Truck Landing Gear Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443631 | Date : Feb, 2026 | Pages : 258 | Region : Global | Publisher : MRU

Truck Landing Gear Market Size

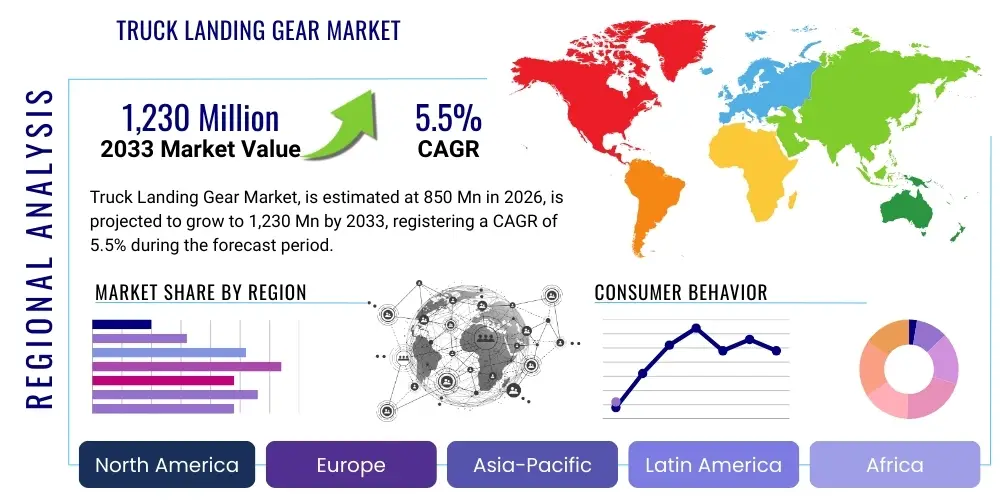

The Truck Landing Gear Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.5% between 2026 and 2033. The market is estimated at USD 850 Million in 2026 and is projected to reach USD 1,230 Million by the end of the forecast period in 2033. This growth trajectory is fundamentally supported by the sustained expansion of global logistics networks, the increasing necessity for robust commercial vehicle safety standards, and the rising demand for heavy-duty trailers capable of handling increased payloads across emerging economies. Investment in infrastructure projects, particularly in Asia Pacific and Latin America, directly correlates with the proliferation of heavy-duty trucks and semi-trailers, thereby boosting the demand for advanced, durable, and reliable landing gear systems designed for demanding operational cycles. Furthermore, regulatory shifts emphasizing gross vehicle weight rating (GVWR) compliance and mandatory safety features are compelling Original Equipment Manufacturers (OEMs) to adopt technologically superior landing gear solutions that offer enhanced stability and easier operation, reducing manual effort and minimizing workplace injuries associated with coupling and decoupling operations.

The market valuation reflects a steady migration toward automated and semi-automated landing gear solutions, moving away from purely manual crank systems, especially in developed markets like North America and Europe where labor efficiency and operational uptime are critical competitive factors. Manufacturers are focusing on incorporating advanced materials, such as high-strength steel alloys and specific composites, to achieve weight reduction without compromising structural integrity or lifting capacity. This focus addresses the perpetual industry challenge of maximizing payload efficiency while adhering to stringent road transport regulations. The drive for improved ergonomics and reduced maintenance costs further underpins the projected market expansion, positioning durable, maintenance-free landing gear systems as a preferred investment for large fleet operators seeking to optimize their total cost of ownership (TCO) over the vehicle's lifecycle.

Truck Landing Gear Market introduction

The Truck Landing Gear Market encompasses the global production, distribution, and utilization of mechanical, hydraulic, or electric devices specifically engineered to support the front end of a detached semi-trailer when it is uncoupled from the tractor unit. Landing gear serves as a critical safety and operational component, providing static support, facilitating coupling and decoupling processes, and ensuring the trailer maintains a stable, level orientation during loading, unloading, and storage phases. Key products within this market range from standard two-speed manual landing gear—historically the market staple—to advanced, electronically controlled automatic systems equipped with sensors for precise height adjustment and load monitoring. Major applications span across heavy-duty trucking, logistics, construction transport, refrigerated transport (reefers), and specialized container handling, essential for maintaining the operational continuity of global supply chains. The primary benefits include enhanced operational safety by preventing trailer tip-over, improved efficiency through quicker connection cycles, and significant ergonomic advantages for drivers, particularly with automated systems that eliminate strenuous manual cranking.

The market's sustained dynamism is driven by several key factors. Firstly, the continuous growth of e-commerce and subsequent increase in ‘last-mile’ logistics necessitates a larger fleet of semi-trailers, directly inflating the demand for landing gear units. Secondly, stringent governmental regulations across industrialized nations mandate specific safety standards for trailer stability, often favoring higher quality, certified landing gear. Thirdly, technological advancements focusing on reducing the overall weight of commercial vehicles without sacrificing load capacity push manufacturers toward innovative material usage and optimized design methodologies. Finally, the replacement cycle of aging trailer fleets, coupled with the rising adoption of specialized trailers (e.g., tandem, tridem axles), provides a consistent baseline demand for both the Original Equipment (OE) and aftermarket segments, cementing landing gear as an indispensable component in the commercial vehicle ecosystem.

Truck Landing Gear Market Executive Summary

The Truck Landing Gear Market is poised for substantial expansion, driven by pivotal shifts in global trade patterns and technological innovation within the commercial vehicle sector. Business trends indicate a strong focus on automation and integration, where key players are developing smart landing gear solutions equipped with Internet of Things (IoT) sensors for real-time monitoring of load balance, operational status, and maintenance requirements. This move towards 'smart trailers' enhances fleet management capabilities, offering predictive maintenance insights that minimize unscheduled downtime—a critical factor for profitability in the highly competitive logistics industry. Geographically, the Asia Pacific region, led by China and India, dominates volume growth due to massive investments in highway infrastructure and burgeoning manufacturing output, demanding huge fleets for material transport. However, North America and Europe retain leadership in terms of value, driven by high adoption rates of premium, high-efficiency, and low-maintenance electric or hydraulic landing gear systems that command higher price points and offer superior lifecycle performance.

Segment trends highlight the mechanical (manual) landing gear retaining the largest share by volume, owing to its cost-effectiveness and robustness in diverse, often challenging, operating environments prevalent in emerging markets. Nevertheless, the fastest growth is observed in the electromechanical segment, which offers an ideal balance between automation, energy efficiency, and high lifting capacity, increasingly preferred by major fleet operators in logistics hubs seeking rapid turnover and reduced human intervention. Furthermore, the segmentation based on lifting capacity shows a strong demand spike in the 20,000 lbs to 50,000 lbs range, catering to the ubiquitous standard semi-trailer class. The focus across all segments is on durability, corrosion resistance (especially vital for units operating in harsh weather or near coastal areas), and compliance with international standards such as TTMA and ISO, ensuring interchangeability and reliability across global operations.

AI Impact Analysis on Truck Landing Gear Market

User queries regarding AI's influence on the Truck Landing Gear Market frequently center on predictive failure analysis, operational efficiency gains through sensor integration, and the potential for fully autonomous coupling processes in future autonomous trucking environments. Users are particularly concerned about how AI-driven predictive maintenance algorithms, using data streamed from smart landing gear sensors, can effectively forecast component wear and schedule proactive servicing, thereby reducing catastrophic failures and maximizing trailer uptime. Furthermore, significant curiosity exists around the use of AI in optimizing trailer stability and load distribution calculations during coupling and decoupling, ensuring maximum safety and adherence to weight regulations without human error. The core themes revolve around minimizing manual intervention, leveraging data for operational savings, and preparing landing gear designs for integration into fully digitized logistics ecosystems that demand flawless inter-connectivity and reliability, suggesting expectations for highly sophisticated, self-diagnostic landing gear systems.

The application of Artificial Intelligence within the landing gear domain is primarily concentrated on data utilization derived from integrated sensor technologies (e.g., load cells, tilt sensors, rotational speed monitors). AI algorithms analyze this multivariate data stream to establish baseline performance metrics and detect anomalies indicative of potential mechanical stress, gear slippage, or structural fatigue long before a failure occurs. This proactive approach transforms traditional scheduled maintenance into just-in-time, condition-based maintenance, significantly extending the lifespan of the equipment and mitigating costly roadside repairs. For example, AI can analyze cranking effort resistance over time (in manual and semi-automatic systems) to predict the need for lubrication or internal component replacement, optimizing fleet asset utilization.

Furthermore, AI plays a crucial role in enabling the smooth transition towards fully autonomous trucking platoons. In such scenarios, landing gear must interface seamlessly with the tractor's autonomous systems. AI facilitates the complex alignment procedures required for autonomous coupling, using computer vision and high-precision sensors to guide the trailer kingpin into the fifth wheel with millimeter accuracy, ensuring safe and secure attachment without human oversight. This not only enhances efficiency but is a fundamental requirement for achieving Level 4 and Level 5 automation in freight transport, positioning intelligent landing gear as a core component of the autonomous trailer infrastructure.

- AI-driven predictive maintenance scheduling based on real-time operational telemetry.

- Optimization of coupling procedures through machine learning algorithms for autonomous trailers.

- Real-time load and stability monitoring using AI to prevent tipping and overloading events.

- Simulation and generative design optimization for new landing gear concepts, focusing on lightweighting and durability.

- Automated diagnostics for electronic and hydraulic components, streamlining service identification.

DRO & Impact Forces Of Truck Landing Gear Market

The Truck Landing Gear Market is shaped by a confluence of powerful Drivers, stringent Restraints, and transformative Opportunities, collectively categorized as Impact Forces. Key drivers include the exponential expansion of global trade and logistics activities, spurred by e-commerce proliferation and sustained industrial output worldwide, which necessitate an increasing volume of trailer movements and robust support equipment. Furthermore, strict regulatory mandates, especially concerning road safety, minimum trailer stability standards, and worker safety/ergonomics (driving adoption of automated systems), provide mandatory market momentum. The primary restraints involve the high initial capital investment required for advanced electric or hydraulic landing gear, which poses an adoption barrier for smaller fleet operators in cost-sensitive regions. Additionally, the inherent challenge of weight reduction in heavy-duty components, coupled with fluctuating raw material costs (steel, aluminum), restricts mass production scale. Opportunities are emerging predominantly in the development of sustainable, lightweight materials and the integration of IoT and smart sensors for remote diagnostics and enhanced fleet management, offering a pathway toward higher value products and services.

The market impact is heavily influenced by the interplay between global economic health and technological advancement. A resilient global economy boosts freight volumes, accelerating the replacement cycle and new trailer acquisitions, thereby driving demand for landing gear. Conversely, economic downturns tend to postpone fleet upgrades, favoring cheaper, less advanced aftermarket replacements. The increasing pressure on logistics providers to reduce operational expenditure (OpEx) while simultaneously improving safety compliance creates a dichotomous force: demanding cost-effective solutions but also requiring investments in premium, durable, maintenance-free systems. Manufacturers that successfully navigate this environment by offering modular, scalable solutions—ranging from basic mechanical units to fully automated, network-connected systems—are best positioned for sustainable growth and market penetration across diverse geographical and operational spectra.

Specific market forces intensify these dynamics. The drive towards electrification in commercial vehicles is subtly influencing landing gear design, favoring electric actuation systems that can draw power from the trailer’s battery or regenerative braking systems, eliminating the complexity and maintenance associated with hydraulic fluids. Furthermore, the competitive intensity among manufacturers compels continuous product innovation, leading to faster incorporation of anti-tipping technologies and improved crank ergonomics. Regulatory changes, such as revised GVWR limits or mandatory anti-lock braking system (ABS) standards (which indirectly link to structural stability requirements), act as non-negotiable compliance impact forces, ensuring a minimum quality threshold for all products entering regulated markets.

Segmentation Analysis

The Truck Landing Gear Market is systematically segmented based on various operational, technical, and commercial criteria to provide granular insights into demand patterns and market penetration opportunities. Key segmentation dimensions include the operating mechanism (manual, semi-automatic, hydraulic, electric), the lifting capacity (ranging from light-duty to extreme heavy-duty applications), the trailer type supported (flatbed, container, tanker, etc.), the sales channel (OEM vs. Aftermarket), and the material utilized (steel, aluminum, composites). This multi-dimensional analysis allows stakeholders to accurately gauge market maturity, identify high-growth niches, and tailor their product offerings to specific end-user requirements, whether prioritizing low acquisition cost (manual systems for basic trailers) or high operational efficiency and safety (electric systems for high-utilization logistics fleets). The evolution of segmentation shows a distinct trend toward customization, where specialized landing gear features—such as specific foot designs for soft ground or corrosion-resistant coatings for maritime environments—are becoming crucial differentiators, moving beyond standardized product catalogs.

- By Operating Mechanism:

- Manual/Mechanical Landing Gear (Standard Two-Speed)

- Hydraulic Landing Gear

- Electric/Electromechanical Landing Gear (Automated)

- By Lifting Capacity:

- Light-Duty (Up to 20,000 lbs)

- Medium-Duty (20,001 lbs to 50,000 lbs)

- Heavy-Duty (Above 50,000 lbs)

- By Sales Channel:

- Original Equipment Manufacturer (OEM)

- Aftermarket (Replacement and Upgrades)

- By Trailer Type:

- Standard Semi-Trailer

- Tanker Trailer

- Flatbed Trailer

- Container Chassis/Skeletal Trailer

- Refrigerated Trailer (Reefer)

Value Chain Analysis For Truck Landing Gear Market

The value chain for the Truck Landing Gear Market begins with the Upstream Analysis, which focuses on the sourcing of critical raw materials, primarily high-grade steel alloys (for legs, gear mechanisms, and structural components), aluminum (for lightweight housing and specific parts), and specialized polymers/lubricants. Key activities at this stage involve raw material extraction, primary processing (rolling, forging), and component manufacturing (precision machining of gear sets, telescopic tubes, and screw mechanisms). The bargaining power of raw material suppliers is significant, especially concerning specific steel grades necessary for high strength and durability, making efficient inventory management and stable sourcing contracts crucial for profitability. Midstream operations involve the core manufacturing processes: assembly, welding, coating (e.g., anti-corrosion treatments), integration of electronic/hydraulic components, rigorous quality testing, and final product certification to meet international safety standards (e.g., EN, ISO, TTMA). Optimization of assembly lines, often incorporating robotics for repetitive tasks like welding, is essential for maintaining cost competitiveness and quality consistency, particularly for high-volume manual gear production.

Downstream analysis focuses on Distribution Channels and market placement. Landing gear products move primarily through two distinct routes: the Original Equipment Manufacturer (OEM) channel and the Aftermarket channel. The OEM channel involves direct sales to major trailer manufacturers (e.g., Wabash, Krone, Schmitz Cargobull), where landing gear is installed as standard equipment on new units. This channel demands long-term supply agreements, stringent quality assurance, and high volume capacity. The Aftermarket channel, crucial for replacement, repair, and upgrades, utilizes extensive networks of authorized distributors, independent spare parts dealers, and large fleet service centers. Direct sales, though less common, are sometimes employed for highly specialized or customized landing gear systems catering to niche industrial applications.

The effectiveness of the distribution channel is paramount, particularly in the aftermarket, where accessibility and speed of delivery are major competitive advantages. Indirect distribution, leveraging regional stocking distributors, is vital for ensuring spare parts availability across vast geographical areas like North America and Europe, minimizing trailer downtime for end-users. Conversely, the direct approach is often preferred in the OEM segment to ensure tighter integration and quality control, facilitating seamless supply chain management from component production to final vehicle assembly. The transition towards smart landing gear requires enhanced technical support and training for distributors and service technicians, adding complexity and value to the downstream service segments.

Truck Landing Gear Market Potential Customers

Potential customers for the Truck Landing Gear Market are diverse but predominantly concentrate within the logistics, transportation, and construction sectors, relying heavily on semi-trailers for their core operations. The primary end-users or buyers fall into three main categories: Trailer Original Equipment Manufacturers (OEMs), who purchase landing gear in bulk for installation on newly produced trailers; Large Fleet Operators (LFOs), encompassing major logistics companies, global shipping lines, and large retail chains with dedicated transport divisions, which purchase units both as OE specifications and for aftermarket replacement/upgrade purposes; and Independent Trucking Operators or Small/Medium Fleet Owners (SMEs), who primarily utilize the aftermarket channel for maintenance and repair due to operational necessity and cost considerations. Demand from LFOs often drives the adoption of premium, automated, and IoT-enabled landing gear, as they prioritize operational efficiency, reduced maintenance, and superior driver ergonomics to maximize vehicle utilization across thousands of assets. Conversely, SMEs frequently seek robust, cost-effective manual systems offering reliability and ease of replacement.

Specific niche customers also contribute significantly to market demand. These include military and defense organizations requiring specialized, heavy-duty landing gear for tactical transport trailers; container port operators and intermodal companies demanding extremely durable and corrosion-resistant landing gear for continuous coupling cycles in harsh environments; and specialized industrial firms (e.g., energy, mining) needing ultra-high capacity landing gear tailored for moving oversized or specialized heavy equipment. The purchase decision across all customer segments is heavily influenced by total cost of ownership (TCO), product lifespan, warranty provisions, availability of spare parts, and the ease of compliance with regional safety and load-bearing regulations. The growth of specialized freight (refrigerated, bulk dry cargo) further segments the customer base, requiring tailor-made landing gear solutions that integrate well with the specific structural demands and operational constraints of these trailer types.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 850 Million |

| Market Forecast in 2033 | USD 1,230 Million |

| Growth Rate | 5.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | JOST Werke AG, SAF-Holland SE, BPW Bergische Achsen KG, Guangdong Fuwa Engineering Manufacturing Co., Ltd., Zhenjiang Baohua Semi-Trailer Parts Co., Ltd., Wuxi Ximei Motor Co., Ltd., CIMC Vehicles Group Co., Ltd., VDL Weweler, YORK Transport Equipment (Asia) Pte Ltd., Haacon Hebetechnik GmbH, Butler Products Corp., Sinotruk Jinan Special Vehicle Co., Ltd., Shandong Huaying Transport Equipment Co., Ltd., Titan Industrial, Ningbo Xingyuan Machinery Co. Ltd., Ningbo Xingchen Mechanical & Electrical Co., Ltd., Qingdao Taishun Landing Gear Co., Ltd., Yangzhou Tongyi Machinery Co., Ltd., Zhejiang SAF-HOLLAND (China) Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Truck Landing Gear Market Key Technology Landscape

The technology landscape of the Truck Landing Gear Market is undergoing a rapid transformation, shifting focus from purely mechanical reliability to integrated smart, efficient, and lightweight systems. A key technology advancement is the proliferation of **Electric and Electro-Hydraulic Actuation Systems**. These systems replace traditional strenuous manual cranking with motorized operation, offering push-button automation, precise height control, and significant time savings during yard movements and coupling operations. Electric systems are energy-efficient, drawing minimal power, and align with the industry's broader electrification goals, making them highly attractive to fleets prioritizing driver comfort and reduced manual labor risks. Furthermore, these automated systems often incorporate overload protection mechanisms and self-locking features, enhancing overall operational safety compared to manual counterparts which rely solely on human judgment and effort. The adoption curve for electric landing gear is steepest in high-wage regions like Western Europe and North America.

Another crucial technological development involves **Lightweighting and Advanced Materials Engineering**. Given the constant regulatory pressure and commercial incentive to maximize payload capacity, manufacturers are exploring the use of high-strength, low-alloy (HSLA) steels, advanced aluminum alloys, and fiber-reinforced composites in the construction of landing gear legs and gear housings. The goal is to reduce the tare weight of the component without sacrificing its static or dynamic load-bearing capacity and fatigue life. Innovative design approaches, such as optimized telescopic geometries and streamlined profiles, further contribute to weight reduction and potentially improved aerodynamic performance, albeit minor, contributing to marginal fuel savings over the trailer's lifetime. Durability technologies, including specialized powder coatings and cataphoresis (KTL) treatments, are also standardizing to enhance corrosion resistance, especially critical for units exposed to road salts, chemicals, or maritime air.

The integration of **Smart Technology and IoT Connectivity** represents the most disruptive technological frontier. This includes embedding sensors (load cells, position encoders, accelerometers) directly into the landing gear structure. This 'Smart Landing Gear' can monitor operational data such as exact vertical load distribution (preventing overloading), detect misalignment during coupling, track the number of operational cycles, and report structural integrity parameters in real-time back to the fleet management system via telematics. This allows for condition-based maintenance alerts, immediate detection of potential failures (like bent legs or compromised gearing), and detailed utilization reports, significantly improving asset management and optimizing maintenance schedules, thereby justifying the higher initial investment costs for tech-savvy fleet operators.

Regional Highlights

- North America (NA): North America represents a mature and highly valuable market segment characterized by a strong emphasis on operational efficiency, driver ergonomics, and safety regulations. The region exhibits high adoption rates of automated (electric and hydraulic) landing gear systems due to high labor costs and the sheer scale of logistics operations requiring fast turnaround times. The presence of major trailer manufacturers and large, integrated trucking fleets drives strong demand in the OEM segment. Furthermore, the robust aftermarket, supported by severe weather conditions (requiring enhanced corrosion protection) and high utilization rates, ensures steady replacement demand. Innovation is focused on IoT integration for predictive maintenance and compatibility with autonomous driving initiatives, positioning the US and Canada as leaders in high-tech landing gear deployment.

- Europe: The European market is highly regulated, placing intense focus on weight limits (driving lightweighting innovations) and strict safety standards (promoting anti-tipping mechanisms and certified component quality). Western Europe, led by Germany, France, and the UK, shows a strong preference for high-quality, durable, and low-maintenance solutions, often prioritizing products from established European suppliers like JOST and SAF-Holland. The diversity of road networks and trailer types (including specialized intermodal and road train combinations) requires versatile product offerings. Eastern Europe, while growing rapidly, still maintains a significant demand for robust, cost-effective manual systems, creating a bifurcated market structure. Sustainability goals also push for enhanced material efficiency and production processes.

- Asia Pacific (APAC): APAC is the largest market in terms of volume growth, propelled by explosive economic expansion, rapid industrialization, and massive infrastructural development, particularly in China, India, and Southeast Asia. The region is characterized by high volume manufacturing of trailers and a corresponding massive demand for basic, reliable, and cost-competitive manual landing gear. While price sensitivity remains a major factor, sophisticated markets like Japan, South Korea, and Australia are increasingly adopting advanced, higher-capacity solutions to handle specialized freight and meet tightening urban logistics constraints. China dominates both production capacity and consumption, heavily influencing global price dynamics, and is witnessing a slow but steady transition towards local production of higher-quality, semi-automated systems.

- Latin America (LATAM) and Middle East & Africa (MEA): These regions are emerging markets showing significant potential, linked directly to investments in natural resource extraction (mining, oil & gas) and agricultural exports, which require heavy-duty transport capabilities. LATAM faces challenges related to infrastructure quality, driving demand for extra-robust and high-clearance landing gear. The MEA region, particularly the GCC countries, sees demand driven by large-scale construction projects and trans-regional logistics hubs, necessitating corrosion-resistant and reliable equipment suitable for extreme climatic conditions. Market penetration in both regions is heavily dependent on imported components, though local assembly and distribution partnerships are steadily increasing, focusing primarily on maintenance simplicity and rugged durability.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Truck Landing Gear Market.- JOST Werke AG

- SAF-Holland SE

- BPW Bergische Achsen KG

- Guangdong Fuwa Engineering Manufacturing Co., Ltd.

- CIMC Vehicles Group Co., Ltd.

- Zhenjiang Baohua Semi-Trailer Parts Co., Ltd.

- Wuxi Ximei Motor Co., Ltd.

- VDL Weweler

- YORK Transport Equipment (Asia) Pte Ltd.

- Haacon Hebetechnik GmbH

- Butler Products Corp.

- Sinotruk Jinan Special Vehicle Co., Ltd.

- Shandong Huaying Transport Equipment Co., Ltd.

- Titan Industrial

- Ningbo Xingyuan Machinery Co. Ltd.

- Ningbo Xingchen Mechanical & Electrical Co., Ltd.

- Qingdao Taishun Landing Gear Co., Ltd.

- Yangzhou Tongyi Machinery Co., Ltd.

- Zhejiang SAF-HOLLAND (China) Co., Ltd.

- Chengdu Guangxing Auto Parts Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Truck Landing Gear market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between manual and electric truck landing gear?

Manual landing gear utilizes a human-operated crank system (often two-speed) to raise and lower the trailer, prioritizing cost-effectiveness and mechanical simplicity. Electric landing gear uses a motorized actuation system, offering push-button automation, faster operation, precise leveling, and superior ergonomics, making it ideal for high-utilization fleets seeking reduced labor and enhanced safety.

How does the integration of IoT technology benefit truck landing gear operation?

IoT integration transforms landing gear into 'smart' components by embedding sensors to monitor critical parameters such as load weight, tilt angle, and usage cycles. This data enables predictive maintenance, real-time diagnostics, and remote asset management, significantly reducing unscheduled downtime and improving overall fleet safety by preventing overloading or instability.

Which geographic region currently leads the demand for high-capacity landing gear?

North America and Europe currently lead the demand for premium, high-capacity, and technologically advanced landing gear, driven by strict regulatory requirements, large fleet operations prioritizing efficiency, and the requirement for robust systems to handle specialized heavy-duty transport, often exceeding 50,000 lbs static load.

What are the main drivers influencing the shift towards lightweight landing gear materials?

The shift towards lightweight materials like aluminum and advanced steel alloys is driven primarily by the constant need to maximize trailer payload capacity within legal weight limits, thus improving the economic efficiency of freight transport. Lightweighting also contributes marginally to fuel savings and addresses regulatory pressure on Gross Vehicle Weight Rating (GVWR).

What criteria are most important for fleet operators when selecting landing gear for new trailers?

Fleet operators prioritize Total Cost of Ownership (TCO), which includes initial price, expected lifespan, ease of maintenance, and the availability of spare parts. Other critical criteria include the landing gear's static lifting capacity, durability/corrosion resistance, compliance with international safety standards, and increasingly, the ergonomic benefits and operational speed offered by automated options.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager