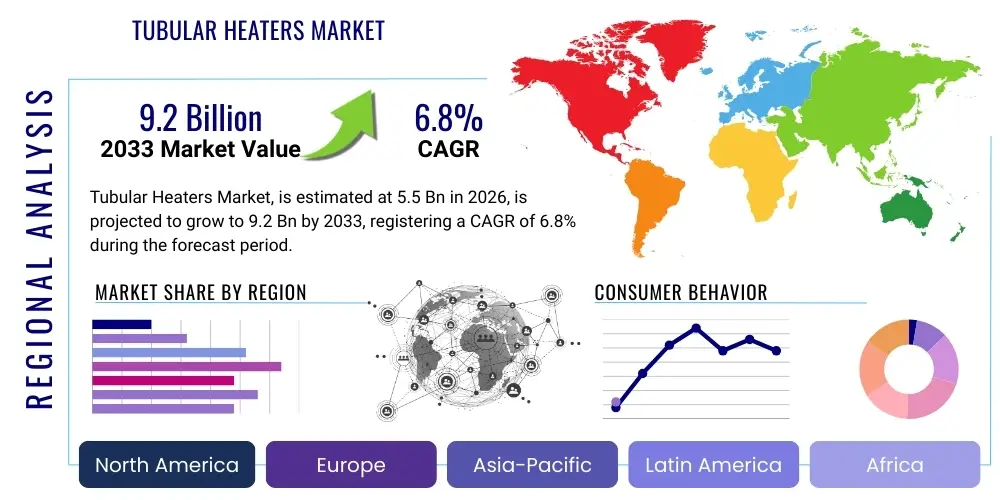

Tubular Heaters Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443185 | Date : Feb, 2026 | Pages : 255 | Region : Global | Publisher : MRU

Tubular Heaters Market Size

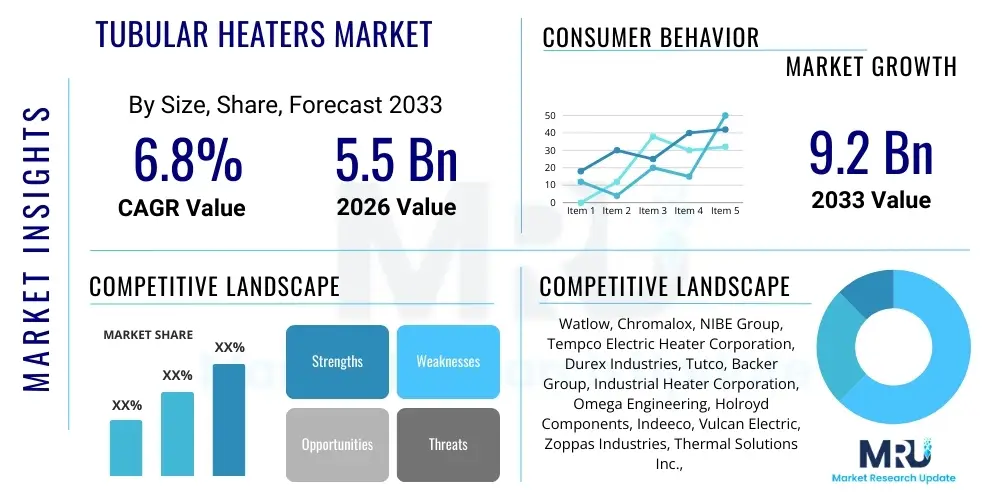

The Tubular Heaters Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 5.5 Billion in 2026 and is projected to reach USD 9.2 Billion by the end of the forecast period in 2033.

This robust expansion is primarily driven by accelerating industrialization across emerging economies, particularly within the Asia Pacific region, coupled with the increasing global emphasis on energy-efficient heating solutions in commercial and residential infrastructure. Tubular heaters, known for their versatility, reliability, and high watt density capability, are becoming indispensable components in complex industrial processes, including petrochemical refining, plastics manufacturing, and semiconductor fabrication. The replacement cycle for older, less efficient heating elements in mature markets further contributes significantly to the market momentum, ensuring sustained demand throughout the forecast period.

Furthermore, the integration of tubular heating elements into advanced technologies such as Electric Vehicle (EV) battery thermal management systems and renewable energy storage solutions is opening substantial new application avenues. Regulatory mandates promoting stricter temperature control and safety standards in food processing and pharmaceuticals also necessitate the adoption of high-quality, standardized heating elements like tubular heaters. The shift towards customized, high-performance heating solutions that can withstand harsh operating environments—such as high temperatures, corrosive fluids, and high pressures—is compelling manufacturers to innovate materials and design, solidifying the market’s positive trajectory towards the projected valuation.

Tubular Heaters Market introduction

Tubular heaters, frequently referred to as electric resistance heating elements or immersion heaters, constitute a foundational technology in thermal processing across virtually all industrial and commercial sectors. These durable heating units are typically constructed from a resistance wire (such as Nichrome) coiled around a magnesium oxide (MgO) insulator, enclosed within a metallic sheath (often stainless steel, Incoloy, or copper). This design ensures superior heat transfer efficiency, mechanical robustness, and operational longevity, making them suitable for demanding environments. They function by converting electrical energy into thermal energy, which can then be directly applied to air, liquids, or solids via conduction, convection, or radiation.

The primary applications for tubular heaters span a wide spectrum, ranging from basic domestic appliances like ovens and water heaters to complex industrial machinery requiring precision thermal control. In industrial settings, they are crucial for oil and gas preheating, mold heating in plastics and rubber industries, hot water storage in large-scale HVAC systems, and sterilization processes in pharmaceuticals. Their major benefits include their exceptional adaptability in shape and size, allowing for customization into straight, U-shaped, or intricate coiled configurations, and their remarkable durability, offering operational reliability even under continuous high-load conditions. This flexibility ensures seamless integration into existing infrastructure and equipment designs.

Driving factors for the market include the rapid expansion of the manufacturing sector globally, demanding reliable and scalable heating infrastructure. Specifically, the boom in specialized manufacturing (e.g., semiconductors, specialized chemicals) necessitates tight thermal tolerances, driving demand for high-precision tubular elements. Moreover, the increasing focus on electrification of energy systems, replacing fossil fuel-based heating with electric alternatives for enhanced sustainability and control, provides a long-term structural tailwind for the tubular heaters market, supported by global energy efficiency standards.

Tubular Heaters Market Executive Summary

The Tubular Heaters Market is defined by consistent demand stabilization in mature sectors combined with high-growth penetration in emerging industrial applications, forecasting a robust CAGR of 6.8% through 2033. Key business trends indicate a strong shift towards advanced material compositions, particularly high-nickel alloys like Incoloy and titanium, to enhance corrosion resistance and withstand extreme temperatures, thereby maximizing product lifecycle and reducing maintenance downtime. Furthermore, manufacturers are increasingly incorporating smart technologies, such as integrated sensors and predictive failure diagnostics, aligning products with the broader Industrial Internet of Things (IIoT) framework to offer customers superior process control and energy management capabilities.

Regionally, the Asia Pacific (APAC) market is projected to be the engine of growth, characterized by massive investments in infrastructure development, burgeoning industrial capacity in China, India, and Southeast Asia, and escalating demand from key end-use industries like automotive manufacturing and power generation. North America and Europe, while experiencing slower overall industrial capacity expansion, demonstrate high demand for premium, customized, and energy-efficient tubular elements, driven by strict environmental regulations and the need for equipment retrofitting. Segment-wise, the sheath material segment dominates, with stainless steel and Incoloy being pivotal materials due to their wide range of applications, while the application segment sees significant growth in the oil and gas processing and HVAC sectors.

Overall, the market is moderately fragmented, with intense competition centered on product differentiation, quality certification (e.g., UL, CE), and competitive pricing strategies aimed at securing large-volume contracts from major original equipment manufacturers (OEMs). Strategic mergers, acquisitions, and technological partnerships focused on expanding regional footprint and enhancing product innovation remain critical strategies for leading market players navigating the competitive landscape and addressing the growing need for application-specific heating solutions.

AI Impact Analysis on Tubular Heaters Market

User inquiries regarding the integration of Artificial Intelligence (AI) in the tubular heaters market predominantly revolve around three core themes: optimizing operational efficiency, implementing predictive maintenance protocols, and enhancing overall system integration within smart factory environments. Users are keenly interested in how AI algorithms can analyze real-time operational data (temperature fluctuations, power consumption, material stress) to automatically adjust heating parameters, thereby minimizing energy waste and ensuring product consistency. Concerns frequently center on the feasibility of retrofitting existing heating infrastructure with AI capabilities, the necessity of large datasets for effective AI training, and the cybersecurity implications of connecting critical heating assets to centralized intelligent systems.

The consensus suggests that AI is poised to revolutionize the lifecycle management of tubular heaters, moving maintenance from reactive or scheduled interventions to genuine predictive models. By identifying subtle thermal signatures or resistance changes indicative of imminent failure, AI systems can schedule maintenance precisely when needed, dramatically reducing unplanned downtime and maximizing the utilization of costly industrial assets. This shift is particularly impactful in highly regulated industries like petrochemicals or pharmaceuticals, where process interruptions carry severe financial and safety risks. Furthermore, AI-driven simulations can optimize the initial design and placement of tubular elements within complex machinery, ensuring superior heat distribution and uniformity based on specific fluid dynamics or material properties.

In essence, AI adoption transforms tubular heaters from passive components into active, intelligent assets capable of self-diagnosis and dynamic optimization. While the initial investment in sensor technology and analytical software is significant, the long-term benefits concerning minimized energy usage, extended equipment life, enhanced safety standards, and improved throughput justify the technological transition. This intelligent integration allows manufacturers to offer value-added services focused on performance monitoring, moving beyond simple component sales to holistic thermal management solutions.

- AI-driven predictive maintenance reducing unplanned failures by up to 40%.

- Optimization of energy consumption through real-time thermal load balancing algorithms.

- Enhanced process control resulting in superior product quality and reduced manufacturing variance.

- Automated fault detection and diagnostic reporting for immediate operational intervention.

- Simulation-based design optimization for application-specific heater geometries and material selection.

- Improved safety mechanisms by continuously monitoring and flagging abnormal operational parameters.

DRO & Impact Forces Of Tubular Heaters Market

The dynamics of the Tubular Heaters Market are shaped by a complex interplay of robust market drivers, significant operational restraints, and compelling technological opportunities, all moderated by external impact forces such as global economic stability and regulatory evolution. Key drivers include the relentless growth of global industrial manufacturing, particularly sectors demanding fluid heating, air heating, and high-temperature processing, such as plastics, chemicals, and food & beverage. Furthermore, the persistent industrial emphasis on energy efficiency pushes manufacturers towards premium tubular designs integrated with advanced control systems, ensuring precise temperature management and minimizing power wastage, thereby stimulating replacement demand.

Conversely, the market faces significant restraints, notably the relatively high initial capital expenditure associated with high-performance, custom-engineered tubular heaters compared to standard heating elements, which can deter smaller enterprises. Additionally, the inherent challenge of corrosion and scaling, especially when heating aggressive liquids or hard water, necessitates frequent maintenance or replacement, increasing lifetime operational costs. The volatility in raw material prices, specifically nickel and copper used in sheath and wiring, poses a continuous challenge to profitability and supply chain stability for manufacturers across the globe.

Opportunities for exponential growth are concentrated in the burgeoning fields of sustainable technology and specialized industrial applications. The transition to electric heating solutions in industrial boilers, coupled with the rising adoption of specialized heating elements in Electric Vehicle (EV) battery thermal management systems (BTMS) and renewable energy storage solutions, presents lucrative market expansion avenues. Regulatory impact forces, such as stringent safety standards (e.g., ATEX certification for hazardous environments) and environmental mandates compelling reduced emissions, further drive innovation toward safer, more durable, and intrinsically efficient tubular heating designs.

Segmentation Analysis

The Tubular Heaters Market is extensively segmented based on crucial attributes including Product Type, Sheath Material, Application, and End-Use Industry, allowing for granular analysis of demand patterns and strategic market positioning. This segmentation provides stakeholders with detailed insights into specific high-growth niches, such as the preference for Incoloy sheathed heaters in highly corrosive environments within the chemical processing industry, versus the prevalent use of stainless steel in HVAC and food processing applications. Understanding these distinct segment behaviors is critical for tailoring product offerings, optimizing manufacturing processes, and targeting specific geographical markets where industrial specialization dictates heating element requirements.

- Product Type:

- Straight Tubular Heaters

- Formed Tubular Heaters (U-Bends, Coiled Heaters)

- Finned Tubular Heaters (Air Heating)

- Immersion Heaters (Flanged, Screw Plug)

- Sheath Material:

- Stainless Steel (304, 316, 321)

- Incoloy (800, 840)

- Copper

- Titanium

- Others (Carbon Steel, Quartz)

- Application:

- Air Heating

- Immersion Heating (Liquid Heating)

- Radiant Heating

- Process Heating

- End-Use Industry:

- Industrial (Oil & Gas, Chemical, Plastics, Automotive)

- Commercial (HVAC Systems, Catering Equipment)

- Residential (Water Heaters, Appliances)

- Energy & Infrastructure (Power Plants, Renewables)

Value Chain Analysis For Tubular Heaters Market

The value chain for the Tubular Heaters Market commences with the upstream activities of raw material procurement, encompassing the sourcing of high-purity resistance wire (Nichrome), magnesium oxide (MgO) powder for insulation, and critical sheath materials such as various grades of stainless steel and high-nickel alloys like Incoloy. Manufacturers prioritize strategic sourcing agreements to mitigate price volatility and ensure consistent material quality, as the performance and lifespan of the final product are heavily dependent on these core inputs. The subsequent core activity involves sophisticated manufacturing processes, including resistance wire coiling, MgO compaction, precise bending and forming, welding, and rigorous quality control testing (e.g., dielectric strength tests, insulation resistance checks) to meet international standards and application-specific requirements.

Midstream activities primarily focus on distribution and channel management, involving a mix of direct sales channels to large Original Equipment Manufacturers (OEMs) and indirect distribution through specialized industrial distributors, electrical wholesalers, and engineering procurement contractors (EPCs). Direct channels are crucial for custom-engineered, high-value tubular assemblies required in large industrial projects, allowing for close technical collaboration between the supplier and the OEM. Indirect channels ensure market penetration into smaller maintenance, repair, and operations (MRO) markets and geographically diverse commercial sectors, relying on distributor expertise and established local logistics networks.

The downstream analysis centers on the installation, integration, and utilization of tubular heaters within end-user applications across diverse industries. After-market services, including technical support, periodic inspection, and the supply of replacement elements, form a critical component of the downstream value proposition, particularly in sectors where uptime is paramount, such as petrochemical refining and power generation. The efficient functioning of the value chain is increasingly reliant on digital tools for inventory management and tracking custom orders, ensuring timely delivery and responsive service, thereby solidifying customer loyalty and driving recurring revenue streams from the maintenance segment.

Tubular Heaters Market Potential Customers

The customer base for tubular heaters is highly diversified, spanning nearly every sector requiring thermal energy application for processing, conditioning, or control, with primary potential customers residing in large-scale industrial manufacturing, commercial infrastructure development, and specialized technology integration. High-volume buyers include major equipment manufacturers (OEMs) specializing in HVAC systems, industrial ovens, and commercial refrigeration units, who integrate tubular elements as core components into their final products. The petrochemical and chemical processing industries represent critical potential customers, utilizing rugged, corrosion-resistant heaters for volatile liquid and gas preheating, distillation, and polymerization processes, where reliable heat transfer is non-negotiable for safety and productivity.

Furthermore, the food and beverage industry constitutes a significant and growing customer segment, relying on sanitary, high-grade stainless steel tubular heaters for sterilization, pasteurization, and cooking processes, demanding compliance with strict hygiene standards like FDA and HACCP guidelines. The automotive sector, particularly with the acceleration of electric vehicle production, has emerged as a high-potential customer group, requiring specialized tubular heaters for precise battery thermal management systems (BTMS) to ensure optimal battery performance and longevity under various environmental conditions, thereby dictating stringent specifications for thermal control and element durability.

Beyond traditional heavy industry, the infrastructure and power generation sectors, including both conventional thermal power plants and emerging renewable energy facilities, are substantial end-users requiring large, high-wattage immersion and circulation heaters for boiler maintenance, fluid conditioning, and anti-condensation measures. The commercial sector, encompassing hospitals, hotels, and large commercial laundries, maintains steady demand for reliable tubular heaters integrated into large volume water heating systems and specialized catering equipment, driving a consistent, volume-based replacement market.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 5.5 Billion |

| Market Forecast in 2033 | USD 9.2 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Watlow, Chromalox, NIBE Group, Tempco Electric Heater Corporation, Durex Industries, Tutco, Backer Group, Industrial Heater Corporation, Omega Engineering, Holroyd Components, Indeeco, Vulcan Electric, Zoppas Industries, Thermal Solutions Inc., San Electro Heat a/s, Hi-Watt Inc., Delta Manufacturing Co., Minco Products, Thermal Engineering Corporation (TEC), Marathon Heater |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Tubular Heaters Market Key Technology Landscape

The technological landscape of the Tubular Heaters Market is rapidly evolving, driven primarily by innovations in material science, advanced manufacturing techniques, and the integration of smart thermal management features. A critical area of development is the refinement of sheath materials, moving beyond standard stainless steel to specialized alloys like high-grade Incoloy and titanium. These materials offer superior resistance to corrosion, particularly in highly acidic or alkaline process fluids, and enable stable operation at significantly higher sheath temperatures, enhancing the overall power density and longevity of the heating element, which is paramount for heavy industrial applications like crude oil processing and high-pressure steam generation.

Another significant technological advancement centers on the internal construction and geometry of the elements. Optimized compaction of Magnesium Oxide (MgO) insulation powder, achieved through sophisticated vibrational and hydraulic presses, maximizes heat transfer efficiency and dielectric strength, preventing premature element failure due to overheating or short-circuiting. Furthermore, computer-aided design (CAD) and computational fluid dynamics (CFD) modeling are increasingly used to design complex formed shapes and fin configurations that optimize convective heat transfer rates for specific mediums (e.g., highly viscous fluids or fast-moving air streams), ensuring uniform heating and reducing the total energy required to reach target temperatures across varied loads.

Crucially, the market is witnessing a strong trend toward smart integration through embedded sensors, commonly thermocouples or Resistance Temperature Detectors (RTDs), placed strategically within the heater structure or external sheath. These sensors allow for highly precise, real-time temperature monitoring. When coupled with modern control systems utilizing Pulse Width Modulation (PWM) or Solid State Relays (SSRs), this technology enables rapid, accurate thermal adjustments. This integration facilitates remote monitoring, connectivity to factory automation systems (IIoT), and the implementation of sophisticated diagnostic features, moving the tubular heater into the realm of intelligent components capable of self-optimization and reporting operational metrics.

Regional Highlights

- Asia Pacific (APAC): APAC represents the largest and fastest-growing market, propelled by massive industrial expansion, particularly in China, India, and Southeast Asian nations. The region’s escalating demand for consumer electronics, automotive components, and infrastructure development fuels the need for high-volume process heating solutions. Government initiatives supporting local manufacturing and investment in specialized chemicals and pharmaceuticals further cement APAC's dominance in volume and capacity expansion.

- North America: Characterized by high technological maturity and rigorous safety standards, North America is a major consumer of custom-engineered, high-performance tubular heaters. Demand is strongly driven by the renovation and retrofitting of aging industrial infrastructure, stringent energy efficiency mandates, and significant investments in oil & gas refinement, specialized plastics, and the burgeoning electric vehicle manufacturing sector, focusing on quality and lifespan over initial cost.

- Europe: The European market is defined by a strong regulatory environment promoting sustainability and low-carbon technologies. This drives demand for energy-efficient, environmentally compliant tubular elements for use in residential and commercial heating, ventilation, and air conditioning (HVAC) systems. Furthermore, Europe's robust machinery manufacturing and pharmaceutical sectors require high-precision, certified heating components for complex sterilization and drying processes.

- Middle East and Africa (MEA): Growth in MEA is primarily linked to extensive investments in the oil and gas infrastructure, where tubular heaters are vital for maintaining viscosity and preventing crystallization in pipelines and processing facilities. Rapid urbanization and subsequent commercial construction in the GCC countries also contribute to consistent demand from the HVAC and large-scale water heating segments, often requiring robust, high-durability elements capable of operating in harsh climates.

- Latin America: This region demonstrates steady growth fueled by the expansion of the food and beverage processing industry, particularly in Brazil and Mexico, alongside ongoing investments in mining and basic chemicals manufacturing. The market often seeks cost-effective and reliable tubular heating solutions for basic process needs, although modernization efforts are increasingly incorporating more sophisticated thermal control technologies.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Tubular Heaters Market.- Watlow

- Chromalox

- NIBE Group

- Tempco Electric Heater Corporation

- Durex Industries

- Tutco

- Backer Group

- Industrial Heater Corporation

- Omega Engineering

- Holroyd Components

- Indeeco

- Vulcan Electric

- Zoppas Industries

- Thermal Solutions Inc.

- San Electro Heat a/s

- Hi-Watt Inc.

- Delta Manufacturing Co.

- Minco Products

- Thermal Engineering Corporation (TEC)

- Marathon Heater

Frequently Asked Questions

Analyze common user questions about the Tubular Heaters market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the demand for high-performance tubular heaters?

The central factor driving demand is the global industrial push for enhanced energy efficiency and the requirement for precise thermal management across critical manufacturing processes. Modern tubular heaters offer superior watt densities and can be integrated with smart control systems to minimize energy waste and ensure consistent product quality, especially in chemical and oil processing.

Which sheath materials are preferred for corrosive liquid heating applications?

For heating corrosive liquids, specialized sheath materials such as Incoloy (800 or 840) and Titanium are highly preferred over standard stainless steel. These high-nickel alloys provide exceptional resistance to acid, alkaline, and salt solutions, significantly extending the operational lifespan of immersion heaters in challenging chemical and wastewater treatment environments.

How is the electric vehicle (EV) sector impacting the tubular heaters market?

The EV sector is creating substantial new demand, particularly for compact, highly precise tubular elements used in Battery Thermal Management Systems (BTMS). These heaters are essential for maintaining optimal operating temperatures for EV batteries, ensuring performance, rapid charging capabilities, and longevity, representing a high-growth niche application.

What are the key differences between finned tubular heaters and standard tubular heaters?

Finned tubular heaters are specifically designed for applications involving air heating or forced convection, such as ducts and ovens. The addition of fins (extended surface area) dramatically increases the element's heat dissipation capacity to the surrounding air, enabling much more efficient and rapid heating compared to standard tubular heaters designed primarily for contact or liquid immersion.

What role does the Asia Pacific region play in the overall tubular heaters market growth?

The Asia Pacific region is the leading market driver due to rapid industrialization, massive investments in new manufacturing plants, and expanding infrastructure development in countries like China and India. The high volume of production across automotive, consumer goods, and infrastructure sectors ensures APAC maintains the highest growth rate in both consumption and production capacity.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager