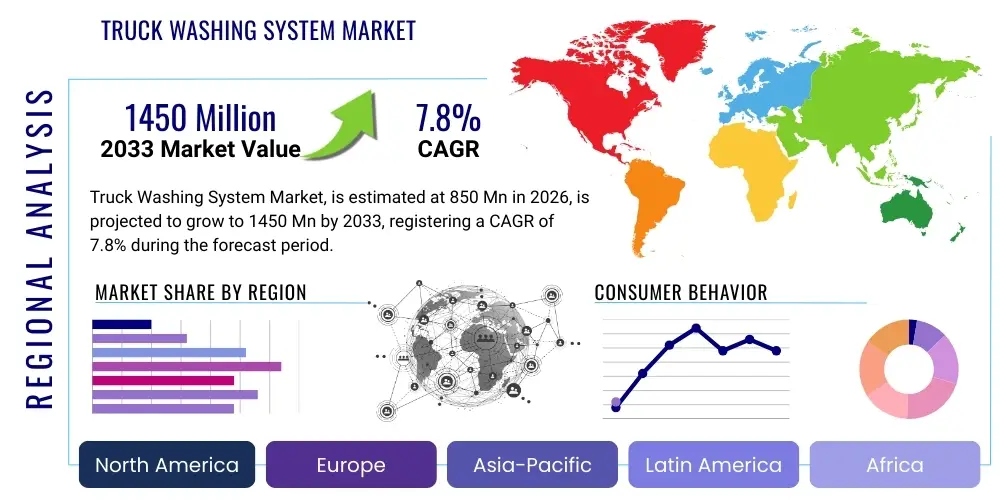

Truck Washing System Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442441 | Date : Feb, 2026 | Pages : 243 | Region : Global | Publisher : MRU

Truck Washing System Market Size

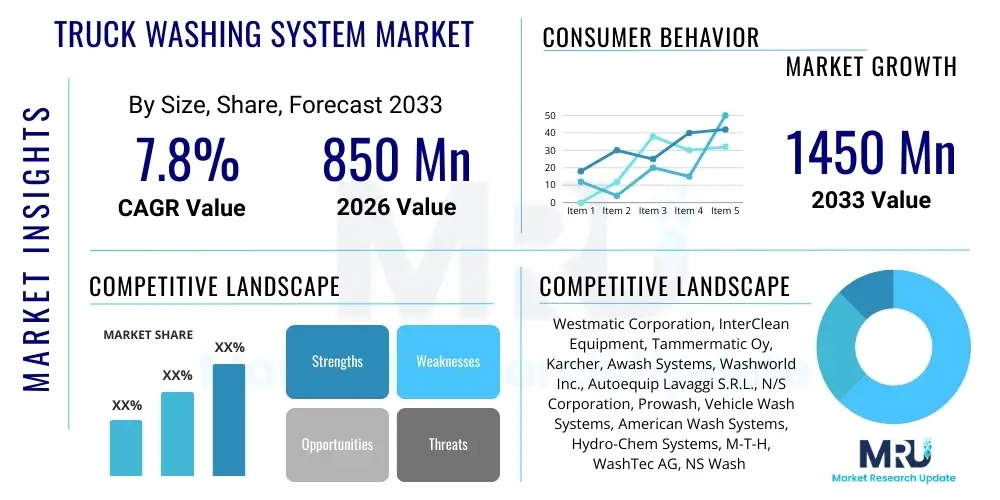

The Truck Washing System Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at USD 850 Million in 2026 and is projected to reach USD 1450 Million by the end of the forecast period in 2033.

The consistent expansion of the global logistics and transportation industry, coupled with increasingly stringent environmental and safety regulations pertaining to commercial vehicle maintenance, is primarily fueling this growth trajectory. Adoption rates are particularly high in developed economies where fleet operators prioritize efficiency, automation, and minimizing vehicle downtime. Furthermore, the shift towards professional, automated washing solutions replaces traditional manual methods, offering superior consistency and significant reductions in water and chemical consumption, thereby supporting sustainable operational practices across large fleets.

Market expansion is also driven by technological advancements, specifically in areas such as water recycling, advanced sensor integration for optimized vehicle contour detection, and the development of specialized chemical agents for effective removal of road grime and corrosive substances. As transportation infrastructure continues to modernize globally, the demand for high-capacity, durable washing systems capable of handling diverse truck sizes, including heavy-duty tractor-trailers and specialized vocational vehicles, remains robust. This secular demand ensures stable market momentum through the forecast period.

Truck Washing System Market introduction

The Truck Washing System Market encompasses the design, manufacturing, sale, and servicing of automated and semi-automated equipment designed for cleaning commercial vehicles, including heavy-duty trucks, trailers, buses, and specialized utility vehicles. These systems utilize advanced mechanical processes, high-pressure water jets, specialized detergents, and drying capabilities to ensure efficient and thorough vehicle sanitation. Major applications span across commercial trucking fleets, municipal transit authorities, construction companies, logistics and distribution centers, and dedicated commercial vehicle wash facilities, where vehicle cleanliness is crucial for brand image, regulatory compliance, operational safety, and preventive maintenance against rust and corrosion. The primary benefits derived from these systems include minimized downtime, consistent cleaning quality, enhanced labor efficiency, and optimized usage of resources such as water and energy compared to outdated manual washing methods.

The market is characterized by diverse product offerings, including Gantry systems, where the equipment moves over a stationary vehicle; Drive-Through systems, where the vehicle moves slowly through fixed washing arches; and Rollover systems, which combine elements of both. Driving factors for market maturation include the rapid expansion of cross-border logistics requiring immaculate fleets, stringent Public Health regulations (especially for food and pharmaceutical transport), and the escalating costs and availability constraints associated with manual labor. Furthermore, the focus on corporate sustainability mandates the adoption of advanced water reclamation and recycling technologies embedded within modern washing systems, making them increasingly attractive to environmentally conscious fleet operators seeking long-term operational viability and compliance adherence.

Technological innovation continues to shape the competitive landscape, with manufacturers increasingly incorporating features such as telematics integration, remote diagnostics, customized wash programs based on vehicle type recognition (often via RFID or optical sensors), and sophisticated chemical dosing systems. These enhancements address the complexities of modern vehicle designs, ensuring that aerodynamic components, specialized sensors, and complex exterior surfaces are cleaned effectively without damage. The resulting efficiency gains and enhanced vehicle lifespan solidify the central role of automated truck washing systems in modern fleet management protocols across various industrial sectors worldwide.

Truck Washing System Market Executive Summary

The Truck Washing System Market demonstrates compelling growth, primarily driven by robust business trends centered on fleet modernization and automation across global supply chains. Regional trends indicate strong demand stabilization in North America and Europe, supported by strict maintenance regulations and a high concentration of large logistics hubs, while the Asia Pacific (APAC) region exhibits the highest potential CAGR, catalyzed by rapid infrastructure development and the mass expansion of local and international logistics networks in countries like China and India. Segmentation trends highlight the dominance of automated Gantry systems due to their flexibility and ability to handle varying vehicle dimensions, alongside a rapid increase in demand for advanced water recycling and filtration systems as regulatory pressure mounts globally regarding industrial water usage and effluent discharge standards.

Strategic growth opportunities lie predominantly in developing highly integrated, Internet of Things (IoT)-enabled washing solutions that offer real-time operational data, predictive maintenance scheduling, and remote management capabilities, appealing directly to large fleet management companies seeking to optimize their Total Cost of Ownership (TCO). Furthermore, consolidation within the service sector—where dedicated truck wash facilities are merging or expanding—is creating larger, more technologically advanced service providers who require high-throughput, premium washing equipment. This competitive environment is pushing innovation towards faster cleaning cycles and reduced utility consumption, translating operational savings directly into enhanced profitability for end-users.

Investment trends are shifting towards sustainability and automation, focusing capital expenditure on modular, scalable systems that can be easily integrated into existing service centers or deployed rapidly in new distribution centers. The market risk profile remains moderate, primarily influenced by fluctuating raw material costs (steel, specialized polymers) and the initial capital outlay required for high-end systems, which can deter smaller fleet operators. However, the long-term operational efficiencies provided by automated systems increasingly offset these upfront costs, driving continued adoption across all major commercial vehicle sectors, reinforcing the market's positive outlook throughout the defined forecast period.

AI Impact Analysis on Truck Washing System Market

User inquiries regarding the integration of Artificial Intelligence (AI) into the Truck Washing System Market overwhelmingly focus on enhanced operational efficiency, predictive maintenance capabilities, and optimization of resource consumption, particularly water and chemicals. Key themes revolve around how AI can move beyond simple automation to achieve true optimization, such as analyzing accumulated grime levels to adjust washing intensity automatically, minimizing cycle time without compromising cleanliness. Concerns often center on the complexity and cost of retrofitting existing infrastructure with AI-driven sensor arrays and the reliability of machine learning algorithms in highly variable, harsh operational environments. Users also express expectations for AI to facilitate highly personalized washing regimes, minimizing wear and tear on specialized vehicle components and improving overall fleet longevity by maintaining optimal exterior cleanliness, directly impacting corrosion prevention and sensor functionality necessary for modern autonomous and semi-autonomous trucking operations.

- AI-driven sensor arrays enable real-time analysis of vehicle dimensions and dirt accumulation, optimizing brush pressure and nozzle positioning dynamically.

- Predictive maintenance algorithms analyze system usage data (motor load, water pressure fluctuations) to forecast equipment failure, minimizing unplanned downtime.

- AI optimizes chemical and water dosing systems based on local water quality and specific vehicle cleanliness requirements, drastically reducing operational waste.

- Integration with fleet telematics allows automated scheduling of washing cycles based on route exposure, mileage, and known environmental conditions.

- Image recognition and computer vision powered by AI confirm wash quality post-cycle, ensuring compliance and reducing the need for manual inspection.

- Machine learning models enhance water recycling efficiency by optimizing filtration rates and backwash cycles based on real-time contamination analysis.

DRO & Impact Forces Of Truck Washing System Market

The Truck Washing System Market is significantly shaped by a confluence of accelerating drivers (D), persistent restraints (R), compelling opportunities (O), and potent impact forces, all influencing investment decisions and technology deployment strategies across the logistics sector. Primary drivers include increasingly stringent regulatory standards across North America and Europe mandating high levels of vehicle sanitation, particularly for food-grade and hazardous material transportation, coupled with the massive expansion of global logistics fueled by e-commerce. Restraints primarily involve the substantial initial capital expenditure required for high-throughput, advanced automated systems, which acts as a barrier to entry for smaller independent fleet operators, alongside growing environmental restrictions on industrial water consumption and effluent discharge, requiring costly investment in sophisticated water treatment infrastructure. Significant opportunities arise from the convergence of IoT and AI technologies, enabling highly efficient, resource-optimized washing cycles, and the untapped potential in emerging markets where rapid urbanization and fleet growth necessitate structured, professional vehicle maintenance solutions.

Impact forces currently reshaping the market center on technological disruption and shifting economic paradigms. The force of automation is profound, addressing chronic labor shortages in vehicle maintenance sectors by providing high-speed, reliable washing solutions that require minimal personnel. Simultaneously, environmental mandates exert immense pressure, forcing manufacturers to innovate in areas like closed-loop water systems and biodegradable chemistry, transforming compliance from a cost center into a competitive differentiator. The economic impact force is characterized by large logistics firms seeking centralized, optimized washing solutions to achieve economies of scale and standardize fleet appearance globally, favoring suppliers offering comprehensive, scalable service packages.

The strategic market landscape mandates that manufacturers balance high performance with sustainability. Companies successfully navigating this balance, typically those offering modular designs that allow for phased investment in water recycling and sophisticated chemical management, are best positioned for long-term dominance. Furthermore, the global drive towards autonomous vehicles necessitates exceptionally clean sensor arrays (Lidar, radar, cameras), which conventional washing methods struggle to achieve consistently. This emerging technical requirement generates a powerful impact force, driving the development of specialized, precision cleaning components within standard truck wash systems, thereby creating a high-value niche market focused on future-proofing automated fleet maintenance protocols.

Segmentation Analysis

The Truck Washing System Market is comprehensively segmented based on Type, Operation Mode, and Application, reflecting the diverse needs of the global commercial vehicle industry. Understanding these segments is critical for manufacturers to tailor product offerings and for service providers to optimize facility design and throughput. The segmentation by Type, encompassing Gantry, Drive-Through, and Rollover systems, addresses the physical configuration and efficiency requirements of different fleet sizes and site layouts. Operation Mode segmentation, dividing the market into Automated, Semi-Automated, and Manual, highlights the varying degrees of labor input and technological sophistication adopted across different regions and economic strata. Finally, segmentation by Application, covering Logistics and Transportation, Construction and Mining, Municipal and Government Fleets, and other specialized uses, directly links system requirements to the specific operational demands and cleanliness standards of the end-user industry, such as regulatory mandates for sanitary transport versus heavy-duty soil removal in mining operations.

The Automated segment currently dominates the market in terms of revenue, driven by mature economies prioritizing labor reduction and high-volume throughput, particularly within major logistics corridors. However, the Semi-Automated segment maintains relevance in markets where capital investment constraints are stricter or where specialized cleaning (e.g., tank cleaning prep) necessitates partial human intervention. The Gantry systems are highly favored globally due to their inherent flexibility, allowing them to accommodate a wider range of vehicle sizes and shapes without complex structural modifications, positioning them as the backbone technology for many centralized commercial wash facilities. Conversely, the growth of the Drive-Through segment is tied directly to high-frequency, standardized transit depots, such as municipal bus yards, where speed and consistency for similar vehicle types are paramount.

The growth trajectory across these segments is strongly correlated with regional economic development and regulatory pressures. For example, the need for robust, environmentally compliant systems incorporating advanced recycling technologies is particularly pronounced in Western Europe, boosting the demand for premium Automated Gantry systems. Meanwhile, rapid infrastructure deployment in APAC drives demand for durable, often simpler, Drive-Through systems capable of withstanding harsh operational environments typical of burgeoning industrial zones. The continued evolution of regulations pertaining to vehicle hygiene, especially following global health crises, is expected to further accelerate the shift towards high-grade, fully automated washing solutions across all geographic and application segments, prioritizing hygiene over mere aesthetics.

- Type:

- Gantry Systems

- Drive-Through Systems

- Rollover Systems

- Operation Mode:

- Automated

- Semi-Automated

- Manual

- Application:

- Logistics and Transportation (TL, LTL, Parcel)

- Construction and Mining Vehicles

- Municipal and Government Fleets (Waste, Public Transit)

- Specialized Industrial Vehicles (Tankers, Refrigerated)

- Cleaning Chemical Type:

- Detergents and Soaps

- Waxes and Protectants

- Specialized Disinfectants

Value Chain Analysis For Truck Washing System Market

The Value Chain for the Truck Washing System Market begins with the upstream procurement of critical raw materials and components, including high-grade stainless steel and structural aluminum for frames, specialized polymer brushes and textiles, pumps, high-pressure nozzles, and sophisticated electronic control units (PLCs). Upstream suppliers are subject to volatility in commodity pricing, necessitating strong supply chain management by manufacturers to ensure cost stability and material quality adherence. Key manufacturing processes involve precision engineering, system integration of mechanical and electronic components, and rigorous testing protocols to ensure durability against continuous exposure to water and chemicals. Manufacturers often specialize, focusing either on mechanical hardware production or advanced chemical formulation for optimal cleaning performance, requiring close collaboration between these two distinct segments.

The downstream distribution channel primarily utilizes a mix of direct sales teams for large, custom fleet installations and a network of specialized distributors and certified installers who manage regional sales, system setup, maintenance, and after-sales support for smaller commercial clients. Direct channels are crucial for large-scale, automated projects where integration with facility infrastructure (water treatment, drainage) is complex and requires specialized engineering consultation. Indirect channels, typically through regional equipment dealers or specialized car/truck wash distributors, serve as vital links to local markets, providing localized inventory, financing options, and immediate technical services, significantly influencing market penetration rates, especially in geographically dispersed markets.

The service aspect constitutes a critical part of the downstream value chain, encompassing routine maintenance, component replacement (e.g., brushes, pumps), chemical replenishment, and system upgrades. This recurring revenue stream often offers higher margins than the initial equipment sale. Effective service delivery requires skilled technicians capable of diagnosing both mechanical and software issues, emphasizing the importance of specialized training and robust supplier support. The trend toward remote diagnostics and IoT integration further optimizes the downstream service model, allowing for preemptive maintenance and reduced field visits, thereby enhancing the overall operational reliability and lifetime value proposition offered to the end-users.

Truck Washing System Market Potential Customers

The primary consumers and end-users of truck washing systems represent a broad spectrum of commercial entities heavily reliant on large-scale vehicle fleets for their core operations. The largest segment comprises commercial logistics and transportation companies, ranging from multinational third-party logistics (3PL) providers operating thousands of tractor-trailers to smaller, regional freight haulers. These customers require high-throughput systems that minimize vehicle turnaround time while ensuring compliance with highway safety and corporate branding standards. Another significant customer base includes public and private municipal fleets, suchcompassing waste management services, public transportation (buses), and government service vehicles (fire, utility), which demand robust, reliable systems capable of handling daily heavy-duty grime and often requiring specialized disinfection capabilities, particularly in the post-pandemic environment.

A rapidly growing customer segment encompasses specialized industrial applications, notably in the construction, mining, and agricultural sectors. Vehicles operating in these harsh environments accumulate extreme levels of abrasive soil, mud, and chemicals, necessitating powerful, high-durability washing systems specifically engineered for these heavy-duty contaminants, often focusing on undercarriage and wheel cleaning for regulatory compliance related to road contamination prevention. Finally, independent, dedicated commercial truck wash facilities represent a critical B2B customer base. These businesses purchase high-capacity, sophisticated systems to provide wash services to multiple external fleets, requiring equipment that offers maximum reliability, advanced water treatment capabilities, and diverse wash programs to cater to a varied clientele, focusing on revenue per wash cycle optimization.

The purchasing decisions of these potential customers are influenced not only by initial cost but predominantly by long-term operational metrics, including water and energy efficiency (TCO), speed of wash cycle, and the reliability of the system to maintain regulatory compliance. As sustainability becomes a core operational mandate, potential customers increasingly prioritize manufacturers who can demonstrate superior water recycling rates and responsible chemical consumption, viewing these features as essential investments rather than optional extras. This trend dictates that suppliers must provide compelling data on resource efficiency and environmental certification to secure high-value contracts with major fleet operators globally.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 850 Million |

| Market Forecast in 2033 | USD 1450 Million |

| Growth Rate | CAGR 7.8% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Westmatic Corporation, InterClean Equipment, Tammermatic Oy, Karcher, Awash Systems, Washworld Inc., Autoequip Lavaggi S.R.L., N/S Corporation, Prowash, Vehicle Wash Systems, American Wash Systems, Hydro-Chem Systems, M-T-H, WashTec AG, NS Wash Systems, PECO Car Wash Systems, Washworld Inc., Envirochem, Wash-Bots, MacNeil Wash Systems |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Truck Washing System Market Key Technology Landscape

The technological landscape of the Truck Washing System Market is rapidly evolving, moving beyond basic high-pressure water and brush applications toward sophisticated, integrated environmental and digital solutions. Central to this evolution is the deployment of advanced sensor technology, including ultrasonic and optical sensors, which map the precise contours and dimensions of diverse vehicle types in real-time. This contour mapping allows for highly efficient, targeted cleaning sequences, minimizing chemical overspray and ensuring optimal brush contact, leading to reduced energy consumption and superior cleaning results. Furthermore, the integration of Programmable Logic Controllers (PLCs) and HMI (Human-Machine Interface) systems provides operators with granular control over wash parameters, allowing for customized programs tailored to specific dirt types or regulatory requirements, such as specialized disinfecting washes for food delivery fleets, significantly enhancing operational flexibility and safety compliance.

A major focus area involves sustainable technology, primarily driven by innovations in water reclamation and recycling systems. Modern truck washes increasingly employ multi-stage filtration processes, including oil/water separators, solids removal tanks, biological water treatment, and advanced membrane filtration (e.g., Ultrafiltration and Reverse Osmosis). These technologies enable facilities to reuse up to 80-90% of wash water, drastically reducing dependency on municipal water sources and minimizing effluent discharge volume, directly addressing the restraint imposed by environmental regulations. Chemical dispensing has also become highly digitized, utilizing precision dosing pumps and monitoring systems to ensure optimal concentration levels, thereby maximizing cleaning efficacy while minimizing the environmental footprint of the detergents and specialized surface treatments employed.

Looking ahead, the market is embracing connectivity and data analytics, embedding IoT devices into washing systems. This allows for continuous monitoring of performance metrics such as water flow rate, chemical usage, motor health, and cycle time. The resulting operational data is crucial for implementing predictive maintenance schedules, optimizing supply chain management (chemical and spare parts inventory), and benchmarking facility performance against industry standards. This technological shift positions the truck washing system not merely as a piece of machinery but as a networked asset within the broader fleet management ecosystem, enabling seamless data flow between the washing operation and the central fleet maintenance management software, thus creating substantial long-term value for the end-user.

Regional Highlights

The global Truck Washing System Market exhibits distinct growth patterns and maturity levels across key geographical regions, dictated by varying regulatory environments, logistical infrastructure development, and fleet concentration. North America, dominated by the United States and Canada, represents a mature and high-value market characterized by large-scale, corporate-owned fleets and a strong emphasis on automation to mitigate high labor costs. The demand here focuses on high-capacity, durable Gantry and Drive-Through systems with advanced water recycling capabilities, driven by federal regulations concerning vehicle safety and environmental protection. Maintenance and replacement cycles are frequent due to the high utilization rates of logistics vehicles, ensuring consistent revenue for suppliers specializing in premium, highly efficient systems capable of integrating with existing smart fleet management platforms.

Europe stands as a pivotal market, driven primarily by stringent environmental mandates (e.g., EU Water Framework Directive) and sophisticated public transit networks. Western European nations, such as Germany and the UK, prioritize systems offering the highest levels of water efficiency and specialized chemical handling to meet rigorous effluent standards. The demand structure favors modular systems that can be easily adapted to urban settings where space is often limited. Eastern Europe shows accelerating adoption, spurred by increasing integration into trans-European logistics corridors, necessitating investment in modern, high-throughput washing infrastructure to service expanding international haulage operations, balancing initial cost considerations with necessary automation benefits.

Asia Pacific (APAC) is projected to be the fastest-growing region, fueled by unprecedented infrastructure investment, burgeoning manufacturing activity, and the exponential expansion of e-commerce driving massive growth in domestic and cross-border trucking fleets in countries like China, India, and Southeast Asia. While capital intensity remains a key purchasing factor, leading to initial dominance by simpler, robust systems, the increasing awareness of regulatory compliance and the need for hygiene in food logistics are rapidly shifting demand toward semi-automated and fully automated systems with basic recycling features. The sheer volume of new vehicle registrations across APAC logistics hubs ensures sustained, aggressive market expansion, creating fertile ground for both established international manufacturers and localized production facilities.

Latin America and the Middle East & Africa (MEA) represent important secondary growth markets. In Latin America, economic recovery and investment in mining and construction sectors drive demand for heavy-duty washing solutions capable of removing specialized contamination. MEA market growth, particularly in the Gulf Cooperation Council (GCC) states, is linked to major infrastructure projects and the expansion of international trade routes, where the requirement for clean, dust-free fleets in harsh desert environments necessitates resilient, high-pressure cleaning systems. These regions often prioritize durability and resilience against extreme temperatures and sand abrasion, requiring specialized material selection in the manufacturing process.

- North America: Dominant market share; driven by large logistics fleets, high labor costs favoring full automation, and strict safety regulations.

- Europe: High focus on environmental compliance (water recycling); growth driven by municipal fleets and cross-border haulage optimization.

- Asia Pacific (APAC): Highest growth rate; propelled by e-commerce logistics, infrastructure boom, and rapid fleet modernization in China and India.

- Latin America: Demand concentrated in mining, construction, and agricultural sectors, requiring heavy-duty soil removal capabilities.

- Middle East & Africa (MEA): Growth linked to infrastructure development and trade routes, emphasizing system resilience against harsh climate conditions (dust, heat).

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Truck Washing System Market.- Westmatic Corporation

- InterClean Equipment

- Tammermatic Oy

- Karcher

- Awash Systems

- Washworld Inc.

- Autoequip Lavaggi S.R.L.

- N/S Corporation

- Prowash

- Vehicle Wash Systems

- American Wash Systems

- Hydro-Chem Systems

- M-T-H

- WashTec AG

- NS Wash Systems

- PECO Car Wash Systems

- Washworld Inc.

- Envirochem

- Wash-Bots

- MacNeil Wash Systems

- Mosmatic AG

- Istobal S.A.

- Bitimec International, Inc.

- Ryko Manufacturing

Frequently Asked Questions

Analyze common user questions about the Truck Washing System market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the estimated Return on Investment (ROI) for installing an automated truck washing system?

The ROI for an automated truck washing system typically ranges from 18 to 36 months, heavily dependent on fleet size, labor cost savings, and water/chemical efficiency gains. High-volume, centralized logistics facilities often achieve faster payback periods due to maximized utilization and substantial reductions in manual cleaning time and associated labor expenses.

How do modern truck washing systems address stringent environmental water regulations?

Modern systems address stringent regulations primarily through advanced water reclamation technologies, including multi-stage filtration, biological treatment, and reverse osmosis, enabling the recycling and reuse of 80% to 90% of wash water. Manufacturers also focus on precise chemical dosing systems to minimize effluent toxicity and volume, ensuring compliance with local discharge limits.

Which type of truck washing system is most suitable for a diverse fleet with varying vehicle heights and widths?

The Gantry system is generally the most suitable option for highly diverse fleets. Gantry systems feature overhead equipment that travels along the length of a stationary vehicle, using advanced sensors to dynamically adjust brush pressure and height, thereby accommodating a wide range of vehicle dimensions, from delivery vans to oversized trailers, with superior consistency and reduced risk of damage.

How is AI and IoT technology being integrated into the operational management of truck washing systems?

AI and IoT integration optimizes system performance through real-time data monitoring, remote diagnostics, and predictive maintenance scheduling. Sensors gather data on vehicle size and dirt level to customize the wash cycle automatically, reducing resource consumption, while IoT connectivity allows fleet managers to track efficiency metrics and schedule preventative repairs, minimizing downtime.

What are the key drivers for market growth in the Asia Pacific (APAC) region compared to North America?

In APAC, market growth is primarily driven by massive infrastructure expansion, the proliferation of e-commerce logistics demanding rapid fleet scaling, and the subsequent need for efficient sanitation infrastructure. Conversely, North American growth is centered on automation adoption to combat high labor costs and the continuous replacement/upgrade of aging equipment within established, large corporate fleets focusing on maximizing TCO.

Are specialized chemicals required for effective washing of modern refrigerated or tanker trucks?

Yes, specialized chemicals are often required, particularly for refrigerated or food-grade tanker trucks. These vehicles necessitate specific detergent formulations and often require sanitizing or disinfecting agents to meet strict public health and food safety regulations (e.g., FDA requirements), moving beyond standard road grime removal to ensure comprehensive microbial safety.

What impact does the transition to electric vehicles (EVs) have on truck washing systems?

The transition to electric vehicles necessitates truck washing systems that utilize corrosion-resistant materials and precise washing methodologies to protect sensitive battery casings and high-voltage electrical components. Systems must also ensure non-aggressive treatment of complex sensor arrays crucial for EV autonomy features, potentially requiring adjustments to water pressure and chemical composition.

What is the primary restraint impacting the immediate adoption of automated truck washing systems globally?

The most significant restraint is the high initial capital expenditure (CAPEX) required for sophisticated automated systems, including the purchase, installation, and necessary infrastructure modifications (e.g., drainage and water recycling setup). This upfront cost can be prohibitive for small to mid-sized fleet operators despite the long-term operational savings.

How important is after-sales service and support in the vendor selection process for truck washing systems?

After-sales service and support are critically important, often outweighing marginal differences in initial equipment pricing. Reliable technical support, rapid availability of specialized spare parts, and comprehensive preventative maintenance contracts are essential to ensure maximum system uptime, which is vital for high-throughput commercial operations where downtime translates directly into significant logistical delays and revenue loss.

Do current market trends favor leasing or outright purchasing of truck washing equipment?

Current market trends show a growing preference for operational leasing or financing options, particularly among mid-sized fleets. Leasing allows companies to deploy advanced technology immediately, preserving capital while benefiting from predictable monthly expense structures that include maintenance and service, facilitating easier budget management and faster technology adoption cycles.

How do manufacturers ensure the durability and longevity of washing system components in harsh industrial environments?

Manufacturers ensure durability by utilizing highly resilient materials such as galvanized or stainless steel frames, engineered plastics for high-wear parts, and industrial-grade sealing for motors and electronic components. They also implement comprehensive corrosion protection strategies and design modular systems that allow for quick replacement of wear items like brushes and nozzles, maximizing operational life.

What role does fleet branding and aesthetics play in the decision to purchase an automated truck wash?

Fleet branding and aesthetics play a crucial role, particularly for logistics companies and public transit services, as a clean vehicle directly reflects corporate professionalism and reliability. Automated washing systems ensure consistent, high-quality cleaning across the entire fleet, which is essential for maintaining a positive public image and complying with corporate identity standards across all geographic locations.

Is there increasing demand for specialized disinfectant systems within the truck wash market?

Yes, there is significant increasing demand for integrated specialized disinfectant systems, particularly post-COVID-19, driven by heightened hygiene awareness in the logistics sector, especially for vehicles transporting food, medical supplies, and hazardous materials. These systems apply specific chemical rinses or sprays to meet mandated sanitation levels beyond aesthetic cleaning.

How does the segmentation of cleaning chemical types influence the overall profitability of a truck wash operation?

The choice of cleaning chemical types significantly influences profitability. High-efficiency, concentrated, and biodegradable chemicals minimize usage volume, reduce water treatment complexity, and lower disposal costs. Strategic selection ensures superior cleaning results quickly, reducing cycle time and maximizing vehicle throughput, thereby directly boosting the daily revenue potential of the facility.

What are the key technical challenges associated with implementing Drive-Through systems in existing fleet depots?

Key technical challenges include requiring a sufficient amount of linear space for both the washing bay and the necessary approach/exit lanes, which can be constrained in older or densely packed depots. Additionally, effective water drainage and infrastructure modification for fixed equipment installation present substantial logistical and engineering challenges during the retrofitting process.

How does the global shortage of skilled labor influence the demand for fully automated washing systems?

The global shortage of skilled maintenance and cleaning labor is a major catalyst for demand, as automated systems minimize reliance on human intervention, require fewer personnel per operation, and ensure consistent 24/7 cleaning capacity. Automation effectively mitigates the operational risks associated with fluctuating labor availability and associated wage inflation pressures.

What is the competitive landscape like for specialized components, such as high-pressure pumps and custom brushes?

The competitive landscape for specialized components is moderately fragmented, with several global manufacturers specializing in industrial-grade pumps and chemical-resistant materials. Competition is driven by component lifespan, energy efficiency ratings, and the integration capability with proprietary control software, requiring continuous R&D investment to maintain market share and quality differentiation.

Are mobile truck washing systems gaining popularity compared to fixed installations?

Mobile truck washing systems are gaining traction in niche markets, particularly for non-fixed fleet locations, military operations, or initial deep cleaning services, offering flexibility and low initial site modification costs. However, fixed installations remain dominant for large-scale logistics hubs due to their superior throughput capacity, advanced water recycling integration, and lower long-term operational cost per wash.

What defines a "heavy-duty" truck washing system in terms of performance specifications?

A "heavy-duty" system is defined by its ability to handle extremely high volumes (e.g., over 150 washes per day), its structural robustness (often stainless steel), high pump pressure (above 1500 PSI), and its specialized capability to remove highly abrasive and caked-on contaminants typical of construction, mining, or waste management vehicles, often featuring dedicated undercarriage wash functionality.

How do manufacturers customize systems for extreme weather conditions, such as freezing temperatures?

For freezing conditions, manufacturers incorporate specialized features such as heated water tanks, antifreeze injection systems, insulated plumbing, and automatic drainage protocols that clear water from exposed pipes immediately after use. These climate control measures prevent component damage, ensuring year-round operational reliability even in severe winter environments.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager