Tung Oil Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443073 | Date : Feb, 2026 | Pages : 245 | Region : Global | Publisher : MRU

Tung Oil Market Size

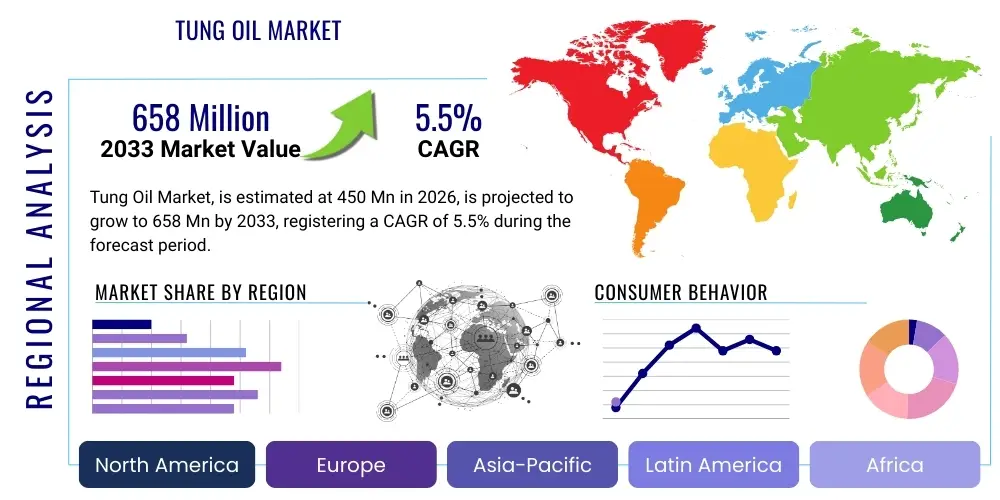

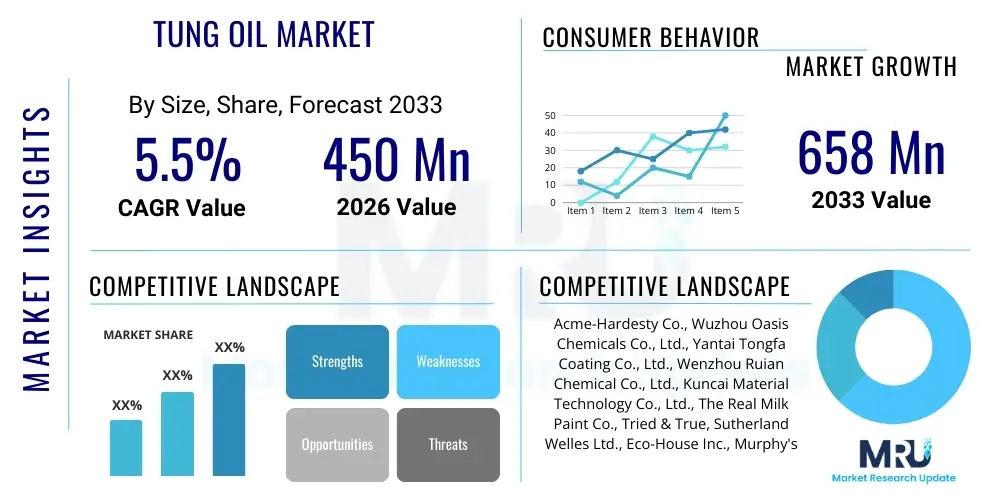

The Tung Oil Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.5% between 2026 and 2033. The market is estimated at $450 Million in 2026 and is projected to reach $658 Million by the end of the forecast period in 2033. This consistent growth trajectory is primarily driven by the increasing demand for natural, eco-friendly finishing products across the global construction, woodworking, and marine industries. As regulatory bodies enforce stricter standards regarding volatile organic compound (VOC) emissions, tung oil, known for its non-toxic nature and superior protective properties, is gaining significant traction over synthetic alternatives.

Tung Oil Market introduction

Tung oil, derived from the seeds of the tung tree (Vernicia fordii or Vernicia montana), is a naturally drying oil that has been utilized for centuries, particularly in traditional Chinese woodwork and preservation. It is highly valued for its exceptional water resistance, durability, elasticity, and fast-drying characteristics, making it a premium choice in high-performance coatings. The product is fundamentally a triglyceride, rich in eleostearic acid, which is responsible for its unique polymerization and hardening capabilities upon exposure to air. This intrinsic chemical structure distinguishes it from other natural oils like linseed oil, offering superior hardness and a clear, durable finish.

Major applications of tung oil span several critical sectors, most notably in paints and coatings, wood finishes for furniture and flooring, and marine applications for boat hulls and decks due to its excellent moisture barrier properties. Furthermore, it finds niche applications in insulating materials, ink manufacturing, and traditional Chinese medicine. The market growth is fundamentally propelled by the global shift towards sustainable and bio-based raw materials, coupled with a renewed consumer appreciation for natural wood aesthetics and long-lasting protection. The oil's ability to penetrate deeply into wood fibers, creating a resilient, flexible sealant without forming a plastic-like film on the surface, secures its position as a preferred finishing agent for high-end woodwork and architectural projects.

Key benefits driving market adoption include its low toxicity profile, making it safe for use on food-contact surfaces and children's toys, and its inherent resistance to mildew and fungal growth. These advantages align perfectly with modern consumer preferences for health-conscious and sustainable building materials. Driving factors encompass regulatory support for bio-based chemicals, expanding renovation and remodeling activities globally, and continuous innovation in blending tung oil with other resins and solvents to enhance application efficiency and performance characteristics across diverse climatic conditions.

Tung Oil Market Executive Summary

The Tung Oil Market is characterized by robust expansion, fueled primarily by escalating environmental consciousness and stringent regulatory frameworks favoring natural, low-VOC alternatives. Business trends indicate a strategic focus among manufacturers on securing sustainable raw material supply chains, especially given that tung tree cultivation is highly geographically concentrated, predominantly in Asia Pacific. Key players are investing heavily in processing technologies that enhance the purity, consistency, and drying time of the final oil product, thereby expanding its applicability in industrial coatings and sealants. This push toward product innovation and supply chain resilience is critical for maintaining competitive advantage in a market increasingly sensitive to price fluctuations and raw material availability.

Regionally, the Asia Pacific dominates both production and consumption, driven by China, which acts as the world's leading producer and major consumer due to its extensive furniture and coating manufacturing base. However, North America and Europe are exhibiting the fastest consumption growth rates, propelled by strong demand from the residential renovation sector and the marine industry, where tung oil is highly valued for its water-repellent properties. The shift in Western markets towards DIY and artisanal woodworking has further amplified retail demand for pure and diluted tung oil products. Latin America and the Middle East and Africa (MEA) are emerging regions, where increased infrastructure development and localized agricultural efforts could spur future market penetration, particularly in construction protection and architectural coatings.

Segment-wise, the Pure Tung Oil segment maintains a commanding position due to its premium performance characteristics and certification compliance in eco-labeling schemes, although the Modified Tung Oil segment is growing rapidly. Modified variants, often mixed with solvents or resins, offer improved user experience, such as faster curing times and easier application for large-scale industrial use. In terms of application, the Paints and Coatings sector represents the largest revenue share, reflecting the widespread use of tung oil as an additive or primary binder in varnishes, lacquers, and sealants. Flooring and Furniture finishing remains a high-growth application due to the oil's ability to provide a hard, durable, yet natural-looking finish, appealing to modern interior design trends emphasizing natural materials.

AI Impact Analysis on Tung Oil Market

Common user questions regarding AI's impact on the Tung Oil Market typically revolve around optimizing agricultural yields, predicting global commodity price volatility, and enhancing quality control during processing. Users are concerned about how AI can address the geographical concentration risks associated with tung tree cultivation, improve the efficiency of oil extraction to minimize waste, and ensure the consistency of final product batches for industrial buyers. The consensus expectation is that AI tools will primarily serve to streamline the upstream segment of the value chain. Specifically, predictive analytics can optimize planting and harvesting schedules based on micro-climatic data, improving yield stability and reducing the impact of unforeseen weather events. Furthermore, AI-driven sensor technology and image recognition systems in processing plants will revolutionize quality assurance, allowing for real-time monitoring of oil purity, viscosity, and chemical composition, thereby setting new standards for industrial-grade tung oil derivatives. This technological integration aims to stabilize supply, mitigate risks inherent in agricultural commodity trading, and enhance the overall competitiveness of tung oil against petrochemical substitutes.

- AI-driven Predictive Analytics: Used for optimizing tung tree cultivation, forecasting harvest yields, and managing supply chain logistics, stabilizing raw material input prices.

- Automated Quality Control: Deployment of computer vision and sensor systems during the oil refining process to ensure purity, consistency, and compliance with high industrial standards (AEO/GEO focus on quality assurance).

- Commodity Price Forecasting: Machine learning models analyze geopolitical factors, inventory levels, and demand signals to provide accurate future pricing, reducing financial risk for buyers and sellers.

- Sustainable Farming Optimization: AI algorithms assist farmers in precision agriculture practices, reducing fertilizer and water use, leading to more sustainable and cost-effective cultivation of tung trees.

- Enhanced R&D of Modified Tung Oil: AI accelerates the formulation process for novel tung oil derivatives by modeling interactions between tung oil and various synthetic resins or solvents.

DRO & Impact Forces Of Tung Oil Market

The Tung Oil Market is governed by a dynamic interplay of factors that both drive expansion and impose restrictions, creating a complex operational environment for stakeholders. The primary driver is the pervasive global mandate for environmental sustainability, compelling industries to transition from solvent-laden synthetic coatings to natural, non-toxic alternatives like tung oil. This regulatory push, particularly in North America and Europe concerning VOC emissions, positions tung oil favorably across construction, furniture, and toy manufacturing sectors. Concurrently, the robust growth in the residential remodeling and DIY market, driven by consumers seeking natural, aesthetically pleasing, and durable wood finishes, continues to be a major consumption engine. These drivers are fundamentally reshaping procurement habits across industrial and consumer segments toward bio-based solutions.

However, significant restraints temper this growth. The most critical constraint is the inherent geographical concentration and volatility of the raw material supply, primarily sourced from China and South America. Tung tree cultivation is sensitive to weather conditions, leading to unpredictable annual yields and subsequent price instability, which poses planning difficulties for large industrial consumers. Furthermore, the slow curing time of pure tung oil, compared to fast-drying synthetic finishes, presents an application challenge in time-sensitive industrial coating operations. These performance and supply limitations necessitate significant investment in technology to mitigate risk and improve product attributes, such as using specialized driers or modifying the oil's chemical structure for faster polymerization.

Opportunities for market players lie predominantly in technological innovation and geographical diversification. Developing advanced modified tung oil products that retain the oil's natural benefits while offering improved drying times and increased hardness will open up new industrial applications. Moreover, strategic initiatives focused on establishing sustainable tung tree cultivation in secondary regions outside traditional Chinese supply centers, such as in parts of Africa and the Southern United States, could stabilize global supply chains and enhance market security. The overarching impact forces are characterized by a high degree of supply side risk offset by consistently strong and growing demand pull from environmentally conscious consumer and regulatory bodies globally. The market's future trajectory hinges on successful mitigation of agricultural supply volatility through diversified sourcing and technological enhancements.

Segmentation Analysis

The Tung Oil Market segmentation provides a granular view of product usage and market dynamics based on type, application, and distribution channel. The differentiation between Pure Tung Oil and Modified Tung Oil is central to understanding consumer choice, where pure variants command premium pricing due to their unadulterated, fully natural profile, favored for food-grade and high-end artisanal applications. Modified variants, which include blends with other oils, resins, or solvents to improve workability or accelerate curing, cater primarily to large-scale industrial users seeking performance optimization and efficiency. The growth in the modified segment reflects the industry's adaptation to industrial processing speeds.

Application analysis highlights the market's reliance on the Coatings and Paints industry, which utilizes tung oil as a high-performance, water-resistant binder in varnishes and sealants. However, the Wood Finishing segment (furniture and flooring) demonstrates robust growth, driven by the global appreciation for natural aesthetics and durable, low-maintenance wood protection. The marine sector remains a crucial, albeit niche, market where tung oil’s exceptional resistance to moisture and saltwater degradation makes it irreplaceable. Understanding these segment dynamics is essential for market players to tailor product development and marketing strategies, focusing on the specific performance requirements of each end-use sector, from quick-drying characteristics for industrial coatings to non-toxic certification for consumer products.

- By Type:

- Pure Tung Oil (Unadulterated)

- Modified Tung Oil (Blends and Formulations)

- By Application:

- Paints and Coatings

- Wood Finishing (Furniture, Cabinets, Flooring)

- Marine (Boat Hulls, Decks)

- Inks and Dyes

- Others (Insulating materials, Traditional medicine)

- By Distribution Channel:

- Direct Sales (B2B Industrial Supply)

- Indirect Sales (Retail, E-commerce, Specialty Stores)

Value Chain Analysis For Tung Oil Market

The Tung Oil value chain is highly geographically focused, commencing with the upstream segment involving the cultivation and harvesting of tung nuts, primarily concentrated in provinces of China, and to a lesser extent, in Argentina and Paraguay. This agricultural stage dictates the quality and quantity of raw materials available for processing. Key activities at this stage include seed selection, meticulous cultivation management, and mechanized or manual harvesting. The subsequent processing step, which is midstream, involves cracking the nuts, separating the kernels, and mechanically pressing them to extract the crude oil. Modern processors utilize advanced expellers and often follow up with refining, bleaching, and deodorizing steps to produce high-purity, clear tung oil suitable for specific industrial applications, thereby maximizing yield and meeting strict quality specifications for exports.

The downstream segment focuses on formulation and distribution. Crude or refined tung oil is transported to formulators who blend it with solvents, natural resins, or driers to create ready-to-use products, such as marine varnishes, interior wood finishes, or industrial coatings. This formulation stage adds significant value by improving the oil's performance characteristics, catering specifically to end-user needs for drying time and hardness. Distribution channels are bifurcated into direct and indirect routes. Direct distribution involves large-volume B2B sales of refined oil to major paint and coating manufacturers globally, often facilitated through long-term supply contracts. This channel ensures consistent bulk supply for industrial consumers.

The indirect channel targets smaller manufacturers, specialized woodworking shops, and the burgeoning retail DIY market. Products here are typically packaged in smaller volumes, branded, and sold through e-commerce platforms, home improvement stores, and specialized chemical distributors. Effective management of the supply chain, particularly the logistics of transporting a temperature-sensitive agricultural commodity across continents, is crucial for maintaining margins and ensuring product quality upon delivery. Market players focus on optimizing logistics to minimize transport time and costs, particularly given the reliance on international shipping from Asia Pacific production hubs to Western consumption centers.

Tung Oil Market Potential Customers

Potential customers for Tung Oil are diverse, spanning multiple industrial sectors that prioritize durable, water-resistant, and natural finishing materials. The largest consumer base resides in the Paint and Coatings manufacturing industry, where companies utilize tung oil as a vital component in formulating high-solid, low-VOC varnishes, lacquers, and oil-based protective coatings. These industrial buyers demand high-volume, consistently refined tung oil that can seamlessly integrate into large-scale batch production processes, often requiring stringent quality certifications regarding purity and viscosity. The marine industry constitutes another key segment, with boat builders, shipyard maintenance operators, and specialized coating companies relying on tung oil’s superior resistance to UV exposure, saltwater corrosion, and fungal growth to protect wooden boat components.

The second major segment comprises the Furniture and Flooring manufacturers, encompassing both large-scale commercial producers and specialized artisanal woodworkers. These customers seek finishes that enhance the natural grain of wood while providing a hard-wearing, easily repairable, and non-toxic surface. This demand is particularly high in the production of high-end, custom furniture, where the natural, matte finish provided by tung oil is preferred over synthetic polyurethane gloss. Furthermore, the retail sector, driven by DIY enthusiasts and professional contractors engaged in residential renovation and restoration, represents a rapidly expanding customer base for consumer-packaged tung oil products, emphasizing ease of application and environmental safety.

Niche but high-value customers include manufacturers of specialized inks and dyes, electrical insulating materials, and traditional consumer goods like cutting boards and children's wooden toys. For these applications, the non-toxic, food-safe nature of pure tung oil is paramount, often mandated by strict safety regulations. Market suppliers must therefore tailor product specifications—from highly refined, consistent oil for industrial coatings to food-grade certified, unadulterated oil for specialty consumer goods—to effectively serve this broad spectrum of end-users across global markets, ensuring compliance with diverse regulatory requirements.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $450 Million |

| Market Forecast in 2033 | $658 Million |

| Growth Rate | 5.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Acme-Hardesty Co., Wuzhou Oasis Chemicals Co., Ltd., Yantai Tongfa Coating Co., Ltd., Wenzhou Ruian Chemical Co., Ltd., Kuncai Material Technology Co., Ltd., The Real Milk Paint Co., Tried & True, Sutherland Welles Ltd., Eco-House Inc., Murphy's Oil Soap, Old Fashioned Milk Paint Co., Wood Kote Products, Inc., General Finishes, Liberon, Rustins Ltd., Bio-Tung Oil, All Natural Wood Finishes, Earth Pigments Co., Vermont Natural Coatings, Eco-Friendly Finishes. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Tung Oil Market Key Technology Landscape

The technological landscape surrounding the Tung Oil market primarily focuses on three critical areas: enhanced extraction efficiency, advanced refining for purity, and modification technologies to improve performance attributes. Traditional cold-pressing methods, while yielding high-quality, unadulterated oil, are often inefficient in terms of oil extraction volume. Modern technology employs screw presses with optimized temperature control and pressure cycles to maximize yield from the tung nut kernels while preventing degradation of the oil's critical chemical structure. Furthermore, ultrasonic extraction methods are being explored in research and development to potentially boost efficiency and reduce energy consumption during the initial processing phase, addressing the inherent volatility of raw material supply by ensuring maximum output from available stock.

Refining and purification technologies are crucial for meeting the stringent quality demands of industrial clients, particularly in the coatings sector. Standard refining processes involve degumming, neutralization, bleaching, and deodorization. Recent technological advancements include the use of membrane filtration and selective adsorption techniques to remove trace impurities and undesirable compounds that might affect the oil’s shelf stability or performance characteristics, such as drying time and film clarity. These advanced purification steps ensure that the refined tung oil maintains consistent viscosity and color, which is vital for sophisticated industrial formulations and compliance with international standards for high-performance coatings.

Crucially, the development of modified tung oil formulations represents the most dynamic technological frontier. This involves reacting tung oil with other chemical compounds, often synthetic resins like phenolic, epoxy, or alkyd resins, through processes such as polymerization or esterification. The goal is to retain the superior water resistance of tung oil while drastically improving the hardness, abrasion resistance, and, most importantly, the curing speed. Technologies focused on creating water-borne tung oil emulsions are also gaining traction, allowing the oil to be incorporated into low-VOC, water-based paint systems, further aligning the product with global environmental and application efficiency mandates. Investment in R&D aims to overcome the natural limitations of the oil, ensuring its competitiveness against synthetic high-performance coatings in demanding industrial environments.

Regional Highlights

The regional dynamics of the Tung Oil Market are heavily skewed towards the Asia Pacific region, primarily due to China’s dominance in both cultivation and processing. China accounts for the majority of global production, making it the central hub for raw material supply. This region also harbors extensive end-use industries, particularly furniture manufacturing and construction, driving robust internal consumption. However, regulatory shifts and rising labor costs within China are gradually leading to diversification in sourcing and processing capabilities across Southeast Asia. North America and Europe stand out as the fastest-growing consumption regions, characterized by high demand for premium, natural finishes in residential remodeling and a strict regulatory environment that strongly favors low-VOC, bio-based products.

- Asia Pacific (APAC): Dominates the global supply chain, led by China, which controls raw material sourcing and primary processing. Strong demand driven by domestic construction and furniture export industries. Investment focuses on modernizing extraction and refining techniques.

- North America: High growth region driven by the strong residential construction and DIY segment. Regulatory pressure on VOCs fuels demand for pure and modified tung oil in coatings and specialized marine applications.

- Europe: Characterized by stringent environmental standards (REACH), driving a strong preference for certified sustainable and natural oils. Significant consumer base in high-end flooring, artisanal woodworking, and architectural restoration.

- Latin America: Emerging supply region (Argentina, Paraguay) focused on increasing cultivation to challenge APAC dominance. Growing domestic demand in infrastructure and woodworking sectors, particularly Brazil.

- Middle East and Africa (MEA): Currently a small market, but experiencing increasing usage in protective coatings for new construction projects and specialized applications requiring resistance to harsh, dry climates.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Tung Oil Market.- Acme-Hardesty Co.

- Wuzhou Oasis Chemicals Co., Ltd.

- Yantai Tongfa Coating Co., Ltd.

- Wenzhou Ruian Chemical Co., Ltd.

- Kuncai Material Technology Co., Ltd.

- The Real Milk Paint Co.

- Tried & True

- Sutherland Welles Ltd.

- Eco-House Inc.

- Murphy's Oil Soap

- Old Fashioned Milk Paint Co.

- Wood Kote Products, Inc.

- General Finishes

- Liberon

- Rustins Ltd.

- Bio-Tung Oil

- All Natural Wood Finishes

- Earth Pigments Co.

- Vermont Natural Coatings

- Eco-Friendly Finishes

Frequently Asked Questions

Analyze common user questions about the Tung Oil market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary differences between Pure and Modified Tung Oil?

Pure Tung Oil is 100% natural, non-toxic, and food-safe, prized for its deep penetration and durable waterproofing qualities. Modified Tung Oil is blended with resins or solvents to improve application speed, hardness, and reduce curing time, making it suitable for large-scale industrial coating processes.

Is Tung Oil considered a viable sustainable alternative to synthetic wood finishes?

Yes, Tung Oil is highly favored as a sustainable alternative due to its natural, bio-based origin, exceptionally low volatile organic compound (VOC) content, and superior long-term durability, aligning with global environmental regulations and green building standards.

Which geographical region dominates the global supply and production of Tung Oil?

The Asia Pacific region, specifically China, dominates the global supply chain for Tung Oil. China is the largest cultivator of tung trees and the primary processor, though production is diversifying across other countries like Argentina and Paraguay to mitigate supply chain risk.

What key factors are driving the accelerated adoption of Tung Oil in developed markets?

Accelerated adoption in markets like North America and Europe is driven by stringent government regulations limiting VOCs in coatings, increased consumer demand for natural and non-toxic products (especially for food-contact surfaces and children’s items), and robust growth in the residential restoration sector.

How is technological innovation impacting the performance characteristics of Tung Oil?

Technology is focused on enhancing extraction efficiency and developing modified formulations. Advanced modification techniques (e.g., polymerization with resins) significantly improve the oil's curing speed and hardness, overcoming traditional application limitations for industrial use.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Tung Oil Market Size Report By Type (Raw Tung Oil, Boiled Tung Oil), By Application (Wood Finishing, Electronic), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- Tung Oil Market Statistics 2025 Analysis By Application (Wood Finishing, Electronic), By Type (Raw Tung Oil, Boiled Tung Oil), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager