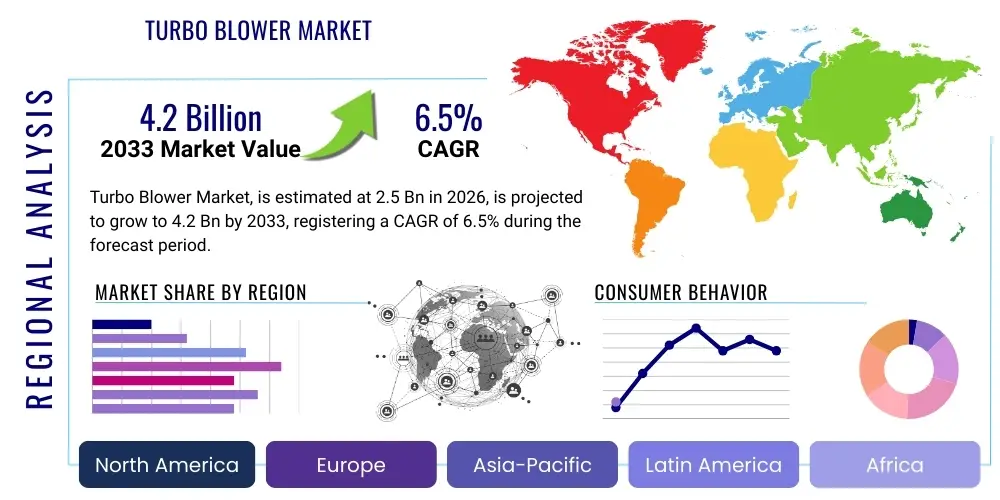

Turbo Blower Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441141 | Date : Feb, 2026 | Pages : 251 | Region : Global | Publisher : MRU

Turbo Blower Market Size

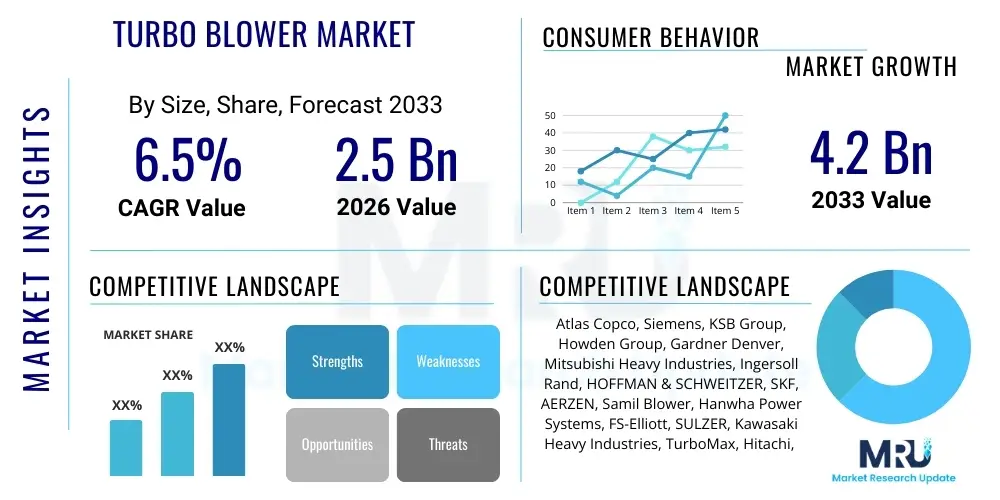

The Turbo Blower Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 2.5 Billion in 2026 and is projected to reach USD 4.2 Billion by the end of the forecast period in 2033. This robust expansion is primarily fueled by increasing global infrastructure development, stringent environmental regulations necessitating efficient wastewater treatment facilities, and the continuous industrial shift towards energy-efficient compression technologies. Turbo blowers, characterized by their high efficiency, low maintenance requirements, and oil-free operation, are rapidly replacing conventional blower systems across critical industrial sectors, contributing significantly to operational cost reductions and enhanced system reliability. The market sizing reflects a growing adoption rate in regions undergoing rapid urbanization and industrialization, particularly in Asia Pacific, where manufacturing and municipal infrastructure projects are booming. The long-term trajectory is further supported by technological advancements, including the integration of magnetic bearing technology and variable frequency drives (VFDs), which optimize performance across varying load conditions, making turbo blowers an economically and environmentally superior choice for air and gas handling applications.

Turbo Blower Market introduction

The Turbo Blower Market encompasses the design, manufacturing, distribution, and utilization of advanced high-speed centrifugal blowers, primarily used for aeration, pneumatic conveying, and gas boosting applications across various industries. These systems utilize sophisticated impellers and often magnetic or air foil bearings to achieve rotational speeds far exceeding traditional positive displacement blowers, resulting in significantly higher energy efficiency and quieter operation. The product description centers on oil-free operation, compact design, reduced vibration, and the ability to deliver precise airflow volumes and pressures. Major applications span municipal and industrial wastewater treatment (aeration basins), chemical and petrochemical processing, power generation (boiler purging), general manufacturing, and pneumatic transport systems in industries such as cement and food processing. The primary benefits include substantial energy savings due to higher adiabatic efficiency, minimal maintenance requirements stemming from the elimination of gears and lubricants, and compliance with stringent environmental standards due to their clean, oil-free output. Key driving factors propelling market growth include the global impetus toward energy conservation, escalating demand for advanced wastewater infrastructure, and the superior total cost of ownership (TCO) offered by these next-generation blowers compared to legacy machinery.

Turbo Blower Market Executive Summary

The global Turbo Blower Market is undergoing a significant transformation driven by sustainability mandates and technological innovation, positioning it as a core component of modern industrial processes requiring efficient air compression. Current business trends indicate a strong move towards digitized and connected blower systems, where manufacturers are embedding Industrial Internet of Things (IIoT) capabilities for predictive maintenance and remote monitoring, thereby enhancing operational uptime and service longevity. This shift is also characterized by intense competition focused on improving magnetic bearing reliability and integrating advanced Variable Frequency Drive (VFD) controls to maximize efficiency across partial loads, a critical factor for utility-intensive operations like wastewater treatment. Regionally, the Asia Pacific (APAC) stands out as the primary growth engine, fueled by massive government investments in smart city infrastructure and environmental remediation projects, especially in China and India. North America and Europe, while mature, are characterized by high replacement demand driven by stringent energy efficiency standards (such as ISO 50001 compliance), prompting end-users to upgrade legacy equipment with high-efficiency turbo blowers. Segment trends highlight that the largest market share continues to be held by the wastewater treatment application, though robust expansion is also observed in the power generation and chemical processing sectors seeking reliable, high-pressure air sources, further underscoring the market's fundamental reliance on industrial energy optimization.

AI Impact Analysis on Turbo Blower Market

User inquiries regarding AI's influence on the Turbo Blower Market frequently center on themes of predictive failure, operational optimization, and autonomous control systems. Common questions revolve around how Artificial Intelligence can detect incipient bearing failures before standard sensors, optimize VFD settings in real-time based on fluctuating load demands, and integrate complex energy consumption patterns across entire plant operations to recommend ideal blower configurations. Key concerns often include the cybersecurity implications of connecting blowers to cloud-based AI platforms and the required investment in sensor infrastructure (data collection) needed to make AI models effective. The overall expectation is that AI integration will fundamentally shift the maintenance paradigm from reactive or preventative scheduled checks to highly precise, predictive interventions. This allows operators to reduce downtime, minimize unexpected catastrophic failures, and significantly reduce energy expenditures by maintaining the highest possible efficiency levels specific to transient operational conditions. Therefore, AI is anticipated to be a major differentiator, enhancing the value proposition of modern turbo blowers beyond just their mechanical efficiency, pushing manufacturers to develop software-as-a-service (SaaS) offerings centered around operational intelligence.

- AI-driven Predictive Maintenance: Utilizing machine learning algorithms to analyze vibration, temperature, and current data to forecast potential failures, optimizing maintenance schedules and increasing mean time between failures (MTBF).

- Real-Time Energy Optimization: Deploying AI to dynamically adjust variable frequency drives (VFDs) and airflow rates based on immediate process requirements, minimizing wasted energy during low-demand cycles.

- Anomaly Detection: Rapidly identifying and flagging unusual operational patterns that indicate performance degradation or potential component stress, significantly reducing diagnosis time.

- Asset Performance Management (APM): Integrating blower performance data with wider plant management systems to provide a holistic view of operational efficiency and resource allocation.

- Autonomous Control Systems: Enabling blowers to automatically adjust parameters in response to environmental changes (e.g., ambient temperature, altitude) or changes in process load without human intervention.

- Simulation and Digital Twins: Creating virtual models of blower operations to test different load scenarios and efficiency improvements before implementing changes in the physical system.

DRO & Impact Forces Of Turbo Blower Market

The dynamics of the Turbo Blower Market are heavily influenced by a confluence of driving factors, critical restraints, and substantial opportunities that collectively shape its growth trajectory and competitive landscape. The primary driver is the accelerating global focus on environmental sustainability, specifically the mandate for efficient wastewater treatment, where aeration is the single largest consumer of energy, making high-efficiency turbo blowers indispensable. Furthermore, supportive governmental policies encouraging industrial energy audits and punitive measures for high-energy consumption across mature industrial economies push large end-users towards adopting these superior technologies, thereby creating sustained demand. However, the market faces significant restraints, most notably the high initial capital expenditure associated with turbo blower technology, particularly those utilizing magnetic bearings, which can deter small and medium-sized enterprises (SMEs) from adoption. Additionally, the technical complexity required for maintenance and the necessity for highly skilled personnel pose a localized challenge in developing regions where specialized technical labor is scarce. These restraining forces necessitate robust financing options and localized technical training programs to foster broader market penetration and mitigate adoption hesitancy among cost-sensitive buyers.

Opportunities within the turbo blower sector are concentrated in leveraging digitalization and addressing underserved niche markets. The burgeoning field of IIoT integration offers manufacturers the chance to create subscription-based service models focused on energy optimization and reliability, transforming the traditional equipment sales model into a long-term service partnership. Moreover, the expanding application scope into specific industries, such such as biogas handling and pharmaceutical processes, represents lucrative new revenue streams where the oil-free, high-purity air delivery capability of turbo blowers is paramount. The shift toward retrofitting older compressor and blower stations in established industrial zones presents a continuous, multi-year opportunity for replacement sales, particularly as global electricity prices continue to rise, amplifying the financial benefit derived from superior efficiency. Impact forces include both macro-economic shifts, such as fluctuating raw material costs (e.g., specialized steel and components for high-speed impellers), and technological breakthroughs that could rapidly accelerate efficiency gains, forcing competitors to continuously innovate or risk obsolescence. These forces mandate strategic supply chain management and sustained investment in research and development, ensuring long-term competitiveness in a market increasingly defined by efficiency standards.

Segmentation Analysis

The Turbo Blower Market is rigorously segmented across various dimensions, including product type, bearing technology, end-use application, and capacity, providing granular insights into demand patterns and competitive positioning. Segmentation by product type typically differentiates between low-pressure and high-pressure turbo blowers, catering to applications like aeration versus gas boosting, respectively. Crucially, the segmentation by bearing technology—Magnetic Bearing Turbo Blowers (MBTB) and Air Foil Bearing Turbo Blowers (AFBTB)—is highly significant, as magnetic bearings dominate the high-end, high-efficiency spectrum due to their superior performance, though air foil bearings offer a more cost-effective, durable solution for certain medium-duty applications. The market's structural analysis reveals that the dominance of the wastewater treatment application is likely to persist, given the massive scale of municipal projects globally, yet segmentation by industry shows robust, faster growth in specialized sectors like food & beverage and pharmaceuticals where the demand for contamination-free air is a strict requirement. Understanding these segment dynamics is essential for market participants to tailor their product offerings, sales channels, and geographical expansion strategies effectively, focusing on regions and applications where their specific technological advantage yields the highest competitive benefit and market penetration.

- By Product Type: Low Pressure Turbo Blowers, Medium Pressure Turbo Blowers, High Pressure Turbo Compressors (often used interchangeably in higher capacity ranges).

- By Bearing Type: Magnetic Bearing Turbo Blowers (MBTB), Air Foil Bearing Turbo Blowers (AFBTB).

- By Capacity: Below 500 HP, 500 HP to 1,000 HP, Above 1,000 HP.

- By End-Use Application: Wastewater Treatment, Chemicals and Petrochemicals, Food and Beverage, Pharmaceuticals, Power Generation, General Manufacturing, Others (Mining, Textiles).

- By Region: North America, Europe, Asia Pacific (APAC), Latin America, Middle East & Africa (MEA).

Value Chain Analysis For Turbo Blower Market

The value chain for the Turbo Blower Market begins with upstream activities focused on the procurement of highly specialized raw materials and components, which are crucial for the blower's high-speed, high-precision operation. This upstream segment is characterized by reliance on niche suppliers for components such as high-grade aluminum or titanium alloys for impellers, precision electrical motors, advanced sensor technology, and, most critically, the magnetic or air foil bearing systems. Manufacturers in this industry often engage in strategic partnerships with technology providers specializing in magnetic levitation and sophisticated electronic control units (ECUs) used for precise speed and stability management. Due to the precision engineering required, the bargaining power of specialized component suppliers can be relatively high. The manufacturing stage involves complex processes including high-speed dynamic balancing, advanced machining, and rigorous testing protocols to ensure the final product meets stringent efficiency and reliability benchmarks. Distribution channels typically involve a mix of direct sales for large, customized industrial projects and indirect sales through certified distributors and System Integrators (SIs) who manage installation, commissioning, and after-sales service, particularly in regional markets requiring local expertise.

Moving into the downstream segment, the focus shifts to installation, commissioning, and comprehensive after-sales support, which forms a critical link in the value chain and significantly impacts the total cost of ownership (TCO) for the end-user. Direct distribution channels are predominantly favored for major municipal contracts and complex chemical processing plants where direct manufacturer oversight of integration into existing plant infrastructure is necessary to guarantee optimal performance and warranty compliance. Conversely, indirect channels, often comprised of specialized mechanical equipment dealers or engineering consulting firms, handle smaller industrial accounts and provide localized maintenance services. The efficiency and reliability of these downstream services are paramount, as the high upfront cost of turbo blowers means end-users prioritize long-term performance guarantees and rapid access to specialized spare parts and technical expertise. Manufacturers are increasingly using digital platforms to connect with distributors, providing remote diagnostic tools and training to ensure standardized, high-quality service delivery globally, thus minimizing geographical disparities in support capabilities.

Optimization of the value chain is increasingly centered on intellectual property and service contracts, extending the value capture beyond the initial equipment sale. Manufacturers who excel in integrated design—combining the blower, VFD, and control system into a seamless package—are able to capture greater margins and reduce dependency on third-party integration efforts. The shift towards IIoT has further introduced 'data value' into the chain, where operational data collected from installed blowers can be monetized through predictive maintenance contracts or used to inform the design of next-generation, even more efficient models. This iterative feedback loop between the field performance data and the R&D department is now a significant value-add component. Supply chain resilience, especially following global disruptions, is also becoming a strategic focus, necessitating diversification of suppliers for critical electronic components and rare earth magnets used in magnetic bearing systems. This comprehensive value chain management, from sourcing high-precision components to providing proactive, data-driven after-market services, is essential for maintaining competitiveness and maximizing customer lifetime value in this technologically intensive market.

Turbo Blower Market Potential Customers

The potential customer base for the Turbo Blower Market is highly diverse, centered around industries that require continuous, large volumes of clean, compressed air or gas for essential operational processes. The primary and largest end-user segment consists of municipal and industrial wastewater treatment plants (WWTPs). In WWTPs, turbo blowers provide the crucial aeration necessary for biological nutrient removal and sludge digestion processes, representing the single largest energy consumption point within the facility. These buyers prioritize ultra-high efficiency, long-term reliability (24/7 operation capability), and low noise levels, often driving demand for magnetic bearing technologies. Other core customers include firms within the chemical and petrochemical sectors, where blowers are used for gas boosting, flare gas recovery, and various process air applications requiring oil-free output to prevent contamination of sensitive chemical streams. These industrial end-users generally require customizable high-pressure solutions and robust construction capable of handling demanding process conditions, influencing their purchasing decisions towards vendors offering heavy-duty industrial specifications and specialized materials.

Beyond the core utility and chemical sectors, significant purchasing power resides in general manufacturing and specialized processing industries. The food and beverage sector, including breweries, sugar processing, and industrial cleaning facilities, relies on turbo blowers for high-volume, contamination-free air necessary for fermentation, drying, and pneumatic conveying. This customer group places a premium on hygiene, compliance with FDA and similar regulatory standards, and easy integration into existing sanitary infrastructure. Similarly, the pharmaceutical industry utilizes turbo blowers for sterile processing environments and conveying powdered materials, mandating highly reliable, oil-free air sources to maintain product integrity and safety standards. These customers often seek systems that are validated for cleanroom environments and offer traceable performance metrics, adding an additional layer of complexity to the sales cycle compared to traditional industrial installations.

Emerging and specialized segments also contribute substantially to the customer pool, demonstrating high growth potential and specific requirements. Customers in the power generation industry use turbo blowers for boiler purging, soot blowing, and flue gas desulfurization systems, where reliability under extreme thermal and operational stress is critical. Furthermore, the cement and mining sectors, focusing on pneumatic conveying of bulk materials over long distances, require extremely high-capacity blowers. These buyers are highly cost-sensitive and often prioritize robust, durable air foil bearing blowers that offer high TCO savings in harsh, dust-laden environments. The diversification of potential customers across municipal infrastructure (driven by regulatory compliance), heavy industry (driven by scale and efficiency), and sensitive manufacturing (driven by purity requirements) ensures a stable and resilient demand profile for advanced turbo blower technologies across the forecast period.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 2.5 Billion |

| Market Forecast in 2033 | USD 4.2 Billion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Atlas Copco, Siemens, KSB Group, Howden Group, Gardner Denver, Mitsubishi Heavy Industries, Ingersoll Rand, HOFFMAN & SCHWEITZER, SKF, AERZEN, Samil Blower, Hanwha Power Systems, FS-Elliott, SULZER, Kawasaki Heavy Industries, TurboMax, Hitachi, Continental Industrie, Spencer Turbine Company, HI-VAC Corporation |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Turbo Blower Market Key Technology Landscape

The technology landscape of the Turbo Blower Market is dominated by advancements aimed at maximizing efficiency, durability, and connectivity, primarily revolving around bearing systems and motor control. The adoption of magnetic bearing technology represents a paradigm shift, eliminating the need for oil lubrication, minimizing mechanical friction, and dramatically reducing maintenance requirements while allowing for extremely high rotational speeds, leading to optimal aerodynamic efficiency. These systems incorporate complex active control loops to maintain rotor stability during operation and startup, requiring precise sensor feedback and sophisticated digital controllers. Furthermore, Variable Frequency Drives (VFDs) are integral to modern turbo blower operation, allowing the speed of the permanent magnet synchronous motor (PMSM) or induction motor to be precisely matched to the specific air demand. This dynamic speed control ensures that the blower operates at its peak efficiency point across a wide range of flow conditions, a necessity in fluctuating load environments like municipal aeration basins, significantly contributing to the overall energy savings proposition.

A second major technological development involves the integration of high-speed permanent magnet synchronous motors (PMSM) which offer superior efficiency compared to traditional induction motors, particularly at the high speeds necessary for turbo applications. These motors, coupled with advanced impeller design utilizing computational fluid dynamics (CFD) for optimal aerodynamics, ensure that the mechanical power input is converted into air flow pressure with minimal loss. Parallel to mechanical and electrical improvements, there is a strong focus on enhancing material science, specifically in developing durable, lightweight alloys for impellers that can withstand high stress and corrosive environments without compromising balancing precision. Manufacturers are continuously refining impeller geometry and diffuser technology to widen the operational map, allowing the blower to maintain high efficiency even when operating far from its design point, which addresses real-world industrial volatility and minimizes the risk of surging, a common operational concern.

The digitalization of turbo blower systems is accelerating, driven by the need for enhanced reliability and operational insight. Key technologies include the proliferation of Industrial Internet of Things (IIoT) sensors monitoring vibration, temperature, current draw, and pressure, which feed into centralized cloud platforms. This capability enables remote diagnostics and, critically, predictive maintenance schedules driven by machine learning algorithms, moving away from time-based servicing. Advanced human-machine interfaces (HMIs) and integrated control panels offer end-users real-time data analysis, energy consumption dashboards, and sophisticated diagnostic alerts, empowering plant managers to make data-driven decisions regarding energy management and load shifting. This technological confluence—high-efficiency motors, friction-reducing magnetic bearings, precise VFD control, and IIoT connectivity—defines the current competitive edge and sets the standard for next-generation blower performance and reliability in resource-intensive industries worldwide, making them essential assets for environmental and industrial compliance.

Regional Highlights

The regional distribution of the Turbo Blower Market reflects a pronounced dichotomy between mature industrial economies focusing on replacement and upgrades, and rapidly developing regions driving growth through new infrastructure establishment. Asia Pacific (APAC) currently dominates the market in terms of growth rate and total installed capacity additions, propelled by massive government initiatives in key economies like China, India, and Southeast Asia focused on urbanization, industrial expansion, and tackling severe water pollution issues. The need for new and upgraded centralized wastewater treatment facilities, coupled with the rapid expansion of the manufacturing base across multiple sectors, ensures robust demand for high-capacity, energy-efficient blowers. Furthermore, lower manufacturing costs and increasing local production capabilities within APAC are enhancing competitive pricing, although the adoption of premium magnetic bearing technology still lags behind Western markets in some segments, prioritizing high TCO savings over absolute efficiency initially.

North America and Europe represent highly mature yet critical markets characterized by stringent regulatory environments and a high emphasis on energy efficiency legislation. In these regions, growth is primarily driven by the replacement cycle, as aging compressor stations and legacy positive displacement blowers are systematically phased out to comply with environmental mandates and achieve substantial operational cost reductions. European market momentum is particularly strong due to the European Union’s commitment to achieving net-zero carbon targets, compelling industries to adopt best available technologies, positioning turbo blowers as a cornerstone solution for compressed air system optimization. The demand in these regions is heavily skewed towards magnetic bearing models that provide maximum efficiency and sophisticated monitoring capabilities, reflecting a customer base willing to invest significant capital expenditure for premium performance and compliance assurance.

Latin America (LATAM) and the Middle East & Africa (MEA) are emerging markets exhibiting accelerated, though often volatile, growth driven primarily by infrastructure investments in large-scale projects related to mining, oil & gas processing, and initial wastewater infrastructure development. In the MEA region, investments driven by diversification away from oil economies, such as in massive infrastructure projects in Saudi Arabia and the UAE, are opening up new opportunities for high-capacity turbo blowers. However, these regions often face challenges related to political instability, fluctuating commodity prices, and less developed local service networks, which necessitates that suppliers provide robust, easy-to-maintain equipment alongside comprehensive, often remotely managed, after-sales service packages. The key to success in these emerging regions lies in strategic partnerships and offering tailored financing solutions that address the specific capital constraints faced by local governmental and private entities embarking on large-scale infrastructure overhauls.

- Asia Pacific (APAC): Highest growth region, driven by urbanization, industrialization, and massive investment in new municipal wastewater treatment facilities in China, India, and Indonesia.

- North America: Mature market characterized by mandatory energy efficiency upgrades, replacement cycles, and high demand for magnetic bearing technology in municipal aeration.

- Europe: Driven by strict environmental regulations and EU directives aiming for energy conservation and carbon neutrality, leading to high adoption rates in industrial processing and utility sectors.

- Middle East & Africa (MEA): Emerging market growth fueled by large-scale infrastructure projects, especially in water management and petrochemical processing, driven by economic diversification strategies.

- Latin America (LATAM): Growth tied to stable investment in mining, pulp and paper, and developing urban infrastructure, though often hindered by economic volatility and reliance on commodity prices.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Turbo Blower Market.- Atlas Copco

- Siemens

- KSB Group

- Howden Group

- Gardner Denver (now part of Ingersoll Rand)

- Mitsubishi Heavy Industries

- Ingersoll Rand

- HOFFMAN & SCHWEITZER

- SKF

- AERZEN

- Samil Blower

- Hanwha Power Systems

- FS-Elliott

- SULZER

- Kawasaki Heavy Industries

- TurboMax

- Hitachi

- Continental Industrie

- Spencer Turbine Company

- HI-VAC Corporation

- Shin-Nippon Machinery

- ClydeUnion Pumps (A SPX FLOW Brand)

Frequently Asked Questions

Analyze common user questions about the Turbo Blower market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the adoption of Turbo Blowers over traditional blowers?

The primary driver is superior energy efficiency, which translates directly into lower operational costs and a reduced carbon footprint. Turbo blowers, particularly those utilizing magnetic bearings, can achieve up to 40% energy savings compared to conventional positive displacement blowers, making them the most cost-effective solution over the lifecycle of large-scale industrial aeration and compression applications, directly addressing high electricity costs in utility sectors like wastewater treatment.

How do Magnetic Bearing Turbo Blowers (MBTB) differ fundamentally from Air Foil Bearing Turbo Blowers (AFBTB)?

MBTBs use electromagnetic forces to levitate the rotor, eliminating all mechanical contact, resulting in zero friction, ultra-low maintenance, and the highest rotational speeds achievable, leading to optimal efficiency. AFBTBs use a thin film of compressed air to support the rotor, offering a more robust and lower-cost, oil-free alternative, though typically operating at slightly lower efficiencies and having a reduced life span compared to the fully frictionless nature of active magnetic bearing systems. MBTBs are often chosen for large, critical infrastructure where maximum efficiency and lowest long-term maintenance are paramount.

Which end-use application holds the largest market share for turbo blowers globally?

The Wastewater Treatment sector holds the largest market share. Turbo blowers are essential for the aeration process in biological treatment basins, which is the single most energy-intensive operation in a wastewater plant. Global population growth, urbanization, and increasingly strict regulations regarding effluent quality necessitate continuous investment in high-efficiency aeration systems, guaranteeing sustained dominance of this application segment throughout the forecast period.

What is the significance of Variable Frequency Drives (VFDs) in modern turbo blower operation?

VFDs are critical for optimizing turbo blower performance by dynamically adjusting the motor speed to match the precise air or gas volume demanded by the process in real-time. Since many industrial and municipal processes have fluctuating air requirements, the VFD ensures the blower operates at its highest efficiency point across a wide range of loads, preventing energy waste during low-demand periods and significantly enhancing system flexibility and overall energy savings, which is vital for maximizing ROI on the high initial capital expenditure.

What geographical region is expected to exhibit the highest growth rate (CAGR) in the Turbo Blower Market?

The Asia Pacific (APAC) region is projected to register the highest Compound Annual Growth Rate (CAGR). This accelerated growth is primarily attributed to unprecedented infrastructural development, rapid industrialization, and substantial governmental investment in new municipal water and wastewater management projects across major economies like China, India, and emerging Southeast Asian nations. These large-scale capacity expansions require the installation of new, highly efficient blower systems rather than just replacement units.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Turbo Blower Market Statistics 2025 Analysis By Application (Wastewater Treatment, Petroleum & Chemical, Power Generation), By Type (Multistage Turbo Blower, Single-Stage Turbo Blower), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Turbo Blower Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Air Compressor, Gas Compressor), By Application (Combined Cycle Power Plant, Water Treatment, Chemical Industry), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager