Tube Diffuser Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443457 | Date : Feb, 2026 | Pages : 248 | Region : Global | Publisher : MRU

Tube Diffuser Market Size

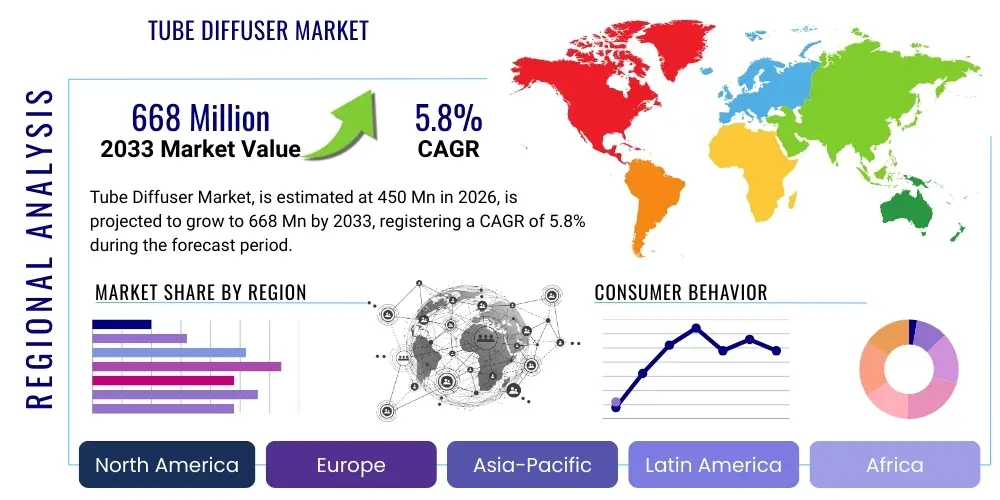

The Tube Diffuser Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 450 Million in 2026 and is projected to reach USD 668 Million by the end of the forecast period in 2033. This substantial growth is primarily driven by the increasing global emphasis on stringent water quality regulations, coupled with rapid urbanization and industrial development, particularly across emerging economies in Asia Pacific and Latin America. The necessity for energy-efficient aeration solutions in wastewater treatment plants (WWTPs) positions fine bubble tube diffusers as a critical infrastructure component, ensuring robust market expansion over the forecast horizon. Investments in retrofitting aging aeration basins in developed regions further contribute to the steady revenue streams within this sector.

Tube Diffuser Market introduction

The Tube Diffuser Market encompasses specialized aeration devices utilized predominantly in municipal and industrial wastewater treatment processes to transfer oxygen efficiently into biological reactors. These systems are essential for supporting aerobic microbial activity, which is crucial for breaking down organic pollutants. Tube diffusers, often constructed from high-quality polymers such as Ethylene Propylene Diene Monomer (EPDM), Silicone, or Polytetrafluoroethylene (PTFE), are characterized by their cylindrical shape, maximizing surface area for bubble generation. They offer superior oxygen transfer efficiency (OTE) and lower head loss compared to older aeration technologies, leading to significant operational cost savings, particularly in energy consumption, which accounts for a substantial portion of a wastewater treatment plant's operational expenditure. The fundamental goal of adopting tube diffusers is the maximization of biological treatment effectiveness while minimizing the overall lifecycle cost of the aeration infrastructure.

Major applications of tube diffusers span the entire spectrum of water resource management, including activated sludge basins, equalization tanks, and aerobic digesters in large-scale municipal facilities. Industrially, they are vital in sectors such as chemicals, pulp and paper, food and beverage, and textiles, where high Biological Oxygen Demand (BOD) and Chemical Oxygen Demand (COD) effluent require aggressive and reliable biological treatment. The inherent design benefits, such as resistance to fouling, ease of installation, and durability in chemically aggressive environments, reinforce their prominence over other aeration methods like surface aerators or jet aerators. Furthermore, the capacity for modular expansion and customized configurations allows these systems to adapt effectively to varying flow rates and treatment demands, making them a highly versatile choice for modern water infrastructure projects globally.

Driving factors for market growth include mandatory governmental regulations regarding discharged water quality, such as those imposed by the EPA in North America and the EU Water Framework Directive. Increased public awareness and corporate social responsibility push industrial users towards highly efficient treatment systems. Technological advancements focused on membrane longevity, reduced pressure loss, and anti-fouling characteristics, particularly through the use of specialized materials and perforation patterns, continuously enhance the performance of modern tube diffusers. These factors collectively establish a robust foundation for sustained growth, emphasizing sustainability and resource efficiency in water management practices worldwide, thereby positioning the market for continued innovation and adoption in both new construction and major refurbishment projects.

Tube Diffuser Market Executive Summary

The global Tube Diffuser Market is poised for significant expansion, underpinned by crucial business trends such as the widespread adoption of fine bubble aeration technology due to its superior energy efficiency and the imperative for operational expenditure reduction in utility management. Key business strategies currently revolve around optimizing membrane materials for extended lifespan and fouling resistance, alongside developing smart aeration systems that integrate IoT sensors and AI-driven controls for real-time adjustments to air flow based on dissolved oxygen (DO) requirements. This shift towards smart infrastructure is a major catalyst, allowing facility operators to precisely manage energy use and maintain optimal biological treatment efficacy. Furthermore, strategic mergers and acquisitions among key market players are focused on broadening geographical reach and consolidating technological expertise, particularly in high-growth areas like specialized industrial wastewater treatment, ensuring competitive advantage and market stability through diverse product offerings and comprehensive service packages.

Regional trends indicate that the Asia Pacific (APAC) region currently dominates the market share, driven by rapid industrialization, burgeoning population growth, and substantial government investments in new sewage treatment infrastructure, notably in China and India. North America and Europe, characterized by mature infrastructure, are focused on high-efficiency retrofitting projects aimed at meeting stricter environmental benchmarks and reducing energy footprints associated with aging WWTPs. Latin America and the Middle East & Africa (MEA) present high-potential emerging markets, fueled by urbanization pressures and newly enforced environmental regulations demanding modern wastewater infrastructure implementation. The concentration of market activity thus reflects a duality: high volume growth in developing regions and high value, efficiency-driven growth in established economies, necessitating tailored sales and distribution strategies across continents.

Segment trends reveal that the Fine Bubble Tube Diffuser segment holds the dominant share, owing to its high Oxygen Transfer Efficiency (OTE), making it the preferred choice for energy-conscious facilities, particularly large municipal plants. Material segmentation shows EPDM rubber remains the standard due to its cost-effectiveness and durability, although specialized materials like PTFE and silicone are gaining traction in industrial applications where chemical resistance is paramount, such as in petrochemical or pharmaceutical wastewater treatment. Application analysis confirms that the Municipal segment consumes the largest volume of tube diffusers, driven by the universal need for sanitation infrastructure. However, the Industrial segment is experiencing faster growth rates, reflecting the escalating stringency of industrial effluent standards globally and the subsequent requirement for highly robust and customized aeration solutions designed to handle complex chemical compositions and fluctuating load demands effectively.

AI Impact Analysis on Tube Diffuser Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Tube Diffuser Market primarily center on optimizing operational efficiency, predicting maintenance needs, and integrating smart controls within existing aeration systems. Users frequently ask about how AI can reduce the immense energy consumption associated with blowers, the feasibility of predictive fouling detection to minimize downtime, and the integration costs of linking diffuser performance data with centralized wastewater management platforms. Key themes emerging from these questions include the shift from reactive maintenance to prescriptive maintenance, the desire for dynamic control mechanisms that respond instantly to changes in influent characteristics (flow, temperature, BOD/COD levels), and expectations surrounding the return on investment (ROI) from adopting AI-enabled aeration control systems. There is a clear market expectation that AI will transform aeration systems from passive infrastructure into intelligently managed, energy-optimized assets, ensuring consistent regulatory compliance while dramatically lowering operational costs, particularly by fine-tuning blower operation based on continuous OTE modeling.

- AI-driven Predictive Maintenance: Utilizing sensor data (e.g., pressure, airflow) to anticipate membrane fouling or failure, scheduling proactive cleaning or replacement, thereby maximizing system uptime and reducing catastrophic failures.

- Energy Consumption Optimization: Implementing machine learning algorithms to dynamically adjust blower speeds and air distribution rates based on real-time Dissolved Oxygen (DO) levels and expected biological load, reducing energy waste associated with over-aeration.

- Process Control and Tuning: Employing AI models to optimize the oxygen transfer efficiency (OTE) of diffuser grids in varying conditions, adjusting parameters far more quickly and accurately than traditional supervisory control systems (SCADA).

- Digital Twin Modeling: Creating virtual representations of aeration basins to simulate different operational scenarios and environmental impacts, allowing operators to test strategies before physical implementation, enhancing training and system resilience.

- Compliance Assurance: Using AI to monitor effluent quality trends and correlate them directly with aeration performance, providing automated alerts or adjustments to maintain regulatory standards consistently and proactively.

DRO & Impact Forces Of Tube Diffuser Market

The Tube Diffuser Market is shaped by a powerful confluence of drivers (D), restraints (R), and opportunities (O), collectively acting as impact forces that dictate market trajectory. Key drivers include stringent global wastewater discharge regulations, the rising scarcity of clean water resources compelling robust treatment solutions, and the persistent need for energy-efficient solutions in high-energy-consuming WWTPs, where aeration constitutes up to 60% of total plant energy use. However, the market faces restraints such as the substantial initial capital expenditure required for installing or retrofitting large-scale fine bubble aeration systems, complexity in integrating new technologies into legacy infrastructure, and operational challenges associated with membrane fouling in certain industrial wastewater streams, which necessitates frequent cleaning and maintenance interventions. The primary opportunities lie in the expanding industrial wastewater treatment sector, driven by new regulatory compliance demands for specific effluent characteristics, and the burgeoning trend towards smart WWTPs leveraging IoT and AI for optimization and predictive maintenance, offering high-value technology integration prospects.

The impact forces exerted on the market emphasize a directional shift toward sustainable and technologically advanced aeration solutions. The most significant driving force remains the global regulatory environment, particularly in developing nations where infrastructure build-out is rapid and must incorporate best available technologies (BAT) to manage environmental impact. This regulatory pressure provides a non-negotiable demand floor for tube diffuser sales. Conversely, the high initial cost barrier acts as a restraining force, often leading smaller municipalities or enterprises in price-sensitive regions to opt for less efficient, lower-cost aeration alternatives, slowing the overall rate of adoption of premium, high-efficiency diffusers. The fluctuating cost of raw materials, especially polymers like EPDM and silicone, adds cost volatility, impacting manufacturer profit margins and final product pricing, further restraining mass adoption in certain cost-sensitive global segments.

Exploiting strategic opportunities is vital for market players seeking long-term revenue growth. The opportunity to provide comprehensive lifecycle services, including regular membrane replacement, predictive maintenance contracts utilizing digitalization, and complete aeration system optimization consulting, represents a significant high-margin revenue stream beyond the initial hardware sale. Furthermore, geopolitical forces and global infrastructure spending initiatives, particularly those focused on climate resilience and water security, channel massive public funds toward modern water infrastructure. Companies that can position their tube diffusers as central components of energy-saving, green infrastructure projects are strategically positioned to capitalize on these macro-economic trends, ensuring market resilience and accelerated penetration into high-growth vertical applications, such as specialized nutrient removal processes (e.g., denitrification and phosphorus removal) which require highly controlled aeration zones.

Segmentation Analysis

The Tube Diffuser Market is systematically segmented based on material, type, and application, allowing for a detailed understanding of market dynamics and targeted strategic planning. The segmentation by material is crucial as it dictates the diffuser's performance characteristics, chemical resistance, and lifespan in specific wastewater environments, influencing purchase decisions based on operational requirements. Segmentation by type differentiates between technologies that produce fine bubbles (high OTE) versus those that produce coarse bubbles (mixing capability), catering to distinct functional needs within the biological treatment process. Application segmentation is fundamental, delineating the massive municipal sector demand from the highly specialized and chemically complex needs of various industrial sectors, each requiring unique product specifications and service models, hence driving heterogeneous growth rates across these segments.

- By Material:

- EPDM (Ethylene Propylene Diene Monomer)

- Silicone

- PTFE (Polytetrafluoroethylene)

- Others (Polyurethane, etc.)

- By Type:

- Fine Bubble Tube Diffusers

- Coarse Bubble Tube Diffusers

- By Application:

- Municipal Wastewater Treatment

- Industrial Wastewater Treatment

- Pulp and Paper

- Chemicals and Petrochemicals

- Food and Beverage

- Pharmaceuticals

- Textiles and Tanning

- Others (Mining, Power Generation)

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East & Africa (MEA)

Value Chain Analysis For Tube Diffuser Market

The value chain for the Tube Diffuser Market begins with upstream activities centered on the procurement and processing of specialized polymer raw materials, primarily EPDM, silicone, and increasingly, high-performance chemically inert materials like PTFE. Key upstream suppliers include major petrochemical companies and specialized rubber/elastomer manufacturers. Success at this stage relies heavily on securing stable supply contracts and maintaining quality control over the membrane compounds, which directly impact the diffuser's critical parameters: porosity, flexibility, and longevity. Research and Development (R&D) is highly critical in this phase, focusing on material science innovations to enhance fouling resistance and minimize plasticizer migration, ensuring the membrane retains optimal OTE over a multi-year lifespan. Manufacturers often vertically integrate or maintain close collaborative relationships with material suppliers to ensure tailored compounding for specific wastewater requirements, thereby optimizing product performance and cost structure before the manufacturing process even begins.

The core manufacturing and assembly stage involves precision molding, laser perforation, and rigorous quality testing of the assembled tube diffusers and associated piping infrastructure. Key manufacturers differentiate themselves through proprietary perforation patterns designed to optimize bubble size and uniformity, and through robust non-return valve designs that prevent water backflow and clogging. Distribution channels are complex, involving both direct sales to large municipal utilities and indirect sales through a network of specialized water technology distributors, engineering, procurement, and construction (EPC) firms, and local systems integrators. Direct sales typically handle large, complex municipal contracts where deep technical consultation is required, while the indirect channel is essential for reaching smaller industrial end-users and facilitating quick replacement part sourcing, requiring robust inventory management and technical training for partner networks globally.

Downstream activities are dominated by installation, commissioning, and long-term after-sales support, which includes membrane replacement and system maintenance contracts. The end-user segment, particularly large municipal and industrial plants, heavily relies on EPC firms and specialized environmental engineering consultants for system design and integration. High switching costs associated with changing aeration grid designs once installed create significant opportunities for incumbent suppliers to secure recurring revenue through membrane replacement cycles (typically every 5-10 years). The growth of the market is increasingly tied to the service aspect; offering digital monitoring tools and predictive maintenance packages enhances customer loyalty and provides essential data for future product development. The effectiveness of the value chain is ultimately measured by the long-term OTE delivered to the end-user and the total reduction in operational energy expenditure achieved over the system's operational lifetime, making robust technical support a critical downstream differentiator.

Tube Diffuser Market Potential Customers

Potential customers for the Tube Diffuser Market are primarily concentrated within two major sectors: municipal water and wastewater utilities, and high-BOD/COD generating industrial facilities. Municipal customers represent the largest volume segment, driven by governmental mandates to treat domestic sewage before discharge and continuous urban expansion requiring new infrastructure or significant capacity upgrades to existing aging plants. These customers prioritize long-term durability, low lifecycle costs, and proven energy efficiency (OTE), often demanding large-scale, standardized EPDM fine bubble systems capable of reliable operation under fluctuating loads. Procurement processes in the municipal sector are lengthy and heavily regulated, favoring established suppliers with demonstrable track records and compliance certifications, and often requiring competitive bidding processes based on strict engineering specifications and total installed cost (TIC).

The industrial sector represents a faster-growing, though smaller volume, segment characterized by unique and complex effluent compositions. Industrial buyers—spanning chemicals, pharmaceuticals, food & beverage, and pulp & paper—require specialized membrane materials (such as silicone or PTFE) that can resist aggressive solvents, high temperatures, or specific cleaning agents. For these customers, reliability in chemically harsh environments and customized engineering solutions to handle high load variability are paramount. Potential buyers in the industrial segment are highly focused on minimizing process downtime and ensuring environmental compliance to avoid heavy fines, meaning they often prioritize premium, high-performance diffusers despite higher upfront costs, viewing them as critical components of uninterrupted production. This segment requires a highly consultative sales approach, often involving direct engagement between the manufacturer's engineering team and the industry client's environmental management personnel.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450 Million |

| Market Forecast in 2033 | USD 668 Million |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Xylem Inc., Suez (Veolia), Evoqua Water Technologies, Aqseptence Group, SSI Aeration, Inc., Sanitaire (Xylem Brand), Aerzen, Ovivo, EDI Environmental Dynamics International, Inc., Purestream, Aerator Solutions, Fluence Corporation, APG-Neuros, Hach (Danaher), Tsurumi Manufacturing Co., Ltd., Wuxi Ruidian, Diffused Gas Technologies, Inc., WesTech Engineering, Degremont (Suez), Jager Umwelt-Technik GmbH |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Tube Diffuser Market Key Technology Landscape

The technological landscape of the Tube Diffuser Market is focused heavily on material science innovation and aeration system optimization to enhance Oxygen Transfer Efficiency (OTE) and extend membrane service life. The transition from older, less efficient plate and disc diffusers to modern tube diffusers is largely complete in mature markets, meaning current R&D is centered on refining existing designs. A primary technological advancement involves the development of advanced polymer compounds, specifically modified EPDM and high-grade silicone, that exhibit superior resistance to plasticizer extraction and chemical attack. This material innovation minimizes membrane hardening and clogging, often caused by grease and biofilm accumulation, thereby maintaining consistent bubble size and distribution over longer periods. Furthermore, manufacturers are employing sophisticated laser cutting and molding techniques to create proprietary perforation patterns and slit shapes that yield ultrafine bubbles, maximizing the surface area for oxygen dissolution while minimizing the required air pressure and subsequent blower energy consumption, directly addressing the critical operational cost driver for end-users.

Beyond the physical diffuser unit, the key technology shift involves the integration of Smart Aeration Control Systems. These systems leverage IoT sensors embedded within the aeration basin, measuring parameters like Dissolved Oxygen (DO), sludge characteristics, temperature, and pressure drop across the diffusers. This real-time data feeds into advanced proprietary control algorithms, often employing model predictive control (MPC) or AI/Machine Learning techniques, which precisely regulate the air flow provided by variable frequency drive (VFD) equipped blowers. This dynamic adjustment ensures that only the required amount of oxygen is supplied to meet biological demand, resulting in significant energy savings—often ranging from 20% to 40% compared to manually controlled or time-based aeration systems. The increasing availability and affordability of these digital control technologies are rapidly making them standard components in new installations and high-value retrofit projects, fundamentally changing how aeration systems are managed and operated.

Another crucial area of technological development involves anti-fouling and self-cleaning mechanisms. In wastewater environments, biofouling and scale buildup on the membrane surface degrade OTE and increase operational pressure over time. Innovations include chemically modified membrane surfaces (e.g., hydrophobic coatings or specific materials like PTFE which inherently resist fouling) and specialized mechanical designs that allow for periodic "relaxation" or flexing of the membrane to shed accumulated debris. Additionally, advancements in the overall aeration grid design, including enhanced header configurations and robust sealing technologies, ensure hydraulic stability and uniform air distribution across large basin footprints. These integrated technological improvements—spanning material composition, intelligent control systems, and design refinement—are collectively driving the market towards highly reliable, minimally managed, and significantly more energy-efficient wastewater treatment processes, crucial for meeting the demands of global sustainable water management goals.

Regional Highlights

- Asia Pacific (APAC): APAC is the dominant market and is projected to exhibit the highest growth rate, primarily driven by rapid industrialization, massive urban population growth, and substantial governmental investment in new sanitation infrastructure, particularly in China, India, and Southeast Asian nations. The region is seeing a rapid shift from basic treatment methods to advanced biological processes utilizing fine bubble tube diffusers to address critical pollution levels and meet emerging national environmental standards.

- North America: North America represents a mature, high-value market focused heavily on upgrading and retrofitting aging municipal wastewater treatment plants (WWTPs). The emphasis here is on maximizing energy efficiency and utilizing advanced control technologies (AI/IoT integration) to comply with stringent regulatory standards, leading to a strong demand for premium, long-life, and highly durable tube diffuser products.

- Europe: Europe exhibits stable growth, highly regulated by the EU Water Framework Directive. The market is driven by sustainability goals, innovation in nutrient removal technologies, and the adoption of energy-neutral WWTP concepts. Demand is concentrated on high-quality, specialized materials like PTFE for industrial applications and energy-saving fine bubble technology for municipal retrofits.

- Latin America (LATAM): LATAM is a high-potential emerging market characterized by increasing urbanization and infrastructural development. Market growth is spurred by government mandates for improved water sanitation coverage, leading to significant new construction projects, although procurement is often price-sensitive, balancing efficiency against initial capital expenditure.

- Middle East & Africa (MEA): Growth in MEA is highly localized, driven by major infrastructure projects in the GCC countries focused on water security, reuse, and large-scale industrial development (e.g., oil & gas, mining). Africa presents substantial long-term growth potential as foundational water infrastructure is developed, focusing initially on cost-effective, durable solutions suitable for harsh conditions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Tube Diffuser Market.- Xylem Inc.

- Suez (Veolia)

- Evoqua Water Technologies

- Aqseptence Group

- SSI Aeration, Inc.

- Sanitaire (Xylem Brand)

- Aerzen

- Ovivo

- EDI Environmental Dynamics International, Inc.

- Purestream

- Aerator Solutions

- Fluence Corporation

- APG-Neuros

- Hach (Danaher)

- Tsurumi Manufacturing Co., Ltd.

- Wuxi Ruidian

- Diffused Gas Technologies, Inc.

- WesTech Engineering

- Degremont (Suez)

- Jager Umwelt-Technik GmbH

Frequently Asked Questions

Analyze common user questions about the Tube Diffuser market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the adoption of fine bubble tube diffusers?

The primary driver is the superior energy efficiency and high Oxygen Transfer Efficiency (OTE) offered by fine bubble technology, leading to significant reductions in operational costs, particularly electrical consumption associated with blowers in wastewater treatment plants (WWTPs).

How long is the typical service life for a tube diffuser membrane?

The service life typically ranges from 5 to 10 years, heavily dependent on the membrane material (EPDM, Silicone, PTFE), the quality of the wastewater being treated (presence of grease or aggressive chemicals), and adherence to recommended periodic maintenance and cleaning schedules.

Which sector consumes the largest share of the Tube Diffuser Market?

The Municipal Wastewater Treatment sector holds the largest volume share of the market, driven by the constant need for sewage treatment infrastructure expansion and regulatory mandates governing effluent discharge quality in populated areas.

What role does Artificial Intelligence (AI) play in modern aeration systems?

AI is increasingly used in smart aeration control systems to optimize blower operation and air flow dynamically based on real-time Dissolved Oxygen (DO) and biological load data, enabling predictive maintenance, minimizing energy use, and ensuring optimal treatment effectiveness.

What are the main types of materials used for tube diffuser membranes?

The main materials are Ethylene Propylene Diene Monomer (EPDM), used widely for general municipal applications due to its balance of cost and durability, and specialized materials like Silicone and Polytetrafluoroethylene (PTFE), preferred for applications requiring higher chemical and temperature resistance in industrial settings.

The global tube diffuser market is characterized by intense competition driven by technological superiority in oxygen transfer efficiency (OTE) and material science longevity. Manufacturers are constantly striving to reduce pressure loss and improve anti-fouling characteristics to provide a lower total cost of ownership (TCO) to end-users. The competition is not just confined to the product itself but extends to comprehensive system design and integration services, including computational fluid dynamics (CFD) modeling for basin optimization. Major players like Xylem and Suez leverage their extensive global distribution networks and reputation for reliable engineering solutions, often integrating diffusers with their proprietary blower and control technologies to offer complete, optimized aeration packages. Smaller, specialized firms, such as EDI and SSI Aeration, differentiate themselves through patented membrane designs and niche expertise, particularly in challenging industrial environments or unique retrofit scenarios, maintaining high margins through technical specialization and rapid deployment capabilities. Price competition remains fierce in high-volume, low-specification segments, especially in the Asia Pacific region, necessitating continuous supply chain optimization and localized manufacturing by global leaders to remain cost-competitive against regional suppliers. The market is witnessing a trend toward consolidation, with larger players acquiring specialized membrane manufacturers to bolster their R&D capabilities and patent portfolios, reinforcing the market's focus on technological differentiation as the key to sustainable market share gain and long-term profitability amidst rising global regulatory standards.

In terms of product strategy, manufacturers are investing heavily in modular designs that allow for easier installation and replacement, crucial for large-scale municipal operations seeking minimal downtime during maintenance. The shift towards sustainable procurement practices also favors companies that can demonstrate environmental compliance not only in the product’s function but also in its manufacturing process, including the use of recycled or bio-based polymers, although this segment is currently nascent. Market leaders are also focusing on digital service offerings, transforming their business models to include ongoing predictive maintenance and performance monitoring subscriptions, moving beyond transactional hardware sales. This strategy locks in customers and generates recurring high-margin revenue streams, positioning these companies as integrated environmental technology partners rather than merely equipment suppliers. Regional variations in product demand necessitate tailored strategies; for instance, European markets demand highly efficient, corrosion-resistant diffusers due to high energy costs, whereas rapidly expanding Asian markets focus on large-scale capacity and initial capital cost minimization. This strategic balancing act between technological advancement, cost-competitiveness, and tailored regional market penetration defines the current competitive landscape of the tube diffuser industry.

The industrial application segment is becoming a key battleground for differentiation, given the higher margins and the requirement for highly customized solutions compared to standardized municipal projects. Companies that have successfully engineered membranes resistant to specific contaminants—such as high oil content in petrochemical effluents or harsh cleaning chemicals in pharmaceutical waste—gain a significant competitive edge. This specialization often requires intensive laboratory testing and validation processes, acting as a barrier to entry for generalized competitors. Furthermore, the competitive impact of alternative aeration technologies, such as jet aeration or mechanical surface aerators, while generally lower in OTE, continues to exert downward price pressure in specific applications, particularly where mixing requirements outweigh the need for high OTE. Therefore, tube diffuser manufacturers must continuously articulate and prove the long-term total lifecycle cost advantage of their products, leveraging data-driven performance metrics derived from installed base monitoring and AI-enabled diagnostics. Successfully navigating this complex competitive environment requires a balance of high-volume efficiency, technical specialization, and advanced digital service integration across all major geographical and application segments.

The market trajectory is intrinsically linked to global population growth and corresponding urbanization, particularly in developing economies, which place immense pressure on existing water infrastructure. Governments and municipalities are increasingly facing the dual challenge of expanding treatment capacity while simultaneously meeting stricter effluent quality mandates, accelerating the adoption cycle for high-efficiency aeration solutions. Furthermore, the global push towards water reclamation and reuse (e.g., in agriculture or industrial cooling) mandates tertiary treatment standards that often necessitate optimized biological treatment, directly benefiting the fine bubble diffuser market. The need to conserve energy as part of national climate commitments also institutionalizes the demand for highly efficient equipment like VFD-controlled blowers paired with fine bubble diffusers, creating a favorable regulatory environment globally. This convergence of environmental, demographic, and energy policy drivers provides a powerful, sustained tailwind for the market, making it resilient to short-term economic fluctuations in infrastructure spending.

Technological refinement is expected to continue focusing on reducing the maintenance burden associated with tube diffusers. Innovations such as self-cleaning cycles activated by pressure differential thresholds, or membranes that use non-sticking surface chemistries, are becoming standard requirements in high-specification contracts. The standardization of communications protocols (e.g., OPC UA) within wastewater treatment facilitates the easier integration of diffuser control systems with broader plant management platforms (SCADA/DCS), further enabling smart operations. The market is also seeing niche growth in specialized small-scale systems for decentralized wastewater treatment (DWT), which require compact, low-maintenance tube diffuser solutions suitable for containerized or modular plants. These emerging decentralized applications offer manufacturers a new growth avenue outside the traditional, large-scale municipal infrastructure bidding process, contributing to a diversified customer base and demand profile. The synthesis of robust material science and advanced digital control is thus solidifying the tube diffuser's position as the optimal technology for efficient biological oxidation in modern wastewater management, setting the stage for continuous market value appreciation through the forecast period.

The challenge of nutrient removal (nitrogen and phosphorus) is also significantly impacting diffuser technology requirements. Nutrient removal often necessitates creating specific aerobic, anoxic, and anaerobic zones within the treatment process. Fine bubble tube diffusers, particularly when deployed in zoned grids with dedicated control valves, allow for precise control over dissolved oxygen levels, crucial for sequential batch reactor (SBR) and advanced nutrient removal processes. This technical capability positions tube diffusers ahead of mixing-focused aeration methods. Consequently, municipal contracts for plants upgrading to Enhanced Biological Phosphorus Removal (EBPR) or biological nutrient removal (BNR) are becoming high-value targets, demanding suppliers who can offer detailed hydraulic and aeration zone modeling alongside the hardware. This shift elevates the complexity of the product offering, moving it further up the value chain from a simple equipment sale to a specialized engineering solution package. Compliance with tightening total nitrogen (TN) and total phosphorus (TP) discharge limits in North America and Europe represents a foundational growth driver for the most advanced segment of the tube diffuser market, emphasizing the need for technical sales expertise and application-specific product development.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager