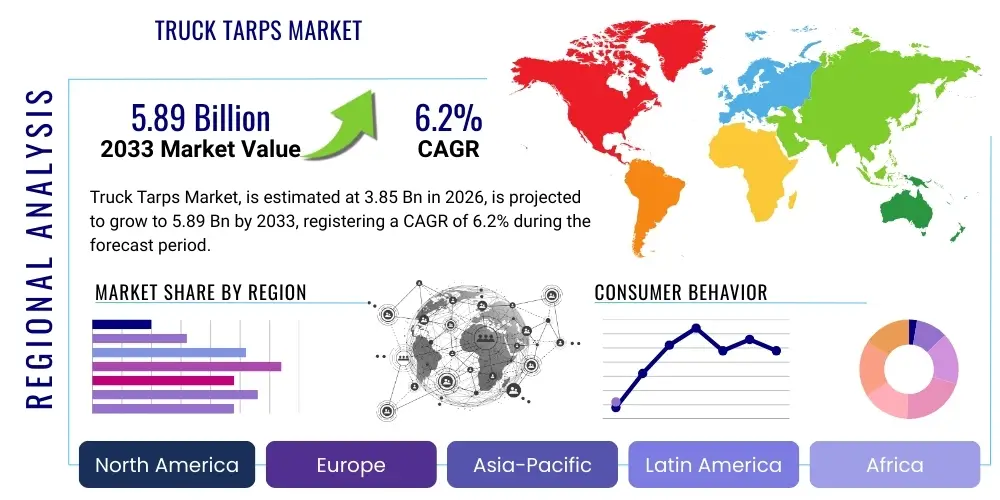

Truck Tarps Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441628 | Date : Feb, 2026 | Pages : 246 | Region : Global | Publisher : MRU

Truck Tarps Market Size

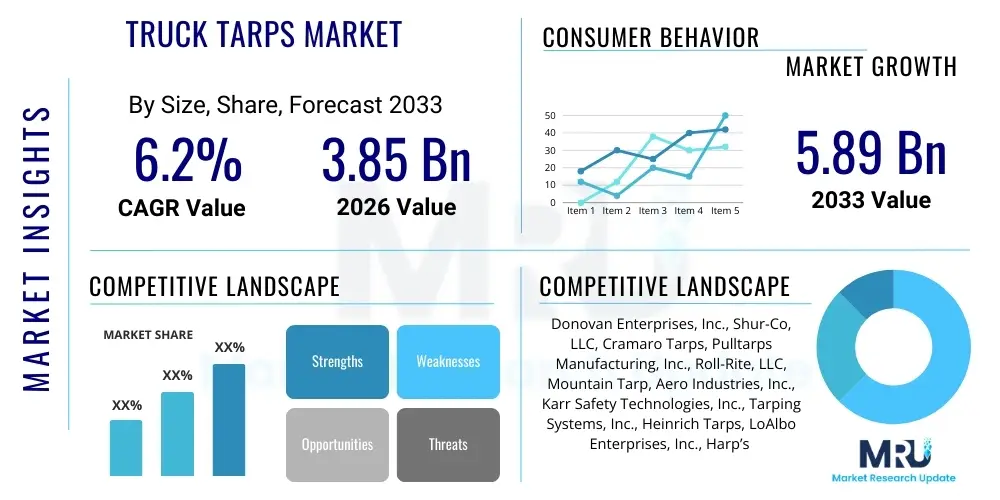

The Truck Tarps Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.2% between 2026 and 2033. The market is estimated at USD 3.85 Billion in 2026 and is projected to reach USD 5.89 Billion by the end of the forecast period in 2033.

Truck Tarps Market introduction

The Truck Tarps Market encompasses the manufacturing, distribution, and utilization of protective covers designed specifically for commercial transport vehicles, including flatbed trailers, dump trucks, roll-off containers, and specialized haulers. These critical accessories are primarily deployed to safeguard transported cargo from environmental damage such as rain, snow, UV radiation, and wind, while also ensuring compliance with stringent government regulations concerning load securement and debris containment, particularly in construction and waste management sectors. The fundamental product line includes durable materials such as reinforced PVC vinyl, canvas, polyethylene, and specialized mesh fabrics, each selected based on the specific cargo type and operational environment, emphasizing durability, tear resistance, and optimal weight.

Major applications of truck tarps span across diverse industries including construction, agriculture, logistics, mining, and waste management. In construction, heavy-duty vinyl tarps are essential for covering debris and aggregates, preventing spillage during transit, which is a key regulatory requirement. Agricultural transport relies on breathable mesh tarps for grain and produce, allowing ventilation while protecting against moisture. Logistics companies utilize custom-fit tarps for valuable or sensitive goods transported on flatbed trailers, ensuring secure long-haul delivery across varied climatic zones. The core benefits derived from the adoption of high-quality truck tarps include minimizing cargo loss, reducing operational liability associated with unsecured loads, and extending the lifespan of the transported goods by mitigating external exposure.

The market growth is primarily driven by the escalating expansion of the global logistics and e-commerce industries, which necessitates high volumes of efficient and safe cargo transportation. Furthermore, the continuous modernization of infrastructure projects globally, especially in developing economies, fuels demand for dump truck and construction vehicle tarps. Heightened regulatory enforcement regarding load containment and increased focus on worker and road safety across North America and Europe also compel fleet operators to invest in sophisticated, automated tarping systems, accelerating the market's transition towards technologically advanced, durable, and easily deployable solutions.

Truck Tarps Market Executive Summary

The Truck Tarps Market is poised for stable and robust growth, underpinned by foundational shifts in global trade patterns, increased regulatory scrutiny on cargo safety, and material science advancements leading to lighter and more durable products. Current business trends indicate a strong focus on automation, with automated and semi-automated tarping systems gaining significant traction, particularly among large-scale fleet operators seeking to improve operational efficiency and reduce manual labor time and associated risks. This shift towards mechanized deployment systems is crucial for meeting the demands of high-frequency logistics operations. Furthermore, customization is emerging as a critical competitive differentiator, as end-users increasingly require application-specific designs, materials, and specialized treatments (e.g., fire retardant or anti-static properties) tailored for diverse loads ranging from hazardous materials to temperature-sensitive agricultural products.

Regionally, North America maintains its dominance, primarily due to the vast highway infrastructure supporting extensive long-haul transportation and the strict enforcement of Federal Motor Carrier Safety Administration (FMCSA) regulations regarding load security. However, the Asia Pacific (APAC) region, driven by rapid industrialization, massive infrastructure development projects, and the maturation of its internal logistics networks (especially in China and India), is projected to exhibit the highest Compound Annual Growth Rate (CAGR) throughout the forecast period. European trends emphasize sustainability, favoring tarp materials that are recyclable, lightweight (to improve fuel efficiency), and compliant with stringent environmental protection standards, pushing manufacturers toward advanced composite and polymer solutions.

Segment trends reveal that the Roll-Up Tarp Systems segment, owing to its operational ease and adaptability to varying trailer sizes, is capturing significant market share. Simultaneously, in terms of material segmentation, high-density polyethylene (HDPE) and advanced reinforced PVC vinyl remain the materials of choice, offering an optimal balance between cost-effectiveness, durability, and resistance to harsh weather conditions. The aftermarket segment is considerably larger than the OEM segment, largely fueled by the regular replacement cycle mandated by wear and tear associated with heavy use and the need for specialized tarp upgrades after vehicle purchase. Strategic investments by key market players are focused on optimizing supply chains and leveraging regional manufacturing hubs to minimize logistics costs and improve delivery timelines for customized orders.

AI Impact Analysis on Truck Tarps Market

Common user questions regarding AI’s impact on the Truck Tarps Market revolve primarily around predictive maintenance for material integrity, optimization of fleet operations that minimize tarp stress, and leveraging image recognition technologies for automated load security inspections. Users are seeking to understand how AI can transition tarp management from a manual, reactive process to an automated, predictive system. Key concerns often center on integrating smart sensors into non-electronic components like flexible fabrics and the return on investment (ROI) for such sophisticated tracking systems. The general expectation is that AI will significantly reduce the frequency of unexpected tarp failure, optimize procurement by predicting material lifecycles, and ensure higher levels of regulatory compliance through continuous, data-driven security audits without human intervention.

- AI-driven predictive maintenance models forecast tarp lifespan based on route topography, climate exposure data, and usage frequency, minimizing unplanned replacements.

- Integration of machine vision and AI algorithms enables real-time, automated verification of load securement and tarp integrity before trucks depart, ensuring regulatory compliance.

- Supply chain optimization using AI minimizes raw material inventory holding costs and predicts localized demand spikes for specialized tarp types (e.g., bulk commodity covers).

- AI analysis of operational data (speed, wind exposure, loading techniques) provides feedback to drivers and fleet managers on practices that accelerate tarp wear and tear, promoting better usage protocols.

- Smart Tarp systems incorporating embedded sensors can use AI to monitor internal cargo conditions (temperature, humidity) and alert operators if the tarp’s protective integrity is compromised.

DRO & Impact Forces Of Truck Tarps Market

The dynamics of the Truck Tarps Market are governed by a complex interplay of internal market mechanisms and external regulatory and economic forces, collectively known as DRO (Drivers, Restraints, Opportunities). The primary driver propelling the market is the sustained growth in the global transportation and logistics industry, particularly the last-mile and heavy-haul sectors, which inherently require robust load protection solutions. Stricter global governmental regulations concerning environmental protection and road safety, especially mandates against debris spillage and requirement for secured loads, act as a powerful catalyst, forcing fleet owners to adopt compliant and high-quality tarp systems. Furthermore, advancements in material science, offering lightweight, high-strength fabrics, enable better fuel efficiency and lower maintenance costs, making premium tarp solutions more attractive.

However, the market faces significant restraints, chiefly the volatility and high cost of raw materials, particularly petroleum-derived polymers like PVC and polyethylene, which directly impact manufacturing costs and final product pricing, leading to purchasing hesitation among smaller fleet operators. The intensive manual labor often required for deploying traditional tarp systems presents an operational challenge and a safety risk, although this restraint is slowly being mitigated by the adoption of automated systems. Additionally, the proliferation of low-quality, inexpensive imports, especially in emerging markets, poses a competitive threat to established manufacturers focused on durable, long-life products, often confusing end-users regarding true cost-effectiveness over time. The manual process of securing oversized loads also remains a labor-intensive restraint that technology is still struggling to fully address seamlessly.

Opportunities for market expansion are abundant, centered around the development and commercialization of "smart tarps" embedded with RFID tags and IoT sensors for real-time tracking of cargo and tarp condition, integrating these assets into broader fleet management software. The growing emphasis on environmental responsibility opens doors for manufacturers specializing in bio-degradable or fully recyclable tarp materials, aligning with corporate sustainability goals. Furthermore, penetration into specialized niche applications, such as temperature-controlled tarps for sensitive pharmaceuticals or high-abrasion resistant tarps for mining operations, offers higher margins and reduced competitive intensity. The transition towards electric and autonomous trucking also presents an opportunity to design fully integrated, aerodynamic tarp solutions that maximize energy efficiency, potentially becoming a standard OEM feature rather than an aftermarket add-on.

Segmentation Analysis

The Truck Tarps Market is highly diversified, segmented based on material composition, deployment type, trailer application, and end-user industry. This granular segmentation allows manufacturers and strategists to precisely target specific operational needs and regulatory requirements across the diverse transportation landscape. Segmentation by material is critical, differentiating between heavy-duty PVC vinyl for maximum protection, lighter polyethylene for economical solutions, and breathable mesh for agricultural use. Segmentation by deployment type, which includes manual roll-ups, electric flip tarps, and side-to-side mechanical systems, dictates operational efficiency and the level of initial investment required by the fleet owner. Understanding these segments is paramount as purchasing decisions are often highly application-specific, influencing product design, pricing strategy, and distribution channel selection, with aftermarket sales dominating most segments due to the high replacement frequency inherent to the product category.

- By Material:

- Polyvinyl Chloride (PVC) Vinyl

- Polyethylene (PE)

- Canvas and Textile Fabrics

- Mesh and Screen Materials

- Specialty Composites

- By Deployment Type:

- Manual Systems (Roll-Up, Tie-Down)

- Semi-Automatic Systems

- Automatic/Electric Systems (Flip Tarp, Side-to-Side)

- By Application/Trailer Type:

- Dump Trucks and Trailers

- Flatbed Trailers

- Roll-Off Containers

- Grain Carts and Hoppers

- Specialized Transport Vehicles (E.g., Livestock, Hazardous Waste)

- By End User:

- Construction and Infrastructure

- Waste Management and Recycling

- Agriculture and Farming

- General Logistics and Transportation (3PLs)

- Mining and Quarrying

- By Distribution Channel:

- Original Equipment Manufacturers (OEM)

- Aftermarket (Retailers, Distributors, Online)

Value Chain Analysis For Truck Tarps Market

The value chain for the Truck Tarps Market begins fundamentally with the upstream analysis involving the sourcing of raw materials, primarily petrochemical derivatives and specialized textiles. Key raw material suppliers include large chemical companies providing PVC resins, polyethylene pellets, and textile manufacturers producing high-denier polyester or nylon threads used for reinforcement. Price fluctuations in crude oil and polymer feedstocks directly impact the profitability of tarp manufacturers, necessitating robust inventory management and hedging strategies. Quality control at this stage is crucial, as the performance characteristics—such as UV resistance, tear strength, and waterproofing—are heavily dependent on the initial material composition and quality of coatings applied before fabrication. Strategic partnerships with stable, certified raw material providers are essential to maintain product consistency and meet strict industry standards for durability.

Midstream activities involve the core manufacturing processes: compounding, coating, welding, sewing, and final assembly, often requiring specialized heavy-duty industrial machinery. Manufacturers convert the bulk raw materials into finished tarp fabrics and then into specific tarp systems, incorporating metal hardware, electric motors (for automated systems), and specialized fittings. The development and continuous improvement of automated welding and sealing techniques are critical for enhancing product lifespan and integrity, reducing the potential for seam failure under extreme weather or mechanical stress. Differentiation often occurs here through proprietary coating formulations that provide enhanced protection against mildew, fire, or chemical degradation, offering a significant competitive edge in specialized end-user sectors.

Downstream analysis focuses on distribution and sales. The distribution channel is bifurcated into Original Equipment Manufacturers (OEMs), who supply tarps as standard or optional features on new trucks and trailers, and the significantly larger aftermarket segment. The aftermarket relies heavily on specialized distributors, parts retailers, and increasingly, e-commerce platforms, offering replacement tarps and customized systems. Direct sales to major fleet operators or large construction companies bypass intermediate distributors, allowing for tailored solutions and direct installation services. Effective downstream logistics, including rapid production turnaround for custom orders and efficient inventory management of standard sizes, are paramount to minimizing truck downtime for end-users. Installation and repair services provided by authorized distributors or specialized service centers complete the value chain, extending the perceived value and lifespan of the product for the final customer.

Truck Tarps Market Potential Customers

The core customer base for the Truck Tarps Market consists of entities and organizations heavily involved in commercial road freight, material handling, and mobile operations that necessitate compliance with load security regulations. End-users span multiple industrial sectors, with the primary buyers being large-scale logistics and third-party logistics (3PL) providers operating extensive fleets of flatbed and curtain-side trailers, where cargo protection during long transit times is non-negotiable for insurance and client satisfaction purposes. These professional buyers prioritize durability, standardization across their fleet, and minimal maintenance requirements, often opting for automated tarp systems to maximize driver efficiency and safety.

Another significant segment comprises the construction, infrastructure, and mining industries. Companies operating in these fields require specialized, heavy-duty tarps for dump trucks and roll-off containers, designed to withstand abrasive materials like gravel, asphalt, excavation debris, and sharp metals. For these customers, the primary purchasing drivers are extreme tear resistance, thickness, and compliance with local municipal waste hauling regulations, which mandate complete material containment. They often purchase heavy-gauge vinyl and specialized composite tarps, valuing product longevity over initial cost savings due to the high operational stress their equipment endures.

Furthermore, the agricultural sector, including large commercial farms and grain elevators, constitutes a steady customer segment, primarily requiring breathable mesh or lightweight, UV-resistant tarps for covering commodities like grains, feeds, and produce during transit. Their focus is on moisture control and ventilation to preserve product quality, driving demand for innovative fabric treatments. Finally, smaller independent owner-operators and local maintenance companies form the crucial aftermarket customer base, frequently purchasing replacement parts, standard roll tarps, and repair kits through local dealers or online platforms to maintain their equipment viability and ensure regulatory adherence without significant capital expenditure.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 3.85 Billion |

| Market Forecast in 2033 | USD 5.89 Billion |

| Growth Rate | 6.2% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Donovan Enterprises, Inc., Shur-Co, LLC, Cramaro Tarps, Pulltarps Manufacturing, Inc., Roll-Rite, LLC, Mountain Tarp, Aero Industries, Inc., Karr Safety Technologies, Inc., Tarping Systems, Inc., Heinrich Tarps, LoAlbo Enterprises, Inc., Harp’s Tarps, The Tarp Stop, Glider Systems, Inc., Vancover Tarps, Inc., Quick Draw Tarpaulin Systems, D & C Supply, Ltd., RollCover, Pioneer Cover-All, M&S Tarpaulins |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Truck Tarps Market Key Technology Landscape

The technological landscape of the Truck Tarps Market is increasingly shifting away from basic fabric production toward integrated system development and advanced material engineering. One of the most significant advancements is the proliferation of automated tarping systems, particularly electric side-to-side and flip-tarp mechanisms. These systems utilize electric motors, remote controls, and advanced gearing to deploy and retract tarps rapidly and safely, drastically reducing the time spent by drivers handling cumbersome manual covers, thereby minimizing operational liability and improving overall turnaround time at loading docks. These automation technologies are becoming essential features in modern fleet management, driving down labor costs associated with manual tarping and significantly reducing workplace injuries related to climbing onto trailers.

In material science, research and development are concentrated on creating superior composite materials that offer a trifecta of benefits: enhanced durability, lighter weight, and improved sustainability. Next-generation polyvinyl chloride (PVC) formulations and high-density polyethylene (HDPE) variants now feature specialized coatings that increase resistance to extreme temperatures, acid rain, and prolonged UV exposure, extending the product lifecycle considerably. Furthermore, the development of fire-retardant and anti-static materials is crucial for specialized transport sectors like mining, chemical hauling, and waste management, ensuring higher safety standards than ever before. Nanotechnology is also being explored to potentially develop self-cleaning or self-healing materials that could passively repair minor tears or repel environmental contaminants, reducing maintenance requirements.

The integration of Information and Communication Technology (ICT) is defining the concept of the 'Smart Tarp'. This involves embedding IoT sensors, RFID tags, or QR codes directly into the tarp fabric or hardware mechanisms. These components allow fleet managers to monitor the geographical location of the specific tarp asset, track its utilization metrics (number of deployments, duration of exposure), and even monitor internal cargo environmental conditions such as temperature and humidity. Such data integration facilitates proactive maintenance scheduling, prevents loss of expensive specialized covers, and provides concrete evidence of compliance or non-compliance during transit, offering comprehensive, data-driven management capabilities that streamline logistics operations and insurance assessments.

Regional Highlights

- North America: This region holds the largest market share, characterized by its extensive network of commercial highways and a high volume of heavy-haul freight movements, particularly across the United States and Canada. Growth is driven by strict government mandates, such as state-level regulations on load securement (e.g., California’s stringent environmental standards and general debris containment laws). The large presence of established heavy machinery and logistics companies here fosters high demand for premium, automated tarp systems and durable PVC/mesh composite materials. The aftermarket segment is exceptionally strong, supported by robust distribution networks and frequent equipment wear and replacement cycles.

- Europe: The European market emphasizes high standards of regulatory compliance, safety, and, uniquely, sustainability. Demand is high for lightweight tarps that contribute to reduced vehicle fuel consumption and materials that are fully recyclable, aligning with the European Union’s Circular Economy Action Plan. Countries such as Germany, France, and the UK prioritize custom-fit, aerodynamic tarp solutions for both flatbed and walking floor trailers. The penetration of semi-automated and advanced curtain-side systems is particularly high due to the density of urban areas and the need for quick, efficient loading and unloading.

- Asia Pacific (APAC): APAC is the fastest-growing market, propelled by massive governmental investments in infrastructure (roads, railways, ports), rapid urbanization, and exponential growth in domestic and cross-border logistics activities, particularly within China, India, and Southeast Asian nations. The demand here is highly cost-sensitive, leading to strong sales in standardized, manually operated polyethylene and basic PVC tarps. However, as logistics standards mature in developed pockets like Japan and South Korea, there is a gradual shift towards higher-quality materials and electric tarp systems, driven by multinational logistics providers entering the region.

- Latin America: This region exhibits steady growth driven by expanding mining activities and agricultural exports (especially Brazil and Argentina). The market faces challenges related to infrastructure quality, increasing the need for robust, durable tarps capable of withstanding rough road conditions and varying climatic extremes. Manual and semi-automatic systems dominate the landscape, but regulatory enforcement remains inconsistent across different countries.

- Middle East and Africa (MEA): Growth in MEA is highly localized, concentrated around Gulf Cooperation Council (GCC) countries due to massive construction and urbanization projects. The severe desert climate dictates a high demand for UV-resistant and heat-stable materials. The construction and waste management sectors are the primary end-users, increasingly adopting basic to mid-range tarp solutions to meet evolving local safety standards in infrastructure development zones.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Truck Tarps Market.- Donovan Enterprises, Inc.

- Shur-Co, LLC

- Cramaro Tarps

- Pulltarps Manufacturing, Inc.

- Roll-Rite, LLC

- Mountain Tarp

- Aero Industries, Inc.

- Karr Safety Technologies, Inc.

- Tarping Systems, Inc.

- Heinrich Tarps

- LoAlbo Enterprises, Inc.

- Harp’s Tarps

- The Tarp Stop

- Glider Systems, Inc.

- Vancover Tarps, Inc.

- Quick Draw Tarpaulin Systems

- D & C Supply, Ltd.

- RollCover

- Pioneer Cover-All

- M&S Tarpaulins

- Tarps and Tie-Downs, Inc.

- Dawson Group

- Dutron Group

- Snyder Manufacturing Inc.

- Grizzly Tarps

Frequently Asked Questions

Analyze common user questions about the Truck Tarps market and generate a concise list of summarized FAQs reflecting key topics and concerns.What material is considered the most durable for heavy-duty truck tarps?

Reinforced PVC vinyl (Polyvinyl Chloride) is generally considered the most durable material for heavy-duty applications like dump trucks and construction debris, offering superior resistance to tears, punctures, abrasion, and extreme weather conditions compared to standard polyethylene or mesh.

How do automated tarping systems improve fleet operational efficiency?

Automated tarp systems, such as electric roll or flip tarps, significantly improve efficiency by reducing the time required to secure a load from several minutes down to mere seconds. This minimizes driver downtime, enhances safety by keeping drivers off the trailer bed, and ensures higher compliance rates with load securement regulations.

What is the primary driver of growth in the Asia Pacific (APAC) Truck Tarps Market?

The primary driver in APAC is rapid infrastructural development and burgeoning growth in the regional logistics and e-commerce sectors, leading to increased demand for commercial transport vehicles and corresponding regulatory pressure to secure construction and haulage loads effectively.

Is the OEM or the Aftermarket segment larger in the Truck Tarps industry?

The Aftermarket segment holds a significantly larger share than the OEM segment. This is due to the inherent nature of tarps as consumable items that require frequent replacement due to wear and tear caused by constant friction, environmental exposure, and mechanical stress during daily loading and transit operations.

What is the concept of a 'Smart Tarp' and its relevance to future logistics?

A 'Smart Tarp' integrates IoT sensors and RFID technology into the cover material, allowing real-time monitoring of the tarp's physical condition, temperature, humidity, and location. This data is critical for predictive maintenance, verifying load security, and optimizing high-value logistics supply chains.

Which regulatory bodies heavily influence the demand for truck tarps in North America?

Demand in North America is heavily influenced by the Federal Motor Carrier Safety Administration (FMCSA) and various state Departments of Transportation (DOTs). These bodies mandate specific load securement standards (e.g., 49 CFR Part 393), requiring high-quality tarps to prevent spillage and ensure public safety.

Are recyclable materials gaining traction in the European Truck Tarps Market?

Yes, recyclable materials are strongly gaining traction in Europe. Driven by stringent EU environmental directives and corporate sustainability initiatives, European fleet operators increasingly favor lightweight and recyclable polymer-based tarps to minimize environmental impact and improve vehicle fuel efficiency.

What are the main drawbacks of using traditional manual tarping systems?

Traditional manual systems suffer from high labor intensity, extended operational downtime required for securement, and significant safety risks associated with drivers having to climb on top of loads or trailers to deploy and tie down the tarp effectively.

How does raw material price volatility affect the manufacturing segment?

Raw material price volatility, particularly for petroleum-based polymers like PVC, directly impacts manufacturing costs and profit margins. Manufacturers must frequently adjust pricing strategies or absorb cost increases, often leading to challenges in stable contract pricing with major fleet customers.

What role does the mining industry play in the Truck Tarps Market?

The mining industry is a key end-user, requiring extremely durable, heavy-gauge, and often specialized fire-retardant tarps for hauling aggregates, coal, and ore. These applications demand high abrasion resistance and specific regulatory compliance for transporting potentially corrosive or flammable materials.

What is the typical lifespan differential between PVC vinyl and polyethylene tarps?

High-quality, reinforced PVC vinyl tarps typically have a significantly longer lifespan, often lasting 5 to 7 years in heavy use environments. Conversely, standard woven polyethylene tarps, while cheaper, generally offer a shorter service life, usually between 1 to 3 years, depending on UV exposure and usage intensity.

How does the demand for roll-off container tarps differ from flatbed trailer tarps?

Roll-off container tarps are typically designed for waste and debris containment, focusing on durable, leak-proof materials and simple tie-down mechanisms. Flatbed tarps, conversely, are customized in size, shape, and weight, focusing on full cargo enclosure and maximum protection against wind whip during high-speed, long-distance highway travel.

Are there technological advancements targeting resistance to high wind exposure?

Yes, advancements include the development of more aerodynamic tarp profiles and specialized automated side-locking mechanisms that reduce wind whip and billowing, which is a major cause of tarp damage and vehicle instability at highway speeds. Material coatings also enhance flexibility to withstand rapid air pressure changes.

Which sub-segment of deployment type is projected to experience the highest growth rate?

The Automatic/Electric Systems sub-segment is projected to experience the highest growth rate. This acceleration is driven by major logistics firms prioritizing driver safety, operational efficiency improvements, and the long-term return on investment offered by mechanized tarp deployment.

How do manufacturers ensure the compatibility of their tarps with diverse trailer models?

Manufacturers often utilize modular design principles and extensive databases of trailer specifications to ensure compatibility. Custom-fit services and easily adjustable universal mounting kits are employed, especially in the aftermarket, to fit various lengths, widths, and trailer configurations, including specialized agricultural or construction vehicles.

What role does digitalization play beyond simple asset tracking in this market?

Digitalization extends beyond tracking to include digitized inventory management for fleet operators (predicting when specific tarp types need replacement), automated compliance logging, and integration with broader Transportation Management Systems (TMS) for total operational oversight.

What are the key differences between mesh tarps and solid vinyl tarps in terms of application?

Mesh tarps are used when ventilation is required (e.g., covering grains or certain landscaping debris), allowing air and some moisture to escape while securing the load. Solid vinyl tarps are mandatory when complete waterproofing, security, and containment of fine particles (like sand or chemicals) are necessary.

Does the rise of electric commercial vehicles impact the design of truck tarps?

Yes, the rise of electric vehicles necessitates more aerodynamic and lighter-weight tarp designs. Reducing air resistance and vehicle mass is crucial for maximizing battery range and energy efficiency, pushing manufacturers towards advanced composites and integrated curtain systems.

What strategies are smaller companies employing to compete against major market players?

Smaller companies often focus on highly specialized niche markets (e.g., custom sizes for historic vehicles or specialized hazardous materials transport) or prioritize exceptional local customer service and rapid, bespoke fabrication turnaround times, differentiating themselves from large-scale standardized production.

In which end-user segment is the demand for custom branding or logos highest?

The demand for custom branding, including corporate logos and high-visibility safety markings, is highest in the General Logistics and Transportation (3PLs) segment, as the tarp surface provides a large, visible area for mobile advertising and reinforcing brand presence during transit.

How significant are leakage and moisture protection requirements for the agricultural segment?

Leakage and moisture protection are highly significant for the agricultural segment, especially when transporting finished feeds or sensitive grains. Excess moisture can lead to spoilage and significant financial loss, driving demand for specialized water-resistant and breathable tarps to maintain commodity quality.

What constitutes an effective upstream risk mitigation strategy for tarp manufacturers?

An effective upstream risk mitigation strategy involves diversifying the supplier base for polymer resins, entering into long-term volume contracts to stabilize feedstock pricing, and potentially investing in proprietary material coating technologies to reduce reliance on generic, volatile raw materials.

Why is the construction sector increasingly demanding heavier gauge tarps?

The construction sector demands heavier gauge tarps because these materials provide superior protection against punctures and tears caused by sharp construction debris, gravel, and rough loading equipment, ensuring the safe containment of loads required by most municipal regulations.

Are anti-mildew and anti-fungal treatments common for truck tarps?

Yes, anti-mildew and anti-fungal treatments are common, particularly for tarps used in high-humidity environments or those covering organic materials (like hay or grain). These chemical treatments significantly prolong the life and usability of the fabric by preventing organic degradation.

How is the adoption of fleet management software influencing purchasing decisions for tarps?

Fleet management software adoption is increasingly influencing purchasing decisions by highlighting the total cost of ownership (TCO). Fleets favor higher-cost, automated, and durable tarps because the reduction in labor costs, maintenance frequency, and compliance issues often provides a better TCO over the long term than cheaper manual alternatives.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager