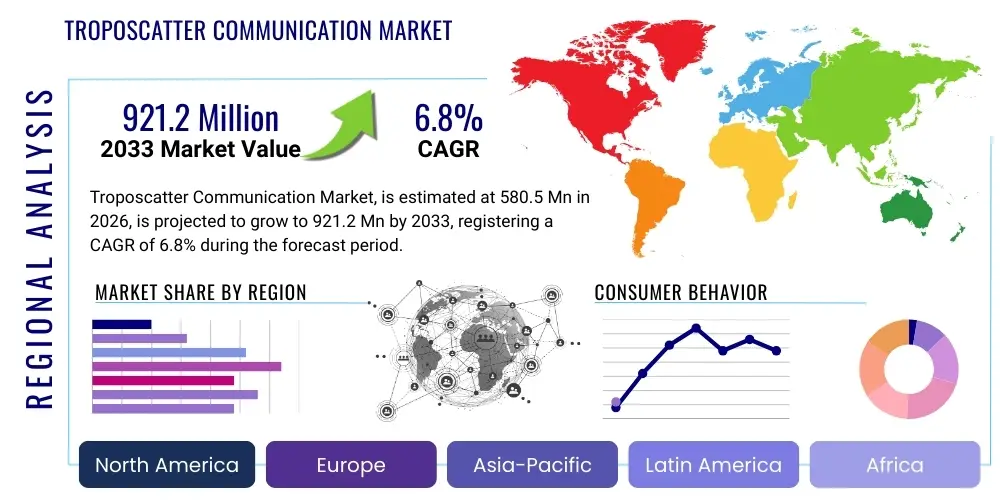

Troposcatter Communication Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441320 | Date : Feb, 2026 | Pages : 246 | Region : Global | Publisher : MRU

Troposcatter Communication Market Size

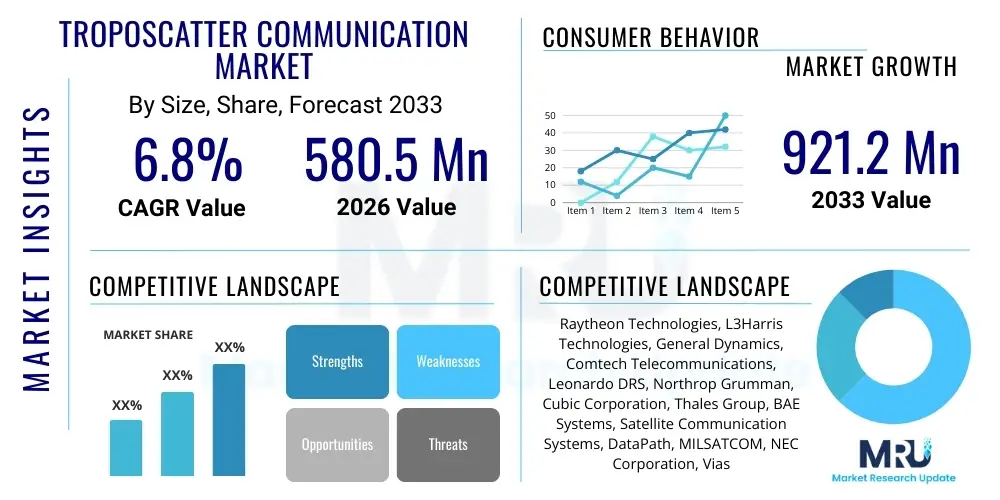

The Troposcatter Communication Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at $580.5 Million in 2026 and is projected to reach $921.2 Million by the end of the forecast period in 2033.

Troposcatter Communication Market introduction

The Troposcatter Communication Market encompasses the development, deployment, and maintenance of high-capacity, beyond-line-of-sight (BLOS) communication systems that utilize the phenomenon of microwave scattering by the Earth's troposphere. These specialized systems facilitate reliable data transmission over distances ranging from 100 to 500 kilometers without relying on intermediate terrestrial infrastructure or vulnerable satellite links. Troposcatter technology is predominantly characterized by its resilience, low latency, and ability to operate effectively in harsh environments, making it indispensable for critical infrastructure and strategic military operations where conventional communication methods are often impractical or too susceptible to interference.

Major applications of troposcatter systems span across military and defense communications, disaster recovery operations, offshore platform connectivity, and the establishment of reliable backbone links in remote areas lacking fiber optic or conventional microwave infrastructure. The product range typically includes high-power amplifiers (HPAs), specialized large parabolic antennas, digital signal processing (DSP) modems optimized for scatter channel characteristics, and integrated network management software. These systems are designed for rapid deployment and high availability, supporting data rates that have significantly increased due to technological advancements in digital modulation techniques and adaptive coding schemes.

The driving factors for market expansion include the increasing demand for secure, high-bandwidth communications in theater operations, the necessity for robust backup communication systems in civilian emergency response scenarios, and ongoing technological modernization efforts by global defense agencies. Furthermore, the inherent resilience against physical attacks and jamming, coupled with advancements in making systems more portable and energy-efficient, solidifies the niche role of troposcatter communication as a vital component in modern, heterogeneous communication architectures. The continuous refinement of spectral efficiency and data throughput capabilities remains a core focus for leading market players.

Troposcatter Communication Market Executive Summary

The Troposcatter Communication Market is poised for substantial growth, driven primarily by escalating geopolitical tensions and the resultant increased spending on resilient military command and control systems globally. Business trends indicate a shift towards digitized, compact, and software-defined troposcatter systems that offer higher data throughput and mobility compared to legacy analog platforms. Strategic collaborations between defense contractors and specialized telecommunications firms are defining the competitive landscape, focusing on integrating advanced anti-jamming techniques and utilizing advanced MIMO (Multiple-Input Multiple-Output) antenna technology to optimize link performance in challenging conditions. The market is witnessing robust investment in R&D to enhance system portability, reduce power consumption, and enable seamless integration with existing IP networks, thereby expanding its utility beyond purely military applications into critical commercial sectors like maritime and energy infrastructure.

Regionally, North America maintains market dominance due to high defense spending, particularly by the U.S. Department of Defense, and the presence of major technology providers specializing in BLOS solutions. However, the Asia Pacific (APAC) region is projected to exhibit the fastest growth, fueled by the modernization of armed forces in countries like China and India, alongside significant investments in regional telecommunications resilience initiatives. Europe also represents a strong, mature market, driven by NATO requirements for interoperable, secure tactical communications. Market fragmentation is moderate, with several key players competing through technological differentiation and system customization tailored to specific geographic and operational requirements.

Segment trends highlight the dominance of the Military & Defense end-user segment, which accounts for the vast majority of deployed systems and revenue, emphasizing fixed and transportable configurations. Based on capacity, the high-data-rate segment is experiencing accelerated adoption, driven by the need to transmit large volumes of sensor data, high-definition video, and complex C4ISR (Command, Control, Communications, Computers, Intelligence, Surveillance, and Reconnaissance) information. Furthermore, the rising awareness of cyber resilience necessitates that new troposcatter installations incorporate stringent security protocols and encryption capabilities, pushing the market towards advanced digital modem technology that offers superior spectral efficiency and layered protection against electronic warfare threats.

AI Impact Analysis on Troposcatter Communication Market

User queries regarding the intersection of Artificial Intelligence (AI) and the Troposcatter Communication Market frequently revolve around optimizing link performance, predicting propagation conditions, and automating network management in dynamic environments. Key themes highlight expectations that AI can significantly mitigate the inherent challenges of troposcatter—such as fading, multipath interference, and sensitivity to meteorological conditions—by dynamically adjusting transmission parameters like power levels, modulation schemes, and antenna alignment in real time. Concerns center on the security implications of integrating AI into military-grade communications and the need for explainable AI models to ensure reliable decision-making in critical defense scenarios. Overall, users anticipate that AI will transition troposcatter systems from static, resource-intensive deployments to agile, self-optimizing communication assets, maximizing spectral efficiency and minimizing operator intervention, thereby substantially improving network resilience and availability.

- AI algorithms are crucial for real-time channel equalization and mitigation of atmospheric fading effects, maximizing data throughput and link stability.

- Machine learning models predict tropospheric propagation losses based on meteorological data inputs (e.g., temperature, humidity, refractivity index), optimizing resource allocation pre-emptively.

- AI-driven network management systems automate fault detection, link restoration, and dynamic bandwidth allocation across complex, dispersed troposcatter networks.

- Deep learning techniques enhance signal processing capabilities, enabling better extraction of weak signals from noise and increasing the usable range of systems.

- Predictive maintenance analytics, powered by AI, minimize system downtime by forecasting component failures in high-power amplifiers and cooling units.

- AI facilitates cognitive electronic warfare capabilities, allowing systems to autonomously detect and counter sophisticated jamming attempts by adapting frequency hopping patterns and beamforming.

- Automated antenna steering and tracking systems utilize computer vision and ML to maintain optimal alignment in rapidly deployed or mobile platforms, critical for transportable systems.

- AI integration supports the goal of developing truly software-defined radios (SDR) for troposcatter, enabling rapid system configuration updates and mission flexibility.

DRO & Impact Forces Of Troposcatter Communication Market

The Troposcatter Communication Market is heavily influenced by a combination of strong drivers, technological restraints, and significant opportunities, with underlying forces dictating market evolution. The principal drivers include the undeniable need for highly resilient, secure, and non-satellite-dependent communication links for military and emergency response units, coupled with the geographic limitations of traditional line-of-sight and fiber infrastructure in remote territories. Conversely, the market faces key restraints stemming from the historically high initial deployment costs, the substantial power consumption required for high-power amplification, and the spectral inefficiency of older analog systems, which limits data rate capacity relative to modern fiber alternatives. Opportunities arise from technological advancements, such as miniaturization, development of solid-state HPAs, and the integration of highly sophisticated digital signal processing and MIMO technologies, which significantly improve link performance and reduce the total cost of ownership. These forces create a dynamic environment where resilience and reliability are prioritized over marginal cost savings, especially in mission-critical applications.

Impact forces are heavily skewed toward government policies and defense budgets globally. High levels of global instability compel nations to invest in secure, redundant communication systems, directly fueling demand for troposcatter solutions. The competitive pressure from emerging high-throughput satellite constellations (e.g., LEO satellites) acts as a moderate countervailing force, pushing troposcatter manufacturers to continually innovate on data rate and mobility to maintain competitive relevance. Furthermore, standardization and interoperability requirements among allied military forces (like NATO members) drive product development towards modular and scalable architectures. Environmental regulations concerning energy efficiency and electromagnetic emissions also marginally impact product design, forcing manufacturers to develop more efficient power systems and advanced filtering techniques.

The underlying impact forces of supply chain resilience and component availability also play a crucial role. Since troposcatter systems rely on highly specialized components, including very high-power transistors and specialized RF components, geopolitical events impacting the semiconductor supply chain can delay production and increase costs. The drive for domestic manufacturing and supply independence, particularly in North America and Europe, is a response to this vulnerability, influencing long-term procurement strategies and market direction. The persistent threat of electronic warfare ensures that the technological imperative for robustness and anti-jam capability remains the most significant long-term market driver, securing the niche existence of troposcatter technology.

Segmentation Analysis

The Troposcatter Communication Market segmentation provides a granular view of revenue streams based on system configuration, end-user type, capacity, and component technology. This analysis is essential for understanding where investment and growth are concentrated within this specialized telecommunications sector. The configuration segment, defining system mobility, clearly illustrates the foundational needs of the primary end-user base—the military—with fixed and transportable systems dominating due to their high power and reliability requirements in persistent deployments. The End-User analysis confirms the market's high dependency on defense procurement, although critical non-military sectors are beginning to adopt the technology for disaster response and remote industrial connectivity. Capacity segmentation reflects the ongoing modernization trend, moving toward higher digital data rates required for contemporary data-intensive applications such as video surveillance and real-time C4ISR data transmission.

- By Component:

- Antennas (Large parabolic dishes, specialized arrays)

- High Power Amplifiers (HPAs) (Solid State Power Amplifiers (SSPAs), Traveling Wave Tube Amplifiers (TWTAs))

- Modems and Baseband Units (Digital signal processors, adaptive equalizers)

- Radio Frequency (RF) Units (Up-converters, Down-converters, Low Noise Amplifiers (LNAs))

- Ancillary Equipment (Power supplies, cooling systems, environmental controls)

- By Configuration:

- Fixed Systems (Permanent installations for backbone communications)

- Transportable Systems (Shelter-based or trailer-mounted for tactical and rapid deployment)

- Portable Systems (Man-pack or vehicle-mounted for highly mobile applications)

- By Capacity/Data Rate:

- Low Capacity (Up to 4 Mbps, typically older or highly mobile systems)

- Medium Capacity (4 Mbps to 16 Mbps, common for voice and basic data)

- High Capacity (16 Mbps and above, utilizing MIMO and advanced digital techniques for broadband data and video)

- By End User:

- Military & Defense (Command and control, tactical links, secure C4ISR)

- Telecommunication Carriers (Remote backbone links, emergency redundancy)

- Disaster Management & Emergency Response (Temporary high-capacity links)

- Oil, Gas, and Maritime (Offshore platform connectivity, remote monitoring)

Value Chain Analysis For Troposcatter Communication Market

The value chain for the Troposcatter Communication Market is highly specialized, beginning with the upstream supply of sophisticated electronic components. This stage involves manufacturers of high-power semiconductor devices (such as GaN and GaAs), precision RF components, and specialized large parabolic antenna fabrication materials. Research and development activities, often driven by government funding and specific military requirements, form a critical upstream component, focusing on improving spectral efficiency, power output, and system miniaturization. Dependence on a limited number of suppliers for critical high-power components presents a structural vulnerability, necessitating strategic sourcing and domestic production capabilities for prime contractors.

The midstream of the value chain is dominated by system integrators and prime contractors who design, assemble, and rigorously test the integrated troposcatter terminals. This phase involves complex digital signal processing (DSP) implementation, system software development (including AI algorithms for link optimization), and compliance testing against stringent military standards (MIL-STD). Distribution channels are primarily direct, particularly in the defense sector, where procurement is handled through long-term contracts and direct negotiation with government agencies and defense ministries. The highly customized nature of these systems means indirect sales channels are minimal, typically reserved for specialized maintenance and aftermarket support providers.

Downstream analysis focuses on deployment, operational support, and maintenance. Given the mission-critical nature of the technology, extensive training, field services, and long-term support contracts are major revenue contributors. End-users, primarily military and defense organizations, demand extremely reliable and secure systems, driving continuous upgrade cycles and hardware refresh programs. The feedback loop from operational deployment back to R&D is crucial, as real-world performance data guides the next generation of technological improvements, focusing on mobility, resilience in extreme weather, and enhanced data security features. This concentrated distribution model ensures high margins but limits market access to providers with significant security clearances and technological expertise.

Troposcatter Communication Market Potential Customers

The primary customers for troposcatter communication systems are governmental and quasi-governmental entities requiring non-conventional, highly resilient communication pathways where physical infrastructure is infeasible or prone to failure. The dominant end-users are global defense forces, including major branches like the Army, Navy, and Air Force, who utilize these systems for beyond-line-of-sight tactical communication, secure command and control links between fixed bases, and establishing reliable communication bridges during large-scale military exercises or deployments in contested territories. These buyers prioritize system security (encryption standards), mobility, rapid deployment capability, and compatibility with existing tactical network infrastructure. Procurement decisions are heavily influenced by national security doctrines and long-term defense spending plans.

A secondary, yet growing, customer base includes national disaster management agencies (e.g., FEMA equivalents) and international aid organizations. These entities require high-bandwidth communication capabilities that can be rapidly established immediately following catastrophic events, such as hurricanes or earthquakes, when conventional cellular networks and fixed communication lines are incapacitated. The resilience of troposcatter makes it ideal for these temporary, mission-critical recovery efforts. Furthermore, the commercial sector, specifically large energy companies managing remote oil and gas exploration sites, large-scale mining operations, and expansive maritime fleets, represents a niche market. These customers purchase troposcatter systems to provide robust, high-availability data links from isolated installations back to centralized operational centers, ensuring continuous monitoring and control independent of vulnerable satellite bandwidth or prohibitive fiber installation costs.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $580.5 Million |

| Market Forecast in 2033 | $921.2 Million |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Raytheon Technologies, L3Harris Technologies, General Dynamics, Comtech Telecommunications, Leonardo DRS, Northrop Grumman, Cubic Corporation, Thales Group, BAE Systems, Satellite Communication Systems, DataPath, MILSATCOM, NEC Corporation, Viasat, IAI (Israel Aerospace Industries), Ultra Electronics, Airbus Defence and Space, Codan Communications, Hughes Network Systems, Gilat Satellite Networks |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Troposcatter Communication Market Key Technology Landscape

The technological landscape of the Troposcatter Communication Market is undergoing a rapid transition from legacy analog systems to highly sophisticated digital platforms, primarily driven by the need for increased data capacity and better resilience against electronic warfare. A key innovation is the adoption of Multiple-Input Multiple-Output (MIMO) technology, which utilizes multiple antennas at both the transmitting and receiving ends to exploit the multipath characteristics inherent in the troposcatter channel. MIMO fundamentally changes the physics of communication by turning potential interference paths into additional, usable data streams, thereby significantly boosting spectral efficiency and data rates—often achieving an order of magnitude increase over legacy single-channel systems. This enables the transmission of modern bandwidth-intensive military and surveillance data.

Another crucial technological development involves the transition from traditional Traveling Wave Tube Amplifiers (TWTAs) to Solid State Power Amplifiers (SSPAs), frequently utilizing Gallium Nitride (GaN) semiconductor technology. GaN-based SSPAs offer several advantages: they are smaller, lighter, require less cooling, consume less power, and exhibit greater linearity and reliability. While TWTAs still offer higher peak power in certain legacy fixed deployments, SSPAs are critical for enabling the development of truly transportable and portable troposcatter systems that can be rapidly deployed in theater. Furthermore, these solid-state solutions contribute substantially to reducing the overall footprint and maintenance burden of the communication terminals, a major requirement for tactical units.

The market also heavily utilizes advanced Digital Signal Processing (DSP) and Software-Defined Radio (SDR) architectures. SDR allows for rapid reconfiguration of modulation, coding schemes, and frequency bands, enabling systems to adapt dynamically to changing atmospheric conditions or hostile interference environments. Advanced forward error correction (FEC) codes and adaptive equalization algorithms are integrated into DSPs to effectively combat the severe fading and delay spread characteristic of the troposcatter channel. The convergence of these technologies—MIMO, GaN SSPAs, and adaptive DSP/SDR—is defining the performance benchmarks for the next generation of resilient beyond-line-of-sight communication systems, moving the technology toward becoming a high-throughput, low-latency alternative to satellite links in specific regional theaters.

Regional Highlights

Regional dynamics heavily influence the adoption and growth trajectory of the Troposcatter Communication Market, primarily dictated by defense budgets and strategic necessity for resilient communication.

- North America: This region holds the largest market share, predominantly driven by the extensive procurement programs of the U.S. Department of Defense (DoD). High defense spending, commitment to C4ISR modernization, and the presence of leading global defense contractors (such as Raytheon and L3Harris) ensure continued dominance. The emphasis here is on secure, high-capacity, mobile tactical systems that integrate seamlessly with joint force communication structures.

- Europe: The European market is stable and mature, fueled by NATO requirements for interoperable, secure tactical communications across member states. Countries like the UK, Germany, and France are investing heavily in modernizing their troposcatter infrastructure, often prioritizing transportable systems for expeditionary forces and rapid response capabilities.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing region. This acceleration is attributed to rising geopolitical tensions, leading countries like China, India, Japan, and Australia to significantly increase defense spending and focus on enhancing communications resilience, particularly in expansive maritime and island environments where conventional infrastructure is lacking.

- Middle East & Africa (MEA): Growth in MEA is spurred by ongoing regional conflicts and the need for communication infrastructure in remote, underserved areas for military and oil & gas operations. Procurement is often tied to technology transfer agreements and involves tailored solutions for extreme desert environments.

- Latin America: This region represents a smaller but expanding market, primarily focusing on utilizing troposcatter technology for border security, disaster relief efforts, and providing essential communication links in geographically challenging terrains such as the Amazon basin, where fixed infrastructure deployment is prohibitively complex.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Troposcatter Communication Market.- Raytheon Technologies

- L3Harris Technologies

- General Dynamics

- Comtech Telecommunications

- Leonardo DRS

- Northrop Grumman

- Cubic Corporation

- Thales Group

- BAE Systems

- Satellite Communication Systems

- DataPath

- MILSATCOM

- NEC Corporation

- Viasat

- IAI (Israel Aerospace Industries)

- Ultra Electronics

- Airbus Defence and Space

- Codan Communications

- Hughes Network Systems

- Gilat Satellite Networks

Frequently Asked Questions

Analyze common user questions about the Troposcatter Communication market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary advantage of troposcatter communication over satellite links?

The main advantage is resilience, security, and low latency. Troposcatter links are inherently difficult to jam or intercept compared to satellites, offering a highly secure, non-vulnerable communication path crucial for tactical military operations and disaster recovery scenarios where satellite access may be denied or compromised.

How far can modern troposcatter systems transmit data reliably?

Modern high-capacity troposcatter systems typically provide reliable communication over ranges extending between 100 kilometers and 500 kilometers, depending on factors such as antenna size, transmitted power, terrain, and atmospheric conditions, operating in a beyond-line-of-sight mode.

What role does MIMO technology play in the Troposcatter Market?

Multiple-Input Multiple-Output (MIMO) technology is critical for modern troposcatter, utilizing multiple antennas to exploit multipath propagation. This significantly increases spectral efficiency and data throughput, allowing systems to support high-bandwidth applications like real-time video and C4ISR data transmission over challenging channels.

Which end-user segment drives the majority of demand in this market?

The Military & Defense segment is the primary driver of demand. Defense agencies rely on troposcatter for secure, resilient, and non-satellite-dependent communication links for tactical command and control operations, particularly in remote or contested geographical theaters.

Are troposcatter systems vulnerable to external interference or weather?

Troposcatter systems are designed to be highly resilient against jamming (due to focused beams and anti-jamming techniques) but are naturally sensitive to severe weather conditions (e.g., heavy rain, temperature inversions) that affect tropospheric scatter. Modern systems use advanced adaptive coding and AI-driven link adaptation to mitigate these fading effects dynamically.

The detailed analysis of the Troposcatter Communication Market structure reveals a niche but technologically intensive sector driven by global security demands. The projected growth reflects sustained investment in resilient BLOS capabilities across defense modernization initiatives worldwide. The shift toward digital, AI-enhanced, and solid-state systems defines the future trajectory, promising higher throughput and increased mobility, further cementing troposcatter's role as a vital component of heterogeneous communication networks. The market remains consolidated around key defense contractors capable of delivering mission-critical, high-reliability solutions to government and military clientele.

Technological differentiation, specifically in the areas of MIMO integration and GaN-based power amplification, is essential for maintaining competitive advantage. Companies that successfully bridge the gap between high power output and increased portability will capture significant market share, particularly in the APAC and European tactical communication sectors. Strategic R&D focused on software-defined architectures will enable faster deployment and greater operational flexibility, crucial features for next-generation military requirements. Furthermore, extending troposcatter reliability for commercial applications, such as connecting remote energy infrastructure, represents a critical adjacent growth opportunity outside the dominant defense segment. The market's resilience is intrinsically linked to geopolitical uncertainty, ensuring sustained governmental demand for robust communication independence.

Future market expansion is contingent on addressing historical limitations, particularly high operational expenditure related to power consumption and the complexity of maintenance. Innovations that simplify field deployment and reduce the reliance on specialized ground crews will lower the barrier to entry for smaller defense agencies and increase adoption in disaster management applications. The market environment is characterized by high barriers to entry due to specialized technology, stringent regulatory compliance, and the necessity for deep integration with existing governmental communication protocols. Successful players will continue to leverage long-standing relationships with defense ministries while proactively investing in AI-driven link optimization to guarantee maximal uptime and data integrity under the most demanding operational circumstances.

The integration of advanced security features, including quantum-resistant encryption methodologies, is becoming paramount for defense contractors operating within this sensitive domain. As communication systems become increasingly networked, troposcatter must not only provide physical resilience but also cyber resilience. Market growth is therefore inseparable from investments in cybersecurity protocols embedded directly within the modem and baseband units. The long-term outlook remains positive, supported by the strategic mandate of major world powers to maintain communication redundancy independent of potentially vulnerable orbital assets, ensuring that troposcatter technology remains a core pillar of strategic military telecommunications.

The competitive landscape is defined by continuous product evolution. Key players are aggressively pursuing contracts for system replacement and modernization, particularly targeting the overhaul of legacy analog systems deployed decades ago. This replacement cycle represents a major revenue opportunity throughout the forecast period. Moreover, the trend towards smaller, tactical communications units has driven innovation in antenna design, moving away from massive fixed installations toward rapid-erect, smaller footprint antennas that maintain high gain. This portability enhancement widens the application scope for troposcatter, moving it closer to the tactical edge of operations. Governments globally are increasingly prioritizing systems that can operate in congested electromagnetic environments, necessitating advanced filtering and interference cancellation technologies inherent in the newest product offerings. This technological leap ensures the sustained relevance of troposcatter in the digital battlefield ecosystem.

Regional procurement trends in APAC are accelerating faster than historical forecasts due to heightened tensions in the South China Sea and along sensitive land borders, necessitating immediate deployment of resilient C4ISR systems. This demand surge is prompting significant technology transfer discussions and local manufacturing agreements. In contrast, the North American market focuses on incremental upgrades and developing cross-platform interoperability standards, ensuring that newly deployed troposcatter terminals can communicate effectively with existing satellite and terrestrial backbones. Understanding these nuanced regional technology demands—from high mobility in APAC to high interoperability in North America—is crucial for market stakeholders aiming to optimize their product portfolios and capture specialized segments.

The market faces external pressure from emerging 5G and 6G standards being adapted for military use (Mil-5G), which offer high data rates. However, Mil-5G currently lacks the inherent BLOS resilience and long-range capability of troposcatter without extensive repeater infrastructure. Troposcatter is therefore viewed not as a replacement technology, but as a critical complementary layer, ensuring communication stability when other networks are unavailable. The future market success hinges on seamlessly integrating troposcatter into the overarching Joint All-Domain Command and Control (JADC2) framework, where it serves as a robust, high-capacity middle-mile solution between dispersed tactical units and strategic command centers. This strategic positioning guarantees sustained investment and innovation within the troposcatter domain throughout the forecast period.

The regulatory environment, particularly concerning frequency allocation and high-power radio emissions, remains a steady constraint. Troposcatter systems require significant power and operate in specific microwave bands (typically 4.4–5.0 GHz or 7.0–8.0 GHz), which necessitates careful coordination with international regulatory bodies and national spectrum management agencies. Compliance with stricter environmental standards for system cooling and power efficiency also adds complexity to the manufacturing process, pushing vendors toward sustainable, yet robust, design choices. The specialization required for regulatory compliance further solidifies the high barrier to entry for potential new market participants.

Investment patterns are focusing on enhancing the automation of link setup and calibration. Historically, establishing a reliable troposcatter link required highly skilled technicians and several hours of manual calibration. New systems are incorporating advanced spectrum sensing, automated antenna alignment, and AI-driven link establishment protocols that drastically reduce setup time from hours to minutes, a necessary evolution for maximizing operational readiness in tactical environments. This automation not only reduces deployment risk but also lowers the lifetime operational costs, making the technology more appealing to budget-conscious defense organizations and emergency service providers. The pursuit of highly autonomous communication systems is a defining trend of the market's technological trajectory, ensuring resilience without relying on constant manual expert intervention.

The competition intensity is moderated by the small pool of qualified defense contractors, but technological competition remains fierce. Companies are continuously vying for key government contracts by demonstrating superior performance metrics, especially in terms of achievable data rate per Hertz (spectral efficiency) and Mean Time Between Failures (MTBF). The long product lifecycle and high cost associated with system procurement mean that contract wins often lock in revenue streams for years or decades, making initial bidding processes highly competitive and technically demanding. Furthermore, the capability to provide comprehensive, global field support and maintenance services acts as a major differentiator among the leading market players.

Finally, the long-term strategic relevance of troposcatter is affirmed by its anti-fragility characteristics. Unlike fixed infrastructure (fiber) or single points of failure (satellites), troposcatter links leverage atmospheric phenomenon, making them inherently robust against localized destruction or targeted satellite strikes. As global militaries prioritize resilience and distributed network architectures, the ability of troposcatter to function reliably in a degraded or contested environment guarantees its sustained adoption and modernization, ensuring its position as a specialized but essential communication asset for strategic and tactical domains well beyond the current forecast period. This strategic importance underpins the projected market valuation and growth rate.

The extensive analysis confirms that the market growth is sustainable, driven by non-negotiable security requirements. The modernization cycle, replacing aging analog infrastructure with cutting-edge digital platforms, forms the primary mechanism for revenue generation. Success in the competitive landscape requires continuous technological investment, especially in areas maximizing mobility and spectral efficiency while maintaining the hallmark reliability that defines troposcatter communication systems. The concentration of demand within governmental and defense sectors dictates that regulatory compliance, security clearance, and long-term service agreements are as crucial as the underlying technology itself.

The market size estimation reflects the specialized nature of the technology, serving specific, high-value mission requirements rather than mass-market telecom needs. The projected CAGR of 6.8% is indicative of steady, technology-driven growth, supported by consistent defense budgetary allocations across major global economies. The focus on integrating technologies like AI for predictive link performance and GaN for system miniaturization suggests a healthy innovation ecosystem aimed at overcoming historical limitations related to size, power, and spectral limitations. This technological evolution is key to expanding the addressable market, potentially including more disaster response and industrial applications in areas currently underserved by conventional high-speed links.

Geographically, while North America provides the foundational revenue base, the strategic urgency of communication resilience in the APAC theater will generate the highest marginal growth. Companies positioning themselves to capitalize on the rapid defense modernization efforts in nations across East and South Asia are poised for accelerated market penetration. The inherent geographical challenges in these regions—vast oceans, mountainous terrain, and remote islands—make the long-range, over-the-horizon capability of troposcatter an exceptionally attractive solution, providing a cost-effective and highly reliable alternative to complex submarine cable or vulnerable geostationary satellite deployments. This regional imperative reinforces the positive market outlook.

The structured segmentation reveals that the high-capacity, transportable system category will be the fastest-growing segment, aligning with the shift towards mobile C4ISR and expeditionary military operations. Defense planners require systems that can move with the forces while providing the necessary bandwidth for modern battlefield intelligence. Consequently, manufacturers focusing on lightweight, modular systems with fast setup times will gain a significant competitive edge over those prioritizing traditional, large-footprint fixed stations. This market evolution towards mobility and speed demonstrates a responsive alignment between technological supply and evolving military operational doctrines.

Final considerations for market participants involve mastering the complexity of international regulatory hurdles related to high-power radio equipment deployment and frequency coordination. Furthermore, maintaining stringent cybersecurity standards, particularly for cryptographic hardware and secure operating systems integrated into the terminals, is non-negotiable for defense customers. The confluence of advanced RF engineering, robust system integration, and military-grade security expertise defines the successful market profile in the troposcatter domain. The necessity for these combined capabilities ensures that the market structure remains relatively concentrated and characterized by high value-added services and products.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager