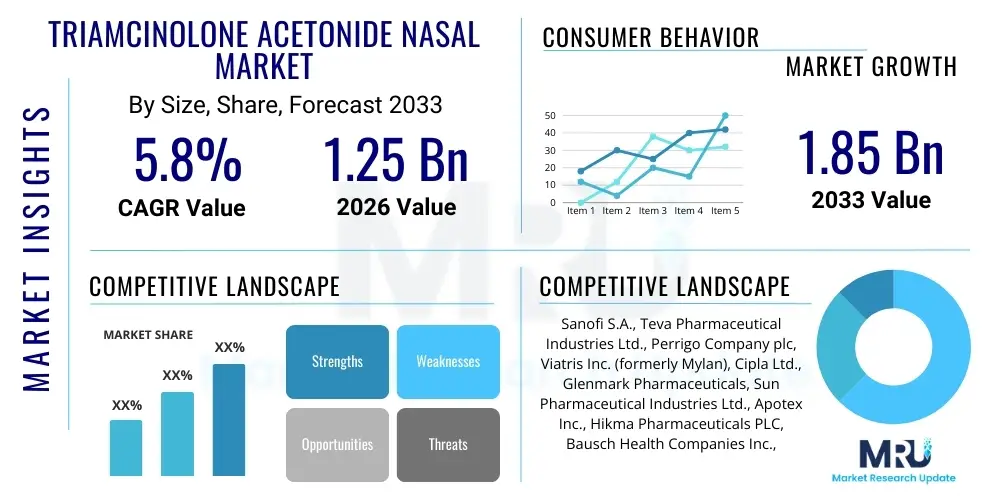

The Triamcinolone Acetonide Nasal Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 1.25 Billion in 2026 and is projected to reach USD 1.85 Billion by the end of the forecast period in 2033. This consistent, moderate growth trajectory is primarily attributable to the stable, high global prevalence of allergic rhinitis coupled with expanding patient access facilitated by widespread Over-The-Counter (OTC) availability. While the market has seen significant generic erosion, the sheer volume increase stemming from non-prescription use counteracts the price depression, leading to steady revenue appreciation over the forecast horizon. The market size reflects the combined revenues generated from both branded and generic formulations across all major global regions, including North America, Europe, and the rapidly expanding Asia Pacific, underscoring the product's fundamental role in chronic allergy management.

Triamcinolone Acetonide Nasal Market introduction

Triamcinolone Acetonide Nasal Spray is a highly efficacious synthetic corticosteroid belonging to the class of glucocorticoids, administered topically to the nasal mucosa for the localized management of symptoms associated with seasonal and perennial allergic rhinitis. Its mechanism of action involves binding to intracellular glucocorticoid receptors, which subsequently modulates the expression of genes responsible for inflammatory pathways. Specifically, it inhibits the release of inflammatory mediators such as histamine, leukotrienes, and cytokines from mast cells, eosinophils, and other immune cells, resulting in a profound reduction in nasal airway inflammation, mucosal edema, and mucus production. This powerful anti-inflammatory effect translates directly into clinical relief from cardinal symptoms including nasal congestion, rhinorrhea (runny nose), sneezing, and nasal pruritus (itching). The formulation is typically a metered-dose aqueous suspension, designed for optimal deposition within the nasal cavity to maximize local therapeutic action while minimizing systemic bioavailability, which is a key clinical benefit driving patient and physician preference over oral steroid treatments. The stability and efficacy profile of triamcinolone acetonide have positioned it as a cornerstone treatment in global allergy management guidelines, ensuring persistent demand.

The product’s market introduction and subsequent success are deeply rooted in its competitive benefits, particularly the shift to a once-daily dosing regimen and its generally well-tolerated profile, which significantly enhances patient compliance compared to older, multi-dose nasal sprays. Major applications extend beyond typical hay fever to include prophylactic treatment ahead of anticipated allergen exposure and use in managing certain cases of nasal polyposis, although its primary commercial footprint remains within the allergic rhinitis segment. Key factors fueling market growth include global demographic shifts towards urbanization, leading to increased exposure to environmental allergens and pollutants, and robust investment in consumer education, particularly by manufacturers capitalizing on the OTC channel. Regulatory approvals that validate the product's safety for long-term use further reinforce its competitive edge against perceived risks associated with chronic steroid use, which often concerns general consumers. The continuous refinement of delivery device technology, aimed at improving spray performance, taste masking, and ease of use for children and the elderly, ensures the sustained relevance and competitiveness of triamcinolone acetonide products in a therapeutic area saturated with alternatives.

The strategic conversion of triamcinolone acetonide formulations from prescription (Rx) status to non-prescription or Over-The-Counter (OTC) status in key markets represents the single most significant market driving factor in the past decade. This transition has dramatically broadened the customer base, moving the product from specialized medical consultation to general retail availability in drugstores and supermarkets, capturing a large segment of patients seeking immediate self-treatment for mild-to-moderate allergy symptoms. This shift required substantial investment in robust clinical data demonstrating safety and efficacy without medical supervision. Consequently, the commercial landscape has evolved, demanding strong brand recognition, competitive pricing, and efficient mass-market distribution networks. The benefits offered by the product—specifically its superior efficacy in reducing congestion compared to oral antihistamines and its localized action—continue to resonate strongly with both healthcare providers recommending OTC options and consumers making purchasing decisions, solidifying its dominant position among intranasal corticosteroids.

Triamcinolone Acetonide Nasal Market Executive Summary

The global Triamcinolone Acetonide Nasal Market exhibits robust volume growth, fundamentally characterized by significant generic competition and strategic efforts by branded manufacturers to maintain market share through product differentiation and focused consumer marketing. Business trends indicate a widespread adoption of lifecycle management strategies, emphasizing the introduction of advanced, patient-friendly formulations, such as preservative-free options and enhanced delivery systems, to secure pricing power and mitigate generic erosion. Critical operational trends involve fierce cost competition, pushing manufacturers to optimize global supply chains and leverage low-cost API sourcing, particularly in Asia. Moreover, strategic mergers and acquisitions focused on consolidating distribution capabilities and enhancing retail presence are key to navigating the intensely competitive OTC environment, where manufacturing scale dictates profitability.

Regionally, North America maintains its market dominance due to high allergy incidence and the profound impact of the OTC conversion, which cemented high sales volumes across retail channels. However, the fastest revenue expansion is anticipated in the Asia Pacific (APAC) region, fueled by rapid urbanization, deteriorating air quality leading to escalating allergic rhinitis cases, and substantial increases in disposable consumer income allocated to effective self-care medications. European markets remain competitive, structured primarily by national health service procurement policies that favor cost-effective generic options, necessitating manufacturers to demonstrate strong real-world evidence of cost-effectiveness and therapeutic value to secure formulary inclusion across diverse national health systems. Strategic focus for global players increasingly targets localization in APAC to capitalize on high anticipated demand growth and circumvent complex import regulations.

Segment trends unequivocally demonstrate the increasing commercial influence of the Generic and Over-The-Counter (OTC) segments. Generic formulations now command the majority of unit sales, shifting the competitive battleground toward supply chain efficiency and pricing strategy rather than clinical novelty. The distribution channel analysis highlights the accelerating importance of mass retail outlets and e-commerce platforms, which are expanding rapidly and requiring sophisticated omnichannel engagement strategies to reach the modern consumer. End-user behavior shows a clear preference for convenient, immediate, and effective self-treatment options for chronic allergy management, driving continuous high volume through non-prescription channels. Companies succeeding in this landscape are those proficient in large-scale, cost-efficient manufacturing and adept at executing targeted, compliant direct-to-consumer digital marketing campaigns.

AI Impact Analysis on Triamcinolone Acetonide Nasal Market

The transformative potential of Artificial Intelligence (AI) and Machine Learning (ML) in the Triamcinolone Acetonide Nasal market is concentrated less on the mature API innovation and more on optimizing commercial processes, enhancing patient engagement, and ensuring robust supply chain efficiency, which is paramount for a high-volume, cost-sensitive OTC product. Common user questions often explore how AI algorithms can personalize treatment, inquiring whether systems are used to tailor dosing schedules based on localized environmental data—such as real-time pollen counts and regional pollution metrics—to maximize efficacy and improve adherence among chronic users. Furthermore, there is significant interest in AI's capacity to streamline complex regulatory data submission processes, especially critical for maintaining or achieving OTC status, tasks where ML excels due to its ability to process vast, complex, and unstructured real-world evidence (RWE) datasets rapidly and accurately, demonstrating ongoing safety and efficacy profiles.

Operationally, AI is becoming indispensable for achieving precision in demand forecasting and manufacturing efficiency. By deploying sophisticated ML models to analyze historical sales, promotional impact, and external climate-related triggers, manufacturers can achieve superior accuracy in anticipating seasonal allergy peaks. This capability directly translates into optimized production scheduling, preventing costly inventory holding periods, mitigating the risk of supply disruptions during critical peak demand periods, and substantially improving working capital management—an essential advantage in an intensely genericized market. Moreover, AI-driven process control systems are being implemented in manufacturing lines to enhance quality assurance, continually monitoring minute variables like suspension particle size uniformity and the mechanical consistency of the metered-dose nozzle, ensuring every product unit meets rigorous quality and regulatory standards crucial for brand reputation and patient confidence.

On the commercial and consumer engagement front, AI plays a pivotal role in maintaining brand relevance and driving profitable repeat purchases in the competitive non-prescription sector. Companies are leveraging AI-powered conversational interfaces (chatbots) on e-commerce sites and dedicated brand applications to provide instant, detailed, and accurate answers regarding usage, side effects, and comparative product information. This approach creates a scalable, 24/7 patient support system, reducing operational costs while enhancing consumer service. Furthermore, advanced AI analytics are employed for comprehensive competitive intelligence, monitoring competitor pricing movements, market sentiment on social media, and emergent trends to provide immediate tactical insights. This allows manufacturers to dynamically adjust pricing and digital marketing campaigns, ensuring that triamcinolone acetonide formulations remain strategically positioned against major competing nasal corticosteroids.

- AI enhances predictive demand forecasting based on environmental, climatic, and epidemiological data, significantly optimizing manufacturing schedules and reducing the risk of costly seasonal stockouts.

- Generative AI tools are utilized for drafting AEO-optimized patient education materials and accelerating content creation for digital platforms, supporting streamlined regulatory submissions documentation.

- Machine learning algorithms substantially improve pharmacovigilance and post-market surveillance by analyzing vast real-world evidence and patient feedback for prompt adverse event signal detection.

- AI-driven supply chain management minimizes lead times, optimizes complex multi-regional logistics, and precisely manages inventory levels, which is crucial for high-volume OTC commodities with narrow margins.

- Personalized digital marketing campaigns driven by AI targeting improve consumer reach and conversion rates by matching advertising exposure to individual allergy profiles and geographic risk factors.

- Optimization of nasal spray formulation parameters, such as ideal particle size and suspension stability, is achieved through computational fluid dynamics and machine learning modeling, reducing R&D cycles.

- AI-powered chatbots and virtual assistants provide scalable, instant customer support, improving patient adherence by offering immediate usage instructions, dosage reminders, and troubleshooting guidance.

- Predictive maintenance schedules for sophisticated manufacturing equipment are generated by ML models analyzing operational sensor data, minimizing unexpected downtime and ensuring continuous production capacity.

DRO & Impact Forces Of Triamcinolone Acetonide Nasal Market

The market expansion for Triamcinolone Acetonide Nasal is primarily driven by the escalating global incidence of allergic rhinitis, propelled significantly by environmental factors such as climate change, which extends pollen seasons, and increased exposure to air pollutants in densely populated urban centers. This high and increasing disease prevalence ensures a constant, large demand base for effective symptomatic relief. A pivotal driving force is the regulatory approval allowing the conversion of prescription-strength triamcinolone acetonide to Over-The-Counter (OTC) status in key Western markets, drastically improving patient access by removing the necessity of a physician's visit. This regulatory shift has fundamentally altered distribution and marketing strategies, resulting in significant volume growth and expanded market reach across general retail channels. The established, favorable safety profile and proven efficacy of the medication further supports continuous consumer adoption over newer, less tested alternatives, reinforcing physician confidence in OTC recommendations.

However, the market faces intense restraints, stemming chiefly from aggressive price competition driven by the ubiquitous availability of low-cost generic versions of triamcinolone acetonide and other competitive nasal corticosteroids like fluticasone propionate and mometasone furoate. This generic erosion severely compresses profit margins for branded manufacturers and necessitates continuous investment in cost reduction and operational efficiency. Another significant restraint involves widespread patient compliance issues; improper administration technique, often due to lack of adequate guidance in the OTC setting, or unfounded patient fears regarding long-term steroid use, can lead to suboptimal therapeutic outcomes and high rates of treatment discontinuation. Furthermore, the rise of alternative allergy treatments, including systemic oral antihistamines, combination therapies, and non-pharmacological interventions, presents constant competition, forcing manufacturers to continuously reinforce the clinical advantages of localized nasal corticosteroid delivery.

Significant opportunities abound, particularly in expanding market penetration within fast-growing developing economies where diagnosis rates for allergic rhinitis are improving alongside rapid healthcare infrastructure development and rising disposable incomes, presenting a large, untapped consumer base. There is a strong product differentiation opportunity through technological innovation, focusing on advanced delivery systems designed to improve patient comfort, minimize local side effects such as mucosal irritation, and simplify administration (e.g., fine-mist, preservative-free formulations). Strategically executed educational campaigns aimed at correcting consumer misconceptions regarding nasal steroid safety and promoting correct, consistent administration techniques can significantly enhance adherence and boost perceived product value, translating directly into increased repeat purchase rates. The primary impact force accelerating market growth is the consumerization of healthcare, where individuals actively seek accessible, efficacious self-care solutions. Conversely, the most critical restraining impact force is the relentless pricing pressure exerted by large pharmaceutical procurement bodies and Pharmacy Benefit Managers (PBMs) in the prescription segments globally.

Segmentation Analysis

The Triamcinolone Acetonide Nasal market is comprehensively segmented based on several key parameters, including Product Type, Application, Distribution Channel, and End-Use, allowing for a granular analysis of market demand, competitive intensity, and optimal commercial strategy. The segmentation by Product Type distinguishes between Branded Formulations, which initially established market leadership and often carry a price premium based on established trust and specific formulation enhancements (like patented delivery systems), and Generic Formulations, which now dominate volume sales across all geographies, driving the overall market accessibility and competitive pricing dynamics, particularly in the mass retail environment following OTC switches.

The segmentation based on Application—Seasonal Allergic Rhinitis (SAR) and Perennial Allergic Rhinitis (PAR)—is crucial for strategic marketing and supply chain planning. SAR applications drive high-volume, predictable, but cyclical demand spikes correlating with allergy seasons, requiring agile inventory management and targeted promotional campaigns. PAR applications, conversely, ensure a more stable, year-round revenue base, emphasizing the necessity of treatments suitable for chronic, long-term use and high patient adherence rates. The third critical axis of segmentation is the Distribution Channel, separating the declining, but highly regulated, Prescription (Rx) channel from the explosively growing Over-The-Counter (OTC) channel, which requires entirely different sales infrastructures and marketing investments focused on brand building and retail placement.

End-User segmentation clarifies the final point of purchase, highlighting the increasing importance of retail channels. Retail Pharmacies and Drugstores serve as the primary volume drivers for OTC sales, demanding robust retail partnerships and shelf presence. Online Pharmacies and E-commerce Platforms represent the fastest-growing sub-segment, driven by consumer convenience and competitive pricing for repeat purchases of chronic allergy medication. Hospital Pharmacies maintain a niche role, focusing on institutional procurement and specialized inpatient care. Understanding the distinct requirements of these segments is vital for manufacturers to tailor pricing, packaging, and logistical strategies effectively, maximizing profitability across the entire complex global market landscape.

- By Product Type:

- Branded Formulations (e.g., Nasacort AQ, targeted at consumers valuing brand legacy and specific non-generic formulation benefits).

- Generic Formulations (Leading the market in unit volume and acting as the primary driver of market accessibility and competitive pricing).

- By Application:

- Seasonal Allergic Rhinitis (SAR - Characterized by high, concentrated demand during specific annual allergy periods, requiring seasonal advertising).

- Perennial Allergic Rhinitis (PAR - Provides stable, continuous demand, necessitating high adherence and year-round availability).

- Non-Allergic Rhinitis (NAR - A specialized application requiring physician oversight, representing a smaller, medically complex segment).

- By Distribution Channel:

- Over-The-Counter (OTC) Channel (The dominant growth channel, relying on mass consumer appeal and retail logistics).

- Prescription (Rx) Channel (Highly regulated, reliant on physician endorsement, and dictated by managed care and government formularies).

- By End User:

- Retail Pharmacies and Drugstores (The core physical distribution point for OTC and generic volume).

- Hospital Pharmacies (Procurement for institutional use and specialized patient care settings).

- Online Pharmacies and E-commerce Platforms (Leveraging digital convenience for customer retention and repeat purchases).

- By Dosage Strength:

- 55 mcg per spray (Standard adult and adolescent daily dosage).

- Lower Doses for Pediatric Use (Addressing the sensitive children's segment requiring regulatory approval for safety).

Value Chain Analysis For Triamcinolone Acetonide Nasal Market

The value chain initiates with the highly specialized and regulated upstream phase: the meticulous sourcing and chemical synthesis of the Triamcinolone Acetonide Active Pharmaceutical Ingredient (API). Given the maturity of the molecule, competitive advantage at this stage rests primarily on cost-efficient manufacturing, reliable long-term supply agreements, and stringent adherence to global Good Manufacturing Practices (cGMP). Key players strategically partner with or operate specialized chemical synthesis facilities, often situated in major Asian manufacturing hubs, to secure the necessary cost-leadership required for success in the highly genericized downstream market. Ensuring API quality and stability is paramount, as any deviations can halt the entire production process, underscoring the necessity for robust supplier audits and quality control protocols across the entire procurement lifecycle.

The midstream segment involves the complex formulation of the API into a stable aqueous microcrystalline suspension and the subsequent high-volume filling of specialized metered-dose nasal spray devices. This stage requires significant capital expenditure in dedicated, sterile manufacturing facilities and specialized expertise in colloid and suspension chemistry to ensure particle uniformity and consistent dosing across the product's lifespan. Downstream activities involve distribution, which is strategically split. For the shrinking Rx market, distribution follows traditional, tightly controlled pharmaceutical channels linked to payers and providers. For the dominant OTC segment, distribution is a logistical masterpiece, leveraging indirect networks through wholesalers and major national retail chains. The success in the OTC channel hinges on optimizing inventory levels across thousands of consumer-facing points of sale to meet volatile seasonal demand while simultaneously minimizing holding costs for a product subject to intensive generic price wars.

The final element of the value chain is focused on marketing, sales, and patient engagement. In the OTC arena, successful value realization requires significant investment in Direct-to-Consumer (DTC) advertising that reinforces brand identity, efficacy, and ease of use, directly influencing the consumer's purchasing decision at the retail shelf. For generic manufacturers, the strategy is concentrated on superior supply chain efficiency and winning centralized tenders from large retailers and group purchasing organizations (GPOs). Regulatory bodies heavily influence pricing and market access throughout the chain; centralized procurement entities, such as PBMs in the US, exert profound pricing pressure, demanding aggressive discounts. Therefore, sustainable profitability within the Triamcinolone Acetonide Nasal market is achieved only by manufacturers who master the art of maintaining impeccable product quality while executing flawless, cost-optimized operations from API synthesis through to final retail shelf placement.

Triamcinolone Acetonide Nasal Market Potential Customers

The primary cohort of potential customers for Triamcinolone Acetonide Nasal Spray encompasses the extensive global population suffering from chronic and acute allergic rhinitis, ranging from pediatric patients (typically age two and above, requiring physician guidance for initial dosing) to adults and the elderly. The core consumer segment is the adult population utilizing the product for self-medication of mild-to-moderate seasonal and perennial symptoms. These customers are proactive in their healthcare decisions, frequently utilize digital platforms for comparative research, and prioritize immediate, reliable symptom relief coupled with the convenience offered by OTC availability. Their purchasing behavior is highly sensitive to brand trust, ease of administration, and perceived value compared to oral alternatives, making effective consumer communication vital for securing repeat purchases.

A crucial secondary customer segment includes the healthcare community: primary care physicians (PCPs), allergists, and nurse practitioners. While the OTC switch has decreased the overall volume of prescriptions, these professionals remain pivotal customers as their initial recommendation validates the product’s therapeutic superiority and safety profile, especially for newly diagnosed or treatment-resistant patients. Pharmaceutical companies must continue targeted medical education focused on the product’s excellent localized safety profile and proven efficacy in comparison to competing therapeutic classes, ensuring that both branded and generic versions of triamcinolone acetonide remain top-of-mind recommendations when patients seek professional advice for escalating or complex allergy symptoms.

The third essential group comprises institutional purchasers and channel partners, including major retail pharmacy chains, large wholesalers, and managed care organizations (MCOs) and government health authorities acting as procurement agencies. For these entities, the purchase decision is fundamentally driven by cost-effectiveness, supply continuity, and inclusion on preferred drug lists or national formularies. Retail chains are particularly important as they function both as buyers (for inventory) and as competitors (through private label generic versions), necessitating sophisticated relationship management by manufacturers. Serving institutional buyers demands achieving maximum manufacturing scale and efficiency to consistently deliver high volumes at the lowest competitive price points, thereby securing long-term contracts and leveraging the benefits of guaranteed volume sales.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.25 Billion |

| Market Forecast in 2033 | USD 1.85 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Sanofi S.A., Teva Pharmaceutical Industries Ltd., Perrigo Company plc, Viatris Inc. (formerly Mylan), Cipla Ltd., Glenmark Pharmaceuticals, Sun Pharmaceutical Industries Ltd., Apotex Inc., Hikma Pharmaceuticals PLC, Bausch Health Companies Inc., Lannett Company, Sandoz (Novartis), Aurobindo Pharma, Dr. Reddy's Laboratories, Pfizer Inc., Johnson & Johnson (Kenvue), Torrent Pharmaceuticals Ltd., Wockhardt Ltd., Zydus Lifesciences, Endo International plc., Lupin Limited, Alkem Laboratories Ltd., Cadila Healthcare (Zydus), Taro Pharmaceutical Industries Ltd., Alvogen, Inc., Stada Arzneimittel AG, Mylan N.V. (Pre-merger entity), Hetero Drugs Ltd., Unichem Laboratories Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Triamcinolone Acetonide Nasal Market Key Technology Landscape

The technological landscape supporting the Triamcinolone Acetonide Nasal market is characterized by focused incremental innovation aimed at optimizing delivery efficiency and enhancing patient experience, rather than exploring novel mechanisms of action for the API. A primary technological focus involves continuous refinement of the metered-dose pump technology, ensuring exceptional dose precision and reproducibility across every actuation of the spray device, a non-negotiable requirement for regulatory compliance and patient trust, especially in the OTC environment. Advanced aerosol engineering is crucial to generate a fine, uniform mist with optimal particle size distribution (typically 3 to 10 micrometers), which maximizes drug deposition in the targeted nasal mucosa while minimizing undesirable runoff or systemic absorption, thereby boosting local efficacy and reducing potential side effects.

A major area of technological differentiation and competitive investment involves the shift towards preservative-free formulations. Conventional nasal sprays often contain antimicrobial agents like Benzalkonium Chloride (BAK), which, upon chronic exposure, can lead to mucosal irritation or damage, potentially affecting long-term patient adherence. Manufacturers are implementing sophisticated packaging technologies, such as proprietary filter systems, specialized anti-backflow mechanisms, or multi-chamber packaging, to eliminate the need for preservatives entirely. This innovation significantly improves the safety profile for chronic users, making preservative-free triamcinolone acetonide a key market differentiator, particularly in premium segments and for pediatric applications where mucosal sensitivity is higher.

Furthermore, formulation stability represents a critical technological challenge. Triamcinolone acetonide is delivered as a microcrystalline suspension, requiring sophisticated rheology and colloid science expertise to prevent phenomena like caking, aggregation, and sedimentation throughout the product's shelf life. Technological advancements in excipient selection and manufacturing processes ensure the suspension remains homogenous and easily dispersible, guaranteeing dose accuracy until the last actuation. Packaging technology also contributes significantly, employing opaque materials to shield the sensitive corticosteroid from light degradation and integrating patient-friendly designs that simplify administration instructions and improve consumer compliance, reinforcing the overall technological readiness of the product for broad market penetration.

Regional Highlights

North America, led by the vast US market, represents the largest revenue generator for Triamcinolone Acetonide Nasal products. This market dominance is structurally reinforced by exceptionally high rates of allergic rhinitis prevalence, robust consumer spending on self-care pharmaceuticals, and the successful regulatory conversion of flagship products like Nasacort to OTC status. The OTC switch fundamentally expanded the consumer base, allowing widespread distribution through non-traditional retail channels and driving massive sales volumes. Despite enduring intense price pressure from generic competitors, sustained market value is maintained through significant investment in consumer education, aggressive brand maintenance campaigns, and efficient supply chain logistics necessary to service the massive retail footprint across the US and Canada. Favorable reimbursement for prescription variants still serves specialized patient cohorts, contributing to steady overall demand.

The European market is mature and highly segmented, presenting a complex operational environment characterized by diverse national healthcare systems and stringent price controls. Western European economies (such as Germany, France, and the UK) exhibit high consumption rates driven by elevated allergy incidence, though revenue growth is often deliberately constrained by national tendering processes and formulary lists that prioritize the most cost-effective generic alternatives. Manufacturers must deploy sophisticated market access strategies demonstrating high real-world cost-effectiveness to secure placement. Central and Eastern European markets offer higher growth potential, capitalizing on improving economic conditions, rising public awareness of effective treatments, and gradual harmonization of regulatory standards, leading to increased demand for both branded and affordable generic versions of nasal steroids.

Asia Pacific (APAC) is projected to record the highest Compound Annual Growth Rate (CAGR) due to several compelling socio-economic and environmental factors. Rapid urbanization and industrialization across major economies, particularly China, India, and Southeast Asia, have drastically increased population exposure to environmental pollutants and allergens, consequently fueling the incidence of respiratory allergies. Concurrently, improving disposable incomes and expanding healthcare access are enabling more patients to afford effective treatments. Success in APAC necessitates localized manufacturing, distribution partnerships, and tailored pricing strategies to address the vast economic diversity and varied regulatory speeds across the region. Latin America and the Middle East and Africa (MEA) offer niche opportunities, particularly in Brazil, Mexico, and the GCC states, where high disposable income and advanced healthcare systems support demand for imported, high-quality branded pharmaceutical products.

- North America (U.S. and Canada): Market volume leader; driven by high allergy prevalence, deep consumer acceptance of self-care, and mature OTC distribution networks; faces intense generic price erosion.

- Europe (Germany, UK, France): Mature but structurally complex market; constrained by national healthcare system pricing and strong preference for generic cost-efficiency; opportunities in specialized and pediatric segments.

- Asia Pacific (China, India, Japan, ASEAN): Forecasted fastest growth region; accelerated by severe urbanization, environmental degradation, rising middle class disposable income, and increasing rates of diagnosis.

- Latin America (Brazil, Mexico, Argentina): Emerging growth market; characterized by improving healthcare infrastructure but high price sensitivity; relies heavily on efficient importation and local regulatory navigation.

- Middle East and Africa (MEA): Niche, high-value growth potential in the GCC (Saudi Arabia, UAE) due to high per capita income and advanced medical infrastructure supporting branded pharmaceutical imports.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Triamcinolone Acetonide Nasal Market, encompassing major pharmaceutical innovators and key generic manufacturers driving market volume and price competition.- Sanofi S.A. (Key player due to its legacy branded product, Nasacort AQ, and subsequent consumer health focus)

- Teva Pharmaceutical Industries Ltd. (Global generic market leader with extensive respiratory portfolio)

- Perrigo Company plc (Major force in the Over-The-Counter generic and private label market specialization)

- Viatris Inc. (formerly Mylan, significant generic presence globally following the Upjohn merger)

- Cipla Ltd. (Strong presence in emerging markets and generic respiratory segment leadership)

- Glenmark Pharmaceuticals (Known for respiratory innovations and robust generic presence)

- Sun Pharmaceutical Industries Ltd. (Leading Indian pharmaceutical major with global generic reach)

- Apotex Inc. (Major player in the Canadian and international generic drug market)

- Hikma Pharmaceuticals PLC (Focus on supplying high-quality generics to the MENA and US markets)

- Bausch Health Companies Inc. (Maintaining diverse pharmaceutical and healthcare product offerings)

- Lannett Company (US-based generic drug manufacturer focused on cost leadership)

- Sandoz (Novartis Group, dominant player in European generic pharmaceuticals)

- Aurobindo Pharma (Major API and formulation provider specializing in high-volume production)

- Dr. Reddy's Laboratories (Global player with strong R&D in generic formulations)

- Pfizer Inc. (Maintaining diverse allergy and respiratory portfolio presence)

- Johnson & Johnson (Kenvue - Consumer Health division focused heavily on OTC distribution and branding)

- Torrent Pharmaceuticals Ltd.

- Wockhardt Ltd.

- Zydus Lifesciences (Formerly Cadila Healthcare)

- Endo International plc.

- Lupin Limited

- Alkem Laboratories Ltd.

- Taro Pharmaceutical Industries Ltd.

- Alvogen, Inc.

- Stada Arzneimittel AG

- Unichem Laboratories Ltd.

- Hetero Drugs Ltd.

- Amneal Pharmaceuticals, Inc.

FAQ

Analyze common user questions about the Triamcinolone Acetonide Nasal market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary factors driving the growth of the Triamcinolone Acetonide Nasal market?

The primary growth drivers include the rising global incidence of allergic rhinitis, heightened by environmental pollution and climate change, and the crucial regulatory shift allowing prescription triamcinolone acetonide to be sold Over-The-Counter (OTC) in major markets, significantly boosting consumer access and sales volumes for generic and branded products.

How has the conversion to OTC status impacted the competitive dynamics?

The OTC conversion has intensified competition by increasing market entry opportunities for generic and private label manufacturers, shifting the focus from physician detailing to direct-to-consumer marketing, and drastically driving pricing pressure and volume competition, especially within the mass retail and e-commerce pharmacy segments.

Is Triamcinolone Acetonide Nasal spray safe for long-term chronic use?

Yes, Triamcinolone Acetonide Nasal spray is generally considered safe for long-term chronic use for allergic rhinitis when administered correctly at the recommended dosage, as it is a localized corticosteroid with minimal systemic absorption, leading to a highly favorable safety profile compared to systemically acting oral steroids or older nasal steroid formulations.

Which geographical region holds the largest market share for Triamcinolone Acetonide Nasal products and why?

North America currently holds the largest market share, predominantly driven by the robust U.S. consumer market, high environmental allergy prevalence rates, and effective commercialization strategies leveraged after the widespread availability of branded and generic versions as non-prescription drugs, facilitating massive volume sales.

What key technological innovations are shaping the future of nasal corticosteroids?

Future innovations focus on enhancing patient comfort and safety, primarily through the development of preservative-free formulations to reduce mucosal irritation, optimizing spray pump technology for consistent micro-mist delivery, and leveraging computational modeling (AI) to improve suspension stability and refine dosing accuracy for enhanced chronic adherence.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager